Formation of hanging man

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

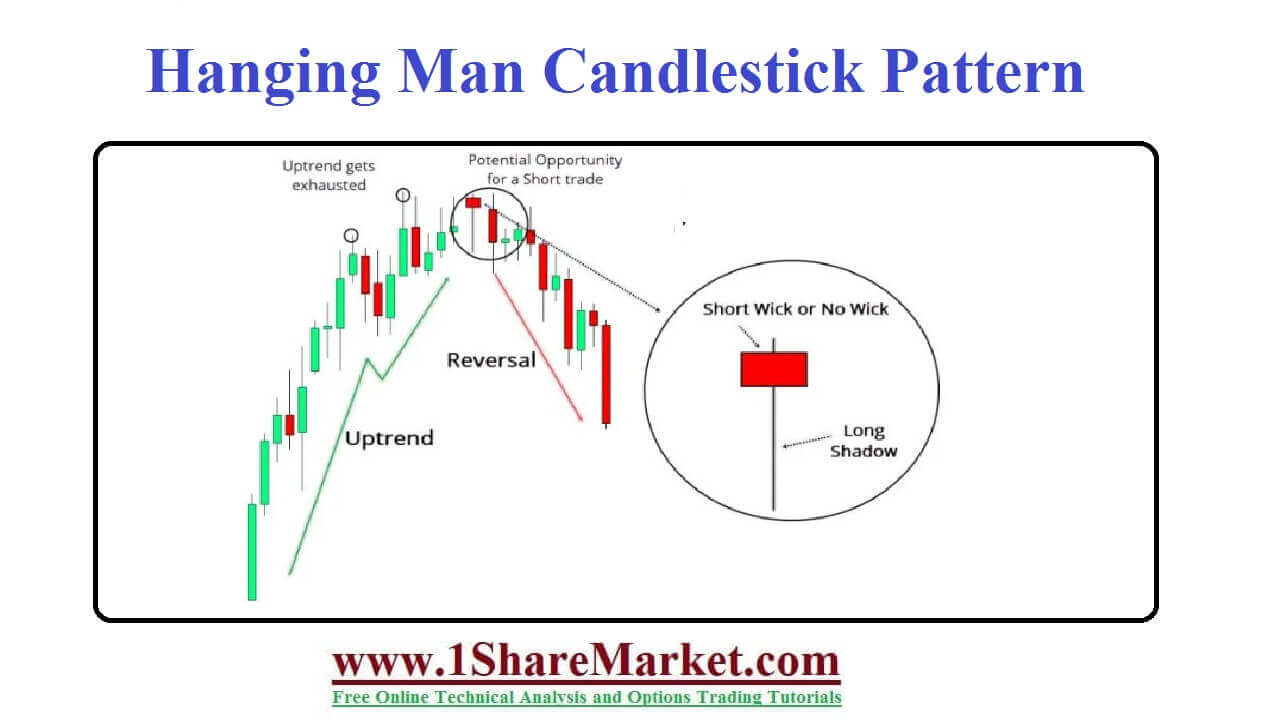

Candlestick pattern ek stock market ki technical analysis tool hai jo stock charts par paya jaata hai. Ye pattern bearish reversal ke liye use kiya jata hai aur ye kisi uptrend ke end ko indicate karta hai.Hanging Man candlestick pattern kisi single candlestick se banta hai jo ki ek vertical line hai jisko shadow or wick kehte hain, aur iske upar ek chota sa body hota hai. Body bearish color me hota hai aur wick body ke upar se bahar ki taraf lamba hota hai. Hanging man pattern ka naam isliye rakha gaya hai kyunki ye candlestick pattern ek aise din par nazar ata hai jab market me buyers ko sell karne ke liye koi mauka nahi mil raha hai aur unke pas stock hold karne ke liye option nahi hai. Is situation me, hanging man candlestick pattern ek strong signal provide karta hai ki bearish trend jald hi shuru hone wala hai.Ye pattern bullish reversal patterns ki tarah na to 100% reliable hota hai aur na hi iske base par hi trading kiya jana chahiye. Iska istemal kiya jana chahiye other technical analysis tools ke sath-sath aur market ke overall trend ko bhi dhyan me rakhte hue. Formation of hanging man Hanging Man" candle pattern ko banane ke liye, pehle apko pata hona chahiye ki candlestick charts kya hote hain aur candlestick patterns kya hote hain. Candlestick charts kisi bhi financial instrument ke price action ko darshata hai aur candlestick patterns bullish ya bearish signals provide karte hain.Hanging Man" candle pattern bearish reversal pattern hota hai, jo ek uptrend ke baad dekha jata hai. Is pattern me, ek small body wala candle hota hai, jismein price open aur close ke beech me kafi difference hota hai aur ek long lower shadow hota hai, jo ki 2 ya 3 guna lamba hota hai upper shadow ke muqablay mein.Is pattern ko banane ke liye, ek trader ko pehle uptrend ki taraf dhyan dena hota hai. Agar price ek uptrend ke beech me hai aur phir ek candle, jismein ek small body aur lamba lower shadow hai, banata hai, to ye ek "Hanging Man" candle pattern ho sakta hai. Is pattern ke confirmation ke liye, ek trader ko next candle ki price action ka dhyan dena hota hai. Agar next candle ki price down direction mein move karti hai, to ye ek bearish reversal signal provide karta hai.Lekin, ye ek bahut hi basic example hai aur is pattern ki samajh ke liye aur aage ki knowledge ke liye, ek trader ko candlestick charting ka adhik gahra study karne ki zarurat hoti hai.Hanging man candle pattren sa trade kasy karen Hanging Man pattern ko technical analysis mein use kiya jata hai aur yeh bearish trend reversal pattern hai. Yeh pattern candlestick chart par dikhta hai aur ek single candlestick se represent kiya jata hai.Agar aap Hanging Man pattern ko trade karna chahte hain toh aapko niche diye gaye steps follow karne honge:Chart Analysis: Sabse pehle aapko price chart par Hanging Man pattern ko identify karna hoga. Yeh pattern ek single candlestick se represent kiya jata hai jo ki upper shadow ke saath ek small body aur no lower shadow wala hota hai.Confirm the Pattern: Hanging Man pattern ko confirm karne ke liye aapko candlestick ki body ke size aur upper shadow ki length ko check karna hoga. Candlestick ki body small hone chahiye aur upper shadow, body se 2-3 times longer hona chahiye.Wait for Confirmation: Hanging Man pattern ko confirm karne ke baad aapko wait karna hoga ki next candlestick kya karta hai. Agar next candlestick Hanging Man pattern ke niche close hota hai toh yeh bearish trend reversal signal hai aur aapko short position lena ha.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Formation of hanging man Hanging man ya hang man candalstick Sy murad Ek Barish single candle satik formation has jo aap trade ke sab se upar wale Makam per Pai Jaati Hai tajir is pattern ko pattern ki changing ke rujan ki Simat Mein use karte hain jase hi bail apni Raftar open lagta hai yah market ke rujan ko change karne ka bhi cues deta hai Hanging man candelstick pattern Hanging man Candelstick pattern ki characteristc small body ky oper Ek shart Vik Hai Jiske niche Ek long Shadow hai agar candle satik green ya white Hai To asisa open Se zyada close ho jata hai agar yah red ya black Hai To yah open se kam band ho jata hai

Hanging man candelstick pattern Hanging man Candelstick pattern ki characteristc small body ky oper Ek shart Vik Hai Jiske niche Ek long Shadow hai agar candle satik green ya white Hai To asisa open Se zyada close ho jata hai agar yah red ya black Hai To yah open se kam band ho jata hai Example chart price mein Kami ko zahar Karte Hain Iske after price Mein kalil muduti izaafa Hota Hai Jahan Ek latka Hua man mombatti banata hai pansi Ke Man ke bad price next mombatti per girti hai petternko complete karne ke liye darkar tasdeek farm karti hai example is Baat per light dalti hai ki pansi per latkane Wale Ko tavil Kadni ke after Aane ki zarurat Nahin Hoti Understanding Hanging man signal candles stick pattern hota hai Kyunki yah Ek ulat pattern hota hai iske liye pattern ke zahr hone se pahle Kuchh long Ka juzan Hona chahie Hota Hai market ko long Upery juzan Mein Rahane ki need Nahin Hoti but pattern se pahle price Mein Kabl identy increase Hona chahie Trade of Hanger howy man ki candel stick ko pattern ki identity Karke aur phr characterise sa faida Utha Kar Trade ki Jaati Hai sabse pahle candlestick pattern Ka One long nichla Saya market Mein sell kundha ke admission Ki Nishanidi karta hai yah Ek finger ka usul hai ke long nichle Sai small nichle wale hang man Candel stick ka Color Red ya green ho sakta hai a green Barrish hang man use Waqt banaa Hota Hai Jab Unchi aur start price Ek Jaisi hoti hai Jab unchai aur band price change Hoti Hai To Ek green Barish Hangman banaat Hota Hai

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 06:34 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим