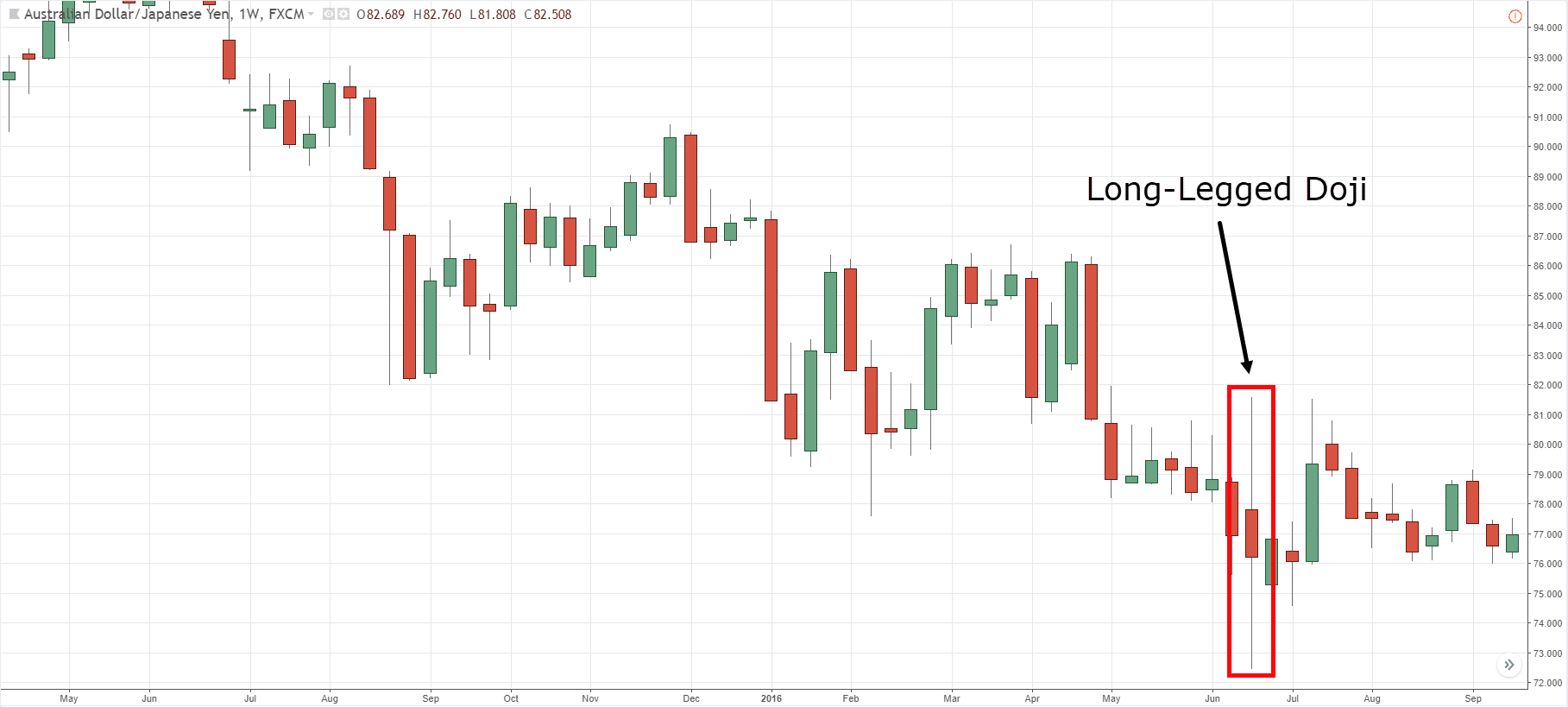

Long Legged Doji Candlesticks.

`

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔ٹیگز: کوئی نہیں

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Assalamu Alaikum dear friend kaise hain Sab ummid Karti hun khairiyat se Honge aur Apna Achcha kam kar rahe Honge Jab aap is market Mein kam karte hain to aapko bahut hi careful hokar kam karna hota hai aur acche experience ke sath kam karna hota hai aaj main aapse bahut important information discuss karungi jo aapki trading ko Achcha result de sakti hai to Mera topic Hai long legged doji candlestick kya hai Ham is per Kaise kam Karke profitable ho sakte hain. Long-Legged Doji Candlesticks: Long legged doji candle ek do ji candle bakair real body Mein Banane wali upper aur lower side per long Shadow rakhne Wali Ek single candle pattern Hai Jisko Aam Taur per price chart pattern per Ek natural candle to Sabar ki Jaati Hai yah candle market Mein supply aur demand khareed aur farok bullish aur bearish resistance aur support takat Mein barabari ki vajah se banti hai candle ke banane ki psychology Kuchh Is Tarah Se Hai ke Ek maksudhab Karta time frame ke dauran price chart per pahle invester price ko ek side per Le jaane ke bad sem dusri side per bhi Usi Tarah Se post karte hain lekin din ke kam per price Apne Aawas wali position per Aakar close hoti hai. Candles Formation: Long Legged Doji candle umuman price main zyda tar Dikhai deti Hain Kyunki yah Ek natural candle shumar Hoti Hai yah candle ek hi time mein market Mein buyers aur sellers ki equal takat ki aakashi Karti Hai Jo price ko ek Khas position per mutahi kam rakhti hai candle ki formation darja zail Tara Se Hoti Hai. Long legged do ji candlestick price ke Darmiyaan Mein jyadatar natural Hoti Hai Jab Ke bottom or top price per trend reversal Ki salaiya rakhti Hai yah candle bagair real body ke Hoti Hai jismein candles ke open aur close same point per hote hain candles ke upar aur lower side per Shadow hota hai jo Ke donon Side per size mein equal Hota Hai. Explanation Of Long Legged Doji Candlesticks: Long legged doji candles take me price candle ke center Ja Darmiyan Mein Ek line serial body banati hai Jiske upper aur lower side per Ek Lamba Saya ya Shadow hota hai yah candle Aam Taur per Ek natural candle tasawar ki Jaati Hai Jisko price chart per bahut jyada Dekha Jata Hai yah candle price ke center Mein Jaaye Ek Trend ke dauran natural value ki Hoti Hai Jab Ke price top ya bottom per banne per yah trend reversal ki houses Yad rakhti Hai long legdoji candlestick ki Hoshiyar bhi Sambhal spinning top candle Highway candle aur do ji star candle Ki Tarah Hoti Hai jismein market ki price jyadatar sem trend ko hi follow karti hai. Trading With Long Legged Doji Candlesticks Pattren: Long legged do ji candlestick trading ke liye Jyada perfect signal is wajah se nahi de sakta hai Kyunki yah candle jyadatar natural behaviour rakhti Hai jyadatar yah candle price chart mein bahut jyada Najar Aati Hai Lekin Aam trend per yah bahut kam Asar Andaaz Hoti Hai price chart ke top per banne per yah candle thodi bahut trend reversal ke sath ka hamil ho sakti hai candles per trading ke liye jaruri hai ki price Trend ke Intha height of bottom Mein Hona chahie Jab Ke candles ke bad Ek confirmation candle Ka Hona Jaruri hota hai jo ki real body Mein lajmi Hona chahie Jab Ke sem trend ki candle Banane per yah trend contination ka roll play karti hai stop loss scandal ke sabse top bottom end sy two pipes above ya below set kare. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Doji Candlesticks, stock market aur financial markets mein trend analysis ke liye bohot ahem hai. Ek candlestick ek particular time frame mein stock ya kisi financial instrument ki opening, closing, high aur low prices ko represent karta hai. Candlesticks traders aur investors ko market ki movement aur price patterns ko samajhne mein madad karte hain. Lambi taang wali doji (Long Legged Doji) candlesticks ek aham candlestick pattern hote hain jinhe technical analysis mein use kia jata hai. Ye pattern doji candlestick se milta julta hai, lekin ismein doji ki tulna mein lambi shadow (taang) hoti hai. Yeh candlestick pattern market ke reversal points ko indicate karta hai. Lambi Taang Wali Doji Kaise Banta Hai: Lambi taang wali doji candlestick jab market mein kisi particular time frame mein halki si price movement hoti hai, jiski wajah se candlestick ki body bahut chhoti hoti hai aur shadow (taang) lambi hoti hai, to ye pattern banta hai. Is pattern mein open aur close price ek doosre ke bohot qareeb hote hain ya phir ek doosre ke barabar. Lambi Taang Wali Doji Ka Matlab Kya Hai: Lambi taang wali doji candlestick pattern bullish ya bearish market ke liye important hota hai, aur iske alag alag interpretations ho sakte hain: 1. Bullish Lambi Taang Wali Doji: Agar lambi taang wali doji ek downtrend ke baad dikhe, to iska matlab ho sakta hai ki bearish pressure khatam ho gaya hai aur market ab upar ki taraf move kar sakta hai. Is pattern ko ek potential trend reversal signal ke roop mein dekha jata hai. 2. Bearish Lambi Taang Wali Doji: Agar lambi taang wali doji ek uptrend ke baad dikhe, to iska matlab ho sakta hai ki bullish trend khatam ho gaya hai aur market ab neeche ki taraf move kar sakta hai. Is pattern ko ek potential trend reversal signal ke roop mein dekha jata hai. Lambi Taang Wali Doji Ka Istemal: Lambi taang wali doji pattern single candlestick se banta hai, isliye isko confirm karne ke liye dusre technical indicators aur price patterns ka istemal karna zaroori hota hai. Traders is pattern ke confirmation ke liye moving averages, trend lines, aur RSI (Relative Strength Index) jaise tools ka istemal karte hain. Khatra (Risk) aur Tadbeer (Strategy): Candlestick patterns ko samajhna aur unka sahi istemal karna traders ke liye khatra (risk) aur munaafa (profit) dono mein madad karta hai. Lambi taang wali doji pattern ki samajh aur sahi tadbeer ke saath traders ko behtar trading decisions lene mein madad milti hai. (Conclusion): Lambi taang wali doji candlesticks ek powerful tool hote hain trend reversal points ko detect karne ke liye. Ye pattern bullish aur bearish markets dono mein dekhe ja sakte hain, lekin isko confirm karne ke liye dusre technical indicators ka sahara lena zaroori hai. Traders ko is pattern ko samajhne ke liye practice aur experience ki zaroorat hoti hai, taki unhe sahi samay par sahi trading decisions lene mein madad mile. -

#4 Collapse

ssalamu Alaikum dear friend kaise hain Sab ummid Karti hun khairiyat se Honge aur Apna Achcha kam kar rahe Honge Jab aap is market Mein kam karte hain to aapko bahut hi careful hokar kam karna hota hai aur acche experience ke sath kam karna hota hai aaj main aapse bahut important information discuss karungi jo aapki trading ko Achcha result de sakti hai to Mera topic Hai long legged doji candlestick kya hai Ham is per Kaise kam Karke profitable ho sakte hain. Long-Legged Doji Candlesticks: Long legged doji candle ek do ji candle bakair real body Mein Banane wali upper aur lower side per long Shadow rakhne Wali Ek single candle pattern Hai Jisko Aam Taur per price chart pattern per Ek natural candle to Sabar ki Jaati Hai yah candle market Mein supply aur demand khareed aur farok bullish aur bearish resistance aur support takat Mein barabari ki vajah se banti hai candle ke banane ki psychology Kuchh Is Tarah Se Hai ke Ek maksudhab Karta time frame ke dauran price chart per pahle invester price ko ek side per Le jaane ke bad sem dusri side per bhi Usi Tarah Se post karte hain lekin din ke kam per price Apne Aawas wali position per Aakar close hoti hai. -

#5 Collapse

**Long-Legged Doji Candlestick Pattern ki Explanation:**Long-Legged Doji ek specific candlestick pattern hai jismein candle ke upper aur lower shadows (wicks) bahut lambi hoti hain aur body bahut chhoti hoti hai, ya phir bilkul na hoti hai. Is pattern mein open aur close price almost ek doosre se same hote hain, jisse candlestick ki shape "+" (plus) ki tarah dikhti hai.**Is ki IQsam:**Long-Legged Doji ki ek hi type hoti hai, jismein candle ke upper aur lower shadows lambi hoti hain aur body chhoti ya bilkul na hoti hai.**Is ki Characteristics:**1. Lambi Wicks: Candle ke upper aur lower shadows (wicks) lambi hoti hain, jisse market mein high aur low price levels indicate hote hain.2. Chhoti ya Zero Body: Candle ki body bahut chhoti hoti hai, ya phir bilkul na hoti hai. Open aur close price almost same hote hain.3. Market Indecision: Long-Legged Doji ek market indecision ka sign hai, jisse price direction clear nahi hota hai.**Is ki Ky Benefits:**1. Reversal Indication: Long-Legged Doji pattern ek trend reversal ka indication bhi ho sakta hai, especially agar ye downtrend ya uptrend ke baad appear kare.2. Market Sentiment: Ye pattern market sentiment aur price action ka insight deta hai, aur traders ko future price movement ke liye alert rakhta hai.3. Entry and Exit Points: Is pattern se traders ko entry aur exit points milte hain, jisse unka risk management improve hota hai.**Is ki Ky Nuqsan (Drawbacks):**1. False Signals: Long-Legged Doji patterns kabhi-kabhi false signals bhi generate kar sakte hain, jisse traders ko galat entry ya exit points milte hain.2. Confirmation Required: Is pattern ke signals ko confirm karne ke liye dusre technical indicators ka bhi istemal karna hota hai, jisse sahi entry aur exit points mil sakein.**Conclusion:**Long-Legged Doji Candlestick Pattern ek powerful candlestick pattern hai jo market indecision aur price reversal ka indication deta hai. Is pattern ki appearance ko confirm karne ke liye, traders ko dusre technical indicators ka bhi istemal karna chahiye. Saath hi, risk management ka dhyaan rakh kar traders ko in patterns ko apni trading strategies mein shamil karna chahiye. Price action analysis aur trend analysis ke sath mila kar, Long-Legged Doji patterns traders ko profitable trading decisions lene mein madad karte hain. -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

**Long-Legged Doji Candlestick Pattern ki Explanation:** Long-Legged Doji ek specific candlestick pattern hai jismein candle ke upper aur lower shadows (wicks) bahut lambi hoti hain aur body bahut chhoti hoti hai, ya phir bilkul na hoti hai. Is pattern mein open aur close price almost ek doosre se same hote hain, jisse candlestick ki shape "+" (plus) ki tarah dikhti hai. **Is ki IQsam:** Long-Legged Doji ki ek hi type hoti hai, jismein candle ke upper aur lower shadows lambi hoti hain aur body chhoti ya bilkul na hoti hai. **Is ki Characteristics:** 1. Lambi Wicks: Candle ke upper aur lower shadows (wicks) lambi hoti hain, jisse market mein high aur low price levels indicate hote hain. 2. Chhoti ya Zero Body: Candle ki body bahut chhoti hoti hai, ya phir bilkul na hoti hai. Open aur close price almost same hote hain. 3. Market Indecision: Long-Legged Doji ek market indecision ka sign hai, jisse price direction clear nahi hota hai. **Is ki Ky Benefits:** 1. Reversal Indication: Long-Legged Doji pattern ek trend reversal ka indication bhi ho sakta hai, especially agar ye downtrend ya uptrend ke baad appear kare. 2. Market Sentiment: Ye pattern market sentiment aur price action ka insight deta hai, aur traders ko future price movement ke liye alert rakhta hai. 3. Entry and Exit Points: Is pattern se traders ko entry aur exit points milte hain, jisse unka risk management improve hota hai. **Is ki Ky Nuqsan (Drawbacks):** 1. False Signals: Long-Legged Doji patterns kabhi-kabhi false signals bhi generate kar sakte hain, jisse traders ko galat entry ya exit points milte hain. 2. Confirmation Required: Is pattern ke signals ko confirm karne ke liye dusre technical indicators ka bhi istemal karna hota hai, jisse sahi entry aur exit points mil sakein. **Conclusion:** Long-Legged Doji Candlestick Pattern ek powerful candlestick pattern hai jo market indecision aur price reversal ka indication deta hai. Is pattern ki appearance ko confirm karne ke liye, traders ko dusre technical indicators ka bhi istemal karna chahiye. Saath hi, risk management ka dhyaan rakh kar traders ko in patterns ko apni trading strategies mein shamil karna chahiye. Price action analysis aur trend analysis ke sath mila kar, Long-Legged Doji patterns traders ko profitable trading decisions lene mein madad karte hain. -

#7 Collapse

Forex market mein candlestick patterns ko samajhna ek ahem hissa hai, kyun ke ye traders ko market ke mizaaj aur mawafiqat ka andaza lagane mein madad karte hain. Long Legged Doji ek aham candlestick pattern hai jo market mein uncertainty ko darust karti hai.

Long Legged Doji:

Long Legged Doji ek aisi candlestick hai jo market mein indecision yaani tashweesh ka izhar karti hai. Iski pehchan uske lambay aur baray upper aur lower wicks se hoti hai. Long Legged Doji candlestick ek chhoti si body ke sath aati hai, jo ke open aur close prices ko darust karti hai, lekin iske upper aur lower wicks lambi hoti hain. Iska matlab hai ke market mein buyers aur sellers ke darmiyan baraabar ki jung hai aur koi clear trend nahi ban raha.

Long Legged Doji ki Tafseelat:- Open aur Close Prices: Long Legged Doji ki body choti hoti hai aur iski open aur close prices aapas mein baraabar hoti hain ya bohot qareeb hoti hain. Ye darust darust market ke opening aur closing prices ko darust karti hai.

- Upper aur Lower Wicks: Iski pehchan iske lambay upper aur lower wicks se hoti hai. Upper wick high price ko represent karta hai jabke lower wick low price ko. Jab dono wicks lambi hoti hain, to ye market mein volatility aur uncertainty ko darust karti hai.

- Indecision ka Nishaan: Long Legged Doji ka sabse ahem maqsad market mein tashweesh aur indecision ko zahir karna hai. Iska kehna hai ke buyers aur sellers ke darmiyan koi wazeh trend nahi hai aur market mein confusion hai.

Long Legged Doji ka Tijarat Mein Istemal:- Trend Reversals: Long Legged Doji ko trend reversals ke liye ek nishaan samjha jata hai. Agar market mein ek strong uptrend ya downtrend ke baad Long Legged Doji aati hai, to ye ishara ho sakta hai ke trend kamzor ho raha hai aur market reversal hone wala hai.

- Breakout ke Liye Tayyari: Long Legged Doji ke baad market mein breakout hone ka imkan hota hai. Traders is pattern ko dekhte hain aur phir breakout ki taraf tawajju dete hain, taake woh trend ka agla rukh sahi se pakad sakein.

- Risk Management: Long Legged Doji traders ko ye bhi batati hai ke market mein uncertainty hai, is liye risk management ka khayal rakhna zaroori hai. Stop-loss orders ka istemal is waqt bhi faida mand ho sakta hai.

- Aggressive Trading: Kuch traders Long Legged Doji ko aggressive trading opportunities ke liye istemal karte hain. Iska matlab hai ke jab ye pattern aata hai, to woh fauran trade karte hain, ummeed hai ke market mein kisi clear trend ki taraf ja raha hoga.

Long Legged Doji aur Dusre Candlestick Patterns:- Dragonfly Doji: Dragonfly Doji bhi ek aisi candlestick hai jo indecision ko darust karti hai. Iski pehchan iske lambay upper wick se hoti hai jo keekar ki tarah hoti hai. Ye bhi market mein reversal ko darust kar sakti hai.

- Gravestone Doji: Gravestone Doji bhi ek tarah ka Doji pattern hai jo market mein indecision ko darust karta hai. Iski pehchan iske lambay lower wick se hoti hai jo keekar ki tarah hoti hai.

- Spinning Top: Spinning Top ek aur pattern hai jo market mein indecision ko zahir karta hai. Iski pehchan iske choti body aur lambay upper aur lower wicks se hoti hai.

- CL

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#8 Collapse

Long legged doji candlesticks.

Candlestick patterns forex aur stocks trading mein aham role ada karte hain. In patterns ki madad se traders market ke mizaaj ko samajhne ka try kartay hain. Aik aham aur ahem candlestick pattern hai "Long-Legged Doji," jo market mein tawafuqat aur uncertainty ko darust karnay ka nishan hai. Is article mein, hum Long-Legged Doji candlestick pattern ke bare mein tafseel se janenge.

1. Tasweer:- Long-Legged Doji candlestick ki pehchan iski choti ya khud mawjood na hone wali body se hoti hai, jo ke iska matlab hai ke opening aur closing prices aapas mein bohat qareeb hain.

- Dono sides, yani upper aur lower shadows ya wicks, lambi hoti hain, iska matlab hai ke trading session ke doran prices mein bohat ziada tezi ya giri hui.

2. Market Mein Tawafuqat:- Long-Legged Doji pattern market mein tawafuqat ya indecision ka zor asar dikhata hai. Ye pattern darust karta hai ke na to bulls aur na hi bears ko control mil saka, jiski wajah se market mein aik tarah ka rukawat mehsoos hoti hai.

3. Volatility:- Is pattern mein lambi wicks ya shadows volatility ko darust karte hain. Iska matlab hai ke trading session ke doran prices mein ziada tezi aur giri hui.

4. Mumkin Reversal Signal:- Long-Legged Doji khud mein kisi clear direction ki taraf ishara nahi karta, lekin isay dekhte hue traders market mein possible reversal ka izhar karte hain. Yeh samjha jata hai ke market mein tawafuqat ka daur hone wala hai.

Long-Legged Doji candlestick pattern market mein uncertainty ka izhar karta hai aur traders ko caution mein daal sakta hai. Lekin, hamesha yaad rahe ke koi bhi pattern ya indicator 100% guarantee nahi deta, is liye isay dusre technical analysis tools ke saath istemal karna behtar hota hai. Trading mein kamiyabi ke liye, hoshyari aur research ka bhi barabar istemal karna zaroori hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 09:12 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим