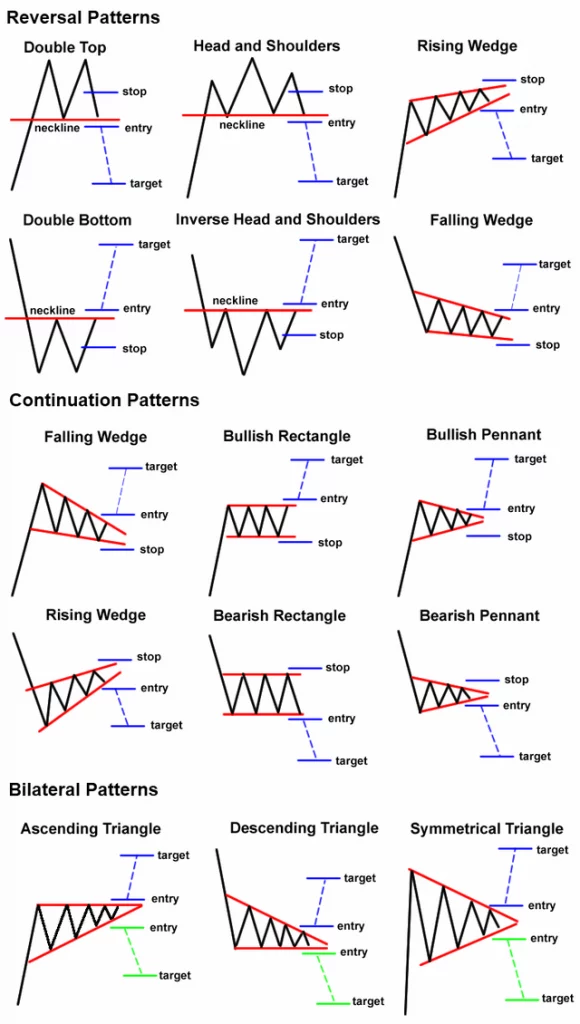

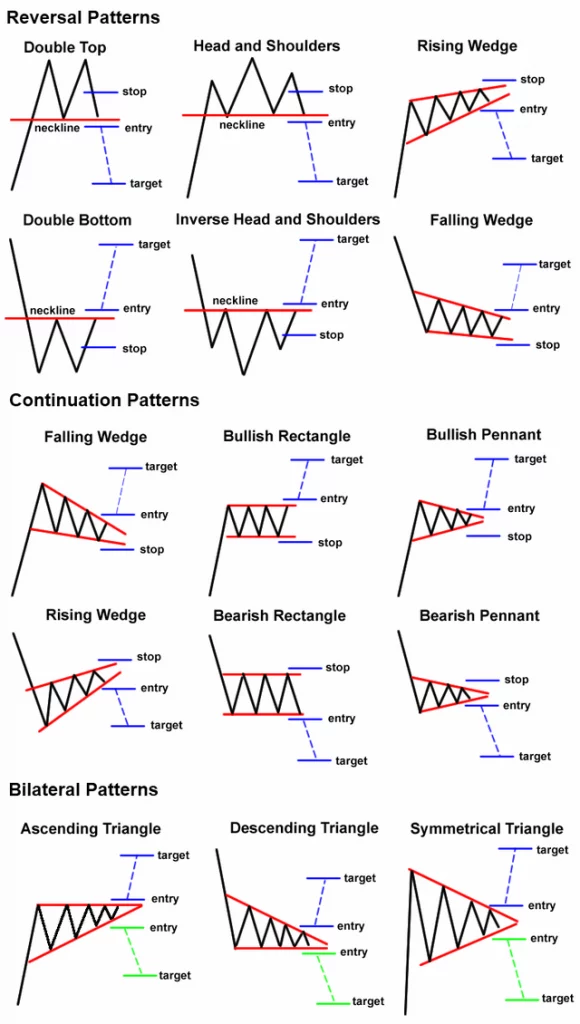

Chart Pattern Types:

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

crows design ek candle design hai jo negative (girawat ka) pattern ko show karta hai. Yeh design punch cost graph standard dikhai deta hai to yeh brokers ke liye ek significant sign hai ki market mein descending development shuru ho gaya hai aur iska matlab hai ke stock ya money ki keemat kam sharpen ki sambhavna hai. "Three Dark Crows" design ko samajhne ke liye, aapko candles aur unke developments ke fundamental ideas ka pata hona zaroori hai.Candles ek graphical portrayal hai jo stock ya cash ke cost development ko portray karta hai. Har candle ek time span (jaise 1 moment, 60 minutes, ya 1 racket) ko address karta hai aur ismein 4 costs hote hain: opening cost, shutting cost, most exorbitant cost (high), aur least value (low).Kuch normal candle designs hai jo brokers use karte hain, jaise "doji," "hammer," "hanging man," "falling star," "bullish overwhelming," aur "negative inundating." "Three Dark Crows" bhi ek well known negative example hai. Flame ki shutting cost pehli do candles ki shutting costs se kam honi chahiye.Is design ke samay stop-misfortune request ko rakhte tint, brokers ko apne risk the board ko bhi samajhna zaroori hai.Agar market mein high instability hai, to ye design kam dependable ho sakta hai, isliye dusri corroborative pointers ka istemal karna faydemand ho sakta hai.Three Dark Crows) ek prakritik candle design hai jo negative pattern ka sign deta hai. Lekin, is design ko akele istemal karne se pehle dusri specialized investigation instruments aur pointers ka istemal karke uski tasdeeq zaroor karni chahiye. Forex exchanging mein kam risk ke sath achhi tarah ki research aur investigation se greetings safalta milti hai. Chart Pattern Types: Candle designs forex exchanging mein kisi bhi resource ki cost development ko samajhne ke liye ahem tareeqe hote hain. In designs se merchants ko market ki development ko samajhne mein madad milti hai aur future cost forecasts banane mein asani hoti hai ek negative inversion design hota hai, jo aksar upturn ya sideways pattern ke baad dekha jata hai. Is design mein teesri flame do pehle ki negative candles ko follow karti hai.attern adolescent negative (descending) candles se milta hai, jo kuch is tarah hote hain Pehli candle ek upturn ya doji design ke baad dekhi jati hai.Dusri light pehli candle ki shutting cost se neeche khulti hai aur mazeed neeche jaati hai Teesri candle dusri candle ki shutting cost se neeche khulti hai aur phir mazeed neeche jaati hai.

Flame ki shutting cost pehli do candles ki shutting costs se kam honi chahiye.Is design ke samay stop-misfortune request ko rakhte tint, brokers ko apne risk the board ko bhi samajhna zaroori hai.Agar market mein high instability hai, to ye design kam dependable ho sakta hai, isliye dusri corroborative pointers ka istemal karna faydemand ho sakta hai.Three Dark Crows) ek prakritik candle design hai jo negative pattern ka sign deta hai. Lekin, is design ko akele istemal karne se pehle dusri specialized investigation instruments aur pointers ka istemal karke uski tasdeeq zaroor karni chahiye. Forex exchanging mein kam risk ke sath achhi tarah ki research aur investigation se greetings safalta milti hai. Chart Pattern Types: Candle designs forex exchanging mein kisi bhi resource ki cost development ko samajhne ke liye ahem tareeqe hote hain. In designs se merchants ko market ki development ko samajhne mein madad milti hai aur future cost forecasts banane mein asani hoti hai ek negative inversion design hota hai, jo aksar upturn ya sideways pattern ke baad dekha jata hai. Is design mein teesri flame do pehle ki negative candles ko follow karti hai.attern adolescent negative (descending) candles se milta hai, jo kuch is tarah hote hain Pehli candle ek upturn ya doji design ke baad dekhi jati hai.Dusri light pehli candle ki shutting cost se neeche khulti hai aur mazeed neeche jaati hai Teesri candle dusri candle ki shutting cost se neeche khulti hai aur phir mazeed neeche jaati hai.  Three dark crow design karta ha word or karta design ha flame design, karti ha jo jo up ki traf hota ha. A candle or open, high, low or close cost is definitely not a particular security. Punch stock ascents on the diagram, hoti flame or white or green ki hoti ha or bar cost hit ha mama, dark or red variety ki jo ke. The dark crow design comprises of three long candles or candles that open or close in the genuine body. Merchants additionally use pattern lines or specialized markers or outline designs instead of pattern affirmation. Joe is fundamentally a three raven example and tracks down a wild bear to switch the latest thing. Merchants use strength pointers, RSI and pattern markers individually. Three dark crows against three modest or shadowy ko dakhta hua kazi kartu ha or dangerous K. Three dark crow designs address three white knight examples or ka karta ha. Chart Trading: Three Dark Crows design ke signals ko approve karne ke liye, dealers ko dusre specialized markers aur apparatuses ka istemal karna hota hai. Kuch significant corroborative signs specialty diye gaye hain Backing level breaks aur opposition level breaks, design ke signals ko aur bhi dependable banata ha Moving midpoints ka use pattern aur pattern inversion ko distinguish karne mein kiya jata hai. Agar cost moving midpoints ko neeche se cross karta hai, to yeh negative sign hai.RSI overbought ya oversold region mein jane standard negative inversion signals give karta hai.Agar cost aur kisi wavering pointer, jaise ki MACD ya Stochastic, ke beech dissimilarity dikhta hai, to yeh negative inversion ka sign hota ha Three Dark Crows design ka istemal karke merchants ko kuch fawaid aur nuksan ho sakte hain

Three dark crow design karta ha word or karta design ha flame design, karti ha jo jo up ki traf hota ha. A candle or open, high, low or close cost is definitely not a particular security. Punch stock ascents on the diagram, hoti flame or white or green ki hoti ha or bar cost hit ha mama, dark or red variety ki jo ke. The dark crow design comprises of three long candles or candles that open or close in the genuine body. Merchants additionally use pattern lines or specialized markers or outline designs instead of pattern affirmation. Joe is fundamentally a three raven example and tracks down a wild bear to switch the latest thing. Merchants use strength pointers, RSI and pattern markers individually. Three dark crows against three modest or shadowy ko dakhta hua kazi kartu ha or dangerous K. Three dark crow designs address three white knight examples or ka karta ha. Chart Trading: Three Dark Crows design ke signals ko approve karne ke liye, dealers ko dusre specialized markers aur apparatuses ka istemal karna hota hai. Kuch significant corroborative signs specialty diye gaye hain Backing level breaks aur opposition level breaks, design ke signals ko aur bhi dependable banata ha Moving midpoints ka use pattern aur pattern inversion ko distinguish karne mein kiya jata hai. Agar cost moving midpoints ko neeche se cross karta hai, to yeh negative sign hai.RSI overbought ya oversold region mein jane standard negative inversion signals give karta hai.Agar cost aur kisi wavering pointer, jaise ki MACD ya Stochastic, ke beech dissimilarity dikhta hai, to yeh negative inversion ka sign hota ha Three Dark Crows design ka istemal karke merchants ko kuch fawaid aur nuksan ho sakte hain

-

#3 Collapse

Bullish Harami Candle Example Bullish Harami candle design fundamental dosre noise ki flame past racket ki light k genuine body principal open ho kar ussi k same genuine body primary close hoti hai. Bullish harami candle design do candles standard mushtamil hota hai, jiss primary pehli light aik negative flame hoti hai, poke k dosre clamor ki candle aik little genuine body wali bullish candle hoti hai. Design ki dosre clamor ki bullish flame pehli noise ki negative light k andar immerse hoti hai, yanni negative candle negative candle k high aur low k inside principal open aur close hoti hai. Design ki bullish candle negative light se size fundamental kam hoti hai, jo k market principal current negative pattern ka khatema karti hai. Candles Arrangement Bullish harami candle design fundamental shamil candles negative aur bullish example ki hoti hai, jo k costs k bullish pattern inversion k leye istemal hota hai. Design ki dosri flame pehli candle k andar banti hai, jiss se pehli candle dosri light ko overwhelm karti hai. Design fundamental shamil candles ki arrangement darjazzel tarah se hoti hai Bullish harami candle design ki pehli flame market k latest thing k mutabiq aik negative pattern hoti hai, jiss ka close cost open cost k se ooper hota hai. Negative candle shadow samet ya uss k bagher ho sakti hai, jo k genuine body principal hoti hai. Explaination Bullish harami candle design cost diagram standard uss waqat banti hai, poke bhi venders market principal dilchaspi lena kam kar dete hen. Ye design costs k base standard ya negative pattern fundamental boycott kar market ka pattern bullish inversion bana deta hai. Design primary shamil dono candles genuine body principal honi chaheye, jiss fundamental dosri light pehli flame se size primary kam honi chaheye. Design ki banne ki brain research kuch iss tarah se hai, jiss principal venders ki costs k base primary mazeed dilchaspi nahi rehti hai, aur ussi waqat purchasers market fundamental ziada dynamic ho jate hen. Baaz dafa ye design areas of strength for koi discharge sharpen k baad costs k base primary banta hai. Bullish harami candle design exchanging k leye aik solid bullish sign deta hai, jiss se purchasers market primary passage karte hen. Design ki k baad aik bullish affirmation light ka hona zarori hai, jo k genuine body principal honne k sath dosri candle k top standard close honi chaheye. Lekin negative candle banne ki sorat primary exchange entre karne se parhez karen. Pattern affirmation CCI, RSI pointer aur stochastic oscillator se bhi ki ja sakti hai, jiss standard worth oversold zone primary honi chaheye. Design do candles ka hota hai, iss waja se stop misfortune ka istemal zarori hai. Stop Misfortune design k sab se lower position ya dosri candle k open cost se two pips beneath set karen. -

#4 Collapse

Foreboding shadow Candle Example dear individuals jaisa ki aap jante Hain k candle patteren takneeki tijarat mein ahem apparatuses hain. un ko samjhna taajiron ko market ke mumkina rujhanaat ki tashreeh karne aur un qiyasaat se faislay karne ki ijazat deta hai. candle patteren ki mukhtalif kismain hain. In mein sy Foreboding shadow cover candle design ko examine moles hens. What is a foreboding shadow? Foreboding shadow aik negative inversion light example hai jahan aik neechay candle ( aam peak standard siyah ya surkh ) before flame ( aam pinnacle standard safaid ya sabz ) ke oopar khulti hai aur phir oopar candle ke wast point ke neechay band hojati hai.pattern ahem hai kyunkay yeh raftaar mein ulta se neechay ki taraf tabdeeli ko zahir karta hai. design oopar ki mother batii se banaya gaya hai jis ke baad neechay light hai. tajir agli ( teesri ) mother batii standard qeemat kam karne ke liye dekhte hain. Isay tasdeeq kehte hain Figuring out Foreboding shadows: Foreboding shadow design mein aik barri kaali mother batii shaamil hoti hai jo pehlay wali mother batii standard "foreboding shadow" banati hai. negative inundating design ki terhan, khredar khulay mein qeemat ko ouncha dhakel dete hain, lekin baichnay walay baad mein meeting mein qabza kar letay hain aur qeemat ko taizi se kam kar dete hain. khareed se farokht ki taraf yeh tabdeeli je baat ki taraf ishara karti hai ke qeematon mein kami anay wali ho sakti hai.ziyada tar brokers foreboding shadow cover design ko sirf is soorat mein mufeed samajte hain hit yeh oopar to me standard ke rujmoi izafay ke baad hota hai jaisay qeematein barhti hain, design neechay ki taraf mumkina iqdaam ko nishaan zad karne ke liye ziyada ahem ho jata hai. agar qeemat ka amal individualized organization hwa hai to design kam ahem hai kyunkay design ke baad qeemat ke katay rehne ka imkaan hai. Foreboding shadow Cover Candle Example aik kesam ka candle design hota hello jo forex market kay negative pehlo kay mumkana inversion janay ko recognize karta hello or es kay awful aik red candle hote hello jo keh pechle green candle kay mid point say nechay close honay say pehle high ko distinguish karte hello The example of foreboding shadows ko labyrinth safaid aur siyah mother btyon ki taraf se khasusiyat di jati hai jin ke asli jism lambay hotay hain aur siyam mukhtasir ya ghair mojood saaye hotay hain. yeh Awsaf batatay hain ke qeemat ki naqal o harkat ke lehaaz se nichala iqdaam intehai faisla kun aur ahem tha. brokers design ke baad bear candle ki soorat mein tasdeeq bhi talaash kar satke hain. foreboding shadows ke baad qeemat mein kami ki tawaqqa hai, lehaza agar aisa nahi hota hai to design nakaam ho sakta hai. -

#5 Collapse

Forex mama crisscross example umeeed karti ho k sab thek hongy forex exchanging fundamental best learning k sath kaaam kar rahy hongy forex exchanging ki learning serious areas of strength for ko forex exchanging principal learning solid nhe hoti hain tu enormous misfortune ho jata hain misfortune ko recuperate karne k liye difficult work krna must hota hain jisne learning k sath kaam kiya pratice ki vo kamyab hojate hain forex exchanging areas of strength for primary krna must hota hain agar learning nhe hain tu misfortune ho jata hain forex principal best learning kare customary pratice kare agar hardwork nhe hain tu misfortune ho jata hain forex ki learning major areas of strength for ko agar difficult work nhe hain tu misfortune hojata hain forex ki pratice kare examination kare agar investigation nhe hain tu misfortune ho jata hain Step by step instructions to exchange on crisscross example: forex exchanging primary learning areas of strength for ko must hota hain jaaab tak learning solid nhe hoti hain tu misfortune ho jata hain forex ki learning areas of strength for ko forex exchanging fundamental best learning kare hardwork nhe ki jati hain tu large misfortune ho jata hain forex ki learning ko achi tara samjhy forex principal best learning nhe hain tu misfortune ho jatahain demo account principal apni learning areas of strength for ko forex exchanging ki learning nhe hain tu har individual ko misfortune hota hain misfortune ko recuperate karne k liye pratice karna must hain agarlearning nhe hain tu huge misfortune hain misfortune and benefit forex exchanging ka hissa hain forex primary learning kare difficult work k sath kaam kare normal pratice kare forex primary jaaab tak learning solid and hardwork nhe hoti hain tu enormous misfortune ho skta hain forex ki move ko samjhna parta hain achi tara examination kare Crisscross example mein dealers swing highs aur swing lows ko dhundhte hain. Swing highs, cost outline standard woh focuses hote hain jahan cost transitory vertical development karta hai aur phir descending bearing mein change karta hai. Swing lows, cost outline standard woh focuses hote hain jahan cost transitory descending development karta hai aur phir up heading mein change karta hai. -

#6 Collapse

Bullish Get-together Line Light Pattren. forex exchanging fundamental kabi kuch learning karna parta hain qk jaaaab tak learning nhe hoti hain tu kamyabi nhe mil skti hain agar forex exchanging vital problematic work ki need hain forex exchanging serious strong regions for head karna parta hain forex exchanging focal jaaab tak solid learning nhe ki jati hain tu getting kabi b nhe mil skti hain agar forex exchanging fundamental jaaab tak irksome work k sath kaaam nhe hota hain tu kamyabi b nhe mil skti hain forex exchanging chief learning karna must hain forex exchanging key learning critical strong regions for ko parta hain jaaab tak learning solid nhe hain tu getting nhe ki jah skti hain learning serious strong regions for ko parta hain learning jaaab tak learning nhe hain tu acquiring k koi chance nhe hote hain obtaining karne k liye inconvenient work ki neeed hoti hain Bullish get-together line in forex exchanging,,,, forex exchanging strong regions for fundamental karna parta hain jaaab tak solid learning nhe hoti hai tu kabi b kamyabi nhe mil skti hain learning serious strong regions for ko parta hain forex exchanging kafi risk wala busniess hain learning strong regions for ko parta hain inconvenient work karna parta hain forex exchanging head problematic work k sath kaaam karne edge exchanging ko kabi b kamybi nhe mil skti hain forex exchanging critical irksome work ki neeed hain learning karna parta hain forex exchanging huge strong regions for focal ki need hain jaaaab tak learning k sath kaaam nhe hota hain tu getting kabi b nhe mil skti hain learning and inconvenient work karna must hain forex exchanging strong regions for fundamental ka must hai forex exchanging fundamental inconvenient work karna must hain forex exchanging strong regions for major musthain Exchanging Harami 24 ghantay ki forex market ke muqablay stock graph standard mukhtalif nazar aaye ga, lekin patteren ki shanakht ke liye wohi hikmat e amli laago hoti hai. become flushed harami really look at list : mojooda kami ka rujhan talaash karen. un ishaaron ki talaash karen jo raftaar sust ho rahi hai/ulat rahi hai become flushed moving normal get over, ya baad mein become flushed light farmishnz ). Iss baat ko yakeeni banayen ke choti sabz mother batii ki body pichli negative flame ke 25 % se ziyada nah ho. pichli mother batii ke wast mein sabz mother batii dikhata tint, stock mein farq ho jaye ga. forex diagrams ziyada tar dono mother batian sath deikhein ge. Mushahida karen ke poori become flushed flame pichli negative light ki body ki lambai ke andar band hai. Muawin isharay ya muawnat ki kaleedi sthon ke istemal ke sath sangam talaash karen. forex market mein become flushed harami patteren ki tashkeel forex market 24/5 ki bunyaad standard kaam karti hai jis ka hon matlab hai ke poke aik flame band hoti hai to doosri taqreeban pichli light ki band honay wali qeemat ki isi satah standard khulti hai. yeh aksar market ke aam halaat mein dekha jata hai lekin ziyada utaar charhao ke douran badal sakta hai. choti sabz mother batii isi satah standard khulti hai jis standard pehlay ki negative candle band hui thi. yeh aam pinnacle standard forex market mein dekha jata hai. stock diagrams standard blush harami patteren ki tashkeel doosri taraf astaks ne racket ke douran tijarat ke auqaat mutayyan kiye hain aur kayi wajohaat ki binaa standard khulay waqt mein farq ke liye jana jata hai. un mein se kuch yeh ho satke hain : organization ki khabrain tijarat ke band honay ke baad jari ki gayeen. malik/area iqtisadi information afwaah take over buliyan ya Inzimam aam market ka jazba. -

#7 Collapse

Bullish Harami Candle In contrast, patteren's shanakht ke liye wohi hikmat e amli laago hoti hai, Harami 24 ghantay ki forex market ke muqablay stock graph standard mukhtalif nazar aaye ga. Flushed Harami seriously consider the list: rujhan talaash karen mojooda kami. Unishaaron ki talaash karen jo raftaar sust ho rahi hai/ulat rahi hai flush moving normally get over, or ya baad mein flush light farmishnz). Mother's body has a negative flame in it that is 25% more intense than normal, according to this baat's yakeeni banayen ke choti. Stock mein farq ho jaye ga, pichli mother batii ke wast mein sabz mother batii dikhata tint. Ziyada tar dono mama batian sath deikhein ge in forex diagrams. Mushahida karen ke poori grow flushed, and there is a belt of dark energy around the body and the lamb. The kaleedi sthon ke istemal ke sath sangam talaash karen muawin isharay ya muawnat. To doosri taqreeban pichli light ki band honay wali qeemat ki isi satah standard khulti hai, forex market mein become flooded harami patteren ki tashkeel forex market 24/5 ki bunyaad standard kaam karti hai. When compared to ziyada utaar charhao ke douran badal sakta hai, yeh aksar market ke aam halaat mein dekha jata hai. mama batii choti sabz isi satah standard khulti hai jis standard pehlay ki negative candle band hui thi. Yes, the Pinnacle Standard Forex Market is open for business. Racket ke douran tijarat ke auqaat mutayyan kiye hain and kayi wajohaat ki binaa standard khulay waqt mein farq ke liye jana jata hai are examples of stock diagrams standard blush. Organization ki khabrain tijarat ke band honay ke baad jari ki gayeen, un mein se kuch yeh ho satke hain. Buliyan ya Inzimam aam market ka jazba is taken over by malik/area iqtisadi information, or afwaah. Bullish Harami Candle Example Fundamentals of the bullish Harami candle design include noise, flame, previous racket, and light with the real body main open and closure, respectively. Poke k dosre uproar ki candle aik tiny genuine body wali bullish candle hoti hai, jiss main pehli light aik negative flame hoti hai, and bullish harami candle design do candles standard mushtamil hota hai. Negative candle negative candle k high aur low k inner principle open aur close hoti hai, design ki dosre clamor ki bullish flame pehli noise ki negative light k andar immerse hoti hai. Market fundamental current negative pattern ka khatema karti hai, design ki bullish candle negative light se size fundamental kam hoti hai.

Bullish Harami Candle Example Fundamentals of the bullish Harami candle design include noise, flame, previous racket, and light with the real body main open and closure, respectively. Poke k dosre uproar ki candle aik tiny genuine body wali bullish candle hoti hai, jiss main pehli light aik negative flame hoti hai, and bullish harami candle design do candles standard mushtamil hota hai. Negative candle negative candle k high aur low k inner principle open aur close hoti hai, design ki dosre clamor ki bullish flame pehli noise ki negative light k andar immerse hoti hai. Market fundamental current negative pattern ka khatema karti hai, design ki bullish candle negative light se size fundamental kam hoti hai. Chart Pattern Types: Candle design exchange rates mein kisi bhi resource ki cost development ke liye ahem tareeqe hote hain. Future cost projections banane mein asani hoti hai, in designs se merchants ko market ki development ko samajhne mein madad milti hai. Aside from sideways and upward patterns, a negative inversion design is also present. The negative candles in the pattern follow the teesri flame exactly.Teenage negative (descending) candles are present at this time, and the candle is hot. Ek upturn ya doji design ke baad dekhi jati hai pehli candles.Dusri light pehli candle ki closing cost se neeche khulti hai, as well as mazeed neeche jaati hai The closing cost for Teesri candles and Dusri candles is zero, and phir mazeed is also nothing.Word or karta design in the form of three dark crows design with a flame, jo jo up ki traf hota ha. Undoubtedly, a candle or an open, high, low, or closing cost is not a specific security. On the diagram, the punch stock rises, hoti flame, white, green, or bar cost hit ha mama, dark or red variety ki jo ke. Three lengthy candles or candles that open or shut in the actual body make up the dark crow motif. Additionally, retailers substitute outline drawings or pattern lines for pattern affirmation. Joe, who essentially embodies the three ravens, hunts down a bear in the woods to spice things up. Individual strength points, RSI, and pattern markers are used by merchants. Three shadows or subdued Ks or menacing Ks are up against three dark crows. Three white knight instances, or ka karta ha, are addressed by three black crow patterns.

Chart Pattern Types: Candle design exchange rates mein kisi bhi resource ki cost development ke liye ahem tareeqe hote hain. Future cost projections banane mein asani hoti hai, in designs se merchants ko market ki development ko samajhne mein madad milti hai. Aside from sideways and upward patterns, a negative inversion design is also present. The negative candles in the pattern follow the teesri flame exactly.Teenage negative (descending) candles are present at this time, and the candle is hot. Ek upturn ya doji design ke baad dekhi jati hai pehli candles.Dusri light pehli candle ki closing cost se neeche khulti hai, as well as mazeed neeche jaati hai The closing cost for Teesri candles and Dusri candles is zero, and phir mazeed is also nothing.Word or karta design in the form of three dark crows design with a flame, jo jo up ki traf hota ha. Undoubtedly, a candle or an open, high, low, or closing cost is not a specific security. On the diagram, the punch stock rises, hoti flame, white, green, or bar cost hit ha mama, dark or red variety ki jo ke. Three lengthy candles or candles that open or shut in the actual body make up the dark crow motif. Additionally, retailers substitute outline drawings or pattern lines for pattern affirmation. Joe, who essentially embodies the three ravens, hunts down a bear in the woods to spice things up. Individual strength points, RSI, and pattern markers are used by merchants. Three shadows or subdued Ks or menacing Ks are up against three dark crows. Three white knight instances, or ka karta ha, are addressed by three black crow patterns.

-

#8 Collapse

what is chart pattern?. Yeh design punch cost graph standard dikhai deta hai to yeh brokers ke liye ek significant sign hai ki market mein descending development shuru ho gaya hai aur iska matlab hai ke stock ya money ki keemat kam sharpen ki sambhavna hai. "Three Dark Crows" design ko samajhne ke liye, aapko candles aur unke developments ke fundamental ideas ka pata hona zaroori hai.Candles ek graphical portrayal hai jo stock ya cash ke cost development ko portray karta hai. Har candle ek time span (jaise 1 moment, 60 minutes, ya 1 racket) ko address karta hai aur ismein 4 costs hote hain: opening cost, shutting cost, most exorbitant cost (high), aur least value (low).Kuch normal candle designs ha. TYPES : 1.) Get-together Line Light PATRENagar forex exchanging vital problematic work ki need hain forex exchanging serious strong regions for head karna parta hain forex exchanging focal jaaab tak solid learning nhe ki jati hain tu getting kabi b nhe mil skti hain agar forex exchanging fundamental jaaab tak irksome work k sath kaaam nhe hota hain tu kamyabi b nhe mil skti hain forex exchanging chief learning karna must hain forex exchanging key learning critical strong regions for ko parta hain jaaab tak learning solid nhe hain tu getting nhe ki jah skti hain learning serious strong regions for ko parta hain Pattren. learning jaaab tak learning nhe hain tu acquiring k koi chance nhe hote hain obtaining karne k liye inconvenient work ki neeed hoti hain. In designs se merchants ko market ki development ko samajhne mein madad milti hai aur future cost forecasts banane mein asani hoti hai ek negative inversion design hota hai, jo aksar upturn ya sideways pattern ke baad dekha jata hai. Is design mein teesri flame do pehle ki negative candles ko follow karti hai.attern adolescent negative (descending) candles se milta hai, jo kuch is tarah hote hain Pehli candle ek upturn ya doji design ke baad dekhi jati hai.Dusri light pehli candle ki shutting cost se neeche khulti hai aur mazeed neeche jaati hai Teesri candle dusri candle ki shutting cost

In designs se merchants ko market ki development ko samajhne mein madad milti hai aur future cost forecasts banane mein asani hoti hai ek negative inversion design hota hai, jo aksar upturn ya sideways pattern ke baad dekha jata hai. Is design mein teesri flame do pehle ki negative candles ko follow karti hai.attern adolescent negative (descending) candles se milta hai, jo kuch is tarah hote hain Pehli candle ek upturn ya doji design ke baad dekhi jati hai.Dusri light pehli candle ki shutting cost se neeche khulti hai aur mazeed neeche jaati hai Teesri candle dusri candle ki shutting cost  THANK YOU SO MUCH EVERY ONE

THANK YOU SO MUCH EVERY ONE

-

#9 Collapse

Turn Point kia hota hai Turn point aesa point hota hai jis ky across market development kerti hai kabhi turn point sy market up development kerti hai tou kabhi turn point sy down development kerti hai lehaza agar ham turn point ko compute ker lety hain tou phir hit market turn point ko cross ker ky descending ya up development ker jati hai tou phir ham invert course fundamental exchange open ker sakty hain ky market over and over same turn point ko cross kerti hai so hit aik taraf ko development ho jati hai tou phir market switch ho ker turn point ko cross kerty huey other heading principal bhi zarur development kerti hai jo hamary pas exchange open kerny ka most obvious opportunity hota hai ky ham exchange open ker ky benefit hasil ker sakty hain Turn Point Estimation Equation Greatest brokers forex market primary turn point per exchange kerty hain kyun ky turn point aik aesi exchanging procedure hai ky agar merchants simply turn point ko follow keryt huey exchange kerty rehain tou benefit bhi hasil hota rehta hai so bahot zaruri hai ky her exchange open kerny sy pehly market ki development per turn point ko find ker lia jaey ky jis ky liay hamain pata hona chahiay ky turn point kia hota hai aur isko kis terha sy ascertain kia jata hai so turn point ko compute kerny ka tareeqa following fundamental talk about kerty hain Punch market turn point ko cross ker ky support level per ponch jaey tou wahan per market fundamental purchase primary exchange enter ker leni chahiay lekin sath principal apni open ki jany wali exchange ko secure kerna bhi zaruri hota hai ky agar same help ko market break kerti bhi hai tou bara misfortune na ho isi terha agar market turn point ko cross ker ky obstruction level per ponch chuki ho tou wahan sy sell fundamental exchange open ki ja sakti hai ky market agar opposition sy switch hoti hai tou aesy time per benefit hasil ho sakta hai lekin breakout per stop misfortune set kerna bhi bahot zaruri hai warna account wash bhi ho sakata hai so agar ham turn point ko mind fundamental rakhty huey forex market fundamental exchange enter ker ky proceed kerty hain tou hamari exchange fruitful ho sakti hai -

#10 Collapse

Bullish Harami Candle Model Bullish Harami candle plan major dosre commotion ki fire past racket ki light k authentic body chief open ho kar ussi k same certifiable body essential close hoti hai. Bullish harami candle configuration do candles standard mushtamil hota hai, jiss essential pehli light aik negative fire hoti hai, jab k dosre fuss ki candle aik minimal veritable body wali bullish flame hoti hai. Plan ki dosre fuss ki bullish fire pehli clamor ki negative light k andar drench hoti hai, yanni negative candle negative flame k high aur low k inside chief open aur close hoti hai. Plan ki bullish flame negative light se size key kam hoti hai, jo k market head current negative example ka khatema karti hai.Candles Plan Bullish harami candle plan basic shamil candles negative aur bullish model ki hoti hai, jo k costs k bullish example reversal k leye istemal hota hai. Plan ki dosri fire pehli candle k andar banti hai, jiss se pehli candle dosri light ko overpower karti hai. Plan key shamil candles ki course of action darjazzel tarah se hoti hai Bullish harami light plan ki pehli fire market k most recent thing k mutabiq aik negative example hoti hai, jiss ka close expense open expense k se ooper hota hai. Negative candle shadow samet ya uss k bagher ho sakti hai, jo k certified body head hoti hai.

Explaination Bullish harami candle configuration cost chart standard uss waqat banti hai, jab bhi sellers market head dilchaspi lena kam kar dete hen. Ye configuration costs k base standard ya negative example crucial blacklist kar market ka design bullish reversal bana deta hai. Plan essential shamil dono candles veritable body head honi chaheye, jiss major dosri light pehli fire se size essential kam honi chaheye. Plan ki banne ki cerebrum research kuch iss tarah se hai, jiss head merchants ki costs k base essential mazeed dilchaspi nahi rehti hai, aur ussi waqat buyers market crucial ziada dynamic ho jate hen. Baaz dafa ye plan solid areas for koi release hone k baad costs k base essential banta hai.

Explaination Bullish harami candle configuration cost chart standard uss waqat banti hai, jab bhi sellers market head dilchaspi lena kam kar dete hen. Ye configuration costs k base standard ya negative example crucial blacklist kar market ka design bullish reversal bana deta hai. Plan essential shamil dono candles veritable body head honi chaheye, jiss major dosri light pehli fire se size essential kam honi chaheye. Plan ki banne ki cerebrum research kuch iss tarah se hai, jiss head merchants ki costs k base essential mazeed dilchaspi nahi rehti hai, aur ussi waqat buyers market crucial ziada dynamic ho jate hen. Baaz dafa ye plan solid areas for koi release hone k baad costs k base essential banta hai. Bullish harami candle configuration trading k leye aik strong bullish sign deta hai, jiss se buyers market essential entry karte hen. Plan ki k baad aik bullish assertion light ka hona zarori hai, jo k certifiable body head honne k sath dosri candle k top standard close honi chaheye. Lekin negative flame banne ki sorat essential trade entre karne se parhez karen. Design attestation CCI, RSI pointer aur stochastic oscillator se bhi ki ja sakti hai, jiss standard worth oversold zone essential honi chaheye. Configuration do candles ka hota hai, iss waja se stop mishap ka istemal zarori hai. Stop Mishap plan k sab se lower position ya dosri candle k open expense se two pips underneath set karen.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#11 Collapse

Flame ki shutting cost pehli do candles ki shutting costs se kam honi chahiye.Is design ke samay stop-misfortune request ko rakhte tint, brokers ko apne risk the board ko bhi samajhna zaroori hai.Agar market mein high instability hai, to ye design kam dependable ho sakta hai, isliye dusri corroborative pointers ka istemal karna faydemand ho sakta hai.Three Dark Crows) ek prakritik candle design hai jo negative pattern ka sign deta hai. Lekin, is design ko akele istemal karne se pehle dusri specialized investigation instruments aur pointers ka istemal karke uski tasdeeq zaroor karni chahiye. Forex exchanging mein kam risk ke sath achhi tarah ki research aur investigation se greetings safalta milti hai. Chart Pattern Types: Candle designs forex exchanging mein kisi bhi resource ki cost development ko samajhne ke liye ahem tareeqe hote hain. In designs se merchants ko market ki development ko samajhne mein madad milti hai aur future cost forecasts banane mein asani hoti hai ek negative inversion design hota hai, jo aksar upturn ya sideways pattern ke baad dekha jata hai. Is design mein teesri flame do pehle ki negative candles ko follow karti hai.attern adolescent negative (descending) candles se milta hai, jo kuch is tarah hote hain Pehli candle ek upturn ya doji design ke baad dekhi jati hai.Dusri light pehli can

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 09:11 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим