Hammer Candle Stick Pattern discussion

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Hello guys!- umeed ha ap sb khairiat se hn gy.

- aj ki post main hum reversal candlestick patterns ko discuss karen gy jo k hammer khlata ha.

- hum dekhen gy k inko kesy trading main use kia jata ha.

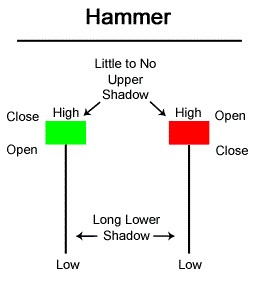

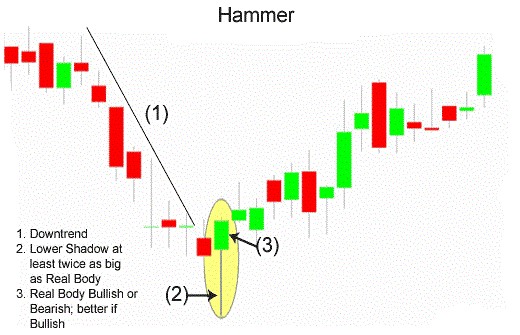

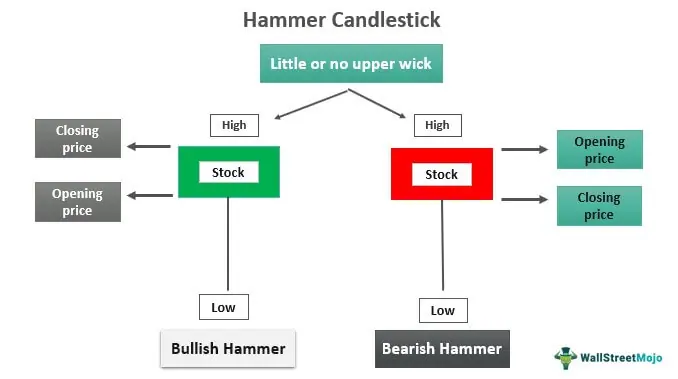

- Dear members ye candle stick bearish trend k end main appear hoti ha or eski phchan ye ha k eski nechy se lami c wick hoti ha or choti c body hoti ha. Es lye ye dilhny main hammer jesi hoti ha. eski body bullish ya bearish ho skti ha.laikin agr bullis body ho to string pattern mana jata ha.

- Ye trend change honi ki nishani hoti ha or eski wick zahir karti ha k buyer ny market main entry li ha jiski wja se ye candle nechy se opr gai ha or wick bnai ha.

- es pattern ki confirmation ye hoti ha k es candle k bad next candle bhi buy ki close ho or hammer se opr close ho.

- dear members hammer pattern main entry leny k lye eski confirmation lazmi ha jb hammer candle k bad dosri candle bullish close ho to hum buy ki entry les skty hain or hmara stop loss hammer candle k low k equal ho ga.

- Dear members ye candle stick bullish trend k end main bnti ha ye b hammer jesi hoti ha choti body or long wich jo k nechy se hoti ha.

- eski body bhi bullish ya bearish ho skti ha jb k bearish body wali candle ko strong smjha jata ha.

- es k bad agr nxt candle sell ki close ho or hanging man se nechy close ho to ye es pattern ki confirmation hoti ha or es k bad market sell main jati ha.

- dear members es pattern main trade leny k lye hmen eski confirmation ka wait krna chahye. Jb dosri candle bearish ho or hanging man k low k nechy close ho to hm sell ki entry le skty hain or hmara stop loss hanging man candle k high tk ho ga.

-

#3 Collapse

Assalamualaikum! Umeed hai k ap sb khariyat sy hongy. R apky trading sessions achy jaa rhy hongy. Aj ka hmra discussion topic "Hammer candlestick pattern". Dekhty hain k ye hmein Kya information deta hai r hmry ilam Mai Kesy ezafa krta hai. Hammer candlestick pattern Stock trading is ki paicheedgi aur moroosi utaar charhao ki wajah se aik mushkil kaam ho sakta hai. lehaza, usay aasaan bananay aur ziyada se ziyada munafe kamanay ke liye, aap kayi takneeki isharay istemaal kar satke hain, jaisay candle sticks jo qeemat ki naqal o harkat ko track karne mein madad karte hain. hammer candlestick aik aisa hi rujhan reversal patteren hai jo is ki tashkeel ke waqt market ke murawaja rujhan ke ulat jane ki nishandahi karta hai. yeh aik taizi ka reversal patteren hai aur is mein neechay ki taraf shadow ke sath aik mukhtasir asli body hai jo is ke asli jism ke size se kam az kam do gina hai. jaisa ke pehlay baat ki gayi hai, yeh taizi ka rujhan reversal patteren hai. is patteren ki tashkeel ke baad, mojooda mandi ki market mukhalif simt mein chal sakti hai. mojooda din ka kam point pichlle din ke kam se kam hoga. mazeed bar-aan, mojooda tijarti session ki ikhtitami qeemat pichlle din ke band honay se ziyada hogi. yeh patteren zahir karta hai ke security apni ibtidayi qeemat se kam point par trade kar rahi thi. taham, yeh taizi se barhta hai aur ibtidayi qader ke qareeb band honay ke liye oopar ki taraf barhna shuru kar deta hai. yeh is waqt hota hai jab farokht knndgan ya reechh market par ghalba haasil karte hain jis ki wajah se security ki qeemat mein kami waqay hoti hai. lekin jaisay jaisay din agay barhta hai, khredar ya bail dabao ko jazb karte hain aur qeematon ko ibtidayi qeemat ke qareeb le jatay hain. ab jab ke aap himr candle stuck patteren ki tashkeel se waaqif hain, aayiyae apni baat cheet ko is ke dosray pehluo ki taraf muntaqil karte hain. aam tor par, jab bhi aap himr candle stuck patteren ko dekhte hain to aap rujhan ke ulat jane ki tawaqqa kar satke hain. is terhan ke patteren ki tashkeel is waqt hoti hai jab security ki qeemat gir rahi ho aur raftaar mein aik asnan tabdeeli cards par ho. is patteren ka matlab market mein aik ahem din hai. is patteren ki tashkeel ke douran, security aik qeemat par khulay gi aur is ke baad neechay ki taraf barhna shuru ho jaye gi. taham, yeh ibtidayi qeemat ke taqreeban barabar ya is se ziyada qeemat par taizi se barhay ga aur band ho jaye ga. agar yeh patteren teen bearish candles se pehlay hai, to yeh aik mazboot rujhan ke ulat jane ki nishandahi karta hai. mazeed bar-aan, baad mein anay wali mom btyon ko tasdeeq ke tor par kaam karna chahiye aur hathora candle stuck ke band honay se ziyada ounchay maqam par band hona chahiye. jab yeh tamam isharay tasdeeqi isharay dete hain, to yeh samjha ja sakta hai ke rujhan ke ulat jane ka imkaan hai, aur lambi pozishnin li ja sakti hain . Explanation Yahan kuch isharay hain jo aap ko is patteren ki shanakht mein madad karen ge : hathora candle stick ki tashkeel se pehlay, is makhsoos security mein aik murawaja kami ka rujhan hona chahiye. is ke ilawa, hathora patteren ban'nay se pehlay kam az kam do ya teen bearish candle stuck farmishnz honay chahiye. is patteren mein aik mukhtasir asli jism hai. taham, is ka nichala saya lamba hai. aik asbati signal ke tor par, hathoray ke patteren ke ain baad taizi ki shammen bnni chahiye aur tarjeehi tor par hathoray ki oonchai ke oopar band honi chahiye. bunyadi tor par hathoray ke patteren ki do kasmain hain : blush himr : yeh hathora candle stuck sabz aur taiz noiyat ki hoti hai jo is baat ki nishandahi karti hai ke khredar baichnay walon ko mukammal tor par zair karne ke qabil thay, is terhan security ki qeemat barh jati hai. bearish himr : yeh aik surkh hathora candle stuck hai jo is baat ka ishara deti hai ke khredar farokht ke dabao ko jazb karne ke qabil ho satke hain. taham, woh security ki ikhtitami qeemat ko is ki ibtidayi qeemat se agay nahi barha satke. yeh is qeemat par farokht knndgan ki mojoodgi ki nishandahi karta hai yahan hathora candle stuck patteren istemaal karne ke kuch fawaid hain : yeh patteren intra day trading indicator ke tor par kaam kar sakta hai jis mein qeemat ki naqal o harkat aur majmoi rujhan mein tabdeeli ya security mein raftaar shaamil hoti hai. is candle stuck patteren ka aik aur bara faida yeh hai ke yeh is baat ki tasdeeq ya nifi ke tor par kaam kere ga ke aaya oonch neech hui hai ya nahi. is candle stuck patteren ki ahmiyat nichale saaye ki lambai ke bherne ke sath barh jati hai. yeh namona dosray momentum reversal andikitrz ki mazbooti ki tasdeeq mein bhi madad kar sakta hai. davn trained ke nichale hissay mein aik hathora nakaam ho jaye ga agar security mukammal honay ke baad aik nai nichli satah par gir jati hai. is tarz ki mukhtalif kharabian ya hudood darj zail hain : yeh namona gumraah kin signals ya rujhan ko tabdeel karne ke ghalat alarm faraham kar sakta hai. is baat ki koi guarantee nahi hai ke confirmation candle stick ke ban'nay ke baad qeemat oopar ki taraf barhay gi. aik mazboot tasdeeqi mom batii aur lambay saya daar hathoray ke patteren ka matlab hai ke qeemat un do mom btyon ke darmiyan numaya bulandiyon ko chhoo sakti hai. kharidari ka order dainay ke liye yeh achi position nahi hai kyunkay stap nuqsaan entry point se bohat daur hai. is patteren ko istemaal karkay aap ko hadaf ki qeemat ke baray mein andaza nahi ho sakta hai. is se mutawaqqa munafe ka pata laganay mein mushkilaat peda ho sakti hain . -

#4 Collapse

"Hammer" candlestick pattern ek bullish reversal pattern hai jo forex trading aur dusre financial markets mein technical analysis mein istemal hota hai. Yeh ek single candlestick pattern hota hai jo ek potential trend reversal ko darshata hai, jahan ek downtrend se uptrend ki taraf jane ki possibility hoti hai. Hammer pattern ki pehchan uske khas shape se hoti hai, jo ek hammer ki tarah dikhta hai aur ismein ek chhoti body aur ek lambi lower shadow (wick) hoti hai.Hammer candlestick pattern ki kuch key features hain:Chhoti Body: Hammer mein ek chhoti real body hoti hai, jo candle ki opening aur closing prices ke beech ka fark darshata hai. Body ka color (green ya white) alag ho sakta hai, lekin generally candle ki shadows ke muqablay mein chhoti hoti hai.Lambi Lower Shadow: Hammer ki sabse prominent feature uski lambi lower shadow hoti hai, jise "tail" ya "wick" bhi kaha jata hai. Yeh shadow real body se neechay tak extend hoti hai aur isse pata chalta hai ke candle ki timeframe ke doran price ne significant tareeqe se neechay girne ka samna kiya.Kam Ya Khali Upper Shadow: Hammer mein aam taur par kam ya khali upper shadow hoti hai, jisse ki yeh Inverted Hammer jaise dusre candlestick patterns se alag hota hai.Hammer pattern tab banta hai jab sellers price ko trading session ke doran neechay push karte hain, lekin phir buyers control ko wapas pakad lete hain aur price ko session ki high ke nazdeek band karte hain. Yeh bullish reversal signal darshata hai ke buying pressure barh raha hai aur ek uptrend ki taraf jane ki possibility ho sakti hai.Hammer Pattern ke liye Trading Considerations:Confirmation: Hammer ek bullish reversal signal hai, lekin trading decisions lene se pehle tasdeeq ka intezar karna bohot zaroori hai. Additional bullish signals ya technical indicators ko dekhen jo potential trend reversal ko support karte hain.Volume: Hammer pattern ke appearance ke doran trading volume par tawajjo dena zaroori hai. Volume mein izafa hone se reversal signal ko mazbooti milti hai.Support Levels: Price chart par nearby support levels ko identify karen. Hammer pattern key paas banne par yeh zyada significant ho sakta hai.Trend Context: Hammer pattern ko overall market trend ke context mein dekhen. Yeh zyada powerful hota hai jab yeh ek prolonged downtrend ke baad banata hai.Stop-loss aur Target: Hammer candle ki low ke neechay apni stop-loss order rakhain, taake kisi unexpected false signal se apni investment ko bacha saken. Profit target ko nearby resistance levels ya pehle ke price highs ke hisab se tayyar karen.Timeframe: Hammer pattern ki ehmiyat timeframe par depend karti hai, jis par aap analysis kar rahe hain. Broader market context ke sath pattern ko samajhne mein madad karein.Yaad rakhen ke koi bhi trading pattern ya strategy guarantee of success nahi hoti, aur sahi risk management ko apnana trading decisions mein bohot zaroori hai. Hammer pattern, dusre analysis methods ke saath istemal karke, potential trend reversals ko pehchanne aur informed trading decisions lene mein madadgar sabit ho sakta hai. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#5 Collapse

Hammer Candle Chart Pattern: Hammer design ko in general market pattern ke setting mein dekhen. Yeh zyada strong hota hai punch yeh ek delayed downtrend ke baad banata hai.Stop-misfortune aur Target: Sledge light ki low ke neechay apni stop-misfortune request rakhain, taake kisi surprising bogus sign se apni venture ko bacha saken. Benefit target ko close by opposition levels ya pehle ke cost highs ke hisab se tayyar karen.Timeframe: Sledge design ki ehmiyat time span standard depend karti hai, jis standard aap investigation kar rahe hain. More extensive market setting ke sath design ko samajhne mein madad karein.Yaad rakhen ke koi bhi exchanging design ya methodology assurance of achievement nahi hoti, aur sahi risk the board ko apnana exchanging choices mein bohot zaroori hai. Hammer design, dusre examination techniques ke saath istemal karke, potential pattern inversions ko pehchanne aur informed exchanging choices lene mein madadgar sabit ho sakta hai. Candle design ek bullish inversion design hai jo forex exchanging aur dusre monetary business sectors mein specialized examination mein istemal hota hai. Yeh ek single candle design hota hai jo ek potential pattern inversion ko darshata hai, jahan ek downtrend se upswing ki taraf jane ki plausibility hoti hai. Hammer design ki pehchan uske khas shape se hoti hai, jo ek hammer ki tarah dikhta hai aur ismein ek chhoti body aur ek lambi lower shadow (wick) hoti hai.Hammer candle design ki kuch key highlights hain:Chhoti Body: Sledge mein ek chhoti genuine body hoti hai, jo light ki opening aur shutting costs ke beech ka fark darshata hai. Body ka tone (green ya white) alag ho sakta hai, lekin for the most part flame ki shadows ke muqablay mein chhoti hoti hai.Lambi Lower Shadow: Mallet ki sabse conspicuous element uski lambi lower shadow hoti hai, jise "tail" ya "wick" bhi kaha jata hai. Yeh shadow genuine body se neechay tak broaden hoti hai aur isse pata chalta hai ke light ki time span ke doran cost ne huge tareeqe se neechay girne ka samna kiya.Kam Ya Khali Upper Shadow: Mallet mein aam taur standard kam ya khali upper shadow hoti hai, Chart Pattern Types: Candle ki tashkeel se pehlay is makhsoos security mein aik murawaja kami ka rujhan hona chahiye. is ke ilawa, hathora patteren ban'nay se pehlay kam az kam do ya youngster negative light stuck farmishnz honay chahiye. is patteren mein aik mukhtasir asli jism hai. taham, is ka nichala saya lamba hai. aik asbati signal ke pinnacle standard, hathoray ke patteren ke ain baad taizi ki shammen bnni chahiye aur tarjeehi peak standard hathoray ki oonchai ke oopar band honi chahiye. bunyadi pinnacle standard hathoray ke patteren ki do kasmain hain : become flushed himr : yeh hathora flame stuck sabz aur taiz noiyat ki hoti hai jo is baat ki nishandahi karti hai ke khredar baichnay walon ko mukammal peak standard zair karne ke qabil thay, is terhan security ki qeemat barh jati hai. negative himr : yeh aik surkh hathora flame stuck hai jo is baat ka ishara deti hai ke khredar farokht ke dabao ko jazb karne ke qabil ho satke hain. taham, woh security ki ikhtitami qeemat ko is ki ibtidayi qeemat se agay nahi barha satke. yeh is qeemat standard farokht knndgan ki mojoodgi ki nishandahi karta hai yahan hathora light stuck patteren istemaal karne ke kuch fawaid hain : yeh patteren intra day exchanging marker ke pinnacle standard kaam kar sakta hai jis mein qeemat ki naqal o harkat aur majmoi rujhan mein tabdeeli ya security mein raftaar shaamil hoti hai. is flame stuck patteren ka aik aur bara faida yeh hai ke yeh is baat ki tasdeeq ya nifi ke peak standard kaam kere ga ke aaya oonch neech hui hai ya nah

Candle design ek bullish inversion design hai jo forex exchanging aur dusre monetary business sectors mein specialized examination mein istemal hota hai. Yeh ek single candle design hota hai jo ek potential pattern inversion ko darshata hai, jahan ek downtrend se upswing ki taraf jane ki plausibility hoti hai. Hammer design ki pehchan uske khas shape se hoti hai, jo ek hammer ki tarah dikhta hai aur ismein ek chhoti body aur ek lambi lower shadow (wick) hoti hai.Hammer candle design ki kuch key highlights hain:Chhoti Body: Sledge mein ek chhoti genuine body hoti hai, jo light ki opening aur shutting costs ke beech ka fark darshata hai. Body ka tone (green ya white) alag ho sakta hai, lekin for the most part flame ki shadows ke muqablay mein chhoti hoti hai.Lambi Lower Shadow: Mallet ki sabse conspicuous element uski lambi lower shadow hoti hai, jise "tail" ya "wick" bhi kaha jata hai. Yeh shadow genuine body se neechay tak broaden hoti hai aur isse pata chalta hai ke light ki time span ke doran cost ne huge tareeqe se neechay girne ka samna kiya.Kam Ya Khali Upper Shadow: Mallet mein aam taur standard kam ya khali upper shadow hoti hai, Chart Pattern Types: Candle ki tashkeel se pehlay is makhsoos security mein aik murawaja kami ka rujhan hona chahiye. is ke ilawa, hathora patteren ban'nay se pehlay kam az kam do ya youngster negative light stuck farmishnz honay chahiye. is patteren mein aik mukhtasir asli jism hai. taham, is ka nichala saya lamba hai. aik asbati signal ke pinnacle standard, hathoray ke patteren ke ain baad taizi ki shammen bnni chahiye aur tarjeehi peak standard hathoray ki oonchai ke oopar band honi chahiye. bunyadi pinnacle standard hathoray ke patteren ki do kasmain hain : become flushed himr : yeh hathora flame stuck sabz aur taiz noiyat ki hoti hai jo is baat ki nishandahi karti hai ke khredar baichnay walon ko mukammal peak standard zair karne ke qabil thay, is terhan security ki qeemat barh jati hai. negative himr : yeh aik surkh hathora flame stuck hai jo is baat ka ishara deti hai ke khredar farokht ke dabao ko jazb karne ke qabil ho satke hain. taham, woh security ki ikhtitami qeemat ko is ki ibtidayi qeemat se agay nahi barha satke. yeh is qeemat standard farokht knndgan ki mojoodgi ki nishandahi karta hai yahan hathora light stuck patteren istemaal karne ke kuch fawaid hain : yeh patteren intra day exchanging marker ke pinnacle standard kaam kar sakta hai jis mein qeemat ki naqal o harkat aur majmoi rujhan mein tabdeeli ya security mein raftaar shaamil hoti hai. is flame stuck patteren ka aik aur bara faida yeh hai ke yeh is baat ki tasdeeq ya nifi ke peak standard kaam kere ga ke aaya oonch neech hui hai ya nah  patteren ki ahmiyat nichale saaye ki lambai ke bherne ke sath barh jati hai. yeh namona dosray force inversion andikitrz ki mazbooti ki tasdeeq mein bhi madad kar sakta hai. davn prepared ke nichale hissay mein aik hathora nakaam ho jaye ga agar security mukammal honay ke baad aik nai nichli satah standard gir jati hai. is tarz ki mukhtalif kharabian ya hudood darj zail hain : yeh namona gumraah family signals ya rujhan ko tabdeel karne ke ghalat caution faraham kar sakta hai. is baat ki koi ensure nahi hai ke affirmation candle ke ban'nay ke baad qeemat oopar ki taraf barhay gi. aik mazboot tasdeeqi mother batii aur lambay saya daar hathoray ke patteren ka matlab hai ke qeemat un do mother btyon ke darmiyan numaya bulandiyon ko chhoo sakti hai. kharidari ka request dainay ke liye yeh achi position nahi hai kyunkay stap nuqsaan passage point se bohat daur hai. is patteren ko istemaal karkay aap ko hadaf ki qeemat ke baray mein andaza nahi ho sakta hai. is se mutawaqqa munafe ka pata laganay mein mushkilaat peda ho sakti hain . Chart Pattern Trading: Stock exchanging is ki paicheedgi aur moroosi utaar charhao ki wajah se aik mushkil kaam ho sakta hai. lehaza, usay aasaan bananay aur ziyada se ziyada munafe kamanay ke liye, aap kayi takneeki isharay istemaal kar satke hain, jaisay candles jo qeemat ki naqal o harkat ko track karne mein madad karte hain. hammer candle aik aisa howdy rujhan inversion patteren hai jo is ki tashkeel ke waqt market ke murawaja rujhan ke ulat jane ki nishandahi karta hai. yeh aik taizi ka inversion patteren hai aur is mein neechay ki taraf shadow ke sath aik mukhtasir asli body hai jo is ke asli jism ke size se kam az kam do gina hai. jaisa ke pehlay baat ki gayi hai, yeh taizi ka rujhan inversion patteren hai. is patteren ki tashkeel ke baad, mojooda mandi ki market mukhalif simt mein chal sakti hai. mojooda racket ka kam point pichlle clamor ke kam se kam hoga. mazeed bar-aan, mojooda tijarti meeting ki ikhtitami qeemat pichlle racket ke band honay se ziyada hogi. yeh patteren zahir karta hai ke security apni ibtidayi qeemat se kam point standard exchange kar rahi thi. taham, yeh taizi se barhta hai aur ibtidayi qader ke qareeb band honay ke liye oopar ki taraf barhna shuru kar deta hai. yeh is waqt hota hai punch farokht knndgan ya reechh market standard ghalba haasil karte hain jis ki wajah se security ki qeemat mein kami waqay hoti hai.

patteren ki ahmiyat nichale saaye ki lambai ke bherne ke sath barh jati hai. yeh namona dosray force inversion andikitrz ki mazbooti ki tasdeeq mein bhi madad kar sakta hai. davn prepared ke nichale hissay mein aik hathora nakaam ho jaye ga agar security mukammal honay ke baad aik nai nichli satah standard gir jati hai. is tarz ki mukhtalif kharabian ya hudood darj zail hain : yeh namona gumraah family signals ya rujhan ko tabdeel karne ke ghalat caution faraham kar sakta hai. is baat ki koi ensure nahi hai ke affirmation candle ke ban'nay ke baad qeemat oopar ki taraf barhay gi. aik mazboot tasdeeqi mother batii aur lambay saya daar hathoray ke patteren ka matlab hai ke qeemat un do mother btyon ke darmiyan numaya bulandiyon ko chhoo sakti hai. kharidari ka request dainay ke liye yeh achi position nahi hai kyunkay stap nuqsaan passage point se bohat daur hai. is patteren ko istemaal karkay aap ko hadaf ki qeemat ke baray mein andaza nahi ho sakta hai. is se mutawaqqa munafe ka pata laganay mein mushkilaat peda ho sakti hain . Chart Pattern Trading: Stock exchanging is ki paicheedgi aur moroosi utaar charhao ki wajah se aik mushkil kaam ho sakta hai. lehaza, usay aasaan bananay aur ziyada se ziyada munafe kamanay ke liye, aap kayi takneeki isharay istemaal kar satke hain, jaisay candles jo qeemat ki naqal o harkat ko track karne mein madad karte hain. hammer candle aik aisa howdy rujhan inversion patteren hai jo is ki tashkeel ke waqt market ke murawaja rujhan ke ulat jane ki nishandahi karta hai. yeh aik taizi ka inversion patteren hai aur is mein neechay ki taraf shadow ke sath aik mukhtasir asli body hai jo is ke asli jism ke size se kam az kam do gina hai. jaisa ke pehlay baat ki gayi hai, yeh taizi ka rujhan inversion patteren hai. is patteren ki tashkeel ke baad, mojooda mandi ki market mukhalif simt mein chal sakti hai. mojooda racket ka kam point pichlle clamor ke kam se kam hoga. mazeed bar-aan, mojooda tijarti meeting ki ikhtitami qeemat pichlle racket ke band honay se ziyada hogi. yeh patteren zahir karta hai ke security apni ibtidayi qeemat se kam point standard exchange kar rahi thi. taham, yeh taizi se barhta hai aur ibtidayi qader ke qareeb band honay ke liye oopar ki taraf barhna shuru kar deta hai. yeh is waqt hota hai punch farokht knndgan ya reechh market standard ghalba haasil karte hain jis ki wajah se security ki qeemat mein kami waqay hoti hai.  jaisay noise agay barhta hai, khredar ya bail dabao ko jazb karte hain aur qeematon ko ibtidayi qeemat ke qareeb le jatay hain. stomach muscle hit ke aap himr light stuck patteren ki tashkeel se waaqif hain, aayiyae apni baat cheet ko is ke dosray pehluo ki taraf muntaqil karte hain. aam peak standard, poke bhi aap himr light stuck patteren ko dekhte hain to aap rujhan ke ulat jane ki tawaqqa kar satke hain. is terhan ke patteren ki tashkeel is waqt hoti hai poke security ki qeemat gir rahi ho aur raftaar mein aik asnan tabdeeli cards standard ho. is patteren ka matlab market mein aik ahem clamor hai. is patteren ki tashkeel ke douran, security aik qeemat standard khulay gi aur is ke baad neechay ki taraf barhna shuru ho jaye gi. taham, yeh ibtidayi qeemat ke taqreeban barabar ya is se ziyada qeemat standard taizi se barhay ga aur band ho jaye ga. agar yeh patteren youngster negative candles se pehlay hai, to yeh aik mazboot rujhan ke ulat jane ki nishandahi karta hai. mazeed bar-aan, baad mein anay wali mother btyon ko tasdeeq ke peak standard kaam karna chahiye aur hathora candle stuck ke band honay se ziyada ounchay maqam standard band hona chahiye. punch yeh tamam isharay tasdeeqi isharay dete hain, to yeh samjha ja sakta hai ke rujhan ke ulat jane ka imkaan hai, aur lambi pozishnin li ja sakti hain .

jaisay noise agay barhta hai, khredar ya bail dabao ko jazb karte hain aur qeematon ko ibtidayi qeemat ke qareeb le jatay hain. stomach muscle hit ke aap himr light stuck patteren ki tashkeel se waaqif hain, aayiyae apni baat cheet ko is ke dosray pehluo ki taraf muntaqil karte hain. aam peak standard, poke bhi aap himr light stuck patteren ko dekhte hain to aap rujhan ke ulat jane ki tawaqqa kar satke hain. is terhan ke patteren ki tashkeel is waqt hoti hai poke security ki qeemat gir rahi ho aur raftaar mein aik asnan tabdeeli cards standard ho. is patteren ka matlab market mein aik ahem clamor hai. is patteren ki tashkeel ke douran, security aik qeemat standard khulay gi aur is ke baad neechay ki taraf barhna shuru ho jaye gi. taham, yeh ibtidayi qeemat ke taqreeban barabar ya is se ziyada qeemat standard taizi se barhay ga aur band ho jaye ga. agar yeh patteren youngster negative candles se pehlay hai, to yeh aik mazboot rujhan ke ulat jane ki nishandahi karta hai. mazeed bar-aan, baad mein anay wali mother btyon ko tasdeeq ke peak standard kaam karna chahiye aur hathora candle stuck ke band honay se ziyada ounchay maqam standard band hona chahiye. punch yeh tamam isharay tasdeeqi isharay dete hain, to yeh samjha ja sakta hai ke rujhan ke ulat jane ka imkaan hai, aur lambi pozishnin li ja sakti hain .

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 10:07 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим