Bullish Kicker Candlestick Pattern ka Introduction

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

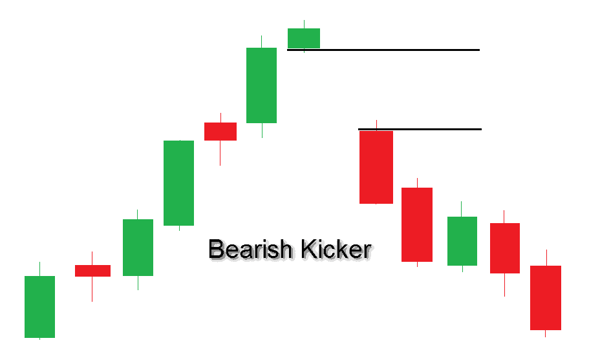

n ek candle design hai jo negative (girawat ka) pattern ko show karta hai. Yeh design punch cost graph standard dikhai deta hai to yeh brokers ke liye ek significant sign hai ki market mein descending development shuru ho gaya hai aur iska matlab hai ke stock ya money ki keemat kam sharpen ki sambhavna hai. "Three Dark Crows" design ko samajhne ke liye, aapko candles aur unke developments ke fundamental ideas ka pata hona zaroori hai.Candles ek graphical portrayal hai jo stock ya cash ke cost development ko portray karta hai. Har candle ek time span (jaise 1 moment, 60 minutes, ya 1 racket) ko address karta hai aur ismein 4 costs hote hain: opening cost, shutting cost, most exorbitant cost (high), aur least value (low).Kuch normal candle designs hai jo brokers use karte hain, jaise "doji," "hammer," "hanging man," "falling star," "bullish overwhelming," aur "negative inundating." "Three Dark Crows" bhi ek well known negative example hai. Chart Pattern Types: CandFlame ki shutting cost pehli do candles ki shutting costs se kam honi chahiye.Is design ke samay stop-misfortune request ko rakhte tint, brokers ko apne risk the board ko bhi samajhna zaroori hai.Agar market mein high instability hai, to ye design kam dependable ho sakta hai, isliye dusri corroborative pointers ka istemal karna faydemand ho sakta hai.Three Dark Crows) ek prakritik candle design hai jo negative pattern ka sign deta hai. Lekin, is design ko akele istemal karne se pehle dusri specialized investigation instruments aur pointers ka istemal karke uski tasdeeq zaroor karni chahiye. Forex exchanging mein kam risk ke sath achhi tarah ki research aur investigation se greetings safalta milti hai.le designs forex exchanging mein kisi bhi resource ki cost development ko samajhne ke liye ahem tareeqe hote hain. In designs se merchants ko market ki development ko samajhne mein madad milti hai aur future cost forecasts banane mein asani hoti hai ek negative inversion design hota hai, jo aksar upturn ya sideways pattern ke baad dekha jata hai. Is design mein teesri flame do pehle ki negative candles ko follow karti hai.attern adolescent negative (descending) candles se milta hai, jo kuch is tarah hote hain Pehli candle ek upturn ya doji design ke baad dekhi jati hai.Dusri light pehli candle ki shutting cost se neeche khulti hai aur mazeed neeche jaati hai Teesri candle dusri candle ki shutting cost se neeche khulti hai aur phir mazeed neeche jaati hai.

Chart Pattern Types: CandFlame ki shutting cost pehli do candles ki shutting costs se kam honi chahiye.Is design ke samay stop-misfortune request ko rakhte tint, brokers ko apne risk the board ko bhi samajhna zaroori hai.Agar market mein high instability hai, to ye design kam dependable ho sakta hai, isliye dusri corroborative pointers ka istemal karna faydemand ho sakta hai.Three Dark Crows) ek prakritik candle design hai jo negative pattern ka sign deta hai. Lekin, is design ko akele istemal karne se pehle dusri specialized investigation instruments aur pointers ka istemal karke uski tasdeeq zaroor karni chahiye. Forex exchanging mein kam risk ke sath achhi tarah ki research aur investigation se greetings safalta milti hai.le designs forex exchanging mein kisi bhi resource ki cost development ko samajhne ke liye ahem tareeqe hote hain. In designs se merchants ko market ki development ko samajhne mein madad milti hai aur future cost forecasts banane mein asani hoti hai ek negative inversion design hota hai, jo aksar upturn ya sideways pattern ke baad dekha jata hai. Is design mein teesri flame do pehle ki negative candles ko follow karti hai.attern adolescent negative (descending) candles se milta hai, jo kuch is tarah hote hain Pehli candle ek upturn ya doji design ke baad dekhi jati hai.Dusri light pehli candle ki shutting cost se neeche khulti hai aur mazeed neeche jaati hai Teesri candle dusri candle ki shutting cost se neeche khulti hai aur phir mazeed neeche jaati hai.  Three dark crow design karta ha word or karta design ha flame design, karti ha jo jo up ki traf hota ha. A candle or open, high, low or close cost is definitely not a particular security. Punch stock ascents on the diagram, hoti flame or white or green ki hoti ha or bar cost hit ha mama, dark or red variety ki jo ke. The dark crow design comprises of three long candles or candles that open or close in the genuine body. Merchants additionally use pattern lines or specialized markers or outline designs instead of pattern affirmation. Joe is fundamentally a three raven example and tracks down a wild bear to switch the latest thing. Merchants use strength pointers, RSI and pattern markers individually. Three dark crows against three modest or shadowy ko dakhta hua kazi kartu ha or dangerous K. Three dark crow designs address three white knight examplree Dark Crows design ke signals ko approve karne ke liye, dealers ko dusre specialized markers aur apparatuses ka istemal karna hota hai. Kuch significant corroborative signs specialty diye gaye hain Backing level breaks aur opposition level breaks, design ke signals ko aur bhi dependable banata ha Moving midpoints ka use pattern aur pattern inversion ko distinguish karne mein kiya jata hai. Agar cost moving midpoints ko neeche se cross karta hai, to yeh negative sign hai.RSI overbought ya oversold region mein jane standard negative inversion signals give karta hai.Agar cost aur kisi wavering pointer, jaise ki MACD ya Stochastic, ke beech dissimilarity dikhta hai, to yeh negative inversion ka sign hota ha Three Dark Crows design ka istemal karke merchants ko kuch fawaid aur nuksan ho sakte hain

Three dark crow design karta ha word or karta design ha flame design, karti ha jo jo up ki traf hota ha. A candle or open, high, low or close cost is definitely not a particular security. Punch stock ascents on the diagram, hoti flame or white or green ki hoti ha or bar cost hit ha mama, dark or red variety ki jo ke. The dark crow design comprises of three long candles or candles that open or close in the genuine body. Merchants additionally use pattern lines or specialized markers or outline designs instead of pattern affirmation. Joe is fundamentally a three raven example and tracks down a wild bear to switch the latest thing. Merchants use strength pointers, RSI and pattern markers individually. Three dark crows against three modest or shadowy ko dakhta hua kazi kartu ha or dangerous K. Three dark crow designs address three white knight examplree Dark Crows design ke signals ko approve karne ke liye, dealers ko dusre specialized markers aur apparatuses ka istemal karna hota hai. Kuch significant corroborative signs specialty diye gaye hain Backing level breaks aur opposition level breaks, design ke signals ko aur bhi dependable banata ha Moving midpoints ka use pattern aur pattern inversion ko distinguish karne mein kiya jata hai. Agar cost moving midpoints ko neeche se cross karta hai, to yeh negative sign hai.RSI overbought ya oversold region mein jane standard negative inversion signals give karta hai.Agar cost aur kisi wavering pointer, jaise ki MACD ya Stochastic, ke beech dissimilarity dikhta hai, to yeh negative inversion ka sign hota ha Three Dark Crows design ka istemal karke merchants ko kuch fawaid aur nuksan ho sakte hain

-

#3 Collapse

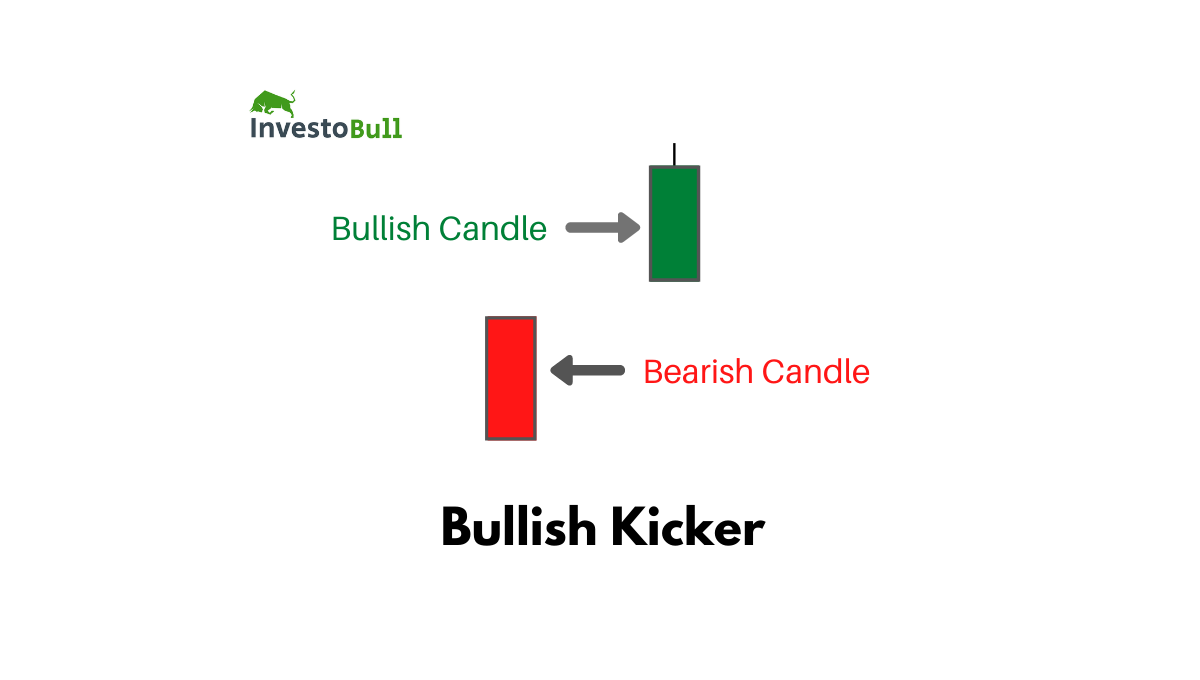

**Bullish Kicker Candlestick Pattern:** Bullish Kicker Candlestick Pattern forex trading mein ek bullish reversal pattern hai, jiska shape do consecutive candlesticks se banta hai. Is pattern mein pahle candle (bearish) ka body bada hota hai aur dusre candle (bullish) ka body pahle candle ke body se completely opposite direction mein open hota hai. **Bullish Kicker Candlestick Pattern Ki Iqsam:** Bullish Kicker Candlestick Pattern single pattern hota hai, jismein do consecutive candlesticks involved hote hain. **Bullish Kicker Candlestick Pattern Ke Characteristics:** 1. **Bearish First Candle:** Pahle candle bearish hota hai aur iska body bada hota hai. Yeh candle existing uptrend ko represent karta hai. 2. **Bullish Second Candle:** Dusre candle bullish hota hai aur iska body pahle candle ke body se completely opposite direction mein open hota hai. Yeh candle pahle bearish candle ke body se completely alag direction mein move karta hai. **Bullish Kicker Candlestick Pattern Ke Benefits:** 1. **Bullish Reversal Signal:** Bullish Kicker Candlestick Pattern market mein potential bullish reversal ka strong signal deta hai, jab price existing uptrend ke opposite direction mein move karta hai. 2. **Confirmation with Other Indicators:** Bullish Kicker Pattern ko confirmatory indicators aur price action analysis ke saath istemal karke traders apni trading decisions ko validate kar sakte hain. 3. **Early Entry Point:** Bullish Kicker pattern se traders ko potential early entry points spot karne mein madad milti hai. **Bullish Kicker Candlestick Pattern Ke Nuqsan (Drawbacks):** 1. **False Signals:** Jaise ki kai candlestick patterns mein hota hai, Bullish Kicker Candlestick Pattern bhi false signals generate kar sakta hai. Isliye confirmatory indicators ke saath use karna zaroori hota hai. 2. **Lack of Confirmation:** Kicker pattern ko confirm karne ke liye dusre candle ki closing ka wait karna padta hai, jisse traders ko late signals milte hain. **Conclusion:** Bullish Kicker Candlestick Pattern potential bullish reversal ko spot karne mein madad karta hai aur existing uptrend ko confirm karta hai. Is pattern ko samajhne ke liye confirmatory indicators aur price action analysis ka istemal karna zaroori hai, taki accurate aur reliable signals mil sake. Agar yeh pattern sahi tarike se identify kiya gaya hai, toh traders apni trading strategies ko modify kar sakte hain aur potential market movements ko samajhne mein help ho sakti hai. Bullish Kicker Candlestick Pattern ek valuable tool hai, jo traders ko market analysis aur trading decisions mein madad karte hain. -

#4 Collapse

Negative Continuation Example Negative Continuation Example mein negative pattern mein sharpen wali brief interruption ya inversion ki jagah negative pattern ka continuation signal hota hai. Is design ko pehchana bohat zaroori hai taake merchant apne positions ko safeguard kar sakein. Is design ko pehchane ke liye dealer ko diagram designs ko dissect karna hota hai. Negative Continuation Examples normally negative pattern ke beech mein hota hai aur hit cost design se bahar nikalta hai to negative pattern mein proceed hota hai. Negative continuation design ke sath howdy broker ko risk the board ke baare mein bhi sochna hota hai. Risk the board strategies ka use karke dealer apni positions ko safeguard kar sakta hai aur apni portfolio ko broadened kar sakta hai. Broadening ek strategy hai jis mein merchant apne portfolio ko various resources aur areas mein contribute karke spread karta hai taake agar ek area ya resource mein misfortune ho jata hai to baki areas ya resources se benefit acquire kar sakein. Exchanging Negative Continuation Example pehchane ke baad broker ko exchanging ke liye is design ki affirmation ki zaroorat hoti hai. Is design ki affirmation ke liye broker ko cost activity, energy aur volume markers ka use karna hota hai. Cost activity markers exchanging graph ki cost activity ko break down karne ke liye use kiye jate hain. Cost activity pointers mein se kuch well known markers hain, jaise ke Moving Normal, Relative Strength Record (RSI), aur Stochastic Oscillator. Force markers pattern ki speed aur heading ko measure karne ke liye use kiye jate hain. Famous energy markers mein se kuch hain, jaise ke Moving Normal Assembly Difference (MACD) aur Pace of Progress (ROC). Volume markers exchanging volume ko examine karne ke liye use kiye jate hain. Volume markers mein se kuch famous pointers hain, jaise ke On Equilibrium Volume (OBV), Volume Weighted Normal Value (VWAP), aur Chaikin Cash Stream. Negative Continuation Example me shamil designs Balanced Triangle: Yeh negative continuation design me se aik hai. Is design ko pehchane ke liye dealer ko cost ke beech symmetric triangle ki shape me dekhna hota hai. Yeh design commonly pattern ke beech mein hota hai aur punch cost triangle se bahar nikalta hai to negative pattern mein proceed hota hai.Jab broker ko affirmation mil jata hai to phir woh short selling, stop misfortune ya take benefit systems ka use karke apne positions ko execute kar sakta hai. Short selling me broker apne resources ko acquire karke bechta hai aur hit cost down hota hai to phir se purchase karke apne resources ko wapis le leta hai. Stop Misfortune ek method hai jis mein merchant apni position ko foreordained level pe close kar leta hai, poke cost us level ko contact karta hai. Take benefit ek procedure hai jis mein merchant apni position ko foreordained benefit level pe close kar leta hai, punch cost us level ko contact karta hai. Broker ko apne positions ko continually screen karna hota hai taake woh ideal exit kar sakein aur benefit acquire kar sakein. Iske alawa merchant ko market patterns ko bhi continually screen karna hota hai taake woh apni positions ko change kar sakein. -

#5 Collapse

Bullish Kicker Candlestick

N'ek candle design hai jo' display karta hai negative (girawat ka) pattern. Design punch cost graph standard dikhai deta hai to brokers ke liye ek crucial indicator hai ki market mein declining development shuru ho gaya hai and iska matlab hai ke stock ya money ki keemat kam sharpen ki sambhavna hai. Aapko candles and unke advancements ke essential notions ka pata hona zaroori hai, "Three Dark Crows" design ko samajhne ke liye.Candles provide a visual representation of the relationship between stock and cash prices and cost development. There are four prices associated with a candle's lifespan (one instant, 60 minutes, or one racket): the opening cost, the closing cost, the most expensive cost (high), and the least expensive cost (low).Brokers utilize standard candle patterns including "doji," "hammer," "hanging man," "falling star," "bullish overwhelming," and "negative inundating." "Three Dark Crows" is a well-known example of a bad example. Chart Pattern Types: Candles' closing expenses are comparable to those of CandFlame, thus they are comparable.Brokers' apne risk the board ko bhi samajhna zaroori hai, is design ke samay stop-misfortune request ko rakhte tint.If the market is very unstable, design will be reliable and there will be a demand for it, according to isliye dusri corroborative pointers ka istemal karna faydemand.Three Dark Crows) candle design has a critical tone with a warning message. Nevertheless, this design's akele istemal karne se pehle dusri specialist investigation tools and pointers' istemal karke uski tasdeeq zaroor karni chahiye. Research and inquiry are the two things that should be wished for while engaging in forex trading.Forex trading le designs mein kisi bhi resource ki cost development ko samajhne ke liye ahem tareeqe hote hain. Future cost projections banane mein asani hoti hai, in designs se merchants ko market ki development ko samajhne mein madad milti hai. Aside from sideways and upward patterns, a negative inversion design is also present. The negative candles in the pattern follow the teesri flame exactly.Teenage negative (descending) candles are present at this time, and the candle is hot. Ek upturn ya doji design ke baad dekhi jati hai pehli candles.Dusri light pehli candle ki closing cost se neeche khulti hai, as well as mazeed neeche jaati hai The closing cost for Teesri candles and Dusri candles is zero, and phir mazeed is also nothing.

Chart Pattern Types: Candles' closing expenses are comparable to those of CandFlame, thus they are comparable.Brokers' apne risk the board ko bhi samajhna zaroori hai, is design ke samay stop-misfortune request ko rakhte tint.If the market is very unstable, design will be reliable and there will be a demand for it, according to isliye dusri corroborative pointers ka istemal karna faydemand.Three Dark Crows) candle design has a critical tone with a warning message. Nevertheless, this design's akele istemal karne se pehle dusri specialist investigation tools and pointers' istemal karke uski tasdeeq zaroor karni chahiye. Research and inquiry are the two things that should be wished for while engaging in forex trading.Forex trading le designs mein kisi bhi resource ki cost development ko samajhne ke liye ahem tareeqe hote hain. Future cost projections banane mein asani hoti hai, in designs se merchants ko market ki development ko samajhne mein madad milti hai. Aside from sideways and upward patterns, a negative inversion design is also present. The negative candles in the pattern follow the teesri flame exactly.Teenage negative (descending) candles are present at this time, and the candle is hot. Ek upturn ya doji design ke baad dekhi jati hai pehli candles.Dusri light pehli candle ki closing cost se neeche khulti hai, as well as mazeed neeche jaati hai The closing cost for Teesri candles and Dusri candles is zero, and phir mazeed is also nothing. Negative Continuation Example me shamil design Triangle in balance: Yeh, the negative continuation design is in effect. Is design's cost per square foot and its symmetric triangular form are both given by the dealer. Punch cost triangle se bahar nikalta hai to negative pattern mein progress hota hai, and yeh design frequently pattern ke beech mein hota hai.If a broker makes an affirmation, then short selling, stopping bad luck, and taking advantage of systems may be stopped and respective positions can be executed, respectively. When a broker engages in short selling, resources are acquired and struck with cost reductions, phir se buy karke apne resources ko wapis le leta hai. Stop Misfortune is a technique that works if the merchant is in the predetermined position and level and closes the door on us at that level. Punch cost us level ko contact karta hai, take advantage ek process hai, merchant apni position ko foreordained profit level pe close kar leta hai. Broker's positions are continuously monitored in order to determine when to leave or profit. Iske alawa traders' market tendencies are continuously monitored, and as a result, their positions are always changing.

Negative Continuation Example me shamil design Triangle in balance: Yeh, the negative continuation design is in effect. Is design's cost per square foot and its symmetric triangular form are both given by the dealer. Punch cost triangle se bahar nikalta hai to negative pattern mein progress hota hai, and yeh design frequently pattern ke beech mein hota hai.If a broker makes an affirmation, then short selling, stopping bad luck, and taking advantage of systems may be stopped and respective positions can be executed, respectively. When a broker engages in short selling, resources are acquired and struck with cost reductions, phir se buy karke apne resources ko wapis le leta hai. Stop Misfortune is a technique that works if the merchant is in the predetermined position and level and closes the door on us at that level. Punch cost us level ko contact karta hai, take advantage ek process hai, merchant apni position ko foreordained profit level pe close kar leta hai. Broker's positions are continuously monitored in order to determine when to leave or profit. Iske alawa traders' market tendencies are continuously monitored, and as a result, their positions are always changing.

-

#6 Collapse

Bullish Kicker Chart Pattern: Negative continuation plan me se aik hai. Is plan ko pehchane ke liye vendor ko cost ke beech symmetric triangle ki shape me dekhna hota hai. Yeh configuration generally design ke beech mein hota hai aur punch cost triangle se bahar nikalta hai to negative example mein continue hota hai.Jab intermediary ko certification mil jata hai to phir woh short selling, stop mishap ya take benefit frameworks ka use karke apne positions ko execute kar sakta hai. Short selling me dealer apne assets ko procure karke bechta hai aur hit cost down hota hai to phir se buy karke apne assets ko wapis le leta hai. Stop Hardship ek technique hai jis mein vendor apni position ko destined level pe close kar leta hai, jab cost us level ko contact karta hai. Take benefit ek method hai jis mein trader apni position ko destined benefit level pe close kar leta hai, punch cost us level ko contact karta hai. Intermediary ko apne positions ko consistently screen karna hota hai taake woh ideal exit kar sakein aur benefit gain kar sakein. Iske alawa vendor ko market designs ko bhi persistently screen karna hota hai taake woh apni positions ko change kar sakein. Continuation Model pehchane ke baad specialist ko trading ke liye is plan ki attestation ki zaroorat hoti hai. Is plan ki attestation ke liye agent ko cost action, energy aur volume markers ka use karna hota hai. Cost movement markers trading chart ki cost action ko separate karne ke liye use kiye jate hain. Cost movement pointers mein se kuch notable markers hain, jaise ke Moving Ordinary, Relative Strength Record (RSI), aur Stochastic Oscillator. Force markers design ki speed aur heading ko measure karne ke liye use kiye jate hain. Popular energy markers mein se kuch hain, jaise ke Moving Typical Gathering Distinction (MACD) aur Speed of Progress (ROC). Volume markers trading volume ko analyze karne ke liye use kiye jate hain. Volume markers mein se kuch well known pointers hain Chart Pattern Types And Formation: Bullish Kicker Candle Example potential bullish inversion ko spot karne mein madad karta hai aur existing upturn ko affirm karta hai. Is design ko samajhne ke liye corroborative markers aur cost activity investigation ka istemal karna zaroori hai, taki precise aur dependable signs mil purpose. Agar yeh design sahi tarike se distinguish kiya gaya hai, toh merchants apni exchanging methodologies ko change kar sakte hain aur potential market developments ko samajhne mein help ho sakti hai. Bullish Kicker Candle Example ek important instrument hai, jo merchants ko market examination aur exchanging choices mein madad karte hain.Kicker design ko affirm karne ke liye dusre flame ki shutting ka stand by karna padta hai, jisse brokers ko late signals milte hain.

Continuation Model pehchane ke baad specialist ko trading ke liye is plan ki attestation ki zaroorat hoti hai. Is plan ki attestation ke liye agent ko cost action, energy aur volume markers ka use karna hota hai. Cost movement markers trading chart ki cost action ko separate karne ke liye use kiye jate hain. Cost movement pointers mein se kuch notable markers hain, jaise ke Moving Ordinary, Relative Strength Record (RSI), aur Stochastic Oscillator. Force markers design ki speed aur heading ko measure karne ke liye use kiye jate hain. Popular energy markers mein se kuch hain, jaise ke Moving Typical Gathering Distinction (MACD) aur Speed of Progress (ROC). Volume markers trading volume ko analyze karne ke liye use kiye jate hain. Volume markers mein se kuch well known pointers hain Chart Pattern Types And Formation: Bullish Kicker Candle Example potential bullish inversion ko spot karne mein madad karta hai aur existing upturn ko affirm karta hai. Is design ko samajhne ke liye corroborative markers aur cost activity investigation ka istemal karna zaroori hai, taki precise aur dependable signs mil purpose. Agar yeh design sahi tarike se distinguish kiya gaya hai, toh merchants apni exchanging methodologies ko change kar sakte hain aur potential market developments ko samajhne mein help ho sakti hai. Bullish Kicker Candle Example ek important instrument hai, jo merchants ko market examination aur exchanging choices mein madad karte hain.Kicker design ko affirm karne ke liye dusre flame ki shutting ka stand by karna padta hai, jisse brokers ko late signals milte hain.  Bullish Kicker Candle Example forex exchanging mein ek bullish inversion design hai, jiska shape do continuous candles se banta hai. Is design mein pahle candle (negative) ka body bada hota hai aur dusre light (bullish) ka body pahle candle ke body se entirely different course mein open hota hai.Pahle candle negative hota hai aur iska body bada hota hai. Yeh candle existing upturn ko address karta hai.Dusre candle bullish hota hai aur iska body pahle light ke body se entirely different bearing mein open hota hai. Yeh candle pahle negative candle ke body se totally alag heading mein move karta hai.Bullish Kicker Example ko corroborative markers aur cost activity examination ke saath istemal karke dealers apni exchanging choices ko approve kar sakte hain. Chart Candles Trading: Cost pehli do candles ki closing costs se kam honi chahiye.Is plan ke samay stop-adversity demand ko rakhte color, representatives ko apne risk the board ko bhi samajhna zaroori hai.Agar market mein high precariousness hai, to ye plan kam reliable ho sakta hai, isliye dusri supportive pointers ka istemal karna faydemand ho sakta hai.Three Dim Crows) ek prakritik light plan hai jo negative example ka sign deta hai. Lekin, is plan ko akele istemal karne se pehle dusri particular examination instruments aur pointers ka istemal karke uski tasdeeq zaroor karni chahiye. Forex trading mein kam risk ke sath achhi tarah ki research aur examination se good tidings safalta milti hai.le plans forex trading mein kisi bhi asset ki cost improvement ko samajhne ke liye ahem tareeqe hote hain. In plans se dealers ko market ki improvement ko samajhne mein madad milti hai aur future expense figures banane mein asani hoti hai ek negative reversal plan hota hai

Bullish Kicker Candle Example forex exchanging mein ek bullish inversion design hai, jiska shape do continuous candles se banta hai. Is design mein pahle candle (negative) ka body bada hota hai aur dusre light (bullish) ka body pahle candle ke body se entirely different course mein open hota hai.Pahle candle negative hota hai aur iska body bada hota hai. Yeh candle existing upturn ko address karta hai.Dusre candle bullish hota hai aur iska body pahle light ke body se entirely different bearing mein open hota hai. Yeh candle pahle negative candle ke body se totally alag heading mein move karta hai.Bullish Kicker Example ko corroborative markers aur cost activity examination ke saath istemal karke dealers apni exchanging choices ko approve kar sakte hain. Chart Candles Trading: Cost pehli do candles ki closing costs se kam honi chahiye.Is plan ke samay stop-adversity demand ko rakhte color, representatives ko apne risk the board ko bhi samajhna zaroori hai.Agar market mein high precariousness hai, to ye plan kam reliable ho sakta hai, isliye dusri supportive pointers ka istemal karna faydemand ho sakta hai.Three Dim Crows) ek prakritik light plan hai jo negative example ka sign deta hai. Lekin, is plan ko akele istemal karne se pehle dusri particular examination instruments aur pointers ka istemal karke uski tasdeeq zaroor karni chahiye. Forex trading mein kam risk ke sath achhi tarah ki research aur examination se good tidings safalta milti hai.le plans forex trading mein kisi bhi asset ki cost improvement ko samajhne ke liye ahem tareeqe hote hain. In plans se dealers ko market ki improvement ko samajhne mein madad milti hai aur future expense figures banane mein asani hoti hai ek negative reversal plan hota hai  Configuration punch cost chart standard dikhai deta hai to yeh dealers ke liye ek huge sign hai ki market mein sliding advancement shuru ho gaya hai aur iska matlab hai ke stock ya cash ki keemat kam hone ki sambhavna hai. "Three Dim Crows" plan ko samajhne ke liye, aapko candles aur unke improvements ke major thoughts ka pata hona zaroori hai.Candles ek graphical depiction hai jo stock ya cash ke cost advancement ko depict karta hai. Har flame ek time frame (jaise 1 second, an hour, ya 1 racket) ko address karta hai aur ismein 4 expenses hote hain: opening expense, closing expense, generally extravagant expense (high), aur least worth (low).Kuch ordinary candle plans hai jo agents use karte hain, jaise "doji," "hammer," "hanging man," "falling star," "bullish overpowering," aur "negative immersing." "Three Dull Crows" bhi ek notable negative model hai.

Configuration punch cost chart standard dikhai deta hai to yeh dealers ke liye ek huge sign hai ki market mein sliding advancement shuru ho gaya hai aur iska matlab hai ke stock ya cash ki keemat kam hone ki sambhavna hai. "Three Dim Crows" plan ko samajhne ke liye, aapko candles aur unke improvements ke major thoughts ka pata hona zaroori hai.Candles ek graphical depiction hai jo stock ya cash ke cost advancement ko depict karta hai. Har flame ek time frame (jaise 1 second, an hour, ya 1 racket) ko address karta hai aur ismein 4 expenses hote hain: opening expense, closing expense, generally extravagant expense (high), aur least worth (low).Kuch ordinary candle plans hai jo agents use karte hain, jaise "doji," "hammer," "hanging man," "falling star," "bullish overpowering," aur "negative immersing." "Three Dull Crows" bhi ek notable negative model hai.

-

#7 Collapse

Negative Continuation Model Negative Continuation Model mein negative example mein hone wali brief interference ya reversal ki jagah negative example ka continuation signal hota hai. Is plan ko pehchana bohat zaroori hai taake shipper apne positions ko defend kar sakein. Is plan ko pehchane ke liye seller ko outline plans ko analyze karna hota hai. Negative Continuation Models typically regrettable example ke beech mein hota hai aur hit cost plan se bahar nikalta hai to negative example mein continue hota hai. Negative continuation plan ke sath hi merchant ko risk the board ke baare mein bhi sochna hota hai. Risk the board procedures ka use karke seller apni positions ko protect kar sakta hai aur apni portfolio ko widened kar sakta hai. Widening ek methodology hai jis mein trader apne portfolio ko different assets aur regions mein contribute karke spread karta hai taake agar ek region ya asset mein mishap ho jata hai to baki regions ya assets se benefit obtain kar sakein. Trading Negative Continuation Model pehchane ke baad specialist ko trading ke liye is plan ki attestation ki zaroorat hoti hai. Is plan ki attestation ke liye intermediary ko cost movement, energy aur volume markers ka use karna hota hai. Cost action markers trading chart ki cost movement ko separate karne ke liye use kiye jate hain. Cost movement pointers mein se kuch notable markers hain, jaise ke Moving Ordinary, Relative Strength Record (RSI), aur Stochastic Oscillator. Force markers design ki speed aur heading ko measure karne ke liye use kiye jate hain. Popular energy markers mein se kuch hain, jaise ke Moving Ordinary Get together Contrast (MACD) aur Speed of Progress (ROC). Volume markers trading volume ko look at karne ke liye use kiye jate hain. Volume markers mein se kuch renowned pointers hain, jaise ke On Balance Volume (OBV), Volume Weighted Ordinary Worth (VWAP), aur Chaikin Money Stream.

Trading Negative Continuation Model pehchane ke baad specialist ko trading ke liye is plan ki attestation ki zaroorat hoti hai. Is plan ki attestation ke liye intermediary ko cost movement, energy aur volume markers ka use karna hota hai. Cost action markers trading chart ki cost movement ko separate karne ke liye use kiye jate hain. Cost movement pointers mein se kuch notable markers hain, jaise ke Moving Ordinary, Relative Strength Record (RSI), aur Stochastic Oscillator. Force markers design ki speed aur heading ko measure karne ke liye use kiye jate hain. Popular energy markers mein se kuch hain, jaise ke Moving Ordinary Get together Contrast (MACD) aur Speed of Progress (ROC). Volume markers trading volume ko look at karne ke liye use kiye jate hain. Volume markers mein se kuch renowned pointers hain, jaise ke On Balance Volume (OBV), Volume Weighted Ordinary Worth (VWAP), aur Chaikin Money Stream. Negative Continuation Model meYeh negative continuation plan me se aik hai. Is plan ko pehchane ke liye seller ko cost ke beech symmetric triangle ki shape me dekhna hota hai.

Yeh configuration regularly design ke beech mein hota hai aur punch cost triangle se bahar nikalta hai to negative example mein continue hota hai.Jab merchant ko insistence mil jata hai to phir woh short selling, stop adversity ya take benefit frameworks ka use karke apne positions ko execute kar sakta hai. Short selling me agent apne assets ko obtain karke bechta hai aur hit cost down hota hai to phir se buy karke apne assets ko wapis le leta hai. Stop Disaster ek technique hai jis mein trader apni position ko predestined level pe close kar leta hai, jab cost us level ko contact karta hai. Take benefit ek technique hai jis mein vendor apni position ko destined benefit level pe close kar leta hai, punch cost us level ko contact karta hai. Merchant ko apne positions ko persistently screen karna hota hai taake woh ideal exit kar sakein aur benefit gain kar sakein. Iske alawa vendor ko market designs ko bhi consistently screen karna hota hai taake woh apni positions ko change kar sakein.

Yeh configuration regularly design ke beech mein hota hai aur punch cost triangle se bahar nikalta hai to negative example mein continue hota hai.Jab merchant ko insistence mil jata hai to phir woh short selling, stop adversity ya take benefit frameworks ka use karke apne positions ko execute kar sakta hai. Short selling me agent apne assets ko obtain karke bechta hai aur hit cost down hota hai to phir se buy karke apne assets ko wapis le leta hai. Stop Disaster ek technique hai jis mein trader apni position ko predestined level pe close kar leta hai, jab cost us level ko contact karta hai. Take benefit ek technique hai jis mein vendor apni position ko destined benefit level pe close kar leta hai, punch cost us level ko contact karta hai. Merchant ko apne positions ko persistently screen karna hota hai taake woh ideal exit kar sakein aur benefit gain kar sakein. Iske alawa vendor ko market designs ko bhi consistently screen karna hota hai taake woh apni positions ko change kar sakein.

-

#8 Collapse

BULLISH CANDLESTICK PATTERN KI WAZAHAT TAFSEELAN BEYAAN KIJIYE ???BULLISH CANDLESTICK PATTERN KA TAARUFF:- Negative continuation plan me se aik hai. Is plan ko pehchane ke liye company ko price ke beech symmetric triangle ki form me dekhna hota hai. Yeh configuration commonly format ke beech mein hota hai aur punch price triangle se bahar nikalta hai to terrible instance mein maintain hota hai.Jab intermediary ko certification mil jata hai to phir woh brief selling, prevent mishap ya take advantage frameworks ka use karke apne positions ko execute kar sakta hai. Short promoting me organisation apne property ko procure karke bechta hai aur hit rate down hota hai to phir se purchase karke apne belongings ko wapis le leta hai. Stop Hardship ek method hai jis mein issuer apni characteristic ko destined diploma pe near kar leta hai, jab price us degree ko contact karta hai. Take benefit ek method hai jis mein corporation apni feature ko destined benefit diploma pe close to kar leta hai, punch fee us degree ko touch karta hai. Intermediary ko apne positions ko constantly display display karna hota hai taake woh superb exit kar sakein aur gain benefit kar sakein.Ska matlab hai ke stock ya cash ki keemat kam sharpen ki sambhavna hai. Aapko candles and unke upgrades ke vital notions ka pata hona zaroori hai, "Three Dark Crows" layout ko samajhne ke liye.Candles offer a seen example of the relationship amongst stock and cash fees and fee improvement. There are 4 fees related to a candle's lifespan (one right away, 60 mins, or one racket): the hole charge, the final rate, the maximum high priced charge (excessive), and the least high-priced charge (low).Brokers lease elegant candle patterns on the trouble of "doji," "hammer," "placing guy... BULLISH CANDLESTICK PATTERN KI EQSAAM:- CandFlame ki shutting charge pehli do candles ki shutting expenses se kam honi chahiye.Is format ke samay save you-misfortune request ko rakhte tint, marketers ko apne danger the board ko bhi samajhna zaroori hai.Agar marketplace mein excessive instability hai, to ye format kam reliable ho sakta hai, isliye dusri corroborative guidelines ka istemal karna faydemand ho sakta hai.Three Dark Crows) ek prakritik candle format hai jo awful pattern ka signal deta hai. Lekin, is format ko akele istemal karne se pehle dusri specialized studies gadgets aur hints ka istemal karke uski tasdeeq zaroor karni chahiye. The the Forex market market converting mein kam danger ke sath achhi tarah ki research aur research se greetings safalta milti hai.Le designs forex converting mein kisi bhi useful beneficial beneficial aid ki rate development ko samajhne ke liye ahem tareeqe hote hain. In designs se customers ko marketplace ki improvement ko samajhne mein madad milti hai aur future rate forecasts banane mein asani hoti hai ek horrible inversion format hota hai, jo aksar upturn ya sideways pattern ke baad dekha jata hai. Is layout mein teesri flame do pehle ki lousy candles ko have a have a look at karti hai.Attern adolescent awful (descending) candles se milta hai. BULLISH CANDLESTICK PATTERN ME TRADING KARNA:- Cost pehli do candles ki remaining charges se kam honi chahiye.Is plan ke samay save you-adversity call for ko rakhte shade, representatives ko apne chance the board ko bhi samajhna zaroori hai.Agar market mein immoderate precariousness hai, to ye plan kam dependable ho sakta hai, isliye dusri supportive hints ka istemal karna faydemand ho sakta hai.Three Dim Crows) ek prakritik mild plan hai jo horrible instance ka signal deta hai. Lekin, is plan ko akele istemal karne se pehle dusri specific exam gadgets aur guidelines ka istemal karke uski tasdeeq zaroor karni chahiye. The the Forex market market looking for and promoting mein kam threat ke sath achhi tarah ki studies aur exam se suitable tidings safalta milti hai.Le plans foreign exchange searching out and promoting mein kisi bhi asset ki charge development ko samajhne ke liye ahem tareeqe hote hain. In plans se sellers ko market ki improvement ko samajhne mein madad milti hai aur destiny fee figures banane mein asani hoti hai ek lousy reversal plan hota hai -

#9 Collapse

Bullish Kicker forex trading mein ek bullish reversal candlestick pattern hai. Ye pattern downtrend ke baad dikhta hai aur market sentiment ka change indicate karta hai. Bullish Kicker pattern ko samajhne ke liye, do candles ka dhyaan dena hota hai: Pehli Candle: Pehli candle ek bearish surkh candle hoti hai, jo downtrend ko represent karti hai aur sellers ki dominance ko dikhata hai. Dusri Candle: Dusri candle ek badi bullish sabz candle hoti hai, jo pehli candle ke neeche se open hoti hai aur uske close ke above close hoti hai. Is candle ka range pehli candle ke range se bada hota hai. Bullish Kicker pattern mein dusri candle pehli candle ko completely engulf cover karti hai, jisse price action ka ek strong bullish reversal signal milta hai. Ye pattern bullish trend ki shuruwat ho sakta hai ya phir ongoing downtrend ko reverse kar sakta hai. Traders ko "Bullish Kicker" pattern ko confirm karne ke liye kuch points ka dhyaan rakhna hota hai: Dusri candle ka open pehli candle ke neeche hona chahiye. Dusri candle ka close pehli candle ke close ke above hona chahiye. Dusri candle ka range pehli candle ke range se bada hona chahiye. Is pattern ko dekh kar traders ko long positions lena ya existing short positions ko exit karke profits book karna ka signal milta hai. Jaisa ki har trading pattern mein hai, Bullish Kicker pattern ko bhi dusre technical analysis tools aur market ki overall condition ke saath confirm karna zaroori hai. Money management aur risk management ka bhi istemal karke trading decisions lene chahiye taki trading losses se bacha ja sake. Akhir mein, Bullish Kicker pattern aur dusre candlestick patterns ko effectively use karne ke liye practice aur experience ka bhi bht acha hai. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#10 Collapse

ek light plan hai jo negative (girawat ka) design ko show karta hai. Yeh configuration punch cost chart standard dikhai deta hai to yeh representatives ke liye ek critical sign hai ki market mein dropping improvement shuru ho gaya hai aur iska matlab hai ke stock ya cash ki keemat kam hone ki sambhavna hai. "Three Dim Crows" plan ko samajhne ke liye, aapko candles aur unke advancements ke central thoughts ka pata hona zaroori hai.Candles ek graphical depiction hai jo stock ya cash ke cost improvement ko depict karta hai. Har flame ek stretch of time (jaise 1 second, an hour, ya 1 racket) ko address karta hai aur ismein 4 expenses hote hain: opening expense, closing expense, generally excessive expense (high), aur least worth (low).Kuch typical candle plans hai jo representatives use karte hain, jaise "doji," "hammer," "hanging man," "falling star," "bullish overpowering," aur "negative immersing." "Three Dull Crows" bhi ek notable negative model hai. Outline Example Types: CandFlame ki closing expense pehli do candles ki closing costs se kam honi chahiye.Is plan ke samay stop-adversity demand ko rakhte color, intermediaries ko apne risk the board ko bhi samajhna zaroori hai.Agar market mein high insecurity hai, to ye plan kam reliable ho sakta hai, isliye dusri supportive pointers ka istemal karna faydemand ho sakta hai.Three Dull Crows) ek prakritik candle plan hai jo negative example ka sign deta hai. Lekin, is plan ko akele istemal karne se pehle dusri specific examination instruments aur pointers ka istemal karke uski tasdeeq zaroor karni chahiye. Forex trading mein kam risk ke sath achhi tarah ki research aur examination se good tidings safalta milti hai.le plans forex trading mein kisi bhi asset ki cost advancement ko samajhne ke liye ahem tareeqe hote hain. In plans se dealers ko market ki improvement ko samajhne mein madad milti hai aur future expense estimates banane mein asani hoti hai ek negative reversal plan hota hai, jo aksar upswing ya sideways design ke baad dekha jata hai. Is plan mein teesri fire do pehle ki negative candles ko follow karti hai.attern young adult negative (slipping) candles se milta hai, jo kuch is tarah hote hain Pehli candle ek upswing ya doji plan ke baad dekhi jati hai.Dusri light pehli candle ki closing expense se neeche khulti hai aur mazeed neeche jaati hai Teesri flame dusri candle ki closing expense se neeche khulti hai aur phir mazeed neeche jaati hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 02:28 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим