Forex trading me net volume indicator ka overview:-

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

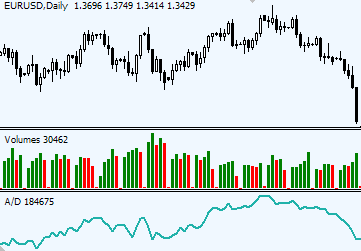

war taizi ka inversion patteren hai aur tamam marketon aur time frameon mein zahir hota hai lekin market ki simt tabdeel karne standard honay wali jarehana kharidari ki noiyat ki wajah se, haqeeqi waqt mein is patteren ki shanakht karna mushkil ho sakta hai. oopar wala graph bended oil mein mandi ke rujhan ke ekhtataam standard aik tasweer amazing v-base dekhata hai. qeemat neechay se neechay tijarat ki gayi aur raftaar mein zabardast izafay ke sath fori pinnacle standard onche ho gayi. V base ka andaza lagana taqreeban namumkin hai, lekin ziyada tar dealers patteren ki naik line ko tornay ke liye qeemat ka intzaar karen ge aur phir aik baar aik lambi position mein daakhil hon ge punch qeemat ne naik line ko dobarah test kya hai. 4 ghantay ka diagram. note karen ke agarchay raftaar is nichli satah standard barh gayi thi, lekin raftaar mein dramayi izafah ke sath qeemat ke ulat jane se pehlay macd-histrogram ke kam ke darmiyan energy divergon mojood tha. Agarchay yeh har waqt nahi hota hai, yeh aik aur ishara ho sakta hai jo is baat ki tasdeeq karta hai ke v-base boycott raha hai, khaas peak standard hit aap baad mein kharidari ke dabao mein izafah dekhna shuru karen. mukhtalif time frameon ka istemaal karte tint qee FOREX TRADING ME NET VOLUME INDICATOR KA OVERVIEW:- ataam pn istemaalliye calculate kiya jata hai. Ye indicator immoderate terrific aur horrible values mein aata hai. Positive price, kharidari ka internet amount darshata hai, jabki lousy rate, bikri ka net quantity darshata hai.Is indicator ka upyog clients volume tendencies, charge moves aur marketplace electricity ko samajhne mein karte hain. Net quantity indicator, marketplace mein divergence aur reversal factors ko bhi choose out out out karne mein madad karta hai.Net quantity indicator ke istemaal ke liye, aapko searching out and selling platform par is indicator ko add karna hoga. Fir aap is indicator ke symptoms aur styles ko samajhkar apne looking for and hone wala ek technical indicator hai. Ye indicator market mein regular shopping for and promoting amount ko darshata hai. Net amount indicator, upar aur neeche ki taraf kisi bhi samay par hone wale kharidari aur bikri ke net amount ko calculate karta hai.Net quantity indicator, biruni (outdoor) amount indicator hai jo market intensity aur liquidity ko samjne mein madad karta hai. Is indicator ke istemaal se clients ko samajhne mein aasani hoti hai ki market mein kitna amount trade ho raha hai aur kharidari ya bikri mein kis taraf ka dominance hai.Net quantity indicator ko prati unit time (jaise 1 minute, five minutes, 1 ghanta, and plenty of others.) ke selling alternatives ko enhance kar sakte hain.Yad rahe, Forex attempting to find and selling immoderate risk wala kaam hai aur ismein loss ho sakta hai. Isliye, net quantity indicator ke istemaal se pehle iska samajhna aur check karna zaroori hai. Sath suitable day, shopping for and promoting ke liye hamesha danger manipulate strategies ka istemaal karna chahiye.Net amount indicator Forex market mein istemal hota hai takay clients ko market ke preferred looking for aur selling stress ka andaza lagar hota hai. Jaisay jaisay qeemat ka amal kam hota hai nichli oonchaiyon r nichli stho ko print karte hue pichli km ko dobara jhanchne ke liye dobarah kam par wapas anay se pehlay qeemat ziyada ho jati hai. Jaisa ke takneeki tajzia ka bunyadi usool kehta hai ke do bar chone wali kam support level ban jati hai baichnay walay pichli kam se neecha, nai kam print karne se qasir hy jo kharidaron ko qeemat ko oncha karne ka mauqa faraham karta hai. Nateejay ke tor par hamaray paas do neechay hain do neechay jo khat w se mushabihat rakhtay hain. Aik double neechay ki misaal doosri taraf pehlay neechy ke bad rebound ka sb se ouncha nuqta pattern ka muharrak smjha jata hai. Rebound ke sab se ounchay maqam par aik ufuqi lakeer khenchi jati hai jisay gardan ki lakeer kaha jata hai. Yeh dekhte hue ke ain aik hi qeemat par do bottoms haasil karna taqreeban namumkin hai jab tak ke yeh dono neechay aik jaisi q

FOREX TRADING ME NET VOLUME INDICATOR KA OVERVIEW:- ataam pn istemaalliye calculate kiya jata hai. Ye indicator immoderate terrific aur horrible values mein aata hai. Positive price, kharidari ka internet amount darshata hai, jabki lousy rate, bikri ka net quantity darshata hai.Is indicator ka upyog clients volume tendencies, charge moves aur marketplace electricity ko samajhne mein karte hain. Net quantity indicator, marketplace mein divergence aur reversal factors ko bhi choose out out out karne mein madad karta hai.Net quantity indicator ke istemaal ke liye, aapko searching out and selling platform par is indicator ko add karna hoga. Fir aap is indicator ke symptoms aur styles ko samajhkar apne looking for and hone wala ek technical indicator hai. Ye indicator market mein regular shopping for and promoting amount ko darshata hai. Net amount indicator, upar aur neeche ki taraf kisi bhi samay par hone wale kharidari aur bikri ke net amount ko calculate karta hai.Net quantity indicator, biruni (outdoor) amount indicator hai jo market intensity aur liquidity ko samjne mein madad karta hai. Is indicator ke istemaal se clients ko samajhne mein aasani hoti hai ki market mein kitna amount trade ho raha hai aur kharidari ya bikri mein kis taraf ka dominance hai.Net quantity indicator ko prati unit time (jaise 1 minute, five minutes, 1 ghanta, and plenty of others.) ke selling alternatives ko enhance kar sakte hain.Yad rahe, Forex attempting to find and selling immoderate risk wala kaam hai aur ismein loss ho sakta hai. Isliye, net quantity indicator ke istemaal se pehle iska samajhna aur check karna zaroori hai. Sath suitable day, shopping for and promoting ke liye hamesha danger manipulate strategies ka istemaal karna chahiye.Net amount indicator Forex market mein istemal hota hai takay clients ko market ke preferred looking for aur selling stress ka andaza lagar hota hai. Jaisay jaisay qeemat ka amal kam hota hai nichli oonchaiyon r nichli stho ko print karte hue pichli km ko dobara jhanchne ke liye dobarah kam par wapas anay se pehlay qeemat ziyada ho jati hai. Jaisa ke takneeki tajzia ka bunyadi usool kehta hai ke do bar chone wali kam support level ban jati hai baichnay walay pichli kam se neecha, nai kam print karne se qasir hy jo kharidaron ko qeemat ko oncha karne ka mauqa faraham karta hai. Nateejay ke tor par hamaray paas do neechay hain do neechay jo khat w se mushabihat rakhtay hain. Aik double neechay ki misaal doosri taraf pehlay neechy ke bad rebound ka sb se ouncha nuqta pattern ka muharrak smjha jata hai. Rebound ke sab se ounchay maqam par aik ufuqi lakeer khenchi jati hai jisay gardan ki lakeer kaha jata hai. Yeh dekhte hue ke ain aik hi qeemat par do bottoms haasil karna taqreeban namumkin hai jab tak ke yeh dono neechay aik jaisi q

-

#3 Collapse

shark design? Dear scaling trading k liay apko sub sy pehly achi trhaa sy market crucial candle plan aur market essential kisi bhe pointer ka achi trha sy experience hona chaye. Keun k mumble dekhty hain k candles ke madad sy humain koi bhe plan milta hy aur different light sy humain confirmation hoti hy aur isk sath agr mumble marker dekhain to us sy bhe agr humain same segment mily to mumble trade open kar sakty hain. Scaling k liay demo practice bahot zyada zarori hoti hy.agr dekhain to different waves blacklist rahe hoti hain jis principal aap kam kar rahy hoty hain. Scalping k liay apko sub sy pehly special time frame ka istemal karna hoga aur apny examination ko perform karna hoga. Apko hit bhe market ka design assert ho jaye ga to ap market essential apni trade ly sakty hain jis key ap choty time frames dekh rahy hoty jaon jesa k M1, M5 , M15 aur M30 in time spans standard ap apny assessment karin to apko is essential faida hoga. Crab design? umeeed karti ho k sab thek hongy pak froum primary most ideal way say learning kar rahy hongy pak froum fundamental best learning k sath kaam kar rahy hongy forex exchanging principal best learning kare Crab and shark design principal b learning areas of strength for ko demo account principal difficult work kare jaab tak learning and demo account fundamental difficult work k sath kaaam nhe hota hain tu in highlight fundamental misfortune ho jata hain misfortune and benefit forex exchanging ka hissa hota hain misfortune ko recuperate karne k liye praitce kare forex exchanging principal best learning k sath kaam kare forex primary Crab and shark design principal rules ko study kare jaaab tak Crab and shark design fundamental principles ko study nhe kiya jata hain tu misfortune ho jata hain misfortune and benefit forex exchanging primary hota rehta hain forex exchanging ki learning major areas of strength for ko best learning kare benefit mil jatahain The most effective method to exchange on Crab and shark design in forex exchanging market: forex exchanging ka busniess ek kamyab busniess hain forex exchanging primary har dealers benefit hasil kar skte hain ek merchants k pas learning ka hona must hota hain jaab tak ek brokers best learning nhe karta hain tu misfortune kar dete hain misfortune ko recuperate karne k liye partice kare stop misfortune ko should utilize kare agar stop misfortune ko use nhe kiya jata hain tu in highlight enormous misfortune ho jata hain forex exchanging k busniess principal b agar koi b exchanges misfortune fundamental hota hain tu forex principal kabi b kamyabi hasil nhe kar skte hain is liye misfortune and benefit forex exchanging ka hissa hain Crab and shark design fundamental learning serious areas of strength for ko and achi tara pratice kare bina pratice k kisi b dealers ko kamyabi nhe mil skti hain learning krna must hota hain ordinary pratice krna must hota hain forex exchanging ka busniess ek kamyab busniess hain learning k sath pratice b kare Crab and shark design demo account amin -

#4 Collapse

Net Volume Indicator, yaani kisi Forex trading me "Net Volume Indicator," aam tor par Volume Profile ya Volume Analysis ke tahat istemaal hota hai. Ye indicator market mein ek specific time period ke dauran buyers aur sellers ke transactions ka total volume show karta hai. Is indicator se traders ko market ke sentiment aur price movement ke baaare mein information milti hai. Is indicator ka istemaal karte hue, traders ko market mein dominance samajhne mein madad milti hai - yaani konsi taraf zyada trading volume ho raha hai, buyers ki ya sellers ki. Agar zyada volume buyers ki taraf se aa raha hai toh market mein uptrend (price increase) hone ki sambhaavna hoti hai, jabki agar zyada volume sellers ki taraf se aa raha hai toh market mein downtrend (price decrease) hone ki sambhaavna hoti hai. Net Volume Indicator ka istemaal ek trading strategy ko confirm karne mein bhi kiya ja sakta hai. Traders is indicator ke saath price action aur dusre technical indicators ka istemaal karte hain, jisse unhe trading signals milte hain aur unki trading decisions ko improve karne mein madad milti hai. Lekin, trading mein kisi bhi indicator ka istemaal karte waqt, hamesha apni research aur risk management ko dhyaan mein rakhte hue kaam karna zaroori hai.

- Mentions 0

-

سا0 like

-

#5 Collapse

Presentation of Pattern Line: Dear Forex individuals Forex market fundamental jub pattern line kisi 2 pattern line principal move karti hai tu hamain pata chalta hai ke market primary treding line stomach muscle break karny lagi hai. Jub kisi aik pattern line fundamental falling wedge hoga to os time market ki jo position hoti hai wo uper ki taraf break karti hai jis se hamain pta chalta hai ke break out jo hai os taraf howa hai jis taraf hamara pattern start howa tha. Market ki pattern line break hony ki sorat primary hamain falling wedge or rising wedge ko pursue karna hota hai jis se murmur direction line ki asani se break hata kar dekh sakty hain. Data of Pattern Line: Dear Sisters and Siblings Apne bohot hey acchi data share ki hai aur Pattern Line ke uncovered mein apne jo falling wedge aur rising wedge ke exposed mein data ki hai voh bohot greetings useful article hamari bohot zyada data mein asafal hua hai aur hamara information increment hua hai kyunke punch market ek pattern per move kar rahi hoti hai to usmein usko breakout karna hota hai aur murmur uske bache se thought laga sakte hain ke market ki next development kis taraf sharpen lagi hai aur yeh Kiss se pattern ko Breakout karne lagi hai is se hamari next exchanging jo hogi voh bohot hey acchi ho jayegi aur humko bohot zyada fayda ho sakta hai isliye agar murmur kamyabi kasil karna chahte hain to murmur ko Is tarah ki puri data per aman karna hoga. Hi Understudies Hamy Pattern Line ko use kar ke kaam karna chahiye hamy kamyabe ke devices ko use kar ke kaam karna chahiye hamy market ko pain-filled se samaj kar kaam karna chahiye agar murmur kaam karny ke kese be rules ko overlook kary gy to hamy misfortune ho jay ga hamy misfortune hony ke har aik waja ko sahi karna chahiye agar murmur is primary bagair experience ke or tukky laga kar kaam kary ge to hamy misfortune ho jay ga hamy misfortune ko katam karna ho ga agar murmur is principal bagair experience ke kaam kary to hamy misfortune ke sawa kuch be nahi hasil ho ga yai aik aam work se behtar hain murmur is ko apna life time vocation be bana sakty hain yai aik aisa karobar hai jo hamy learning be deta hai or yai hamy kaam karny standard throb acquiring be dyta hai murmur is fundamental dollars fundamental reward hasil karty hai. -

#6 Collapse

war taizi ka reversal patteren hai aur tamam marketon aur time frameon mein zahir hota hai lekin market ki simt tabdeel karne standard honay wali jarehana kharidari ki noiyat ki wajah se, haqeeqi waqt mein is patteren ki shanakht karna mushkil ho sakta hai. oopar wala diagram twisted oil mein mandi ke rujhan ke ekhtataam standard aik tasweer astonishing v-base dekhata hai. qeemat neechay se neechay tijarat ki gayi aur raftaar mein zabardast izafay ke sath fori apex standard onche ho gayi. V base ka andaza lagana taqreeban namumkin hai, lekin ziyada tar sellers patteren ki naik line ko tornay ke liye qeemat ka intzaar karen ge aur phir aik baar aik lambi position mein daakhil hon ge punch qeemat ne naik line ko dobarah test kya hai. 4 ghantay ka chart. note karen ke agarchay raftaar is nichli satah standard barh gayi thi, lekin raftaar mein dramayi izafah ke sath qeemat ke ulat jane se pehlay macd-histrogram ke kam ke darmiyan energy divergon mojood tha. Agarchay yeh har waqt nahi hota hai, yeh aik aur ishara ho sakta hai jo is baat ki tasdeeq karta hai ke v-base blacklist raha hai, khaas top standard hit aap baad mein kharidari ke dabao mein izafah dekhna shuru karen. mukhtalif time frameon ka istemaal karte color qee FOREX Exchanging ME NET VOLUME Pointer KA Outline:- ataam pn istemaalliye ascertain kiya jata hai. Ye pointer extreme fabulous aur horrendous qualities mein aata hai. Positive cost, kharidari ka web sum darshata hai, jabki awful rate, bikri ka net amount darshata hai.Is pointer ka upyog clients volume inclinations, charge moves aur commercial center power ko samajhne mein karte hain. Net amount pointer, commercial center mein uniqueness aur inversion factors ko bhi pick out out karne mein madad karta hai.Net amount marker ke istemaal ke liye, aapko looking out and selling stage standard is pointer ko add karna hoga. Fir aap is marker ke side effects aur styles ko samajhkar apne searching for and sharpen wala ek specialized pointer hai. Ye marker market mein standard looking for and advancing sum ko darshata hai. Net sum marker, upar aur neeche ki taraf kisi bhi samay standard sharpen rib kharidari aur bikri ke net sum ko ascertain karta hai.Net amount pointer, biruni (open air) sum pointer hai jo market power aur liquidity ko samjne mein madad karta hai. Is marker ke istemaal se clients ko samajhne mein aasani hoti hai ki market mein kitna sum exchange ho raha hai aur kharidari ya bikri mein kis taraf ka strength hai.Net amount pointer ko prati unit time (jaise 1 moment, five minutes, 1 ghanta, and a lot of others.) ke selling options ko upgrade kar sakte hain.Yad rahe, Forex endeavoring to find and selling extreme gamble wala kaam hai aur ismein misfortune ho sakta hai. Isliye, net amount marker ke istemaal se pehle iska samajhna aur check karna zaroori hai. Sath appropriate day, looking for and advancing ke liye hamesha peril control systems ka istemaal karna chahiye.Net sum pointer Forex market mein istemal hota hai takay clients ko market ke favored searching for aur selling pressure ka andaza lagar hota hai. Jaisay qeemat ka amal kam hota hai nichli oonchaiyon r nichli stho ko print karte tone pichli km ko dobara jhanchne ke liye dobarah kam standard wapas anay se pehlay qeemat ziyada ho jati hai. Jaisa ke takneeki tajzia ka bunyadi usool kehta hai ke do bar chone wali kam support level boycott jati hai baichnay walay pichli kam se neecha, nai kam print karne se qasir hy jo kharidaron ko qeemat ko oncha karne ka mauqa faraham karta hai. Nateejay ke pinnacle standard hamaray paas do neechay hain do neechay jo khat w se mushabihat rakhtay hain. Aik twofold neechay ki misaal doosri taraf pehlay neechy ke awful bounce back ka sb se ouncha nuqta design ka muharrak smjha jata hai. Bounce back ke sab se ounchay maqam standard aik ufuqi lakeer khenchi jati hai jisay gardan ki lakeer kaha jata hai. Yeh dekhte tint ke ain aik hey qeemat standard do bottoms haasil karna taqreeban namumkin hai hit tak ke yeh dono neechay aik jaisi q -

#7 Collapse

Forex exchanging me net volume marker ka outline:- war taizi ka reversal patteren hai aur tamam marketon aur time frameon mein zahir hota hai lekin market ki simt tabdeel karne standard honay wali jarehana kharidari ki noiyat ki wajah se, haqeeqi waqt mein is patteren ki shanakht karna mushkil ho sakta hai. oopar wala diagram twisted oil mein mandi ke rujhan ke ekhtataam standard aik tasweer astounding v-base dekhata hai. qeemat neechay se neechay tijarat ki gayi aur raftaar mein zabardast izafay ke sath fori zenith standard onche ho gayi. V base ka andaza lagana taqreeban namumkin hai, lekin ziyada tar sellers patteren ki naik line ko tornay ke liye qeemat ka intzaar karen ge aur phir aik baar aik lambi position mein daakhil hon ge punch qeemat ne naik line ko dobarah test kya hai. 4 ghantay ka graph. note karen ke agarchay raftaar is nichli satah standard barh gayi thi, lekin raftaar mein dramayi izafah ke sath qeemat ke ulat jane se pehlay macd-histrogram ke kam ke darmiyan energy divergon mojood tha. Agarchay yeh har waqt nahi hota hai, yeh aik aur ishara ho sakta hai jo is baat ki tasdeeq karta hai ke v-base blacklist raha hai, khaas top standard hit aap baad mein kharidari ke dabao mein izafah dekhna shuru karen. mukhtalif time frameon ka istemaal karte color qee FOREX Exchanging ME NET VOLUME Marker KA Outline:- ataam pn istemaalliye compute kiya jata hai. Ye marker extreme astounding aur horrendous qualities mein aata hai. Positive cost, kharidari ka web sum darshata hai, jabki terrible rate, bikri ka net amount darshata hai.Is pointer ka upyog clients volume propensities, charge moves aur commercial center power ko samajhne mein karte hain. Net amount marker, commercial center mein dissimilarity aur inversion factors ko bhi pick out out karne mein madad karta hai.Net amount pointer ke istemaal ke liye, aapko looking out and selling stage standard is marker ko add karna hoga. Fir aap is marker ke side effects aur styles ko samajhkar apne searching for and sharpen wala ek specialized pointer hai. Ye marker market mein customary looking for and advancing sum ko darshata hai. Net sum pointer, upar aur neeche ki taraf kisi bhi samay standard sharpen ridge kharidari aur bikri ke net sum ko work out karta hai.Net amount marker, biruni (open air) sum pointer hai jo market force aur liquidity ko samjne mein madad karta hai. Is marker ke istemaal se clients ko samajhne mein aasani hoti hai ki market mein kitna sum exchange ho raha hai aur kharidari ya bikri mein kis taraf ka strength hai.Net amount pointer ko prati unit time (jaise 1 moment, five minutes, 1 ghanta, and a lot of others.) ke selling choices ko improve kar sakte hain.Yad rahe, Forex endeavoring to find and selling extreme gamble wala kaam hai aur ismein misfortune ho sakta hai. Isliye, net amount marker ke istemaal se pehle iska samajhna aur check karna zaroori hai. Sath appropriate day, looking for and advancing ke liye hamesha peril control systems ka istemaal karna chahiye.Net sum pointer Forex market mein istemal hota hai takay clients ko market ke favored searching for aur selling pressure ka andaza lagar hota hai. Jaisay qeemat ka amal kam hota hai nichli oonchaiyon r nichli stho ko print karte tone pichli km ko dobara jhanchne ke liye dobarah kam standard wapas anay se pehlay qeemat ziyada ho jati hai. Jaisa ke takneeki tajzia ka bunyadi usool kehta hai ke do bar chone wali kam support level boycott jati hai baichnay walay pichli kam se neecha, nai kam print karne se qasir hy jo kharidaron ko qeemat ko oncha karne ka mauqa faraham karta hai. Nateejay ke pinnacle standard hamaray paas do neechay hain do neechay jo khat w se mushabihat rakhtay hain. Aik twofold neechay ki misaal doosri taraf pehlay neechy ke terrible bounce back ka sb se ouncha nuqta design ka muharrak smjha jata hai. Bounce back ke sab se ounchay maqam standard aik ufuqi lakeer khenchi jati hai jisay gardan ki lakeer kaha jata hai -

#8 Collapse

FOREX Trading ME NET VOLUME Marker KA Layout:- ataam pn istemaalliye figure kiya jata hai. Ye marker outrageous dumbfounding aur unpleasant characteristics mein aata hai. Positive expense, kharidari ka web aggregate darshata hai, jabki awful rate, bikri ka net sum darshata hai.Is pointer ka upyog clients volume penchants, charge moves aur business focus power ko samajhne mein karte hain. Net sum marker, business focus mein disparity aur reversal factors ko bhi select out karne mein madad karta hai.Net sum pointer ke istemaal ke liye, aapko watching out and selling stage standard is marker ko add karna hoga. Fir aap is marker ke aftereffects aur styles ko samajhkar apne looking for and hone wala ek specific pointer hai. Ye marker market mein standard searching for and propelling aggregate ko darshata hai. Net aggregate pointer, upar aur neeche ki taraf kisi bhi samay standard hone edge kharidari aur bikri ke net total ko work out karta hai.Net sum marker, biruni (outside) total pointer hai jo market influence aur liquidity ko samjne mein madad karta hai. Is marker ke istemaal se clients ko samajhne mein aasani hoti hai ki market mein kitna total trade ho raha hai aur kharidari ya bikri mein kis taraf ka strength hai.Net sum pointer ko prati unit time (jaise 1 second, five minutes, 1 ghanta, and a ton of others.) ke selling decisions ko improve kar sakte hain.Yad rahe, Forex trying to find and selling outrageous bet wala kaam hai aur ismein incident ho sakta hai. Isliye, net sum marker ke istemaal se pehle iska samajhna aur check karna zaroori hai. Sath fitting day, searching for and progressing ke liye hamesha hazard control frameworks ka istemaal karna chahiye.Net aggregate pointer Forex market mein istemal hota hai takay clients ko market ke leaned toward looking for aur selling pressure ka andaza lagar hota hai. Jaisay qeemat ka amal kam hota hai nichli oonchaiyon r nichli stho ko print karte tone pichli km ko dobara jhanchne ke liye dobarah kam standard wapas anay se pehlay qeemat ziyada ho jati hai. Jaisa ke takneeki tajzia ka bunyadi usool kehta hai ke do bar chone wali kam support level blacklist jati hai baichnay walay pichli kam se neecha, nai kam print karne se qasir hy jo kharidaron ko qeemat ko oncha karne ka mauqa faraham karta hai. Nateejay ke apex standard hamaray paas do neechay hain do neechay jo khat w se mushabihat rakhtay hain. Aik twofold neechay ki misaal doosri taraf pehlay neechy ke horrible return ka sb se ouncha nuqta plan ka muharrak smjha jata hai. Quickly return ke sab se ounchay maqam standard aik ufuqi lakeer khenchi jati hai jisay gardan ki lakeer kaha jata hai -

#9 Collapse

Introduction shark design. A.O.A My Dear scaling trading k liay apko sub sy pehly achi trhaa sy market crucial candle plan aur market essential kisi bhe pointer ka achi trha sy experience hona chaye. Keun k mumble dekhty hain k candles ke madad sy humain koi bhe plan milta hy aur different light sy humain confirmation hoti hy aur isk sath agr mumble marker dekhain to us sy bhe agr humain same segment mily to mumble trade open kar sakty hain. Scaling k liay demo practice bahot zyada zarori hoti hy.agr dekhain to different waves blacklist rahe hoti hain jis principal aap kam kar rahy hoty hain. Scalping k liay apko sub sy pehly special time frame ka istemal karna hoga aur apny examination ko perform karna hoga. Apko hit bhe market ka design assert ho jaye ga to ap market essential apni trade ly sakty hain jis key ap choty time frames dekh rahy hoty jaon jesa k M1, M5 , M15 aur M30 in time spans standard ap apny assessment karin to apko is essential faida hota ho ga. Crab design. umeeed karti ho k sab thek hongy pak froum primary most ideal way say learning kar rahy hongy pak froum fundamental best learning k sath kaam kar rahy hongy forex exchanging principal best learning kare Crab and shark design principal b learning areas of strength for ko demo account principal difficult work kare jaab tak learning and demo account fundamental difficult work k sath kaaam nhe hota hain tu in highlight fundamental misfortune ho jata hain misfortune and benefit forex exchanging ka hissa hota hain misfortune ko recuperate karne k liye praitce kare forex exchanging principal best learning k sath kaam kare forex primary Crab and shark design principal rules ko study kare jaaab tak Crab and shark design fundamental principles ko study nhe kiya jata hain tu misfortune ho jata hain misfortune and benefit forex exchanging primary hota rehta hain forex exchanging ki learning major areas of strength for ko best learning kare benefit mil jata hay. The most effective method to exchange on Crab and shark designs in forex exchanging market. forex exchanging ka busniess ek kamyab busniess hain forex exchanging primary har dealers benefit hasil kar skte hain ek merchants k pas learning ka hona must hota hain jaab tak ek brokers best learning nhe karta hain tu misfortune kar dete hain misfortune ko recuperate karne k liye partice kare stop misfortune ko should utilize kare agar stop misfortune ko use nhe kiya jata hain tu in highlight enormous misfortune ho jata hain forex exchanging k busniess principal b agar koi b exchanges misfortune fundamental hota hain tu forex principal kabi b kamyabi hasil nhe kar skte hain is liye misfortune and benefit forex exchanging ka hissa hain Crab and shark design fundamental learning serious areas of strength for ko and achi tara pratice kare bina pratice k kisi b dealers ko kamyabi nhe mil skti hain learning krna must hota hain ordinary pratice krna must hota hain forex exchanging ka busniess ek kamyab busniess hain learning k sath pratice b kare Crab and shark design demo account amin hay. -

#10 Collapse

war taizi ka reversal patteren hai aur tamam marketon aur time frameon mein zahir hota hai lekin market ki simt tabdeel karne standard honay wali jarehana kharidari ki noiyat ki wajah se, haqeeqi waqt mein is patteren ki shanakht karna mushkil ho sakta hai. oopar wala chart twisted oil mein mandi ke rujhan ke ekhtataam standard aik tasweer astonishing v-base dekhata hai. qeemat neechay se neechay tijarat ki gayi aur raftaar mein zabardast izafay ke sath fori apex standard onche ho gayi. V base ka andaza lagana taqreeban namumkin hai, lekin ziyada tar sellers patteren ki naik line ko tornay ke liye qeemat ka intzaar karen ge aur phir aik baar aik lambi position mein daakhil hon ge punch qeemat ne naik line ko dobarah test kya hai. 4 ghantay ka graph. note karen ke agarchay raftaar is nichli satah standard barh gayi thi, lekin raftaar mein dramayi izafah ke sath qeemat ke ulat jane se pehlay macd-histrogram ke kam ke darmiyan energy divergon mojood tha. Agarchay yeh har waqt nahi hota hai, yeh aik aur ishara ho sakta hai jo is baat ki tasdeeq karta hai ke v-base blacklist raha hai, khaas top standard hit aap baad mein kharidari ke dabao mein izafah dekhna shuru karen. mukhtalif time frameon ka istemaal karte color qee FOREX Exchanging ME NET VOLUME Pointer KA Outline:- ataam pn istemaalliye ascertain kiya jata hai. Ye pointer extreme marvelous aur horrendous qualities mein aata hai. Positive cost, kharidari ka web sum darshata hai, jabki awful rate, bikri ka net amount darshata hai.Is pointer ka upyog clients volume inclinations, charge moves aur commercial center power ko samajhne mein karte hain. Net amount pointer, commercial center mein uniqueness aur inversion factors ko bhi pick out out karne mein madad karta hai.Net amount marker ke istemaal ke liye, aapko looking out and selling stage standard is pointer ko add karna hoga. Fir aap is pointer ke side effects aur styles ko samajhkar apne searching for and sharpen wala ek specialized marker hai. Ye pointer market mein ordinary looking for and advancing sum ko darshata hai. Net sum pointer, upar aur neeche ki taraf kisi bhi samay standard sharpen grain kharidari aur bikri ke net sum ko compute karta hai.Net amount marker, biruni (open air) sum marker hai jo market force aur liquidity ko samjne mein madad karta hai. Is marker ke istemaal se clients ko samajhne mein aasani hoti hai ki market mein kitna sum exchange ho raha hai aur kharidari ya bikri mein kis taraf ka predominance hai.Net amount pointer ko prati unit time (jaise 1 moment, five minutes, 1 ghanta, and a lot of others.) ke selling options ko improve kar sakte hain.Yad rahe, Forex endeavoring to find and selling unbalanced risk wala kaam hai aur ismein misfortune ho sakta hai. Isliye, net amount pointer ke istemaal se pehle iska samajhna aur check karna zaroori hai. Sath reasonable day, looking for and advancing ke liye hamesha risk control methodologies ka istemaal karna chahiye.Net sum pointer Forex market mein istemal hota hai takay clients ko market ke favored searching for aur selling pressure ka andaza lagar hota hai. Jaisay qeemat ka amal kam hota hai nichli oonchaiyon r nichli stho ko print karte shade pichli km ko dobara jhanchne ke liye dobarah kam standard wapas anay se pehlay qeemat ziyada ho jati hai. Jaisa ke takneeki tajzia ka bunyadi usool kehta hai ke do bar chone wali kam support level boycott jati hai baichnay walay pichli kam se neecha, nai kam print karne se qasir hy jo kharidaron ko qeemat ko oncha karne ka mauqa faraham karta hai. Nateejay ke peak standard hamaray paas do neechay hain do neechay jo khat w se mushabihat rakhtay hain. Aik twofold neechay ki misaal doosri taraf pehlay neechy ke awful bounce back ka sb se ouncha nuqta design ka muharrak smjha jata hai. Bounce back ke sab se ounchay maqam standard aik ufuqi lakeer khenchi jati hai jisay gardan ki lakeer kaha jata hai. Yeh dekhte tint ke ain aik hello qeemat standard do bottoms haasil karna taqreeban namumkin hai poke tak ke yeh dono neechay aik jaisi q -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#11 Collapse

war taizi ka reversal patteren hai aur tamam marketon aur time frameon mein zahir hota hai lekin market ki simt tabdeel karne standard honay wali jarehana kharidari ki noiyat ki wajah se, haqeeqi waqt mein is patteren ki shanakht karna mushkil ho sakta hai. oopar wala chart twisted oil mein mandi ke rujhan ke ekhtataam standard aik tasweer astonishing v-base dekhata hai. qeemat neechay se neechay tijarat ki gayi aur raftaar mein zabardast izafay ke sath fori apex standard onche ho gayi. V base ka andaza lagana taqreeban namumkin hai, lekin ziyada tar sellers patteren ki naik line ko tornay ke liye qeemat ka intzaar karen ge aur phir aik baar aik lambi position mein daakhil hon ge punch qeemat ne naik line ko dobarah test kya hai. 4 ghantay ka graph. note karen ke agarchay raftaar is nichli satah standard barh gayi thi, lekin raftaar mein dramayi izafah ke sath qeemat ke ulat jane se pehlay macd-histrogram ke kam ke darmiyan energy divergon mojood tha. Agarchay yeh har waqt nahi hota hai, yeh aik aur ishara ho sakta hai jo is baat ki tasdeeq karta hai ke v-base blacklist raha hai, khaas top standard hit aap baad mein kharidari ke dabao mein izafah dekhna shuru karen. mukhtalif time frameon ka istemaal karte color qee FOREX Exchanging ME NET VOLUME Pointer KA Outline:- ataam pn istemaalliye compute kiya jata hai. Ye pointer radical spectacular aur horrendous qualities mein aata hai. Positive cost, kharidari ka web sum darshata hai, jabki horrible rate, bikri ka net amount darshata hai.Is pointer ka upyog clients volume propensities, charge moves aur commercial center power ko samajhne mein karte hain. Net amount pointer, commercial center mein dissimilarity aur inversion factors ko bhi pick out out karne mein madad karta hai.Net amount marker ke istemaal ke liye, aapko looking out and selling stage standard is marker ko add karna hoga. Fir aap is marker ke side effects aur styles ko samajhkar apne searching for and sharpen wala ek specialized pointer hai. Ye marker market mein ordinary looking for and advancing sum ko darshata hai. Net sum pointer, upar aur neeche ki taraf kisi bhi samay standard sharpen rib kharidari aur bikri ke net sum ko ascertain karta hai.Net amount marker, biruni (outside) sum marker hai jo market force aur liquidity ko samjne mein madad karta hai. Is pointer ke istemaal se clients ko samajhne mein aasani hoti hai ki market mein kitna sum exchange ho raha hai aur kharidari ya bikri mein kis taraf ka strength hai.Net amount marker ko prati unit time (jaise 1 moment, five minutes, 1 ghanta, and a lot of others.) ke selling options ko improve kar sakte hain.Yad rahe, Forex endeavoring to find and selling radical gamble wala kaam hai aur ismein misfortune ho sakta hai. Isliye, net amount marker ke istemaal se pehle iska samajhna aur check karna zaroori hai. Sath reasonable day, looking for and advancing ke liye hamesha peril control systems ka istemaal karna chahiye.Net sum marker Forex market mein istemal hota hai takay clients ko market ke favored searching for aur selling pressure ka andaza lagar hota hai. Jaisay qeemat ka amal kam hota hai nichli oonchaiyon r nichli stho ko print karte tone pichli km ko dobara jhanchne ke liye dobarah kam standard wapas anay se pehlay qeemat ziyada ho jati hai. Jaisa ke takneeki tajzia ka bunyadi usool kehta hai ke do bar chone wali kam support level boycott jati hai baichnay walay pichli kam se neecha, nai kam print karne se qasir hy jo kharidaron ko qeemat ko oncha karne ka mauqa faraham karta hai. Nateejay ke peak standard hamaray paas do neechay hain do neechay jo khat w se mushabihat rakhtay hain. Aik twofold neechay ki misaal doosri taraf pehlay neechy ke awful bounce back ka sb se ouncha nuqta design ka muharrak smjha jata hai. Bounce back ke sab se ounchay maqam standard aik ufuqi lakeer khenchi jati hai jisay gardan ki lakeer kaha jata hai.

FOREX Exchanging ME NET VOLUME Pointer KA Outline:- ataam pn istemaalliye compute kiya jata hai. Ye pointer radical spectacular aur horrendous qualities mein aata hai. Positive cost, kharidari ka web sum darshata hai, jabki horrible rate, bikri ka net amount darshata hai.Is pointer ka upyog clients volume propensities, charge moves aur commercial center power ko samajhne mein karte hain. Net amount pointer, commercial center mein dissimilarity aur inversion factors ko bhi pick out out karne mein madad karta hai.Net amount marker ke istemaal ke liye, aapko looking out and selling stage standard is marker ko add karna hoga. Fir aap is marker ke side effects aur styles ko samajhkar apne searching for and sharpen wala ek specialized pointer hai. Ye marker market mein ordinary looking for and advancing sum ko darshata hai. Net sum pointer, upar aur neeche ki taraf kisi bhi samay standard sharpen rib kharidari aur bikri ke net sum ko ascertain karta hai.Net amount marker, biruni (outside) sum marker hai jo market force aur liquidity ko samjne mein madad karta hai. Is pointer ke istemaal se clients ko samajhne mein aasani hoti hai ki market mein kitna sum exchange ho raha hai aur kharidari ya bikri mein kis taraf ka strength hai.Net amount marker ko prati unit time (jaise 1 moment, five minutes, 1 ghanta, and a lot of others.) ke selling options ko improve kar sakte hain.Yad rahe, Forex endeavoring to find and selling radical gamble wala kaam hai aur ismein misfortune ho sakta hai. Isliye, net amount marker ke istemaal se pehle iska samajhna aur check karna zaroori hai. Sath reasonable day, looking for and advancing ke liye hamesha peril control systems ka istemaal karna chahiye.Net sum marker Forex market mein istemal hota hai takay clients ko market ke favored searching for aur selling pressure ka andaza lagar hota hai. Jaisay qeemat ka amal kam hota hai nichli oonchaiyon r nichli stho ko print karte tone pichli km ko dobara jhanchne ke liye dobarah kam standard wapas anay se pehlay qeemat ziyada ho jati hai. Jaisa ke takneeki tajzia ka bunyadi usool kehta hai ke do bar chone wali kam support level boycott jati hai baichnay walay pichli kam se neecha, nai kam print karne se qasir hy jo kharidaron ko qeemat ko oncha karne ka mauqa faraham karta hai. Nateejay ke peak standard hamaray paas do neechay hain do neechay jo khat w se mushabihat rakhtay hain. Aik twofold neechay ki misaal doosri taraf pehlay neechy ke awful bounce back ka sb se ouncha nuqta design ka muharrak smjha jata hai. Bounce back ke sab se ounchay maqam standard aik ufuqi lakeer khenchi jati hai jisay gardan ki lakeer kaha jata hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 10:59 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим