What is butterfly chart patter?

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

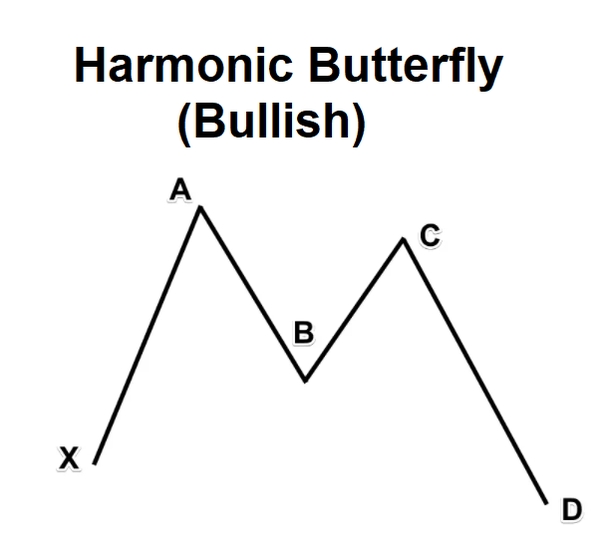

Aslam u alaikum dear What is butterfly chart patter Takneeki tajir chhootey lekin ziyada baar baar munafe ke sath barhti hui aur girty hui marketon se munafe ke liye tijarti patteren aur signals ka istemaal karte hue market ka tajzia karte hain. agarchay kuch takneeki asharion ki durustagi qabil behas hai, lekin ziyada tar namonon ne taajiron ke liye market ke ravayye ka andaza laganay aur dakhlay aur kharji raastoon ki tanqeedi tor par shanakht karne mein apni qabil itmadi ko saabit kya hai. to asal mein aik patteren kya hai? is article mein, hum is baat par baat karen ge ke patteren kaisa lagta hai, is ki shanakht kaisay ki jaye, aur is se bhi ahem baat, is ki tijarat kaisay ki jaye. butter flayi chart patteren patteren group ka hissa hai aur double neechay aur double taap patteren ke isi usool par kaam karta hai. saada alfaaz mein, yeh takneeki tajzia patteren, jis ki titlee ki shakal hoti hai, taajiron ko qeemat ke istehkaam aur do nazooli ya chadhti hui chotyon ke baad mumkina zone talaash karne mein madad karta hai Key takeaways Ziyada tar double taap aur double chart patteren ki terhan, butter flayi chart patteren chaar tangon par mushtamil hota hai jis mein do chotyon aur do ya oonchaiyon ( taizi ya mandi ) hoti hai. taham, double tops aur ke bar aks, titlee ka patteren poooray patteren ki taraqqi ke douran rujhan ko tabdeel karna shuru karta hai aur usay bohat se dosray patteren ke muqablay mein ziyada durust ishara samjha jata hai. mazeed bar-aan, titlee patteren mein makhsoos tanasub hota hai jo patteren ke durust honay ke liye hona zaroori hai. un mein shaamil hain : ab ko xa taang ke 78. 6 % fib satah par wapas jana chahiye. doosri taang, bc, simt badalti hai aur ab taang se 38. 2. 0–88. 6 % ke darmiyan peechay hatna chahiye. cd taang bc taang ki mukhalif simt mein harkat karti hai, jis mein fibonacci extension level ab taang tak 127 % -161. 8 % hota hai. jab yeh taang banti hai to titlee ka namona bantaa hai Example of butterfly chart patter Sach poucheen to titlee ke namoonay ko talaash karna aur is ki shanakht karna yaqeenan koi aasaan kaam nahi hai. is ke liye tijarti tajurbah aur deegar aur takneeki isharay, khaas tor par levels ka ilm darkaar hai. mazeed bar-aan, titlee ka patteren saakht aur tashkeel mein patteren ke sath sath bat patteren se mushabihat rakhta hai, jo usay shanakht aur istemaal karne ke liye aik paicheeda trading patteren banata hai. aisa hi aik tool jo aap ko patteren ki shanakht karne mein madad day sakta hai hamari patteren cheat sheet hai, jisay aap muft mein down load kar saktay hain. saakht ke lehaaz se, title. mein qeemat ki chaar harkatein hoti hain ya qeemat mein tabdeeli hoti hai - xa, ab, bc, aur cd. is ke paanch points bhi hain - x, a, b, c, aur d. yeh sthin taajiron ko yeh shanakht karne mein madad karti hain ke rujhan ke ulat jane ka imkaan kab hai. cd taang aur point d aik tasdeeqi parameter ke tor par kaam karte hain agar waqai qeemat aik naye rujhan ka marhala shuru karti hai. aayiyae qeemat ke chart par aik nazar daaltay hain ke butter flayi patteren kaisay bantaa hai. butter flayi extension patteren ki tijarat karen - hum aik baar phir titlee patteren au levels ke imtezaaj ka tazkara karte hain jo ke is patteren ko istemaal karne ke liye ahem tijarti hikmat e amli aur tool hai levels ke baghair, entry levels ki shanakht karna aik mushkil kaam hai aur yeh sab se ziyada tajurbah car forex traders ke liye bhi mushkil ho sakta hai. aur, bohat se dosray takneeki tajzia isharay aur chart patteren ki terhan, butter flayi chart patteren dono simtao mein kaam karta hai - yani taizi aur mandi -

#3 Collapse

**Butterfly Chart Pattern:** Butterfly Chart Pattern forex trading mein ek price pattern hai, jo price movements ko indicate krta hai. Is pattern mein price ek specific geometric shape banata hai, jiska naam butterfly se liya gaya hai, kyunki iski shape ek butterfly ke jaisi hoti hai. **Butterfly Chart Pattern Ki Iqsam:** Butterfly Chart Pattern ke kai iqsam hote hain, jinmein se kuch common ones hain: 1. Bullish Butterfly Pattern: Isme price pehle downtrend mein hota hai, phir ek sharp rally hota hai, fir price thoda retracement karta hai, aur phir ek strong upswing hota hai. 2. Bearish Butterfly Pattern: Isme price pehle uptrend mein hota hai, phir ek sharp decline hota hai, fir price thoda retracement karta hai, aur phir ek strong downtrend hota hai. **Butterfly Chart Pattern Ke Characteristics:** 1. Fibonacci Ratios: Butterfly pattern mein Fibonacci retracement aur extension levels ka use hota hai, jisse price levels ko identify kiya jata hai. 2. Symmetry: Butterfly pattern ek symmetric shape hota hai, jismein ek harmonic balance hota hai. 3. Swing Highs and Lows: Pattern ke shape ko define karne ke liye previous swing highs aur lows ka use hota hai. **Butterfly Chart Pattern Ke Benefits:** 1. **Trend Reversals:** Butterfly pattern trend reversals ko identify karne mein madad karta hai aur potential trend changes ka indication deta hai. 2. **Entry and Exit Points:** Is pattern se traders ko potential entry aur exit points spot karne mein madad milti hai. 3. **Harmonic Trading:** Butterfly pattern harmonic trading strategy mein use hota hai, jisse traders ko profitable trading opportunities milte hain. **Butterfly Chart Pattern Ke Nuqsan (Drawbacks):** 1. **Complexity:** Butterfly pattern ko identify karne mein thoda complexity hota hai, kyun ki isme Fibonacci retracement aur extension levels ka use hota hai. 2. **False Signals:** Jaise ki kai complex patterns mein hota hai, butterfly pattern bhi false signals generate kar sakta hai, isliye confirmatory indicators ke saath use karna zaroori hota hai. **Conclusion:** Butterfly Chart Pattern ek harmonious price pattern hai, jo trend reversals ko spot karne mein madad karta hai aur traders ko profitable trading opportunities provide karta hai. Is pattern ko samajhne ke liye confirmatory indicators aur price action analysis ka istemal karna zaroori hai, taki accurate aur reliable signals mil sake. Agar pattern sahi tarike se identify kiya gaya hai, toh traders apni trading strategies ko modify kar sakte hain aur potential market movements ko samajhne mein help ho sakti hai. Butterfly Chart Pattern ek valuable tool hai, jo traders ko market movements ko samajhne aur profitable trading opportunities ko spot karne mein madad karta hai. -

#4 Collapse

market ka tajzia karte hain. agarchay kuch takneeki asharion ki durustagi qabil behas hai, lekin ziyada tar namonon ne taajiron ke liye market ke ravayye ka andaza laganay aur dakhlay aur kharji raastoon ki tanqeedi tor par shanakht karne mein apni qabil itmadi ko saabit kya hai. to asal mein aik patteren kya hai? is article mein, hum is baat par baat karen ge ke patteren kaisa lagta hai, is ki shanakht kaisay ki jaye, aur is se bhi ahem baat, is ki tijarat kaisay ki jaye. butter flayi chart patteren patteren group ka hissa hai aur double neechay aur double taap patteren ke isi usool par kaam karta hai. saada alfaaz mein, yeh takneeki tajzia patteren, jis ki titlee ki shakal hoti hai, taajiron ko qeemat ke istehkaam aur do nazooli ya chadhti hui chotyon ke baad mumkina zone talaash karne mein madad karta hai Pattern forex trading mein ek price pattern hai, jo price movements ko indicate krta hai. Is pattern mein price ek specific geometric shape banata hai, jiska naam butterfly se liya gaya hai, kyunki iski shape ek butterfly ke jaisi hoti hai. **Butterfly Chart Pattern Ki Iqsam:**Butterfly Chart Pattern ke kai iqsam hote hain, jinmein se kuch common ones hain: 1. Bullish Butterfly Pattern: Isme price pehle downtrend mein hota hai, phir ek sharp rally hota hai, fir price thoda retracement karta hai, aur phir ek strong upswing hota hai. 2. Bearish Butterfly Pattern: Isme price pehle uptrend mein hota hai, phir ek sharp decline hota hai, fir price thoda retracement karta hai, aur phir ek strong downtrend hota hai. **Butterfly Chart Pattern Ke Characteristics:** 1. Fibonacci Ratios: Butterfly pattern mein Fibonacci retracement aur extension levels ka use hota hai, jisse price levels ko identify kiya jata hai. 2. Symmetry: Butterfly pattern ek symmetric shape hota hai, jismein ek harmonic balance hota hai. 3. Swing Highs and Lows: Pattern ke shape ko define karne ke liye previous swing highs aur lows ka use hota hai. **Butterfly Chart Pattern Ke Benefits:** 1. **Trend Reversals:** Butterfly pattern trend reversals ko identify karne mein madad karta hai aur potential trend changes ka indication deta hai. 2. **Entry and Exit Points:** Is pattern se traders ko potential entry aur exit points spot karne mein madad milti hai. 3. **Harmonic Trading:** Butterfly pattern harmonic trading strategy mein use hota hai, jisse traders ko profitable trading opportunities milte hain. **Butterfly Chart Pattern Ke Nuqsan (Drawbacks):** 1. **Complexity:** Butterfly pattern ko identify karne mein thoda complexity hota hai, kyun ki isme Fibonacci retracement aur extension levels ka use hota hai. 2. **False Signals:** Jaise ki kai complex patterns mein hota hai, butterfly pattern bhi false signals generate kar sakta hai, isliye confirmatory indicators ke saath use karna zaroori hota hai.

-

#5 Collapse

Cup and Handle candle design: Dear forex exchanging forex market mein exchanging karne ke liye different outline designs istemal hote hain jinko agar murmur follow karte tint exchanging Karti Hain to hamen bahut achcha benefit hasil hota hai aur UN design mein se Hello there Ek design cup and handle design hai. Cup and handle a specialized diagram design hota hai jo ki ek cup aur handle ki madad se look like hota hai aur kab u shape mein hota hai aur handle slide descending float ki shakal mein hota hai yah bole signal stretching out up Pattern ko consider karta hai aur isko spot potential open doors mein long haul exchanging ke liye istemal Kiya jata hai specialized brokers isko come by request might exchange line ke upar place karte Hain. Exchanging technique: Dear companions cup and handle design ke sath exchanging karne ke liye mukhtalif tarike istemal kiye jaate hain lekin UN mein se sabse best ya essential long position ke lene ke liye istemal hota hai cup and handle design ke sath exchanging karne ke liye stop bye request train line ke upar place Kiya jata hai aur punch cost break Karti hai to hamara request execute ho jata hai obstruction level se aur apne experience ko ke mutabik is design per exchanging Karti Hain aur slippech ke mutabik kam karte hain aur jaise greetings market utilize level tak pahunchti hai to Is Tarah Unka request open ho jata hai uske substitute vah use baat ka intezar karte Hain ki cost train line ke upar pahunche ya kab ke handle tak pahunch jaaye to utilize Tarah vah limit request place Karke to Is Tarah vah design per break out level per apna request place karte hain aur hit cost rate dresses Karti hai to Is Tarah Unka request execute ho jata hai lekin is surat mein unko unki exchange game mein sone ka risk ho sakta hai kyunki Is Tarah cost agar soti rahti hai to aur vah pul back nahin karti to uncarder execute Nahin hota. Impersonations of Cup and Handle Example: The mother specialized pointers ki Tarah cup and handle design bhi use waqt hamare liye beneficial sabit hota hai agar usko acchi tarike se samajh Kar usmein passage li jaati hai to aur iske sath dusre markers aur signal ko bhi follow Kiya jata hai aur unke mutabik apni exchanging dynamic ki jaati hai to vah hamen bahut achcha benefit dilati hai khastaur per cup and handle design mein kuchh constraints hoti hain jinko follow karna jaruri hota hai sabse pahle aapko is design ke complete sharpen ka vate Karna chahie kyunki Is Tarah aap right choices Lete Hain aur ek manth ya 1 sal bahut achcha time period hota hai Kisi ka Pyar handle design ke banne ke liye yah bahut jaldi bhi boycott jata hai aur iske banne mein vas aukat kuchh sal bhi slack sakte hain Ek aur masala Jo cake and handle design ki development ke sath hota hai sab time a sweeper Ek signal deta hai aur iske sath dusri time span mein Ek gehra cup falls signal demonstrate karta hai to Is Tarah Ek cup boycott jata hai without qualities handle ke Is Tarah aakhirkar specialized range mein Ek restriction share across hoti hai jo ki temperamental hoti hai. -

#6 Collapse

What is head and houlder sir aur kaandhon ka patteren youngster chotyon ke outline patteren ke sath aik takneeki isharay hai, jahan bairooni do oonchai mein qareeb hain, aur darmiyan mein sab se ziyada hai. aik sir aur kaandhon ka patteren — jo sab se ziyada qabil aetmaad prepared inversion patteren mein se aik samjha jata hai — aik outline ki tashkeel hai jo taizi se mandi ke rujhan ke ulat jane ki paish goi karti hai. aik ulta sir aur kaandhon ka patteren mandi se taizi ke rujhan ki paish goi karta hai. patteren ki simt ke lehaaz se, naik line support ya muzahmati linon standard tiki hui hai. sir aur kaandhon ka patteren adolescent chotyon ke diagram patteren ke sath aik takneeki isharay hai, jahan bairooni do oonchai mein qareeb hain, aur darmiyan mein sab se ziyada hai. aik sir aur kaandhon ka patteren — jo sab se ziyada qabil aetmaad prepared inversion patteren mein se aik samjha jata hai — aik diagram ki tashkeel hai jo taizi se mandi ke rujhan ke ulat jane ki paish goi karti hai. aik ulta sir aur kaandhon ka patteren mandi se taizi ke rujhan ki paish goi karta hai. patteren ki simt ke lehaaz se, naik line support ya muzahmati linon standard tiki hui hai . Working of head and shoulder aur kaandhon ka patteren youngster chotyon ke graph patteren ke sath aik takneeki isharay hai, jahan bairooni do oonchai mein qareeb hain, aur darmiyan mein sab se ziyada hai. aik sir aur kaandhon ka patteren — jo sab se ziyada qabil aetmaad prepared inversion patteren mein se aik samjha jata hai — aik diagram ki tashkeel hai jo taizi se mandi ke rujhan ke ulat jane ki paish goi karti hai. aik ulta sir aur kaandhon ka patteren mandi se taizi ke rujhan ki paish goi karta hai. patteren ki simt ke lehaaz se, naik line support ya muzahmati linon standard tiki hui hai. sir aur kaandhon ka patteren adolescent chotyon ke diagram patteren ke sath aik takneeki isharay hai, jahan bairooni do oonchai mein qareeb hain, aur darmiyan mein sab se ziyada hai. aik sir aur kaandhon ka patteren hota hy. Head and Shoulder candle design: Dear my sisters and siblings forex market principal head and shoulder design wo design hota hai jis primary market pehly aik bari motivation wave deti hai jis fundamental wo apna aik left shoulder banati hy us ky terrible aik or bari drive wave deny k awful market thora negative primary any k terrible pher aik bari motivation wave k sath bullish principal move kar jati hai pher kuch remedy k sath market apna right shoulder bnati hai jahan se murmur market ko achi trha se dekh skty hain k market principal head and shoulder boycott rha hai jis ko murmur follow kar k murmur apni exchange kar skty hain. Head and Shoulder base example: Aziz shagirdo Market mein Punch upar se Specialty ki taraf move kar rahi ho to Specialty 1 point se reject Hoti Hai ya market ka first shoulder boycott jata hai Uske terrible market thoda sa up aati hai aur fir uper se reject hoti hai (Definitely first shoulder ki support hoti hai) aur pher down Jati Hai Pichhle shoulder ke support se market thoda sa zyada down Chale Jaate Hain head banti hai (jisse Ham outline design me head bolate Hain) aur pher reject hoti hai aur pher uper ajati Hai uper market first shoulder ke obstruction Tak aati hai aur uske awful again market Specialty Chale Jaate Hain aur first shoulder ke support se reject hokar market oper ki traf move karti hai Iske andar Jo two shoulder ki opposition banti hai ais per Ham Ek line draw Karte Hain jisse Ham neck line Kahate Hain aur poke market neck area se up hote hain to utilize Waqt Hamen Ek Achcha passage point mil raha Hota Hai Jis per Ham Purchase ki exchange laga ke Ek Bada benefit Le sakte hain for all intents and purposes aap is picture Mein samajh sakte hain. -

#7 Collapse

WHAT IS A BUTTERFLY CHART PATTERN : Butterfly ak harmonic pattern ha or ya ak reversal chart pattern ha jo ka appears hota ha jab koi trend move karta hua end hona wala ho. Ya ak bahot hi advanced or complicated harmonic patterns ha jis ko used karta ha forex traders or identify karta ha trend reversals ko. Or isi time ma ya ak bahot hi reliable or accurate chart pattern ha trading m agar is ko used correctly kiya jay. Ya butterfly pattern kam same principle par karta ha jasa ka double bottom pr double top chart patterns ha. Ya ak technical analysis charting pattern ha ,jo ka butterfly ki shape ma banta ha, or ya help karta ha traders ki potential reversal ka zone ko find karna ki or ya following karta ha price consolidation ko or ya two descending or ascending peaks ko banata hua banta ha. Jasa ka double top or doenble bottom banta ha. Ya jo butterfly chart pattern ha ya four legs ka sath composed hota ga is ma sa jo do hoti ha ya peaks hoti ha or do lows or highs hoti ha or ya depend kar rahi hoti ha bullish ya bearish par q ka ya butterfly pattern bullish ma bhi banta ha or bearish ma bhi. Butterfly pattern starts karta ha trend ka reversal ko apni development ka start sa hu pattern ku or ya ak bahot hi accurate indicator ki trha sa bhi kam karta ha jo ka strong indication karta ha. Ya butterfly pattern ak specific Fibonacci ratios ha jo ka must occur hota ha pattern ko valid karna ka liya. HOW TO IDENTIFY AND USE BATTERFLY PATTERN : Is bullerfly pattern ko funding karna or identified karna koi easy trick ni ha. Is ka liya treading experience or kuch knowledge hona chaiya or other techniques or technical indicators ka bara ma jasa ka Fibonacci retracement levels. Ya butterfly pattern resembels karta ha structure ko or formation ko jo ka marle karta ha complicated reversal ko trading pattern sa jis ko identify kar ka use kar saka. Is butterfly pattern ko dakha to us ma four price movements hoti ha or is ma four swings banta ha XA,AB,BC,or CD. Or is ma five points ho ga X,A,B,C or D. Ya jo levels ha ya help karay ga traders ki identify karna ka liya trend ka reversal ko or ya lukely ocvur ho ga. Jo is ma CD leg ho ge or jo point D banay ga ya confirmation karay ga parameter ki agar price begins ho ge new trend ki traf. Kuch steps ha jin ko use kar ka identify or trade ku jati ha is butterfly pattern ma : 1: Sab sa phalay is ma find karna ha chart pattern jis ma two descending highs ho or jis ma to ascending lows ho ya depends kar raha ho ga bullish or bearish butterfly par. 2: Second step ma dray karna ho ga Fibonacci retracement levels ki jo ka low sa high ma ho ga A level ka. 3: Is ma wait karay ga trend ka reversal hona ka or jab reversal ho ga to jo CD line ho ge ya exceeds karay ge X level ko. 4: Enter karay ga is ma long or short position ko or set karay ga profit target ko B or C levels par or ya phir in ka higher ma. 5: Place karay ga stop loss ko X level ka slightly above ma ya below ma ya depends kar raha ho ga trading strategy ma jo ka bullish ya bearish butterfly pattern ho ga. HOW TO TRADE USING BUTTERFLY PATTERN: Agar trade karni ha is butterfly pattern ma to sab sa phalay combination karni ho ge is butterfly pattern or fibonacci retracement levels ko or ya is pattern ma main trading strategy ho ge or ya tool ho ga is pattern ko use karna ka liya. Without fibonacci levels ka entry level ko identify karna entry level ko hard ho ge. Jasa ka or technical analysis indicators or chart patterns ,jo butterfly chart pattern ho ga ya bhi works karay ga dono directions ma yani ka bullish or bearish. 1: BULLISH BUTTERFLY PATTERN: Bullish butterfly pattern ha ya start ho ga to is ka start ma XA ki lune banay ge jis ma price high ma jat ge or is ma ak high ma peak ka bad,price A sa B ma small retrace ho ge or phir sa B sa C ki traf high ma jay ge or ak or peak ko banay ge or last ma phir sa price lowee ke traf ay ge C sa point D ki janab or jo butterfly shape ho ge ya complete ho jay ge oe traders ko is sa price ka bullish ki traf jana ka signal mila ga. Ya jo chart ha show kar raha ha bullish butterfly ki example ko ,is ma dalha ja sakta ha ka kasa bana ha butterfly pattern USD/JPY ma 15 min ka time frame par. Is chart ma dakh sakta ha ka jo CD line ha ya longer ha XA line sa or is ma two descending highs bana ha. Or jab is ma price consolidation hoi ha point D ka around ma or is ma price bounces ho kar back hoi ha or jo bullish ttend ya begins ho ga. 2: BEARISH BUTTERFLY PATTERN: Ya bearish butterfly chart pattern exactly same ho ga bullish ki trha sa magar ya other direction ma ho ga. Jasa ka jo below ma chart ha ya example shoe kar raha ha bearish butterfly pattern ko or ya pattern formed ho ga end ma bullish ka trend par. Is ma jo price ho ge ya retests ho ge B da or ya phir D levels par hat ge or ya confirm karay ge or bearish trend banay ga. Is ma used karay ga Fibonacci retracement levels sa jo XA line ha ya first bearish line ha butterfly pattern ki. Is ma dakh sakta ha ka jo D level ha ya stop ha or is point sa clear bearish ttend reversal bana ha. ADVANTAGES OF BUTTERFLY PATTERN: Is butterfly pattern ki jo advantages ha wo ya ha ka ya ak accurate or reliable chart pattern ha jis ma especially tab hota ha jab is ko fibonacci retracement levels ha. Jab us butterfly pattern ko other chart patterns sa compared kar ka provide karta ha strong indication ko ttend reversal ka liya. Is ma stop loss ko placement kiya jata ha X level ma. DISADVANTAGES OF BUTTERFLY PATTERN: Butterfly pattern ko mistaken use liya jata ha double top or bottom chart pattern sa. Ya butterfly pattern relatively difficult hota ha identify karna. Is pattern ko use larna ka liya required hoti ha knowledge pr technical analysis tools or RSI or Fibonacci moving averages ki. -

#8 Collapse

Butterfly Chart Pattern: Butterfly design ki jo benefits ha wo ya ha ka ya ak precise or dependable graph design ha jis mama particularly tab hota ha punch is ko fibonacci retracement levels ha. Poke us butterfly design ko other diagram designs sa looked at kar ka give karta ha solid sign ko ttend inversion ka liya. Is mama stop misfortune ko situation kiya jata ha Butterfly design ko mixed up use liya jata ha twofold top or base diagram design sa. Ya butterfly design moderately troublesome hota ha recognize karna. Is design ko use larna ka liya required hoti ha bullish butterfly ki model ko ,is mama dalha ja sakta ha ka kasa bana ha butterfly design USD/JPY mama 15 min ka time period standard. Is outline mama dakh sakta ha ka jo Cd line ha ya longer ha XA line sa or is mama two dropping highs bana ha. Or then again poke is mama cost union hoi ha point D ka around mama or is mama cost bobs ho kar back hoi ha or jo bullish ttend ya starts ho ga. Bullish butterfly design ha ya start ho ga to is ka start mama XA ki lune banay ge jis mama cost high mama jat ge or is main ak high mama top ka bad,price A sa B mama little remember ho ge or phir sa B sa C ki traf high mama jay ge or ak or pinnacle ko banay ge or last mama phir sa cost lowee ke traf ay ge C sa point D ki janab or jo butterfly shape ho ge ya complete ho jay ge oe merchants ko is sa cost ka bullish ki traf jana ka signal mila ga.Agar exchange karni ha is butterfly design mama to sab sa phalay blend karni ho ge is butterfly design or fibonacci retracement levels ko or ya is design mama fundamental exchanging system ho ge or ya device ho ga is design ko use karna ka liya. Without fibonacci levels ka section level ko recognize karna passage level ko hard ho ge. Jasa ka or specialized investigation markers or outline designs ,jo butterfly diagram design ho ga Chart Pattern Formation: Butterfly ak consonant example ha or ya ak inversion diagram design ha jo ka seems hota ha hit koi pattern move karta hua end hona wala ho. Ya ak bahot hey progressed or muddled symphonious examples ha jis ko utilized karta ha forex dealers or recognize karta ha pattern inversions ko. Or then again isi time mama ya ak bahot hello there solid or precise graph design ha exchanging m agar is ko utilized accurately kiya jay. Ya butterfly design kam same standard karta ha jasa ka twofold base pr twofold top diagram designs ha. Ya ak specialized examination diagramming design ha ,jo ka butterfly ki shape mama banta ha, or ya help karta ha merchants ki potential inversion ka zone ko find karna ki or ya following karta ha cost union ko or ya two sliding or climbing tops ko banata hua banta ha. Jasa ka twofold top or doenble base banta ha. Ya jo butterfly diagram design ha ya four legs ka sath created hota ga is mama sa jo do hoti ha ya tops hoti ha or do lows or highs hoti ha or ya depend kar rahi h

Bullish butterfly design ha ya start ho ga to is ka start mama XA ki lune banay ge jis mama cost high mama jat ge or is main ak high mama top ka bad,price A sa B mama little remember ho ge or phir sa B sa C ki traf high mama jay ge or ak or pinnacle ko banay ge or last mama phir sa cost lowee ke traf ay ge C sa point D ki janab or jo butterfly shape ho ge ya complete ho jay ge oe merchants ko is sa cost ka bullish ki traf jana ka signal mila ga.Agar exchange karni ha is butterfly design mama to sab sa phalay blend karni ho ge is butterfly design or fibonacci retracement levels ko or ya is design mama fundamental exchanging system ho ge or ya device ho ga is design ko use karna ka liya. Without fibonacci levels ka section level ko recognize karna passage level ko hard ho ge. Jasa ka or specialized investigation markers or outline designs ,jo butterfly diagram design ho ga Chart Pattern Formation: Butterfly ak consonant example ha or ya ak inversion diagram design ha jo ka seems hota ha hit koi pattern move karta hua end hona wala ho. Ya ak bahot hey progressed or muddled symphonious examples ha jis ko utilized karta ha forex dealers or recognize karta ha pattern inversions ko. Or then again isi time mama ya ak bahot hello there solid or precise graph design ha exchanging m agar is ko utilized accurately kiya jay. Ya butterfly design kam same standard karta ha jasa ka twofold base pr twofold top diagram designs ha. Ya ak specialized examination diagramming design ha ,jo ka butterfly ki shape mama banta ha, or ya help karta ha merchants ki potential inversion ka zone ko find karna ki or ya following karta ha cost union ko or ya two sliding or climbing tops ko banata hua banta ha. Jasa ka twofold top or doenble base banta ha. Ya jo butterfly diagram design ha ya four legs ka sath created hota ga is mama sa jo do hoti ha ya tops hoti ha or do lows or highs hoti ha or ya depend kar rahi h  Market mein Punch upar se Specialty ki taraf move kar rahi ho to Specialty 1 point se reject Hoti Hai ya market ka first shoulder blacklist jata hai Uske horrendous market thoda sa up aati hai aur fir uper se reject hoti hai (Certainly first shoulder ki support hoti hai) aur pher down Jati Hai Pichhle shoulder ke support se market thoda sa zyada down Chale Jaate Hain head banti hai (jisse Ham frame plan me head bolate Hain) aur pher reject hoti hai aur pher uper ajati Hai uper market first shoulder ke obstacle Tak aati hai aur uske terrible again market Specialty Chale Jaate Hain aur first shoulder ke support se reject hokar market oper ki traf move karti hai Iske andar Jo two shoulder ki resistance banti hai ais per Ham Ek line draw Karte Hain jisse Ham neck line Kahate Hain aur jab market neck region se up hote hain to use Waqt Hamen Ek Achcha entry point mil raha Hota Hai Jis per Ham Buy ki trade laga ke Ek Bada benefit Le sakte hain in every way that really matters, aap is picture Mein samajh sakte hain. Chart Pattern Trading View: forex market mein trading karne ke liye different diagram plans istemal hote hain jinko agar mumble follow karte color trading Karti Hain to hamen bahut achcha benefit hasil hota hai aur UN plan mein se Hi Ek configuration cup and handle plan hai. Cup and handle a specific chart plan hota hai jo ki ek cup aur handle ki madad se look like hota hai aur kab u shape mein hota hai aur handle slide plummeting float ki shakal mein hota hai yah bole signal loosening up Example ko consider karta hai aur isko spot potential entryways mein long stretch trading ke liye istemal Kiya jata hai particular intermediaries isko stop in response to popular demand could trade line ke upar place karte Hain.

Market mein Punch upar se Specialty ki taraf move kar rahi ho to Specialty 1 point se reject Hoti Hai ya market ka first shoulder blacklist jata hai Uske horrendous market thoda sa up aati hai aur fir uper se reject hoti hai (Certainly first shoulder ki support hoti hai) aur pher down Jati Hai Pichhle shoulder ke support se market thoda sa zyada down Chale Jaate Hain head banti hai (jisse Ham frame plan me head bolate Hain) aur pher reject hoti hai aur pher uper ajati Hai uper market first shoulder ke obstacle Tak aati hai aur uske terrible again market Specialty Chale Jaate Hain aur first shoulder ke support se reject hokar market oper ki traf move karti hai Iske andar Jo two shoulder ki resistance banti hai ais per Ham Ek line draw Karte Hain jisse Ham neck line Kahate Hain aur jab market neck region se up hote hain to use Waqt Hamen Ek Achcha entry point mil raha Hota Hai Jis per Ham Buy ki trade laga ke Ek Bada benefit Le sakte hain in every way that really matters, aap is picture Mein samajh sakte hain. Chart Pattern Trading View: forex market mein trading karne ke liye different diagram plans istemal hote hain jinko agar mumble follow karte color trading Karti Hain to hamen bahut achcha benefit hasil hota hai aur UN plan mein se Hi Ek configuration cup and handle plan hai. Cup and handle a specific chart plan hota hai jo ki ek cup aur handle ki madad se look like hota hai aur kab u shape mein hota hai aur handle slide plummeting float ki shakal mein hota hai yah bole signal loosening up Example ko consider karta hai aur isko spot potential entryways mein long stretch trading ke liye istemal Kiya jata hai particular intermediaries isko stop in response to popular demand could trade line ke upar place karte Hain.  Butterfly Graph Example ek amicable cost design hai, jo pattern inversions ko spot karne mein madad karta hai aur dealers ko beneficial exchanging open doors give karta hai. Is design ko samajhne ke liye corroborative markers aur cost activity examination ka istemal karna zaroori hai, taki exact aur solid signs mil purpose. Agar design sahi tarike se recognize kiya gaya hai, toh merchants apni exchanging methodologies ko alter kar sakte hain aur potential market developments ko samajhne mein help ho sakti hai. Butterfly Outline Example ek significant instrument hai, jo brokers ko market developments ko samajhne aur productive exchanging amazing open doors ko spot karne mein madad karta hai.s article mein, murmur is baat standard baat karen ge ke patteren kaisa lagta hai, is ki shanakht kaisay ki jaye, aur is se bhi ahem baat, is ki tijarat kaisay ki jaye. spread flayi outline patteren bunch ka hissa hai aur twofold neechay aur twofold taap patteren ke isi usool standard kaam karta hai. saada alfaaz mein, yeh takneeki tajzia patteren, jis ki titlee ki shakal hoti hai, taajiron ko qeemat ke istehkaam aur do nazooli ya chadhti hui chotyon ke baad mumkina zone talaash karne mein madad karta hai

Butterfly Graph Example ek amicable cost design hai, jo pattern inversions ko spot karne mein madad karta hai aur dealers ko beneficial exchanging open doors give karta hai. Is design ko samajhne ke liye corroborative markers aur cost activity examination ka istemal karna zaroori hai, taki exact aur solid signs mil purpose. Agar design sahi tarike se recognize kiya gaya hai, toh merchants apni exchanging methodologies ko alter kar sakte hain aur potential market developments ko samajhne mein help ho sakti hai. Butterfly Outline Example ek significant instrument hai, jo brokers ko market developments ko samajhne aur productive exchanging amazing open doors ko spot karne mein madad karta hai.s article mein, murmur is baat standard baat karen ge ke patteren kaisa lagta hai, is ki shanakht kaisay ki jaye, aur is se bhi ahem baat, is ki tijarat kaisay ki jaye. spread flayi outline patteren bunch ka hissa hai aur twofold neechay aur twofold taap patteren ke isi usool standard kaam karta hai. saada alfaaz mein, yeh takneeki tajzia patteren, jis ki titlee ki shakal hoti hai, taajiron ko qeemat ke istehkaam aur do nazooli ya chadhti hui chotyon ke baad mumkina zone talaash karne mein madad karta hai

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#9 Collapse

Chart Pattern forex trading mein ek price pattern hai, jo price movements ko indicate krta hai. Is pattern mein price ek specific geometric shape banata hai, jiska naam butterfly se liya gaya hai, kyunki iski shape ek butterfly ke jaisi hoti hai. **Butterfly Chart Pattern Ki Iqsam:**Butterfly Chart Pattern ke kai iqsam hote hain, jinmein se kuch common ones hain: 1. Bullish Butterfly Pattern: Isme price pehle downtrend mein hota hai, phir ek sharp rally hota hai, fir price thoda retracement karta hai, aur phir ek strong upswing hota hai. 2. Bearish Butterfly Pattern: Isme price pehle uptrend mein hota hai, phir ek sharp decline hota hai, fir price thoda retracement karta hai, aur phir ek strong downtrend hota hai. **Butterfly Chart Pattern Ke Characteristics:** 1. Fibonacci Ratios: Butterfly pattern mein Fibonacci retracement aur extension levels ka use hota hai, jisse price levels ko identify kiya jata hai. 2. Symmetry: Butterfly pattern ek symmetric shape hota hai, jismein ek harmonic balance hota hai. 3. Swing Highs and Lows: Pattern ke shape ko define karne ke liye previous swing highs aur lows ka use hota hai. **Butterfly Chart Pattern Ke Benefits:** 1. **Trend Reversals:** Butterfly pattern trend reversals ko identify karne mein madad karta hai aur potential trend changes ka indication deta hai. 2. **Entry and Exit Points:** Is pattern se traders ko potential entry aur exit points spot karne mein madad milti hai. 3. **Harmonic Trading:** Butterfly pattern harmonic trading strategy mein use hota hai, jisse traders ko profitable trading opportunities milte hain. **Butterfly Chart Pattern Ke Nuqsan (Drawbacks):** 1. **Complexity:** Butterfly pattern ko identify karne mein thoda complexity hota hai, kyun ki isme Fibonacci retracement aur extension levels ka use hota hai. 2. **False Signals:** Jaise ki kai complex patterns mein hota hai, butterfly pattern bhi false signals generate kar sakta hai, isliye confirmatory indicators ke saath use karna zaroori hota hai. BULLISH BUTTERFLY PATTERN: Bullish butterfly pattern ha ya start ho ga to is ka start ma XA ki lune banay ge jis ma price high ma jat ge or is ma ak high ma peak ka bad,price A sa B ma small retrace ho ge or phir sa B sa C ki traf high ma jay ge or ak or peak ko banay ge or last ma phir sa price lowee ke traf ay ge C sa point D ki janab or jo butterfly shape ho ge ya complete ho jay ge oe traders ko is sa price ka bullish ki traf jana ka signal mila ga.

Ya jo chart ha show kar raha ha bullish butterfly ki example ko ,is ma dalha ja sakta ha ka kasa bana ha butterfly pattern USD/JPY ma 15 min ka time frame par. Is chart ma dakh sakta ha ka jo CD line ha ya longer ha XA line sa or is ma two descending highs bana ha. Or jab is ma price consolidation hoi ha point D ka around ma or is ma price bounces ho kar back hoi ha or jo bullish ttend ya begins ho ga. 2: BEARISH BUTTERFLY PATTERN: Ya bearish butterfly chart pattern exactly same ho ga bullish ki trha sa magar ya other direction ma ho ga. Jasa ka jo below ma chart ha ya example shoe kar raha ha bearish butterfly pattern ko or ya pattern formed ho ga end ma bullish ka trend par. Is ma jo price ho ge ya retests ho ge B da or ya phir D levels par hat ge or ya confirm karay ge or bearish trend banay ga. Is ma used karay ga Fibonacci retracement levels sa jo XA line ha ya first bearish line ha butterfly pattern ki. Is ma dakh sakta ha ka jo D level ha ya stop ha or is point sa clear bearish ttend reversal bana ha.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 05:09 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим