Trading With Negative Harami

No announcement yet.

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔ٹیگز: کوئی نہیں

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

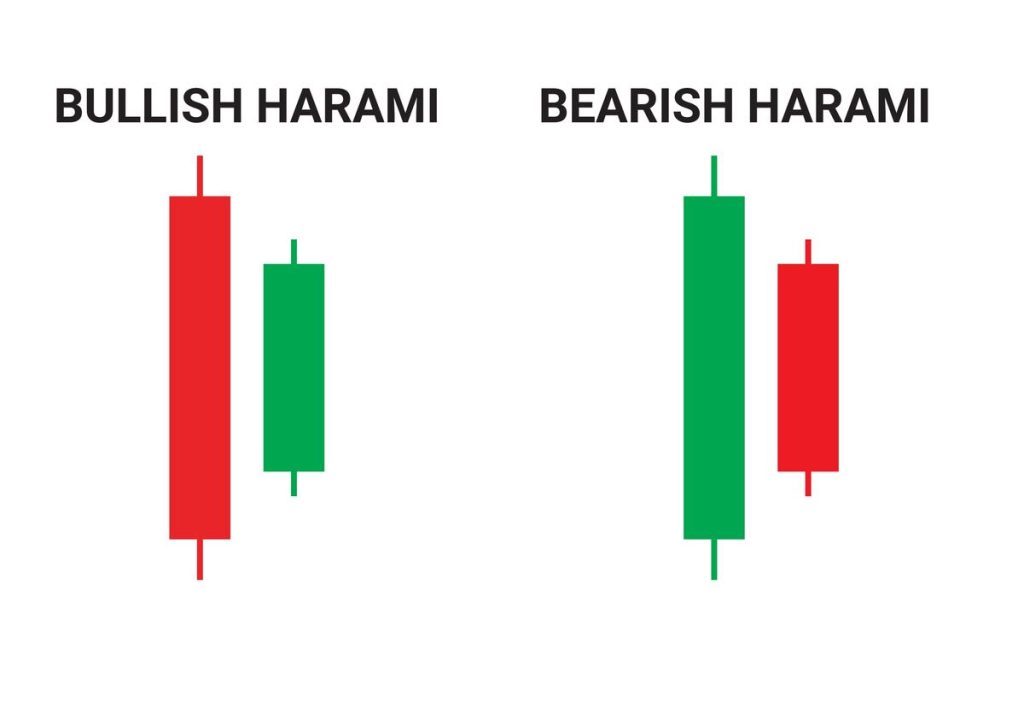

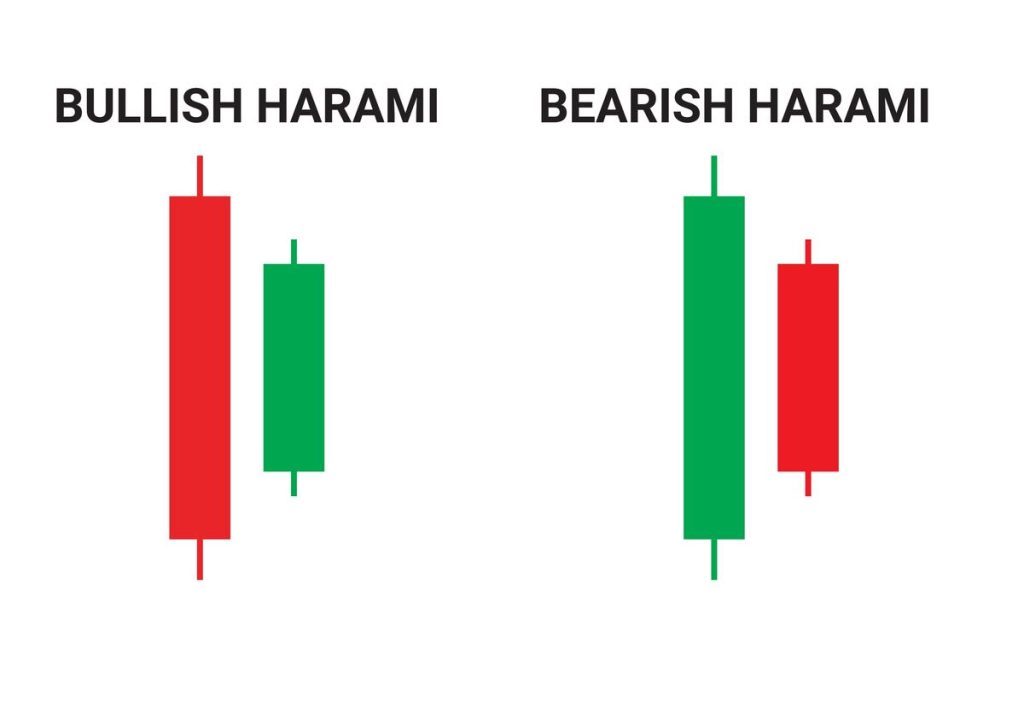

Trading With Negative HaramiDosto Negative Harami Candle Example ek aisa graph design hai jo horrific feeling ko mirror karta hai aur costs ki girawat ka sign deta hai. Yeh format brokers aur financial backers ke liye precious hai jo marketplace traits ko count on karna chahte hain aur apni changing structures .Upward push ruk jata hai. Ye sample dekhne major identical to equal descending hawk sample jaisa kagta hai, lekin dosri candle ka bearish banne se sample predominant tabdeeli waqea ho jati hai. Ko beautify karna chahte hain. Is format ko samajhne ke liye, ek version ke thru samjhate hain. Maan lijiye ke aapko ek company ke shares mein hobby hai aur aap uski fee graph dekh rahe hain. Aap dekhte hain ke kuch dino se charges gir rahe hain aur aapko lagta hai ke stomach muscle yeh sample alternate ho jayega. Aap ke graph mein ek Negative Harami Candle Example nazar ata hai.Pehle candle ka size bara hai aur iska rang sabz hai. Yeh bullish candle hai aur iska open price neechay ki taraf hai aur near charge oopar ki taraf. Dusra candle pehle candle se chota hai aur iska rang surkh hai. Iska open price pehle candle ke close price ke qareeb hai aur close rate neechay ki taraf hai.Iska matlab hota hai ke pehle commotion bulls control mein thay aur prices oopar ki taraf jaa rahe thay. Lekin doosre commotion bears control mein aa gaye aur costs girne lage. Yeh format bad pattern ki continuation ka sign deta hai aur iska matlab hota hai ke prices aur neechay jaa sakte hain. What's the horrible harami in forex

Bearish harami candlestick sample aik bearish fashion reversal sample hai, jo price chart par do candles se mel kar banta hai. Pattern fundamental shamil pehli candles bullish hoti hai, issi waja se pattern good enough leye costs ka pehle se high area ya bullish fashion fundamental hona zarori hai. Two cease k dowran ban kar fees ko mazeed ooper jane se rok leti hai. Ye candle aik robust trend reversal ka sign deti hai. Pattern two days candles par mushtamil hai, jiss ki pehli candle aik robust bullish candle hoti hai, jo k prices good enough bullish ya upward fashion ki alamat hoti hai. Pattern ki dosri candle aik areeb hai aur near charge neechay ki taraf hai.Iska matlab hota hai ke pehle commotion bulls control mein thay aur charges oopar ki taraf jaa rahe thay. Lekin doosre commotion bears control mein aa gaye aur prices girne lage. Yeh layout negative sample ki continuation ka sign deta hai aur iska matlab hota hai ke expenses aur neechay jaa sakte hain.Bearish candle hoti hai, aur ye candle pehli candle ki nisbat real frame important kam bhi hoti hai aur ye pehli candle ki real body ki inside fundamental bhi banti hai, jiss se prices ka mazeed up-upward push ruk jata hai. Ye sample dekhne main identical to equal descending hawk sample jaisa kagta hai, lekin dosri candle ka bearish banne se pattern principal tabdeeli waqea ho jati hai. Days candles ki accuracy unmarried day pattern se behtar hota hai, q okay iss primary aik candle thori bohut affirmation bhi deti hai. Jab bhi market primary consumers charges ko aik khas level tak ooper push karte chicken, to yahan par style reversal okay imkanat ziada hote bird, ye fashion affirmation aksar kuch pattern se verify ho jati hai, jiss major bearish harami pattern bhi shamil hai.

-

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

NEGATIVE HARAMI CANDLESTICKS Candlesticks, or Mumayyiz Mishal, are a popular tool used in technical analysis to interpret price charts. One important pattern is the "Negative Harami" candlestick pattern, which indicates a potential trend reversal in the financial market.Candlestick patterns are visual representations of price movements in the form of candles on a chart. These patterns provide insights into the psychology of market participants and help traders make informed decisions. 2. UNDERSTANDING THE NEGATIVE HARAMI CANDLESTICK The Negative Harami pattern is a two-candle pattern that forms during a bullish trend. It suggests a possible trend reversal or a temporary pause in the upward movement. 3. CHARACTERISTICS OF NEGATIVE HARAMI CANDLESTICK. - The first candle is a large bullish candle, representing the prevailing uptrend. - The second candle is smaller and completely contained within the body of the first candle. - The color of the second candle is not important, but it's usually bearish. - The pattern indicates that the buying momentum has slowed down, and there might be a potential shift in sentiment. 4. INTERPRETATION OF NEGATIVE HARAMI CANDLESTICK When the Negative Harami pattern forms, traders should be cautious as it could signal a possible trend reversal. However, it's essential to consider other factors and indicators to confirm the potential reversal before making any trading decisions. 5. CONFIRMATION AND TRADING STRATEGIES. - Traders often wait for additional confirmation, such as a bearish follow-through candle, or other technical indicators to validate the potential reversal. - If other indicators align with the Negative Harami pattern, traders might consider short-selling or exiting long positions. 6. RISK MANAGEMENT Like all trading strategies, the Negative Harami pattern is not foolproof and carries risks. Traders should implement appropriate risk management techniques, such as setting stop-loss orders, to protect their capital. 7. CONCLUSION OF NEGATIVE HARAMI CANDLESTICK The Negative Harami Candlestick pattern is a valuable tool for traders to identify potential trend reversals in a bullish market. However, it should be used in conjunction with other technical analysis tools for better accuracy. It's essential to stay disciplined and follow risk management practices while making trading decisions. -

#4 Collapse

### Negative Harami Ke Saath Trading Kaise Karein?

Negative Harami ek candlestick pattern hai jo technical analysis me bearish reversal ya market ki weakness ko indicate karta hai. Yeh pattern traders ko potential sell signals provide karta hai aur market ke downward trend ko identify karne me madad karta hai. Is post me, hum Negative Harami pattern ko detail me samjhenge aur forex trading me iske sath effective trading strategies discuss karenge.

**1. Negative Harami Pattern Ki Definition:**

Negative Harami ek two-candle pattern hota hai jisme pehli candle ek large bullish (green) candle hoti hai aur doosri candle ek small bearish (red) candle hoti hai. Doosri candle ki body pehli candle ki body ke andar hoti hai, jo market me indecision aur potential bearish reversal ko indicate karta hai.

**2. Negative Harami Ki Formation:**

- **Pehli Candle:** Pehli candle ek large bullish candle hoti hai jo market ke strong upward movement ko reflect karti hai. Yeh candle market ke strong buying pressure ko dikhati hai.

- **Doosri Candle:** Doosri candle ek small bearish candle hoti hai jo pehli candle ki body ke andar form hoti hai. Iska matlab hai ke market me buyers ke control me kami aayi hai aur sellers ka dominance badh raha hai.

- **Pattern Confirmation:** Negative Harami pattern ki confirmation ke liye, ek additional bearish candle ka formation zaroori hota hai jo pattern ke baad market me downward movement ko signal kare.

**3. Negative Harami Ki Characteristics:**

- **Bearish Reversal:** Negative Harami pattern market me bullish trend ke baad bearish reversal signal provide karta hai. Yeh pattern indicate karta hai ke market me buying pressure kam ho raha hai aur selling pressure badh raha hai.

- **Indecision Signal:** Is pattern ke formation ke dauran market me indecision aur uncertainty hoti hai, jahan buyers aur sellers ke beech balance banta hai.

- **Volume:** Pattern ke formation ke dauran volume bhi ek important factor hota hai. High volume ke saath Negative Harami ka formation bearish sentiment ko confirm karta hai.

**4. Trading Strategy for Negative Harami Pattern:**

- **Entry Point:** Negative Harami pattern ke entry point ko identify karna tab zaroori hota hai jab pattern ke formation ke baad market me bearish movement start hoti hai. Entry point ke liye, bearish confirmation candle ke baad sell trade consider kiya jata hai.

- **Stop-Loss Placement:** Effective stop-loss orders ko set karna zaroori hai taake potential losses ko limit kiya ja sake. Stop-loss ko pattern ke high ke slightly above set kiya jata hai taake market ke unexpected upward movements se bachav ho sake.

- **Target Setting:** Target setting bhi important hoti hai. Negative Harami pattern ke zariye price projections aur targets ko determine kiya jata hai. Targets ko pattern ke formation ke basis par calculate kiya jata hai, jaise ke previous support levels ke aas-paas.

- **Risk Management:** Proper risk management techniques ko implement karna zaroori hai. Position sizing aur risk-to-reward ratio ko balance karna trading risk ko manage karne me madad karta hai. Negative Harami pattern ke saath risk management strategies ko follow karna chahiye.

**5. Example of Negative Harami in Forex Trading:**

Maan lijiye, EUR/USD currency pair me ek strong uptrend chal raha hai aur ek din Negative Harami pattern form hota hai. Is pattern ke formation ke baad, agar next candle bearish signal deti hai, to yeh sell trade ke liye entry point ban sakta hai. Agar market me downward movement continue hoti hai, to aap apni position ko profit ke saath close kar sakte hain.

**Conclusion:**

Negative Harami candlestick pattern forex trading me ek valuable tool hai jo market ke potential bearish reversals ko identify karne me madad karta hai. Pattern ki formation, characteristics, aur trading strategies ko samajhkar, aap effective trading decisions le sakte hain aur market trends ko better analyze kar sakte hain. Negative Harami pattern ke zariye aap market ke potential downward movements ko predict karke apni trading performance ko enhance kar sakte hain.

-

#5 Collapse

Negative Harami Pattern ek bohot mashhoor candlestick pattern hai jo trading main use hota hai. Ye pattern aksar bearish reversal ko indicate karta hai, yani ke market ke trend ka ulatna. Negative Harami pattern ko samajhne ke liye, humein pehle candlestick charts ka basic structure samajhna zaroori hai. Ye charts ek specific time period mein ek asset ki opening, closing, high, aur low prices ko dikhate hain. Trading main Harami ek do-candlestick pattern hota hai, jismein pehla candlestick bara hota hai aur doosra chhota. Negative Harami Pattern ko samajhne ke liye, sabse pehle ye samajhna zaroori hai ke iska context kya hota hai aur ye kis situation mein form hota hai. Iss pattern ko aksar bullish trend ke baad dekha jata hai, jismein pehla candlestick bullish hota hai aur doosra candlestick bearish hota hai. Isse yeh indication milta hai ke shayad ab market ka trend bearish ho sakta hai.

Candlestick Chart Ka Basic Taaruf

Candlestick charts trading ke world mein kafi common hain kyunki yeh price movement ko visually depict karte hain. Har candlestick ek time period ki price information deta hai, jismein:- Body: Jo price difference dikhati hai open aur close ke darmiyan.

- Wicks (Shadows): Yeh highest aur lowest prices ko indicate karti hain.

- Color: Green ya white candlestick bullish move ko show karta hai, jabke red ya black candlestick bearish move ko dikhata hai.

Harami ek Japanese lafz hai jiska matlab hota hai "pregnant," aur is pattern ka naam bhi isliye diya gaya hai kyunki iska structure aise lagta hai jaise ek chhoti candle ek bari candle ke andar ho. Harami pattern bullish aur bearish dono forms mein milta hai, lekin yahan hum Negative Harami ya Bearish Harami ko discuss karenge.

Negative Harami Pattern Ki Shakal

Negative Harami pattern mein do candles hoti hain:- Pehli Candle (Bullish): Pehli candle ek strong bullish candle hoti hai jisme market upar ki taraf move kar raha hota hai.

- Doosri Candle (Bearish): Doosri candle pehli candle ke body ke andar hoti hai, lekin yeh ek bearish candle hoti hai, yani market ne apna direction change kar liya hota hai.

Negative Harami Pattern Ka Technical Tafseelat

Is pattern mein jo sabse pehli cheez dekhi jati hai wo hai pehla candlestick jo strong bullish hota hai. Yeh bullish candle market mein buying pressure ko indicate karta hai. Doosra candlestick chhota hota hai aur iske body ke andar hota hai, jo ke bearish hota hai. Yani ke pehli candle ke range ke andar doosri candle close hoti hai, jo market ke andar indecision aur reversal ke indications ko strong karta hai.

Trend Reversal Ki Ahmiyat

Negative Harami Pattern aksar market ke top pe form hota hai jab ek bullish trend ka aakhri hissah hota hai. Jab yeh pattern form hota hai, toh iska matlab hota hai ke buyers ab thak gaye hain aur sellers control lenay ko tayyar hain. Yeh pattern sirf ek bearish reversal ko indicate karta hai jab yeh ek upward trend ke baad form hota hai.

Key points jo Negative Harami Pattern ko samajhne mein madad deti hain- Bullish Trend ka End: Negative Harami pattern aksar ek strong bullish trend ke baad dikhai deta hai, jismein market ko neeche jaane ki ahmiyat milti hai.

- Bearish Signal: Jab bearish candle pehli candle ke body ke andar hoti hai, toh yeh ek clear signal hota hai ke ab shayad market neeche jaane wala hai.

- Volume Confirmation: Harami pattern ka zyada reliable hone ka ek tareeqa yeh hai ke volume ko bhi analyze kiya jaye. Agar second candle ke time pe volume high hai, toh yeh aur zyada confirmation deta hai ke trend reverse hone wala hai.

Trading mein patterns ke peeche psychology ko samajhna bohot zaroori hai. Negative Harami Pattern ke andar pehli bullish candle ye indicate karti hai ke market abhi bhi buyers ke control mein hai. Magar doosri candle ke chhota aur bearish hone ka matlab yeh hota hai ke buyers ab overextend ho gaye hain aur unka momentum kamzor ho gaya hai. Yani ke pehla candlestick jo kaafi bara tha, uske baad market ko neeche jaane ka pressure mehsoos hota hai.

Ye pattern traders ko signal deta hai ke market ab reverse hone wala hai aur ab buyers ki power kam ho rahi hai. Is pattern ke baad market ke andar jo indecision create hoti hai, usse aur zyada traders profit book karna shuru kar dete hain, jo selling pressure ko aur barhata hai.

Trading Strategy Negative Harami Pattern Ke Sath

Negative Harami Pattern ko dekhne ke baad, traders ke paas kai strategies hoti hain jo wo use karte hain. Aksar log is pattern ko bearish confirmation ke saath use karte hain aur trend ke ulatne ka wait karte hain. Trading mein risk management bohot zaroori hai, aur Negative Harami ke baad trade enter karte waqt stop-loss lagana bohot important hota hai.- 1. Confirmation ke liye Wait karna: Bohot se traders Negative Harami Pattern ke baad ek extra confirmation ka wait karte hain, jese ke ek bearish candle jo is pattern ke baad form ho. Yeh confirmation iss baat ka izhar karti hai ke ab market ka trend ulat gaya hai.

- 2. Stop Loss Setting: Jab Negative Harami Pattern ke baad trade enter ki jati hai, toh stop-loss aksar pehli bullish candle ke high pe lagaya jata hai, taake agar market wapas bullish ho jaye toh aapka loss minimize ho sake.

- 3. Target Setting: Bearish Harami ke baad jab market neeche jata hai, toh aapko apne profit targets realistic rakhne chahiye. Aksar traders is pattern ke baad short karte hain aur apne targets ko previous support levels ke aas paas rakhte hain.

Samajh lein ke ek stock continuously upar ja raha hai, aur ek bullish trend mein hai. Phir achanak ek bearish Harami pattern form hota hai. Pehli candle green hai jo ke kaafi bari hai aur bullish trend ko continue karti hai. Agle din, ek chhoti red candle form hoti hai jo pehli candle ke andar close hoti hai. Yeh indication hai ke ab market bearish hone wala hai. Is situation mein, aap apne long positions ko close kar sakte hain aur bearish trend ke liye tayyari shuru kar sakte hain.

Real-world Application

Trading mein Negative Harami Pattern ko bohot se traders use karte hain jab unhein lagta hai ke market ke trend mein reversal aane wala hai. Magar, yeh zaroori hai ke aap is pattern ko doosre technical indicators ke saath combine karein jese ke Relative Strength Index (RSI), Moving Averages, aur volume analysis taake aap apni strategy ko aur zyada strengthen kar sakein.

Is pattern ka use forex, stock markets, aur cryptocurrencies mein bhi hota hai. For example, agar Bitcoin ya kisi aur cryptocurrency ka price continuously barh raha ho aur phir Negative Harami pattern form ho, toh yeh signal ho sakta hai ke ab price neeche jaane wala hai.

Harami Pattern ke Limitations

Harami pattern ki kuch limitations bhi hoti hain jo traders ko samajhni chahiye:- False Signals: Yeh pattern aksar false signals bhi generate karta hai, isliye confirmation ka wait karna zaroori hai.

- Contextual Importance: Is pattern ka zyada reliable hona uske context pe depend karta hai. Agar yeh pattern ek weak trend mein form ho raha hai toh shayad iska impact kam ho.

- Time Frames: Is pattern ka performance different time frames par farq kar sakta hai. Aapko apni strategy ke mutabiq time frames ka analysis karna chahiye.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

- Bitcoin

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Negative Harami ek technical pattern hai jo candlestick analysis mein use hota hai, aur yeh traders aur investors ke liye kaafi useful hota hai jab woh trend reversal ka signal dhoondhte hain. Yeh term Negative Harami Japan mein traditional candlestick patterns se aayi hai, jo trading aur investing mein market ke behavior aur sentiments ko samajhne mein madad karti hai. Negative Harami pattern mein do candlesticks hoti hain jo ek bearish trend ke continuation ka signal hoti hain ya uske baad bullish trend ke reversal ka bhi ishara kar sakti hain. Agar aap forex, stocks, ya kisi bhi asset class mein trading kar rahe hain, toh Negative Harami pattern ko samajhna aur identify karna aapke trading decisions ko improve kar sakta hai.

Negative Harami

Negative Harami ek aisa pattern hai jo do candlesticks se milkar banta hai. Pehla candlestick bullish hota hai, jo ke ek strong price movement ko show karta hai, aur doosra candlestick bearish hota hai, jo pehle wale candlestick ke body ke andar contain hota hai. Is pattern ka formation bullish trend ke baad hota hai aur yeh trend reversal ka signal ho sakta hai, yani ke bullish se bearish mein shift ho sakta hai.

Negative Harami Ki Characteristics

Negative Harami pattern ki kuch khas characteristics hain jo traders ko ye pattern pehchanne mein madad karti hain:- Pehla Candlestick Bullish Hota Hai: Pehla candlestick bullish (green) hota hai jo strong buying pressure ko represent karta hai. Yeh bada aur noticeable candlestick hota hai jo ke bullish trend ka confirmation deta hai.

- Doosra Candlestick Bearish Hota Hai: Doosra candlestick bearish (red) hota hai jo chhota hota hai aur pehle wale candlestick ke body ke andar aata hai. Yeh buying pressure mein kamzor hote hue market mein bearish sentiment ko represent karta hai.

- Trend Reversal Ka Signal: Negative Harami pattern trend reversal ka ek clear signal ho sakta hai. Iska matlab hai ke agar pehle bullish trend chal raha hai toh Negative Harami ke formation ke baad market bearish ho sakti hai.

- Volume Confirmation: Is pattern ko confirm karne ke liye volume ka analysis bhi zaroori hai. Agar pehle candlestick ke dauraan high volume ho aur doosre candlestick mein low volume ho, toh yeh aur bhi clear signal deta hai ke market mein shift ho sakta hai.

Negative Harami ko asaan tarike se trading ke liye use kiya ja sakta hai. Is pattern ko detect karne ke baad, traders entry aur exit points identify kar sakte hain, jisse woh market ke reversal ka faida utha sakte hain. Iske kuch steps hain jo har trader ko samajhni chahiye:- Pehchan: Chart ko dekhte waqt identify karna hota hai ke kya Negative Harami pattern banta hai. Yani ke aapko ek bullish candlestick aur uske baad ek bearish candlestick dhoondhna hota hai jo uske body ke andar contain ho.

- Confirmation Ka Wait Karna: Negative Harami ka confirmation tab hota hai jab bearish candlestick ke baad agle candlesticks mein bearish trend continue hota hai. Matlab ke aapko ek aur bearish candlestick ya phir lower low formation dekhne ko milta hai.

- Entry Aur Exit Points: Agar Negative Harami ka pattern confirm ho jata hai, toh trader ko apni position open karni chahiye. Entry ke liye ideal point wo hai jab bearish trend aur bhi zyada confirm ho. Stop-loss set karna bhi zaroori hai jo pehle wale bullish candlestick ke high ke paas hona chahiye.

- Volume Analysis: Harami pattern mein volume ka analysis bhi zaroori hota hai. Volume agar first candlestick mein high aur second mein low hai, toh yeh bhi ek indication hai ke market mein reversal hone wala hai.

Yeh pattern usually daily aur hourly charts mein identify kiya jata hai. Agar aap higher timeframe pe hain toh yeh pattern zyada significant ho sakta hai. Pehla step yeh hai ke bullish trend ko identify karein aur dekhain ke pehla candlestick bullish aur strong hai, aur doosra chhota bearish candlestick uske body mein hai.

Agar ye pattern intraday trading ya short-term trading mein use kiya jaye toh zyada effective ho sakta hai lekin ismein risk management ka bhi khas khayal rakhna chahiye. Trend reversal ke patterns mein kabhi kabhi false signals bhi hotay hain, isliye volume aur price action ka analysis saath mein zaroori hai.

Practical Examples of Negative Harami

Samajhne ke liye kuch examples dekhte hain:- Example 1: Agar stock XYZ ke prices mein bullish trend chal raha hai aur ek lambi green candlestick form hui, toh uske baad ek chhoti red candlestick uske body ke andar form ho rahi hai. Yeh Negative Harami ka pattern bana rahi hai jo ke bearish reversal ka signal ho sakta hai.

- Example 2: Forex trading mein, agar EUR/USD ke prices bullish trend mein hain aur ek lamba bullish candle aaya, phir uske baad ek chhota bearish candle aaya jo pehle wale candle ke range mein hai. Yeh bhi Negative Harami ka example ho sakta hai.

Har technical pattern ki tarah, Negative Harami ke bhi kuch limitations hain:- False Signals: Kabhi kabhi yeh pattern false signal de sakta hai, yani ke bearish reversal nahi hota aur market bullish hi rahti hai. Iske liye zaroori hai ke traders aur indicators ka bhi istimaal karein jaise ke RSI ya MACD.

- Volume Analysis: Volume analysis ke bagair yeh pattern utna effective nahi hota, kyun ke kabhi kabhi trend mein temporary pullback hota hai jo real reversal nahi hota.

- Market Conditions: Yeh pattern sirf trending markets mein reliable hota hai. Agar market sideways ya choppy ho toh yeh pattern itna significant nahi hota.

- Risk Management Ki Zaroorat: Negative Harami ko follow karte waqt risk management zaroori hai. Stop-loss aur profit targets ko set karna trading ka important aspect hai.

Risk management trading ka ek important hissa hai. Jab bhi Negative Harami pattern ka signal mile toh apni trade ko manage karna zaroori hai. Sabse pehle, stop-loss set karna chahiye jo ke pehle bullish candlestick ke high ke paas hona chahiye. Isse yeh hoga ke agar pattern fail bhi hota hai toh zyada loss nahi hoga.

Secondly, position size ko calculate karna chahiye. Apna risk reward ratio decide karna aur uske hisaab se position ko adjust karna help karega. For example, agar aapka risk reward ratio 1:2 hai, toh apni position size ko uske mutabiq rakhna chaahiye.

Negative Harami ek effective aur powerful pattern hai jo bearish reversal ka signal de sakta hai, lekin iska use samajhdaari se karna zaroori hai. Trend reversal ke patterns ko kabhi bhi individually nahi follow karna chahiye, balkay volume aur price action ke saath analyse karna chahiye. Indicators jaise ke RSI aur MACD bhi helpful hote hain confirmation ke liye.

Agar aapko pattern pe confidence ho aur risk management ka use karein, toh Negative Harami pattern ek effective trading tool ban sakta hai jo aapko market ke trends aur reversals samajhne mein madad de sakta hai.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 06:50 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим