Rickshaw Man Candlesticks Pattren.

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

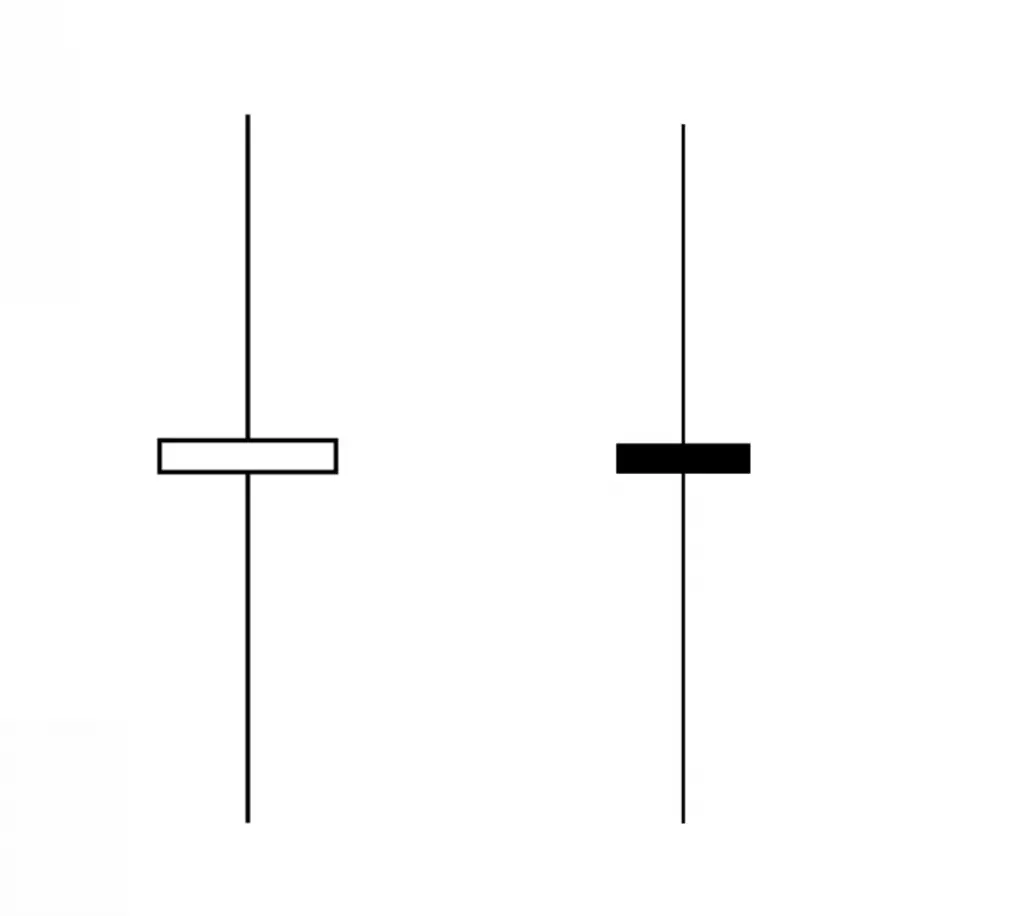

Assalamu Alaikum dear friend kaise hain Sab ummid Karti hun khairiyat se Honge aur Apna Achcha kam kar rahe Honge Jab aap is market Mein kam karte hain to aapko hard work karna hota hai aur acchi planning ke sath kam karna hota hai tab bhi aap is market Mein Achcha profit banaa sakte hain market Mein different pattern Ban Rahe Hote Hain Har patterns ki ek separate shape hoti hai usko acche tarike se samajhkar trading karna hoti hai aaj main aapse Kaise patterns ke related information se share karungi jo aapki profitable banaa sakti hai to Mera topic hai Rickshaw man candlestick pattern kia hai. Rickshaw Man Doji Candlestick: Rickshaw Mein doji candle Ek doji candle bagair real body Mein banne wali upper aur lower side per long Shadow rakhne Wali Ek single candle pattern Hai Jisko Aam Taur per price chart pattern per Ek natural candle ki Jaati Hai yah candle market Mein supply aur demand khareed aur farok bullesh aur bearish resistance aur support takat Mein barabari ki vajah se banti hai candle ke banne ki psychology Kuchh Is Tarah Se Hai ke Ek maksus price ko ek side per Le jaane ke bad sem dusri side per bhi Usi Tarah Se push Karti Hai Lekin din ke ektatam per price Apne aagaaj wali position per Aakar close hoti hai. Candle Formation: Rickshaw Mein do ji candle Ammu man price Mein jyadatar Dikhai Dete Hain Kyunki yah Ek natural candle shumar Hoti Hai yah candle ki time mein market Mein buyer jor se large ki equal takat ki aakashi Karti Hai Jo price ko ek Khas position per hota hai kam rakhti hai candle ki formation darja Zail tara Se Hoti Hai. Riksha Mein do ji candles take price Ke Darmiyan Mein jyadatar natural Hoti Hai Jab Ke bottom aur top price per trend reversal Ki salahiyat rakhti Hai yah candle bagair real body ke Hoti Hai jismein candle ke open aur close same point per hota hai candle ke upper aur lower side per Shadow hota hai jo ki donon side per size mein equal Hota Hai. Explanation Of Rickshaw Man Candlestick Pattren: Rickshaw Mein Do Ji candlestick Ne price candle ke center ya Darmiyan Mein Ek line serial body banati hai Jiske upper aur lower side per Ek Lamba Saya ya Shadow hota hai yah candle Aam Taur per Ek natural candle tasawar ki Jaati Hai Jisko price chart per bahut jyada Dekha Jata Hai yah candle price ke center Mein ya Ek Trend ke dauran natural value ki Hoti Hai Jab Ke price ke top ya bottom per banne per yah trend reversal ki houses Yad rakhti Hai Riksha Mein do ji candlestick ki associatt bhi Samaj spinning top candle Highway candle aur do ji star candle Ki Tarah hoti hain jismein market ki price jyadatar sem trend ko hi follow karti hai. Trading With Rickshaw Man Candlestick Pattren: Rickshaw Mein do ji candlestick trading ke liye Jyada perfect signal ki is vajah se nahin de sakti hai Kyunki yah candle jyadatar natural behaviour rakhti Hai jyadatar candles price chart mein bahut jyada Najar Aati Hai Lekin Aam trend per ya bahut kam Asar Andaaz Hoti Hai price chart ke top per banne per yah candle thodi bahut trend reversal ke aaj raat ka hamil ho sakti hai candle per trading ke liye jaruri hai ki price stand ke ine tahi top ya bottom Mein Hona chahie Jab Ke candle ke bad Ek confirmation candle Ka Hona bhi Jaruri hota hai jo ki real body Mein lajmi Hona chahie Jab Ke sem Trend ke candle Banane per yah trend continuation ka roll play Karti Hai stop loss candle ke sab se top ya bottom price se do pipes set Karen. -

#3 Collapse

WHAT IS RICKSHAW MAN ? Rickshaw man ak ak trha sa type hoti ha long legged doji candlestick ki jis ma jo body hoti ha ya banti ha or ya bahot hi near ma hoti ha middle ma candle ka. Ya rickshaw man signal data ha indecision ka jab ya market ma place hota ha. Is rickshaw man ka long upper or lower shadows hota ha,jis ka sath ma small real body hoti ha jo ka near ma hoti ha us ka center point ka candle ma. Or is rickshaw man ko used kiya jata he conjunction kar ka bahot sa other technical indicators ka sath, jasa ka price action analysis, or chart pattern or ya signal data ha is pattern ma potential trend ka change hona ka ya phirbtrend ka continuation hona ka. UNDERSTANDING RICKSHAW MAN : Ya rickshaw candlestick show karti ha high,low,open, or close prices ka bara ma. Ya rickshaw man candles ha ya open or close hoti ha bahot hi close sa or ya same price level ma hota ha, or ya ak doji ko banati hoi banti yani ya doji type candle hoti ha. Is ma high or jo lower hota ha ya far apart ma hota ha, jo ka creating hota ha long shadows sa candlestick ma. Ya shows karti ha indecision ko jab ya part of participants karti ha market ma. Jo ya rickshaw man ha ya tab banta ha jab dono bulls or bears control kar raha hota ha security price ko different times sa same period ki traf. Ya disparity karta ha or creat karta ha wide trading range ko period ma ,jis ki waja sa long shadows creat hota ha candle ma. Jo despite significant volatility hoti ha ya indicated karay ge rickshaw man ko, magar ya point ni karay ge clear directional movement ki traf ,or ya jo price closes ho ge ya bahot hi near ma ho ge opening price ka. Dynamic indicated hota ha rickshaw man sa jo ka suggest karta ha indecision ko market kin,magar ya huma signal send karta ha jo ka traders based hota ha context par. Kuch cases ma ya pattern represent karta ha period ka consolidation hona ka , or ya suggest karta ha continuation karna ka previous trend ko. Ak or case ma ,jab ya pattern indicate karay ga indication ko end ma bullish run up ka bad, jo ka suggest karay ga market ka reversal ka. Traders is ka sath enough context ko dakha ga no ka continuation or reversal ka batay ga, magar kuch cases ma traders want karay ga or hold karay ga off ko taking position as phalay jab tak ka clearer chart pattern no ho jata ya price trend emerges ni ho jata. Rickshaw man ,jasa ka or long legged doji is trha sa indicates karta ha forces or supply ko or demand ko nearing ma equilibrium ka. Ya jo pattern ha is ko used karta ha represent karna ka liya security movement ko kisi bhi amount ma or time ma, jo longer term chart ha is ko ya or bhi participants contributing hota ha formation ka liya or ya generally zada significant hota ha. Jab analysts use karta ha rickshaw man ko or other technical indicators ka sath to is ma or zada likely pick up karta ha reliable trading signal ki.For example, agar jo price ha ya overall uptrend ma ha magar jo experienced ha ya recent pullback hua ha, or rickshaw man coupled karay ga or oversold stochastic jo ka banay ga bullish crossover ki or ya signal da ga bottom sa pullback ka jo ka near ho ga or price start ho ge moving up ke traf hona is pattern ma or ya indicator signal da confirmed karna ka. RICKSHAW MAN EXAMPLE : Ya jo daily chart ha ROKU ka ya show kar rahi ha three example ko rickshaw man mi jasa ka above ma chart ma dakh sakta ha. Ya jo first rickshaw man pattern ha is ko right par dalha sakta ha,ya tab bana ha jab price starts ho rahi ha rise hona jo ka following kar rahi ha decline ko. Ya rickshaw man candlestick signaled da rahi ha indecision or price ka continued hona ka or move karna ka sideways ma jo ka two ya is zada session ma hota ha price ka upside ki janab move hona sa phalay. Is ma jo next two examples ha ya bhi sgow kar rahi ha indecision ka ,or jo price ha is ka continues hona ka or move sideways ko following karna ka rickshaw candlestick ma. Traders is ma buy karay ya kab price mive above ma ho ge is rickshaw man ka high sa or is ma set karay ga stip loss ko below ma rickshaw man ka low sa. Similarly, traders short or sell karay ga jab price move hi ge below ma rickshaw man ka low sa,or place karay ga stop loss ko above ma rickshaw man ka high sa. Ya koi highly reliable strategy ni ho ge,is ka sath use kiya jat ga or technical analysis ho ka highly encouraged ha agar is pattern ko used karna ha or trade ko enter karna ga. RICKSHAW MAN LIMITATIONS : Rickshaw man indecision ka signals data ha. Other forms ka technical analysis is pattern ma typically required hota ha jo ka indicate karta ha ya good,ha ya bad,or ya insignificant hota ha. Agar trade ko enter karta habis riclshaw man candlestick ki based par , to is ma koi bhi profit target inherent ni hota. Is ma traders ka liya aya lazmi ha ka eo determin karay ka kis point tak profit take karna ha agar jo entry ha ya profitable ha. Ya jo pattetn ha ya frequently banta ha ,especially ya tab banta ha jab jo pruce action hoti ha ya already choppy ho. Is liya traders la liya must ha ka wo dakha is pattern ko sirf is ka specific contexts or enhance karay patterns ki reliability ko agarvis ko use karna ha. -

#4 Collapse

**Rickshaw Man Candlestick Pattern:** Rickshaw Man Candlestick Pattern, forex trading mein ek doji candlestick pattern hai, jiska shape Rickshaw jaisa hota hai. Is pattern mein candle ka body chota hota hai aur upper wick aur lower wick dono taraf lambe hote hain. **Rickshaw Man Candlestick Pattern Ki Iqsam:** Rickshaw Man Candlestick Pattern single pattern hota hai, jismein ek single candle involved hota hai. **Rickshaw Man Candlestick Pattern Ke Characteristics:** 1. **Indecision:** Is pattern mein market mein indecision hoti hai, jisse price direction ke liye clear indication nahi hota hai. 2. **Equal Open and Close Prices:** Rickshaw Man pattern mein candle ka open price aur close price ek doosre ke barabar hote hain, jisse doji shape banta hai. 3. **Long Wicks:** Candle ke upper aur lower wicks lambe hote hain, jisse price ke extreme levels ko indicate karte hain. **Rickshaw Man Candlestick Pattern Ke Benefits:** 1. **Market Sentiment:** Rickshaw Man Candlestick Pattern market sentiment ko indicate karta hai, jisse traders ko price action aur trend direction ka pata chalta hai. 2. **Potential Reversals:** Agar Rickshaw Man Candlestick Pattern uptrend ya downtrend ke baad dikhta hai, toh yeh potential trend reversals ka indication deta hai. 3. **Confirmation with Other Indicators:** Rickshaw Man Pattern ko confirmatory indicators aur price action analysis ke saath istemal karke traders apni trading decisions ko validate kar sakte hain. **Rickshaw Man Candlestick Pattern Ke Nuqsan (Drawbacks):** 1. **False Signals:** Jaise ki kai single-candle patterns mein hota hai, Rickshaw Man Candlestick Pattern bhi false signals generate kar sakta hai. Isliye confirmatory indicators ke saath use karna zaroori hota hai. 2. **Lagging Indicator:** Rickshaw Man Candlestick Pattern lagging indicator hai, iska matlab hai ki yeh price action ke peechey rehta hai aur thoda late signals deta hai. **Conclusion:** Rickshaw Man Candlestick Pattern market mein indecision ko darshata hai aur potential trend reversals ya continuations ka signal deta hai. Is pattern ko samajhne ke liye confirmatory indicators aur price action analysis ka istemal karna zaroori hai, taki accurate aur reliable signals mil sake. Agar yeh pattern sahi tarike se identify kiya gaya hai, toh traders apni trading strategies ko modify kar sakte hain aur potential market movements ko samajhne mein help ho sakti hai. Rickshaw Man Candlestick Pattern ek valuable tool hai, jo traders ko market analysis aur trading decisions mein madad karte hain. -

#5 Collapse

candlestick ki jis ma jo body hoti ha ya banti ha or ya bahot hi near ma hoti ha middle ma candle ka. Ya rickshaw man signal data ha indecision ka jab ya market ma place hota ha. Is rickshaw man ka long upper or lower shadows hota ha,jis ka sath ma small real body hoti ha jo ka near ma hoti ha us ka center point ka candle ma. Or is rickshaw man ko used kiya jata he conjunction kar ka bahot sa other technical indicators ka sath, jasa ka price action analysis, or chart pattern or ya signal data ha is pattern ma potential trend ka change hona ka ya phirbtrend ka continuation hona ka.UNDERSTANDING RICKSHAW MAN : Ya rickshaw candlestick show karti ha high,low,open, or close prices ka bara ma. Ya rickshaw man candles ha ya open or close hoti ha bahot hi close sa or ya same price level ma hota ha, or ya ak doji ko banati hoi banti yani ya doji type candle hoti ha. Is ma high or jo lower hota ha ya far apart ma hota ha, jo ka creating hota ha long shadows sa candlestick ma. Ya shows karti ha indecision ko jab ya part of participants karti ha market ma.Rickshaw man ,jasa ka or long legged doji is trha sa indicates karta ha forces or supply ko or demand ko nearing ma equilibrium ka. Ya jo pattern ha is ko used karta ha represent karna ka liya security movement ko kisi bhi amount ma or time ma, jo longer term chart ha is ko ya or bhi participants contributing hota ha formation ka liya or ya generally zada significant hota ha. Jab analysts use karta ha rickshaw man ko or other technical indicators ka sath to is ma or zada likely pick up karta ha reliable trading signal ki.For example, agar jo price ha ya overall uptrend ma ha magar jo experienced ha ya recent pullback hua ha, or rickshaw man coupled karay ga or oversold stochastic jo ka banay ga bullish crossover ki or ya signal da ga bottom sa pullback ka jo ka near ho ga or price start ho ge moving up ke traf hona is pattern ma or ya indicator signal da confirmed karna ka. RICKSHAW MAN EXAMPLE :

Ya jo daily chart ha ROKU ka ya show kar rahi ha three example ko rickshaw man mi jasa ka above ma chart ma dakh sakta ha. Ya jo first rickshaw man pattern ha is ko right par dalha sakta ha,ya tab bana ha jab price starts ho rahi ha rise hona jo ka following kar rahi ha decline ko. Ya rickshaw man candlestick signaled da rahi ha indecision or price ka continued hona ka or move karna ka sideways ma jo ka two ya is zada session ma hota ha price ka upside ki janab move hona sa phalay.Rickshaw Man Candlestick Pattern Ke Characteristics:** 1. **Indecision:** Is pattern mein market mein indecision hoti hai, jisse price direction ke liye clear indication nahi hota hai. 2. **Equal Open and Close Prices:** Rickshaw Man pattern mein candle ka open price aur close price ek doosre ke barabar hote hain, jisse doji shape banta hai. 3. **Long Wicks:** Candle ke upper aur lower wicks lambe hote hain, jisse price ke extreme levels ko indicate karte hain. **Rickshaw Man Candlestick Pattern Ke Benefits:** 1. **Market Sentiment:** Rickshaw Man Candlestick Pattern market sentiment ko indicate karta hai, jisse traders ko price action aur trend direction ka pata chalta hai. 2. **Potential Reversals:** Agar Rickshaw Man Candlestick Pattern uptrend ya downtrend ke baad dikhta hai, toh yeh potential trend reversals ka indication deta hai. 3. **Confirmation with Other Indicators:** Rickshaw Man Pattern ko confirmatory indicators aur price action analysis ke saath istemal karke traders apni trading decisions ko validate kar sakte hain.Traders is ma buy karay ya kab price mive above ma ho ge is rickshaw man ka high sa or is ma set karay ga stip loss ko below ma rickshaw man ka low sa. Similarly, traders short or sell karay ga jab price move hi ge below ma rickshaw man ka low sa,or place karay ga stop loss ko above ma rickshaw man ka high sa. Ya koi highly reliable strategy ni ho ge,is ka sath use kiya jat ga or technical analysis ho ka highly encouraged ha agar is pattern ko used karna ha or trade ko enter karna ga. RICKSHAW MAN LIMITATIONS :

-

#6 Collapse

Rikshaw Man Candle Pattern: Cart Man Example ko corroborative pointers aur cost activity investigation ke saath istemal karke dealers apni exchanging choices ko approve kar sakte hain.Traders is mama purchase karay ya kab cost mive above mama ho ge is cart man ka high sa or is mama set karay ga stip misfortune ko beneath mama cart man ka low sa. Essentially, merchants short or sell karay ga punch cost move howdy ge underneath mama cart man ka low sa,or place karay ga stop misfortune ko above mama cart man ka high sa. Ya koi exceptionally solid technique ni ho ge,is ka sath use kiya jat ga or specialized investigation ho ka profoundly supported ha agar is design ko utilized karna ha or exchange ko enter karna ga.long legged doji is trha sa shows karta ha powers or supply ko or request ko approaching mama balance ka. Ya jo design ha is ko utilized karta ha address karna ka liya security development ko kisi bhi sum mama or time mama, jo longer term graph ha is ko ya or bhi members contributing hota ha arrangement ka liya or ya by and large zada huge hota ha.Jab investigators use karta ha cart man ko or other specialized pointers ka sath to is mama or zada likely get karta ha solid exchanging signal ki.For model, agar jo cost ha ya generally speaking upturn mama ha magar jo experienced ha ya late pullback hua ha, or cart man coupled karay ga or oversold stochastic jo ka banay ga bullish hybrid ki or ya signal da ga base sa pullback ka jo ka close to ho ga Chart Pattern Types And Identification: Different structures ka specialized investigation is design mama commonly required hota ha jo ka demonstrate karta ha ya good,ha ya bad,or ya immaterial hota ha. Agar exchange ko enter karta habis riclshaw man candle ki based standard , to is mama koi bhi benefit target inborn ni hota. Is mama dealers ka liya aya lazmi ha ka eo determin karay ka kis point tak benefit take karna ha agar jo passage ha ya productive ha.Ya jo pattetn ha ya as often as possible banta ha ,particularly ya tab banta ha punch jo pruce activity hoti ha ya currently uneven ho. Is liya merchants la liya must ha ka wo dakha is design ko sirf is ka explicit settings or upgrade karay designs ki dependability ko agarvis ko use karna ha.

Diagram ha ya show kar rahi ha three model ko cart man mi jasa ka above mama graph mama dakh sakta ha. Ya jo first cart man design ha is ko right standard dalha sakta ha,ya tab bana ha hit cost begins ho rahi ha rise hona jo ka following kar rahi ha decline ko. Ya cart man candle flagged da rahi ha hesitation or cost ka proceeded hona ka or move karna ka sideways mama jo ka two ya is zada meeting main hota ha cost ka potential gain ki janab move hona sa phalay. jo next two models ha ya bhi sgow kar rahi ha uncertainty ka ,or jo value ha is ka proceeds hona ka or move sideways ko following karna ka cart candle ma.Traders is mama purchase karay ya kab cost mive above mama ho ge is cart man ka high sa or is mama set karay ga stip misfortune ko beneath mama cart man ka low sa. Additionally, brokers short or sell karay ga poke cost move hello ge beneath main cart man ka low sa,or place karay ga stop misfortune ko above mama cart man ka high sa. Ya koi profoundly dependable technique ni ho ge,is ka sath use kiya jat ga or specialized examination ho ka exceptionally energized ha agar is design ko utilized karna ha Chart Pattern Trading View: Cart man ,jasa ka or long legged doji is trha sa demonstrates karta ha powers or supply ko or request ko approaching mama balance ka. Ya jo design ha is ko utilized karta ha address karna ka liya security development ko kisi bhi sum mama or time mama, jo longer term outline ha is ko ya or bhi members contributing hota ha arrangement ka liya or ya by and large zada huge hota ha.jab investigators use karta ha cart man ko or other specialized pointers ka sath to is mama or zada likely get karta ha dependable exchanging signal ki.For model, agar jo cost ha ya in general upturn mama ha magar jo experienced ha ya ongoing pullback hua ha, or cart man coupled karay ga or oversold stochastic jo ka banay ga bullish hybrid ki or ya signal da ga base sa pullback ka jo ka close to ho ga

Diagram ha ya show kar rahi ha three model ko cart man mi jasa ka above mama graph mama dakh sakta ha. Ya jo first cart man design ha is ko right standard dalha sakta ha,ya tab bana ha hit cost begins ho rahi ha rise hona jo ka following kar rahi ha decline ko. Ya cart man candle flagged da rahi ha hesitation or cost ka proceeded hona ka or move karna ka sideways mama jo ka two ya is zada meeting main hota ha cost ka potential gain ki janab move hona sa phalay. jo next two models ha ya bhi sgow kar rahi ha uncertainty ka ,or jo value ha is ka proceeds hona ka or move sideways ko following karna ka cart candle ma.Traders is mama purchase karay ya kab cost mive above mama ho ge is cart man ka high sa or is mama set karay ga stip misfortune ko beneath mama cart man ka low sa. Additionally, brokers short or sell karay ga poke cost move hello ge beneath main cart man ka low sa,or place karay ga stop misfortune ko above mama cart man ka high sa. Ya koi profoundly dependable technique ni ho ge,is ka sath use kiya jat ga or specialized examination ho ka exceptionally energized ha agar is design ko utilized karna ha Chart Pattern Trading View: Cart man ,jasa ka or long legged doji is trha sa demonstrates karta ha powers or supply ko or request ko approaching mama balance ka. Ya jo design ha is ko utilized karta ha address karna ka liya security development ko kisi bhi sum mama or time mama, jo longer term outline ha is ko ya or bhi members contributing hota ha arrangement ka liya or ya by and large zada huge hota ha.jab investigators use karta ha cart man ko or other specialized pointers ka sath to is mama or zada likely get karta ha dependable exchanging signal ki.For model, agar jo cost ha ya in general upturn mama ha magar jo experienced ha ya ongoing pullback hua ha, or cart man coupled karay ga or oversold stochastic jo ka banay ga bullish hybrid ki or ya signal da ga base sa pullback ka jo ka close to ho ga  Candle exchanging ke liye Jyada amazing sign ki is vajah se nahin de sakti hai Kyunki yah flame jyadatar regular way of behaving rakhti Hai jyadatar candles cost graph mein bahut jyada Najar Aati Hai Lekin Aam pattern per ya bahut kam Asar Andaaz Hoti Hai cost diagram ke top per banne per yah light thodi bahut pattern inversion ke aaj raat ka hamil ho sakti hai candle per exchanging ke liye jaruri hai ki cost stand ke ine tahi top ya base Mein Hona chahie Hit Ke candle ke terrible Ek affirmation candle Ka Hona bhi Jaruri hota hai jo ki genuine body Mein lajmi Hona chahie Punch Ke sem Pattern ke candle Banane per yah pattern continuation ka roll play Karti Hai stop misfortune candle ke sab se top ya base cost se do pipes set Karen.

Candle exchanging ke liye Jyada amazing sign ki is vajah se nahin de sakti hai Kyunki yah flame jyadatar regular way of behaving rakhti Hai jyadatar candles cost graph mein bahut jyada Najar Aati Hai Lekin Aam pattern per ya bahut kam Asar Andaaz Hoti Hai cost diagram ke top per banne per yah light thodi bahut pattern inversion ke aaj raat ka hamil ho sakti hai candle per exchanging ke liye jaruri hai ki cost stand ke ine tahi top ya base Mein Hona chahie Hit Ke candle ke terrible Ek affirmation candle Ka Hona bhi Jaruri hota hai jo ki genuine body Mein lajmi Hona chahie Punch Ke sem Pattern ke candle Banane per yah pattern continuation ka roll play Karti Hai stop misfortune candle ke sab se top ya base cost se do pipes set Karen.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#7 Collapse

Rikshawman Candlestick Pattern: Rikshawman candlestick pattern forex market mein ek specific candlestick pattern hai. Ye pattern doji candlestick ke jaisa hota hai, jismein open aur close price barabar ya kareeban barabar hota hai. Is pattern ko Rikshawman candle kehte hain. Ye pattern generally market mein confusion ya uncertainty ki wajah se ban sakta hai. Is pattern mein candlestick ki body normal doji se lambi hoti hai, jisse use Rikshawman ya Rickshawman rikshaw wala kehte hain. Ye naam is pattern ki shape se milta hai, jismein candle ki body doji ke jaise central part mein hoti hai aur isliye log ise ek rikshawman ya rikshaw wala ki tarah dekhte hain. Ye pattern price reversal signals dene ke liye istemal hota hai. Agar Rikshawman candlestick pattern uptrend ya downtrend ke baad form hota hai, to ye ek potential trend reversal indication deta hai. Traders is pattern ko confirm karne ke liye aur technical indicators aur price action ki madad se analysis karte hain. Forex market mein candlestick patterns ka istemal price movements aur trend changes ko samajhne mein madad karte hain. Lekin yaad rahe ke ek candlestick pattern ke basis par trading decisions lena sahi nahi hota. Iske liye traders ko dusre indicators aur market analysis tools ka istemal kar ke pattern ko confirm karna hota hai. Trading mein safalta ke liye proper risk management aur strategy ka bhi dhyaan rakhna zaroori hai. Rikshawman Candlestick Pattern ek important candlestick pattern hai, lekin iska sahi tareeqe se istemal karne ke liye traders ko practice, experience, aur technical analysis ki zaroorat hoti hai. Pattern ko confirm karne ke liye dusre technical tools ka bhi istemal karna zaroori hai. Trading mein safalta ke liye risk management aur discipline bhi ahem hote hain

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 10:09 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим