Falling Three pattern

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

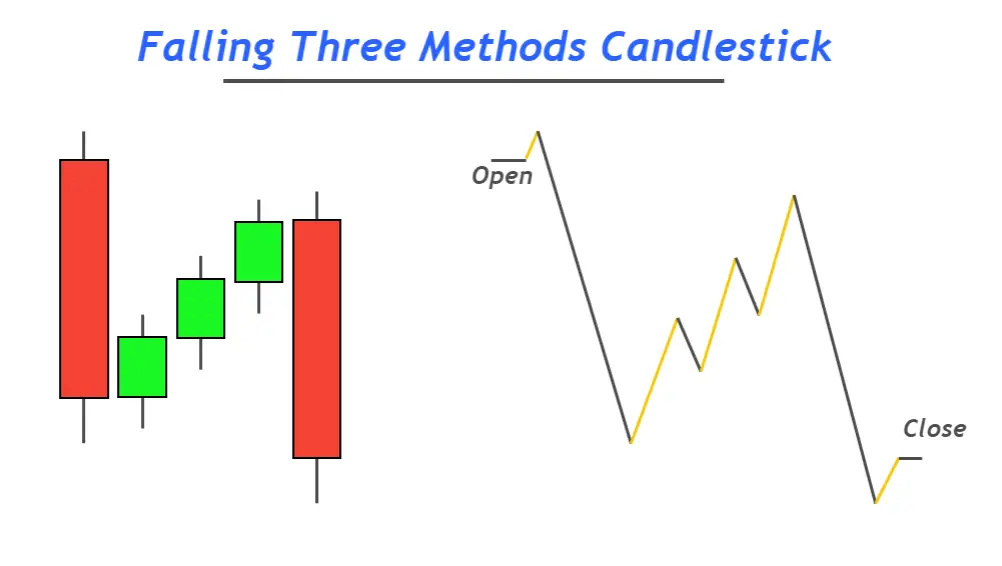

Falling Three pattern Definition girnay wala teen tareeqa aik bearish patteren hai jo paanch mom btyon ke sath hota hai jo aik musalsal patteren mein hota hai. candle stuck ke girnay ke teen tareeqon ka paanch candle patteren kisi rukawat ki nishandahi karta hai lekin takneeki tor par mojooda kami ke rujhan ko tabdeel nahi karta. is ka matlab yeh hai ke girty hui teen tareeqon candle stick is baat ki nishandahi karti hai ke mojooda girty hui qeematein kuch waqt ke liye barh sakti hain lekin mustaqbil mein dobarah gireen gi kyunkay neechay ka rujhan khatam nahi sun-hwa hai. girtay hue teen tareeqon candle stuck patteren ki shanakht mojooda neechay ke rujhan ki simt mein do lambi mom btyon se hoti hai, jo shuru aur aakhir mein position mein hoti hain, is ke sath sath teen mukhtasir insidaad trained candle jo darmiyan mein rakhi jati hain. girnay walay teen tareeqon candle stuck patteren ko samjhna market mein do rujhanaat hain : Understanding the falling Three pattern bearish aur blush. mandi ka rujhan, jisay down trained bhi kaha jata hai, is waqt hota hai jab reechh ya baichnay walay ya to munafe bikny ya –apne nuqsaan ko kam karne ke liye stock ki farokht shuru karkay barray pemanay par farokht ka aaghaz karte hain. doosri taraf, taizi ka rujhan, jisay up trained bhi kaha jata hai, is waqt hota hai jab bail ya khredar stock ko mojooda satah par is hajam par khareedna shuru karte hain jo farokht ke hajam se ziyada hai. aisi soorat mein, stock ki qeemat barh jati hai aur yeh is waqt tak jari rehti hai jab tak ke kharidari ka hajam ziyada nah ho. girnay ke teen tareeqon candle ki tashkeel teen tareeqon se girnay wali mom btyon ki tashkeel ka imkaan is waqt shuru hota hai jab chart surkh rang ki bohat si mom batian dekhata hai, jo jari kami ke rujhan ki nishandahi karta hai. agar kayi sabz mom batian hain, to girnay walay teen tareeqon ka patteren ban'nay ka imkaan nahi hai. yeh hai ke girnay walay teen tareeqon se candle stuck patteren kaisay bantaa hai : Formation is the falling Three pattern pehli mom batii aik lambi surkh mom batii hai, jo musalsal neechay ke rujhan ki nishandahi karti hai. pehli lambi surkh mom batii ke baad teen choti sabz mom batian aati hain, jo aik jawabi rujhan aur earzi rujhan ke ulat jane ki nishandahi karti hain. agar mandarja baala tamam awamil candle stuck chart par mojood hain, to aap muaser tareeqay se girnay walay teen tareeqon ki shanakht kar satke hain aur is baat ko yakeeni bana satke hain ke aap –apne orders ko isi ke mutabiq adjust ya shuru karen. girnay walay teen tareeqon ki tijarat sarmaya karon ke girnay walay teen tareeqon ko istemaal karne ka behtareen tareeqa mukhtasir farokht ki tijarat shuru karna hai. jab woh girtay hue teen tareeqon ki nishandahi karte hain, to woh jantay hain ke down trained mein aik mukhtasir waqfa aa raha hai, lekin is ke baad mazeed neechay ka rujhan aaye ga. aisi soorat e haal mein, aap aakhri candle stick ke band honay par tijarat shuru kar satke hain. mazeed bar-aan, woh sarmaya car jo munafe bikna chahtay hain aur tijarat se bahar niklana chahtay hain woh earzi izafay ke waqt aisa kar satke hain. taham, girtay hue teen tareeqon ko trade karne se pehlay aap ko do awamil par ghhor karna chahiye : Trading the Falling Three pattern tasdeeq : girnay walay teen tareeqon candle stuck patteren ki tijarat karne se pehlay tasdeeq ka intzaar karna danishmandi hai. is ki wajah yeh hai ke aakhri surkh mom batii ke baad market ka control sambhalay walay ki misali soorat e haal asal tijarat ke waqt mukhtalif ho sakti hai. chart ke girtay hue teen tareeqon ke patteren ko zahir karne ke baad bhi market up trained ki pairwi kar sakti hai. lehaza, yeh zaroori hai ke aap paanch baron par ghhor karen aur phir aik misali dakhlay aur kharji nuqta ka faisla karen. yeh wasee tar mandi ke rujhan ki tasdeeq ko yakeeni banaye ga aur aap ki tijarat ko kam khatrah banaye ga. hajam : aik aur pehlu jis par aap ko girnay walay teen tareeqon candle stuck par trade karne se pehlay ghhor karna chahiye woh tridz ka hajam hai. girty hui teen tareeqon candle stuck aik mandi ka namona hai aur sarmaya karon ko short saylng position shuru karne ki targheeb deti hai. taham, agar teen choti sabz mom btyon ka tijarti hajam dono lambi surkh mom btyon se kam hai to aap ko hamesha mukhtasir position shuru karni chahiye. Conclusion aakhri kalaam girnay walay teen tareeqon candle stuck aik mo-asar candle stuck patteren hai jo sarmaya karon ko mojooda rujhan ko samajhney, mustaqbil ke rujhan ki pishin goi karne aur kisi makhsoos stock ke liye misali dakhlay aur kharji nuqta talaash karne ki ijazat deta hai. khaas tor par, yeh muaser short saylng hikmat amlyon ki tashkeel ki bhi ijazat day sakta hai aur khatray ke Ansar ko kam karte hue munafe ki salahiyat ko barha sakta hai. taham, yeh mahswara diya jata hai ke aap girnay walay teen tareeqon candle stuck ke sath deegar takneeki awamil ka istemaal karen taakay yeh yakeeni banaya ja sakay ke aap behtareen tareeqay se rujhan ki shanakht kar satke hain . -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Assalamu Alaikum Dosto!Falling Three Candlestick Pattern

"Falling three candlesticks" ek bearish candlestick pattern hai jo technical analysis mein istemal hota hai taake future mein kisi financial instrument ki price ke reversals ya downtrends ka andaaza lagaya ja sake. Falling three candlesticks ek qisam ka pattern hai jo paanch musalsal candlesticks se bana hota hai. Falling three patterns ko samajhna traders ke liye ahem hai, chahe woh forex market ka koi bhi had tak ilm rakhte hon. Ye pattern market ke mukhtalif shifts ko pehchanne mein madadgar hota hai, aur na sirf maharat rakhe hue traders balkay new log bhi is se faida utha sakte hain.

Falling three pattern trading mein ahmiyat rakhta hai kyunke ye traders ko amli hidayat faraham karta hai. Is pattern ko pehchan kar traders strategic decisions le sakte hain, khaaskar short-selling ke context mein. Traders iski madad se expect kiye gaye downtrend se faida uthate hain aur price ke girne se munafa kamate hain. Ye pattern ek rahnuma ka kaam karta hai, market ke potential future direction ka andaza lagate hue traders ko unke strategies ko mutabiq banane mein madad deta hai.

Falling three patterns traders ke liye faida mand hote hain, chunanche unki expertise level kuch bhi ho. Pehli baat to ye hai ke iski asan aur visual fitrat wajah se ye logon ke liye dastiyab hai jo stock market mein kam ilm rakhte hain. Ye pattern potential market reversals ka wazeh signal deta hai, jis se naye log bhi uske asraat samajh sakte hain. Mazeed, falling three pattern ek aamalati tool hai jo mukhtalif timeframes aur financial instruments par laagu kiya ja sakta hai.

Ye laagu hone ki wajah se traders ise mukhtalif markets mein apne trading strategies mein shamil kar sakte hain. Aakher mein, falling three pattern doosre technical analysis tools aur indicators ke saath istemal hota hai, jo traders ki strategies ko behtar banata hai. Traders apni faisla kun salahiyat ko behtar banate hain aur falling three patterns ke faide ka faida uthakar apni mukhtalif trading performance ko behtar banate hain.

Falling Three Pattern Basic Concept

Falling three-candlestick pattern ek bearish pattern hai jo technical analysis mein istemal hota hai taake financial instrument ki price mein downtrends ko pehchane ja sake. Chaliye falling three-candlestick pattern par nazar dalte hain. Pehla candlestick aik lambi kali (bearish) candle hai jo ek mazboot downtrend ko darust karta hai. Doosri, teesri, aur chouthi candlesticks chhoti-jism wali hoti hain, aam tor par safed ya kali, aur inki bulandiyon aur nichon ka pahar pehli candlestick ke daire mein hota hai.

In teen candlesticks ko "rising" ya "upside gap" candlesticks kaha jata hai. Paanchwan aur aakhri candlestick phir se ek lambi kali (bearish) candle hoti hai jo teen rising candlesticks ke nichon band hoti hai. Ye darust karta hai ke ek potential downtrend ka jari rehna. Falling three-candlestick pattern yeh sujhaata hai ke ek chhoti si upar ki tahqiq ke bawajood, bearain dobara control mein aa jaate hain, aur downtrend jari rehne ka imkaan hai. Traders aur analysts is pattern ko aksar short positions mein dakhil hone ka signal samajhte hain.

Falling Three Candlestick pattern ka ek ahem faida hai ke ye potential reversals ya downtrends ke jari hone ka ishara deta hai. Ye sujhaata hai ke jab ye pattern hota hai to traders ko ek waqtan-fa-waqtan consolidation ya correction ka samna karna hota hai jo ek mojooda bearish trend ke andar hota hai. Traders isey ye samajhte hain ke bearish momentum jari reh sakta hai, jis se woh apni trading positions ko mutabiq tarteeb de sakte hain. Ye pattern traders ko short positions ke liye potential entry points ka pata lagane mein madad karta hai ya phir unko apni positions ko mehfooz karne ke liye stop-loss orders tight karne ki ijazat deta hai.

Falling Three Candlestick pattern ko pehchanna traders ke liye aasan hai uske khaas visual appearance ke wajah se. Kam technical analysis ke maharat wale traders is pattern ko pehchan kar apni analysis mein shaamil kar sakte hain. Iski asani ke wajah se ye alag-alag maharat ke traders ke liye dastiyab hai. Ek aur faida ye hai ke ye pattern mukhtalif timeframes aur financial instruments par lagoo kiya ja sakta hai. Ye pattern laagu rehta hai chahe aap stocks, forex, commodities, ya doosre assests ka tajziya kar rahe hon. Iski mutawaazan istemal ki wajah se traders ise apni trading strategies mein shamil kar sakte hain.

Falling three candlesticks ek khaas sequence ke zariye banate hain. Ye ek lambi bearish candlestick se shuru hota hai, jo teen musalsal rising candlesticks ke zariye poora hota hai. Har ek rising candlestick pehle candlestick ke daire mein apni bulandi aur nichi mein hoti hai. Ye pattern mojooda downtrend mein ek waqtan-fa-waqtan consolidation ya correction ko darust karta hai. Ye identify aur confirm karne ke liye traders ko kuch khaas qawaid ko follow karna hota hai. Ye qawaid pattern ki kefiyat ko tasdiq karne aur darust karne ke liye madadgar hote hain.

Pattern Formation

Falling Three Candlestick pattern aam tor par paanch trading days mein banata hai. Ye ek silsile mein paanch musalsal candlesticks se banta hai, jisme pehli aur aakhri candlesticks long black (bearish) candlesticks hoti hain. Beech ke teen candlesticks aam tor par chhoti hoti hain aur pehli candlestick ke daire mein apni bulandi aur nichi mein hoti hain. Har candlestick ek trading day ko darust karta hai, isliye poora pattern banane mein paanch trading days lagte hain. Ye timeframe daily, weekly, ya monthly charts jaise chart intervals par laagu hota hai, mauqay ke mutabiq.

Falling Three Candlestick pattern aam tor par ek downtrend ke dauran ya jab market mein bearish sentiment hoti hai dekha jata hai. Ye pattern mojooda downtrend ka jari rehne ka potential sujhaata hai, kehte hue ke bechne wale dabao jari reh sakta hai. Falling Three Candlestick pattern ko technical analysis mein parhna maqsad ko samajhne ke liye pattern ki khaas khasiyat aur structure ka tajziya karta hai. Niche diye gaye 6 steps mein falling three candlestick patterns ko kaise parhna hai.- Pattern ko pehchane: Price chart par paanch musalsal candlesticks ki talash karen. Pehli aur aakhri candlesticks lambi kali (bearish) candlesticks honi chahiye. Beech ke teen candlesticks chhoti hote hain aur unki bulandiyon aur nichon pehli candlestick ke daire mein hoti hain.

- Downtrend ko tasdiq karen: Falling Three pattern se pehle market mein clear downtrend ya bearish sentiment honi chahiye. Iski pehchan nichli highs aur nichli lows mein hoti hai.

- Psychology ko samjhen: Ye pattern mojooda downtrend ka potential jari rehne ka sujhaav deta hai. Pehli lambi kali candlestick taqatwar bechnay ka dabao darust karti hai, jiska baad choti candlesticks temporary consolidation ya correction ko darust karti hain. Aakhri lambi kali candlestick ye darust karta hai ke bearain dobara control mein hain, aur bechnay ka dabao jari reh sakta hai.

- Volume ko dekhen: Volume analysis mazeed insights faraham karta hai. Aam tor par, volume pehli lambi kali candlestick ke doran sab se zyada hota hai, taake taqatwar bechnay ka activity dikh sake. Volume consolidation doran kam hota hai aur aakhri lambi kali candlestick ke doran dobara barhta hai.

- Tasdiq talash karen: Traders ko doosre technical indicators ya chart patterns ko analyze aur shamil karne ki zaroorat hoti hai jo bearish outlook ko barhane mein madad karta hai. Ye trendlines, support aur resistance levels, momentum oscillators, ya doosre bearish reversal patterns shamil hote hain. Mazeed signals ke milne se pattern ki reliability barh jati hai.

[/COLOR][/FONT] [/B] Amal karen: [/COLOR][/FONT] [/B] Traders ko Falling Three Candlestick pattern ko pehchan kar aur tasdiq karne ke baad positions shuru karne par ghor karna chahiye.

Technical Analysis mein Falling Three Candlestick pattern ko doosre tools aur strategies ke saath integrate karna highly recommended hai taake ek mazeed tajaweez karobar samajh mein aaye. Ye approach, sound Technical Analysis practice ka aik hissa hai, is se yaqeeni tor par ye maloom hota hai ke tawil ki base par faislay nahi hote, balkay woh ek mukammal tajziya ke natayej hote hain. Iske ilawa, traders ko apni Technical Analysis ko amal se pehle practice aur tasdiq karne ki zaroorat hai, taake unke trading decisions sirf is pattern par nahi balkay unke market strategies par bhi mabni hon. Is tarah, unka trading performance behtar hoti hai.

Falling Three Pattern Accuracy

Falling Three Candlestick patterns ki darustgi, jaise ke kisi bhi doosre technical analysis pattern ki, mukhtalif hoti hai. Yeh yaad rakhna zaroori hai ke koi pattern ya indicator 100% darustgi nahi deta. Falling Three Candlestick pattern ki darustgi market conditions, timeframe, aur mazeed tasdiq karne wale indicators ya patterns ki mojoodgi par mabni hoti hai. Ye panch points ko dekhte hain, aur woh is tarah hain:- Market conditions: Pattern jari rehne ka zyada imkaan hota hai jab market sentiment bearish hoti hai.

- Confirmation with other indicators: Traders ko doosre technical indicators ya patterns se tasdiq talash karni chahiye takay Falling Three Candlestick pattern ki darustgi barh sake. Ye trendlines, support aur resistance levels, momentum oscillators, ya doosre bearish reversal patterns shamil hote hain.

- Timeframe: Falling Three pattern ki darustgi timeframe par mabni hoti hai jo analysis ki ja rahi hai. Specific timeframe ke context mein pattern ko dekhte hue trading strategy ke saath milta hai.

- False signals: Falling Three pattern ko jhootay signals ya market ki shor ko nahi bachana chahiye. Ye zaroori hai ke traders zyada alerts ke liye sabr se kaam lein aur volume, market context, ya fundamental analysis jaise doosre factors ko bhi madde nazar rakhen.

- Practice aur experience: Falling Three Candlestick patterns ko sahi taur par samajhne aur istemal karne ke liye practice aur experience ki zaroorat hoti hai. Traders ko patterns ko pehchanne aur unhe sahi taur par validate karne ke liye nazariya banane ki zaroorat hoti hai.

Falling Three Candlestick patterns ki darustgi market conditions, timeframe, aur mazeed tasdiq karne wale indicators ya patterns ki mojoodgi par mabni hoti hai. Traders is pattern ka istemal karke potential bearish continuation ke valuable insights hasil karte hain aur alag-alag tools ka analysis karke ek mukammal trading approach banate hain. Risk management aur signals ko sahi taur par validate karna kaafi ahem hai safal trading ke liye.

Falling Three Candlestick Pattern ki Importance

Falling Three Candlestick pattern ki darusti ko behtar nahi kiya ja sakta kyun ke yeh ek tareekhi pattern hai jo guzishta qeemat ke harkat aur market ka rawayya par mabni hai. Technical analysis patterns, jese ke Falling Three, mustaqbil ke qeemat ke harkat aur tajziyaat ke liye keemat ke deta aur patterns ki tabeer par mabni hoti hain. Magar, market ke shiraa'it harkati hain aur mukhtalif factors par mabni hoti hain, jiski wajah se kisi bhi pattern ki darusti ko yaqeenan ke sath yaqeeni nahi kiya ja sakta.

Aap Falling Three pattern ke mazi mein kitni kargar rahi hai aur kya yeh aapke trading approach mein madadgar ho sakti hai, iska andaza laga sakte hain. Falling Three pattern ka mukhtasir pehchaan karein. Is mein kitne candlesticks shamil hain, unki rangat, aur woh kahan price chart par maujood hain, ye decide karein. Wo guzishta qeemat ke maloomat ko select karen jise aap test karna chahte hain. Ye maloomat daily, weekly, ya monthly timeframes se hosakti hai.

Historical data mein jaakar Falling Three pattern ke instances ko talash karen jin par aap pehle se mutayin karte hain. Wo dates aur prices jab pattern pesh aya tha, note karein. Har Falling Three pattern ke baad price ke sath kya hua, isko study karen. Kya yeh sahi taur par aage ki qeemat mein kami ka daawa kiya? Kya ye munafa deh trading opportunities par pohnchti hai? Pattern ki eficacy ko tay karne ke liye kuch asaan performance measures ka hisaab karen.

Masalan, kitni martaba ye kamyabi se mukammal hoti hai? In trades se average munafa ya nuqsan kya hai? Ye dekhnay ke liye basic statistical techniques ka istemal karen ke jo nateejay aapne dekhe hain woh qabil-e-aitbaar hain aur sirf itefaq se nahi hain. Ye aapko samajhne mein madad karta hai ke pattern ki performance statistically significant hai ya nahi. Pattern ko mukhtalif time periods ya markets ke liye dohrana zaroori hai taake pattern hamesha milti julti nateejay dikhaye. Ye tasdiq karta hai uski mufeediyat ko.

Falling Three Candlestick patterns ki kamiyabi dar market ke shiraa'at, timeframe, aur doosre indicators se tasdiq par mabni hoti hai. Falling Three patterns zyada mufeed qisam ke established downtrends mein strong selling pressure ke sath hoti hain. Pattern ko trendlines ya support/resistance levels jese doosre indicators ke sath tasdiq karna iski darusti ko farogh dena kaam karta hai.

Humain false signals aur market noise ka bhi khaas taur par khayal rakhna chahiye kyun ke yeh kamiyabi dar ko kam kar saktay hain. Zaroori hai yaad rakhna ke koi bhi pattern 100% kamiyabi nahi deta. Traders ko risk ko manage karna chahiye, munasib position sizing ka istemal karna chahiye, aur pattern ki mufeediyat ko barqarar rehne ke liye baar baar tashheer karna chahiye ke saath faislay lene chahiye.

Falling Three Candlestick Pattern ka Istemal

Falling Three Candlestick pattern ka istemal pattern recognition, tasdiq, aur munasib trading strategies ke aik combination ke zariye kiya jata hai. Sab se pehle, Falling Three pattern ke characteristics ko dhoondhein, jo ek lambi bearish candlestick se shuru hota hai, phir teen musalsal chhoti bullish (hara) candlesticks aur, aakhir mein, ek lambi bearish candlestick jo pehli candlestick ke low ke neeche band hoti hai. Tasdiq karen ke pattern criteria ke mutabiq hai phir trade ke bare mein sochein. Falling Three pattern ki darusti ko barhane ke liye ise doosre technical indicators ya patterns ke sath tasdiq karen.

Aur aur bearish signals ko talash karen, jese trendline breaks, oscillators jese RSI par overbought shorat, ya bearish chart patterns jese head aur shoulders. Ye tasdiq is trading signal ko mazboot karta hai. Falling Three Candlestick ki tasdiq ke baad hamesha short trade mein dakhil hona ahem hai. Entry last bearish candlestick ke low ke neeche rakhi ja sakti hai. Behtareen risk management tareeqa ye hai ke stop-loss order ko last bearish candlestick ke high ke upar rakha jaaye ya phir ek mukhtasir level par jahan pattern khatam hota hai.

Apna munafa target apni risk-reward ratio aur doosre support factors ke base par tay karen. Iska matlab hai potential support levels aur peechle swing lows ya phir Fibonacci retracement levels ka pata lagana. Raaste mein hissa munafa lena ya apni stop-loss ko trailing karna bhi zaroori hai taake munafa ko mehfooz kiya ja sake. Sahi risk management jab trade kiya jaata hai Falling Three pattern ya koi doosri strategy ke saath. Apna position size apni risk tolerance aur entry aur stop-loss levels ke darmiyan ki doori ke base par calculate karen. Discpline ka khayal rakhna aur apna risk management plan follow karna zaroori hai taake trading capital ko mehfooz rakha ja sake. Apne trade ko dekhbhaal se monitor karen jab wo develop hota hai. Agar price aapke favor mein move kar raha hai to stop-loss ko adjust karne ya trailing stop implement karne ka tayyar rahen. Agar price aapke khilaaf move kar raha hai aur pattern ko invalid kar raha hai to apne pehle tay kiye gaye stop-loss level ke mutabiq trade se bahar nikalne ke liye tayyar rahen.

Falling Three pattern ko sahi risk management, continuing analysis, aur apne trading plan ka paalan karte hue istemal karna ahem hai. Koi bhi trading pattern ya strategy har trade mein kamiyabi nahi guarantee karta. Sirf tab tak aap track kar sakte hain jab tak aap market conditions ko nazarandaaz na karen aur evolvng price action ke base par soch samajhkar faislay lene ki salahiyat na rakhen.

Trading

Haan, volume Falling Three pattern ke trading ke doran hisaab mein lena chahiye. Volume valuable insights faraham kar sakta hai pattern ki strength aur validtiy ke baare mein. Volume shares ka ta'adad hota hai stock market mein. Jab hum Falling Three pattern trade karte hain to volume sab se zyada ahem hai. Iski volume jo bhi bharakta hai pattern ki reliability ko tasdeeq karta hai aur zyada traders bech rahe hain. Yeh matlab hai ke pattern zyada mazboot hai.

Ek single indicator Falling Three Candlestick pattern ke saath behtareen kaam nahi karega. Yahan 5 indicators hain jo uski analysis ko mukammal karte hain.- Moving Averages: Moving averages overall trend ko pehchanne aur support aur resistance levels faraham karte hain. Wo Falling Three pattern ki direction ko tasdeeq karte hain aur mazeed entry ya exit signals faraham karte hain.

- Relative Strength Index (RSI): RSI price ka overbought ya oversold conditions ko napta hai. Yeh determine karta hai ke price extreme levels ko pohanch rahi hai aur potential reversal ya trend ki jaari hone ki signal deta hai.

- Volume: Volume Falling Three pattern ki strength aur validity ko tasdeeq karta hai. Pattern formation ke doran zyada volume credibility ko add karta hai bearish sentiment ke liye, jabke volume ke divergences potential weakness ko indicate kar sakta hai.

- Trendlines: Price chart par trendlines draw karna overall trend ko pehchanne aur Falling Three pattern ke liye additional confirmation faraham kar sakta hai. Trendline ka Falling Three pattern ke sath miltne ka intersection strong resistance level ke taur par kaam karta hai.

- Support aur Resistance Levels: Key support aur resistance levels ko pehchanne Falling Three pattern ke liye tasdeeq faraham kar sakta hai. Ye levels potential entry aur exit points ke liye additional confirmation faraham karte hain.

- Bollinger Band Indicator: Bollinger Bands aur Falling Three Candlestick pattern effective technical analysis tools ke tor par kaam kar sakte hain. Dono ke apne faide hain aur market trends aur potential trading opportunities mein qeemti insights faraham karte hain. Bollinger Bands volatility, support aur resistance levels, aur potential price breakouts ko pehchanne mein madad karte hain. Unka istemal market conditions ka jaanch karne aur price movements ko bands ke mutabiq trading decisions lene ke liye kiya jata hai.

Ye yaad rakhiye ke koi bhi single indicator trading mein kamiyabi ka itminan nahi deta. Multiple indicators ko combine karna zyada mukammal analysis faraham kar sakta hai aur Falling Three Candlestick pattern ki overall effectiveness ko behtar banata hai.

Pattern Advantages

Falling Three candlestick pattern active traders ko unke market analysis aur faislay ka process mein faide pohanchata hai. Pattern 5 mukhtalif faide faraham karta hai traders aur investors ke liye.- Pattern Recognition

Falling Three pattern ek mukhtasir aur aasani se pehchane jaane wala candlestick pattern hai. Iska makhsoos formation ise price charts par jaldi se pata lagane mein madad karta hai. Ye traders ko jaldi se potential bearish continuation patterns ko pehchanne mein madad karta hai. - Bearish Continuation Signal

Falling Three pattern prevailing downtrend ke andar ek bearish continuation signal ka kaam karta hai. Yeh suggest karta hai ke ek chhoti pause ya consolidation ke baad, downtrend jaari rahega. Traders ise confirm aur reinforce karte hain apni bearish bias ko, jo unhein inform trading decisions lene mein madad deta hai. - Entry aur Exit Points

Traders active tor par potential entry points ko short-selling ya doosre bearish trading strategies ke liye consider karte hain Falling Three pattern ko pehchan kar. Pattern ek khaas price level faraham karta hai jo ek trade mein dakhil hone ke liye istemal hota hai. Ye ek exit point bhi faraham karta hai agar price pattern ke aakhri laal candle ke low ke neeche break hota hai. - Risk Management

Falling Three pattern risk ko manage karne mein madad karta hai ek mukarrar stop-loss level faraham kar ke. Traders apne stop-loss orders ko pattern ke aakhri laal candle ke high ke upar rakhte hain taake agar pattern expected taur par materialize nahi hota toh nuqsanain mehdood rahen. - Compatibility with Other Tools

Falling Three pattern ka istemal doosre technical analysis tools aur indicators ke saath karne mein kaam ka hota hai aur trading decisions ko behtar banata hai. Traders ise aksar trendlines, moving averages, ya oscillators ke saath combine karte hain apni analysis ko mazboot karne aur successful trades ke probability ko barhane ke liye.

Yad rakhiye ke jabke Falling Three Candlestick pattern faide faraham karta hai, wo infallible nahi hai aur ise doosri forms of analysis aur risk management techniques ke saath istemal kiya jana chahiye. Hamesha behtareen trading decisions lene se pehle overall market context ko aur thorough analysis ko mad e nazar rakhen.

Pattern Disadvantages

Ye sach hai ke Falling Three Candlestick pattern ke faide hain, magar iske paanch limitations ya nuqsanat bhi hain jin par traders ko agah hona chahiye.- Reliability Issues

Traders ko hamesha yaad rakhna chahiye ke Falling Three pattern 100% reliable nahi hai. Aise instances hote hain jahan pattern expected bearish continuation produce nahi karta. Yad rakhiye ke koi bhi single pattern ya indicator market mein accurate predictions guarantee nahi kar sakta. Traders ko Falling Three pattern ko doosre tools aur analysis techniques ke saath istemal karke successful trades ki probability barhane chahiye. - Limited Timeframe

Falling Three pattern aam tor par ek relatively short timeframe ke andar hota hai. Ye short-term pattern hai aur longer-term trading ya investment strategies ke liye significant insights faraham nahi karta. Traders jo longer time horizons ke sath hote hain unko apni analysis ko mukammal karne ke liye additional indicators ya patterns ka istemal karna chahiye. - Interpretation Challenges

Falling Three pattern ko samajhne ke liye experience aur skill ki zarurat hoti hai. Isme candlestick sizes, unki positioning, aur overall market context ke darmiyan relationship ko analyze karna shamil hai. Ye novices traders ke liye challenging ho sakta hai sahi tarah se pattern ko pehchanne aur samajhne mein, jis se potential misinterpretations aur trading errors hosaktay hain. - Market Conditions

Falling Three pattern ki effectiveness market conditions ke mutabiq badalti hai. Pattern strongly trending markets mein zyada reliable hoga, jabke sideways markets mein predictive power kam ho jayega. Traders ko overall market environment ko mad e nazar rakhte hue pattern ko apply karna chahiye. - False Signals

Falling Three pattern jaise anya pattern mein false signals create hote hain. Aise instances hote hain jahan pattern banana toh lagta hai magar expected bearish continuation mein nahi pohnchata. Traders cautious rahen aur pattern ko doosre confirming indicators ya patterns ke saath validate karen trading decisions lene se pehle.

Koi bhi pattern ya indicator trading mein kamiyabi ki guarantee nahi deta. Traders ko Falling Three pattern ko doosri analysis tools aur risk management techniques ke saath combine karna chahiye aur overall market situation ko mad e nazar rakhte hue behtar decisions lene chahiye.

Falling Three Pattern Market

Falling Three pattern kisi bhi market mein ho sakta hai. Pattern ek bearish continuation pattern hai, jo ek downtrend ke dubara shuru hone ki mumkin nishandahi karta hai. Ye markets mein paya jata hai, jese ke stocks, commodities, forex, aur doosre. Pattern ki buniyadi principles wohi rehti hain, chaahe jis market ko analyze kiya jaye.

Kya Falling Three Bearish ya Bullish hai?

Falling Three pattern ko bearish samjha jata hai. Pattern khud ek bearish continuation pattern hai jo ek potential resumption of a downtrend ko nishandahi karta hai. Isme ek lambi laal candle ke beech teen chhoti hare candlesticks hoti hain (jo temporary price consolidation ya short-term pause in selling pressure ko zahir karte hain).

Falling Three pattern differ kaise hota hai doosre bearish patterns jese ke Bearish Engulfing aur Dark Cloud Cover se?

Falling Three pattern dusre bearish patterns jese ke Bearish Engulfing aur Dark Cloud Cover se apni makhsoos candlestick formation aur bearish signal ke asalat mein farq hota hai. Falling Three pattern ek series of teen chhoti hare candlesticks (temporary price consolidation ya short-term pause in selling pressure ko zahir karte hain) ke beech mein do lambi laal candlesticks (bearish pressure ko zahir karte hain) se makhsoos hota hai. Yeh pattern ek brief pause ya consolidation ke doran prevailing downtrend ko darust karta hai, indicating ke bearish pressure ka jaari rahne ka nishandahi deta hai. Pattern ko bearish continuation pattern ke taur par samjha jata hai, further downward movement in price ka signal dete hue.

Falling Three Candlestick aur Rising Three Candlestick mein Differences

Falling Three Candlestick pattern aur Rising Three Candlestick pattern do mukhtalif candlestick formations hain jo mukhtalif market conditions ko signify karte hain aur mukhtalif trading signals faraham karte hain. Falling Three pattern ek bearish continuation pattern hai jo ek downtrend ke andar hota hai. Isme ek lambi laal candlestick ke beech teen chhoti hare candlesticks aur phir ek aur lambi laal candlestick hoti hai. Yeh pattern ek temporary consolidation ya pause in the downtrend ko zahir karta hai, indicating a potential continuation of bearish momentum. Chhoti hare candlesticks Falling Three pattern ke andar price consolidation ya short-term pause in selling pressure ko represent karte hain.- Falling Three pattern prevailing downtrend ko confirm karta hai aur traders ko bearish strategies jese ke short-selling ya long positions ko exit karne ka signal deta hai.

- Rising Three pattern ek bullish continuation pattern hai jo ek uptrend ke andar hota hai. Isme ek lambi hare candle ke beech teen chhoti laal candlesticks aur phir ek aur lambi hare candle hoti hai. Yeh pattern ek temporary consolidation ya pause in the uptrend ko zahir karta hai, indicating a potential continuation of bullish momentum. Chhoti laal candlesticks Rising Three pattern mein price consolidation ya short-term pause in buying pressure ko represent karte hain.

- Rising Three pattern prevailing uptrend ko confirm karta hai aur traders ko bullish strategies jese ke buying ya long positions ko hold karne ka signal deta hai.

- Falling Three Candlestick pattern aur Rising Three Candlestick pattern mukhtalif market conditions aur price movements ko signify karte hain aur traders ko unke trading decisions ke liye maddad faraham karte hain, depending on whether the market is in a downtrend or an uptrend.

-

#4 Collapse

Falling Three pattern.

Falling Three Methods" ek bearish continuation pattern hai jo candlestick chart analysis mein istemal hota hai. Yeh pattern commonly forex trading aur stock market mein dekha jata hai.

Is pattern mein kuch steps hote hain.

1.Upar ki taraf ek bearish (red) candlestick.

Is pattern ki shuruaat ek lambi bearish candlestick se hoti hai jo current downtrend ko darust karta hai.

2.Choti bullish (green) candles.

Iske baad, choti bullish candles aati hain jo bearish candle ki nichli body aur upper body mein fit hoti hain. Ye choti candles bearish candle ke upper ya neeche ho sakti hain.

3.Dobara bearish candle.

Iske baad, ek dobara lambi bearish candle aati hai jo pehli bearish candle ki taraf choti candles tak ja sakti hai, lekin generally, iska close pehli bearish candle ke upper se hota hai.

4.Choti bullish candles.

Dobara choti bullish candles aati hain, jo pehle wali choti candles ke range mein rehti hain.

5.Final bearish candle.

Pattern ko complete karne ke liye, ek aur lambi bearish candle aati hai jo pehli bearish candle ki taraf close hoti hai, indicating continuation of the downtrend.

Falling Three pattern ke istemal.Falling Three Methods" pattern ko forex trading mein bearish continuation signal ke roop mein istemal kiya jata hai. Agar traders ko lagta hai ki market ki current downtrend continue hoga, toh yeh pattern unke liye helpful ho sakta hai.

Yeh kuch tareeqe hain jinhe traders is pattern ko istemal karke follow kar sakte hain.

1.Identify the Pattern.

Sabse pehle, traders ko chart par Falling Three Methods pattern ko identify karna hota hai. Yeh pattern ek sequence mein bearish aur bullish candles se banta hai.

2.Entry Point.

Pattern ko identify karne ke baad, traders ko entry point determine karna hota hai. Yeh generally pehli bearish candle ke neeche ki taraf ek short position lete hue kiya jata hai, ya fir pehli bearish candle ke close ke just neeche.

3.Stop Loss.

Risk management ke liye, traders ko ek stop loss level set karna hota hai. Yeh level pehli bearish candle ke high ya kisi aur technical level par set kiya ja sakta hai.

4.Take Profit.

Target ke liye, traders ko ek take profit level set karna hota hai, jo market ki movement aur unki risk tolerance ke hisaab se decide kiya jata hai.

5.Risk Management.

Hamesha ek proper risk management plan ke saath trade karein. Position size, stop loss, aur take profit levels ko carefully calculate karein.

6.Confirmation.

Is pattern ko confirm karne ke liye, traders ko aur bhi technical indicators aur tools ka istemal karke analysis karna hota hai, jaise ki moving averages, RSI, aur trend lines.

Falling Three pattern ke tips.

Falling Three Methods" pattern ka istemal karne se pehle, yeh kuch tips hain jo traders ko madadgar sabit ho sakti hain.

1.Practice and Learning.

Pehle demo account par is pattern ko identify aur analyze karne mein practice karein. Isse aapko confidence milega aur aap sahi tareeke se is pattern ko recognize karne mein mahir ho jayenge.

2.Confirmation.

Sirf Falling Three Methods pattern ko dekh kar trade na karein. Iske alawa bhi aur technical indicators aur tools ka istemal karein, jaise ki moving averages, trend lines, aur momentum oscillators, jisse aapko ek complete picture mil sake market ki movement ka.

3.Risk Management.

Hamesha stop loss aur take profit levels set karein. Position size ko calculate karke apne risk tolerance ke hisaab se trade karein.

4.Market Context.

Yeh dekhein ki Falling Three Methods pattern market ki current context mein kahan aata hai. Jaise ki uptrend ke baad ya strong downtrend ke beech mein yeh pattern aane par iski value badhti hai.

5.Avoid Overtrading.

Har pattern par trade karne ki jagah, sirf sabse strong aur clear patterns par trade karein. Overtrading se bachein.

6.Stay Informed.

Market news, economic indicators, aur global events par nazar rakhein. Yeh factors bhi trading decisions ko influence kar sakte hain.

7.Emotional Control.

Trading ke dauraan emotions ko control mein rakhein. Impulsive decisions se bachein aur apne trading plan ko follow karein.

8.Review and Adapt.

Apne trades ko regularly review karein aur apne strategies ko adapt karte rahein market conditions ke hisaab se.

Summary.

Yeh tips Falling Three Methods pattern ka istemal karne mein madadgar sabit ho sakti hain, lekin trading mein kisi bhi pattern ya strategy ko istemal karte waqt hamesha caution aur research ke saath kaam karna chahiye. -

#5 Collapse

**Falling Three Pattern Kya Hai?**

Forex aur stock trading mein technical analysis ki duniya mein candlestick patterns ek ahem role play karte hain, jo market ke potential reversals aur trends ko samajhne mein madadgar hote hain. In patterns mein se ek khas pattern hai "Falling Three Pattern." Yeh pattern market ke bearish trend ko continue karne ke liye useful hota hai aur traders ko market ke downward momentum ko identify karne mein madad karta hai. Aaiye, detail se samjhte hain ke Falling Three Pattern kya hai aur isse trading mein kaise use kiya jata hai.

**Falling Three Pattern Kya Hai?**

Falling Three Pattern ek bearish continuation pattern hai jo ek strong downtrend ke dauran develop hota hai. Yeh pattern ek large bearish candle ke baad teen small candles aur phir ek aur large bearish candle ko form karta hai. Is pattern ka formation market ke downward momentum ko confirm karta hai aur bearish trend ke continuation ke liye signal provide karta hai.

**Pattern Ki Characteristics:**

1. **Formation:**

- **Initial Large Bearish Candle:** Falling Three Pattern ek large bearish candle se start hota hai jo market ke strong downward momentum ko reflect karti hai. Yeh candle pattern ke shuruat ko indicate karti hai.

- **Three Small Candles:** Initial large bearish candle ke baad, market mein teen chhoti candles form hoti hain jo temporary upward retracement ko show karti hain. In small candles ka range pehli bearish candle ke comparison mein chhota hota hai.

- **Final Large Bearish Candle:** Pattern ke end mein, ek aur large bearish candle form hoti hai jo teen chhoti candles ke high se neeche close hoti hai. Yeh final candle market ke downward trend ko reinforce karti hai.

2. **Price Action:**

- Falling Three Pattern market ke short-term consolidation aur corrective phase ko depict karta hai. Yeh phase ek strong bearish trend ke beech temporary upward movement ko show karta hai, lekin overall trend downward rehta hai.

3. **Volume Analysis:**

- Volume bhi Falling Three Pattern ke analysis mein important hota hai. Pattern ke initial aur final large bearish candles ke saath high volume bearish trend ke strength ko confirm karta hai. Small candles ke dauran volume generally low hota hai, jo market ke temporary retracement ko indicate karta hai.

**Trading Insights:**

1. **Entry Points:**

- Traders Falling Three Pattern ke completion ke baad sell positions enter karte hain. Entry point usually final large bearish candle ke close ke aas-paas set kiya jata hai, jo pattern ke bearish signal ko confirm karta hai.

2. **Stop-Loss:**

- Stop-loss orders ko pattern ke peak ke upar set kiya jata hai. Yeh unexpected price movements aur false breakouts se protection provide karta hai.

3. **Take-Profit:**

- Profit targets ko pattern ke height aur market ke overall bearish trend ke analysis ke basis par set kiya jata hai. Traders apne targets ko recent price action aur bearish trend ke hisaab se adjust karte hain.

**Example:**

Agar GBP/USD pair pe Falling Three Pattern develop hota hai, jahan pehle large bearish candle ke baad teen small candles form hoti hain aur phir ek aur large bearish candle aati hai, to traders sell positions open kar sakte hain aur stop-loss ko pattern ke peak ke upar set kar sakte hain.

**Conclusion:**

Falling Three Pattern ek valuable bearish continuation pattern hai jo market ke downward momentum ko confirm karta hai. Is pattern ki accurate identification aur trading signals ko use karke, traders effective trading decisions le sakte hain aur market movements ko capitalize kar sakte hain. Proper risk management aur profit-taking strategies ke sath, Falling Three Pattern aapki trading strategy ko enhance kar sakta hai aur market trends ko better analyze karne mein madad kar sakta hai.

-

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

**Falling Three Pattern**

Falling Three Pattern, jo ke ek candlestick continuation pattern hai, trading aur technical analysis mein bohot important role play karta hai. Ye pattern bearish trend continuation ka indication deta hai aur traders ko market ke movement ko samajhne mein madad deta hai.

### Pattern ki Pehchaan

Falling Three Pattern mein total paanch candlesticks hoti hain. Ismein pehli candlestick ek lambi bearish candle hoti hai jo ke existing downtrend ko confirm karti hai. Is ke baad aane wali teen choti candlesticks usually bullish hoti hain, jo ke pehli candlestick ke range mein hi banti hain. Ye choti candlesticks market ke temporary pause aur consolidation ko indicate karti hain. Last candlestick phir se ek bearish candle hoti hai jo ke pehli candlestick se milti julti hoti hai aur downtrend ke continuation ko confirm karti hai.

### Pattern ki Ahmiyat

Falling Three Pattern ka main faida ye hai ke ye traders ko ye samajhne mein madad karta hai ke market ke short-term consolidation ke bawajood, major trend bearish hai. Is pattern ka samajhna un traders ke liye bohot zaroori hai jo price movements ko analyze karke profitable trades execute karna chahte hain.

### Pattern ki Interpretation

1. **Pehli Candle**: Pehli bearish candle strong selling pressure ko indicate karti hai, jo ke downtrend ka hissa hota hai.

2. **Teen Choti Candlesticks**: Ye teen bullish candles usually buyers ki temporary activity ko represent karti hain jo ke market ko upwards push karne ki koshish karte hain, magar ye utni strong nahi hoti ke downtrend ko break kar sakein.

3. **Aakhri Candle**: Aakhri bearish candle sellers ki dominance ko show karti hai aur ye clear kar deti hai ke downtrend abhi bhi barkarar hai. Ye candle pehli candle se zyada nahi toh us jitni strong hoti hai aur market ko neeche ki taraf le jati hai.

### Trading Strategy

Falling Three Pattern ko trade karne ke liye, traders ko fourth bullish candle ke close hone ka wait karna chahiye aur phir jab paanchwi bearish candle start ho, tab short position initiate karni chahiye. Is ke saath, risk management bhi bohot important hai. Stop-loss order ko pehli bearish candle ke high ke thoda sa upar place karna chahiye taake agar market unexpected move kare toh losses ko minimize kiya ja sake.

### Conclusion

Falling Three Pattern ek reliable continuation pattern hai jo ke traders ko market ke bearish trend ko samajhne mein madad deta hai. Is pattern ka sahi tarike se interpretation aur execution karne se traders ko apne trading decisions ko improve karne mein madad mil sakti hai. Har pattern ki tarah, is pattern ko bhi market ke aur indicators ke sath mila kar use karna chahiye taake zyada accurate aur profitable trades execute kiye ja sakein. -

#7 Collapse

Falling Three Pattern

Falling Three Pattern ek candlestick pattern hota hai jo technical analysis mein istimaal hota hai. Yeh pattern bearish continuation ka indication deta hai, yani yeh signal karta hai ke market downtrend mein continue karega. Falling Three Pattern jab banta hai to yeh dikhata hai ke market temporarily pause kar raha hai, lekin overall trend abhi bhi downward hi hai.

Identification:

Is pattern ko identify karne ke liye humein paanch candlesticks ka combination dekhna hota hai:- First Candle: Yeh ek long bearish candle hoti hai jo strong selling pressure ko indicate karti hai.

- Middle Three Candles: Yeh choti bullish candles hoti hain jo temporary upward correction ko dikhati hain. Inka range first candle ke range ke andar hota hai.

- Fifth Candle: Yeh phir se ek long bearish candle hoti hai jo downtrend ko confirm karti hai aur market mein selling pressure ko dikhati hai.

Confirmation:

Is pattern ki confirmation tab hoti hai jab fifth candle close hoti hai aur yeh first candle ke close ke neeche hoti hai. Is se yeh confirm hota hai ke market abhi bhi bearish sentiment mein hai aur downtrend continue hoga.

Trading Strategy:

- Entry: Jab pattern confirm ho jaye aur fifth candle close ho jaye, tab ek short position open kar sakte hain.

- Stop Loss: Stop loss ko middle three candles ke high ke upar rakhna chahiye taake risk manage ho sake.

- Target: Target ko previous support level ya Fibonacci extension levels ke aas paas rakh sakte hain.

Explanation

Falling Three Pattern ka matlab yeh hai ke market mein selling pressure dominate kar raha hai. Pehle ek strong bearish move aata hai, uske baad thoda sa upward correction hota hai, lekin yeh bulls ki weakness ko dikhata hai. Phir se ek strong bearish move aata hai jo confirm karta hai ke downtrend abhi bhi intact hai.

Yeh pattern traders ko yeh signal deta hai ke downtrend continue hone wala hai aur yeh entry ke liye ek acchi opportunity ho sakti hai. Is pattern ko identify karne aur trade plan banane ke liye technical analysis ke sath-sath market ki overall conditions ko bhi dekhna zaroori hota hai.

Conclusion:

Falling Three Pattern ek powerful tool hai bearish continuation ko identify karne ke liye. Isko use karne ke liye practice aur market understanding zaroori hai. Is pattern ko successfully trade karne ke liye hamesha risk management aur proper analysis ka khayal rakhna chahiye.

-

#8 Collapse

Falling Three Methods pattern ek bearish continuation candlestick pattern hai jo technical analysis mein use hota hai, khas taur par forex trading aur stock market mein. Yeh pattern ek existing downtrend mein ek short-term consolidation phase ko dikhata hai jo ke trend continuation ki taraf indicate karta hai. Falling Three Methods pattern traders ko yeh batata hai ke market mein temporarily bullish sentiment hai, lekin overall downtrend continue hoga.

Falling Three Methods Pattern

Falling Three Methods pattern paanch candles ka ek sequence hota hai. Yeh pattern typically downtrend ke doran banta hai aur yeh dikhata hai ke market mein temporary bullish sentiment ke bawajood downtrend continue hoga. Is pattern mein paanch candles hoti hain, jismein se pehli aur akhri candle bearish hoti hai, jabke darmiyani teen candles choti bullish candles hoti hain.

Pattern Ki Structure

Falling Three Methods pattern ki structure kuch is tarah hoti hai:- Pehli Bearish Candle: Pehli candle ek lambi bearish candle hoti hai jo existing downtrend ko continue karti hai. Yeh candle market ke bearish sentiment ko dikhati hai aur trend continuation ki taraf indicate karti hai.

- Teen Choti Bullish Candles: Iske baad teen choti bullish candles hoti hain jo pehli bearish candle ke range ke andar hoti hain. Yeh candles consolidation phase ko dikhati hain jismein temporarily buying pressure hota hai. Yeh candles previous bearish candle ke high ko break nahi karti aur pehli candle ke body ke andar hi reh jati hain.

- Akhri Bearish Candle: Akhri candle ek lambi bearish candle hoti hai jo pehli bearish candle ke close ke neeche close hoti hai. Yeh candle previous consolidation phase ka end dikhati hai aur downtrend continuation ka signal deti hai.

Falling Three Methods pattern ko identify karna aur interpret karna forex traders ke liye important hai, kyunki yeh pattern ek bearish continuation ka strong signal deti hai. Is pattern ki interpretation kuch is tarah se hoti hai:- Downtrend Continuation: Is pattern ki presence indicate karti hai ke market mein downtrend continue hone wala hai. Pehli aur akhri bearish candles ke beech mein consolidation phase ke bawajood, akhri bearish candle market ke selling pressure ko confirm karti hai aur trend continuation ka signal deti hai.

- Temporary Bullish Sentiment: Teen choti bullish candles jo beech mein hoti hain, temporary bullish sentiment ko dikhati hain. Lekin, yeh sentiment significant nahi hota kyunki yeh candles pehli bearish candle ke range ko exceed nahi kar pati. Yeh indicate karta hai ke market mein temporarily buying pressure to hai, lekin overall selling pressure zyada strong hai.

- Bearish Confirmation: Akhri bearish candle pattern ka confirmation hoti hai. Yeh candle previous bearish candle ke close se neeche close hoti hai aur downtrend continuation ka strong signal deti hai. Yeh pattern typically high volume ke sath hota hai, jo market participants ke selling interest ko dikhata hai.

Falling Three Methods Pattern Ka Istemaal

Falling Three Methods pattern ko different trading strategies mein use kiya ja sakta hai. Yeh pattern market ke bearish continuation ka signal deti hai, isliye traders aksar isko short positions enter karne ke liye use karte hain. Kuch common strategies jisme Falling Three Methods pattern use hota hai, unmein trend following aur breakout trading strategies shamil hain.- Trend Following Strategy: Is strategy mein, traders existing downtrend ko follow karte hain. Jab Falling Three Methods pattern identify ho jata hai, to yeh downtrend continuation ka signal hota hai. Is point par traders short positions enter kar sakte hain aur trend ke continue hone se fayda utha sakte hain.

- Breakout Trading Strategy: Falling Three Methods pattern mein akhri bearish candle ka formation ek significant breakout point ho sakta hai. Yeh breakout downtrend continuation ko confirm karta hai. Traders akhri bearish candle ke low ke neeche sell orders place kar sakte hain aur breakout ke baad market ke further downward move hone ka wait kar sakte hain.

Risk Management

Falling Three Methods pattern ko trade karte waqt risk management ko madde nazar rakhna bohot zaroori hai. Yeh pattern downtrend continuation ka signal deta hai, lekin market unpredictable ho sakti hai. Kuch important risk management techniques ko follow karna chahiye:- Stop-Loss Placement: Stop-loss orders ko use karna bohot important hai taake unexpected price movements se protect kiya ja sake. Stop-loss ko usually consolidation phase ke high ya akhri bearish candle ke high ke upar rakhna chahiye. Yeh aapko losses ko limit karne mein madadgar hoga agar market aapki expected direction ke khilaf move kare.

- Confirmation Indicators: Falling Three Methods pattern ko trade karte waqt, confirmation indicators ka use karna chahiye. Yeh indicators, jaise ke moving averages, RSI , aur MACD (Moving Average Convergence Divergence), additional confirmation provide karte hain aur false signals se bachne mein madadgar hote hain.

- Proper Analysis: Market conditions, fundamental news, aur economic events ko madde nazar rakhte hue trading decisions lena chahiye. Yeh factors market sentiment ko bohot jaldi change kar sakte hain aur unexpected price movements ho sakti hain.

Falling Three Methods pattern ek bearish continuation candlestick pattern hai jo forex trading mein market ke downtrend continuation ka signal deta hai. Yeh pattern paanch candles par mushtamil hota hai jismein pehli aur akhri candles bearish hoti hain, jabke darmiyani teen candles choti bullish candles hoti hain. Is pattern ko identify karna aur use karna traders ke liye profitable trading opportunities ko recognize karne mein madadgar ho sakta hai. Lekin, hamesha yaad rakhein ke market unpredictable hoti hai, isliye proper risk management aur market analysis ko madde nazar rakhte hue trading decisions lena chahiye taake aap apne capital ko protect kar sakein aur long-term success hasil kar sakein.

- CL

- Mentions 0

-

سا0 like

-

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

**Falling Three Pattern**

Falling Three Pattern aik bearish continuation pattern hai jo ke technical analysis mein istamal hota hai. Ye pattern traders aur investors ko yeh signal deta hai ke market ka trend abhi tak bearish hai aur future mein bhi prices gir sakti hain. Is pattern ko samajhna aur identify karna trading strategies ko improve karne ke liye bohat zaroori hai.

### Falling Three Pattern Ki Pehchaan

Falling Three Pattern ke liye paanch candles ki zaroorat hoti hai. Is pattern ki shakal kuch is tarah hoti hai:

1. **Pehli Candle:** Ye ek lambi bearish candle hoti hai jo ke downward trend ko confirm karti hai. Is candle mein selling pressure bohot zyada hota hai.

2. **Beech Ki Teen Candles:** Ismein teen choti bullish candles hoti hain jo pehli lambi bearish candle ke beech mein aati hain. In candles ka range pehli bearish candle ke andar hota hai, yani ye pehli candle ke high aur low ke beech mein rehti hain. Ye bullish candles temporary buying ko represent karti hain lekin trend ko reverse nahi karti.

3. **Aakhri Candle:** Ye candle ek aur lambi bearish candle hoti hai jo ke pehli candle ke low ko break karti hai aur downward trend ko confirm karti hai. Ye candle pehli bearish candle ki tarah strong selling pressure ko represent karti hai.

### Falling Three Pattern Ka Significance

Ye pattern is baat ki nishandahi karta hai ke market mein selling pressure abhi bhi zyada hai aur price aage chal kar aur gir sakti hai. Jab ye pattern form hota hai, toh ye traders ko sell signals deta hai, ya existing short positions ko hold karne ka mashwara deta hai.

### Falling Three Pattern Ka Istemaal

Traders jo technical analysis par rely karte hain, woh Falling Three Pattern ko dekh kar apni trading strategy adjust karte hain. Is pattern ka istemaal bohot saari cheezon mein hota hai, jaise:

- **Short Selling:** Jab Falling Three Pattern banta hai, traders apni positions short karte hain takay girti hui market se munafa kama sakein.

- **Risk Management:** Ye pattern risk management mein bhi madadgar sabit hota hai. Traders apni stop-loss levels ko adjust karte hain takay potential losses se bach sakein.

- **Trend Confirmation:** Ye pattern existing bearish trend ko confirm karne mein madadgar hota hai aur traders ko confident banata hai ke downward trend abhi bhi intact hai.

### Falling Three Pattern Ke Liye Tips

1. **Volume Analysis:** Is pattern ko identify karte waqt volume par bhi nazar rakhein. Agar volume pehli aur aakhri bearish candle par zyada hai, toh ye pattern zyada reliable hai.

2. **Other Indicators:** Sirf Falling Three Pattern par rely na karein. Is ke sath sath other technical indicators jaise ke RSI (Relative Strength Index) aur MACD (Moving Average Convergence Divergence) ka bhi analysis karein.

3. **Market Context:** Hamesha overall market context ko samajhne ki koshish karein. Falling Three Pattern tabhi effective hoga jab overall market bearish sentiment dikha rahi ho.

### Conclusion

Falling Three Pattern ek powerful tool hai jo traders ko market ke bearish trends ko identify karne aur apni strategies ko adjust karne mein madad deta hai. Is pattern ko samajhna aur sahi waqt par istamal karna, traders ke liye munafa kamaane ka aik acha tareeqa ho sakta hai. Hamesha yaad rakhein ke trading mein risk management aur thorough analysis bohot zaroori hoti hai. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#10 Collapse

**Falling Three Pattern: Forex Trading Mein Ek Ahem Technical Indicator**

Forex trading mein candlestick patterns ka role market trends aur reversals ko identify karne mein bahut aham hota hai. In patterns mein se ek important pattern "Falling Three" hai. Yeh pattern bearish trend ke continuation ko indicate karta hai aur traders ko market ke downward movement ke signals provide karta hai. Is post mein hum Falling Three pattern ko detail mein samjhenge, iski formation, aur trading strategy ko discuss karenge.

**Falling Three Pattern Kya Hai?**

1. **Definition:**

Falling Three pattern ek bearish continuation pattern hai jo downtrend ke dauran banta hai. Yeh pattern market ke existing downward trend ko continue karne ka signal hota hai. Is pattern ki formation teen bearish candles aur do bullish candles se mil kar hoti hai, jo market ke bearish sentiment ko confirm karti hai.

2. **Formation:**

Falling Three pattern ki formation teen bearish candles aur do bullish candles ke combination se hoti hai. Pattern ka sequence kuch is tarah hota hai:

- **Pehli Candle:** Strong bearish candle jo existing downtrend ko continue karti hai.

- **Doosri Aur Teesri Candle:** Yeh dono candles chhoti aur bearish hoti hain, jo ek temporary consolidation ya correction ko indicate karti hain. Yeh candles downtrend ke dauran price mein kuch temporary upward movement ko show karti hain.

- **Chhati Candle:** Ek strong bearish candle jo pattern ke completion ke baad market ke downward trend ko continue karti hai.

**Trading Strategy With Falling Three Pattern:**

1. **Identification:**

Falling Three pattern ko identify karne ke liye, traders ko candlestick chart par dhyan dena hota hai. Jab pattern ka sequence complete hota hai aur fifth candle form hoti hai, to yeh pattern bearish trend continuation ka strong signal hota hai.

2. **Entry Points:**

Entry points ko identify karne ke liye, traders ko pattern ke completion ka intezaar karna chahiye. Jab fifth candle strong bearish hoti hai aur previous support levels ko break karti hai, to traders sell order place kar sakte hain. Yeh signal market ke downward trend ke continuation ka hota hai.

3. **Stop Loss Aur Take Profit Levels:**

Stop loss ko pattern ke high ke thoda upar set kiya jata hai, taake market ke unexpected movements se bachne ki security mile. Take profit levels ko previous support levels ke basis par set kiya jata hai, jo potential price targets ko define karte hain.

4. **Confirmatory Indicators:**

Falling Three pattern ko other technical indicators ke sath combine karke use karna zyada effective hota hai. Indicators jaise RSI (Relative Strength Index) ya MACD (Moving Average Convergence Divergence) ki madad se pattern ke signals ko confirm karke trading decisions ko aur strengthen kiya ja sakta hai.

**Pattern Ki Importance:**

1. **Trend Continuation:**

Falling Three pattern market ke existing downward trend ko continue karne ka signal provide karta hai. Yeh pattern bearish sentiment ko highlight karta hai aur traders ko market ke downward movements ko capitalize karne mein madad karta hai.

2. **Risk Management:**

Stop loss aur take profit levels ko pattern ke highs aur support levels ke basis par set karke, traders apne risk management ko effectively handle kar sakte hain. Yeh levels market ke fluctuations se bachne aur profits ko secure karne mein madad karte hain.

**Conclusion:**

Falling Three pattern Forex trading mein bearish continuation ke signals ko identify karne ke liye ek valuable tool hai. Iski effective identification aur use se traders market ke downward trends ko accurately capture kar sakte hain aur apni trading strategies ko optimize kar sakte hain. Falling Three pattern ko other technical indicators ke sath combine karke trading signals ki accuracy aur performance ko enhance kiya ja sakta hai, jo successful trading aur improved results mein madad karta hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 03:12 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим