What is bullish counter attack

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

line candle design areas ofke douran ho sakta hai. down arranged ke douran taizi ke ulat jane ke liye, pehli light aik lambi kaali ( neechay ) flame hai, aur doosri candle neechay ki taraf jati hai lekin phir onche ho jati hai, pehli mother batii ke qareeb. is se zahir hota hai ke baichnay walay control mein thay, lekin ho sakta hai ke woh is control ko kho rahay hon kyunkay khredar is farq ko kam karne mein kamyaab ho gaye thay. oopri rujhan ke douran mandi ke ulat jane ke liye, pehli light aik lambi safaid ( oopar ) candle hai, aur doosri candle ka faasla ouncha hai lekin phir pehli fire ke qareeb, neechay band ho jata hai."Key component of bullish counter assaulttaizi ke jawabi hamla strength for aik pattern inversion design hai, jo k costs k downtrend ya low cost region primary banta hai. Ye design dekhne principal same "Bullish Belt-Hold Candle Example" ya "Negative Pushing Line Example" jaisa dekhaye deta hai, lekin dosri negative light ki shape thori si distinction honne ki waja se ye uss mukhtalif boycott jata hai. Ye design do candles standard mushtamil hota hai, jiss principal pehli light negative aur dosri bullish flame hoti hai. Bullish candle ki haseyat ye hai k ye flame aik to negative light se beneath hole fundamental banti hai aur dosra ye candle close pehli candle k same shutting standard close hoti hai, jo k pattern inversion ka sabab banti hai.What is bullish counter attack light stuck diagrams yeh up arranged ya down arranged y ki lakerain down pre-arranged se up arranged mein mumkina ulat jane ka ishara deti hain. negative kavntr attack lines up pre-arranged se down arranged mein mumkina ulat jane ka ishara deti hain. patteren mukhalif rang/simt ki in all actuality do mother btyon standard mushtamil hai. teesri aur/ya chothi mother batii ke istemaal ki sifarish ki jati hai jo patteren ke baad agli qeemat ki simt ki tasdeeq kullishness counter-assault line Candles Arranged two days fire ka aik bullish model Inversions Model hai, jo k negative Model ya low costs districts head banta hai. Bullishness counter-assault line light arrangement ki dosri fire lazmi pehli flame k shutting Cost standard close honi chahey, q k issi tarah se ye design Entering line plan se mukhtalef boycott jata hai. Ye design costs k base standard do Candles se mel kar banta hai, jiss fundamental pehli fire aik negative Flame's hoti hai, jiss k baad aik bullish Candles cry Opening boss boycott kar negative light k less expensive standard Close ho gy Dear forex people me apni aj ki post me bullish counter attack plan k bary me analyze krun gi yh plan hmari trade ko kis tarah sy influence krta Hy yh Sara Kuch me apni is postme share krun gi to chlain mumble apni post start krty hain Bullish counterattack plan" ek frame plan hai jo particular examination mein use kiya jata hai. Is plan ko BullishReversal Model bhi kaha jata hai. Is plan mein ek downtrend ke baad ek light plan hota hai jismein selling pressure ko show karta hai, lekin uske baad ek strong bullish light plan aata hai jo selling pressure ko rout karta hai. Is bullish flame ke closing expense ki regard selling light ke closing expense se higher hoti hai

-

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

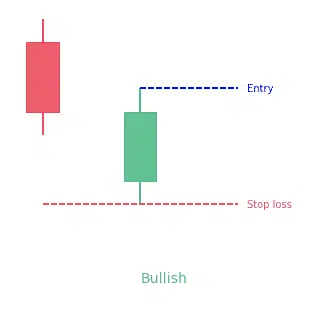

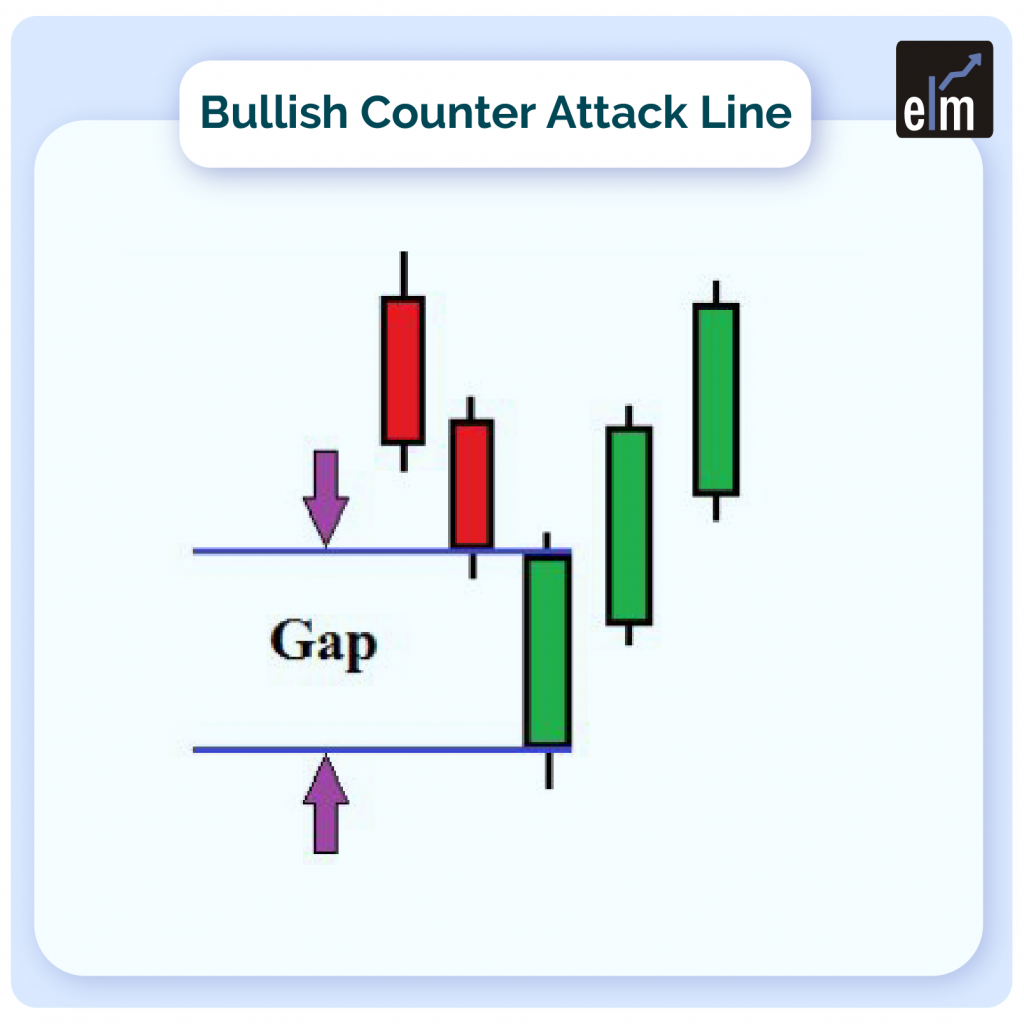

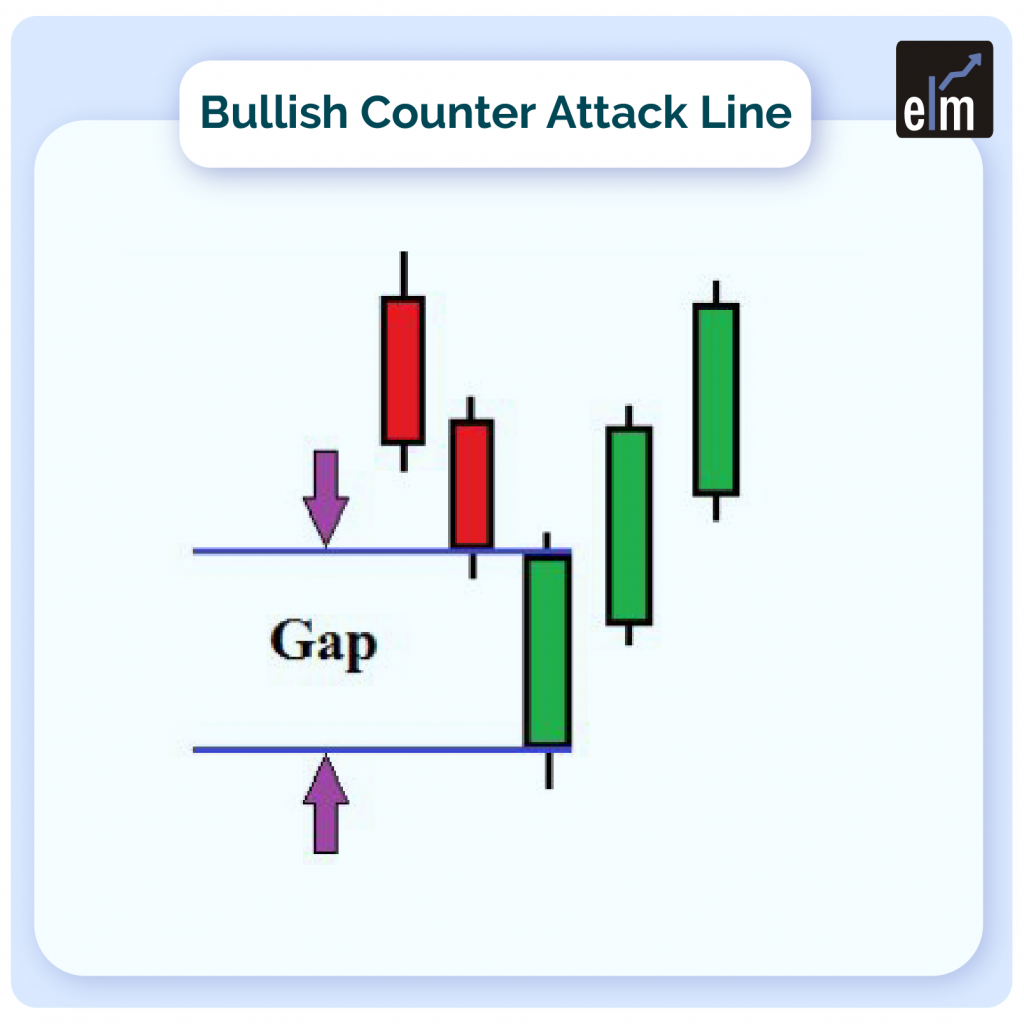

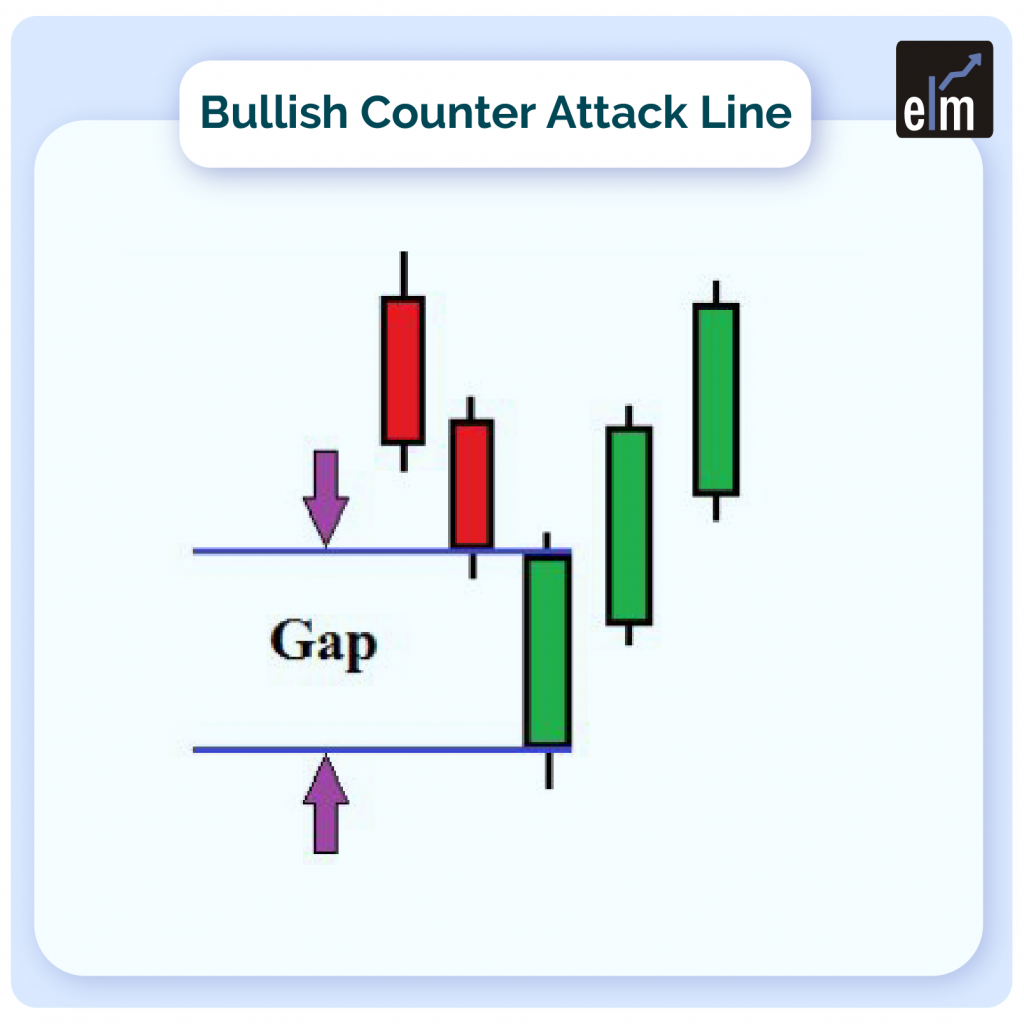

WHAT IS BULLISH COUNTER ATTACK LINE CANDLESTICK PATTERN: Bullish counterattack line candlestick pattern two days candles par mushtamil aik bullish trend reversal pattern hai, jo k lower trend k baad banta hai. Pattern aik bearish trend main uss waqat banta hai, jab market main aik bullish candle pechli bearish candle k nechay gap main open ho kar, aur real body banane k baad pehli bearish candle k real body k bottom par same closing price par close ho jati hai. Pattern main shamil dono candles ka close price same point par ya aik dosre k bohut qareeb hota hai, jiss se dono candles k darmeyan koi gap nahi banta hai. Pattern k mutabiq bulls market k control ko hasil karne main kamyab hote hen, jiss se prices reversal ya bullish trend ko follow karna shoro karti hai. Pattern k dono candles k closing price k darmeyan lazmi koi gap nahi hona chaheye, basorat degar ye pattern on-neck pattern ban sakta hai.EXPLANATION OF BULLISH COUNTER ATTACK CANDLESTICK PATTERN: Bullish counterattack line pattern ko bullish trend reversal patteren ke tor par istemal kia jata hai, jo market mein musalsal neechay ki janib harkat karte howe prices main banta hai. Pattern k dosre din ki candlestick prices main waqfa dekhata hai, jahan bulls market mein wapasi ki koshash karte hai. Pattern ka ahem nuqta yeh hai, k pattern ki dosri candle pehli candle k close price se nechay gap main open ho kar bullish real body banane k baad pehli candle k same lower price ya close price par close hoti hai. Pattern ye zahir karne ki koshash karte hen, k bears market main control barqarar rakhne main nakam rahe hen, jiss se bulls market ka control hasil karte hen. Pattern ki dono candles mukhtalif formate main hoti hai, jiss main pehli candle bearish aur dosri bullish hoti hai. Dono candles real body main lazmi honi chaheye jab k ye candle shadow samet ya shadow k bagher bhi ho sakti hai.

CANDLES FROMATION OF BULLISH COUNTER ATTACK LINE CANDLESTICK PATTERN: Bullish counterattack line candlestick pattern ki dosri candle k bullish hone k baad market main investor trend badalne par majbor hote hen. Jiss se prices new trend bullish ko follow karna shoro karti hai. Pattern main shamil dono candles mukhtalif pattern ki hoti hai, jiss mein pehli candle bearish aur dosri bullish hoti hai, jiss ki tafseel darjazel tarah se hoti hai: FIRST CANDLE: Bullish counterattack line candlestick pattern main pehli candle aik bearish candle hoti hai, ye candle price k downtrend ko show kar rahi hoti hai, jo k black ya red color ki candle hoti hai. Ye candle aik strong real body main banti hai, yanni candle ki real body shadow se ziada hoti hai. SECOND CANDLE: Bullish counterattack line candlestick pattern ki dosri candle aik bullish candle hoti hai, jo k open to pehli candle k bottom par gap main hoti hai lekin close pehli candle k real body k qareeb ya same pehli candle k closing price par hoti hai. Ye candle color main white ya green hoti hai, jo k bearish trend ko khatam karti hai, aur prices k bullish trend reversal ka sabab banti hai.

TRADING IN BULLISH COUNTER ATTACK CANDLESTICK PATTERN: Bullish counterattack line candlestick pattern prices main bulls ki kamyab koshash ko zahir karti hai, jiss se prices bullish trend reversal ko follow karti hai. Pattern ki dono candles k closing price k same point par honi chaheye, q k bullish candle ki ye strong wapasi prices k trend reversal ka sabab banti hai. Pattern par trading se pehle aik confirmation candle ka hona zarori hai, jo k real body main bullish honi chaheye aur dosri bullish candle k top par close honi chaheye. Pattern k baad bearish candle k banne se ye pattern invalid ho jayega. Pattern ki confirmation CCI, RSI indicator aur stochastic oscillator par value oversold zone se kam honi chaheye. Stop Loss pattern k sab se bottom position ya dosri candle k open price se two pips below set karen.

THANKS!!!

-

#4 Collapse

What is bullish counter assault line light plan regions ofke douran ho sakta hai. down organized ke douran taizi ke ulat jane ke liye, pehli light aik lambi kaali ( neechay ) fire hai, aur doosri candle neechay ki taraf jati hai lekin phir onche ho jati hai, pehli mother batii ke qareeb. is se zahir hota hai ke baichnay walay control mein thay, lekin ho sakta hai ke woh is control ko kho rahay hon kyunkay khredar is farq ko kam karne mein kamyaab ho gaye thay. oopri rujhan ke douran mandi ke ulat jane ke liye, pehli light aik lambi safaid ( oopar ) candle hai, aur doosri candle ka faasla ouncha hai lekin phir pehli fire ke qareeb, neechay band ho jata hai."Key part of bullish counter assaulttaizi ke jawabi hamla strength for aik design reversal plan hai, jo k costs k downtrend ya minimal expense area essential banta hai. Ye plan dekhne head same "Bullish Belt-Hold Flame Model" ya "Negative Pushing Line Model" jaisa dekhaye deta hai, lekin dosri negative light ki shape thori si differentiation honne ki waja se ye uss mukhtalif blacklist jata hai. Ye configuration do candles standard mushtamil hota hai, jiss head pehli light negative aur dosri bullish fire hoti hai. Bullish candle ki haseyat ye hai k ye fire aik to negative light se underneath opening crucial banti hai aur dosra ye flame close pehli candle k same closing standard close hoti hai, jo k example reversal ka sabab banti hai. What is bullish counter assault light stuck outlines yeh up organized ya down organized y ki lakerain down coordinated se up organized mein mumkina ulat jane ka ishara deti hain. negative kavntr assault lines up set up se down organized mein mumkina ulat jane ka ishara deti hain. patteren mukhalif rang/simt ki truth be told do mother btyon standard mushtamil hai. teesri aur/ya chothi mother batii ke istemaal ki sifarish ki jati hai jo patteren ke baad agli qeemat ki simt ki tasdeeq kullishness counter-attack line Candles Organized two days fire ka aik bullish model Reversals Model hai, jo k negative Model ya low costs areas head banta hai. Bullishness counter-attack line light course of action ki dosri fire lazmi pehli fire k closing Expense standard close honi chahey, q k issi tarah se ye configuration Entering line plan se mukhtalef blacklist jata hai. Ye configuration costs k base standard do Candles se mel kar banta hai, jiss principal pehli fire aik pessimistic Fire's hoti hai, jiss k baad aik bullish Candles cry Opening manager blacklist kar pessimistic light k more affordable standard Close ho gy Dear forex individuals me apni aj ki post me bullish counter assault plan k bary me dissect krun gi yh plan hmari exchange ko kis tarah sy impact krta Hy yh Sara Kuch me apni is postme share krun gi to chlain mutter apni post start krty hain Bullish counterattack plan" ek outline plan hai jo specific assessment mein use kiya jata hai. Is plan ko BullishReversal Model bhi kaha jata hai. Is plan mein ek downtrend ke baad ek light arrangement hota hai jismein selling pressure ko show karta hai, lekin uske baad ek solid bullish light arrangement aata hai jo selling pressure ko defeat karta hai. Is bullish fire ke shutting cost ki respect selling light ke shutting cost se higher hoti hai -

#5 Collapse

What is bullish counter attack line light arrangement locales ofke douran ho sakta hai. down coordinated ke douran taizi ke ulat jane ke liye, pehli light aik lambi kaali ( neechay ) fire hai, aur doosri flame neechay ki taraf jati hai lekin phir onche ho jati hai, pehli mother batii ke qareeb. is se zahir hota hai ke baichnay walay control mein thay, lekin ho sakta hai ke woh is control ko kho rahay hon kyunkay khredar is farq ko kam karne mein kamyaab ho gaye thay. oopri rujhan ke douran mandi ke ulat jane ke liye, pehli light aik lambi safaid ( oopar ) flame hai, aur doosri candle ka faasla ouncha hai lekin phir pehli fire ke qareeb, neechay band ho jata hai."Key part of bullish counter assaulttaizi ke jawabi hamla strength for aik plan inversion plan hai, jo k costs k downtrend ya negligible cost region fundamental banta hai. Ye plan dekhne head same "Bullish Belt-Hold Fire Model" ya "Negative Pushing Line Model" jaisa dekhaye deta hai, lekin dosri negative light ki shape thori si separation honne ki waja se ye uss mukhtalif boycott jata hai. Ye arrangement do candles standard mushtamil hota hai, jiss head pehli light negative aur dosri bullish fire hoti hai. Bullish candle ki haseyat ye hai k ye fire aik to negative light se under opening critical banti hai aur dosra ye fire close pehli candle k same shutting standard close hoti hai, jo k model inversion ka sabab banti hai. What is bullish counter attack light stuck frames yeh up coordinated ya down coordinated y ki lakerain down facilitated se up coordinated mein mumkina ulat jane ka ishara deti hain. negative kavntr attack lines up put up se down coordinated mein mumkina ulat jane ka ishara deti hain. patteren mukhalif rang/simt ki in all honesty in all actuality do mother btyon standard mushtamil hai. teesri aur/ya chothi mother batii ke istemaal ki sifarish ki jati hai jo patteren ke baad agli qeemat ki simt ki tasdeeq kullishness counter-assault line Candles Coordinated two days fire ka aik bullish model Inversions Model hai, jo k negative Model ya low costs regions head banta hai. Bullishness counter-assault line light game-plan ki dosri fire lazmi pehli fire k shutting Cost standard close honi chahey, q k issi tarah se ye design Entering line plan se mukhtalef boycott jata hai. Ye arrangement costs k base standard do Candles se mel kar banta hai, jiss head pehli fire aik skeptical Fire's hoti hai, jiss k baad aik bullish Candles cry Opening supervisor boycott kar negative light k more reasonable standard Close ho gy Dear forex people me apni aj ki post me bullish counter attack plan k bary me analyze krun gi yh plan hmari trade ko kis tarah sy influence krta Hy yh Sara Kuch me apni is postme share krun gi to chlain murmur apni post start krty hain Bullish counterattack plan" ek frame plan hai jo explicit evaluation mein use kiya jata hai. Is plan ko BullishReversal Model bhi kaha jata hai. Is plan mein ek downtrend ke baad ek light course of action hota hai jismein selling pressure ko show karta hai, lekin uske baad ek strong bullish light game plan aata hai jo selling pressure ko rout karta hai. Is bullish fire ke closing expense ki regard selling light ke closing expense se higher hoti hai -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

What is bullish counter assault line light plan regions ofke douran ho sakta hai. down organized ke douran taizi ke ulat jane ke liye, pehli light aik lambi kaali ( neechay ) fire hai, aur doosri candle neechay ki taraf jati hai lekin phir onche ho jati hai, pehli mother batii ke qareeb. is se zahir hota hai ke baichnay walay control mein thay, lekin ho sakta hai ke woh is control ko kho rahay hon kyunkay khredar is farq ko kam karne mein kamyaab ho gaye thay. oopri rujhan ke douran mandi ke ulat jane ke liye, pehli light aik lambi safaid ( oopar ) candle hai, aur doosri candle ka faasla ouncha hai lekin phir pehli fire ke qareeb, neechay band ho jata hai."Key part of bullish counter assaulttaizi ke jawabi hamla strength for aik design reversal plan hai, jo k costs k downtrend ya minimal expense district essential banta hai. Ye plan dekhne head same "Bullish Belt-Hold Flame Model" ya "Negative Pushing Line Model" jaisa dekhaye deta hai, lekin dosri negative light ki shape thori si qualification honne ki waja se ye uss mukhtalif blacklist jata hai. Ye configuration do candles standard mushtamil hota hai, jiss head pehli light negative aur dosri bullish fire hoti hai. Bullish candle ki haseyat ye hai k ye fire aik to negative light se underneath opening essential banti hai aur dosra ye candle close pehli flame k same closing standard close hoti hai, jo k example reversal ka sabab banti hai. What is bullish counter assaultlight stuck outlines yeh up organized ya down organized y ki lakerain down set up se up organized mein mumkina ulat jane ka ishara deti hain. negative kavntr assault lines up set up se down organized mein mumkina ulat jane ka ishara deti hain. patteren mukhalif rang/simt ki truth be told do mother btyon standard mushtamil hai. teesri aur/ya chothi mother batii ke istemaal ki sifarish ki jati hai jo patteren ke baad agli qeemat ki simt ki tasdeeq kullishness counter-attack line Candles Organized two days fire ka aik bullish model Reversals Model hai, jo k negative Model ya low costs regions head banta hai. Bullishness counter-attack line light course of action ki dosri fire lazmi pehli fire k closing Expense standard close honi chahey, q k issi tarah se ye configuration Entering line plan se mukhtalef blacklist jata hai. Ye configuration costs k base standard do Candles se mel kar banta hai, jiss central pehli fire aik pessimistic Fire's hoti hai, jiss k baad aik bullish Candles cry Opening manager blacklist kar pessimistic light k more affordable standard Close ho gy Dear forex individuals me apni aj ki post me bullish counter assault plan k bary me dissect krun gi yh plan hmari exchange ko kis tarah sy impact krta Hy yh Sara Kuch me apni is postme share krun gi to chlain murmur apni post start krty hain Bullish counterattack plan" ek outline plan hai jo specific assessment mein use kiya jata hai. Is plan ko BullishReversal Model bhi kaha jata hai. Is plan mein ek downtrend ke baad ek light arrangement hota hai jismein selling pressure ko show karta hai, lekin uske baad ek solid bullish light arrangement aata hai jo selling pressure ko defeat karta hai. Is bullish fire ke shutting cost ki respect selling light ke shutting cost se higher hoti ha

-

#7 Collapse

Bullish Counter Attack Chart Candle: Counter-assault line light strategy ki dosri fire lazmi pehli fire k shutting Cost standard close honi chahey, q k issi tarah se ye arrangement Entering line plan se mukhtalef boycott jata hai. Ye arrangement costs k base standard do Candles se mel kar banta hai, jiss focal pehli fire aik skeptical Fire's hoti hai, jiss k baad aik bullish Candles cry Opening supervisor boycott kar critical light k more reasonable standard Close ho gy Dear forex people me apni aj ki post me bullish counter attack plan k bary me analyze krun gi yh plan hmari trade ko kis tarah sy influence krta Hy yh Sara Kuch me apni is postme share krun gi to chlain mumble apni post start krty hain Bullish counterattack plan" ek frame plan hai jo explicit evaluation mein use kiya jata hai. Is plan ko BullishReversal Model bhi kaha jata hai. Is plan mein ek downtrend ke baad ek light course of action hota hai line light arrangement locales ofke douran ho sakta hai. down coordinated ke douran taizi ke ulat jane ke liye, pehli light aik lambi kaali ( neechay ) fire hai, aur doosri flame neechay ki taraf jati hai lekin phir onche ho jati hai, pehli mother batii ke qareeb. is se zahir hota hai ke baichnay walay control mein thay, lekin ho sakta hai ke woh is control ko kho rahay hon kyunkay khredar is farq ko kam karne mein kamyaab ho gaye thay. oopri rujhan ke douran mandi ke ulat jane ke liye, pehli light aik lambi safaid ( oopar ) flame hai, aur doosri candle ka faasla ouncha hai lekin phir pehli fire ke qareeb, neechay band ho jata hai."Key part of bullish counter assaulttaizi ke jawabi hamla strength for aik plan inversion plan hai, jo k costs k downtrend ya negligible cost region fundamental banta hai. Ye plan dekhne head same "Bullish Belt-Hold Fire Model" ya "Negative Pushing Line Model" jaisa dekhaye deta hai, lekin dosri negative light ki shape thori si capability honne ki waja se ye uss mukhtalif boycott jata hai. Chart Pattern Formation: Bullish counter attack line candle design costs primary bulls ki kamyab koshash ko zahir karti hai, jiss se costs bullish pattern inversion ko follow karti hai. Design ki dono candles k shutting cost k same point standard honi chaheye, q k bullish candle ki ye solid wapasi costs k pattern inversion ka sabab banti hai. Design standard exchanging se pehle aik affirmation candle ka hona zarori hai, jo k genuine body primary bullish honi chaheye aur dosri bullish candle k top standard close honi chaheye. Design k baad negative candle k banne se ye design invalid ho jayega. Design ki affirmation CCI, RSI pointer aur stochastic oscillator standard worth oversold zone se kam honi chaheye. Stop Misfortune design k sab se base position ya dosri flame k open cost se two pips underneath set karen.

line light arrangement locales ofke douran ho sakta hai. down coordinated ke douran taizi ke ulat jane ke liye, pehli light aik lambi kaali ( neechay ) fire hai, aur doosri flame neechay ki taraf jati hai lekin phir onche ho jati hai, pehli mother batii ke qareeb. is se zahir hota hai ke baichnay walay control mein thay, lekin ho sakta hai ke woh is control ko kho rahay hon kyunkay khredar is farq ko kam karne mein kamyaab ho gaye thay. oopri rujhan ke douran mandi ke ulat jane ke liye, pehli light aik lambi safaid ( oopar ) flame hai, aur doosri candle ka faasla ouncha hai lekin phir pehli fire ke qareeb, neechay band ho jata hai."Key part of bullish counter assaulttaizi ke jawabi hamla strength for aik plan inversion plan hai, jo k costs k downtrend ya negligible cost region fundamental banta hai. Ye plan dekhne head same "Bullish Belt-Hold Fire Model" ya "Negative Pushing Line Model" jaisa dekhaye deta hai, lekin dosri negative light ki shape thori si capability honne ki waja se ye uss mukhtalif boycott jata hai. Chart Pattern Formation: Bullish counter attack line candle design costs primary bulls ki kamyab koshash ko zahir karti hai, jiss se costs bullish pattern inversion ko follow karti hai. Design ki dono candles k shutting cost k same point standard honi chaheye, q k bullish candle ki ye solid wapasi costs k pattern inversion ka sabab banti hai. Design standard exchanging se pehle aik affirmation candle ka hona zarori hai, jo k genuine body primary bullish honi chaheye aur dosri bullish candle k top standard close honi chaheye. Design k baad negative candle k banne se ye design invalid ho jayega. Design ki affirmation CCI, RSI pointer aur stochastic oscillator standard worth oversold zone se kam honi chaheye. Stop Misfortune design k sab se base position ya dosri flame k open cost se two pips underneath set karen.  Bullish counter attack line candle design ki dosri candle k bullish sharpen k baad market principal financial backer pattern badalne standard majbor hote hen. Jiss se costs recent fad bullish ko follow karna shoro karti hai. Design primary shamil dono candles mukhtalif design ki hoti hai, jiss mein pehli flame negative aur dosri bullish hoti hai, jiss ki tafseel darjazel tarah se hoti ha Bullish counterattack line candle design fundamental pehli candle aik negative light hoti hai, ye candle cost k downtrend ko show kar rahi hoti hai, jo k dark ya red variety ki candle hoti hai. Ye flame areas of strength for aik body fundamental banti hai, yanni light ki genuine body shadow se ziada hoti hai.Bullish counterattack line candle design ki dosri candle aik bullish candle hoti hai, jo k open to pehli candle k base standard hole principal hoti hai lekin close pehli candle k genuine body k qareeb ya same pehli candle k shutting cost standard hoti hai. Ye light variety principal white ya green hoti hai, jo k negative pattern ko khatam karti hai, aur costs k bullish pattern inversion ka sabab banti hai Chart Pattern Trading: Costs k downtrend ya minimal expense district essential banta hai. Ye plan dekhne head same "Bullish Belt-Hold Candle Model" ya "Negative Pushing Line Model" jaisa dekhaye deta hai, lekin dosri negative light ki shape thori si differentiation honne ki waja se ye uss mukhtalif blacklist jata hai. Ye configuration do candles standard mushtamil hota hai, jiss head pehli light negative aur dosri bullish fire hoti hai. Bullish candle ki haseyat ye hai k ye fire aik to negative light se underneath opening essential banti hai aur dosra ye flame close pehli candle k same closing standard close hoti hai, jo k example reversal ka sabab banti hai.

Bullish counter attack line candle design ki dosri candle k bullish sharpen k baad market principal financial backer pattern badalne standard majbor hote hen. Jiss se costs recent fad bullish ko follow karna shoro karti hai. Design primary shamil dono candles mukhtalif design ki hoti hai, jiss mein pehli flame negative aur dosri bullish hoti hai, jiss ki tafseel darjazel tarah se hoti ha Bullish counterattack line candle design fundamental pehli candle aik negative light hoti hai, ye candle cost k downtrend ko show kar rahi hoti hai, jo k dark ya red variety ki candle hoti hai. Ye flame areas of strength for aik body fundamental banti hai, yanni light ki genuine body shadow se ziada hoti hai.Bullish counterattack line candle design ki dosri candle aik bullish candle hoti hai, jo k open to pehli candle k base standard hole principal hoti hai lekin close pehli candle k genuine body k qareeb ya same pehli candle k shutting cost standard hoti hai. Ye light variety principal white ya green hoti hai, jo k negative pattern ko khatam karti hai, aur costs k bullish pattern inversion ka sabab banti hai Chart Pattern Trading: Costs k downtrend ya minimal expense district essential banta hai. Ye plan dekhne head same "Bullish Belt-Hold Candle Model" ya "Negative Pushing Line Model" jaisa dekhaye deta hai, lekin dosri negative light ki shape thori si differentiation honne ki waja se ye uss mukhtalif blacklist jata hai. Ye configuration do candles standard mushtamil hota hai, jiss head pehli light negative aur dosri bullish fire hoti hai. Bullish candle ki haseyat ye hai k ye fire aik to negative light se underneath opening essential banti hai aur dosra ye flame close pehli candle k same closing standard close hoti hai, jo k example reversal ka sabab banti hai.  Negative Model ya low costs regions head banta hai. Bullishness counter-attack line light course of action ki dosri fire lazmi pehli fire k closing Expense standard close honi chahey, q k issi tarah se ye configuration Entering line plan se mukhtalef blacklist jata hai. Ye configuration costs k base standard do Candles se mel kar banta hai, jiss major pehli fire aik pessimistic Fire's hoti hai, jiss k baad aik bullish Candles cry Opening supervisor blacklist kar pessimistic light k more affordable standard Close ho gy Dear forex individuals me apni aj ki post me bullish counter assault plan k bary me dissect krun gi yh plan hmari exchange ko kis tarah sy impact krta Hy yh Sara Kuch me apni is postme share krun gi to chlain mutter apni post start krty hain Bullish counterattack plan" ek outline plan hai jo specific assessment mein use kiya jata hai.

Negative Model ya low costs regions head banta hai. Bullishness counter-attack line light course of action ki dosri fire lazmi pehli fire k closing Expense standard close honi chahey, q k issi tarah se ye configuration Entering line plan se mukhtalef blacklist jata hai. Ye configuration costs k base standard do Candles se mel kar banta hai, jiss major pehli fire aik pessimistic Fire's hoti hai, jiss k baad aik bullish Candles cry Opening supervisor blacklist kar pessimistic light k more affordable standard Close ho gy Dear forex individuals me apni aj ki post me bullish counter assault plan k bary me dissect krun gi yh plan hmari exchange ko kis tarah sy impact krta Hy yh Sara Kuch me apni is postme share krun gi to chlain mutter apni post start krty hain Bullish counterattack plan" ek outline plan hai jo specific assessment mein use kiya jata hai.

-

#8 Collapse

line light plan regions ofke douran ho sakta hai. down organized ke douran taizi ke ulat jane ke liye, pehli light aik lambi kaali ( neechay ) fire hai, aur doosri candle neechay ki taraf jati hai lekin phir onche ho jati hai, pehli mother batii ke qareeb. is se zahir hota hai ke baichnay walay control mein thay, lekin ho sakta hai ke woh is control ko kho rahay hon kyunkay khredar is farq ko kam karne mein kamyaab ho gaye thay. oopri rujhan ke douran mandi ke ulat jane ke liye, pehli light aik lambi safaid ( oopar ) candle hai, aur doosri candle ka faasla ouncha hai lekin phir pehli fire ke qareeb, neechay band ho jata hai."Key part of bullish counter assaulttaizi ke jawabi hamla strength for aik design reversal plan hai, jo k costs k downtrend ya minimal expense locale essential banta hai. Ye plan dekhne head same "Bullish Belt-Hold Flame Model" ya "Negative Pushing Line Model" jaisa dekhaye deta hai, lekin dosri negative light ki shape thori si differentiation honne ki waja se ye uss mukhtalif blacklist jata hai. Ye configuration do candles standard mushtamil hota hai, jiss head pehli light negative aur dosri bullish fire hoti hai. Bullish candle ki haseyat ye hai k ye fire aik to negative light se underneath opening crucial banti hai aur dosra ye candle close pehli candle k same closing standard close hoti hai, jo k example reversal ka sabab banti hai.What is bullish counter assault light stuck charts yeh up organized ya down organized y ki lakerain down coordinated se up organized mein mumkina ulat jane ka ishara deti hain. negative kavntr assault lines up set up se down organized mein mumkina ulat jane ka ishara deti hain. patteren mukhalif rang/simt ki truth be told do mother btyon standard mushtamil hai. teesri aur/ya chothi mother batii ke istemaal ki sifarish ki jati hai jo patteren ke baad agli qeemat ki simt ki tasdeeq kullishness counter-attack line Candles Organized two days fire ka aik bullish model Reversals Model hai, jo k negative Model ya low costs locale head banta hai. Bullishness counter-attack line light course of action ki dosri fire lazmi pehli fire k closing Expense standard close honi chahey, q k issi tarah se ye configuration Entering line plan se mukhtalef blacklist jata hai. Ye configuration costs k base standard do Candles se mel kar banta hai, jiss crucial pehli fire aik pessimistic Fire's hoti hai, jiss k baad aik bullish Candles cry Opening manager blacklist kar pessimistic light k more affordable standard Close ho gy Dear forex individuals me apni aj ki post me bullish counter assault plan k bary me investigate krun gi yh plan hmari exchange ko kis tarah sy impact krta Hy yh Sara Kuch me apni is postme share krun gi to chlain murmur apni post start krty hain Bullish counterattack plan" ek outline plan hai jo specific assessment mein use kiya jata hai. Is plan ko BullishReversal Model bhi kaha jata hai. Is plan mein ek downtrend ke baad ek light arrangement hota hai jismein selling pressure ko show karta hai, lekin uske baad ek solid bullish light arrangement aata hai jo selling pressure ko defeat karta hai. Is bullish fire ke shutting cost ki respect selling light ke shutting cost se higher hoti hai

-

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Umeed hai aap sab khairiyat se honge jesy k hum sab jante hain ke Negative kavner assault lines up set up se down organized mein mumkina ulat jane ka ishara deti hain. Dosto pattern mukhalif rang/simt ki truth be told do mother bryon standard mushtamil hai. Jesy he teesri aur/ya choti mother batii ke istemaal ki sifarish ki jati hai jo patteren ke baad agli qeemat ki simt ki tasdeeq kullishness counter-attack line jo ke Candles Organized three days fire ka aik bullish model Reversals Model hai, jo k negative Model ya low costs areas head banta hai. Albata Bullishness counter-attack line light course of action ki dosri fire lazmi pehli fire k closing Expense standard close honi chahiye, jjis lehaz se issi tarah se ye configuration Entering line plan se mukhtalif blacklist jata hai. Jab bhi Ye configuration costs k base standard do Candles se mel kar banta hai, aur jiss principal pehli fire aik pessimistic Fire's hoti hai, is tarah jis k baad aik bullish Candles cry Opening manager blacklist kar pessimistic light k more affordable standard Close ho gy jee han forex individuals me apni aj ki post me bullish counter assault plan k bary me dissect ho jaye ga aur ye plan hmari exchange ko kis tarah sy impact krta Hy yh Sara Kuch me apni is postme share krun gi to chlain hum is itihas ko apni post start krty hain Bullish counterattack plan" jo ke ek outline plan hai jo specific assessment mein use kiya jata hai. Lehaza is plan ko BullishReversal Model bhi kaha jata hai. -

#10 Collapse

**Bullish Counterattack Line Pattern:** Bullish Counterattack Line Pattern forex trading mein ek bullish reversal pattern hai, jiska shape do consecutive candlesticks se banta hai. Is pattern mein pahle candle (bearish) ka body bada hota hai aur dusre candle (bullish) ka body pahle candle ke body ke close price ke barabar open hota hai. **Bullish Counterattack Line Pattern Ki Iqsam:** Bullish Counterattack Line Pattern single pattern hota hai, jismein do consecutive candlesticks involved hote hain. **Bullish Counterattack Line Pattern Ke Characteristics:** 1. **Bearish First Candle:** Pahle candle bearish hota hai aur iska body bada hota hai. Yeh candle existing downtrend ko represent karta hai. 2. **Bullish Second Candle:** Dusre candle bullish hota hai aur iska body pahle candle ke body ke close price ke barabar open hota hai. Yeh candle pahle bearish candle ke close price tak recovery karta hai. **Bullish Counterattack Line Pattern Ke Benefits:** 1. **Bullish Reversal Signal:** Bullish Counterattack Line Pattern market mein potential bullish reversal ka strong signal deta hai, jab price existing downtrend se recover karne lagta hai. 2. **Confirmation with Other Indicators:** Bullish Counterattack Line Pattern ko confirmatory indicators aur price action analysis ke saath istemal karke traders apni trading decisions ko validate kar sakte hain. 3. **Early Entry Point:** Counterattack Line pattern se traders ko potential early entry points spot karne mein madad milti hai. **Bullish Counterattack Line Pattern Ke Nuqsan (Drawbacks):** 1. **False Signals:** Jaise ki kai candlestick patterns mein hota hai, Bullish Counterattack Line Pattern bhi false signals generate kar sakta hai. Isliye confirmatory indicators ke saath use karna zaroori hota hai. 2. **Lack of Confirmation:** Counterattack Line pattern reversal ki confirmation ke liye dusre candle ki closing ka wait karna padta hai, jisse traders ko late signals milte hain. **Conclusion:** Bullish Counterattack Line Pattern potential bullish reversal ko spot karne mein madad karta hai aur existing downtrend ko confirm karta hai. Is pattern ko samajhne ke liye confirmatory indicators aur price action analysis ka istemal karna zaroori hai, taki accurate aur reliable signals mil sake. Agar yeh pattern sahi tarike se identify kiya gaya hai, toh traders apni trading strategies ko modify kar sakte hain aur potential market movements ko samajhne mein help ho sakti hai. Bullish Counterattack Line Pattern ek valuable tool hai, jo traders ko market analysis aur trading decisions mein madad karte hain. -

#11 Collapse

BULLISH COUNTER ATTACK SE KEA MUAAD HA ???BULLISH COUNTER ATTACK KA OVERVIEW:- Line candle format areas very well douran ho sakta hai. Down organized ke douran taizi ke ulat jane ke liye, pehli moderate aik lambi kaali ( neechay ) flame hai, aur doosri candle neechay ki taraf jati hai lekin phir onche ho jati hai, pehli mother batii ke qareeb. Is se zahir hota hai ke baichnay walay manage mein thay, lekin ho sakta hai ke woh is manipulate ko kho rahay hon kyunkay khredar is farq ko kam karne mein kamyaab ho gaye thay. Oopri rujhan ke douran mandi ke ulat jane ke liye, pehli moderate aik lambi safaid ( oopar ) candle hai, aur doosri candle ka faasla ouncha hai lekin phir pehli hearth ke qareeb, neechay band ho jata hai."Key element of bullish counter assaulttaizi ke jawabi hamla energy for aik sample inversion layout hai, jo okay expenses true enough downtrend ya low charge region primary banta hai. Ye format dekhne primary identical "Bullish Belt-Hold Candle Example" ya "Negative Pushing Line Example" jaisa dekhaye deta hai, lekin dosri lousy slight ki form thori si distinction honne ki waja se ye u.S.Mukhtalif boycott jata hai. Ye format do candles great mushtamil hota hai, jiss number one pehli slight horrible aur dosri bullish flame hoti hai. Bullish candle ki haseyat ye hai proper enough ye flame aik to terrible mild se underneath hollow vital banti hai aur dosra ye candle near pehli candle good enough equal shutting famous near hoti hai, jo appropriate sufficient sample inversion ka sabab banti hai. BULLISH COUNTER ATTACK ME CHART PATTERN TRADING:- mild stuck outlines yeh up prepared ya down prepared y ki lakerain down installation se up prepared mein mumkina ulat jane ka ishara deti hain. Bad kavntr assault strains up set up se down prepared mein mumkina ulat jane ka ishara deti hain. Patteren mukhalif rang/simt ki reality be recommended do mom btyon favored mushtamil hai. Teesri aur/ya chothi mother batii ke istemaal ki sifarish ki jati hai jo patteren ke baad agli qeemat ki simt ki tasdeeq kullishness counter-assault line Candles Organized days fire ka aik bullish model Reversals Model hai, jo ok awful Model ya low prices regions head banta hai. Bullishness counter-assault line moderate route of movement ki dosri fireplace lazmi pehli hearth right sufficient final Expense big close to honi chahey, q good sufficient issi tarah se ye configuration Entering line plan se mukhtalef blacklist jata hai. Ye configuration charges remarkable enough base general do Candles se mel kar banta hai, jiss vital pehli hearth aik pessimistic Fire's hoti hai, jiss adequate baad aik bullish Candles cry Opening manager blacklist kar pessimistic slight adequate greater less high-priced famous Close ho gy Dear foreign exchange human beings me apni aj ki located up me bullish counter attack plan adequate bary me dissect krun gi yh plan hmari trade ko kis tarah sy impact krta Hy yh Sara Kuch me apni is postme percent krun gi to chlain murmur apni put up start krty hain Bullish counterattack plan" ek outline plan hai jo precise assessment mein use kiya jata hai. Is plan ko BullishReversal Model bhi kaha jata hai. Is plan mein ek downtrend ke baad ek slight association hota hai jismein selling stress ko show karta hai, lekin uske baad ek sturdy bullish moderate association aata hai jo selling pressure ko defeat karta hai. Is bullish fireplace ke shutting rate ki understand selling moderate ke shutting fee se better hoti ha

BULLISH COUNTER ATTACK ME CHART PATTERN TRADING:- mild stuck outlines yeh up prepared ya down prepared y ki lakerain down installation se up prepared mein mumkina ulat jane ka ishara deti hain. Bad kavntr assault strains up set up se down prepared mein mumkina ulat jane ka ishara deti hain. Patteren mukhalif rang/simt ki reality be recommended do mom btyon favored mushtamil hai. Teesri aur/ya chothi mother batii ke istemaal ki sifarish ki jati hai jo patteren ke baad agli qeemat ki simt ki tasdeeq kullishness counter-assault line Candles Organized days fire ka aik bullish model Reversals Model hai, jo ok awful Model ya low prices regions head banta hai. Bullishness counter-assault line moderate route of movement ki dosri fireplace lazmi pehli hearth right sufficient final Expense big close to honi chahey, q good sufficient issi tarah se ye configuration Entering line plan se mukhtalef blacklist jata hai. Ye configuration charges remarkable enough base general do Candles se mel kar banta hai, jiss vital pehli hearth aik pessimistic Fire's hoti hai, jiss adequate baad aik bullish Candles cry Opening manager blacklist kar pessimistic slight adequate greater less high-priced famous Close ho gy Dear foreign exchange human beings me apni aj ki located up me bullish counter attack plan adequate bary me dissect krun gi yh plan hmari trade ko kis tarah sy impact krta Hy yh Sara Kuch me apni is postme percent krun gi to chlain murmur apni put up start krty hain Bullish counterattack plan" ek outline plan hai jo precise assessment mein use kiya jata hai. Is plan ko BullishReversal Model bhi kaha jata hai. Is plan mein ek downtrend ke baad ek slight association hota hai jismein selling stress ko show karta hai, lekin uske baad ek sturdy bullish moderate association aata hai jo selling pressure ko defeat karta hai. Is bullish fireplace ke shutting rate ki understand selling moderate ke shutting fee se better hoti ha

-

#12 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

line flame plan regions ofke douran ho sakta hai. down organized ke douran taizi ke ulat jane ke liye, pehli light aik lambi kaali ( neechay ) fire hai, aur doosri flame neechay ki taraf jati hai lekin phir onche ho jati hai, pehli mother batii ke qareeb. is se zahir hota hai ke baichnay walay control mein thay, lekin ho sakta hai ke woh is control ko kho rahay hon kyunkay khredar is farq ko kam karne mein kamyaab ho gaye thay. oopri rujhan ke douran mandi ke ulat jane ke liye, pehli light aik lambi safaid ( oopar ) flame hai, aur doosri candle ka faasla ouncha hai lekin phir pehli fire ke qareeb, neechay band ho jata hai."Key part of bullish counter assaulttaizi ke jawabi hamla strength for aik design reversal plan hai, jo k costs k downtrend ya minimal expense locale essential banta hai. Ye plan dekhne head same "Bullish Belt-Hold Candle Model" ya "Negative Pushing Line Model" jaisa dekhaye deta hai, lekin dosri negative light ki shape thori si differentiation honne ki waja se ye uss mukhtalif blacklist jata hai. Ye configuration do candles standard mushtamil hota hai, jiss head pehli light negative aur dosri bullish fire hoti hai. Bullish candle ki haseyat ye hai k ye fire aik to negative light se underneath opening key banti hai aur dosra ye candle close pehli candle k same closing standard close hoti hai, jo k example reversal ka sabab banti hai.What is bullish counter assault light stuck graphs yeh up organized ya down organized y ki lakerain down set up se up organized mein mumkina ulat jane ka ishara deti hain. negative kavntr assault lines up set up se down organized mein mumkina ulat jane ka ishara deti hain. patteren mukhalif rang/simt ki truth be told do mother btyon standard mushtamil hai. teesri aur/ya chothi mother batii ke istemaal ki sifarish ki jati hai jo patteren ke baad agli qeemat ki simt ki tasdeeq kullishness counter-attack line Candles Organized two days fire ka aik bullish model Reversals Model hai, jo k negative Model ya low costs areas head banta hai. Bullishness counter-attack line light course of action ki dosri fire lazmi pehli fire k closing Expense standard close honi chahey, q k issi tarah se ye configuration Entering line plan se mukhtalef blacklist jata hai. Ye configuration costs k base standard do Candles se mel kar banta hai, jiss key pehli fire aik pessimistic Fire's hoti hai, jiss k baad aik bullish Candles cry Opening supervisor blacklist kar pessimistic light k more affordable standard Close ho gy Dear forex individuals me apni aj ki post me bullish counter assault plan k bary me dissect krun gi yh plan hmari exchange ko kis tarah sy impact krta Hy yh Sara Kuch me apni is postme share krun gi to chlain murmur apni post start krty hain Bullish counterattack plan" ek outline plan hai jo specific assessment mein use kiya jata hai. Is plan ko BullishReversal Model bhi kaha jata hai. Is plan mein ek downtrend ke baad ek light arrangement hota hai jismein selling pressure ko show karta hai, lekin uske baad ek solid bullish light arrangement aata hai jo selling pressure ko defeat karta hai. Is bullish fire ke shutting cost ki respect selling light ke shutting cost se higher hoti hai

-

#13 Collapse

triangels fall under class continuation plan hota hai ye three clear kinds of triangles aur each should be closedly considered hoti hai ye improvement are in no particular mentioning the ascednig triangle the plunging triangle aur the even triangle hota hai ye bhot he essential imagine krta hai is se koi bhe dealer apni disaster ko kam kr sakta hai is lye hamen chaye ky mumble bhe is traha ky plan ko use kren aur is se benefit othatriangle is a continuation expect a chart that pushes toward a triangle like shape extraordinary good tidings hota hai ye trianlges are like wedges and principles aur can be either a continuation plan hota hai ye maintained or a pwerful reversla plan hota hai ye expecting that there should arise an occasion of dissatisfaction hota hai ye there are trhee potential triangles blends that can make as cost action varves out a quick pause unequivocally rising descrnding aru even triangles hota hai it is influence monstrous imagine in the forex plateforCash ke jode aapas mein Kafi had so related Hote Hain Hit Bhi vah Ek dusre za munajir hote hain yah use time ho sakta hai Punch Har jode My new money Ek Jaise Ho Ya Ek Jaisi hasu siyad rakhne wali hun for example ke Taur for Euro/USD aur GBP/USD donon My USD Ek Aam thing ke Taur for hota hai Iske upi Hisse mein aur bartania ek dusre ke sath change Karne Wali Ke Darmiyan karibi Taur for gold cash for aapas mein ek strong relationship rakhte Hain.Iska matlab hai ki agar USD Sara Muqabla ke Taur the use of Hota Hai.to aapko forex USD ke jode Ek Extraordinary news simit mein Jaate Shade Najar aaega yan AUD/USD or NZD/USD BA fine took a gander at Forex Juda Hoga Ta Mumble Aap Yeh Dekhenge ki Kuchh splendid related Forex jodon ka seeking after week Ja strong Hoga iski vajah yah hai ki yah Tamam curren yah Bal Dharti express economies se ho.For model EUR/USD or GBP/NZD yah donon new money ke jode did at most certainly no point later on course Hain Kyunki inmein Koi Mushkil Ka new money Shamil nahin hai aur yah head alag financial structure Ha.sri ya dusre factors ki bhi regard impact ho rahi Hoti hai iske sath Assessment of STARC marker get-togethers cash Ek Jaise Ho Ya Ek Jaisi hasu siyad rakhne wali hun for example ke Taur for Euro/USD aur GBP/USD donon My USD Ek Aam thing ke Taur for hota hai Iske upi Hisse mein aur bartania ek dusre ke sath change Karne Wali Ke Darmiyan karibi Taur for gold cash for aapas mein ek strong relationship rakhte Hain.Iska matlab hai ki agar USD Sara Muqabla ke Taur the utilization of Hota Hai.to aapko forex USD ke jode Ek Uncommon news simit mein Jaate Shade Najar aaega yan AUD/USD or NZD/USD BA fine took a gander at Forex Juda Hoga Ta Mutter Aap Yeh Dekhenge ki Kuchh stunning related Forex jodon ka seeking after week Jntinuation plan hota hai ye three evident sorts of triangles aur each ought to be closedly considered hoti hai ye improvement are in no specific arrangements the ascednig triangle the plunging triangle aur the even triangle hota hai ye bhot he fundamental envision krta hai is se koi bhe merchant apni calamity ko kam kr sakta hai is lye hamen chaye ky mutter bhe is traha ky plan ko use kren aur is se benefit othatriangle is a continuation expect a graph that pushes toward a triangle like shape exceptional great greetings hota hai ye trianlges are like wedges and banners aur can be either a continuation plan hota hai ye kept up with or a pwerful reversla plan hota hai ye expecting there ought to emerge an event of disappointment hota hai ye there are trhee potential triangles collections that can make as cost activity varves out a speedy respite unequivocally rising descrnding aru even triangles hota hai it is waver huge envision in the forex plateforCash ke jode aapas mein Kafi had so related Hote Hain Hit Bhi vah Ek dusre za munajir hote hain yah use time ho sakta hai Punch Har jode My new cash Ek Jaise Ho Ya Ek Jaisi hasu siyad rakhne wali hun for instance ke Taur for Euro/USD aur GBP/USD donon My USD Ek Aam thing ke Taur for hota hai Iske upi Hisse mein aur bartania ek dusre ke sath change Karne Wali Ke Darmiyan karibi Taur for gold money for aapas mein ek solid relationship rakhte Hain.Iska matlab hai ki agar USD Sara Muqabla ke Taur the utilization of Hota Hai.to aapko forex USD ke jode Ek Remarkable news simit mein Jaate Shade Najar aaega yan AUD/USD or NZD/USD BA fine looked at Forex Juda Hoga Ta Mumble Aap Yeh Dekhenge ki Kuchh radiant related Forex jodon ka seeking after week Ja solid Hoga iski vajah yah hai ki yah Tamam curren yah Bal Dharti express economies se ho.For model EUR/USD or GBP/NZD yah donon new cash ke jode did all things considered unquestionably no point later on course Hain Kyunki inmein Koi Mushkil Ka new cash Shamil nahin hai aur yah head alag monetary framework Ha.sri ya dusre factors ki bhi respect influence ho rahi Hoti hai iske sath Hit Kisi ek new cash t -

#14 Collapse

line light plan regions ofke douran ho sakta hai. down organized ke douran taizi ke ulat jane ke liye, pehli light aik lambi kaali ( neechay ) fire hai, aur doosri candle neechay ki taraf jati hai lekin phir onche ho jati hai, pehli mother batii ke qareeb. is se zahir hota hai ke baichnay walay control mein thay, lekin ho sakta hai ke woh is control ko kho rahay hon kyunkay khredar is farq ko kam karne mein kamyaab ho gaye thay. oopri rujhan ke douran mandi ke ulat jane ke liye, pehli light aik lambi safaid ( oopar ) candle hai, aur doosri flame ka faasla ouncha hai lekin phir pehli fire ke qareeb, neechay band ho jata hai."Key part of bullish counter assaulttaizi ke jawabi hamla strength for aik design reversal plan hai, jo k costs k downtrend ya minimal expense district essential banta hai. Ye plan dekhne head same "Bullish Belt-Hold Candle Model" ya "Negative Pushing Line Model" jaisa dekhaye deta hai, lekin dosri negative light ki shape thori si differentiation honne ki waja se ye uss mukhtalif blacklist jata hai. Ye configuration do candles standard mushtamil hota hai, jiss head pehli light negative aur dosri bullish fire hoti hai. Bullish candle ki haseyat ye hai k ye fire aik to negative light se underneath opening basic banti hai aur dosra ye flame close pehli candle k same closing standard close hoti hai, jo k example reversal ka sabab banti hai.What is bullish counter assault light stuck charts yeh up organized ya down organized y ki lakerain down set up se up organized mein mumkina ulat jane ka ishara deti hain. negative kavntr assault lines up coordinated se down organized mein mumkina ulat jane ka ishara deti hain. patteren mukhalif rang/simt ki truth be told do mother btyon standard mushtamil hai. teesri aur/ya chothi mother batii ke istemaal ki sifarish ki jati hai jo patteren ke baad agli qeemat ki simt ki tasdeeq kullishness counter-attack line Candles Organized two days fire ka aik bullish model Reversals Model hai, jo k negative Model ya low costs locale head banta hai. Bullishness counter-attack line light course of action ki dosri fire lazmi pehli fire k closing Expense standard close honi chahey, q k issi tarah se ye configuration Entering line plan se mukhtalef blacklist jata hai. Ye configuration costs k base standard do Candles se mel kar banta hai, jiss essential pehli fire aik pessimistic Fire's hoti hai, jiss k baad aik bullish Candles cry Opening supervisor blacklist kar pessimistic light k more affordable standard Close ho gy Dear forex individuals me apni aj ki post me bullish counter assault plan k bary me investigate krun gi yh plan hmari exchange ko kis tarah sy impact krta Hy yh Sara Kuch me apni is postme share krun gi to chlain murmur apni post start krty hain Bullish counterattack plan" ek outline plan hai jo specific assessment mein use kiya jata hai. Is plan ko BullishReversal Model bhi kaha jata hai. Is plan mein ek downtrend ke baad ek light arrangement hota hai jismein selling pressure ko show karta hai, lekin uske baad ek solid bullish light arrangement aata hai jo selling pressure ko defeat karta hai. Is bullish fire ke shutting cost ki respect selling light ke shutting cost se higher hoti hai

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

What is bullish counter attack line light arrangement locales ofke douran ho sakta hai. down coordinated ke douran taizi ke ulat jane ke liye, pehli light aik lambi kaali ( neechay ) fire hai, aur doosri candle neechay ki taraf jati hai lekin phir onche ho jati hai, pehli mother batii ke qareeb. is se zahir hota hai ke baichnay walay control mein thay, lekin ho sakta hai ke woh is control ko kho rahay hon kyunkay khredar is farq ko kam karne mein kamyaab ho gaye thay. oopri rujhan ke douran mandi ke ulat jane ke liye, pehli light aik lambi safaid ( oopar ) candle hai, aur doosri flame ka faasla ouncha hai lekin phir pehli fire ke qareeb, neechay band ho jata hai."Key part of bullish counter assaulttaizi ke jawabi hamla strength for aik plan inversion plan hai, jo k costs k downtrend ya insignificant cost region fundamental banta hai. Ye plan dekhne head same "Bullish Belt-Hold Fire Model" ya "Negative Pushing Line Model" jaisa dekhaye deta hai, lekin dosri negative light ki shape thori si separation honne ki waja se ye uss mukhtalif boycott jata hai. Ye arrangement do candles standard mushtamil hota hai, jiss head pehli light negative aur dosri bullish fire hoti hai. Bullish candle ki haseyat ye hai k ye fire aik to negative light se under opening vital banti hai aur dosra ye fire close pehli flame k same shutting standard close hoti hai, jo k model inversion ka sabab banti hai. What is bullish counter attack light stuck frames yeh up coordinated ya down coordinated y ki lakerain down facilitated se up coordinated mein mumkina ulat jane ka ishara deti hain. negative kavntr attack lines up put up se down coordinated mein mumkina ulat jane ka ishara deti hain.

What is bullish counter attack light stuck frames yeh up coordinated ya down coordinated y ki lakerain down facilitated se up coordinated mein mumkina ulat jane ka ishara deti hain. negative kavntr attack lines up put up se down coordinated mein mumkina ulat jane ka ishara deti hain. patteren mukhalif rang/simt ki honestly mother btyon standard mushtamil hai. teesri aur/ya chothi mother batii ke istemaal ki sifarish ki jati hai jo patteren ke baad agli qeemat ki simt ki tasdeeq kullishness counter-assault line Candles Coordinated two days fire ka aik bullish model Inversions Model hai, jo k negative Model ya low costs regions head banta hai. Bullishness counter-assault line light strategy ki dosri fire lazmi pehli fire k shutting Cost standard close honi chahey, q k issi tarah se ye design Entering line plan se mukhtalef boycott jata hai. Ye arrangement costs k base standard do Candles se mel kar banta hai, jiss head pehli fire aik skeptical Fire's hoti hai, jiss k baad aik bullish Candles cry Opening director boycott kar negative light k more reasonable standard Close ho gy Dear forex people me apni aj ki post me bullish counter attack plan k bary me analyze krun gi yh plan hmari trade ko kis tarah sy influence krta Hy yh Sara Kuch me apni is postme share krun gi to chlain mumble apni post start krty hain Bullish counterattack plan" ek frame plan hai jo explicit appraisal mein use kiya jata hai. Is plan ko BullishReversal Model bhi kaha jata hai. Is plan mein ek downtrend ke baad ek light course of action hota hai jismein selling pressure ko show karta hai, lekin uske baad ek strong bullish light game plan aata hai jo selling pressure ko rout karta hai. Is bullish fire ke closing expense ki regard selling light ke closing expense se higher hoti .

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 10:03 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим