Spinning TOP Candlestick pattern discussion

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Assalam alaikum dear forum members!- umeed karta hun aap sb khairiat se hn gy or apki trading achi jaa rahi ho ge.

- dear members trading karty hovy hmara hr waqt candlesticks se taluq hota ha or hum inko dkh kr price read karty hain.

- ye candle sticks price k ilawa or b bahut kuch btati hain jesa k trend k bary main support resistance k bary main or reversal k bary main bhi btati hain.

- esi silsly main aj hum aik important candle ko read karen gy jisy k spinning top candle stick kaha jata ha.

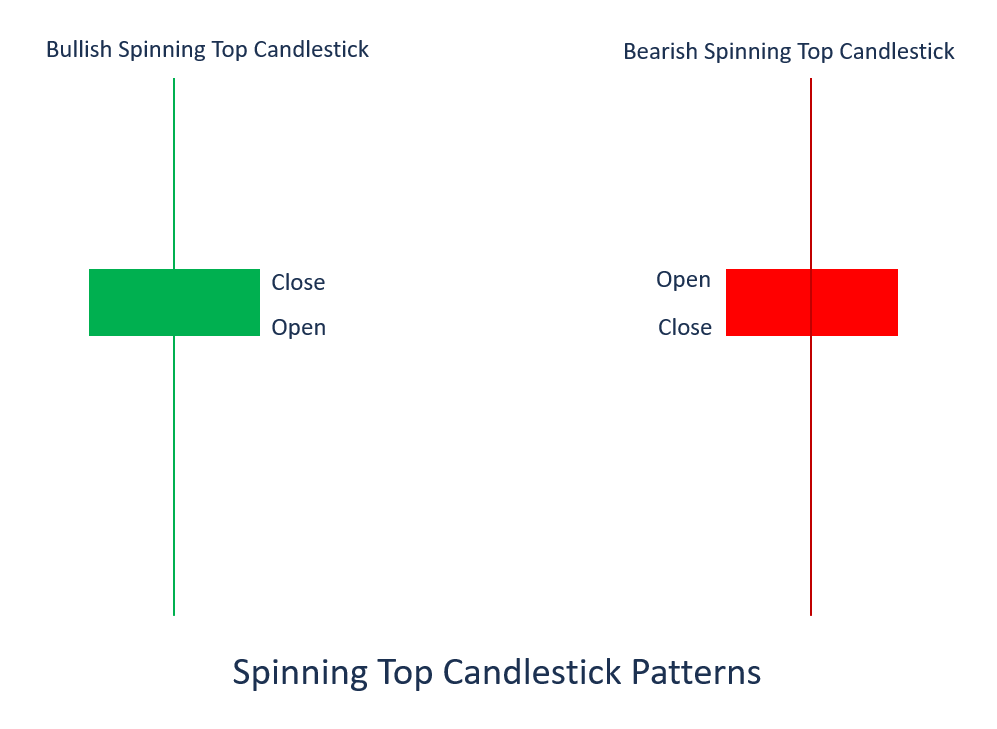

- dear members spinning top candle ki short real body hoti ha jo k opr or nechy shadow k drmyan hoti ha ye body bearish ya bullish ho skti ha.

- spinning top market main indecision ko zahir karti ha mtlb k buyer or sellers equal force main thy or market main koe faisla ni ho ska.

- Jb market opr hai to seller ny sell kia or opr ki trf wick ya shadow bn gya

- or jb market nechy gai to buyers ny buy kia jski waja se nechy se wick bn gai or darmyan main choti c body bni ha.

- agr ye pattern strong support ya resistance py bny or es se agli candle eski confirmation kar dy to ye trend reversal ka sign ho skta ha.

- Yeh candlestick pattern us time banta ha jab buyers aik given time k doran price ko down push kr deta ha. Liken closing price open k bht qareeb close hojati ha. Strong price mein izafa ya kami k baad, spinning top potential price reversal ka signals dy sakti ha. Spinning top above open k oper ya below close ho sakti ha. Liken dono prices hamesha aik dusry k qareeb hoti hein.

- Spinning top aik candlestick pattern ha jis ki short real body hoti ha jo long upper aur lower shadows k darmeyan hota ha. Is ki real body choti honi chaiye jo open aur close prices mein thora farq dekhata hai. Kyun k buyers aur sellers dono ny price ko agy barhaya liken usy maintain nae rakh saky. Pattern indecision ko show karta ha aur us k sath sath mazid sideways movement bhi ho sakti hai. Umeed ha k aj ka topic ap sab doston ko zarur samjh aye ga ta k ap trading k doran is candle ko pehchan saken aur us k baad he apni trade ko active karen ta k ap loss sy bach saken.

- es main hum dosri candle ki confirmation k bad buy ki trade lety hain or hmara stop loss spinning top candle k low k equal hota ha.

- Bearish reversal Spinning top candlestick

- Dear memebrs ye pattern bullish trend k end main resistance muqam py bnta ha. Resistance py aikspinning top candle banti ha bearish body k sth or eski confirmation k lye next bearish candle ko spinning top candle k low k nechy close hona chahye. Es k bad market ka trend reverse hota ha or market bearish move karti ha.

- es main dosri candle k closing k bad hum sell ki trade lety hain or hmara stop loss spinning top candle k high k equal hota ha.

-

#3 Collapse

umeed karta hun aap sb khairiat se hn gy or apki exchanging achi jaa rahi ho ge.dear individuals exchanging karty hovy hmara hr waqt candles se taluq hota ha or murmur inko dkh kr cost read karty hain.ye candles cost k ilawa or b bahut kuch btati hain jesa k pattern k bary principal support opposition k bary fundamental or inversion k bary primary bhi btati hain.esi silsly principal aj murmur aik significant flame ko read karen gy jisy k turning top candle kaha jata ha. Significance of turning top example, Yeh candle design us time banta ha punch purchasers aik given time k doran cost ko down push kr deta ha. Compare shutting cost open k bht qareeb close hojati ha. Solid cost mein izafa ya kami k baad, turning top potential cost inversion ka signals dy sakti ha. Turning top above open k oper ya underneath close ho sakti ha. Compare dono costs hamesha aik dusry k qareeb hoti hein.Turning top aik candle design ha jis ki short genuine body hoti ha jo long upper aur lower shadows k darmeyan hota ha. Is ki genuine body choti honi chaiye jo open aur close costs mein thora farq dekhata hai. Kyun k purchasers aur venders dono ny cost ko agy barhaya compare usy keep up with nae rakh saky. Design uncertainty ko show karta ha aur us k sath mazid sideways development bhi ho sakti hai. Umeed ha k aj ka theme ap sab doston ko zarur samjh affirmative ga ta k ap exchanging k doran is candle ko pehchan saken aur us k baad he apni exchange ko dynamic karen ta k ap misfortune sy bach saken. Bullish inversion Turning top example Dear individuals ye design negative pattern k end principal support py banta ha or ye inversion ki nishani hota ha es k awful market bullish ho jati ha.laikin es se phly eski affirmation lazmi ha.eski affirmation ye ha k help muqam py phly turning top candle bny bullish body k sth or phr us k awful usi time period primary next flame turning top ki shutting cost se opr close ho. What is Turning Top Candle? dear individuals turning top candle ki short genuine body hoti ha jo k opr or nechy shadow k drmyan hoti ha ye body negative ya bullish ho skti ha.turning top market fundamental uncertainty ko zahir karti ha mtlb k purchaser or dealers equivalent power principal thy or market primary koe faisla ni ho ska.Jb market opr hai to vender ny sell kia or opr ki trf wick ya shadow bn gyaor then again jb market nechy gai to purchasers ny purchase kia jski waja se nechy se wick bn gai or darmyan fundamental choti c body bni ha. a candlestick pattern that has a short real body that's vertically centered between long upper and lower shadows -

#4 Collapse

Assalamualaikum! Umeed hai k ap sb khariyat sy hongy. R apky trading sessions achy jaa rhy hongy. Aj ka hmra discussion topic "Spinning top candlestick pattern discussion". Dekhty hain k ye hmein Kya information deta hai r hmry ilam Mai Kesy ezafa krta hai. Spinning top candlestick pattern Spinning top candle stuck chart patteren aik aisi tashkeel hai jo is waqt hoti hai jab khredar aur baichnay walay aik dosray ko mutawazan karte hain, jis ke nateejay mein qeemat ki sthin yaksaa hoti hain. market ki simt mein is nisbatan choti tabdeeli ki wajah se, is candle stick ko tasalsul ke patteren ke tor par jana jata hai. is chart patteren ki do tagayuraat hain : blush aspnng taap ( rang mein sabz ) aur bearish aspnng taap ( rang mein surkh ). taizi ki tashkeel is waqt hoti hai jab ikhtitami qeemat iftitahi qeemat se ziyada hoti hai, jab ke bearish patteren is waqt hota hai jab iftitahi qeemat ikhtitami qeemat se ziyada hoti hai. tamam candle stuck patteren ki terhan, ghoomnay walay taap mein aik vÙk aur aik body hoti hai : batii amoodi lakeer se banti hai jabkay jism ufuqi lakiron se bantaa hai vÙk ki lambai mukhtalif ho sakti hai, kyunkay oopar wala sab se ziyada qeemat ko zahir karta hai aur neechay ka hissa kam ko zahir karta hai. jism oonchai mein bhi mukhtalif ho sakta hai, kyunkay yeh iftitahi aur band honay wali qeemat ke darmiyan farq ki numaindagi karta hai a ghoomnay wali taap candle stick is waqt banti hai jab bail ibtidayi qeemat se ziyada qeemat bhaijtay hain, aur reechh phir market band honay se pehlay usay neechay ki taraf dhakel dete hain. ya, jab mandi walay tajir qeematon ko khuli qeemat se kam karte hain aur taizi ke tajir market band honay se pehlay usay wapas oopar dhakel dete hain. dosray lafzon mein, market ne oopar ki taraf aur neechay ki taraf aapshnz ki talaash ki hai lekin phir kam o besh aik hi ibtidayi qeemat par settle ho jati hai – jis ke nateejay mein koi maienay khaiz tabdeeli nahi hoti. aik ghoomnay wala taap taajiron ko batata hai ke market mein ghair yakeeni sorat e haal hai, kyunkay iftitahi aur ikhtitami qeemat ke darmiyan ziyada tabdeeli nahi aayi thi. is ka matlab ya to yeh ho sakta hai ke mazeed ghair janabdaar harkatein agay hain, ya qeemat ka ulat jane wala hai. agar aspnng taap ko neechay ke rujhan mein dekha jata hai, to is ka matlab yeh ho sakta hai ke taizi se ulat phair ho sakti hai. is ke bar aks, agar yeh up trained ke sab se oopar hota hai, to yeh bearish reversal ka ishara day sakta hai. taham, taajiron ko takneeki tajzia ki deegar aqsam par ghhor kiye baghair kisi bhi candle stuck ke tarz par amal nahi karna chahiye. hamesha dosray namonon aur isharay par ghhor karen, signal ki tasdeeq karen, aur yakeeni banayen ke aap –apne tijarti mansoobay aur rissk managment ki hikmat e amli se bhatak nah jayen . Explanation Jab aap spinning top candle stuck patteren ko dekhte hain to tijarat karne ke kuch tareeqay hain. pehla ahem qadam signal ki tasdeeq karna hai. ziyada tar tajir takneeki asharion ka istemaal is baat ki tasdeeq ke liye karte hain ke woh kya samajte hain ke ghoomnay wala top signaling kar raha hai, kyunkay yeh isharay qeemat ke rujhanaat mein mazeed baseerat faraham kar satke hain. misaal ke tor par, agar aap ko lagta hai ke down trained ke nichale hissay mein ghoomnay wala taap anay walay ulat jane ki nishandahi kar sakta hai, to aap stock accelators ka istemaal karte hue signal ki jaanch kar satke hain. yeh isharay qeemat ki naqal o harkat ka andaza laganay mein aap ki madad kar sakta hai kyunkay yeh aik makhsoos time frame par market ki raftaar aur raftaar ko zahir karta hai. agar anay walay ulat jane ki tasdeeq ho jati hai, to aap khareedna chahtay hain ( lamba jana ). jab aap ghumte hue taap candle stuck patteren ko dekhte hain to tijarat karne ke liye, aap spread beats ya cfds jaisay mushtakqat istemaal kar saktay hain. Mushtakqat ke sath, aap bunyadi asason ki malkiat nahi letay, lekin un ki qeemat ki naqal o harkat par qiyaas karte hain. is ka matlab hai ke aap barhti hui aur girty hui mandiyon ki tijarat kar satke hain taakay taizi aur mandi ke dono terhan ke aspnng tops ke baad action le saken. aayiyae farz karen ke aap aston martin ke hasas ki qeemat ki pairwi kar rahay hain, jo ke tijarti din 442p par khilta hai. jaisay hi baichnay walay market mein daakhil hotay hain, hasas ki qeemat barhna shuru ho jati hai, jo 430p ki kam tareen satah par pahonch jati hai. khredar peechay hatna shuru kar dete hain, aur hasas ki qeemat 455p ki oonchai tak pahonch jati hai is se pehlay ke market set ho jaye aur hasas ki qeemat 445p par band ho jaye. aspnng taap candle stuck chart patteren aik aisi tashkeel hai jo is waqt hoti hai jab kisi asasay ki qeemat isi satah par khulti aur band hoti hai – yeh aaraam aur istehkaam ki alamat hai. aspnng taap patteren ki do mukhtalif halatain hain blush aspnng taap aur bearish aspnng taap aik ghoomnay wali taap candle stuck is waqt banti hai jab market oopar ki taraf aur neechay ki taraf aapshnz ko talaash kar layte hai lekin phir kam o besh isi qeemat par band hoti hai jo is ki ibtidayi qeemat par hoti hai. jab aap aspnng taap candle stuck chart patteren dekhte hain, to aap spread beats ya cfds jaisay mushtakqat ka istemaal kar ke tijarat kar satke hain. Mushtakqat ke sath, aap taweel ya mukhtasir ja satke hain kyunkay aap bunyadi asasa ke maalik nahi hain . -

#5 Collapse

- candle sticks price k ilawa or b bahut kuch btati hain jesa k trend k bary main support resistance k bary main or reversal k bary main bhi btati hain.

- esi silsly main aj hum aik important candle ko read karen gy jisy k spinning top candle stick kaha jata ha.

- dear members spinning top candle ki short real body hoti ha jo k opr or nechy shadow k drmyan hoti ha ye body bearish ya bullish ho skti ha.

- spinning top market main indecision ko zahir karti ha mtlb k buyer or sellers equal force main thy or market main koe faisla ni ho ska.

- Jb market opr hai to seller ny sell kia or opr ki trf wick ya shadow bn gya

- or jb market nechy gai to buyers ny buy kia jski waja se nechy se wick bn gai or darmyan main choti c body bni ha.

- agr ye pattern strong support ya resistance py bny or es se agli candle eski confirmation kar dy to ye trend reversal ka sign ho skta ha.

- Yeh candlestick pattern us time banta ha jab buyers aik given time k doran price ko down push kr deta ha. Liken closing price open k bht qareeb close hojati ha. Strong price mein izafa ya kami k baad, spinning top potential price reversal ka signals dy sakti ha. Spinning top above open k oper ya below close ho sakti ha. Liken dono prices hamesha aik dusry k qareeb hoti hein.

- Spinning top aik candlestick pattern ha jis ki short real body hoti ha jo long upper aur lower shadows k darmeyan hota ha. Is ki real body choti honi chaiye jo open aur close prices mein thora farq dekhata hai. Kyun k buyers aur sellers dono ny price ko agy barhaya liken usy maintain nae rakh saky. Pattern indecision ko show karta ha aur us k sath sath mazid sideways movement bhi ho sakti hai. Umeed ha k aj ka topic ap sab doston ko zarur samjh aye ga ta k ap trading k doran is candle ko pehchan saken aur us k baad he apni trade ko active karen ta k ap loss sy bach saken.

- es main hum dosri candle ki confirmation k bad buy ki trade lety hain or hmara stop loss spinning top candle k low k equal hota ha.

- Bearish reversal Spinning top candlestick

- Dear memebrs ye

- muqam py bnta ha. Resistance py aikspinning top candle banti ha bearish body k sth or eski confirmation k lye next bearish candle ko spinning top candle k low k nechy close hona chahye. Es k bad market ka trend reverse hota ha or market bearish move karti ha.

-

#6 Collapse

Spinning Top Chart Pattern: Candle design us time banta ha poke purchasers aik given time k doran cost ko down push kr deta ha. Compare shutting cost open k bht qareeb close hojati ha. Solid cost mein izafa ya kami k baad, turning top potential cost inversion ka signals dy sakti ha. Turning top above open k oper ya underneath close ho sakti ha. Compare dono costs hamesha aik dusry k qareeb hoti hein.Spinning top aik candle design ha jis ki short genuine body hoti ha jo long upper aur lower shadows k darmeyan hota ha. Is ki genuine body choti honi chaiye jo open aur close costs mein thora farq dekhata hai. Kyun k purchasers aur dealers dono ny cost ko agy barhaya compare usy keep up with nae rakh saky. Design hesitation ko show karta ha aur us k sath mazid sideways development bhi ho sakti hai. Umeed ha k aj ka subject ap sab doston ko zarur samjh affirmative ga ta k ap exchanging k doran is light ko pehchan saken aur us k baad he apni exchange ko dynamic karen Turning top light stuck patteren ko dekhte hain to tijarat karne ke kuch tareeqay hain. pehla ahem qadam signal ki tasdeeq karna hai. ziyada tar tajir takneeki asharion ka istemaal is baat ki tasdeeq ke liye karte hain ke woh kya samajte hain ke ghoomnay wala top flagging kar raha hai, kyunkay yeh isharay qeemat ke rujhanaat mein mazeed baseerat faraham kar satke hain. misaal ke pinnacle standard, agar aap ko lagta hai ke down prepared ke nichale hissay mein ghoomnay wala taap anay walay ulat jane ki nishandahi kar sakta hai, to aap stock accelators ka istemaal karte tint signal ki jaanch kar satke hain. yeh isharay qeemat ki naqal o harkat ka andaza laganay mein aap ki madad kar sakta hai kyunkay yeh aik makhsoos time period standard market ki raftaar aur raftaar ko zahir karta hai. agar anay walay ulat jane ki tasdeeq ho jati hai, to aap khareedna chahtay hain ( lamba jana ). poke aap ghumte shade taap light stuck patteren ko dekhte hain to tijarat karne ke liye, aap spread beats ya cfds jaisay mushtakqat istemaal kar saktay hain. Mushtakqat ke sath, aap bunyadi asason ki malkiat nahi letay, lekin un ki qeemat ki naqal o harkat standard qiyaas karte hain. Chart Candles Formation: Light plan us time banta ha punch buyers aik given time k doran cost ko down push kr deta ha. Analyze closing expense open k bht qareeb close hojati ha. Strong expense mein izafa ya kami k baad, turning top potential expense reversal ka signals dy sakti ha. Turning top above open k oper ya under close ho sakti ha. Look at dono costs hamesha aik dusry k qareeb hoti hein.Turning top aik flame plan ha jis ki short real body hoti ha jo long upper aur lower shadows k darmeyan hota ha. Is ki authentic body choti honi chaiye jo open aur close expenses mein thora farq dekhata hai. Kyun k buyers aur sellers dono ny cost ko agy barhaya contrast usy keep up and nae rakh saky. Plan vulnerability ko show karta ha aur us k sath mazid sideways advancement bhi ho sakti hai. Umeed ha k aj ka subject ap sab doston ko zarur samjh certifiable ga ta k ap trading k doran is candle ko pehchan saken aur us k baad he apni trade ko dynamic karen ta k ap incident sy bach saken.

Turning top light stuck patteren ko dekhte hain to tijarat karne ke kuch tareeqay hain. pehla ahem qadam signal ki tasdeeq karna hai. ziyada tar tajir takneeki asharion ka istemaal is baat ki tasdeeq ke liye karte hain ke woh kya samajte hain ke ghoomnay wala top flagging kar raha hai, kyunkay yeh isharay qeemat ke rujhanaat mein mazeed baseerat faraham kar satke hain. misaal ke pinnacle standard, agar aap ko lagta hai ke down prepared ke nichale hissay mein ghoomnay wala taap anay walay ulat jane ki nishandahi kar sakta hai, to aap stock accelators ka istemaal karte tint signal ki jaanch kar satke hain. yeh isharay qeemat ki naqal o harkat ka andaza laganay mein aap ki madad kar sakta hai kyunkay yeh aik makhsoos time period standard market ki raftaar aur raftaar ko zahir karta hai. agar anay walay ulat jane ki tasdeeq ho jati hai, to aap khareedna chahtay hain ( lamba jana ). poke aap ghumte shade taap light stuck patteren ko dekhte hain to tijarat karne ke liye, aap spread beats ya cfds jaisay mushtakqat istemaal kar saktay hain. Mushtakqat ke sath, aap bunyadi asason ki malkiat nahi letay, lekin un ki qeemat ki naqal o harkat standard qiyaas karte hain. Chart Candles Formation: Light plan us time banta ha punch buyers aik given time k doran cost ko down push kr deta ha. Analyze closing expense open k bht qareeb close hojati ha. Strong expense mein izafa ya kami k baad, turning top potential expense reversal ka signals dy sakti ha. Turning top above open k oper ya under close ho sakti ha. Look at dono costs hamesha aik dusry k qareeb hoti hein.Turning top aik flame plan ha jis ki short real body hoti ha jo long upper aur lower shadows k darmeyan hota ha. Is ki authentic body choti honi chaiye jo open aur close expenses mein thora farq dekhata hai. Kyun k buyers aur sellers dono ny cost ko agy barhaya contrast usy keep up and nae rakh saky. Plan vulnerability ko show karta ha aur us k sath mazid sideways advancement bhi ho sakti hai. Umeed ha k aj ka subject ap sab doston ko zarur samjh certifiable ga ta k ap trading k doran is candle ko pehchan saken aur us k baad he apni trade ko dynamic karen ta k ap incident sy bach saken.  People ye configuration pessimistic example k end chief help py banta ha or ye reversal ki nishani hota ha es k terrible market bullish ho jati ha.laikin es se phly eski insistence lazmi ha.eski certification ye ha k assistance muqam py phly turning top candle bny bullish body k sth or phr us k dreadful usi time span essential next fire turning top ki closing expense se opr close ho. turning top candle ki short veritable body hoti ha jo k opr or nechy shadow k drmyan hoti ha ye body negative ya bullish ho skti ha.turning top market major vulnerability ko zahir karti ha mtlb k buyer or vendors identical power head thy or market essential koe faisla ni ho ska.Jb market opr hai to merchant ny sell kia or opr ki trf wick ya shadow bn gyaor of course jb market nechy gai to buyers ny buy kia jski waja se nechy se wick bn gai or darmyan key choti c body bni ha. Chart Trading View: Trading achi jaa rahi ho ge.dear people trading karty hovy hmara hr waqt candles se taluq hota ha or mumble inko dkh kr cost read karty hain.ye candles cost k ilawa or b bahut kuch btati hain jesa k example k bary chief help resistance k bary major or reversal k bary essential bhi btati hain.esi silsly head aj mumble aik critical fire ko read karen gy jisy k turning top flame kaha jata ha.dosri light ki affirmation k awful purchase ki exchange lety hain or hmara stop misfortune turning top candle k low k equivalent hota ha.Bearish inversion design bullish pattern k end fundamental obstruction muqam py bnta ha. Obstruction py aikspinning top light banti ha negative body k sth or eski affirmation k lye next negative flame ko turning top candle k low k nechy close hona chahye.

People ye configuration pessimistic example k end chief help py banta ha or ye reversal ki nishani hota ha es k terrible market bullish ho jati ha.laikin es se phly eski insistence lazmi ha.eski certification ye ha k assistance muqam py phly turning top candle bny bullish body k sth or phr us k dreadful usi time span essential next fire turning top ki closing expense se opr close ho. turning top candle ki short veritable body hoti ha jo k opr or nechy shadow k drmyan hoti ha ye body negative ya bullish ho skti ha.turning top market major vulnerability ko zahir karti ha mtlb k buyer or vendors identical power head thy or market essential koe faisla ni ho ska.Jb market opr hai to merchant ny sell kia or opr ki trf wick ya shadow bn gyaor of course jb market nechy gai to buyers ny buy kia jski waja se nechy se wick bn gai or darmyan key choti c body bni ha. Chart Trading View: Trading achi jaa rahi ho ge.dear people trading karty hovy hmara hr waqt candles se taluq hota ha or mumble inko dkh kr cost read karty hain.ye candles cost k ilawa or b bahut kuch btati hain jesa k example k bary chief help resistance k bary major or reversal k bary essential bhi btati hain.esi silsly head aj mumble aik critical fire ko read karen gy jisy k turning top flame kaha jata ha.dosri light ki affirmation k awful purchase ki exchange lety hain or hmara stop misfortune turning top candle k low k equivalent hota ha.Bearish inversion design bullish pattern k end fundamental obstruction muqam py bnta ha. Obstruction py aikspinning top light banti ha negative body k sth or eski affirmation k lye next negative flame ko turning top candle k low k nechy close hona chahye.  Turning top flame ki short genuine body hoti ha jo k opr or nechy shadow k drmyan hoti ha ye body negative ya bullish ho skti ha.spinning top market fundamental hesitation ko zahir karti ha mtlb k purchaser or merchants equivalent power primary thy or market principal koe faisla ni ho ska.jab market opr hai to vender ny sell kia or opr ki trf wick ya shadow bn gyaor jb market nechy gai to purchasers ny purchase kia jski waja se nechy se wick bn gai or darmyan primary choti c body bni ha.trading karty hovy hmara hr waqt candles se taluq hota ha or murmur inko dkh kr cost read karty hain.ye candles cost k ilawa or b bahut kuch btati hain jesa k pattern k bary primary help obstruction k bary primary or inversion k bary principal bhi btati hain.esi silsly primary aj murmur aik significant light ko read karen gy jisy k turning top candle kaha jata ha.

Turning top flame ki short genuine body hoti ha jo k opr or nechy shadow k drmyan hoti ha ye body negative ya bullish ho skti ha.spinning top market fundamental hesitation ko zahir karti ha mtlb k purchaser or merchants equivalent power primary thy or market principal koe faisla ni ho ska.jab market opr hai to vender ny sell kia or opr ki trf wick ya shadow bn gyaor jb market nechy gai to purchasers ny purchase kia jski waja se nechy se wick bn gai or darmyan primary choti c body bni ha.trading karty hovy hmara hr waqt candles se taluq hota ha or murmur inko dkh kr cost read karty hain.ye candles cost k ilawa or b bahut kuch btati hain jesa k pattern k bary primary help obstruction k bary primary or inversion k bary principal bhi btati hain.esi silsly primary aj murmur aik significant light ko read karen gy jisy k turning top candle kaha jata ha.

-

#7 Collapse

spining taap jaisay maqbool candle stuck patteren maliyati mandiyon mein baqaidagi se dekhe jatay hain jin mein equity, ghair mulki currency, aur cripto currency shaamil hain. yeh apni makhsoos zahiri shakal ki badolat bahar khara hota hai, jis mein thora sa haqeeqi jism aur saaye ( vicks ) shaamil hotay hain jo khud jism se ounchay aur neechay hotay hain. jab qeemat ke chart par aspnng taap zahir hota hai, to yeh aksar kharidaron aur baichnay walon ke darmiyan market ki ghair yakeeni sorat e haal ko zahir karta hai . Small Real Body: trading period ki ibtidayi aur ikhtitami qeematon ke darmiyan farq ko aspnng taap ki choti asli body se zahir kya jata hai. is se koi farq nahi parta ke asli jism ka rang kya hai Ø› yeh taizi ( sabz ya safaid ) ya bearish ( surkh ya siyah ) ho sakta hai . Long Upper and Lower Shadows: aspnng taap ko is ke lambay oopar aur nichale saaye se pehchana jata hai, jisay VICKS ya tell bhi kaha jata hai. yeh saaye, jo asal body se lambay hain, zahir karte hain ke qeemat khilnay aur band honay ki satah se numaya tor par hatt gayi hai . Indecisiveness: market ki ghair mutawaqayat aur ibham aspnng taap se zahir hota hai. is ka matlab yeh hai ke nah to kharidaron aur nah hi baichnay walon ki qeematon ki naqal o harkat par mazbooti hai, jis ke nateejay mein dono fareeqon ke darmiyan Ù¹Ú¯ of waar hota hai jo kaafi had tak mutawazan hai . Reversal Signal: ghoomnay wala taap mumkina rujhan ke ulat jane ya neechay ke rujhan mein farokht ke dabao mein kami ka ishara day sakta hai. is ke bar aks, yeh mumkina rujhan ke ulat jane ya izafay ke douran kharidari ke muharrak mein kami ki nishandahi kar sakta hai . Continuation Signal: aik aspnng taap is baat ki nishandahi kar sakta hai ke mojooda rujhan ghair faisla kin waqt ke baad bhi jari rahay ga agar yeh consolidation marhalay ke douran ya side way market mein aata hai . Market Sentiment Indicator: spining taap market ke mizaaj ke baray mein baseerat angaiz maloomat paish karta hai. yeh aksar ahem khabron ke ajra ya barray waqeat se pehlay hota hai, jo market ke shurka ki be cheeni aur samajhdaari ki akkaasi karta hai . Trading Strategies Using the Spinning Top Candlestick: Confirmation Required: tijarti faislay karne ke liye sirf aspnng taap ka mushahida karna kaafi nahi ho sakta. mumkina ulat jane ya tasalsul ki tasdeeq karne ke liye, tajir aksar mustaqbil ki qeemat ki karwai se tasdeeq ka intzaar karte hain, jaisay taaqatwar taizi ya mandi ki mom batii . Combine with Support and Resistance: ird gird ke halaat ke baray mein sochen, jaisay aspnng taap ki ahem support aur muzahmati sthon se qurbat. muzahmat ke qareeb ghoomta sun-hwa taap mumkina kami ka mahswara day sakta hai, jabkay aik ahem support level par mumkina uuchaal ka mahswara day sakta hai . Use Indicators: aap aspnng taap patteren ki inhisaar ko barha satke hain aur market ki haalat ka mazeed jaiza le satke hain usay takneeki isharay jaisay moving everages, relativ strenth index ( rsi ) ya macd ke sath mila kar . yaad rakhen ke aspnng taap kaamil nahi hai, bilkul isi terhan jaisay tamam candle stuck patteren, aur yeh ke usay deegar takneeki aur bunyadi tajzia tools ke sath mil kar istemaal kya jana chahiye. mazeed bar-aan, khatray ka muaser tareeqay se intizam karna aur apni pozishnon ki hifazat ke liye stap loss orders ko istemaal karna zaroori hai agar market aap ki tawaqqa se mukhtalif tareeqay se bartao kere . -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#8 Collapse

Assalam alaikum Dear forum members!- umeed karta hun aap sb khairiat se hn gy or apki trading achi jaa rahi ho ge.

- dear members trading karty hovy hmara hr waqt candlesticks se taluq hota ha or hum inko dkh kr price read karty hain.

- ye candle sticks price k ilawa or b bahut kuch btati hain jesa k trend k bary main support resistance k bary main or reversal k bary main bhi btati hain.

- esi silsly main aj hum aik important candle ko read karen gy jisy k spinning top candle stick kaha jata hay.

- dear members spinning top candle ki short real body hoti ha jo k opr or nechy shadow k drmyan hoti ha ye body bearish ya bullish ho skti ha.

- spinning top market main indecision ko zahir karti ha mtlb k buyer or sellers equal force main thy or market main koe faisla ni ho ska.

- Jb market opr hai to seller ny sell kia or opr ki trf wick ya shadow bn gya

- or jb market nechy gai to buyers ny buy kia jski waja se nechy se wick bn gai or darmyan main choti c body bni ha.

- agr ye pattern strong support ya resistance py bny or es se agli candle eski confirmation kar dy to ye trend reversal ka sign ho skta hay.

- Yeh candlestick pattern us time banta ha jab buyers aik given time k doran price ko down push kr deta ha. Liken closing price open k bht qareeb close hojati ha. Strong price mein izafa ya kami k baad, spinning top potential price reversal ka signals dy sakti ha. Spinning top above open k oper ya below close ho sakti ha. Liken dono prices hamesha aik dusry k qareeb hoti hein.

- Spinning top aik candlestick pattern ha jis ki short real body hoti ha jo long upper aur lower shadows k darmeyan hota ha. Is ki real body choti honi chaiye jo open aur close prices mein thora farq dekhata hai. Kyun k buyers aur sellers dono ny price ko agy barhaya liken usy maintain nae rakh saky. Pattern indecision ko show karta ha aur us k sath sath mazid sideways movement bhi ho sakti hai. Umeed ha k aj ka topic ap sab doston ko zarur samjh aye ga ta k ap trading k doran is candle ko pehchan saken aur us k baad he apni trade ko active karen ta k ap loss sy bach saken.

- es main hum dosri candle ki confirmation k bad buy ki trade lety hain or hmara stop loss spinning top candle k low k equal hota ha.

- Bearish reversal Spinning top candlestick

- Dear memebrs ye pattern bullish trend k end main resistance muqam py bnta ha. Resistance py aikspinning top candle banti ha bearish body k sth or eski confirmation k lye next bearish candle ko spinning top candle k low k nechy close hona chahye. Es k bad market ka trend reverse hota ha or market bearish move karti ha.

- es main dosri candle k closing k bad hum sell ki trade lety hain or hmara stop loss spinning top candle k high k equal hota hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 01:15 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим