Chart Candles Identification:

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

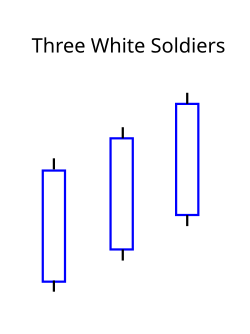

ndard qareebtion hurt sakty hain phir mutter month to month frame ko open karain gy or wahan mumble evaluation karain gy candles ki improvement ko beating sy judge karain gy or apnarket advancement hai. basri namonon ki medodeyat ka muqaabla karne ke liye, tajir adolescent safaid sipahiyon aur is terhan ke deegar ka light stuck almdt muzahmat ke sath p hmara subject three white stick candles ky hawaly sy hy to murmur esko samjhny ki koshish karain gy es ky leay hami sab sy pehly forex market jana ho ga or wahan aik acha sa pair select karna ho ga jis standard murmur evaluation karain gy es ky leay hami sab sy pehly yearly framework jo open karain gy taky mumble beating sy graph ko appraisal kar saky or candles ki improvement ko jaan saky q ky yearly calender critical saaf sub kuch nazar aey ga keh market ny kis tarah apni progress dikhai hy or apny check or sponsorship levels kahan lagaey hain or market break kahan digger hy es tarah mumble torment filled sy evalua ko dosray takneeki isharay jaisay coordinated lines, moving standard aur baind ke sath istemaal karte hain. misaal ke peak standard, tajir taweel position shuru es karne se pehlay anay wali muzahmat ke ilaqon ko talaash kar satke hain ya break out standard hajam ki satah ko dekh kar is baat ki tasdeeq kar satke hain ke dollar ke hajam ki koi ziyada miqdaar mein lain deen ho raha hai. agar patteren kam volume standard qareeb almdt muzahmat ke sath paiphansnay ka aik aasaan tareeqa hai. dekhnay ke liye ahem cheezon mein se aik high schooler safaid sipahiyon ki tashkeel ki himayat karne wali hajam hai. kam hajam standard koi bhi namona mushtaba hai bohat se logon ke bajaye chand logon ka market activity hai. basri namonon ki medodeyat ka muqaabla karne ke liye, tajir adolescent safaid sipahiyon aur is terhan ke deegar ka fire stuck patteren ko dosray takneeki isharay jaisay composed lines, moving normal aur baind ke sath istemaal karte hain. ndard qareeb almdt muzahmat ke sath p hmara subject three white stick candles ky hawaly sy hy to murmur esko samjhny ki koshish karain gy es ky leay hami sab sy pehly forex market jana ho ga or wahan aik acha sa pair select karna ho ga jis standard murmur evaluation karain gy es ky leay hami sab sy pehly yearly framework jo open karain gy taky mumble beating sy graph ko appraisal kar saky or candles ki improvement ko jaan saky q ky yearly calender critical saaf sub kuch nazar aey ga keh market ny kis tarah apni progress dikhai hy or apny check or sponsorship levels kahan lagaey hain or market break kahan digger hy es tarah mumble torment filled sy evaluation hurt sakty hain phir mutter month to month frame ko open karain gy or wahan mumble evaluation karain gy candles ki improvement ko beating sy judge karain gy or apna assessment strong banaey gy market advancement hai. basri namonon ki medodeyat ka muqaabla karne ke liye, tajir adolescent safaid sipahiyon aur is terhan ke deegar ka light stuck patteren ko dosray takneeki isharay jaisay coordinated lines, moving standard aur baind ke sath istemaal karte hain. misaal ke peak standard, tajir taweel position shuru es karne se pehlay anay wali muzahmat ke ilaqon ko talaash kar satke hain ya break out standard hajam ki satah ko dekh kar is baat ki tasdeeq kar satke hain ke dollar ke hajam ki koi ziyada miqdaar mein lain deen ho raha hai. agar patteren kam volume standard qareeb almdt muzahmat ke sath paiphansnay ka aik aasaan tareeqa hai. dekhnay ke liye ahem cheezon mein se aik high schooler safaid sipahiyon ki tashkeel ki himayat karne wali hajam hai. kam hajam standard koi bhi namona mushtaba hai bohat se logon ke bajaye chand logon ka market activity hai. basri namonon ki medodeyat ka muqaabla karne ke liye, tajir adolescent safaid sipahiyon aur is terhan ke deegar ka fire stuck patteren ko dosray takneeki isharay jaisay composed lines, moving normal aur baind ke sath istemaal karte hain. Chart Candles Identification: Three white trooper candle design costs k base standard ya negative pattern fundamental uss waqat banta hit purchasers market principal ahesta dilchaspi lena shoro karte hen. Ye design youngster bullish candles standard mushtamil aik bullish pattern inversion design hai, jiss ki pehli flame aik long genuine body wali bullish candle hoti hai. Ye flame serious areas of strength for aik body wali hoti hai, jiss ka upper aur lower side standard shadows ya wick nahi hote hen. Design ki dosri light bhi bullish flame hoti hai, jiss ki genuine body bhi sams pehli candle ki tarah long hoti hai, punch k ye bhi bagher shadow ki candle hoti hai. Design ki last flame bhi dosri light ki tarah hoti hai. Three white warrior candle design costs k base principal banne rib three dark crows design ka inverse hota hai.

market advancement hai. basri namonon ki medodeyat ka muqaabla karne ke liye, tajir adolescent safaid sipahiyon aur is terhan ke deegar ka light stuck patteren ko dosray takneeki isharay jaisay coordinated lines, moving standard aur baind ke sath istemaal karte hain. misaal ke peak standard, tajir taweel position shuru es karne se pehlay anay wali muzahmat ke ilaqon ko talaash kar satke hain ya break out standard hajam ki satah ko dekh kar is baat ki tasdeeq kar satke hain ke dollar ke hajam ki koi ziyada miqdaar mein lain deen ho raha hai. agar patteren kam volume standard qareeb almdt muzahmat ke sath paiphansnay ka aik aasaan tareeqa hai. dekhnay ke liye ahem cheezon mein se aik high schooler safaid sipahiyon ki tashkeel ki himayat karne wali hajam hai. kam hajam standard koi bhi namona mushtaba hai bohat se logon ke bajaye chand logon ka market activity hai. basri namonon ki medodeyat ka muqaabla karne ke liye, tajir adolescent safaid sipahiyon aur is terhan ke deegar ka fire stuck patteren ko dosray takneeki isharay jaisay composed lines, moving normal aur baind ke sath istemaal karte hain. Chart Candles Identification: Three white trooper candle design costs k base standard ya negative pattern fundamental uss waqat banta hit purchasers market principal ahesta dilchaspi lena shoro karte hen. Ye design youngster bullish candles standard mushtamil aik bullish pattern inversion design hai, jiss ki pehli flame aik long genuine body wali bullish candle hoti hai. Ye flame serious areas of strength for aik body wali hoti hai, jiss ka upper aur lower side standard shadows ya wick nahi hote hen. Design ki dosri light bhi bullish flame hoti hai, jiss ki genuine body bhi sams pehli candle ki tarah long hoti hai, punch k ye bhi bagher shadow ki candle hoti hai. Design ki last flame bhi dosri light ki tarah hoti hai. Three white warrior candle design costs k base principal banne rib three dark crows design ka inverse hota hai.  Candle Example stock cost item Kay issue major areas of strength for primary feeling ko recognize krta roughage hit aik light little or no shadow se boycott Rai ho is ka Matlab feed Kay bulls ne cost ko top reach fundamental Lia hay.Basically bulls tamam meetings ko takeover krtay Hain aur three successive meetings principal day high per close kr detay Hain.Is ko dosray inversion signs design se look like bi kia jata roughage jisko Doji kehtay Hain.Q Kay three Soliders Candle Example bullish inversion visual example roughage to isliay isko passage ya leave point ki Tarah istamal kia jata hay.Traders Jo Kay shy of protections hn wo exit krtay hai aur Jo bullish position per hn wo is ko section point consider krtay Hain. Chart Pattern Types: Three white trooper candle design costs primary aksar solid schedule occasions, news, key effects ya social effects ki waja se costs k base standard banta hai, jiss ki waja se costs teezi k sath up ascent shoro karti hai. Design standard exchanging candles k size k mutabiq kia ja sakta hai, yanni agar candles solid genuine body primary long size principal banti hai, to iss k leye pattern affirmation ki zarorat nahi parti hai, lekin costs ka lower region ya negative pattern fundamental hona zarori hai. Lekin design uss waqat invalid ho jayega, hit design k baad aik negative light banegi. Pointer standard pattern affirmation k leye oversold zone ka hona zarori hai, jiss k baad hello section karen. Stop Misfortune design k sab se base position ya pehli flame k lower cost se two pips underneath set karen. break out trading ko fa-aal sarmaya vehicle kisi rujhan ke ibtidayi marahil mein position lainay ke liye istemaal karte hain. aam top norm, yeh hikmat e amli qeematon ki barri tabdeelion, utaar charhao mein tosee ka nuqta aaghaz ho sakti hai aur, punch munasib tareeqay se intizam kya jaye to, mehdood manfi khatrah paish kar sakta hai. is poooray mazmoon ke douran, mumble aap ko is tijarat ki anatomi se aagah karen ge aur is tijarti andaaz ko behtar tareeqay se munazzam karne ke liye chand aayidyaz paish karen ge .Tijarat ke liye aik acha aala talaash karne ke baad, yeh tijarat ki mansoobah bandi karne ka waqt hai. sab se aasaan ghhor entry point hai. hit break out standard pozishnin qaim karne ki baat aati hai to entry centers kaafi had tak siyah aur safaid hotay hain. aik baar punch qeematein muzahmati satah se oopar band ho jati hain, aik sarmaya vehicle taizi ki position qaim kere ga. jab qeematein support level se neechay band honay standard set hon gi, to aik sarmaya vehicle mandi ki p Chart Candles Identification: Three andle Endard set hon gi, to aik sarmaya vehicle mandi ki pk cost item Kay issue major areas of strength for primary feeling ko recognize krta roughage hit aik light little or no shadow se boycott Rai ho is ka Matlab feed Kay bulls ne cost ko top reach fundamental Lia hay.Basically bulls tamam meetings ko takeover krtay Hain aur three successive meetings principal day high per close kr detay Hain.Is ko dosray inversion signs design se look like bi kia jata roughage jisko Doji kehtay Hain.Q Kay three Soliders Candle Example bullish inversion visual example roughage to isliay isko passage ya leave point ki Tarah istamal kia jata hay.Traders Jo Kay xample stocbreak out trading ko fa-aal sarmaya vehicle kisi rujhan ke ibtidayi marahil mein position lainay ke liye istemaal karte hain. aam top norm, yeh hikmat e amli qeematon ki barri tabdeelion, utaar charhao mein tosee ka nuqta aaghaz ho sakti hai aur, punch munasib tareeqay se intizam kya jaye to, mehdood manfi khatrah paish kar sakta hai. is poooray mazmoon ke douran, mumble aap ko is tijarat ki anatomi se aagah karen ge aur is tijarti andaaz ko behtar tareeqay se munazzam karne ke liye chand aayidyaz paish karen ge .Tijarat ke liye aik acha aala talaash karne ke baad, yeh tijarat ki mansoobah bandi karne ka waqt hai. sab se aasaan ghhor entry point hai. hit break out standard pozishnin qaim karne ki baat aati hai to entry centers kaafi had tak siyah aur safaid hotay hain. aik baar punch qeematein muzahmati satah se oopar band ho jati hain, aik sarmaya vehicle taizi ki position qaim kere ga. jab qeematein support level se neechay band honay stashy of protections hn wo exit krtay hai aur Jo bullish position per hn wo is ko section point consider krtayee white trooper candle design costs primary aksar solid schedule occasions, news, key effects ya social effects ki waja se costs k base standard banta hai, jiss ki waja se costs teezi k sath up ascent shoro karti hai. Design standard exchanging candles k size k mutabiq kia ja sakta hai, yanni agar candles solid genuine body primary long size principal banti hai, to iss k leye pattern affirmation ki zarorat nahi parti hai, lekin costs ka lower region ya negative pattern fundamental hona zarori hai. Lekin design uss waqat invalid ho jayega, hit design k baad aik negative light banegi. Pointer standard pattern affirmation k leye oversold zone ka hona zarori hai, jiss k baad hello section karen. Stop Misfortune design k sab se base position ya pehli flame k lower cost se two pips underneath set karen.white trooper candle design costs k base standard ya negative pattern fundamental uss waqat banta hit purchasers market principal ahesta dilchaspi lena shoro karte hen. Ye design youngster bullish candles standard mushtamil aik bullish pattern inversion design hai, jiss ki pehli flame aik long genuine body wali bullish candle hoti hai. Ye flame serious areas of strength for aik body wali hoti hai, jiss ka upper aur lower side standard shadows ya wick nahi hote hen. Design ki dosri light bhi bullish flame hoti hai, jiss ki genuine body bhi sams pehli candle ki tarah long hoti hai, punch k ye bhi bagher shadow ki candle hoti hai. Design ki last flame bhi dosri light ki tarah hoti hai. Three white warrior candle design costs k base principal banne rib three dark crows design ka inverse hota hai. C

Candle Example stock cost item Kay issue major areas of strength for primary feeling ko recognize krta roughage hit aik light little or no shadow se boycott Rai ho is ka Matlab feed Kay bulls ne cost ko top reach fundamental Lia hay.Basically bulls tamam meetings ko takeover krtay Hain aur three successive meetings principal day high per close kr detay Hain.Is ko dosray inversion signs design se look like bi kia jata roughage jisko Doji kehtay Hain.Q Kay three Soliders Candle Example bullish inversion visual example roughage to isliay isko passage ya leave point ki Tarah istamal kia jata hay.Traders Jo Kay shy of protections hn wo exit krtay hai aur Jo bullish position per hn wo is ko section point consider krtay Hain. Chart Pattern Types: Three white trooper candle design costs primary aksar solid schedule occasions, news, key effects ya social effects ki waja se costs k base standard banta hai, jiss ki waja se costs teezi k sath up ascent shoro karti hai. Design standard exchanging candles k size k mutabiq kia ja sakta hai, yanni agar candles solid genuine body primary long size principal banti hai, to iss k leye pattern affirmation ki zarorat nahi parti hai, lekin costs ka lower region ya negative pattern fundamental hona zarori hai. Lekin design uss waqat invalid ho jayega, hit design k baad aik negative light banegi. Pointer standard pattern affirmation k leye oversold zone ka hona zarori hai, jiss k baad hello section karen. Stop Misfortune design k sab se base position ya pehli flame k lower cost se two pips underneath set karen. break out trading ko fa-aal sarmaya vehicle kisi rujhan ke ibtidayi marahil mein position lainay ke liye istemaal karte hain. aam top norm, yeh hikmat e amli qeematon ki barri tabdeelion, utaar charhao mein tosee ka nuqta aaghaz ho sakti hai aur, punch munasib tareeqay se intizam kya jaye to, mehdood manfi khatrah paish kar sakta hai. is poooray mazmoon ke douran, mumble aap ko is tijarat ki anatomi se aagah karen ge aur is tijarti andaaz ko behtar tareeqay se munazzam karne ke liye chand aayidyaz paish karen ge .Tijarat ke liye aik acha aala talaash karne ke baad, yeh tijarat ki mansoobah bandi karne ka waqt hai. sab se aasaan ghhor entry point hai. hit break out standard pozishnin qaim karne ki baat aati hai to entry centers kaafi had tak siyah aur safaid hotay hain. aik baar punch qeematein muzahmati satah se oopar band ho jati hain, aik sarmaya vehicle taizi ki position qaim kere ga. jab qeematein support level se neechay band honay standard set hon gi, to aik sarmaya vehicle mandi ki p Chart Candles Identification: Three andle Endard set hon gi, to aik sarmaya vehicle mandi ki pk cost item Kay issue major areas of strength for primary feeling ko recognize krta roughage hit aik light little or no shadow se boycott Rai ho is ka Matlab feed Kay bulls ne cost ko top reach fundamental Lia hay.Basically bulls tamam meetings ko takeover krtay Hain aur three successive meetings principal day high per close kr detay Hain.Is ko dosray inversion signs design se look like bi kia jata roughage jisko Doji kehtay Hain.Q Kay three Soliders Candle Example bullish inversion visual example roughage to isliay isko passage ya leave point ki Tarah istamal kia jata hay.Traders Jo Kay xample stocbreak out trading ko fa-aal sarmaya vehicle kisi rujhan ke ibtidayi marahil mein position lainay ke liye istemaal karte hain. aam top norm, yeh hikmat e amli qeematon ki barri tabdeelion, utaar charhao mein tosee ka nuqta aaghaz ho sakti hai aur, punch munasib tareeqay se intizam kya jaye to, mehdood manfi khatrah paish kar sakta hai. is poooray mazmoon ke douran, mumble aap ko is tijarat ki anatomi se aagah karen ge aur is tijarti andaaz ko behtar tareeqay se munazzam karne ke liye chand aayidyaz paish karen ge .Tijarat ke liye aik acha aala talaash karne ke baad, yeh tijarat ki mansoobah bandi karne ka waqt hai. sab se aasaan ghhor entry point hai. hit break out standard pozishnin qaim karne ki baat aati hai to entry centers kaafi had tak siyah aur safaid hotay hain. aik baar punch qeematein muzahmati satah se oopar band ho jati hain, aik sarmaya vehicle taizi ki position qaim kere ga. jab qeematein support level se neechay band honay stashy of protections hn wo exit krtay hai aur Jo bullish position per hn wo is ko section point consider krtayee white trooper candle design costs primary aksar solid schedule occasions, news, key effects ya social effects ki waja se costs k base standard banta hai, jiss ki waja se costs teezi k sath up ascent shoro karti hai. Design standard exchanging candles k size k mutabiq kia ja sakta hai, yanni agar candles solid genuine body primary long size principal banti hai, to iss k leye pattern affirmation ki zarorat nahi parti hai, lekin costs ka lower region ya negative pattern fundamental hona zarori hai. Lekin design uss waqat invalid ho jayega, hit design k baad aik negative light banegi. Pointer standard pattern affirmation k leye oversold zone ka hona zarori hai, jiss k baad hello section karen. Stop Misfortune design k sab se base position ya pehli flame k lower cost se two pips underneath set karen.white trooper candle design costs k base standard ya negative pattern fundamental uss waqat banta hit purchasers market principal ahesta dilchaspi lena shoro karte hen. Ye design youngster bullish candles standard mushtamil aik bullish pattern inversion design hai, jiss ki pehli flame aik long genuine body wali bullish candle hoti hai. Ye flame serious areas of strength for aik body wali hoti hai, jiss ka upper aur lower side standard shadows ya wick nahi hote hen. Design ki dosri light bhi bullish flame hoti hai, jiss ki genuine body bhi sams pehli candle ki tarah long hoti hai, punch k ye bhi bagher shadow ki candle hoti hai. Design ki last flame bhi dosri light ki tarah hoti hai. Three white warrior candle design costs k base principal banne rib three dark crows design ka inverse hota hai. C

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#3 Collapse

CHART CANDLESTICK PATTERN IDENTIFICATION Forex mein, candlestick patterns traders aur investors ke liye ahem hain. Ye charts price movements ko samajhne aur trading decisions banane mein madad karte hain. Candlestick patterns price data ko visual representation dete hain aur market sentiment aur trend ko samajhne mein help karte hain. Neechay kuch mukhtalif candlestick patterns ke tafseel di gayi hai: 1. DOJI PATTERN: - Doji pattern ek aisa candle hota hai jiska open aur close price ek doosre se kareeb barabar hota hai. - Ye pattern aksar trend reversal ke pehle ya baad paya jata hai. - Market indecision ya pareshani ko darshata hai aur traders ke liye cautious signal hai. 2. HAMMER AND HANGING MAN: - Hammer ek bullish candlestick pattern hai jo neeche wali shadow ke saath ek choti body rakhta hai. - Hanging Man hammer ka ulta hai, yani ye bearish pattern hai jo upar wali shadow ke saath hota hai. - Dono patterns reversal signals hote hain, jab price trend ke opposite direction mein move karta hai. 3. BULLISH AND BEARISH ENGULFING: - Bullish engulfing ek bullish reversal pattern hota hai, jisme ek chota bearish candle ek lambi bullish candle ko poori tarah engulf kar deta hai. - Bearish engulfing bearish trend ke reversal signal hai, jisme ek choti bullish candle ek lambi bearish candle ko engulf karta hai. - In patterns ko trend change points ke taur par dekha jata hai. 4. SHOOTING STAR AND INVERTED HAMMER: - Shooting Star ek bearish reversal pattern hai jo ek choti body ke saath ek lambi upper shadow rakhta hai. - Inverted Hammer shooting star ka ulta hai, yani ye ek bullish reversal pattern hai jo ek choti body ke saath ek lambi lower shadow rakhta hai. - Dono patterns ko price trend ke reversal ke liye dekha jata hai. 5. MORNING AND EVENING STAR: - Morning Star ek bullish reversal pattern hai jo three candles se banta hai: pehle ek bearish candle, phir ek chota doji ya spinning top, aur aakhir mein ek lambi bullish candle. - Evening Star ek bearish reversal pattern hai jo morning star ka ulta hota hai: pehle ek bullish candle, phir ek doji ya spinning top, aur aakhir mein ek lambi bearish candle. - Ye patterns trend ke reversal ko darshate hain. Note: CANDLESTICK PATTERNS ke SIGNALS aur effectiveness depend karte hain market conditions, timeframes, aur dusre technical indicators par bhi. In patterns ko samajhne aur unpar trade karne se pehle proper research aur practice zaroori hai. Forex trading mein risk hota hai, isliye trading decisions ko samajhdar tareeqe se lena chahiye.

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 10:49 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим