Engulfing candlestick pattern in Forex Trading?

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

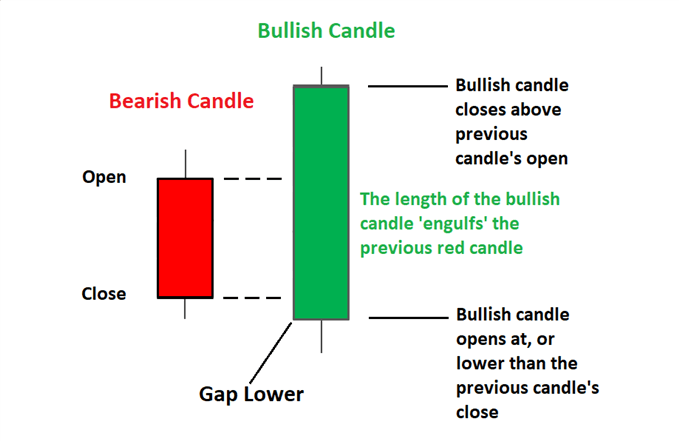

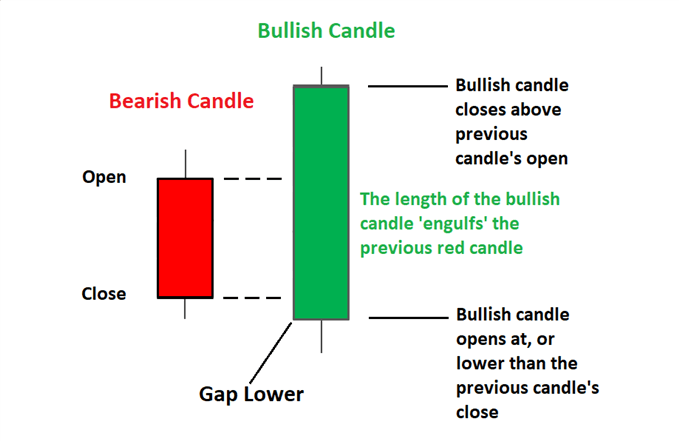

Assalamualaikum aj is thread me apko me Pakistan forex trading ke ak bhot he important topic engulfing candlestick pattern ki importance ke bare me btao Ga or me umeed karta ho ke jo information me apse share Karo ga wo apke knowledge or experience me zaror izafa Kare ge. Definition Engulfing candlestick pattern market mein mojooda rujhan ke ulat jane ka ishara deta hai. is makhsoos namoonay mein do mom batian shaamil hoti hain jin mein baad wali mom batii is ke samnay mom batii ke poooray jism ko engulfing karti hai. Engulfing candle is baat par munhasir ho sakti hai ke yeh mojooda rujhan ke hawalay se kahan banti hai. neechay di gayi tasweer taizi se lipti hui mom batii ko paish kar rahi hai . Key Takeaways Bullish engulfing patteren aik candle stuck patteren hai jo is waqt bantaa hai jab aglay din aik choti si kaali candle stuck ke baad aik barri safaid mom batii chalti hai, jis ka body mukammal tor par pichlle din ki candle stick ke jism ko lapait layte hai. jo taizi se lapaitnay ka namona banata hai balkay is se pehlay wali mom btyon tak bhi . Understanding Bullish engulfing patteren do candle reversal patteren hai. doosri mom batii ponch ke saaye ki lambai ki parwah kiye baghair, pehli mom batii ke asal jism ko mukammal tor par' engulfing' kar deti hai. yeh patteren neechay ke rujhan mein zahir hota hai aur aik gehri mom batii ka majmoa hai jis ke baad aik barri khokhli mom batii aati hai. patteren ke dosray din, qeemat pichli kam se kam khulti hai, phir bhi kharidari ka dabao qeemat ko pichli bulandi se buland satah tak le jata hai, jis ka nateeja kharidaron ke liye aik wazeh jeet hai . -

#3 Collapse

Assalamu Alaikum Dosto!

Engulfing Candlestick Pattern

Engulfing candlestick pattern ek aham technical analysis tool hai jo forex aur stock markets mein price reversals ya trend changes ko detect karne ke liye istemal hota hai. Is pattern ko samjhna market analysis ka ahem hissa hai. Engulfing Candlestick Pattern ek reversal pattern hai jo bearish ya bullish ho sakta hai, is par depend karta hai ke yeh kis trend ke end par nazr aata hai. Yeh do candles se banta hai, jahan pehle candle ka jism doosre candle ke jism se "engulf" hota hai. Engulfing pattern traders ko market mein dakhil hone ka ek tareeqa faraham karta hai umeed hai ke ek mumkinah trend reversal ho.

Engulfing pattern ek reversal candlestick pattern hai jo context par bearish ya bullish ho sakta hai.

Yeh traders ko market mein dakhil hone ka signal deta hai umeed hai ke ek mumkinah trend reversal ho.

Bullish engulfing pattern ek potential uptrend ke liye strong signal hai, jabke bearish engulfing pattern ek potential downtrend ke liye strong signal hai.

Traders ko pattern ke banne ke baad move ka tasdeeq ka intezar karna chahiye taa ke trend reversal barqarar rahe.

Candlestick ke Length ki Ahmiyat

Ek bullish aur bearish engulfing candlestick pattern mein wick ki lambaai ki ahmiyat uske andar price action aur buyers aur sellers ke darmiyan larei ke baray mein maloomat faraham karti hai jo trading session ke doran hoti hai. Yahan wick ki lambaai ke kis tarah se in patterns mein ahmiyat hai:- Bullish Engulfing Candlestick Pattern:

Ek bullish engulfing pattern mein, pehle candle par lambi lower wick ke baad doosre candle par kisi short ya na honay wali lower wick ka mojood hona zyada buying pressure ko darust karta hai.

Pehle candle par lambi lower wick yeh darust karta hai ke sellers ne price ko neeche dhakelne ki koshish ki lekin nakam rahe, jo ke sentiment mein reversal ko le kar aya.

Doosre candle par kisi lower wick ka na hona ya phir short lower wick ka mojood hona darust karta hai ke buyers poori session mein qaboo mein rahe aur price ko oopar le gaye, peechle candle ko engulf karke. - Bearish Engulfing Candlestick Pattern:

Ek bearish engulfing pattern mein, pehle candle par lambi upper wick ke baad doosre candle par kisi short ya na honay wali upper wick ka mojood hona zyada selling pressure ko darust karta hai.

Pehle candle par lambi upper wick yeh darust karta hai ke buyers ne price ko oopar dhakelne ki koshish ki lekin nakam rahe, jo ke sentiment mein reversal ko le kar aya.

Doosre candle par kisi upper wick ka na hona ya phir short upper wick ka mojood hona darust karta hai ke sellers poori session mein qaboo mein rahe aur price ko neeche le gaye, peechle candle ko engulf karke.

Wick ki lambaai ek bullish ya bearish engulfing candlestick pattern mein buyers aur sellers ke darmiyan larei, reversal signal ki taqat aur pattern ke baad price movement ke potential direction ke baray mein maloomat faraham karti hai. Traders aksar wick ki lambaai ko doosri factors ke sath milakar istemal karte hain taake engulfing patterns par adharit soch samajh kar trading decisions le sakein.

Bullish 1st and 2nd Candle:

- First Candle (Bearish): Engulfing pattern ka process start hota hai jab pehli candle ek bearish candle hoti hai. Iska matlab hai ke is candle mein market mein selling pressure hai aur price down jata hai. Pehli candle ki high aur low levels important hoti hain.

- Second Candle (Bullish): Engulfing pattern ki doosri candle ek bullish candle hoti hai, jo ke pehli candle ki high aur low levels ko engulf karti hai. Yani ke is candle mein buyers control mein aate hain aur price up jata hai. Is candle ki high aur low levels pehli candle ki high aur low levels ke bahar hone chahiye.

Bearish 1st and 2nd Candle:

- First Candle (Bullish): Agar bearish trend ke beech mein engulfing pattern form hota hai, to pehli candle ek bullish candle hoti hai. Iska matlab hai ke is candle mein market mein buying pressure hai aur price up jata hai. Pehli candle ki high aur low levels important hoti hain.

- Second Candle (Bearish): Engulfing pattern ki doosri candle ek bearish candle hoti hai, jo ke pehli candle ki high aur low levels ko engulf karti hai. Yani ke is candle mein sellers control mein aate hain aur price down jata hai. Is candle ki high aur low levels pehli candle ki high aur low levels ke bahar hone chahiye.

Explaination

Engulfing pattern ka explanation yeh hai ke doosri candle pehli candle ko puri tarah se engulf karti hai, jaise ke use swallow kar leti hai. Agar bullish engulfing pattern hai, to yeh bullish reversal signal provide karta hai, aur traders ko yeh indication deta hai ke bearish trend khatam ho sakta hai aur bullish trend shuru ho sakta hai. Agar bearish engulfing pattern hai, to yeh bearish reversal signal provide karta hai, aur traders ko yeh indication deta hai ke bullish trend khatam ho sakta hai aur bearish trend shuru ho sakta hai.

Comparison with Other Candlestick Patterns

Engulfing Candlestick Pattern aur doosre candlestick patterns ke darmiyan tafreeq aur mawazna karte hain:- Engulfing Candlestick Pattern vs. Hammer Pattern:

Engulfing pattern ek reversal pattern hai jo bearish ya bullish ho sakta hai, jabke hammer pattern sirf bullish reversal ke liye hota hai.

Engulfing pattern mein do candles hoti hain, jabke hammer pattern mein sirf ek candle hoti hai.

Engulfing pattern mein pehli candle ki body doosri candle ki body ko "engulf" karti hai, jabke hammer pattern mein pehli candle ka chhota body aur lamba lower wick hota hai. - Engulfing Candlestick Pattern vs. Doji Pattern:

Engulfing pattern ek strong reversal signal hai, jabke doji pattern ek indecision ya reversal signal ho sakta hai.

Engulfing pattern mein do candles hoti hain, jabke doji pattern mein sirf ek candle hoti hai jiska body almost nonexistent hota hai.

Engulfing pattern mein pehli candle ka body doosri candle ko puri tarah se cover karta hai, jabke doji pattern mein body bilkul choti hoti hai aur wick lambi hoti hai. - Engulfing Candlestick Pattern vs. Harami Pattern:

Engulfing pattern mein do candles hoti hain, jabke harami pattern mein sirf do candles hote hain.

Engulfing pattern mein pehli candle ki body doosri candle ki body ko poora engulf karti hai, jabke harami pattern mein doosri candle pehli candle ki body mein contain hoti hai.

Engulfing pattern ko usually strong reversal signal ke liye dekha jata hai, jabke harami pattern ko indecision ya potential reversal ke liye dekha jata hai.

In tafreeqat aur mawaznaat se zahir hota hai ke har candlestick pattern apne apne maqasid aur ahmiyat ke sath mukhtalif hota hai. Traders ko in patterns ko samajh kar aur unke context ko madde nazar rakhte hue trading decisions lena chahiye.

Trading

Engulfing pattern ko samjhne aur trading par istemal karne ke liye niche di gayi tafseelat ka palan karein:

- Pattern Recognition: Pehle to traders ko engulfing pattern ko recognize karna hota hai. Iske liye traders ko price charts par dhyan dena hota hai aur do consecutive candlesticks mein pattern ki pehchan karni hoti hai.

- Confirmation: Engulfing pattern ko confirm karne ke liye doosre technical indicators aur price patterns ka bhi analysis kiya jata hai. Confirmatory signals ke bina trading nahi karni chahiye.

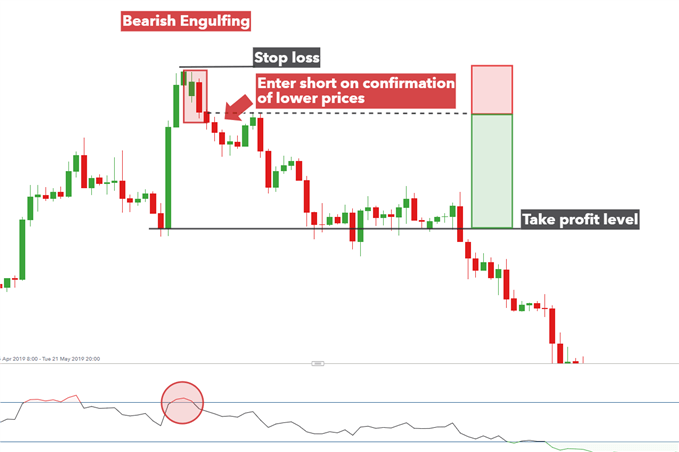

- Entry Point: Jab engulfing pattern confirm ho jata hai, tab traders entry point tay karte hain. Agar bullish engulfing pattern hai, to traders long position lete hain, aur agar bearish engulfing pattern hai, to traders short position lete hain.

- Stop-Loss Aur Take-Profit Orders: Risk management ke liye stop-loss aur take-profit orders set kiye jate hain. Stop-loss order nuksan se bachane mein madadgar hota hai, jabki take-profit order munafa haasil karne mein madadgar hota hai.

- Risk Management: Trading ke dauraan risk management ka dhyan rakhna zaroori hai. Position size ko manage karna aur risk tolerance ke hisab se trading karna chahiye.

- Market Analysis: Engulfing pattern ke sath-sath market analysis bhi karni chahiye. Market trend aur overall market conditions ko samajhna important hai.

- Education: Engulfing pattern aur trading strategies ko samjhne ke liye educational resources ka istemal karna chahiye. Books, online courses, aur expert opinions se traders apne knowledge ko enhance kar sakte hain.

Engulfing candlestick pattern ek powerful tool hai trend reversals ko identify karne ke liye, lekin isse trading decisions lene se pehle thorough analysis ki zaroorat hoti hai. Risk management aur education bhi trading success ke liye ahem hote hain.

- Bullish Engulfing Candlestick Pattern:

-

#4 Collapse

Engulfing Candlestick Pattern

Engulfing Candlestick Pattern ek popular reversal pattern hai jo typically trend ke reversal ko indicate karta hai. Is pattern mein ek candlestick dusre candlestick ko "engulfs" karta hai, yaani ki pehle candlestick ka range dusre candlestick ke range ke andar hota hai.

Engulfing Candlestick Pattern do tarah ke hote hain:- Bullish Engulfing Pattern: Bullish Engulfing pattern downtrend ke baad dikhai deta hai aur bullish reversal ko indicate karta hai. Is pattern mein pehla candlestick bearish (downward) hota hai aur doosra candlestick larger bullish (upward) hota hai, jiske range mein pehle candlestick completely engulf ho jata hai.

- Pehla candlestick typically small real body ke saath hota hai.

- Doosra candlestick ka real body pehle candlestick ke real body ko engulf karta hai aur typically large hota hai.

- Bullish Engulfing pattern ko confirm karne ke liye traders volume ki bhi confirmation dekhte hain. Agar doosra candlestick pehle candlestick se zyada volume ke saath form hota hai, toh ye pattern ka reliability increase hota hai.

- Bearish Engulfing Pattern: Bearish Engulfing pattern uptrend ke baad dikhai deta hai aur bearish reversal ko indicate karta hai. Is pattern mein pehla candlestick bullish (upward) hota hai aur doosra candlestick larger bearish (downward) hota hai, jiske range mein pehle candlestick completely engulf ho jata hai.

- Pehla candlestick ka real body typically small hota hai.

- Doosra candlestick ka real body pehle candlestick ke real body ko engulf karta hai aur typically large hota hai.

- Bearish Engulfing pattern ko confirm karne ke liye traders volume ki bhi confirmation dekhte hain. Agar doosra candlestick pehle candlestick se zyada volume ke saath form hota hai, toh ye pattern ka reliability increase hota hai.

Treading Strategy

Engulfing Candlestick Pattern market mein reversal ka strong signal provide karta hai, lekin hamesha yaad rahe ki kisi bhi pattern ko confirm karne se pehle thorough analysis aur risk management ki zarurat hoti hai. Market conditions vary karte rehte hain aur false signals bhi ho sakte hain, isliye trading decisions lene se pehle dhyan se analysis karein.

- Bullish Engulfing Pattern: Bullish Engulfing pattern downtrend ke baad dikhai deta hai aur bullish reversal ko indicate karta hai. Is pattern mein pehla candlestick bearish (downward) hota hai aur doosra candlestick larger bullish (upward) hota hai, jiske range mein pehle candlestick completely engulf ho jata hai.

-

#5 Collapse

Engulfing candlestick pattern forex trading mein aik ahem pattern hai jo price action analysis ka hissa hai. Ye pattern typically reversal signals provide karta hai jab market trend change hone ka indication hota hai.

Engulfing pattern mein do candlesticks shamil hotay hain:

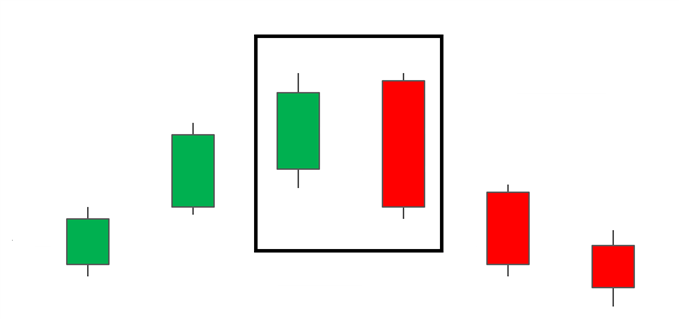

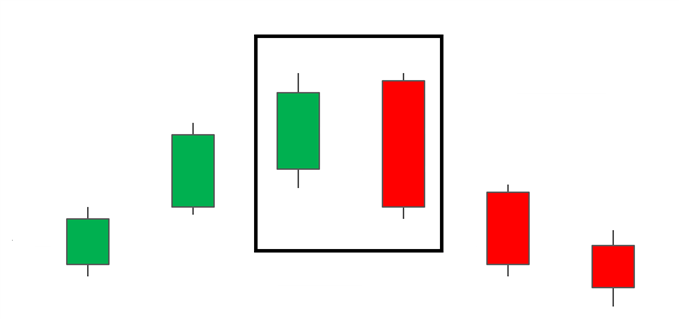

Bearish Engulfing Pattern (Ghatta Shamil Hone Wala Pattern):

Ye pattern uptrend ya sideways trend ke baad aata hai. Pehla candlestick chhota hota hai aur bullish hota hai (price up). Dusra candlestick pehle candle ko poora cover karta hai aur bearish hota hai (price down). Yeh bearish candlestick pehle bullish candlestick ko engulf karta hai, isliye isay "engulfing" pattern kaha jata hai.

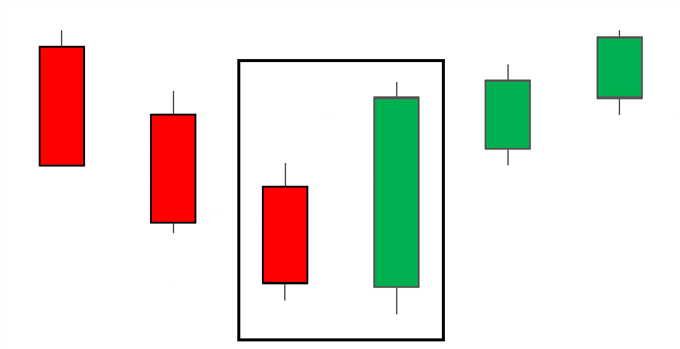

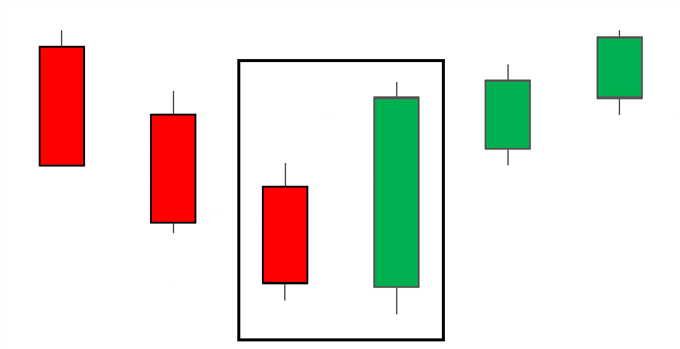

Bullish Engulfing Pattern (Ghatta Shamil Hone Wala Pattern):

Ye pattern downtrend ya sideways trend ke baad aata hai. Pehla candlestick chhota hota hai aur bearish hota hai (price down). Dusra candlestick pehle candle ko poora cover karta hai aur bullish hota hai (price up). Yeh bullish candlestick pehle bearish candlestick ko engulf karta hai. Engulfing pattern ko identify karne ke liye yeh points dekhein: Pehla candlestick ka range ya body chhota hona chahiye. Dusra candlestick ka range ya body pehle wale candlestick ko cover karna chahiye. Volume ke sath confirm karein. Jab engulfing pattern confirm ho, traders isay entry aur exit points ke liye istemal karte hain. Agar bearish engulfing pattern milta hai, toh traders selling ki taraf jate hain. Aur agar bullish engulfing pattern milta hai, toh traders buying ki taraf jate hain. Lekin hamesha, is pattern ko dusri technical analysis tools aur risk management ke sath istemal karna zaroori hai.

-

#6 Collapse

Engulfing candlestick pattern in Forex Trading?

Forex Trading mein engulfing candlestick pattern ek ahem trading signal hai jo traders ko market ke reversals ka pata lagane mein madad karta hai. Ye pattern do mumtaz candlesticks se bana hota hai, ek choti candle aur dusra bara candle, jismein bara candle choti candle ko poora cover karta hai. Jab ye pattern market chart par dekha jata hai, to iska matlab hota hai ke market mein trend ki mukhalif raftar aa sakti hai.

Engulfing pattern ko samajhna bohot aasan hai. Jab ek bullish engulfing pattern hota hai, to pehli choti candle bearish hoti hai, matlab ke price gir rahi hai. Dusri bara candle ise poori tarah se cover kar leti hai aur bullish direction mein close hoti hai. Iska matlab hota hai ke buyers control lena shuru kar rahe hain aur market mein bullish momentum barh rahi hai.

Umeed hai ke yeh samajhna aasan hoga ke kyun ye pattern itna ahem hai Forex Trading mein. Iski wajah se traders ko ek signal milta hai ke market ka trend badalne wala hai, aur woh apni trading strategy ke mutabiq positions adjust kar sakte hain. Lekin, hamesha yaad rakhein ke sirf engulfing pattern par bharosa na karein, dusri technical analysis tools aur risk management ke saath mila kar hi trading karein.

Ikhtitami tor par, engulfing candlestick patterns forex traders ke liye ahem asaasiyon mein se ek hain takay wo potential reversals ya price trends mein mazeed jaari rakh sakein. In patterns ko samajh kar aur market ke dynamics ke behtar context mein sahi taur par istemal karke, traders apne trading decisions ko behtar bana sakte hain aur apni kul munafa ko behtar bana sakte hain.

- CL

- Mentions 0

-

سا0 like

-

#7 Collapse

Engulfing candlestick pattern forex trading mein aik ahem pattern hai jo price action analysis ka hissa hai. Ye pattern typically reversal signals provide karta hai jab market trend change hone ka indication hota hai.

Engulfing pattern mein do candlestick pattern s shamil hotay hain:

Bearish Engulfing Pattern (Ghatta Shamil Hone Wala Pattern):

Ye pattern uptrend ya sideways trend ke baad aata hai. Pehla candlestick pattern chhota hota hai aur bullish hota hai (price up). Dusra candlestick pattern pehle candle ko poora cover karta hai aur bearish hota hai (price down). Yeh bearish candlestick pattern pehle bullish candlestick pattern ko engulf karta hai, isliye isay "engulfing" pattern kaha jata hai.

Bullish Engulfing Pattern (Ghatta Shamil Hone Wala Pattern):

Asal mein ye pattern downtrend ya sideways trend ke baad aata hai. Pehla candlestick pattern chhota hota hai aur bearish hota hai (price down). Dusra candlestick pattern pehle candle ko poora cover karta hai aur bullish hota hai (price up). Yeh bullish candlestick pattern pehle bearish candlestick pattern ko engulf karta hai. Engulfing pattern ko identify karne ke liye yeh points dekhein: Pehla candlestick pattern ka range ya body chhota hona chahiye. Dusra candlestick pattern ka range ya body pehle wale candlestick pattern ko cover karna chahiye. Volume ke sath confirm karein. Jab engulfing pattern confirm ho, traders isay entry aur exit points ke liye istemal karte hain. Agar bearish engulfing pattern milta hai, toh traders selling ki taraf jate hain. Aur agar bullish engulfing pattern milta hai, toh traders buying ki taraf jate hain. Lekin hamesha, is pattern ko dusri technical analysis tools aur risk management ke sath istemal karna zaroori ha

-

#8 Collapse

Engulfing Candlestick Pattern

Engulfing Candlestick Pattern ek popular reversal pattern hai jo typically trend ke reversal ko indicate karta hai. Is pattern mein ek candlestick dusre candlestick ko "engulfs" karta hai, yaani ki pehle candlestick ka range dusre candlestick ke range ke andar hota hai.

Engulfing Candlestick Pattern do tarah ke hote hain:- Bullish Engulfing Pattern: Bullish Engulfing pattern downtrend ke baad dikhai deta hai aur bullish reversal ko indicate karta hai. Is pattern mein pehla candlestick bearish (downward) hota hai aur doosra candlestick larger bullish (upward) hota hai, jiske range mein pehle candlestick completely engulf ho jata hai.

- Pehla candlestick typically small real body ke saath hota hai.

- Doosra candlestick ka real body pehle candlestick ke real body ko engulf karta hai aur typically large hota hai.

- Bullish Engulfing pattern ko confirm karne ke liye traders volume ki bhi confirmation dekhte hain. Agar doosra candlestick pehle candlestick se zyada volume ke saath form hota hai, toh ye pattern ka reliability increase hota hai.

- Bearish Engulfing Pattern: Bearish Engulfing pattern uptrend ke baad dikhai deta hai aur bearish reversal ko indicate karta hai. Is pattern mein pehla candlestick bullish (upward) hota hai aur doosra candlestick larger bearish (downward) hota hai, jiske range mein pehle candlestick completely engulf ho jata hai.

- Pehla candlestick ka real body typically small hota hai.

- Doosra candlestick ka real body pehle candlestick ke real body ko engulf karta hai aur typically large hota hai.

- Bearish Engulfing pattern ko confirm karne ke liye traders volume ki bhi confirmation dekhte hain. Agar doosra candlestick pehle candlestick se zyada volume ke saath form hota hai, toh ye pattern ka reliability increase hota hai.

Treading Strategy

Engulfing Candlestick Pattern market mein reversal ka strong signal provide karta hai, lekin hamesha yaad rahe ki kisi bhi pattern ko confirm karne se pehle thorough analysis aur risk management ki zarurat hoti hai. Market conditions vary karte rehte hain aur false signals bhi ho sakte hain, isliye trading decisions lene se pehle dhyan se analysis karein - Bullish Engulfing Pattern: Bullish Engulfing pattern downtrend ke baad dikhai deta hai aur bullish reversal ko indicate karta hai. Is pattern mein pehla candlestick bearish (downward) hota hai aur doosra candlestick larger bullish (upward) hota hai, jiske range mein pehle candlestick completely engulf ho jata hai.

-

#9 Collapse

**Engulfing Candlestick Pattern Forex Trading Mein**

Engulfing candlestick pattern Forex trading mein ek important reversal signal hai jo market trends ke potential changes ko identify karne mein madad karta hai. Yeh pattern price chart par significant bullish ya bearish reversals ko indicate karta hai. Aaj hum engulfing candlestick pattern ke types, identification aur trading strategy ko detail mein samjhenge.

### Engulfing Candlestick Pattern Kya Hai?

Engulfing candlestick pattern ek two-candle reversal pattern hai jo market trends ke potential changes ko indicate karta hai. Is pattern mein do candles hoti hain:

**1. Bearish Engulfing Pattern:**

Bearish engulfing pattern tab form hota hai jab ek large bearish candle ek small bullish candle ko engulf karti hai. Pehli candle generally uptrend ke dauran hoti hai aur dusri candle downtrend ko indicate karti hai. Yeh pattern bearish reversal signal hota hai aur market ke downward movement ko suggest karta hai.

**2. Bullish Engulfing Pattern:**

Bullish engulfing pattern tab form hota hai jab ek large bullish candle ek small bearish candle ko engulf karti hai. Pehli candle generally downtrend ke dauran hoti hai aur dusri candle uptrend ko indicate karti hai. Yeh pattern bullish reversal signal hota hai aur market ke upward movement ko suggest karta hai.

### Engulfing Pattern Ki Identification

**1. Candle Characteristics:**

Engulfing pattern ko identify karne ke liye, candles ke body aur size ko analyze karna zaroori hai. Bearish engulfing pattern mein pehli candle ka body chhota hota hai aur dusri candle ka body bada hota hai jo pehli candle ko completely engulf karti hai. Bullish engulfing pattern mein bhi pehli candle ka body chhota hota hai aur dusri candle ka body bada hota hai jo pehli candle ko completely engulf karti hai.

**2. Trend Context:**

Engulfing pattern ke effectiveness ko market ke existing trend ke context mein analyze karna chahiye. Bearish engulfing pattern ko uptrend ke baad aur bullish engulfing pattern ko downtrend ke baad identify karna chahiye. Yeh patterns trend reversal signals ko validate karte hain.

**3. Volume Analysis:**

Volume analysis bhi important hai. Engulfing pattern ke formation ke dauran, volume ka increase hona pattern ke validity ko confirm karta hai. High volume se pattern ke signal ki strength ko validate kiya jata hai.

### Trading Strategy

**1. Entry Point:**

Engulfing pattern ke confirmation ke baad, ideal entry point pattern ke signal ke sath hota hai. Bearish engulfing pattern ke case mein, sell position ko second candle ke close ke baad open kiya jata hai. Bullish engulfing pattern ke case mein, buy position ko second candle ke close ke baad open kiya jata hai.

**2. Stop-Loss Aur Take-Profit:**

Stop-loss ko engulfing pattern ke opposite side ke close ke paas place karna chahiye. Bearish engulfing pattern ke case mein, stop-loss ko recent high ke upar place karein aur bullish engulfing pattern ke case mein, stop-loss ko recent low ke neeche place karein. Take-profit level ko predefined risk/reward ratio ke hisaab se determine kiya jata hai. Yeh level market ke recent support/resistance levels ya predefined targets ke basis par hota hai.

**3. Confirmatory Indicators:**

Additional technical indicators ka use bhi kiya ja sakta hai. For example, Moving Averages, Relative Strength Index (RSI), aur MACD se trend confirmation aur momentum analysis kiya ja sakta hai. Yeh indicators engulfing pattern ke signals ko validate karte hain aur trading decisions ko support karte hain.

### Benefits Aur Limitations

**1. Benefits:**

- **Clear Reversal Signals:** Engulfing pattern clear reversal signals provide karta hai, jo trading decisions ko accurate banata hai.

- **Effective Trend Reversal Identification:** Yeh pattern trend reversal ko identify karne mein madad karta hai, jo profit opportunities ko enhance karta hai.

**2. Limitations:**

- **False Signals:** Kabhi kabhi engulfing pattern false signals bhi generate kar sakta hai, isliye confirmatory indicators ka use zaroori hai.

- **Market Conditions:** Pattern ki effectiveness market conditions aur volatility ke according vary kar sakti hai.

### Conclusion

Engulfing candlestick pattern Forex trading mein ek valuable tool hai jo trend reversal signals ko identify karta hai. Accurate pattern identification aur effective trading strategy ke zariye, traders is pattern ko use karke profit earning opportunities ko leverage kar sakte hain. Effective risk management aur confirmatory indicators se trading decisions ko enhance kiya ja sakta hai aur market trends ko better analyze kiya ja sakta hai.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#10 Collapse

**Engulfing Candlestick Pattern in Forex Trading: Tafseel se Samjhaaiye**

Forex trading mein candlestick patterns ka istemal ek ahem tool hai jo market ke direction aur sentiment ko samajhne mein madad karta hai. In patterns mein se aik mashhoor aur reliable pattern **Engulfing Candlestick Pattern** hai. Aaj hum is post mein is pattern ko tafseel se discuss kareinge aur dekhein ge ke kis tarah se ye buying aur selling opportunities ko identify karne mein madadgar hota hai.

### Engulfing Candlestick Pattern Kya Hai?

Engulfing Candlestick Pattern do candlesticks ka milap hota hai jisme doosri candlestick pehli candlestick ko poori tarah se “engulf” ya cover kar leti hai. Is pattern ko market ke reversal ya continuation signal ke tor par dekha jata hai. Ye pattern do tarah ka hota hai:

1. **Bullish Engulfing Pattern**

2. **Bearish Engulfing Pattern**

### Bullish Engulfing Pattern

Bullish Engulfing Pattern tab banta hai jab pehli candlestick bearish (red ya black) hoti hai, aur doosri candlestick bullish (green ya white) hoti hai. Is pattern mein, doosri candlestick pehli candlestick ke body ko poori tarah se engulf karti hai, yani doosri candlestick ki opening aur closing pehli se zyada hoti hai. Ye pattern aksar downtrend ke end par banta hai aur is baat ka indication hota hai ke market mein bullish reversal aanay wala hai.

**Key Features:**

- Pehli candlestick bearish hoti hai.

- Doosri candlestick bullish hoti hai aur poori tarah se pehli ko cover karti hai.

- Ye pattern buying signal deta hai, khas tor par jab market downtrend mein ho.

**Trading Tip:** Jab Bullish Engulfing Pattern form hota hai to aap isay buy signal ke tor par use kar sakte hain, lekin confirmation ke liye doosre indicators jaise RSI ya Moving Averages ko bhi dekhna zaroori hai.

### Bearish Engulfing Pattern

Bearish Engulfing Pattern tab banta hai jab pehli candlestick bullish hoti hai, aur doosri candlestick bearish hoti hai jo pehli candlestick ko poori tarah engulf kar leti hai. Iska matlab hota hai ke market ke bulls (buyers) ab weak ho rahe hain aur bears (sellers) ne control le liya hai. Ye pattern aksar uptrend ke end par banta hai aur bearish reversal ka indication hota hai.

**Key Features:**

- Pehli candlestick bullish hoti hai.

- Doosri candlestick bearish hoti hai aur pehli candlestick ko engulf karti hai.

- Ye pattern selling signal deta hai, khas tor par jab market uptrend mein ho.

**Trading Tip:** Bearish Engulfing Pattern ko sell signal ke tor par dekha jata hai. Agar doosre technical indicators bhi selling pressure dikhate hain to aap short selling position le sakte hain.

### Engulfing Pattern Ki Ahmiyat

1. **Reversal Indicator:** Engulfing pattern aksar market ke reversal ka signal deta hai. Bullish engulfing pattern market ke bottom par form hota hai, jabke bearish engulfing pattern market ke top par form hota hai.

2. **Strong Signal:** Ye pattern tab zyada powerful hota hai jab doosri candlestick ki body zyada badi ho. Ye is baat ka indication hota hai ke market mein significant sentiment shift ho raha hai.

3. **Trend Confirmation:** Aap engulfing pattern ko doosre indicators ke sath mila kar use kar sakte hain taake trend ko confirm kar sakein. Is se aapke trading decisions zyada accurate ho jate hain.

### Conclusion

Engulfing Candlestick Pattern ek reliable aur asan technical indicator hai jo forex traders ko market ke reversal points identify karne mein madad deta hai. Is pattern ka sahi istemal aapko buying aur selling opportunities ka andaza lagane mein madad de sakta hai. Lekin hamesha yaad rakhein ke kisi bhi pattern ya indicator ka akela istemal kabhi bhi 100% accurate nahi hota. Risk management aur doosre indicators ko sath mila kar use karna hamesha behtareen trading strategy hoti hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 06:51 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим