What is Bullish Counterattack line ?

`

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔ٹیگز: کوئی نہیں

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

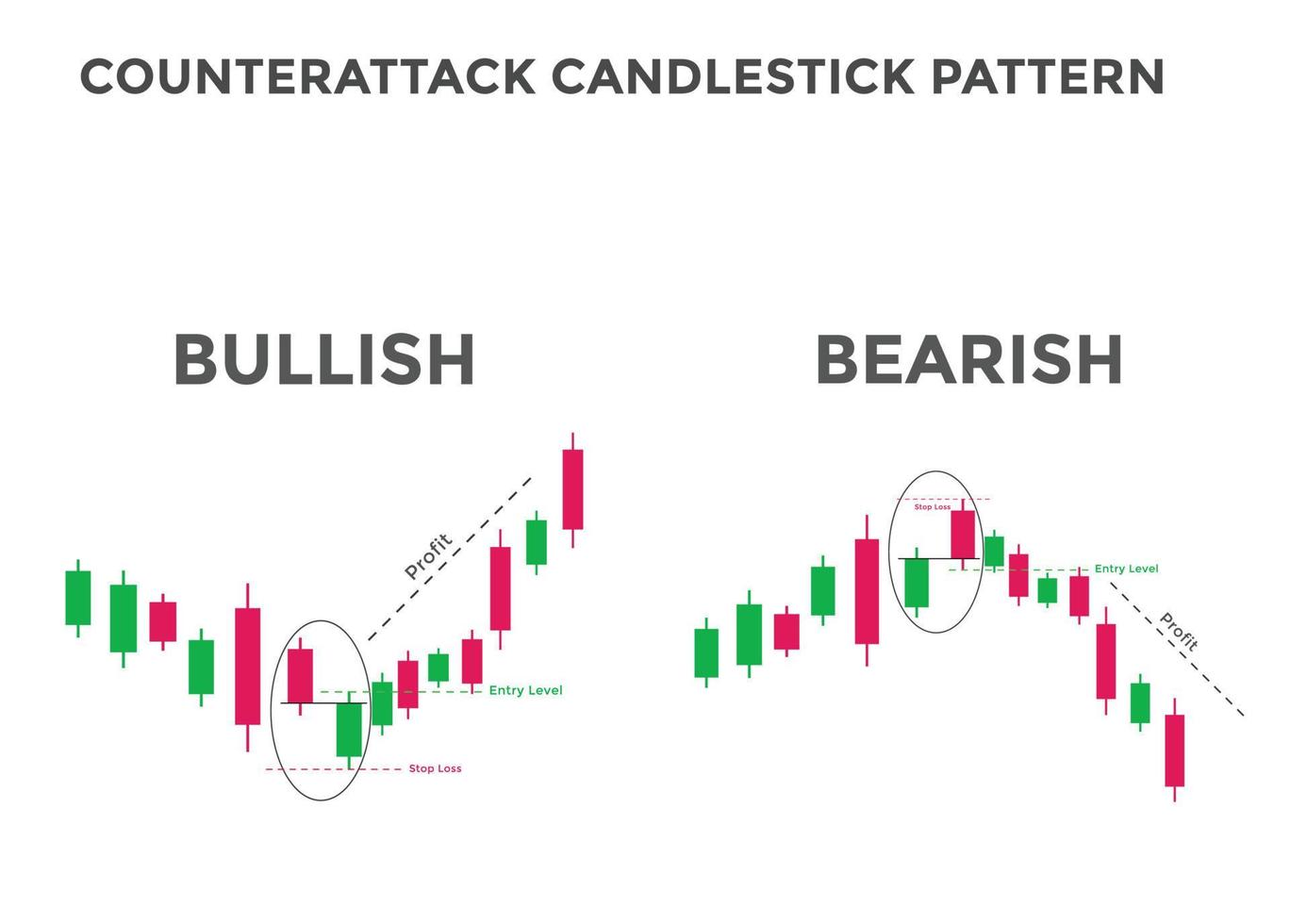

What is Bullish Counterattack line ?Bullish counter assault line candlestick pattern fundamental dosre din ki candle previous din ki candle k bottom par gap principal open ho kar u.S.A. Okay final factor par close hoti hai. Bullish counter nche ho jati hai, pehli mother batii ke qareeb qareeb. Is se zahir hota hai. ke baichnay walay manipulate mein thay, lekin ho sakta hai ke woh is control ko kho rahay hon kyunkay khredar is farq ko kam karne mein kamyaab ho gaye thay. Up educated ke douran mandi ke ulat jane ke liye, pehli candle aik lambi safaid ( oopar ) candle hai, aur doosri mom batii khaattack line candlestick pattern do candles par mushtamil hota hai, jiss primary pehli candle aik bearish candle hoti hai, jab okay dosre din ki candle aik bullish candle hoti hai. Pattern ki dosre din ki bullish candle pehli din ki bearish candle k contemporary fashion okay asarat ko kam karti hai, ynni bullish candle bearish candle k lower aspect par hole important khulti hai, jab ok close usa k equal last point par hoti hai. Pattern ki bullish candle bearish candle se nechay hole most important open hoti hai, lekin ye gap bullish candle ki real body se cover hota hai, jiss ka iss waja se andaza ya clear nazar nahi ata hai. Key Takeaways

Bullish counterattackyeh chart patteren doosri mother batii ke khilnay par mojooda rujhan saazi ki simt mein aik khala ki khasusiyat rakhta hai, is ke baad khalaa ko band karne ke liye mukhalif simt mein aik mazboot harkat hoti hai. Ibtidayi rujhan ke ghair paidaar honay ke sath, market ka rukh morta hai aur qeematein doosri simt bhijti hain ( doosri mom batii ki simt line candlestick sample charge chart par united states of americawaqat banti hai, jab bhi dealers market predominant dilchaspi lena kam kar dete hen. Ye pattern expenses k bottom par ya bearish trend dle banne ki sorat primary exchange entre karne se parhez karen. Trend confirmation CCI, RSI indicator aur stochastic oscillator se bhi ki ja sakti hai, jiss par price oversold region essential honi chaheye. Pattern do candles ka hota hai, iss waja se forestall loss ka istemal zarori hai. Stop Loss sample k sab se lower position ya dosri candle ok open price se two pips beneath par set karen. Essential ban kar marketplace ka trend bullish reversal bana deta hai. Pattern fundamental shamil dono candles actual body predominant honi chaheye, jiss predominant dosri candle pehli candle se se nechay gap fundamental open hoti hai. Pattern ki banne ki psychology kuch iss tarah se hai, jiss predominant dealers price ko pehle nechay push karte hen, jiss se bullish candle bearish candle se nechay gap important open hoti hai, lekin baad important sellers ki fees ok bottom essential mazeed dilchaspi nahi rehti hai, aur u.S.A. Waqat shoppers marketplace fundamental ziada active ho jate bird. Baaz dafa ye pattern koi robust information release hone ok baad charges ok bottom essential banta hai.

-

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Assalamu Alaikum Dosto!Bullish Counterattack Line Candlestick PatternBullish counterattack line pattern dark cloud cover candlestick pattern ki tarah aik bullish trend reversal pattern hai jiss main aik candle apne se pehle din ki candle par lower side se gap main open ho kar attack karti hai, jiss k nateejay main bearish trend ka khatma ho jata hai, iss waja se iss pattern ko bullish meeting line pattern kaha jata hai. Ye pattern bearish trend ya bottom of the price main banta hai, jo k two days candles par mushtamil hota hai. Pattern ki pehli candle aik real body wali bearish candle hoti hai, jo k prices main bearish trend ki trend ki akasi karti hai, jab k dosre din ki candle aik real body wali bullish candle hoti hai, jo k pehli candle se below gap main open ho kar ussi k same close par close hoti hai.Candles FormationBullish counterattack line pattern trend reversal pattern honne ki waja se prices k bottom par ya bearish trend main banta hai, jiss se prices apne trend ko badalne main majboor ho jati hai. Pattern do candles par mushtamil hota hai, jiss ki tafseel darjazzel hai;- First Candle: Bullish counterattack line candlestick pattern ki pehli candle aik long real body wali bearish candle honi chahie, jo k bearish trend ya low prices ko zahir karti hai. Ye candle black ya red color main hoti hai.

- Second Candle: Bullish counterattack line candlestick pattern ki dosri candle aik real body wali bullish candle hoti hai, jo k pehli candle k bottom par open ho kar ussi k close point par same ye bhi close hoti hai. Ye candle color main white ya green hoti hai.

Explaination Bullish counterattack line pattern market main sellers ki prices k bottom par push karne k baad uss ki dilchaspi khatam hone k baad market main banta hai. Ye pattern dekhne main same "Belt-Hold Line Pattern" jaisa dekhta hai, lekin dosri candle k bottom par wick ya small shadow hone aur dono candles k close point same hone ki waja se uss se mukhtalif hota hai. Pattern do candle par mushtamil hota hai, jiss main pehli candle aik bearish candle hoti hai. Pattern ki dosri candle aik bearish trend wali candle hoti hai, jo pehli candle k bottom par open ho kar ussi k close point par close hoti hai. Pattern ki dono candles k closing point same lazmi hone chaheye, warna pattern ki formation mukhtalif ho sakta hai. TradingBullish counterattack line pattern ki dosri candle k baad market main buyers active ho jate hen, q k ye aik bullish signal de rahi hoti hai. Pattern k baad aik bullish confirmation candle ka hona zarori hai, jo k long real body main pehli candle k real body main close ho jaye. Agar indicator se confirmation karna ho to Stochastics Oscillator aur CCI oscillator oversold area main hona chaheye. Pattern k baad agar black ya red candle banti hai to iss se ye pattern invalid ho jayega. Stop Loss pattern k sab se bottom position jo k dosri candle ka open ya low price ho sakta hai, se two pips below set karen. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#4 Collapse

BULLISH COUNTERATTOCK LINE:-Bullish Counterattack Line" ek technical analysis pattern hai jo stock market aur financial markets mein istemal hota hai. Iska maqsad market trends aur price movements ko samajhne mein madadgar hona hota hai. Bullish Counterattack Line pattern typically market mein bearish (girawat ki taraf) trend ke baad dikhai deta hai aur yeh ek reversal pattern hai, yaani ke yeh dikhaata hai ke bearish trend ke baad bullish (uchhaal) trend shuru hone ki sambhavna hai. BULLISH COUNTERATTOCK LINE KY MAIN CONCEPTS:-1. Bullish Counterattack Line Pattern Ki Tanqeed: Bullish Counterattack Line pattern ek technical analysis ka aala hai jo khas tor par stock trading mein istemal hota hai. Iska asal maqsad market trends aur price movements ko samajhne mein madadgar hona hai. 2. Bullish Counterattack Line Pattern Ke Hissaat: Yeh pattern do candlesticks se banta hai: a. Pehla candlestick: Yeh ek bearish candle hoti hai jo market mein neeche ki taraf movement ko confirm karti hai. b. Dusra candlestick: Yeh candle pehle candlestick ki high price ke qareeb khulta hai aur pehle candlestick ki low price ke qareeb band hoti hai. Is tarah se, dusra candlestick pehle candlestick ki bearish trend ko counter karta hai aur bullish trend ki shuruaat ki taraf ishara karta hai. 3. Bullish Counterattack Line Pattern Ki Tafseelat: Jab Bullish Counterattack Line pattern nazar aata hai, to yeh bearish trend ko bullish trend mein mukhtalif hone ki sambhavna ko ishara karta hai. Dusra candlestick ki khasosiyat yeh dikhata hai ke market sentiment bearish se bullish mein tabdeel ho rahi hai. 4. Trading aur Invest Ki Soch: Traders aur investors Bullish Counterattack Line pattern ko apni faislon mein madadgar tool ke taur par istemal karte hain. Lekin isko amal karne se pehle zaroori hai ke dusre factors ko bhi madde nazar rakha jaye, jaise ke market sentiment, technical indicators, aur fundamental analysis. Yeh pattern ek ahem signal provide kar sakta hai, lekin yeh akele trading faislon ka sole asas nahi hona chahiye. 5. Ikhtitam: Ikhtitam mein, Bullish Counterattack Line pattern ek reversal pattern hai jo traders aur investors ko financial markets mein trend tabdeel hone ki sambhavna ko pehchanne mein madadgar ho sakta hai. Isse bearish trend se bullish trend mein tabdeel hone ki alamat hoti hai. Is pattern ko apni analysis mein shaamil karne mein, yeh ahem hai ke aap ise dosre maqool factors ke sath istemal karain takay aap achi tarah se soch-samajh kar trading faislay kar saken.

BULLISH COUNTERATTOCK LINE KY MAIN CONCEPTS:-1. Bullish Counterattack Line Pattern Ki Tanqeed: Bullish Counterattack Line pattern ek technical analysis ka aala hai jo khas tor par stock trading mein istemal hota hai. Iska asal maqsad market trends aur price movements ko samajhne mein madadgar hona hai. 2. Bullish Counterattack Line Pattern Ke Hissaat: Yeh pattern do candlesticks se banta hai: a. Pehla candlestick: Yeh ek bearish candle hoti hai jo market mein neeche ki taraf movement ko confirm karti hai. b. Dusra candlestick: Yeh candle pehle candlestick ki high price ke qareeb khulta hai aur pehle candlestick ki low price ke qareeb band hoti hai. Is tarah se, dusra candlestick pehle candlestick ki bearish trend ko counter karta hai aur bullish trend ki shuruaat ki taraf ishara karta hai. 3. Bullish Counterattack Line Pattern Ki Tafseelat: Jab Bullish Counterattack Line pattern nazar aata hai, to yeh bearish trend ko bullish trend mein mukhtalif hone ki sambhavna ko ishara karta hai. Dusra candlestick ki khasosiyat yeh dikhata hai ke market sentiment bearish se bullish mein tabdeel ho rahi hai. 4. Trading aur Invest Ki Soch: Traders aur investors Bullish Counterattack Line pattern ko apni faislon mein madadgar tool ke taur par istemal karte hain. Lekin isko amal karne se pehle zaroori hai ke dusre factors ko bhi madde nazar rakha jaye, jaise ke market sentiment, technical indicators, aur fundamental analysis. Yeh pattern ek ahem signal provide kar sakta hai, lekin yeh akele trading faislon ka sole asas nahi hona chahiye. 5. Ikhtitam: Ikhtitam mein, Bullish Counterattack Line pattern ek reversal pattern hai jo traders aur investors ko financial markets mein trend tabdeel hone ki sambhavna ko pehchanne mein madadgar ho sakta hai. Isse bearish trend se bullish trend mein tabdeel hone ki alamat hoti hai. Is pattern ko apni analysis mein shaamil karne mein, yeh ahem hai ke aap ise dosre maqool factors ke sath istemal karain takay aap achi tarah se soch-samajh kar trading faislay kar saken.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 01:35 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим