Matching low candlestick pattern

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

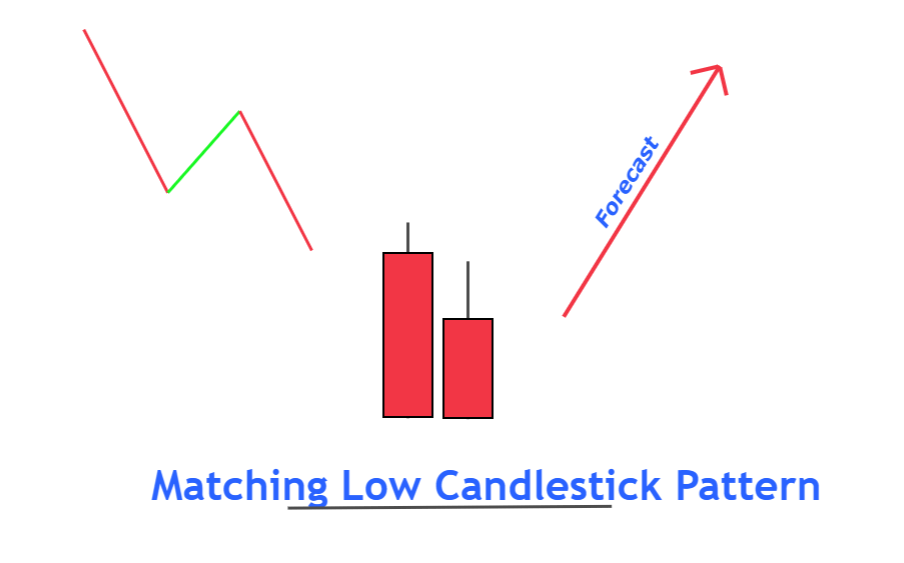

What is matching low candlestick pattern mumasil kam aik do candle blush patteren hai jo candle stuck charts par zahir hota hai. yeh kami ke rujhan ke baad hota hai aur nazriya tor par, mumasil bundon ke sath do long davn ( siyah ya surkh ) candle ke zariye farokht ke mumkina khatmay ka ishara deta hai. is ki tasdeeq patteren ke baad qeemat mein izafay se hoti hai . haqeeqat mein, mamaslat kam aksar manfi pehlu ke tasalsul ke patteren ke tor par kaam karti hai Key takeways mumasil kam patteren ko do neechay candle se mlitay jaltay ya mumasil ikhtitami qeematon ke sath banaya gaya hai . patteren qeemat mein kami ke baad hota hai aur yeh ishara karta hai ke mumkina neechay hai ya qeemat support level tak pahonch gayi hai . haqeeqat mein, qeemat patteren ke baad kisi bhi simt ja sakti hai, aur aksar yeh neechay ki taraf jari rehti hai . Understanding candle stuck patteren mumasil lo patteren mandarja zail khususiyaat ke sath do candle blush patteren hai : market neechay ka rujhan hai . pehli mom batii mein aik lambi siyah ( neechay ) asli jism hai . doosri mom batii mein aik siyah asli body hai jo pehli mom batii ke band honay ke barabar qeemat ki satah par band hoti hai . mom btyon ke saaye kam ho saktay hain lekin yeh mumasil band honay wali qeematein hain jo ahem hain. nichale saaye mein bhi isi terhan ki kam hosakti hai . patteren ke peechay nazriya yeh hai ke doosri mom batii ki pehli mom batii ke qareeb se neechay band honay mein nakami taizi ke ulat jane ke liye support level peda karti hai. imkaan hai ke bail support level ko spring board ke tor par istemaal karte hue really ki koshish karen ge, jis se aik naya rujhan buland hoga . traders mumasil kam patteren ke baad qeemat mein talaash kar satke hain, jab ke position ke liye pichlle din ke band ( ya kam ) ko support level ke tor par ya mumkina tor par stap loss point ke tor par istemaal karte hain. misaal ke tor par, agar teesri mom batii pehli ya doosri mom batii ki oonchai se oopar jati hai, to yeh mom batian aik aur do ki nichli satah se neechay stap nuqsaan ke sath indraaj ko mutharrak kar sakta hai. teesri mom batii, is muamlay mein, tasdeeq ki mom batii kehlati hai. yeh mutawaqqa simt mein chalta hai . Example macy' s inc. ( m ) ka rozana chart do mumasil kam candle stuck patteren dekhata hai. aik misaal ke nateejay mein aik choti si harkat mein izafah hota hai jab qeemat do mom batii patteren ki oonchai se oopar jati hai. is ne candle three par patteren lo ke neechay aik ghalat break out ko bhi mutharrak kya . doosri misaal shadeed kami ke douran paish aayi. qeemat mom batii for par kam patteren se neechay gir gayi jis se manfi break out aur mumkina mukhtasir tijarat ka ishara milta hai. qeemat ziyada uchalnay se pehlay mazeed do sishnon ke liye kam rahi .

- Mentions 0

-

سا0 like

-

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Assalamu Alaikum Dosto!Matching Low Candlesticks PatternMatching low candlestick pattern two days candles ka aik bullish trend reversal hai, jiss main shamil dono candles same support ya bottom levels ko touch karti hai, lekin uss se nechay breakout nahi karti hai. Iss pattern ki aik khas baat ye hai k iss main shamil dono candles ka lower ya bottom same price ya level par hota hai. Matching low candlestick pattern main sellers market ko khas position tak nechay le kar jati hai, jahan par buyers active ho kar prices ko wapis upward push karti hai. Ye pattern prices k bottom main banne wale tweezers bottom candlestick chart pattern se melta julta hai.Candles FormationMatching low candlestick pattern prices k bottom ya bearish trend main uss waqat banata hai, jahan par sellers market main mazeed dilchaspi ka muzahira nahi karte hen, jiss se prices bullish trend reversal ko follow karna shoro karti hai. Pattern k bottom main banne wale iss pattern ki candles ki formation darjazel tarah se hoti hai;- First Candle: Tweezers bottom candlestick pattern ki pehli candle aik bearish candle hoti hai, aur iss ki main reason ye hai, k prices k pehle se market trend bearish ya downtrend hota hai. Ye candle market k prices ko nechay ki taraf push karne ki koshash karti hai.

- Second Candle: Matching low candlestick pattern ki dosri candle bhi same bearish candle hoti hai, jo k trend reversal ka sabab banti hai. Ye candle same pehli bearish candle k close price par close hoti hai, ya iss candle ka low pehli candle k low k in-line hoti hai.

ExplainationMatching low candlestick pattern price chart pattern main bearish trend k dowran sab se bottom position ya support level par banta hai, jahan se prices trend reversal ho jati hai. Pattern do candles par mushtamil hota hai, jiss ki ki pehli candle aik bearish candle hoti hai. Bearish candle aik real body main banti hai, jo k prices ko nechay ki taraf push karti hai. Pattern ki dosri candle bhi same bearish candle hoti hai, jo same pehli candle k close price ki bajaye upward open ho kar bearish real body k sath same pehli candle k close price par close hoti hai. Pattern ki dono candles same support level banati hai, jahan se prices rebound hoti hai.TradingMatching low candlestick pattern market main current trend k bar-aks bullish signal deta hai, jiss par buy ki entry hoti hai. Ye pattern prices ko nechley satah se rebound hone ki peshangoy karta hai. Pattern par trade enter karne se pehle aik confirmation candle ka hona zarori hai, jo k real body main bullish honi chaheye aur dosri candle k top par close honi chaheye. Pattern ki confirmation CCI, RSI, MACD indicator aur stochastic oscillator se bhi ki ja sakti hai, jiss par value oversold zone main honi chaheye. Jab k pattern k baad bearish candle banne par ye pattern in-valid ho jayega. Stop Loss pattern k sab se bottom ya dono candles k support level se two pips below set karen. -

#4 Collapse

Introduction of Matching Low Candlesticks Pattern Aoa Ummid karta hon Ap Sab khariat Say Hon gy AJ Marching low candlestick pattern two days candles ka aik Bullishness trend reversal hai, jiss main shamil dono candles same support ya bottom levels ko touch karti hai, lekin uss se nechay breakout nahi karti hai. Iss pattern ki aik khas baat ye hai k iss main shamil dono candles ka lower ya bottom same price ya level par hota hai. Matching low candlestick pattern main sellers market ko khas position tak Neechay le kar jati hai, jahan par buyers active ho kar prices ko wapis upward ki Trah Movement ho gy The Formation of Matching low candlestick pattern Dear Jab Matchings low candlestick pattern prices k bottom ya bearish trend main uss waqat banata hai, jahan par sellers market main mazeed dilchaspi ka muzahira nahi karte hen, jiss se Prices bullish trend reversal ko follow karna shoro karti hai. Pattern k bottom main banne wale iss PATTERN ki candles ki Trah First Candle Tweezes BOTTOM candlestick PATTERN ki pehli candle aik bearish candle hoti hai, aur iss ki main reason ye hai, k prices k pehle se market trend BEARISH ya downtrend hota hai. Ye candle market k prices ko nechay ki taraf push karne say hy Tu Marching low candlestick pattern ki dosri candle bhi same bearish candles say hi Following ho gy Trading Stradgy Dear Jab Matchings low candlestick pattern price chart pattern main bearish trend k dowran sab se bottom position ya support level par banta hai, jahan se prices trend reversal ho jati hai. Pattern do candles par mushtamil hota hai, jiss ki ki pehli candle aik bearish candle hoti hai. Bearish candle aik real body main banti hai, jo k prices ko nechay ki taraf push karti hai. Pattern ki dosri candles bhi same bearish candles hoti hai, jo same pehli candle k closed Price ki bajaye upward Open ho kar bearish real body k sath same pehli candle k close price par closed hoti hai. Pattern ki dono CANDLES same support level banati hai aor Matching low candlestick PATTERN market main current Trending k bar-aks bullish signal deta hai, jiss par buy ki entry hoti hai. Ye PATTERN prices ko nechley satah se rebound hone ki peshangoy karta hai. Pattern par trade enter karne se pehle aik confirmation candle ka hona zarori hai, jo k real body main bullish honi chaheye aur dosri candle k top par close honi chaheye. PATTERN ki confirmation CCI, RSI, MACD indicator aur stochastic oscillator se bhi ki ja sakti hai, jiss par value oversold zone main Stop loss and Take profit Say Trade Len gy -

#5 Collapse

UNDERSTANDING OF MATCHING LOW CANDLESTICK PATTERN: Dear members MATCHING low candlestick pattern ko trade ky liye perfect isal karty hen eour yeh Pattren selling our buying Mei used bhi kiyaa jata hay our two days candles ka aik bullish trend reversal hai, jiss main shamil dono candles same support ya bottom levels ko touch karti hai, lekin uss se nechay breakout nahi karti hai. Iss pattern ki aik khas baat ye hai k iss main shamil dono candles ka lower ya bottom same price ya level par hota hai. Matching low candlestick pattern main sellers market ko khas position tak nechay le kar jati hai, jahan par buyers active ho kar prices ko wapis upward push karti hai. Ye pattern prices k bottom main banne wale tweezers bottom candlestick chart pattern se melta Hei our account bhi save the forex trading marketing Mei hoty hein.EXPLANATION OF MATCHING LOW CANDLESTICK PATTERN: Dear friends Forex tradings Marketing main MATCHING low candlestick pattern price chart pattern main bearish trend k dowran sab se bottom position ya support level par banta hai, jahan se prices trend reversal ho jati hai. Pattern do candles par mushtamil hota hai, jiss ki ki pehli candle aik bearish candle hoti hai. Bearish candle aik real body main banti hai, jo k prices ko nechay ki taraf push karti hai. Pattern ki dosri candle bhi same bearish candle hoti hai, jo same pehli candle k close price ki bajaye upward open ho kar bearish real body k sath same pehli candle k close price par close hoti hai. Pattern ki dono candles same support level banati hai, jahan se prices rebound hoti KEY TAKEAWAYES; Dear friends Forex tradings Marketing main MATCHING low candlestick pattern market main current trend k bar-aks bullish signal deta hai, jiss par buy ki entry hoti hai. Ye pattern prices ko nechley satah se rebound hone ki peshangoy karta hai. Pattern par trade enter karne se pehle aik confirmation candle ka hona zarori hai, jo k real body main bullish honi chaheye aur dosri candle k top par close honi chaheye. Pattern ki confirmation CCI, RSI, MACD indicator aur stochastic oscillator se bhi ki ja sakti hai, jiss par value oversold zone main honi chaheye. Jab k pattern k baad bearish candle banne par ye pattern in-valid ho jayega

TRADINGS WITH MATCHING LOW CANDLESTICK PATTERN:Piyary members forex exchanging Market Mei yeh ziyada mehnat karni chaye hoti hey our yeh Pattren mukhtalif pannal ko follow up karty hen our Forex Mei profit hasil kar sakty hen Matching low candlestick pattern prices k bottom ya bearish trend main uss waqat banata hai, jahan par sellers market main mazeed dilchaspi ka muzahira nahi karte hen, jiss se prices bullish trend reversal ko follow karna shoro karti hai. Pattern k bottom main banne wale iss pattern ki candles ki formation darjazel tarah tradings Mei hasil karty hen.

-

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Candlestick sample Matching low candlestick pattern two days candles ka aik bullish fashion reversal hai, jiss principal shamil dono candles same support ya backside degrees ko touch karti hai, lekin americase nechay breakout nahi karti hai. Iss pattern ki aik khas baat ye hai okay iss foremost shamil dono candles ka decrease ya backside identical charge ya stage par hota hai. Mumasil kam aik do candle blush patteren hai jo candle stuck charts par zahir hota hai. Yeh kami ke rujhan ke baad hota hai aur nazriya tor par, mumasil bundon ke sath do long davn candle ke zariye farokht ke mumkina khatmay ka ishara deta hai. Is ki tasdeeq patteren ke baad qeemat mein izafay se hoti hai . Haqeeqat mein, mamaslat kam aksar manfi pehlu ke tasalsul ke patteren ke tor par kaam karti hai,patteren qeemat mein kami ke baad hota hai aur yeh ishara karta hai ke mumkina neechay hai ya qeemat guide stage tak pahonch gayi hai . Haqeeqat mein, qeemat patteren ke baad kisi bhi simt ja sakti hai, aur aksar yeh neechay ki taraf jari rehti hai .Example; doosri mom batii mein aik siyah asli body hai jo pehli mom batii ke band honay ke barabar qeemat ki satah par band hoti hai .Mom btyon ke saaye kam ho saktay hain lekin yeh mumasil band honay wali qeematein hain jo ahem hain. Nichale saaye mein bhi isi terhan ki kam hosakti hai.Patteren ke peechay nazriya yeh hai ke doosri mom batii ki pehli mom batii ke qareeb se neechay band honay mein nakami taizi ke ulat jane ke liye support level peda karti hai. Imkaan hai ke bail support degree ko spring board ke tor par istemaal karte hue genuinely ki koshish karen ge, jis se aik naya rujhan buland hoga .Macy' s inc. Ka rozana chart do mumasil kam candle stuck patteren dekhata hai. Aik misaal ke nateejay mein aik choti si harkat mein izafah hota hai jab qeemat do mother batii patteren ki oonchai se oopar jati hai. Is ne candle three par patteren lo ke neechay aik ghalat escape ko bhi mutharrak kya . Doosri misaal shadeed kami ke douran paish aayi. Qeemat mom batii for par kam patteren se neechay gir gayi jis se manfi break out aur mumkina mukhtasir tijarat ka ishara milta hai. Qeemat ziyada uchalnay se pehlay mazeed do sishnon ke liye kam rahi .

Candles Formation; Matching low candlestick pattern costs ok backside ya bearish fashion main united stateswaqat banata hai, jahan par sellers marketplace most important mazeed dilchaspi ka muzahira nahi karte bird, jiss se costs bullish trend reversal ko comply with karna shoro karti hai. Pattern okay bottom fundamental banne wale iss sample ki candles ki formation darjazel tarah se hoti hai;Pattern ki dosri candle bhi equal bearish candle hoti hai, jo identical pehli candle ok near fee ki bajaye upward open ho kar bearish real body okay sath equal pehli candle okay near fee par close hoti hai. Pattern ki dono candles same assist degree banati hai, jahan se charges rebound hoti hai.

-

#7 Collapse

"Matching Low" candlestick pattern, jo kay ek bearish continuation pattern hai, yeh do candlesticks se mil kar banta hai. Iska tajziyah aur samjhna niche diye gaye hain: Matching Low Candlestick Pattern:- Tasavvur: Matching Low pattern do candlesticks se banta hai. Pehli candle ek lambi bearish (neechay ki taraf) candle hoti hai, aur doosri candle wohi pehli candle ki close ke qareeb open hoti hai lekin thora sa pehli candle ki close ke upar band hoti hai.

- Samjhna: Matching Low pattern ishara karta hai ke mojudah bearish trend ka jari rehne ka imkan hai. Yeh darust karta hai ke ek ahem neechay ki taraf le jane ke baad (pehli bearish candle), kharidari karne wale ne qeemat ko upar le jane ki koshish ki (doosri candle), lekin unka upar ki taraf rujhan qaim nahi reh paya, jo pehli candle ki close ke qareeb ya wohi close hone se hasil hua.

- Tasdeeq: Traders aksar mazeed bearish signals ya bearish continuation ke liye aane wale candlesticks ki tehqiqat karte hain.

-

#8 Collapse

"Matching Low Candlestick Pattern" ek technical analysis tool hai jo financial markets mein trading aur investing mein istemal hota hai. Ye pattern bearish (neechay ki taraf) trend ke continuation ko darust karnay mein madadgar hota hai. Is pattern ki pehchan aur tafseelat niche di gayi hai: Matching Low Candlestick Pattern:- Tasveer: Matching Low pattern do candlesticks se mil kar banta hai. Pehla candle ek lamba bearish (girawat wala) candle hota hai, jiska matlab hota hai ke market mein sellers (bechne wale) dominate kar rahay hain aur prices neeche ja rahi hain. Doosra candle pehle candle ki close ke kareeb open hota hai, lekin iska close pehle candle ki close ke thora oopar hota hai.

- Tafseelat: Matching Low pattern yeh darust karta hai ke bearish trend jari hai, lekin buyers (khareedne wale) ne koshish ki hoti hai ke prices ko upar le jayen. Lekin, yeh koshish nakam rehti hai aur market phir se bearish mode mein aa jati hai.

- Tasdeeq: Traders aksar is pattern ko confirm karne ke liye doosre bearish signals ya phir market mein aagayi bearish movement ki tafseelat dekhtay hain.

-

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Presentation of Matching Low Candles Example Aoa Ummid karta hon Ap Sab khariat Say Hon gy AJ Walking low candle design two days candles ka aik Bullishness pattern inversion hai, jiss principal shamil dono candles same help ya base levels ko contact karti hai, lekin uss se nechay breakout nahi karti hai. Iss design ki aik khas baat ye hai k iss fundamental shamil dono candles ka lower ya base same cost ya level standard hota hai. Matching low candle design fundamental dealers market ko khas position tak Neechay le kar jati hai, jahan standard purchasers dynamic ho kar costs ko wapis up ki Trah Development ho gyTradingThe Development of Matching low candle design Dear Punch Matchings low candle design costs k base ya negative pattern primary uss waqat banata hai, jahan standard merchants market principal mazeed dilchaspi ka muzahira nahi karte hen, jiss se Costs bullish pattern inversion ko follow karna shoro karti hai. Design k base principal banne ridge iss Example ki candles ki Trah First Light Tweezes Base candle Example ki pehli flame aik negative candle hoti hai, aur iss ki fundamental explanation ye hai, k costs k pehle se market pattern Negative ya downtrend hota hai. Ye flame market k costs ko nechay ki taraf push karne say hy Tu Walking low candle design ki dosri light bhi same negative candles say hello there Following ho gyExchanging Stradgy Dear Punch Matchings low candle design cost outline design principal negative pattern k dowran sab se base position ya support level standard banta hai, jahan se costs pattern inversion ho jati hai.

Design do candles standard mushtamil hota hai, jiss ki pehli light aik negative flame hoti hai. Negative flame aik genuine body primary banti hai, jo k costs ko nechay ki taraf push karti hai. Design ki dosri candles bhi same negative candles hoti hai, jo same pehli flame k shut Cost ki bajaye up Open ho kar negative genuine body k sath same pehli light k close cost standard shut hoti hai. Design ki dono CANDLES same help level banati hai aor Matching low candle Example market primary current Moving k bar-aks bullish sign deta hai, jiss standard purchase ki passage hoti hai. Ye Example costs ko nechley satah se bounce back sharpen ki peshangoy karta hai. Design standard exchange enter karne se pehle aik affirmation light ka hona zarori hai, jo k genuine body primary bullish honi chaheye aur dosri flame k top standard close honi chaheye. Design ki affirmation CCI, RSI, MACD pointer aur stochastic oscillator se bhi ki ja sakti hai, jiss standard worth oversold zone fundamental Stop misfortune and Take benefit Say Exchange Len gy.

-

#10 Collapse

MACHING LOW CANDLESTICK PATTERN:-Matching Low candlestick pattern forex trading mein ek technical analysis tool hai jo market mein trend reversal ya trend continuation ko indicate karne mein madadgar ho sakta hai. Is pattern ki wazahat is tarah se hoti hai.Matching Low candlestick pattern do consecutive (lag-bhag ek sath) red (bearish) candles se banti hai. Yeh pattern bearish trend ke darmiyan paya jata hai aur bullish reversal ya continuation signal provide kar sakta hai. Is pattern ki kuch khas pehchanen hoti hain. MACHING LOW CANDLESTICK PATTERN KI DETAIL:-1. Matching Low Candlestick Pattern Introduction (Matching Low Candlestick Pattern Ki Ibtida): Matching Low candlestick pattern forex trading mein ek technical analysis tool hai. Yeh pattern bearish trend mein paya jata hai aur reversal ya continuation signals provide kar sakta hai. 2. Matching Low Pattern Components (Matching Low Pattern Ke Hissa): Pehli Candle: Pehli candle bearish (red) hoti hai aur down move ko represent karti hai. Dusri Candle: Dusri candle bhi bearish (red) hoti hai aur pehli candle ki low se nicha khulti hai. 3. Range (Shuruaat Se Lekar Tajaweez Tak Ki Qisam): Dusri candle ki low pehli candle ki low ke sath match hoti hai ya thodi si lower ho sakti hai, lekin dono ki lows lag-bhag ek sath honi chahiye. Dusri candle ki opening price pehli candle ki closing price ke sath match ho sakti hai ya thodi si lower ho sakti hai. 4. Matching Low Pattern Trading (Matching Low Pattern Mein Trading): Matching Low candlestick pattern bearish trend mein ek potential reversal point ko darust karti hai jab market mein selling pressure kam ho rahi hoti hai. Is pattern ko samajhne ke liye market mein overall context, trend, aur dusre technical indicators ka bhi sahara lena zaroori hota hai. 5. Confirmation and Trading Strategies (Tasdeeq aur Trading Strategies): Matching Low pattern ek strong support level ya key Fibonacci retracement level ke sath milta hai aur dusre technical indicators bhi reversal ko suggest kar rahe hain to iska matlab hai ke market mein trend reversal hone ke chances hote hain. Lekin, hamesha yaad rahe ke kisi bhi ek pattern par pura bharosa na karein aur market analysis ko mukhtasar aur puri tarah se samajh kar hi trading decisions lein. 6. Risk Management (Risk Prabandhan): Market mein trading karne se pehle risk management aur stop-loss orders ka bhi dhyan rakhein, taaki nuksan se bacha ja sake. Yeh headings aapko Matching Low candlestick pattern ko samajhne mein madadgar sabit ho sakti hain aur aapke forex trading decisions ko behtar bana sakti hain.

MACHING LOW CANDLESTICK PATTERN KI DETAIL:-1. Matching Low Candlestick Pattern Introduction (Matching Low Candlestick Pattern Ki Ibtida): Matching Low candlestick pattern forex trading mein ek technical analysis tool hai. Yeh pattern bearish trend mein paya jata hai aur reversal ya continuation signals provide kar sakta hai. 2. Matching Low Pattern Components (Matching Low Pattern Ke Hissa): Pehli Candle: Pehli candle bearish (red) hoti hai aur down move ko represent karti hai. Dusri Candle: Dusri candle bhi bearish (red) hoti hai aur pehli candle ki low se nicha khulti hai. 3. Range (Shuruaat Se Lekar Tajaweez Tak Ki Qisam): Dusri candle ki low pehli candle ki low ke sath match hoti hai ya thodi si lower ho sakti hai, lekin dono ki lows lag-bhag ek sath honi chahiye. Dusri candle ki opening price pehli candle ki closing price ke sath match ho sakti hai ya thodi si lower ho sakti hai. 4. Matching Low Pattern Trading (Matching Low Pattern Mein Trading): Matching Low candlestick pattern bearish trend mein ek potential reversal point ko darust karti hai jab market mein selling pressure kam ho rahi hoti hai. Is pattern ko samajhne ke liye market mein overall context, trend, aur dusre technical indicators ka bhi sahara lena zaroori hota hai. 5. Confirmation and Trading Strategies (Tasdeeq aur Trading Strategies): Matching Low pattern ek strong support level ya key Fibonacci retracement level ke sath milta hai aur dusre technical indicators bhi reversal ko suggest kar rahe hain to iska matlab hai ke market mein trend reversal hone ke chances hote hain. Lekin, hamesha yaad rahe ke kisi bhi ek pattern par pura bharosa na karein aur market analysis ko mukhtasar aur puri tarah se samajh kar hi trading decisions lein. 6. Risk Management (Risk Prabandhan): Market mein trading karne se pehle risk management aur stop-loss orders ka bhi dhyan rakhein, taaki nuksan se bacha ja sake. Yeh headings aapko Matching Low candlestick pattern ko samajhne mein madadgar sabit ho sakti hain aur aapke forex trading decisions ko behtar bana sakti hain. -

#11 Collapse

What is matching low candle designmumasil kam aik do flame become flushed patteren hai jo light stuck diagrams standard zahir hota hai. yeh kami ke rujhan ke baad hota hai aur nazriya pinnacle standard, mumasil bundon ke sath do long davn ( siyah ya surkh ) flame ke zariye farokht ke mumkina khatmay ka ishara deta hai. is ki tasdeeq patteren ke baad qeemat mein izafay se hoti hai .haqeeqat mein, mamaslat kam aksar manfi pehlu ke tasalsul ke patteren ke peak standard kaam karti haKey takewaysmumasil kam patteren ko do neechay candle se mlitay jaltay ya mumasil ikhtitami qeematon ke sath banaya gaya hai .patteren qeemat mein kami ke baad hota hai aur yeh ishara karta hai ke mumkina neechay hai ya qeemat support level tak pahonch gayi hai .haqeeqat mein, qeemat patteren ke baad kisi bhi simt ja sakti hai, aur aksar yeh neechay ki taraf jari rehti hai .Understandingcandle stuck patterenmumasil lo patteren mandarja zail khususiyaat ke sath do candle become flushed patteren hai :market neechay ka rujhan hai .pehli mother batii mein aik lambi siyah ( neechay ) asli jism hai .doosri mother batii mein aik siyah asli body hai jo pehli mother batii ke band honay ke barabar qeemat ki satah standard band hoti hai .mother btyon ke saaye kam ho saktay hain lekin yeh mumasil band honay wali qeematein hain jo ahem hain. nichale saaye mein bhi isi terhan ki kam hosakti hai .patteren ke peechay nazriya yeh hai ke doosri mother batii ki pehli mother batii ke qareeb se neechay band honay mein nakami taizi ke ulat jane ke liye support level peda karti hai. imkaan hai ke bail support level ko spring board ke pinnacle standard istemaal karte shade truly ki koshish karen ge, jis se aik naya rujhan buland hoga .dealers mumasil kam patteren ke baad qeemat mein talaash kar satke hain, hit ke position ke liye pichlle commotion ke band ( ya kam ) ko support level ke peak standard ya mumkina pinnacle standard stap misfortune point ke peak standard istemaal karte hain. misaal ke peak standard, agar teesri mother batii pehli ya doosri mother batii ki oonchai se oopar jati hai, to yeh mother batian aik aur do ki nichli satah se neechay stap nuqsaan ke sath indraaj ko mutharrak kar sakta hai. teesri mother batii, is muamlay mein, tasdeeq ki mother batii kehlati hai. yeh mutawaqqa simt mein chalta hai .Modelmacy' s inc. ( m ) ka rozana diagram do mumasil kam light stuck patteren dekhata hai. aik misaal ke nateejay mein aik choti si harkat mein izafah hota hai punch qeemat do mother batii patteren ki oonchai se oopar jati hai. is ne light three standard patteren lo ke neechay aik ghalat break out ko bhi mutharrak kya .doosri misaal shadeed kami ke douran paish aayi. qeemat mother batii for standard kam patteren se neechay gir gayi jis se manfi break out aur mumkina mukhtasir tijarat ka ishara milta hai. qeemat ziyada uchalnay se pehlay mazeed do sishnon ke liye kam rahi .

-

#12 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

"Matching Low Candlestick Pattern" Matching low candlestick pattern ek technical analysis tool hai jo stock market mein istemal hota hai. Yeh pattern traders ko market ke future movements ko samjhne mein madadgar hota hai. Yeh pattern tab banta hai jab do candlesticks aik sath aik khas tarah se dikhte hain. Pehli candlestick ek downtrend ya bearish trend ke doran hoti hai aur nicha girti hai. Dusri candlestick bhi bearish hoti hai aur pehli candlestick ki low price se kareebi hoti hai. Yeh pattern market mein selling pressure ko darust karta hai aur ye ishara karta hai ke bearish trend jari hai. Traders is pattern ko dekhte hue selling positions le sakte hain. Magar, hamesha yaad rahe ke kisi bhi ek pattern par pura bharosa na karen aur doosre technical indicators aur analysis tools ka bhi istemal karen. Market mein risk hota hai, aur prudent trading hi aapko safalta dilati hai. -

#13 Collapse

Matching Low Candlestick Pattern:

Matching Low Shama Pattern:

Matching Low Candlestick Pattern ek aham technical analysis pattern hai jo market mein hone wale bullish reversals ko darust karta hai. Is pattern mein do consecutive candles hote hain jinmein se second candle pehli candle ke close price ke barabar ya usse qareeb close hoti hai. Yeh pattern traders ko market ke trend reversals ke baray mein maloomat faraham karta hai. Yahan Matching Low Candlestick Pattern ke tafseelat Roman Urdu mein di gayi hain:

Pattern Ki Tafseelat:- Consecutive Candles:

Matching Low Candlestick Pattern mein do consecutive candles hote hain. Dusri candle pehli candle ke close price ke barabar ya usse qareeb close hoti hai. - Bullish Reversal Signal:

Matching Low Pattern ek bullish reversal signal hai. Jab market downtrend mein hota hai aur Matching Low Pattern ban jata hai, toh yeh indicate karta hai ke bearish momentum khatam ho kar bullish momentum shuru hone wala hai. - Volume ki Tafseelat:

Is pattern ko confirm karne ke liye, traders volume ki bhi tafseelat ka dekhte hain. Agar matching low pattern ke sath high volume bhi ho, toh yeh pattern ki authenticity ko barhata hai.

Tijarat Mein Istemal:

Matching Low Candlestick Pattern ko tijarat mein istemal karne ke liye, traders ko kuch zaroori asoolon ka bhi khayal rakhna chahiye:- Confirmation: Pattern ko confirm karne ke liye, traders doosre technical indicators jese ke volume, trend lines, aur moving averages ka istemal kar sakte hain.

- Entry Point: Pattern ko dekhte hue, traders apne entry point ko define karte hain. Jab matching low pattern form ho jata hai, traders long positions le sakte hain.

- Risk Management: Har tijarat mein risk management ka khayal rakhna zaroori hai. Stop-loss orders ka istemal karke traders apne nuksan ko control mein rakh sakte hain.

- Target Setting: Pattern ko dekhte hue, traders apne target prices tay karte hain. Ye targets resistance levels par rakhe jate hain.

Mukhtasar Guftagu:

Matching Low Candlestick Pattern, agar sahi taur par samjha jaye aur dusre indicators ke sath milakar istemal kiya jaye, toh ye traders ke liye ek powerful tool ban sakta hai jo market trends ko samajhne mein madad karta hai. Lekin, hamesha yaad rakhein ke kisi bhi ek indicator par pura bharosa karne se pehle, market ke mukhtalif factors ko bhi tajziya karna zaroori hai.

- Consecutive Candles:

-

#14 Collapse

Matching Low Candlestick Pattern: Forex Trading Mein Ahem Tijarat Alat

Matching Low Kya Hai? Matching Low candlestick pattern forex trading mein ek mukhtalif pattern hai jo market mein potential bullish reversals ko indicate karta hai. Yeh pattern typically downtrend ke doran dikhai deta hai aur bearish trend ke bad ek trend reversal ki nishani ho sakta hai.

Matching Low Ki Nishaniyan:- Do Candles: Matching Low pattern mein do candles hote hain jin ki bodies ek doosre ke sath barabar ya kareeb hoti hain. Pehli candle bearish trend ke doran dikhai deti hai, jabke doosri candle iske neeche close hoti hai, lekin unka close prices barabar ya kareeb hota hai.

- Volume Ka Istemal: Matching Low pattern ke confirmation ke liye traders volume ka bhi istemal karte hain. Agar doosri candle ki volume pehli candle se kam hai, toh yeh bullish reversal signal ko aur bhi mazboot karta hai.

Matching Low Ka Istemal:- Entry Point Talaash Karein: Matching Low pattern ko dekhte hue traders apne entry point talaash karte hain. Jab doosri candle pehli candle ki neeche close hoti hai, traders bullish positions enter karte hain.

- Stop Loss Aur Target Levels Tayaar Karein: Matching Low pattern ke istemal mein traders apne stop loss aur target levels ko tay karte hain. Stop loss order lagane se traders apne nuksanat ko limit kar sakte hain.

- Confirmation Ke Liye Aur Indicators Ka Istemal: Matching Low pattern ko confirm karne ke liye traders doosre technical indicators jaise ke volume, RSI, ya Stochastic Oscillator ka bhi istemal karte hain.

Conclusion: Matching Low candlestick pattern ek ahem tijarat alat hai jo traders ko potential bullish reversals ko samajhne mein madad karta hai. Lekin, is pattern ko istemal karne se pehle traders ko market ki aur doosre factors ki puri tehqiqat karni chahiye.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Matching Low Candlestick Pattern ek technical analysis tool hai jo traders ko market mein hone wale price reversals aur trend changes ka pata lagane mein madad karta hai. Is pattern ka istemal karke traders price action ko analyze karte hain aur potential trading opportunities identify karte hain. Is article mein hum Matching Low Candlestick Pattern ke fawaid aur nuksanat ke bare mein tafseel se baat karenge.

Fawaid:- Reversal Signal: Matching Low Candlestick Pattern price reversal ka ek strong signal provide karta hai. Agar ye pattern downtrend ke doran form hota hai toh ye bullish reversal ko darust karta hai, jabke agar uptrend ke doran form hota hai toh ye bearish reversal ko darust karta hai.

- Easy Identification: Ye pattern aasani se identify kiya ja sakta hai kyunki ismein do consecutive candles involved hote hain. Pehli candle bearish hoti hai aur dusri candle bullish hoti hai lekin dono ka close price same ya phir bohot qareeb hota hai.

- Confirmation: Matching Low Candlestick Pattern ko confirm karne ke liye traders aur technical analysts dusre indicators ka istemal kar sakte hain jaise ki volume, moving averages, aur RSI. Agar ye pattern dusre technical indicators ke sath confirm hota hai toh iska reliability aur strength badh jata hai.

- Entry aur Exit Points: Is pattern ka istemal karke traders ko entry aur exit points ka pata lagta hai. Agar downtrend ke baad Matching Low Candlestick Pattern form hota hai toh traders ko long positions ke liye entry point mil jata hai. Isi tarah, agar uptrend ke baad Matching Low Candlestick Pattern form hota hai toh traders ko short positions ke liye entry point mil jata hai.

- Risk aur Reward: Matching Low Candlestick Pattern ke istemal se traders ko risk aur reward ka pata lagta hai. Agar ye pattern confirmed ho jata hai toh traders apne stop loss aur target levels ko set kar sakte hain, jisse unka risk reward ratio improve hota hai.

Nuksanat:- False Signals: Kabhi kabhi Matching Low Candlestick Pattern false signals generate kar sakta hai. Ye pattern market conditions aur price action ke hisaab se kaam karta hai, lekin kabhi kabhi ye incorrect signals bhi provide kar sakta hai jisse traders ko nuksan uthana pad sakta hai.

- Subjectivity: Pattern interpretation subjective hoti hai aur har trader ke liye alag ho sakti hai. Kuch traders is pattern ko galat taur par interpret kar sakte hain aur isse nuksan uthana pad sakta hai.

- Limited Information: Matching Low Candlestick Pattern sirf price action ke basis par hota hai aur kisi aur factor ko ignore karta hai. Is pattern se sirf short term reversals ki information milti hai aur long term trends ko predict karna mushkil ho sakta hai.

- Market Volatility: High market volatility ke doran Matching Low Candlestick Pattern ka formation ho sakta hai, jisse pattern ke reliability par asar padta hai. Isse false signals ka risk badh jata hai aur pattern ke interpretation mein confusion ho sakti hai.

- Overuse: Kuch traders Matching Low Candlestick Pattern ko overuse kar sakte hain aur har ek pattern ko blindly follow kar sakte hain. Agar ek trader sirf is pattern par hi rely karta hai aur kisi aur factor ko ignore karta hai, toh woh trading decision ko galat ho sakta hai.

Samanya roop se, Matching Low Candlestick Pattern ke fawaid aur nuksanat hote hain jo traders ko samajhna zaroori hai. Agar sahi tarah se istemal kiya jaye, to ye ek valuable technical analysis tool ho sakta hai jo traders ko potential reversals aur trend changes identify karne mein madad karta hai. Lekin, traders ko hamesha caution aur risk management ke sath trading karna chahiye aur Matching Low Candlestick Pattern ke signals ko confirm karne ke liye dusre technical indicators ka istemal karna chahiye.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 10:42 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим