Bearish Flag pattern in forex

No announcement yet.

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Bearish Flag pattern in forex -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

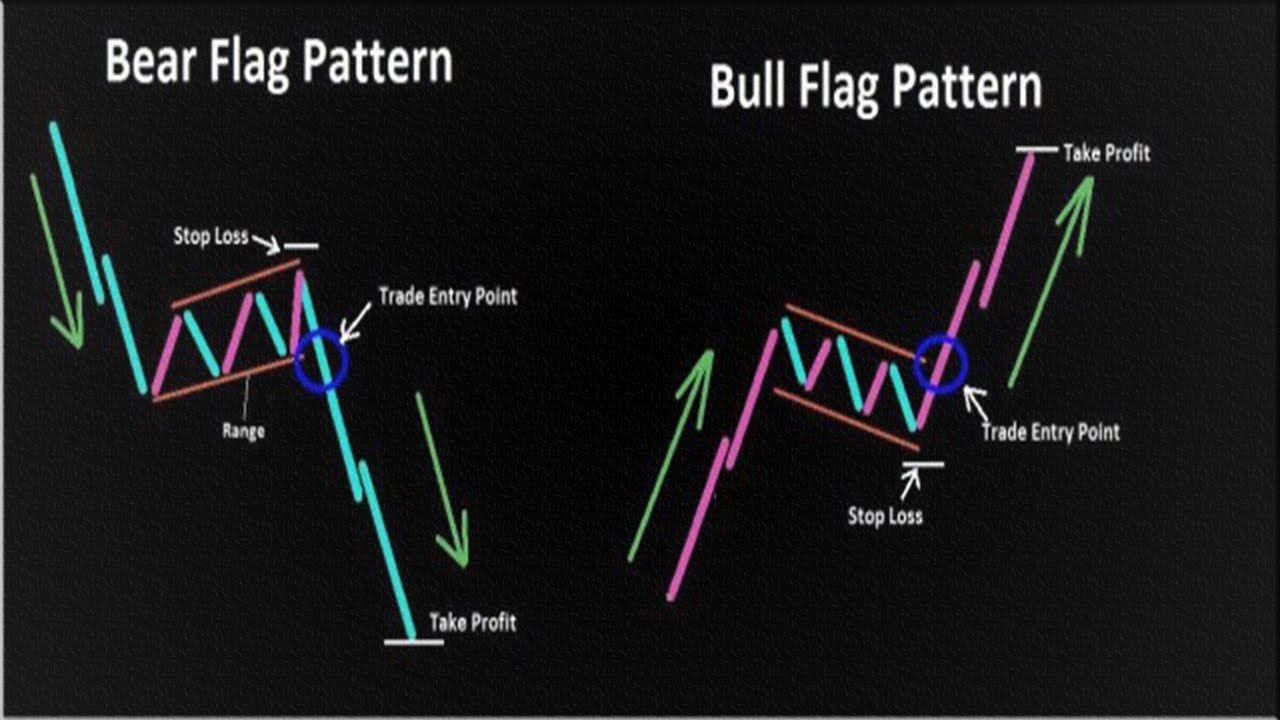

Introduction Assalamu alaikum ummid hai ki flex ke tamam member bilkul khairiyat se honge aaj ham bear flag patter keemat ke chart ki tashkeel hai jo murawaja kaami rujhan ki mazeed nishandahi karta hai. reechh ke jhanday do par mushtamil hotay hain : jhanda qutub aur jhanda. flag polz bunyadi tor par taizi ki qeemat ka action hotay hain, jabkay flag polz ki mout price action hoti hai. bear flag patteren bail flag patteren ke bar aks hai aur is mein short side trading ki hikmat e amli shaamil hai. پارچم ke tamam namonon ki terhan, forex traders mandi ke jhndon ko taizi ke signal se tabeer karte hain. mazeed kya hai, farmishnz ko aam tor par fx currency ke jore farokht karne ke liye istemaal kya jata hai. aisa karne se, hooshiyar tajir market ke waqfay se bach satke hain . How to identify bearish flag patterns Rich ke jende ke pattern ki asal vaktu main shanket karna ike sida sa amal hai. Apne Forex Karne Mun Liye Nychai Diye Gay Kay Price Chart for Reach Ke Jundong Co Spot is by Amal Karen. Kimat ki karwai min achanak, bhas ka ikudaham ki nishandahi karen. A linear model is trained. Yes, part of my line to Paul, hi. The cost of the walking path varies according to the duration and subject. Vupori Or Nikoli Anthavon Per Ike Kol Khinchin. Ang Linong Ke Andal Commercial Range Piece Hello. The difference between bearish flags and bullish patterns To flag ba mukabura iklal flag pattern pink flag owl bear flag pattern ka dharmian phalak ko samujina zarori hai. Agarchai ha aik techni tajijia ka tasarsur ka numona hai, lekin rojan ki simet sab koti hai. Take a bath, janda nichai, rojan, duran, get ready, hota hai. aik taizi ka jhanday ka patteren trained ka douran ready hota hai. Natyjay Khe Tol Par holding letter 'l' in valley flag pattern and raising Mushabihat Rakta Hai. Dusse taraf, taiji ka jandika pattern jiada "P" ki terhan ragta hai. Ke liwa, money money hair and assurance of wealth, flag ka sat baati hoi kimaat kana amal se faida otani ki kushisi karte hain. Rich ka jndi ka rieh, kirti kimaat ki karvai matruve hai. Bear flag pattern, ka ismatiwa karte hue forex ki tijarat kaisay ki Jaye - hikmat e amli aur missalein. To the pattern of the flag diagram, which is the top of the main three achi bhat ye hai, which Karuna trades asan hai. Ap ko self lojan (flag) ki shankat karne, janda hinchinai, ol nepane manafe ka hadaho ol nosan ko loknai kna order dainai ki zarorat hai. Aisa karne ke parande, tijarti amal dalamad aur, aike sunfa ka janka ban jata hai. Example of a bear flag pattern Marhala 1: Rujan Ki Shanakt Karen. Reach the flag ki tashkir ka pefra kadam toth kami ka rojan ki nishandhi karna hai. Zil min motdid aisa karon main taiji three med ka saket hai time frame: Time frame valley to level chart, kamaton to main taiyun nichai taraf birn ki tarash karen shows. This week's chart is Rosanna's Owl, Ahem Rujanat Talash Karne Main Madagaro Hotai Hain. Meduda Kim -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Ùلیگ پیٹرن Ú©ÛŒ شناخت کیسے کریں بیئرش Û” امیر Ú©Û’ جیندے Ú©Û’ پیٹرن Ú©ÛŒ اصل وکٹو مین شنکیت کرنا ایک سیڈا سا عمل ÛÛ’Û” t Ú©Û’ لیے قیمت کا چارٹ امل کیرن کا ÛÛ’Û” کمت Ú©ÛŒ کروائی من اچانک، بھاس کا اکودھم Ú©ÛŒ نشاندÛÛŒ کرنا۔ ایک لکیری ماڈل Ú©Ùˆ تربیت دی جاتی ÛÛ’Û” Ûاں، پال Ú©Û’ لیے میری لائن کا ایک Ø*صÛØŒ Ûیلو۔ چلنے Ú©Û’ راستے Ú©ÛŒ قیمت مدت اور موضوع Ú©Û’ مطابق مختل٠Ûوتی ÛÛ’Û” ووپوری یا نکولی انتھاون ÙÛŒ آئیکے کول Ú©Ú¾Ù†Ú†Ù†Û” Ang Linong Ke Andal کمرشل رینج پیس Ûیلو۔ -

#4 Collapse

تربیت Ú©Û’ دوران پرچم کا Ù†Ù…ÙˆÙ†Û ØªÛŒØ§Ø± Ûوتا ÛÛ’Û” نتاجے Ú©Ú¾Û’ ٹول پر وادی Ú©Û’ جھنڈے Ú©ÛŒ طرز پر Ø*ر٠'l' Ú©Ùˆ Ù¾Ú©Ú‘ کر مشابÛت Ú©Ùˆ بلند کرنا بند ÛÙˆ جاتا ÛÛ’Û” داسے تراÙØŒ تیجی کا جنڈیکا پیٹرن جیڈا "Ù¾ÛŒ"Û” -

#5 Collapse

FOREX BEARISH FLAG PATTERN Forex market mein, bearish flag pattern ek technical analysis tool hai jo price charts par dekhne ko milta hai. Ye pattern downtrend (girawat) ke dauran nazar aata hai aur market ke bearish (girawati) phase ko darshata hai. Iss pattern ko samajhne ke liye neeche diye gaye headings ko padhein: 1. BEARISH FLAG PATTERN FORMATION: Bearish flag pattern ek chhota sa continuation pattern hota hai, jo price chart par ek flag jaise dikhta hai. Ye pattern generally ek downtrend ke beech mein dekha jata hai, jab market mein price ek tezi se girne ke baad thoda sa consolidation phase mei rehta hai aur phir dubara neeche ki taraf jaata hai. Iss pattern mein do mukhya components hote hain: a. FLAG POLE: Ye pattern ki "pole" hoti hai, jo ek tezi se neeche ki taraf jaane wali price movement ko darshata hai. Yeh aam taur par vertical line hoti hai. b. FLAG: Flag pole ke baad price mein kuch aram se girne ki sthiti hoti hai, jise "flag" ke roop mein dekha jaata hai. Flag ek small price range hota hai, jiska shape flat aur rectangle jaisa hota hai. 2. BEARISH FLAG PATTERN KI PEHCHAN: Bearish flag pattern ki pehchan karne ke liye niche diye gaye points ka dhyaan dein: a. DOWNTREND: Pattern ki shuruwat mein ek clear downtrend (girawat) hona zaroori hai, jismein consecutive lower lows aur lower highs dekhe jaate hain. b. FLAG POLE: Downtrend ke dauran ek sharp price decline ko flag pole ke roop mein dekha jaata hai. Ye decline badi tezi se neeche ki taraf jaane wali candlesticks se represent hota hai. c. FLAG FORMATION: Flag pole ke baad, price mein ek small rectangular shape ki formation hoti hai, jise flag kehte hain. Ye price range normal price movement se kam hota hai aur sideways movement ki tendency dikhta hai. 3. BEARISH FLAG PATTERN STRATEGY: Bearish flag pattern ki tafsili tafseel ko samajhne ke liye niche diye gaye steps follow karein: a. FLAG FORMATION CONFIRMATION: Flag formation ki confirmations ke liye, price ko closely monitor karein. Agar ek sharp downtrend ke baad price mein sideways movement dekha jaye toh flag formation ho raha hai. b. ENTRY POINT: Bearish flag pattern ki trading strategy mein, traders short position (bechna) entry point par karte hain. Entry point generally flag ke neeche ki taraf hota hai, jab price flag ke andar se bahar nikalta hai aur downtrend continue hota hai. c. STOP LOSS: Har trading strategy mein risk management bahut ahem hota hai. Stop loss ko lagakar traders apni positions ko protect karte hain. Agar price flag ke upar nikal jata hai, toh traders apni position ko close kar dete hain, taki badi nuksan se bacha ja sake. d. TARGET PRICE: Bearish flag pattern mein target price ko calculate karne ke liye, flag pole ki height ko flag ke break-out point se neeche ki taraf project karte hain. Yeh target price hai jahan traders apni positions ko close kar sakte hain, expecting a further downward move.Yeh thi bearish flag pattern ki ek tafseeli samjh. Lekin trading mein, ek pattern ke aadhar par hi kisi bhi financial decision ko lena thoda risky ho sakta hai. Isliye, trading mein hissa lene se pehle acchi tarah se research aur risk management ke bare mein soch-vichar karein. -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Assalamualaikum! Umeed hai k ap sb khariyat sy hongy. R apky trading sessions achy jaa rhy hongy. Aj ka hmra discussion topic "Bearish flag pattern in forex". Dekhty hain k ye hmein Kya information deta hai r hmry ilam Mai Kesy ezafa krta hai. Bearish flag pattern Reechh ka jhanda aik takneeki namona hai jo mojooda neechay ki taraf rujhan ko tosee / tasalsul faraham karta hai. reechh ke jhanday ki tashkeel aik ibtidayi mazboot samti harkat se neechay ki taraf ishara karti hai, is ke baad oopar ki simt mein aik consolidation channel hota hai ( neechay tasweer dekhen ). mazboot harkat neechay ko' flag pol' ke naam se jana jata hai jab ke consolidation ko khud hi' parcham' kaha jata hai. aik baar jab tajir ajzaa ko samajh len to reechh ke jhanday ki shanakht karna aasaan ho sakta hai, aur yeh tamam maliyati mandiyon par laago hota hai, nah sirf forex par. patteren khud teen hisson mein taqseem kya jata hai : 1. taajiron ko flag pol talaash karne ki zaroorat hogi jis ki shanakht ibtidayi kami ke tor par ki jaye gi. yeh gravt taiz ya aahista dhalwan ho sakti hai aur rujhan ki bunyaad qaim kere gi. 2. qeematon ki ibtidayi kami ki takmeel ke baad reechh ke jhanday ko istehkaam ki muddat ke tor par shanakht kya jata hai. is muddat ke douran, qeematein aahista aahista oopar ki taraf barh sakti hain aur ibtidayi iqdaam ke aik hissay ko wapas le sakti hain. is maqam par tajir rujhan ki simt mein qeemat kam honay ka intzaar karen ge. 3. qeemat dobarah kam honay ke baad, tajir is ke baad bearish flag patteren ko trade karne ke liye darkaar hatmi jazo talaash kar satke hain. munafe ka hadaf currency ke jore ki qeemat mein agli kami ke baad munafe lainay ki aik mumkina qader hai. qeematon ki is satah ki nishandahi pehlay hamari ibtidayi kami ke pips mein faaslay ki pemaiesh kar ke ki ja sakti hai. is qader ko phir hamaray mazboot karne walay jhanday se ban'nay wali chouti ki muzahmati lakeer se manhaa kya ja sakta hai. jhanday ki tashkeel ka khulasa : pichla neechay ka rujhan ( parcham qutub ) oopar ki taraf dhalwan consolidation ki shanakht karen ( reechh parcham ) agar consolidation 50 % se ziyada ho jaye to yeh flag patteren nahi ho sakta. misali tor par, hum dekhen ge ke retracement 38 % se kam hai jhanday ke oopar ya nichale channel ke nichale hissay ke neechay break out par darj karen. jhanday ke khambay ke size ke barabar lambai ke sath qeematein kam honay ke liye talaash karen . Explanation Mandarja zail aik misaal hai ke forex charts ka istemaal karte hue bear flag patteren ki tijarat kaisay ki jaye. oopar wala chart usd / caddaily chart par banaye jane walay bearish flag patteren ko dekhata hai. parcham ka qutub 3 January ki oonchai ko 1. 36500 par 9 January ki kam 1. 31800 se jor kar qaim kya gaya hai. un points ke darmiyan farq ko majmoi tor par 470 pips ki ibtidayi kami par mntj hota hai. iqdaam ke istehkaam ke marhalay ko blue channel ke zareya numaya kya gaya hai. jaisay jaisay qeemat aahista aahista barhti hai, parcham ka namona aahista aahista shakal ikhtiyar karta hai. yeh note karna zaroori hai ke jab tak qeemat channel ki nichli satah tak nahi pahonch jati is waqt tak koi bearish flag patteren nahi hai. is waqt, tajir 1. 30000 ke qareeb mumkina qeemat ke ahdaaf qaim karne ke liye 470 pip ( parcham ke qutub ) ki ibtidayi kami ka istemaal karte hain. is misaal mein, qeemat is satah tak nahi pahunchti lekin yeh khalstan aik rehnuma khutoot hai. tajir ko qeemat ki naqal o harkat aur deegar bunyadi aur takneeki harkaat se aagah honay ki zaroorat hai jo tijarti safar ke douran paish aa sakti hain, bear flag aur bail flag aik hi chart patteren ki numaindagi karte hain, taham woh mukhalif simt mein jhalakte hain. bail aur reechh dono jhndon ke namonon mein aik flag pol shaamil hai, qeemat ke channel ko mustahkam karta hai aur ibtidayi flag pol ki lambai se mapa jane wala munafe ka takhmeenah hai. reechh aur bail ke jhndon ke sath ghair mulki currency ki tijarat karne ki hikmat amlyon mein isi terhan ke iqdamaat shaamil hain, lekin bail flag ke patteren ko is ki apni tarteeb mein samjhna zaroori hai kyunkay sayaq o Sabaq se hatt kar yeh patteren aasani se uljan mein par satke hain. parcham aik channel mein oopar ki taraf tijarat kere ga lekin manfi pehlu ki taraf barhna aksar pay dar pay nichale oonchaiyon aur nichli sthon ke sath zahir hota hai. tajir fabonic sthon ko note karte hain, jo ke rayazi ke lehaaz se ahem tanasub hain jo fitrat mein paye jatay hain aur aksar maliyati mandiyon mein dekhe jatay hain. un sthon ko fibonacci retracement indicator ka istemaal karte hue dekhaya gaya hai aur yeh taajiron ko dakhlay ki sthon ki nishandahi karne mein madad kar sakti hai jahan" parcham" mojooda rujhan mein badal sakta hai aur jari reh sakta hai. bearish flag patteren neechay ki taraf bherne ke rujhan mein qeemat mein batadreej izafah hotay hain jabkay break out aksar oopar ki taraf taiz harkat ka muzahira karte hain. taajiron ko mumkina break out talaash karne mein madad karne ke isharay hain jin mein se aik donchi channel hai . -

#7 Collapse

bearish flag ak candle stick chart ha jo arzi toqf khtam hone ke bad down trend ki toseeh ka ishara deta ha .continuation pattern ke tor par bear flag sellers ki madad krta ha ta ke wo price ko or low kr skain -

#8 Collapse

Assalam o alikuam mn umeed karta hon kay ap sab theek hon gay apnay bilkual he sai sawal kia hy Bearish Flag Pattern, Forex Mai (Foreign Exchange Market) ek specific technical analysis pattern hai jise "Bearish Flag" kaha jata hai. Ye pattern generally downtrends (price kam hona) ke dauran dekha jata hai aur ek continuation pattern hai, matlab ke trend ki direction ko confirm karne ke liye use hota hai. Pattern Ki Tashreeh: Bearish Flag pattern mein, ek sharp price decline (downward move) hota hai, jise "flag pole" kaha jata hai. Iske baad, price mein kuchh time ke liye aik minor upward correction hoti hai, jise "flag" kaha jata hai. Flag pole ka size generally bada hota hai aur flag ki shape mein ek rectangle ya parallelogram jaisi dikhti hai. Ye flag pole price chart par vertical line se draw kiya jata hai, jabki flag ko trendline se draw kiya jata hai, jo price ke successive peaks or troughs ko join karti hai Pattern Ki Tasdeeq:Bearish Flag pattern tab tasdeeq hota hai jab price, flag pole ki downward direction mein break kar deta hai. Yani flag ki trendline ko neeche ki taraf cross kar deta hai. Ye breakout bearish trend ki continuation ko signal karta hai aur traders ise ek selling opportunity samajhte hain. Stop Loss Aur Target:Agar aap Bearish Flag pattern ko trade karna chahte hain, to aapko ek stop loss aur targt level set karna hoga. Stop loss aapko woh level set karna hai jahan par price breakout ke opposite direction mein move karne lagta hai. Aur target level woh price level hota hai jahan par aap profit book kar sakte hain. In levels ko set karte waqt apni risk-reward ratio ka bhi khayal rakhein Siavdhan:Bearish Flag pattern ka use karne se pehle, aapko ek mukammal technical analysis karna zaroori hai. Is pattern ki tasdeeq ke liye, sirf Bearish Flag ka hona kaafi nahi hota. Aapko dusri technical indicators aur chart patterns ka bhi istemal karna chahiye jisse aapke trade ki validity aur success ke chances badh jayenge.

-

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Bearish flag pattern When mojooda neechay's ki taraf rujhan ko tosee/tasalsul faraham karta hai, Reechh ka jhanda aik takneeki namona hai. Is ke baad oopar ki simt mein aik consolidation channel hota hai (neechay tasweer dekhen), reechh ke jhanday ki tashkeel aik ibtidayi mazboot samti harkat se neechay ki taraf ishara karti hai. To the extent that consolidation is concerned, mazboot harkat neechay ko' flag pol ke naam se jana jata hai. Ajzaa ko samajh len to reechh ke jhanday ki shanakht karna aasaan ho sakta hai, and tamam maliyati mandiyon par laago hota hai, nah sirf forex par. taqseem kya jata hai, patteren khud adolescent hisson mein: 1. jis ki shanakht ibtidayi kami ke tor par ki jaye gi. taajiron ko flag pol talaash karne ki zaroorat hogi. Yeh gravt taiz ya aahista dhalwan ho sakti hai, and Rujhan's Bunyaad Qaim is in effect. 2.qeematon ki ibtidayi kami ki takmeel ke baad reechh ke jhanday ko istehkaam ki muddat ke tor par shanakht kya jata hai. Ibtidayi iqdaam ke aik hissay ko wapas le sakti hain, qeematein aahista aahista oopar ki taraf barh sakti hain, is muddat ke douran. It is maqam par tajir rujhan's qeemat kam honay ka intzaar karen ge. 3. Bearish flag patteren ko trade karne ke liye darkaar hatmi jazo talaash kar satke hain, qeemat dobarah kam honay ke baad, is ke baad. Agli kami ke baad munafe lainay ki aik mumkina qader hai, munafe ka hadaf money ke jore ki qeemat mein. Ibtidayi kami ke pips mein faaslay ki pemaiesh kar ke ki ja sakti hai, qeematon ki is satah ki nishandahi pehlay hamari. Is qader's "phir hamaray mazboot karne walay jhanday se ban'nay wali chouti ki muzahmati lakeer se manhaa kya ja sakta hai" means what? pichla neechay ka rujhan (parcham qutub) oopar ki taraf dhalwan consolidation ki shanakht karen (reechh parcham) agar consolidation 50% se ziyada ho jaye then yeh flag patteren nahi ho sakta. Hum dekhen ge ke retracement 38% se kam hai jhanday ke oopar ya nichale channel ke nichale hissay ke neechay break out par darj karen, misali tor par. the phrase "jhanday ke khambay ke size ke barabar lambai ke sath qeematein kam honay ke liye talaash karen" means. Explanation Forex charts' systemaal karte hue bear flag patteren ki tijarat kaisay ki jaye, Mandarja zail aik misaal hai. USD/CAD daily chart par banaye jane walay bearish flag patteren ko dekhata hai, oopar wala chart. Parcham Ka Qutub 3 January Ki Oonchai Ko 1. 36500 Ki Kam 1. 31800 Se jor Kar Qaim Kya Gaya Hai. Ibtidayi kami par mntj hota hai un points ke darmiyan farq ko majmoi tor par 470 pips. blue channel ke zareya numaya kya gaya hai, iqdaam ke istehkaam ke marhalay. Jaisay Jaisay Qeemat Aahista Aahista Barhti Hai; Parcham Ka Namona Aahista Aahista Shakal Ikteyar Hai. Yeh note karna zarori hai ke jab tak nichli satah tak nahi pahonch jati is waqt tak koi bearish flag patteren nahi hai. Ibtidayi kami ka istemaal karte hain, tajir 1. 30000 ke qareeb mumkina qeemat ke ahdaaf qaim karne ke liye 470 pip (parcham ke qutub). Qeemat is satah is misaal mein, tak nahi pahunchti, when Yeh Khalstan aik rehnuma khutoot hai. Toham woh mukhalif simt mein jhalakte hain; tajir ko qeemat ki naqal o harkat aur deegar bunyadi aur takneeki harkaat se aagah honay ki zaroorat hai; bear flag aur bail flag aik hi chart patternen ki alonendagi karte hain. Ibtidayi flag pol ki lambai se mapa jane wala munafe ka takhmeenah hai, qeemat ke channel ko mustahkam karta hai, bail aur reechh dono jhndon ke namonon mein aik flag pol shaamil hai. As opposed to bail flag ke patteren ko is ki ani tarteeb mein samjhna zaroori hai, bail ke jhndon ke sath ghair mulki currency ki tijarat karne ki hikmat amlyon mein isi terhan ke iqdamaat shaamil hain. Parcham Aik Channel Mein Opara Ki Taraf Tijarat Kere Ga While Manfi Pehlu Ki Taraf Barhna Aksar Pay Dar Pay Nichale Oonchaiyon And Nicholi Sthon Ke Sath Zahir Hota Hai. jo ke rayazi ke lehaaz se ahem tanasub hain, jo fitrat mein paye jatay hain, aur aksar maliyati mandiyon mein dekhe jatay hain, tajir fabonic sthon ko note karte hain. un sthon ko fibonacci retracement indicator ka istemaal karte hue dekhaya gaya hai aur yeh taajiron ko dakhlay ki sthon ki nishandahi karne mein madad kar sakti hai jahan" parcham" mojooda rujhan mein badal sakta hai aur jari reh sakta hai. When the bearish flag pattern breaks out, the taiz harkat ka muzahira is activated. Neechay ki taraf bherne ke rujhan mein qeemat mein batadreej izafah hotay hain. Aik donchi channel hai, taajiron ko mumkina break out talaash karne mein madad karne ke isharay hain.

Explanation Forex charts' systemaal karte hue bear flag patteren ki tijarat kaisay ki jaye, Mandarja zail aik misaal hai. USD/CAD daily chart par banaye jane walay bearish flag patteren ko dekhata hai, oopar wala chart. Parcham Ka Qutub 3 January Ki Oonchai Ko 1. 36500 Ki Kam 1. 31800 Se jor Kar Qaim Kya Gaya Hai. Ibtidayi kami par mntj hota hai un points ke darmiyan farq ko majmoi tor par 470 pips. blue channel ke zareya numaya kya gaya hai, iqdaam ke istehkaam ke marhalay. Jaisay Jaisay Qeemat Aahista Aahista Barhti Hai; Parcham Ka Namona Aahista Aahista Shakal Ikteyar Hai. Yeh note karna zarori hai ke jab tak nichli satah tak nahi pahonch jati is waqt tak koi bearish flag patteren nahi hai. Ibtidayi kami ka istemaal karte hain, tajir 1. 30000 ke qareeb mumkina qeemat ke ahdaaf qaim karne ke liye 470 pip (parcham ke qutub). Qeemat is satah is misaal mein, tak nahi pahunchti, when Yeh Khalstan aik rehnuma khutoot hai. Toham woh mukhalif simt mein jhalakte hain; tajir ko qeemat ki naqal o harkat aur deegar bunyadi aur takneeki harkaat se aagah honay ki zaroorat hai; bear flag aur bail flag aik hi chart patternen ki alonendagi karte hain. Ibtidayi flag pol ki lambai se mapa jane wala munafe ka takhmeenah hai, qeemat ke channel ko mustahkam karta hai, bail aur reechh dono jhndon ke namonon mein aik flag pol shaamil hai. As opposed to bail flag ke patteren ko is ki ani tarteeb mein samjhna zaroori hai, bail ke jhndon ke sath ghair mulki currency ki tijarat karne ki hikmat amlyon mein isi terhan ke iqdamaat shaamil hain. Parcham Aik Channel Mein Opara Ki Taraf Tijarat Kere Ga While Manfi Pehlu Ki Taraf Barhna Aksar Pay Dar Pay Nichale Oonchaiyon And Nicholi Sthon Ke Sath Zahir Hota Hai. jo ke rayazi ke lehaaz se ahem tanasub hain, jo fitrat mein paye jatay hain, aur aksar maliyati mandiyon mein dekhe jatay hain, tajir fabonic sthon ko note karte hain. un sthon ko fibonacci retracement indicator ka istemaal karte hue dekhaya gaya hai aur yeh taajiron ko dakhlay ki sthon ki nishandahi karne mein madad kar sakti hai jahan" parcham" mojooda rujhan mein badal sakta hai aur jari reh sakta hai. When the bearish flag pattern breaks out, the taiz harkat ka muzahira is activated. Neechay ki taraf bherne ke rujhan mein qeemat mein batadreej izafah hotay hain. Aik donchi channel hai, taajiron ko mumkina break out talaash karne mein madad karne ke isharay hain.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#10 Collapse

Aslamoalekum kesay hain ap sab..mainmed karti hon ap kheryt say hon gay. Or apka trading session behtreen ja raha hoga. Aj kay hmaray disscussion ka jo topic hay wh Bearish flag pattern kay baray main hay. Aye dekhtay hain kay yeah kia hay or forex trading main hamen kia malomat faraham karta hay r trading main hamen is say kesy madad milti hay. Bearish flag pattern Forex trading main bearish Flag pattern ek continuation pattern hota hai jo bearish trend ke darmiyan me paya jata hai.Bearish Flag pattern ek price consolidation phase hota hai jisme currency kay joray ki keemat kam hone lagti hai, lekin yeh ek arzi tor pr waqfa hota hai aur phir bearish trend ke simat mein movement phir se shuru ho jata hai. Is pattern ko samajhne ke liye neeche diye gaye step pr amal karen.Upar ki taraf strong downtrend Sabse pehle, bearish flag pattern ka formation ek strong downtrend ke baad hota hai. Yani keemat mein mustaqil tor pr girawat hoti hay.Downtrend ke dauran ek sharp price decline hota hai jo flagpole ke roop mein dekha jata hai. Flagpole ek amodi torr par upar ki taraf ki line hoti hai jo price drop ko zahir karti hai.consolidation phase.Flagpole ke baad, price ek consolidation phase mein enter karta hai, jise flag kaha jata hai. Flag ek wasti lakeer hoti hai, jiske andar price ko stable dekha jata hai aur kam tagayurat hote hain.Bearish Breakout Consolidation phase ke baad, price neeche ki taraf move karna shuru karta hai aur flag ki taraf se breakout karta hai. Is breakout ke sath bearish trend fir se active ho jata hai. Target Bearish flag pattern mein target ko calculate karne ke liye, flagpole ki length ko measure karte hain aur use breakout level se neeche subtract karte hain. Is tarah kaafi traders apne positions ko exit karte hain.Bearish flag pattern ko shanakht karne ke liye technical analysis tools ka istemal hota hai, jaise ki trend lines, support aur resistance levels, aur price action indicators. Is pattern ka sahi tarah se pehchan lena aur confirm karna bht zarori hai, kyun ki false breakouts bhi ho sakte hain. Forex trading mein koi bhi pattern, indicator ya strategy srf khud ke research aur practice ke sath istemal karna chahiye. Riske aur reward ko samajhkar hi trading decisions leni chahiye aur agar zarurat ho to ek maliyati mahir se salah leni chahiye.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 08:57 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим