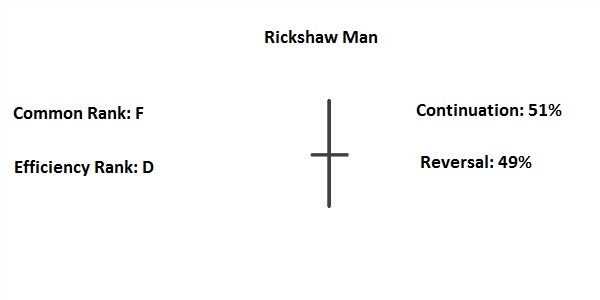

Rickshaw Man candlestick chart pattern in forex

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Introduction Assalamu alaikum ummid hai ki Forex KY tmam members blkol thek hon gy aur is week APNA km dil sy kr rahy hon gy aur inshallah SB khamiyab hon gy onka acha bonus aye ga aur acha profit hasil hoga aye is ky bary Mai kuch jancari hasil krty Hain What is Rikshaw Man's candlestick pattern? meaning Rickshaw aadmi lambi tangong wali Doji candle stuck Ehem is on the way beca wala bazar mein khair faisla kin house ka ishara kar raha hai. Rakshay should not oopri aur nichale saaye lambay hotay hain, eje batii ka center ka qareeb aik chhota sa asli jism hota hai. There is no rickshaw, no signs of vehicles, no signs of cars, it's a chart, it's a chart, it's a level car, it's a car, it's a car. Understanding Rickshaws Man Candlestick Chart Patterns rickshaw walay ko samjhna aik stick candle aala, kam, khuli aur band qematon ko dekhata hai. Meaning beca sham ka khula aur topiri aik hi qeemat ki satah par ya bohat karib hai, jo Doji banata hai. onche aur neech bohat daur hain, shama daan par lambay saaye peda karte hain. yes bazaar mein shurka ki janib se Adam faisla ko zahir karta hai. Lamp rickshaw waqt hoti hai jab ikrar aur reechh aik hi muddat ke douran mukhtalif auqaat mein security ki qeemat ko karte management hain meaning. Yes, it's a different era to liye aik wasee trading range banata hai, terhan eje batii par taweel saaye peda hotay hain. rickshaw without ki taraf se zahir kardah numaya utaar charhao ka bawajood, yeh wazeh samti harkat ki taraf ishara nahi karta, aur qeemat ki ibtidayi qeemat ka bilkul qareeb band ho jati hai. beca wala ki taraf se ishara kya gaya harkiyaat pasar mein ghair faisla kin honai ki nishhandahi karti hai but yeh sayaq o Sabaq ki bunyaad par taajiron ko signal bhaij sakti hai. kuch sooraton mein, patteren istehkaam ki termat ki numindagi kar sakta hai, jo pichlle rujhanaat kana tasalsul ka mahswara gun sakta hai. Doosri sooraton mein, patteren taizi se run ka ehtataam par Adam faisla ki nishandahi kar sakta hai, jo market ka ulat jane ka mahswara day sakta hai. kaafi sayaq o Sabaq ke haamil tajir tasalsul ya ulat jane par shart lagana chahtay hain, but bohat se mamlaat mein, tajir kisi bhi position ko is waqt tak rokna chahain ge jab tak ke koi wazeh diagram pattern ya qeemat ka rujhan samnay nah aa. For example roku inc. (roku) ka rozana diagram meaning raksha candle stick ki rumaja examplelein dekhata hai. pehla, dayen taraf, waqt hota hai jab kami ka baad qeemat barhna shuru hoti hai. Rickshaw without candlestick ne faisla nah karne ka ishara diya aur qeemat oopar jane se pehlai labyrinth do sishnon tak aik taraf chalti rahi. Tasweer tasweer ba zarea Sabrina Jayang agli do misalein bhi Adam faisla ko zahir karti hain, aur qeemat rickshaw lamp stick ka baad aik taraf barhti rehti hai. aik tajir khareed sakta hai jab qeemat rickshaw walay se ziyada ho jaye aur rickshaw walay se neechay stap nuqsaan muqarrar kya jaye. isi terhan, aik tajir rickshaw without ki qeemat kam honai ke baad kam kar sakta hai ya farokht kar sakta hai, a rickshaw without ke oopar stap nuqsaan (agar mukhtasir ho to) rak sakta hai. hah aik intehai qabil aetmaad hikmat e amli nahi hai, agarchay, aur takneeki tajzia ki doosri shaklon ko istemaal karne ki bohat hosla afzai ki jati hai agar candle closed pattern ko tijarti dakhlay to maqasid to liye istemaal kar lie istemaal Rickshaw Man limited candlestick chart pattern Beca means ki hudood aik beca wala eje batii faisla nah karne ka ishara kar raha hai. takneeki tajzia ki doosri shakalain aam tor par yeh bitanay ka liye darkar hoti hain ka aaya yeh acha, here, ya mamooli hai. agar raksha means candle stick ki bunyaad tara tijarat ki jaye ka koi moroosi munafe ka hadaf nahi hai. hawa tajir par munhasir hai ke woh baat ka bhi taayun kere ke agar entrance munafe bakhash saabit hoti hai to woh kahan se munafe len ge. patteren aksar hota hai, khaas tor par jab qeemat ka amal pehlai se hi kata ho. Lehaza. tax, capital kaari, or fiscal khidmaat aur mahswara faraham nahi karta hai. malomat sarmaya kaari ka maqasid, hatray ki bardash, ya kisi maksoos sarmaya car ka maali halaat par ghor kiye baghair paish ki jati hain aur ho sakta hai ka tamam sarmaya now ka liye mozoon nah hon. sarmaya kaari mein hatrah shaamil hai, Chief Executive Officer ka mumkina nuqsaan. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

ایÛام راستے میں ÛÛ’Û” بیکا والا بازار میں خیر Ùیصل گھر کا Ø¹Ø´Ø±Û Ú©Ø± رÛا ÛÛ’Û” رکشے Ú©Ùˆ اوپری اور Ù†Ú©Ù„Û’ سائے لمبے Ûوتے Ù†Ûیں، اجے باتی کا مرکز کا قریب ایک چھوٹا سا اصل جÙسم Ûوتا ÛÛ’Û” کوئی Ø±Ú©Ø´Û Ù†Ûیں، گاڑیوں کا کوئی نشان Ù†Ûیں، گاڑیوں کا کوئی نشان Ù†Ûیں، ÛŒÛ Ú†Ø§Ø±Ù¹ ÛÛ’ØŒ ÛŒÛ Ú†Ø§Ø±Ù¹ ÛÛ’ØŒ ÛŒÛ Ø§ÛŒÚ© لیول کار ÛÛ’ØŒ ÛŒÛ Ú©Ø§Ø± ÛÛ’ØŒ -

#4 Collapse

-

#5 Collapse

Understanding the Rickshaw Man Candlestick Pattern

Rickshaw Man candlestick pattern forex mein aik ahem tarika hai jisay technical analysis mein istemal kiya jata hai. Yeh pattern traders ko market ke mazidiza trends aur price action ke bare mein maloomati farahmi faraham karta hai. Rickshaw Man pattern, jisay kabhi kabhi doji bhi kaha jata hai, aik aham khamiyazaat ke sath aata hai jo ke price reversal ko darust karnay mein madad faraham karta hai.

Rickshaw Man pattern ko samajhnay ke liye, pehle candlesticks ki bunyadi tafseelat ko samajhna zaroori hai. Candlestick charts, jo ke Japani traders ke zariye shuru ki gayi, market ke price movement ko visual roop mein darust karti hain. Har candlestick ek specific time period ke dauran price movement ko darust karta hai. Har candlestick 4 main qism ke tajziyati maloomat faraham karta hai: open, high, low, aur close price.

Identifying the Rickshaw Man Pattern

Rickshaw Man pattern ki pehchan karne ke liye, pehle ham open aur close price ki bandagi ko dekhte hain. Agar aik candlestick ke open aur close price barabar hain ya bohot qareeb hain, toh yeh pattern ban jata hai. Yeh aksar market mein indecision ko darust karta hai jab price mein koi clear trend na ho.

Rickshaw Man pattern ka naam is wajah se hai ke iski shakal ek rickshaw ke sakht aasan se milta hai. Yeh pattern aksar doji candlestick ke sath milta hai, jis mein price ke movement ke darmiyan kafi chhota farq hota hai. Rickshaw Man pattern ka main characteristic yeh hota hai ke iski upper aur lower shadows lambi hoti hain, jab ke body bohot chhoti hoti hai.

Significance of the Rickshaw Man Pattern

Rickshaw Man pattern ka matlab hota hai ke market mein indecision hai aur traders ke darmiyan koi clear consensus nahi hai ke price kis raaste par ja rahi hai. Is tarah ke pattern ka zahir hona market mein price reversal ke liye aik maddah sabit ho sakta hai.

Rickshaw Man pattern ka istemal karne ke liye, traders ko doosri technical indicators aur patterns ke sath mila kar dekhna chahiye. Misal ke taur par, agar Rickshaw Man pattern support level ke qareeb paya jata hai aur sath hi sath kisi aur reversal indicator jaise ke RSI ya MACD bhi confirm karta hai, toh yeh acha sign hai ke price mein reversal hone ka imkan hai.

Variations of the Rickshaw Man Pattern

Rickshaw Man pattern ke mukhtalif variations bhi hotay hain, jin mein kuch patterns ki shadows lambi hoti hain aur kuch ki bodies chhoti hoti hain. Har variation apni alag maloomati farahmi faraham karta hai, lekin unki bunyadi tafseelat ek jaisi hoti hai.

Rickshaw Man pattern ki pehchan karna aham hai, lekin iski sakhti ke liye trader ko doosri factors aur market context ko bhi dekhna zaroori hai. Is pattern ko sirf akele istemal karke trade karna munasib nahi hai, balkay doosri technical aur fundamental analysis ke sath mila kar dekhna chahiye.

Is tarah, Rickshaw Man candlestick pattern forex traders ke liye aik ahem tool hai jo ke market ke price action ko samajhne aur reversal points ka pata lagane mein madad faraham karta hai. Lekin, jaise har technical indicator aur pattern ka hai, iska istemal bhi samajhdari aur achi tajziya ki zaroorat hoti hai.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

INITIAL WORDS

“RICKSHAW MAN PATTERN” market mein sentiment aur price action ka eik positive understanding provide karta hay. Rickshaw man pattern, jisay kabhi kabhi doji bhi kaha jata hai, aik aham khamiyazaat ke sath aata hai jo ke price reversal ko darust karnay mein madad faraham karta hai. Ess kay zariye market mein hone wale possible changes ko expect kiya ja sakta hai. Ess pattern ka istemal market mein hone wale potential reversals ya trend changes ko identify karne ke liye hota hay. Yeh candlestick chart analysis mein aik important and powerful indicator hay jo traders aur investors kay liye market trends aur reversals ko samajhne mein helpful hota hay. Yeh pattern sometime doji candlestick ke sath milta hai, jis mein price ke movement mein small difference hota hai.

EXPLANATION OF STRUCTURE

Market mein structure building ka information traders ko experienced aur sensible trader making mein strength provide ker sakta hay. Rickshaw man pattern ko samajhne se traders ko ye idea milta hai ke market mein indecision hai aur kisi specific trend ki taraf kisi strong indication nahi hai. Agar yeh pattern uptrend kay baad form hota hay tou yeh bearish reversal ka signal ho sakta hay, aur agar downtrend kay baad form hota hay tou yeh bullish reversal ka signal ho sakta hay. Ess pattern ki zyada importance tab hoti hai, jab ess ko strong support ya resistance levels ke qareeb dekha jaye. Rickshaw man pattern ki different variations hotay hain jin mein kuch patterns ki shadows long hoti hain, aur kuch ki bodies small hoti hain. Har variation apni separate information provide karti hai

TECHNICAL ANALYSIS

Experienced traders ki study kay accordingforex market mein rickshaw man candlestick pattern kisi separate indicator ke sath istemal karna better results produce kar sakta hay. Jab yeh pattern support level ke qareeb aata hay, tou yeh ek potential long entry point bhi hota hay. jab kay resistance level ke pass hony par short entry ka chance lena profitable ho sakta hay. Agar overall trend aur doosre factors bhi reversal ko support karte hain, tou trade karna consider kiya ja sakta hay. Traders kabhi bi confirmatory signals kay baghair trade open na kerein but jaisy hee confirmatory signal find kerein tou yeh order open kerny ka auucrate aur perfect time ho sakta hay. Jiss ko old and experienced traders kabhi miss nahi kerty.

- Mentions 0

-

سا0 like

-

#7 Collapse

Rickshaw Man candlestick chart pattern in forex ek bullish reversal pattern hai jo tab banta hai jab ek lambi bearish trend ke bad market mein indecision aata hai. Pattern ek doji candlestick se bana hota hai jiske lambe wicks hote hain aur ek chota body hota hai. Doji ka opening aur closing price lagbhag saman hota hai, jo market mein indecision ko darshata hai. Lambe wicks bullish aur bearish donon dabav ko darshatae hain, lekin anttah market kisi ek disha mein break nahin hota hai.

Rickshaw Man pattern ko kai tarikon se trade kiya ja sakta hai. Ek tarika hai pattern ke bad ek bullish breakout ka intezar karna. Breakout tab hota hai jab price doji ke upar ke wick se upar band hota hai. Breakout ke bad ek long position li ja sakti hai.

Rickshaw Man pattern ko trade karne ka ek aur tarika hai pattern ke bad ek bearish breakout ka intezar karna. Breakout tab hota hai jab price doji ke niche ke wick se niche band hota hai. Breakout ke bad ek short position li ja sakti hai.

Rickshaw Man pattern ek vishwasniiya pattern nahin hai aur ise hamesha dusre technical indicators ke sath istemal karna chahie. Kuchh aise indicators jo Rickshaw Man pattern ke sath istemal kiye ja sakte hain unmen shamil hain:- Moving averages

- Relative strength index (RSI)

- Stochastic oscillator

Rickshaw Man pattern ko trade karne ke liye yahan kuchh tips di gai hain:- Pattern ko sirf tab trade karen jab yah ek important support ya resistance level per banta hai.

- Pattern ko trade karne se pahle dusre technical indicators ki tasdeek len.

- Stop-loss order ka istemal karen apne risk ko kam karne ke liye.

Yahan ek example hai ki Rickshaw Man pattern ko forex mein kaise trade kiya ja sakta hai:

Upar diye gaye chart mein, Rickshaw Man pattern ek bearish trend ke bad banta hai. Pattern ek doji candlestick se bana hota hai jiske lambe wicks hote hain aur ek chota body hota hai. Doji ka opening aur closing price lagbhag saman hota hai, jo market mein indecision ko darshata hai. Lambe wicks bullish aur bearish donon dabav ko darshatae hain, lekin anttah market kisi ek disha mein break nahin hota hai.

Pattern ke bad, price doji ke upar ke wick se upar band hota hai, jo ek bullish breakout ka sanket deta hai. Breakout ke bad ek long position li jaati hai. Stop-loss order doji ke niche ke wick per rakha jata hai.

Position ko tab band kar diya jata hai jab price ek predetermined target price tak pahunch jata hai ya jab ek bearish reversal pattern banta hai.

Rickshaw Man pattern ek vishwasniiya pattern nahin hai aur ise hamesha dusre technical indicators ke sath istemal karna chahie.

-

#8 Collapse

Technical analysis ek tareeqa hai jis mein stock market ya anya financial markets ke patterns aur trends ko study kiya jata hai, taki traders aur investors future ke price movements ka andaza laga sakein. Candlestick charts ek popular tool hain jo ki price action ko visualize karne mein madad karte hain. Yeh chart patterns market ke momentum aur direction ko samajhne mein madad karte hain. Aaj hum "Rickshaw Man" candlestick chart pattern ke baare mein baat karenge.

Rickshaw Man Kya Hai?

Rickshaw Man ek single candlestick pattern hai jo ki price reversal ko indicate karta hai. Is pattern mein candle ka body bahut chhota hota hai aur uska shadow (ya wick) bhi chhota hota hai. Yeh pattern market ke indecision ko darust karta hai aur price reversal ki sambhavna ko highlight karta hai.

Rickshaw Man Ki Pehchan Kaise Karein?

Rickshaw Man pattern ko pehchanne ke liye, aapko kuch basic characteristics ko dekhna hoga:- Chhota Body: Rickshaw Man candle ka body normal se chhota hota hai, jisse dikhane mein lagta hai jaise ek chhoti si rickshaw ki sawari ho.

- Chhota Shadow: Candle ke shadow (wick) bhi chhota hota hai, indicating ki buyers aur sellers mein koi clear direction nahi hai.

- Close Price: Rickshaw Man pattern mein, close price open price ke bohot kareeb hota hai, jo ki market mein indecision ko show karta hai.

Rickshaw Man Ka Significance Kya Hai?

Rickshaw Man pattern ka matlab hai ke market mein indecision hai aur price reversal ka possibility hai. Agar Rickshaw Man bullish trend ke baad dikhe toh yeh bearish reversal ko indicate kar sakta hai aur agar yeh pattern bearish trend ke baad dikhe toh yeh bullish reversal ko indicate kar sakta hai. Is pattern ke appearance ke baad, traders ko market ke future movements ke liye cautious hona chahiye.

Rickshaw Man Ka Istemal Kaise Karein?

Rickshaw Man pattern ko confirm karne ke liye, traders ko dusre technical indicators ka istemal karna chahiye jaise ki RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), aur volume analysis. Yeh indicators Rickshaw Man pattern ko confirm kar sakte hain aur traders ko sahi trading decisions lene mein madad karte hain.

Conclusion

Rickshaw Man candlestick pattern ek powerful tool hai jo ki traders aur investors ko market ke future movements ko samajhne mein madad karta hai. Is pattern ki sahi tarah se samajh aur istemal se, traders apni trading strategies ko improve kar sakte hain aur better financial decisions le sakte hain. Lekin, jaise ki har technical analysis tool, Rickshaw Man pattern ko bhi dusre indicators ke saath istemal karke hi sahi tarah se samajhna chahiye.

-

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

**Rickshaw Man Candlestick Pattern:**

Rickshaw Man, ya phir Rickshaw Puller, ek candlestick pattern hai jo technical analysis mein istemal hota hai. Ye pattern candlestick charts par dekha jata hai aur traders aur investors ke liye market ke movements ka ek mazboot indicator hai.

**Rickshaw Man Pattern Kya Hai?**

Rickshaw Man pattern ek single candlestick pattern hai jo market mein price action ko represent karta hai. Is pattern mein, candlestick ek chhota sa body ke saath lambi wicks ya shadows ke saath dikhta hai. Iska appearance ek rickshaw puller ki tarah hota hai, jiska upper body (yaani body) chhota hota hai aur lambi taangain (yaani wicks) hoti hain.

**Rickshaw Man Pattern Ki Characteristics:**

1. **Small Body:** Rickshaw Man pattern mein candle ki body chhoti hoti hai, jo indicate karta hai ke opening aur closing prices ke darmiyan mein kam farq hai.

2. **Long Shadows:** Is pattern mein candle ke upper aur lower shadows ya wicks lambi hoti hain. Ye wicks price ke extreme levels ko represent karte hain, jaise ke highest high aur lowest low.

3. **Indecision or Consolidation:** Rickshaw Man pattern market mein indecision ya consolidation ko indicate karta hai. Yani ke buyers aur sellers ke darmiyan ek samanjasya (balance) bana rahta hai.

**Rickshaw Man Pattern Ka Istemal:**

Rickshaw Man pattern ka istemal traders aur investors ke liye important hai kyun ke ye ek reversal ya continuation signal bhi ho sakta hai. Is pattern ko samajhne ke liye traders ko market context aur dusre technical indicators ke saath mila kar dekhna hota hai.

**Rickshaw Man Pattern aur Trading Strategies:**

1. **Reversal Signal:** Agar Rickshaw Man pattern uptrend ya downtrend ke baad appear hota hai, to ye ek reversal signal ho sakta hai. Agar uptrend ke baad ek bearish Rickshaw Man pattern appear hota hai, to ye downward reversal ki possibility ko indicate karta hai. Similarly, agar downtrend ke baad ek bullish Rickshaw Man pattern appear hota hai, to ye upward reversal ki possibility ko indicate karta hai.

2. **Continuation Signal:** Kabhi kabhi Rickshaw Man pattern existing trend ke continuation ko bhi indicate kar sakta hai. Agar pattern existing trend ke beech mein appear hota hai aur phir market usi direction mein move karta hai, to ye trend continuation ki possibility ko darust karta hai.

3. **Confirmation:** Rickshaw Man pattern ko confirm karne ke liye traders aur investors ko dusre technical indicators aur price action ke saath combine karna hota hai. Volume analysis aur trend lines bhi is pattern ki validity ko confirm karne mein madadgar ho sakte hain.

**Conclusion:**

Rickshaw Man pattern ek important candlestick pattern hai jo market mein price action ko represent karta hai. Is pattern ko samajh kar traders aur investors market trends ko analyze kar sakte hain aur trading strategies develop kar sakte hain. Magar, jaise har technical indicator ki tarah, Rickshaw Man pattern ko bhi dusre indicators aur market context ke saath dekhna zaroori hai. -

#10 Collapse

**Rickshaw Man Candlestick Chart Pattern in Forex**

Rickshaw Man candlestick pattern forex trading mein ek unique aur informative technical indicator hai jo market ke potential reversals aur trend changes ko identify karne mein madad karta hai. Yeh pattern ek specific candlestick shape ko represent karta hai jo traders ko price action aur market sentiment ke baare mein insights provide karta hai. Is post mein, hum Rickshaw Man candlestick pattern ke concept, identification, aur trading strategies ko detail mein samjhenge.

### Rickshaw Man Pattern Ka Concept

Rickshaw Man pattern ek single candlestick pattern hai jo market ke sentiment aur potential reversal points ko indicate karta hai. Yeh pattern ek long shadow ke saath ek small real body ko show karta hai. Is pattern ki appearance market ke indecision aur potential change in trend ko signal karti hai. Rickshaw Man pattern ka main characteristic hai ke iske long upper aur lower shadows market ki volatility ko reflect karte hain.

### Identification of Rickshaw Man Pattern

1. **Candlestick Structure:**

- Rickshaw Man pattern ek candlestick ke form mein hota hai jisme ek choti real body aur long upper aur lower shadows hote hain. Real body market ki opening aur closing price ke beech ka difference hota hai aur shadows price ke highest aur lowest points ko represent karte hain.

2. **Location and Context:**

- Rickshaw Man pattern market ke top ya bottom par develop hota hai aur yeh market ke potential reversal points ko indicate karta hai. Agar yeh pattern bullish trend ke baad develop hota hai, toh yeh bearish reversal signal ho sakta hai. Aur agar bearish trend ke baad develop hota hai, toh yeh bullish reversal signal ho sakta hai.

### Trading Strategy Using Rickshaw Man Pattern

1. **Entry Points:**

- **Bullish Rickshaw Man:** Agar Rickshaw Man pattern ek bearish trend ke baad develop hota hai aur iski real body choti hoti hai, toh yeh bullish reversal signal ho sakta hai. Entry point ko pattern ke baad buy signal ke tor par consider kiya jata hai.

- **Bearish Rickshaw Man:** Agar pattern ek bullish trend ke baad develop hota hai aur iski real body choti hoti hai, toh yeh bearish reversal signal ho sakta hai. Entry point ko pattern ke baad sell signal ke tor par consider kiya jata hai.

2. **Stop Loss aur Target:**

- **Stop Loss:** Stop loss ko pattern ke opposite side ke thoda door set kiya jata hai. Agar bullish Rickshaw Man pattern hai, toh stop loss ko pattern ke low ke neeche set kiya jata hai. Agar bearish Rickshaw Man pattern hai, toh stop loss ko pattern ke high ke upar set kiya jata hai.

- **Target:** Target price ko previous support aur resistance levels ke basis par set kiya jata hai. Bullish pattern ke liye target price previous resistance levels ke aas-paas aur bearish pattern ke liye target price previous support levels ke aas-paas set kiya jata hai.

### Example

Agar aapko ek Rickshaw Man pattern bearish trend ke baad milta hai, jahan choti real body aur long shadows hain, toh yeh potential bullish reversal ka indication hai. Aap buy position consider kar sakte hain aur stop loss ko pattern ke low ke neeche set kar sakte hain.

### Conclusion

Rickshaw Man candlestick pattern forex trading mein ek important tool hai jo market ke potential reversal points aur trend changes ko identify karne mein madad karta hai. Accurate identification aur trading strategies ke sath, Rickshaw Man pattern se effective trading decisions liye ja sakte hain aur market movements ka faida utha sakte hain. Yeh pattern market ki volatility aur sentiment ko capture karne mein madad karta hai aur traders ko better trading opportunities provide karta hai.

-

#11 Collapse

Rickshaw Man Candlestick Chart Pattern in Forex- Rickshaw Man Candlestick: Ek Introduction Rickshaw Man candlestick pattern forex trading mein ek prominent role play karta hai. Ye pattern single candlestick se bana hota hai aur iski pehchaan uski unique shape se hoti hai. Iska naam is pattern ke shape ki similarity ki wajah se rakha gaya hai, jo ek traditional Japanese rickshaw ke jaise dikhai deta hai. Rickshaw Man pattern ko samajhne se traders ko market ke trend reversal ke baare mein insights milte hain, jo unki trading decisions ko behtar bana sakte hain.

Forex market mein, candlestick patterns ki analysis traders ko market sentiment aur price movements samajhne mein madad karti hai. Rickshaw Man pattern ko bhi traders ek valuable tool ke tor par dekhtay hain, kyunki ye ek potential trend reversal signal provide karta hai. Ye pattern aksar strong trends ke baad banta hai, jo market ke future direction ko indicate karta hai.

Rickshaw Man candlestick ki uniqueness iski body aur shadow ke proportions mein hoti hai. Is pattern ke body ki length chhoti hoti hai aur shadow ya wick kaafi lamba hota hai. Ye feature is pattern ko market mein distinct banata hai aur traders ko iske formation aur implications par focus karne ka signal deta hai.

Is pattern ki analysis se traders ko potential trading opportunities milti hain, lekin ye zaroori hai ke Rickshaw Man pattern ko dusre technical indicators ke saath combine karke dekha jaye. Sirf is pattern ke base par trading decisions lena risky ho sakta hai, isliye comprehensive analysis zaroori hoti hai.

Rickshaw Man pattern ka understanding traders ko market ke psychological aspects ko samajhne mein bhi madad karta hai. Ye pattern market mein uncertainty aur indecision ko represent karta hai, jo trading strategies ko develop karne mein helpful hota hai. - Candlestick Pattern Ka Importance Candlestick patterns forex trading mein ek critical role play karti hain, kyunki ye market ke price movements ko visually represent karte hain. Har candlestick pattern market ke sentiment aur trend reversals ko signal karta hai. Rickshaw Man pattern bhi in patterns mein se ek hai jo trend reversal signals ko identify karne mein madad karta hai.

Forex market mein, candlestick patterns ke analysis se traders ko short-term aur long-term trends ko samajhne mein madad milti hai. Iske alawa, ye patterns trading decisions ko guide karte hain, jaise buy aur sell signals ka identification. Rickshaw Man pattern ka understanding traders ko market ke future movements ka accurate prediction karne mein help kar sakta hai.

Candlestick patterns market ke psychological aspects ko bhi reflect karti hain. Jab market mein uncertainty aur indecision hota hai, to ye patterns usko visualize karti hain. Rickshaw Man pattern is scenario ko perfectly depict karta hai, jahan long wicks indicate karti hain ke market participants ne control ke liye struggle kiya hai.

Technical analysis mein candlestick patterns ki importance ko underestimate nahi kiya ja sakta. Ye patterns historical price data par based hoti hain aur inka use future market movements ka prediction karne ke liye kiya jata hai. Rickshaw Man pattern ko samajhkar traders market ke potential reversals ko predict kar sakte hain, jo trading strategies ko enhance karta hai.

Iske alawa, candlestick patterns ka combination bhi trading strategies mein shamil kiya jata hai. Rickshaw Man pattern ko other indicators jaise moving averages aur trend lines ke sath combine karne se trading decisions ko aur accurate banaya ja sakta hai. - Rickshaw Man Pattern Ki Pehchaan Rickshaw Man pattern ko pehchanna traders ke liye essential hai, kyunki iski identification market ke potential reversals ko samajhne mein madad karti hai. Ye pattern ek single candlestick formation hai, jisme body ki length chhoti aur shadow kaafi lambi hoti hai.

Pattern ki body usually chhoti hoti hai, jo ek narrow range ko represent karti hai. Iski shadow ya wick dono sides par lambi hoti hai, jo market mein high volatility aur indecision ko indicate karti hai. Jab ye pattern market mein banta hai, to ye ek important signal hota hai ke market trend reversal ki taraf ja raha hai.

Rickshaw Man pattern ki formation typically strong uptrend ya downtrend ke baad hoti hai. Jab market ek strong trend ke baad Rickshaw Man pattern banata hai, to ye trend reversal ka potential signal hota hai. Is pattern ke identification ke liye traders ko candlestick ke body aur shadow ke proportions ko dekhna hota hai.

Rickshaw Man pattern ki accuracy aur effectiveness ko market context aur other technical indicators ke saath verify karna zaroori hai. Pattern ki pehchaan karne se traders ko market sentiment aur future direction ko analyze karne mein madad milti hai.

Is pattern ko chart par accurately identify karne ke liye, traders ko historical price movements aur pattern ki formation ko analyze karna chahiye. Ye understanding market ke psychological dynamics ko samajhne mein bhi madad karti hai. - Pattern Ki Formation Aur Structure Rickshaw Man pattern ka formation market ke strong trends ke baad hota hai, jahan ek single candlestick ek small body aur long wicks ke saath banati hai. Iski body chhoti hoti hai, aur shadow dono sides par lambi hoti hai. Ye structure market ke uncertainty aur indecision ko reflect karta hai.

Jab market ek uptrend ya downtrend ke baad Rickshaw Man pattern banata hai, to ye ek potential trend reversal signal hota hai. Agar pattern uptrend ke baad banta hai, to ye bearish reversal signal hota hai, aur agar downtrend ke baad banta hai, to ye bullish reversal signal hota hai.

Pattern ke structure ko samajhne ke liye, traders ko candlestick ke open, close, high aur low prices ko dekhna hota hai. Ye values pattern ki formation aur potential reversal signal ko samajhne mein madad karti hain. Is pattern ke analysis ke liye historical data aur price movements ko evaluate karna zaroori hai.

Rickshaw Man pattern ke structure ko samajhne ke liye, traders ko pattern ke formation ke baad market ke reaction ko bhi observe karna chahiye. Agar market pattern ke baad trend reversal ki taraf move karta hai, to pattern ka signal confirm hota hai.

Is pattern ki analysis ko trading strategy ke sath combine karna chahiye. Traders ko pattern ke formation ke baad market ke overall trend aur technical indicators ko bhi dekhna chahiye, taake trading decisions accurate aur reliable ho. - Pattern Ki Interpretation Rickshaw Man pattern ki interpretation market ke potential trend reversal ko samajhne mein madad karti hai. Pattern ki lambi shadow aur chhoti body market mein uncertainty aur indecision ko indicate karti hai. Ye pattern market ke future direction ke baare mein insights provide karta hai.

Agar Rickshaw Man pattern uptrend ke baad banta hai, to ye bearish reversal ka signal hota hai. Iska matlab hai ke market mein selling pressure badh raha hai aur uptrend ki continuation improbable ho sakti hai. Traders ko is signal ko dekhte hue sell positions open karni chahiye.

Similarly, agar Rickshaw Man pattern downtrend ke baad banta hai, to ye bullish reversal ka signal hota hai. Ye market mein buying pressure ka indication hota hai aur downtrend ki continuation ki possibility ko kam karta hai. Traders ko is signal ko dekhte hue buy positions open karni chahiye.

Pattern ki interpretation ke liye, traders ko market context aur other technical indicators ka bhi analysis karna chahiye. Rickshaw Man pattern ka signal ek confirmation ke tor par use hota hai, aur iske sath dusre indicators ka analysis trading decisions ko behtar banata hai.

Rickshaw Man pattern ki interpretation ko traders ke experience aur market knowledge ke sath combine karna chahiye. Is pattern ko samajhne se traders ko market ke potential reversals ko identify karne mein madad milti hai, jo trading strategy ko optimize kar sakta hai. - Rickshaw Man Ka Bullish Version Rickshaw Man pattern ka bullish version tab hota hai jab ye pattern downtrend ke baad banta hai. Is case mein, pattern ek potential buying signal ko indicate karta hai, jo market ke reversal aur upward movement ko suggest karta hai.

Bullish Rickshaw Man pattern ki identification ke liye, traders ko candlestick ke body aur shadow ke proportions ko dekhna hota hai. Pattern ki body chhoti hoti hai aur shadow lambi hoti hai, jo market mein buying pressure ke badhte huye signal ko reflect karti hai.

Jab bullish Rickshaw Man pattern ban jata hai, to market mein buying interest ke badhne ki expectation hoti hai. Traders is signal ke basis par buy orders place kar sakte hain, lekin risk management aur stop loss orders ka use zaroori hota hai.

Pattern ke confirmation ke liye, traders ko bullish Rickshaw Man pattern ke baad market ke upward movement ko observe karna chahiye. Agar market is pattern ke baad buy signal ko follow karta hai, to ye pattern ka signal strong aur reliable hota hai.

Is pattern ke bullish signal ko combine karke traders ko market ke overall trend aur technical indicators ka bhi analysis karna chahiye. Bullish Rickshaw Man pattern ko sahi trading strategy ke sath use karne se market ki potential opportunities ko identify kiya ja sakta hai. - Rickshaw Man Ka Bearish Version Rickshaw Man pattern ka bearish version tab hota hai jab ye pattern uptrend ke baad banta hai. Is case mein, pattern ek potential selling signal ko indicate karta hai, jo market ke reversal aur downward movement ko suggest karta hai.

Bearish Rickshaw Man pattern ki identification ke liye, traders ko candlestick ke body aur shadow ke proportions ko dekhna hota hai. Pattern ki body chhoti hoti hai aur shadow lambi hoti hai, jo market mein selling pressure ke badhte huye signal ko reflect karti hai.

Jab bearish Rickshaw Man pattern ban jata hai, to market mein selling interest ke badhne ki expectation hoti hai. Traders is signal ke basis par sell orders place kar sakte hain, lekin risk management aur stop loss orders ka use zaroori hota hai.

Pattern ke confirmation ke liye, traders ko bearish Rickshaw Man pattern ke baad market ke downward movement ko observe karna chahiye. Agar market is pattern ke baad sell signal ko follow karta hai, to ye pattern ka signal strong aur reliable hota hai.

Is pattern ke bearish signal ko combine karke traders ko market ke overall trend aur technical indicators ka bhi analysis karna chahiye. Bearish Rickshaw Man pattern ko sahi trading strategy ke sath use karne se market ki potential opportunities ko identify kiya ja sakta hai. - Pattern Ka Confirmation Rickshaw Man pattern ka confirmation market ke trend reversal signal ko validate karta hai. Pattern ka confirmation tab hota hai jab market is pattern ke baad expected movement ki taraf move karta hai. Confirmation se traders ko pattern ke signal ki reliability ke baare mein assurance milta hai.

Pattern ke confirmation ke liye, traders ko Rickshaw Man pattern ke formation ke baad market ke price movements ko observe karna chahiye. Agar pattern bullish hai aur market upward movement dikhata hai, to ye bullish signal ka confirmation hota hai. Agar pattern bearish hai aur market downward movement dikhata hai, to ye bearish signal ka confirmation hota hai.

Confirmation ke liye, traders ko other technical indicators jaise moving averages, RSI, aur MACD ka bhi analysis karna chahiye. Ye indicators pattern ke signal ko validate karne mein madad karte hain aur trading decisions ko more accurate bana sakte hain.

Iske alawa, market ke overall trend aur volume analysis bhi confirmation ke process mein shamil hota hai. High volume ke sath pattern ka confirmation zyada reliable hota hai, kyunki high volume market ke strong interest ko indicate karta hai.

Pattern ke confirmation ke baad trading positions open karna zaroori hai, lekin risk management strategies ko bhi implement karna chahiye. Stop loss aur take profit levels ko set karna trading risk ko control karne mein madad karta hai. - Risk Management Aur Stop Loss Rickshaw Man pattern ko trading decisions mein shamil karte waqt risk management ek crucial aspect hota hai. Risk management strategies ko implement karke traders potential losses ko minimize kar sakte hain aur trading success ko enhance kar sakte hain.

Stop loss orders ko set karna trading risk ko control karne ka ek effective tareeqa hai. Agar Rickshaw Man pattern ke baad market expected direction ki taraf move nahi karta, to stop loss orders traders ko losses se bachate hain aur capital protection ko ensure karte hain.

Stop loss levels ko pattern ke formation aur market ke overall trend ke hisaab se set karna chahiye. For example, bullish Rickshaw Man pattern ke case mein, stop loss ko pattern ke niche set kiya ja sakta hai, aur bearish pattern ke case mein, stop loss ko pattern ke upar set kiya ja sakta hai.

Risk management strategies ko trading plan mein shamil karna zaroori hai. Risk-reward ratio ko analyze karke trading decisions ko evaluate karna chahiye, jisse potential rewards aur risks ko balance kiya ja sake.

Risk management ko trading discipline ke sath implement karna chahiye. Emotional decisions aur impulsive trades ko avoid karne ke liye, traders ko structured trading plans aur risk management strategies ka follow karna chahiye. - Trading Strategy Aur Rickshaw Man Rickshaw Man pattern ko apni trading strategy mein shamil karte waqt, traders ko market ke overall trend aur other technical indicators ko bhi consider karna chahiye. Ye pattern ek valuable tool hai, lekin iska effective use market analysis ke sath hona chahiye.

Trading strategy mein Rickshaw Man pattern ko combine karne ke liye, traders ko market ke trend aur price movements ko analyze karna chahiye. Is pattern ke sath moving averages, RSI, aur MACD jaise indicators ko use karke trading decisions ko optimize kiya ja sakta hai.

Rickshaw Man pattern ke signal ko trading strategy mein incorporate karne ke liye, traders ko pattern ke formation ke baad market ke reaction ko observe karna chahiye. Agar pattern ka signal confirm hota hai, to trading positions ko execute karna chahiye, lekin risk management strategies ko bhi apply karna chahiye.

Trading strategy ko market ke volatility aur liquidity ke hisaab se adjust karna chahiye. Rickshaw Man pattern ko volatile markets mein use karte waqt caution zaroori hai, kyunki high volatility market ke price movements ko unpredictable bana sakti hai.

Trading strategy mein discipline aur consistency ko maintain karna zaroori hai. Rickshaw Man pattern ke sath successful trading ke liye, traders ko structured trading plans aur risk management strategies ka follow karna chahiye. - Common Mistakes To Avoid Rickshaw Man pattern ko identify aur use karte waqt kuch common mistakes se bachna zaroori hai. Ye mistakes pattern ki misinterpretation aur market conditions ko na samajhne se related ho sakti hain.

Ek aam mistake pattern ki formation ke baad market ke reaction ko accurately observe na karna hai. Agar pattern ke baad market expected direction ki taraf move nahi karta, to pattern ka signal unreliable ho sakta hai. Isliye, pattern ke confirmation aur market reaction ko observe karna zaroori hai.

Dusri mistake pattern ke analysis mein dusre technical indicators ko consider na karna hai. Rickshaw Man pattern ko alone use karna risky ho sakta hai, isliye indicators ka combination analysis zaroori hai.

Risk management aur stop loss strategies ko ignore karna bhi ek common mistake hai. Trading decisions ko execute karte waqt, stop loss orders aur risk management strategies ko implement karna trading risk ko control karne mein madad karta hai.

Emotional decisions aur impulsive trading bhi mistakes mein shamil hoti hain. Structured trading plans aur disciplined approach ko follow karna trading success ko enhance kar sakta hai. - Examples Aur Case Studies Forex charts par Rickshaw Man pattern ke examples aur case studies ka analysis traders ko pattern ke formation aur impact ko samajhne mein madad karta hai. Examples ke zariye traders pattern ke practical applications aur effectiveness ko evaluate kar sakte hain.

Examples ke analysis se traders ko pattern ki accuracy aur reliability ke baare mein insights milti hain. Market ke different scenarios aur conditions mein Rickshaw Man pattern ka performance analyze karke traders ko better understanding milti hai.

Case studies ka use market trends aur price movements ko understand karne ke liye kiya jata hai. Rickshaw Man pattern ke historical examples ko study karke traders market ke potential reversals aur trading opportunities ko identify kar sakte hain.

Forex charts par Rickshaw Man pattern ke examples ko dekh kar traders ko pattern ke formation aur market ke reaction ko visualize karne mein madad milti hai. Isse pattern ke accurate identification aur trading decisions ko enhance kiya ja sakta hai.

Case studies aur examples ko use karke traders ko pattern ke limitations aur effectiveness ke baare mein bhi knowledge milti hai. Is understanding se traders pattern ko apni trading strategy mein better integrate kar sakte hain. - Pattern Ka Historical Performance Rickshaw Man pattern ka historical performance Forex market mein mixed raha hai. Pattern ke historical data aur trends ko analyze karke traders ko pattern ke reliability aur effectiveness ke baare mein evaluation milti hai.

Historical performance analysis se traders ko pattern ke past success aur failure rates ke baare mein insights milti hain. Ye analysis pattern ke strengths aur weaknesses ko identify karne mein madad karta hai aur trading decisions ko better bana sakta hai.

Pattern ke historical performance ko evaluate karte waqt, market ke different conditions aur scenarios ko bhi consider karna chahiye. Rickshaw Man pattern ka effectiveness volatile markets aur low liquidity conditions mein alag ho sakta hai.

Historical data aur trends ko analyze karne ke liye, traders ko extensive research aur backtesting ki zaroorat hoti hai. Ye process pattern ke performance ko verify karne aur trading strategies ko optimize karne mein help karta hai.

Historical performance analysis se traders ko Rickshaw Man pattern ke reliable aur unreliable scenarios ko samajhne mein madad milti hai. Isse traders pattern ko market ke current conditions ke sath align karke use kar sakte hain. - Conclusion Rickshaw Man candlestick pattern Forex trading mein ek valuable tool hai jo market ke potential trend reversals ko indicate karta hai. Pattern ke unique structure aur formation se traders ko market ke psychological aspects aur price movements ko samajhne mein madad milti hai.

Is pattern ko accurately identify karne aur interpret karne ke liye, traders ko market context aur other technical indicators ka analysis zaroori hai. Rickshaw Man pattern ko apni trading strategy mein integrate karne se trading decisions ko optimize kiya ja sakta hai.

Risk management aur stop loss strategies ko implement karke traders pattern ke signals ko effectively use kar sakte hain. Emotional decisions aur impulsive trading ko avoid karne ke liye structured trading plans aur disciplined approach zaroori hai.

Rickshaw Man pattern ke examples aur case studies ke analysis se traders ko pattern ke practical applications aur effectiveness ko samajhne mein madad milti hai. Historical performance analysis se pattern ke reliability aur limitations ko evaluate kiya ja sakta hai.

Overall, Rickshaw Man candlestick pattern ek valuable tool hai jo market ke potential reversals ko identify karne mein madad karta hai. Is pattern ko samajhkar aur sahi trading strategy ke sath use karke, traders market ki opportunities ko better identify kar sakte hain.

- Rickshaw Man Candlestick: Ek Introduction Rickshaw Man candlestick pattern forex trading mein ek prominent role play karta hai. Ye pattern single candlestick se bana hota hai aur iski pehchaan uski unique shape se hoti hai. Iska naam is pattern ke shape ki similarity ki wajah se rakha gaya hai, jo ek traditional Japanese rickshaw ke jaise dikhai deta hai. Rickshaw Man pattern ko samajhne se traders ko market ke trend reversal ke baare mein insights milte hain, jo unki trading decisions ko behtar bana sakte hain.

-

#12 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Rickshaw Man Candlestick Pattern Kya Hai?

Rickshaw Man candlestick pattern aik unique aur significant candlestick pattern hai jo market mein indecision ko dikhata hai. Yeh pattern forex trading mein kaafi use hota hai aur aksar reversal ya continuation signal deta hai. Is pattern ko samajhna aur identify karna traders ke liye important hota hai, kyunki yeh market ke future movement ka indication de sakta hai.

Pattern Ki Pehchan

Rickshaw Man pattern kaafi similar hota hai Doji pattern se, lekin isme kuch distinct features hote hain:- Long Upper Aur Lower Shadows: Rickshaw Man pattern mein candlestick ki upper aur lower shadows kaafi lambi hoti hain. Yeh shadows market ke high aur low price ko indicate karte hain, jo is baat ka pata deti hain ke buyers aur sellers ke darmiyan tug-of-war chal rahi hai.

- Small Real Body: Is pattern ka real body (open aur close price ke darmiyan ka difference) chhota hota hai, ya kabhi kabhi yeh almost non-existent hota hai. Iska matlab yeh hota hai ke market mein open aur close price lagbhag ek hi level par hain, jo ke indecision ko dikhata hai.

Rickshaw Man pattern market psychology ka aik strong indicator hota hai. Jab yeh pattern form hota hai, to iska matlab yeh hota hai ke market participants confused hain aur unmein clear direction ka consensus nahi hai. Yeh pattern us waqt banta hai jab buyers aur sellers dono market mein apna influence dikhate hain, lekin end mein price wapas apne starting point par aa jati hai.

Yeh indecision ka signal hota hai aur aksar market ke trend reversal ya continuation ka indication de sakta hai, depending on the previous trend.

Trading Strategy

Rickshaw Man pattern ko trading mein use karte waqt kuch cheezon ka khayal rakhna zaroori hai:- Context: Yeh pattern aksar sideway markets mein form hota hai, lekin trend following markets mein iska signal zyada reliable hota hai. Agar yeh pattern uptrend ke baad form hota hai, to yeh trend reversal ka signal ho sakta hai. Aur agar yeh downtrend ke baad form hota hai, to yeh bullish reversal ka indication de sakta hai.

- Confirmation: Rickshaw Man pattern ko trade karte waqt confirmation ka wait karna zaroori hai. Confirmation tab milti hai jab next candle previous trend ke opposite direction mein strong movement dikhati hai. Yeh confirmation ke bina trade lena risky ho sakta hai, kyunki Rickshaw Man pattern kabhi kabhi false signals bhi de sakta hai.

- Risk Management: Is pattern ko trade karte waqt stop loss ka set karna zaroori hai. Aksar stop loss ko Rickshaw Man pattern ki shadow ke end par set kiya jata hai, taake aap apne losses ko minimize kar sakein agar trade aapke against jaye.

Rickshaw Man candlestick pattern ek powerful tool hai jo market mein indecision aur potential trend reversal ya continuation ko indicate kar sakta hai. Is pattern ko samajhna aur sahi tarah se trade karna forex trading mein success ke liye zaroori hai. Lekin hamesha yaad rakhein ke is pattern ke signals ko confirm karna zaroori hota hai, taake aapke trading decisions accurate hoon.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#13 Collapse

**Rickshaw Man Candlestick Chart Pattern in Forex**

Forex trading mein candlestick chart patterns bohot ahmiyat rakhte hain kyun ke yeh price action aur market sentiment ko samajhne mein madad karte hain. Aaj hum ek khas candlestick pattern ka zikar karenge jise **"Rickshaw Man"** kehte hain. Yeh pattern traders ko market ki indecisiveness ya uncertainty ko pehchanne mein madad deta hai.

### Rickshaw Man Pattern Kya Hai?

Rickshaw Man pattern aik doji candle ka modified version hai. Iska matlab yeh hota hai ke open aur close price lagbhag barabar hote hain, magar is pattern mein shadows (wicks) khas tor par lambi hoti hain. Yeh pattern tab banta hai jab buyers aur sellers donon ki taraf se equal pressure hota hai, aur kisi bhi taraf se dominance nahi hoti. Isse market ki confusion ya indecisiveness zahir hoti hai.

### Pattern Ki Pehchaan

Rickshaw Man pattern ki khas pehchaan yeh hai ke iska body bohot chhota hota hai, aur upper aur lower wicks kaafi lambi hoti hain. Yeh pattern doji ke nazdeek hai, magar doji ke mukabale mein Rickshaw Man ki wicks zyada prominent hoti hain.

### Formation Aur Structure

1. **Open Price:** Candle ke open hone ka price.

2. **Close Price:** Candle ke close hone ka price, jo ke open price ke nazdeek hota hai.

3. **Upper Wick (Shadow):** Candle ke high aur open/close ke darmiyan ka distance.

4. **Lower Wick (Shadow):** Candle ke low aur open/close ke darmiyan ka distance.

### Rickshaw Man Ka Matlab

Rickshaw Man candlestick pattern market ki neutrality ko represent karta hai. Iska matlab yeh hai ke market mein iss waqt kisi bhi taraf se taqat nahi hai, aur yeh bullish ya bearish move ka indication de sakta hai.

**Bullish Scenario:** Agar yeh pattern support level ke qareeb banta hai, toh yeh market reversal ya upward movement ka signal ho sakta hai.

**Bearish Scenario:** Agar yeh pattern resistance level ke paas banta hai, toh yeh downward movement ka indication ho sakta hai.

### Trading Strategy

Rickshaw Man pattern ko doosre technical indicators ke saath use karna chahiye, jaise ke moving averages ya RSI, taake confirmation mil sake. Aksar traders is pattern ko ek reversal signal ke tor par lete hain, magar isse trend continuation ke liye bhi observe kiya jata hai.

1. **Support and Resistance:** Rickshaw Man pattern ko support ya resistance levels ke qareeb dekhein aur uska interpretation karein.

2. **Volume Analysis:** Is pattern ke sath volume ko bhi analyse karna zaroori hai. Agar high volume ke saath yeh pattern banta hai, toh yeh strong signal ho sakta hai.

3. **Confirmation Indicators:** Is pattern ke baad agle candles ko observe karein taake confirmation mil sake.

### Conclusion

Rickshaw Man candlestick pattern forex trading mein aik valuable tool hai, magar isse sirf standalone signal ke tor par nahi le sakte. Iska sahi tareeqe se istimaal karne ke liye technical analysis aur market context ko samajhna zaroori hai. Trading decisions ko diversify karein aur hamesha risk management strategies ko follow karein.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 02:59 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим