What is a dynamic momentum index?

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

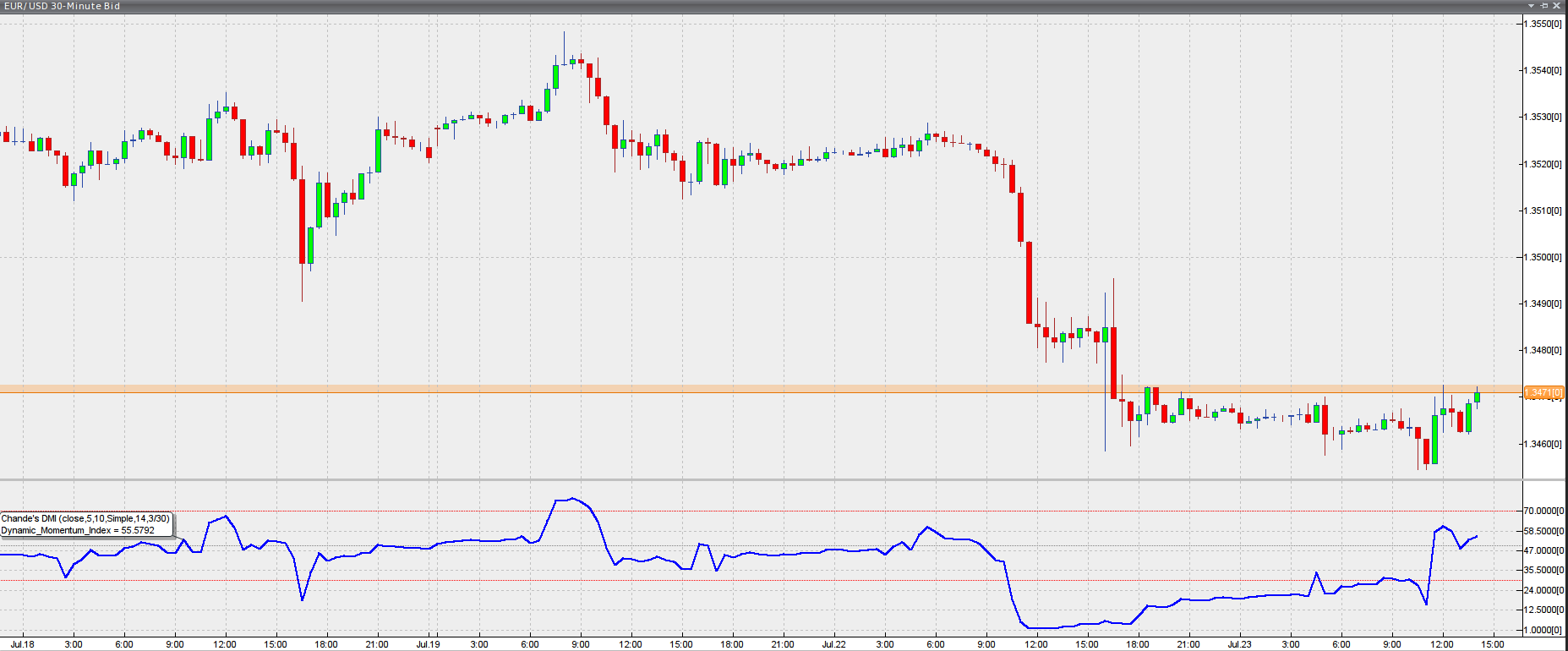

WHAT IS A DYNAMIC MOMENTUM INDEX ? Dynamic momentum index ak technical indicator ha is ko used karta hua hum determine karta ha overbought or oversold ka asset ko. Or is ko used kar ka generate kiya jata ha trade ka signals ko trading or ranging markets ma. Ya jo dynamic momentum index ha ya referred hota ha hota ha DIM sa ,magar ya confused ni hota directional movement index DIM sa. Is dynamic momentum index ko uses kiya jata ha kuch calculation sa jis ma jab volatility high hoti ha to is ma fewer period hota ha or jab dad periods hota ha tab volatility low hota ha. Jab indicator below ma hoti ha 30 ka price sa to ya asset karta ha or ya is ko considered karta ha oversold or jab ya above ma 70 ka hota ha to price ko considered kiya jata ha overbought. Jab price move out ma hoti ha oversold sa yo ya buy ka signal da ga jab price ringing ho ge ho ge uptrend ma. Or jab price move out ho ge overbought sa to is ko used karta hua short sell signal mila ga or price ranging ho ge down trend ma. UNDERSTANDING DYNAMIC MOMENTUM INDEX : Is dynamic momentum index ko developed kiya ha Tushar Chande or Stanley Krill na or ya similar hota ha relative strength index RSI ka. Jo main different ho ge in dono ma jo RSI ho ga ya uses ho ga fixed number time period ma usually 14 ho ge or ya calculation karay ga or jo ya dynamic momentum index ho ga ya different or time period or volatility ma changes ho ge or ya between ma ho ge five or 30 ka. Jo number of time periods used hota ha dynamic momentum index ma ya decreases karay ga volatility ko jab security increases ho ge or ya banay ge indicator ko jo ka bahot hi responsive changing karay ga prices ko RSI sa .Ya particularly use tab hota ha jab is price quickly approaches kar rahi hoti ha support or resistance levels ko. Q ka ya indicator bahot sensitive ho ga, traders is ma potiential find karay ga earlier entry or exit point ko or is ma zada false signals mila ga. DYNAMIC MOMENTUM IN DIFFERENT MARKET CONDITION : 1: RANGING : Jab ringing market ho ge,traders is ma watch karay ga ka jo indecator ha ya fall karau ga below ma 30 ka, or move ho ge back ma above ma ho ge, or traders is ma trigger karay ga long trade ko. Ya is ma sell karay ga jab indicator move karay ga above ma 70 sa or ya approaches karay ga top ma range ka . Or is ma short sell ki jay ge jab indecator cross karay ge back below ma 70 range ka. 2: UPTREND : Market ma jab uptrend ho ga ,traders is time par dakha ga indicator ka fall below ma hona ko 30 sa or rise back above ma ho ge to order trigger liya jay ga long trade as. 3: DOWNTREND : Or jab downtrend chal raha ho ga watch karay ga indicator rise above ho ge 70 sa Or ya fall below ma ho ga or is ma order trigger karay ga short trade ko. FORMULA FOR DYNAMIC MOMENTUM INDEX:​Dynamic Momentum Index=RSI=100− 100/1+RSCalculating RS requires a look back period (typically 14) which changes if creating a DMI To calculate how many periods to use for DMI: StdA​=MA10​ of StdC5​ Vi​=Stdc5/STda​TD​=INT14​/viTD​ defines how many periods to use for each RS value TD​ Max=30 TD​ Min=5 where: Std=Standard deviation MA1​0=10-Period simple moving average StdC5​=Five-day standard deviation of closing prices TD​ Max=Use 30 if TD is greater than 30 TD​ Min=Use 5 if TD is less than 5 RS=Relative strength​ DYNAMIC MOMENTUM INDEX CALCULATION: 1: First is ma calculate karna ho ga standard deviation ko jo ka last five closing prices ki ho ge. 2: Is ma la ga 10 period moving average non-standard deviation sa or calculated karay ga step 1 ko ya std ho ga. 3: Divide karay ga step 1 ko step 2 sa or is ma get karay ga Vi ko. 4: calculate kara ga TD ko dividing kar ka 14 ko Vi sa or ya sirf tab use ho gavja b integers ho ga result,is ka matlab ha ya represent karay ga time periodsbko or ya no ho ga fractions or decimals ma. 5: Jo ya TD ho ga limited ma ho ga jo ka 5 or 30 ka between ma ho ga.jab over 30 jo ga 30 ko use karay ga or agar under 5 ho ga to use karay ga 5 ko .TD wo ho ga or is ma many periods used ho ge RS ki calculation ka liya. 6: calculate karay ga RS ko using karta hua number period ko or ya educated karay ga TD ko. 7: Repeat karay ga each period ko ends ma. DYNAMIC MOMENTUM INDEX EXAMPLE: Ya jo chart ha ya show kar raha ha dynamic momentum index ko . Jo circled area ha ya shows kar raha ha potential trade ka setup ko. Jab using karay ga dynamic momentum index ko or ya horizontal price support ho ge. Jab price retraced ho ge or test ho ga previous swing low ho ga April ka start ma,jo indicator ho ga ya gave karay ga oversold reading ko below ma 30 ko. Jab trafe step confirmed ho ga or jab price failed ho ge close below ma previous low ka,or jo indicator ho ga ya started karay ga rise above ma 30 ka. Traders place karay ga stop loss ko below ma previous ka swing low sa or below sa most recent swing ka low sa or prevent loss ho ga or trade moves against ma ho ge. DYNAMIC MOMENTUM INDEX LIMITATIONS: Is ma jo overbought ho ga ya necessarily ni ho ga is ka matlab ha ya time sell ka ho ga, or jo jo oversold ho ga ya necessarily ho ga mean ka is time buy karay ga. Jab prices falling ho ge ya asset karay ge or remain raha ge oversold ma long time ma. Jo DIM indicator ho ga ya jab move our ma ho ga oversold ka, or is ka matlab ha ka price rise ho ge significantly. Jan uptrend ho habor price overbought ho ge long term ma or jo DIM moves ho ga ya out ma overbought ka ho ga or is ka ya matlab ni ho ga ka price fall ho ge. Jab indicator lags less o ga RSI ma or is ma still lag ho ga. Or jo price ho ge ya already run ho ge ya significantly ho ge trade signal ka banay sa phalay. Is ka matlab ha ka signal ho ga yabappear good ho ga chart ma ,magar ya banay ga late or trafersvis ma bull price ka move ko karay ga. Trafers is ma encouraged ho ga or is ma consider ho ga asset ka rangingbor trending,or ya help karay ga filter karna ka liya trade signals ko. Or analysis jasa ka price action, fundamental analysis, or other technical indicators ko is ma recommended kiya jay ga. -

#3 Collapse

Dynamic Momentum Index: Tushare Chande or Stanley Kroll ny Dynamic momentum index indicator tayyar kya aur usay 1993 mein Astaks and commodities magazine mein shaya kya. isharay ko kisi bhi market ya tijarti alay par laago kya ja sakta hai taakay mumkina tijarti signal talaash karne mein madad miley. dmi welles welledrs ke rishta daar taaqat ke asharih se mumasil hai siwaye is ke ke adwaar ki tadaad mutaghayyar honay ki bajaye mutaghayyar ho .mutharrak momentum index aik taiz response impulse index hai jo rishta daar taaqat index ya rsi se akhaz kya gaya hai. yeh rsi aur kuch dosray momentum andikitrz ke muqablay raftaar mein honay wali tabdeelion ka taizi se jawab day sakta hai kyunkay yeh rsi calculations mein istemaal honay walay waqfon ki aik muqarara tadaad ke bajaye –apne hisaab kitaab mein mutaghayyar adwaar ka istemaal karta hai .is se forex traders ko market mein samti tabdeelion ka paishgi andaza laganay mein madad mil sakti hai. lehaza, tajir aksar usay aisay halaat mein istemaal karte hain jahan market taizi se simt badal sakti hai, jaisay ke jab qeemat support ya muzahmat ki bunyadi satah tak pahonch jati hai . RSI Indicator: Dynamic momentum index rsi jaisa hi maqsad poora karta hai, jo ziyada kharidi hui ya ziyada farokht honay wali halaton ki nishandahi karta hai jo ke market ko ulatnay ka baais ban satke hain. 70 se oopar ki ridngz ziyada kharidi jane wali sharait ki nishandahi karti hain, aur 30 ​sy nechy ki reading over sealed market ki nishandahi karti hai . SupportAnd Resistance: rozana support point support / muzahmat ki aik ahem satah hai, jis par qeemat is qeemat par rikori ke baad taizi se simt badal sakti hai. deegar ahem support aur muzahmati sthon mein ahem moving averages aur mojooda trained lines shaamil hain. un sthon par, forex traders aik mutharrak momentum index ka istemaal kar satke hain taakay yeh taayun kya ja sakay ke market ke rivers honay ka kitna imkaan hai . Overbought / Oversold . hum dynamic index indicator over soled aur over bought areas ko trade kar satke hain. agar qeemat 70. 0 ki satah tak pahonch jati hai, to usay zaroorat se ziyada khareeda jata hai aur hum is satah par mukhtasir tijarat kar satke hain. isi terhan, agar dmi line 30. 0 ki satah tak pahonch jati hai, to usay over sealed samjha jata hai aur hum is satah par taweel tijarat mein daakhil ho satke hain . Conclusion: Dynamic momentum index indicator ko aap ke trading plate form charts par istemaal kya ja sakta hai taakay aik majmoi tijarti hikmat e amli ke hissay ke tor par mumkina tijarti signals ko flutter kya ja sakay. aap isharay ko kayi tareeqon se istemaal kar satke hain. yeh rsi isharay ki terhan kaam karta hai aur tijarti signal ko badhaane ke liye usay support aur muzahmati sthon ke sath milaya ja sakta hai .mutharrak momentum index aik momentum indicator hai jo is baat ka taayun karne ke liye istemaal hota hai ke aaya koi asasa ziyada khareeda gaya hai ya ziyada farokht sun-hwa hai. dynamic momentum index mein istemaal honay walay waqt ki tagayuraat ko qeematon ke haliya utaar charhao se control kya jata hai. ziyada utaar charhao wali qeematein qeematon mein tabdeeli ke liye ziyada hassas dynamic momentum index tajweez karti hain . -

#4 Collapse

Forex trading mein, technical indicators traders ko market trends aur potential entry aur exit points identify karne mein madad karte hain. Ek ahem indicator jo forex trading mein use hota hai wo hai Dynamic Momentum Index (DMI). Yeh indicator traditional Relative Strength Index (RSI) ka advanced version hai aur market conditions ko aur behtar samajhne ke liye design kiya gaya hai.

Background aur Importance

Forex market highly volatile hota hai, aur traders ko effective tools ki zarurat hoti hai taake woh price movements ko accurately predict kar sakein. Traditional indicators jese ke RSI kabhi kabar overbought ya oversold conditions accurately predict nahi kar pate, especially jab market highly volatile ho. Isi liye, Tushar Chande aur Stanley Kroll ne DMI develop kiya, jo ke RSI ka adaptive version hai aur market volatility ko bhi consider karta hai.

Understanding DMI

Dynamic Momentum Index, jese ke naam se pata chalta hai, ek momentum indicator hai jo asset ki price strength aur direction measure karta hai. Iski khas baat yeh hai ke yeh indicator dynamic hota hai, yani apni calculation period ko adjust karta rehta hai based on market conditions. Yeh feature isko traditional RSI se zyada effective banata hai in capturing real-time market movements.

Calculation

DMI ka calculation complex hota hai kyunki yeh dynamically apni calculation period adjust karta hai. Yahan par iske basic calculation steps diye gaye hain:- Standard Deviation Calculation:

- Pehle standard deviation calculate kiya jata hai over a set period of time. Yeh market volatility ko measure karta hai.

- Dynamic Period Adjustment:

- Standard deviation ke basis par, DMI apna calculation period adjust karta hai. High volatility mein, period reduce hota hai aur low volatility mein, period increase hota hai. Isse indicator zyada responsive ban jata hai during volatile periods aur smoother during less volatile periods.

- RSI Calculation:

- Adjusted period ke saath RSI calculate kiya jata hai. Isse DMI ko traditional RSI ke comparison mein zyada adaptive banata hai.

DMI ko interpret karna kaafi similar hai traditional RSI se. Iske basic interpretations kuch is tarah hain:- Overbought aur Oversold Conditions:

- Jab DMI 70 ke upar ho, asset overbought condition mein hota hai, indicating ke asset ki price bohot zyada high ho gayi hai aur reversal ho sakta hai.

- Jab DMI 30 ke neeche ho, asset oversold condition mein hota hai, indicating ke asset ki price bohot zyada low ho gayi hai aur upward reversal ho sakta hai.

- Bullish aur Bearish Divergence:

- Jab price new high banaye lekin DMI new high nahi banata, yeh bearish divergence indicate karta hai aur possible price reversal ka signal hota hai.

- Similarly, jab price new low banaye lekin DMI new low nahi banata, yeh bullish divergence indicate karta hai aur possible upward reversal ka signal hota hai.

- Trend Confirmation:

- DMI trending markets mein bohot useful hota hai. Jab DMI rising trend show kare, yeh confirm karta hai ke current trend strong hai aur continue karega. Jab DMI declining trend show kare, yeh indicate karta hai ke trend weakening hai aur reversal possible hai.

Dynamic Momentum Index ka use forex trading mein bohot se benefits provide karta hai:- Adaptability:

- DMI ki sabse badi strength uski adaptability hai. Yeh market volatility ke hisaab se adjust hota rehta hai, jo isko real-time market conditions ko accurately capture karne mein madad karta hai.

- Reduced False Signals:

- Due to its dynamic nature, DMI traditional RSI se kam false signals generate karta hai. Yeh feature traders ko zyada accurate entry aur exit points identify karne mein madad karta hai.

- Better Trend Identification:

- DMI trend strength ko effectively measure karta hai, jo traders ko strong aur weak trends ko differentiate karne mein madad karta hai.

- Versatility:

- DMI ko different time frames aur trading instruments ke saath use kiya ja sakta hai, jo isko ek versatile tool banata hai.

Jahan DMI bohot se benefits provide karta hai, wahin kuch limitations bhi hain:- Complexity:

- DMI ki calculation complex hai, jo beginners ke liye mushkil ho sakti hai. Proper understanding aur implementation ke liye technical knowledge zaruri hai.

- Lagging Indicator:

- Jaise ke RSI, DMI bhi ek lagging indicator hai. Yeh price movements ke baad signals generate karta hai, jo sometimes late ho sakte hain.

- Market Conditions:

- DMI trending markets mein zyada effective hota hai. Choppy aur range-bound markets mein yeh kabhi kabar inaccurate signals de sakta hai.

Forex trading mein DMI ko use karne ke bohot se tariqe hain. Yahan kuch practical applications diye gaye hain:- Combination with Other Indicators:

- DMI ko doosre indicators ke saath combine karna zyada effective results de sakta hai. For example, DMI aur Moving Averages ka combination trend confirmation aur entry/exit points identify karne mein madadgar hota hai.

- Setting Dynamic Parameters:

- Traders apni trading strategy ke hisaab se DMI ke parameters adjust kar sakte hain. For instance, highly volatile pairs ke liye short period aur less volatile pairs ke liye long period use kiya ja sakta hai.

- Backtesting:

- DMI ko trading strategies mein incorporate karne se pehle backtesting zaruri hai. Historical data par DMI ki performance analyze karna traders ko strategy ki effectiveness evaluate karne mein madad karta hai.

- Risk Management:

- DMI ko risk management ke tools ke saath combine karna trading strategy ko aur robust banata hai. For example, stop-loss aur take-profit levels ko DMI signals ke basis par adjust karna risk minimize karne mein madad karta hai.

Dynamic Momentum Index ek powerful tool hai forex trading mein jo traditional RSI ke comparison mein zyada effective aur reliable hai. Iski adaptability aur dynamic nature isko market volatility ke hisaab se adjust hone mein madadgar banati hai, jo ultimately traders ko zyada accurate signals provide karta hai. Although, DMI ki complexity aur lagging nature ko consider karna zaruri hai, lekin proper understanding aur application ke saath yeh indicator forex trading mein kaafi beneficial ho sakta hai.

Traders ko DMI ko doosre technical indicators aur risk management strategies ke saath combine karna chahiye taake trading strategies zyada effective aur profitable ho sakhein. Overall, DMI ek versatile aur reliable indicator hai jo forex market ke complex nature ko effectively handle kar sakta hai.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

- Standard Deviation Calculation:

-

#5 Collapse

Dynamic Momentum Index:Dynamic Momentum Index (DMI) aik advanced technical analysis tool hai jo traders aur investors ko market trends aur price momentum ko analyze karne mein madad deta hai. Yeh index, Relative Strength Index (RSI) ki tarah hi hota hai lekin yeh zyada flexible aur adaptive hota hai, jise trends aur market volatility ko better track kiya ja sakta hai. Dynamic Momentum Index ko 1993 mein Tushar Chande aur Stanley Kroll ne introduce kiya tha. Yeh indicator moving averages aur price momentum ka combination use karta hai taake more accurate aur timely trading signals provide kiye ja sakein.

DMI ka basic principle yeh hai ke yeh price data ko analyze karke overbought aur oversold conditions ko identify karta hai. Iska calculation dynamic period lengths use karke hota hai jo market volatility ke mutabiq adjust hota hai. Iska matlab yeh hai ke jab market zyada volatile hoti hai to DMI zyada sensitive hota hai aur jab market kam volatile hoti hai to yeh kam sensitive hota hai.

Kaam karneka tareeqa:

DMI ko calculate karne ka basic formula yeh hai:

Calculation:

\[ DMI = 100 \times \frac{EMA_{Positive Momentum} (n) - EMA_{Negative Momentum} (n)}{EMA_{Positive Momentum} (n) + EMA_{Negative Momentum} (n)} \]

Jahan, EMA ka matlab hai Exponential Moving Average aur n se murad hai dynamic period jo market volatility ke mutabiq adjust hota hai.

Overbought Condition:

Interpretation:

Jab DMI ki value 70 ya us se upar ho, to yeh indicate karta hai ke asset overbought condition mein hai aur price reversal ka chance hai.

Oversold Condition:

Jab DMI ki value 30 ya us se neeche ho, to yeh indicate karta hai ke asset oversold condition mein hai aur price recovery ka chance hai.

Trend Strength:

DMI ki value jitni zyada hoti hai, market trend utna hi strong hota hai aur jitni kam hoti hai, trend utna hi weak hota hai.

Adaptive Nature:

Faide:

Yeh changing market conditions ke mutabiq adjust hota hai, jo isse RSI se zyada effective banata hai.

Accurate Signals:

Yeh zyada timely aur accurate trading signals provide karta hai jo traders ko better decision making mein madad dete hain.

Risk Management:

Overbought aur oversold conditions ko accurately identify karke risk management mein madad karta hai.

Complexity:

Limitation:

Iska calculation aur interpretation thoda complex ho sakta hai, especially beginners ke liye.

False Signals:

Kabhi kabhar yeh false signals bhi generate kar sakta hai, especially low volume markets mein.

Dynamic Momentum Index aik powerful tool hai jo market trends aur price momentum ko analyze karne mein madad deta hai. Yeh traders ko better trading decisions lene aur risk management mein help karta hai. Lekin, isko use karte waqt proper understanding aur experience zaroori hai taake accurate results hasil kiye ja sakein.

Conclusion:

-

#6 Collapse

### What is a Dynamic Momentum Index?

Dynamic Momentum Index (DMI) ek advanced technical indicator hai jo trading mein price momentum aur trend strength ko measure karne ke liye use hota hai. Yeh indicator Tushar Chande aur Stanley Kroll ne 1993 mein develop kiya tha. DMI ko Relative Strength Index (RSI) ka improved version kaha ja sakta hai, jo price movement ko dynamically adjust karta hai.

#### Dynamic Momentum Index ka Ta'aruf

DMI ek oscillator hai jo 0 se 100 ke range mein move karta hai. Iska main purpose overbought aur oversold conditions ko identify karna hai, lekin yeh dynamic adjustments ke zariye market volatility ko bhi incorporate karta hai. Jab DMI value 70 se upar hoti hai, to market overbought condition mein hoti hai aur jab 30 se neeche hoti hai to market oversold condition mein hoti hai.

#### DMI Indicator ka Calculation

DMI ki calculation thodi complex hai lekin basic formula kuch is tarah hai:

1. **Calculate RSI:** Pehle standard RSI ko calculate kiya jata hai.

2. **Dynamic Period:** Phir dynamic period ko calculate kiya jata hai jo market volatility ke hisaab se adjust hota hai.

3. **Adjust RSI:** Lastly, dynamic period ko use karte hue RSI ko adjust kiya jata hai aur final DMI value nikalti hai.

#### Dynamic Momentum Index Trading Strategy

Ab hum discuss karte hain ek simple aur effective trading strategy jo DMI indicator pe base karti hai.

**1. Identify Overbought and Oversold Conditions:**

Jab DMI value 70 se upar ho, to yeh overbought condition ko indicate karta hai. Yeh sell signal ho sakta hai. Aur jab DMI value 30 se neeche ho, to yeh oversold condition ko indicate karta hai. Yeh buy signal ho sakta hai.

**2. Trend Confirmation:**

DMI ko dusre indicators ke sath mila kar use karna chahiye taake trend ko confirm kiya ja sake. For example, moving averages ya MACD ko DMI ke sath use kar sakte hain taake trend strength aur direction ko better samjha ja sake.

**3. Entry and Exit Points:**

Entry signal ke liye DMI ki value 30 se upar move kare to buy position le sakte hain aur jab 70 se neeche move kare to sell position le sakte hain. Exit points ke liye stop-loss aur take-profit levels ko predefined karna chahiye taake risk management ho sake.

#### Risk Management

Risk management trading strategy ka bohot zaroori hissa hai. Stop-loss aur take-profit levels ko predefined karna chahiye. Yeh aapki trading ko disciplined aur systematic banata hai aur unnecessary losses se bachata hai.

#### Conclusion

Dynamic Momentum Index ek powerful tool hai jo market volatility ko incorporate karte hue better trading signals de sakta hai. Isko sahi tarah se use karke aur dusre indicators ke sath mila kar aap profitable trades kar sakte hain. Hamesha yaad rakhein ke trading mein risk management aur continuous learning bohot zaroori hai.

-

#7 Collapse

Forex Mein Dynamic Momentum Index:@:@:@:

Dynamic Momentum Index (DMI) ek technical indicator hai jo trading mein istemal hota hai, Forex market mein bhi, taake price momentum ki strength aur direction ko assess kiya ja sake. Yeh Tushar Chande ne develop kiya tha aur yeh Relative Strength Index (RSI) ka aik variation hai, lekin is mein market volatility ke base par look-back period ko dynamically adjust karne ka feature hai. Yeh adjustment DMI ko market conditions ke muqable mein zyada responsive banata hai traditional RSI ke muqable.

Forex Mein Dynamic Momentum Index Ke Features:@:@:@:- Variable Period: Fixed period RSI ke mukablay, DMI look-back period ko market volatility ke level ke base par adjust karta hai. Jab high volatility hoti hai to yeh chhoti period use karta hai, jis se yeh price changes ke liye zyada sensitive hota hai. Low volatility mein yeh longer period use karta hai.

- Overbought aur Oversold Levels: DMI bhi overbought (70 se upar) aur oversold (30 se neeche) levels ko identify karne mein madad karta hai, jaise RSI karta hai. Yeh levels indicate karte hain ke price trend might reverse ya temporarily pause karega.

- Trend Detection: DMI price trends ko detect karne mein madadgar hai. Agar DMI value increasing trend mein hai, to market mein bullish momentum ho sakta hai. Agar DMI value decreasing trend mein hai, to market mein bearish momentum ho sakta hai.

- Smoothing Effect: DMI ka calculation method ek smoothing effect provide karta hai, jo ke short-term price fluctuations ke effect ko reduce karta hai aur more reliable signals provide karta hai.

- Adaptive Nature: Iska sabse bara advantage yeh hai ke yeh market ki changing conditions ke saath adapt hota hai. Yeh volatile periods mein fast react karta hai aur quiet periods mein slow, jis se false signals kam hotay hain.

Forex Mein Dynamic Momentum Index Ka Use:@:@:@:- Entry and Exit Points: DMI ko use karke traders overbought aur oversold levels identify karte hain taake entry aur exit points determine kiye ja sakein.

- Trend Confirmation: DMI ko use karke existing trends ko confirm kiya jata hai. Agar DMI bullish ho aur price bhi upward trend mein ho, to yeh ek strong buy signal hai.

- Risk Management: DMI ki help se market volatility ko gauge kiya ja sakta hai, jo risk management strategies mein madadgar hota hai.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#8 Collapse

**Dynamic Momentum Index Kya Hai?**

Dynamic Momentum Index (DMI) ek technical indicator hai jo traders aur investors dwara market analysis mein istemal hota hai. Yeh indicator price momentum ko measure karta hai aur trend reversals ko identify karne mein madad deta hai.

**DMI Ka Calculation**

DMI ka calculation price ke recent highs aur lows par based hota hai. Iske calculation mein lagataar price changes ko consider kiya jata hai jo ki ek exponential smoothing technique se adjust kiya jata hai. Isse indicator current price momentum ko reflect karta hai.

**DMI Ke Components**

Dynamic Momentum Index do components par based hota hai:

1. **Price Momentum:** DMI price momentum ko measure karta hai jo ki current price movements ke sath sath past price movements ko bhi consider karta hai.

2. **Trend Confirmation:** DMI trend confirmations provide karta hai. Yeh indicator bullish ya bearish trends ko confirm karne mein madad deta hai, jisse traders ko market ke direction ka pata chalta hai.

**DMI Ke Advantages**

DMI ka istemal karne se traders ko kuch advantages milte hain:

1. **Trend Identification:** DMI trend directions ko identify karne mein madad deta hai, jisse traders trend following strategies ka istemal kar sakte hain.

2. **Volatility Adjusted:** DMI price volatility ko adjust karta hai, jisse ki false signals kam hote hain aur accurate market movements ko interpret kiya ja sakta hai.

3. **Entry/Exit Points:** DMI entry aur exit points provide karta hai. Is indicator ke signals ke basis par traders apne trades ko manage kar sakte hain.

**DMI Ka Istemal**

Traders DMI ko alag-alag timeframes par use karte hain jaise daily, weekly ya monthly charts par. Is indicator ki madad se short-term aur long-term trends ko analyze kiya ja sakta hai aur trading decisions liye ja sakte hain.

**Conclusion**

Dynamic Momentum Index ek powerful technical indicator hai jo market analysis mein istemal hota hai. Iske calculation aur components ko samajhna traders ke liye zaroori hai taake wo price momentum ko effectively analyze kar sakein aur profitable trading strategies develop kar sakein. DMI ke sath sath dusre technical indicators aur price action ko bhi consider karna important hai trading decisions lene ke liye.

- CL

- Mentions 0

-

سا0 like

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 09:00 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим