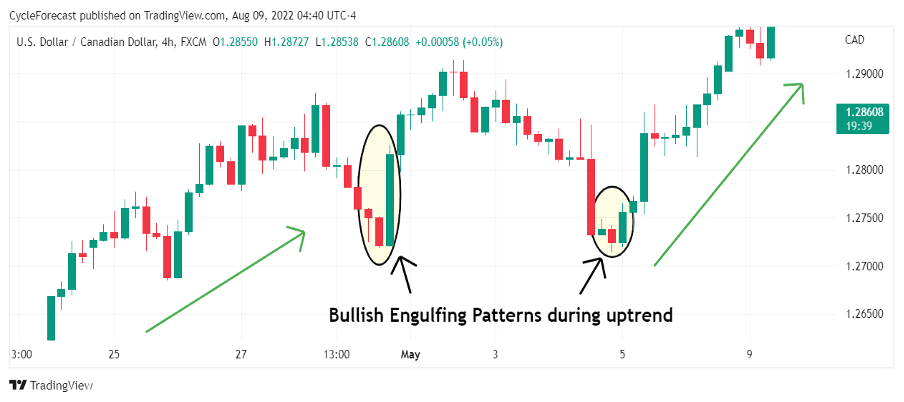

Trade Bullish Engulfing Candlestick Pattern zail mein paish kardah GBP/USD daily ka chart hey jes mein Engulfing candlestick pattern amal mein daikha ja sakta hey yhan par frex market kay pattern ko nechay kay trend mein dakh saktay hein bad mein anay wale candlestick say signal ke toseeq melte hey or bllish candlestick highs say oper close ho jate hey Englfing pattern lower darjay say nechay set keya ja sakta hey jes mein aik important level ka targetfix keya ja sakta hey jes ke price pehlay say he bonce ho choke hote hey yeh forex market mein recenly swing highs ka positive risk o reward ratio ko frahm kar saktay hein.

Candles Formation

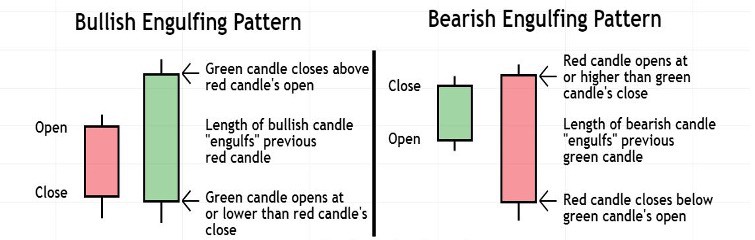

Bullish engulfing candlestick pattern bhi ziada tar dosre two days candlestick pattern ki tarah trend reversal ka kaam karti hai, jiss main pattern ki location ka bearish ya downtrend main hona zarori hai. Pattern main shamil candles ki formation darjazel tarah se hoti hai; - First Candle: Bullish engulfing candlestick pattern ki pehli candle aik bearish candle hoti hai, jo prices k bottom par ya bearish trend ki continuation ka kaam karti hai, q k ye aik real body wali candle hoti hai, jo k black ya red color ki candle hoti hai.

- Second Candle: Bullish engulfing candlestick pattern ki dosri candle aik real body wali bullish candle hoti hai. Ye candle long real body candle hoti hai, jo k open pehli candle k bottom par hoti hai aur close pehli candle k upper side par hoti hai. Bullish candle white ya green color main hoti hai, jo k prices ko bearish jane se rokti hai.

Trading

Bullish engulfing candlestick pattern price chart k bottom par banne se aik strong message melta hai, k ab market mazeed nechay jane muatahamel nahi ho sakta hai. Iss waja se ye pattern jab bhi bearish trend ya low price main banta hai, to ye bullish trend reversal ka aik strong signal deta hai. Yahan par market main buyers active hone ki koshash kartte hen. Trading k leye bullish trend ki continuation aur bullish trend reversal dono main prices bohut teezi k sath bullish jati hai. Pattern main trade open karne se pehle trend confirmation ka indicator se zarror karen, q k aksar ziada peak value par market main entry bare loss ka bhi sabbab bantti hai. Pattern ki trend confirmation price action yanni aik aur bullish candle se bhi ho saktti hai. Stop Loss ko pehli candle k lower point ye candle k open price se k lower price se two pips below par set karen.

thanks

thanks

تبصرہ

Расширенный режим Обычный режим