What is mat hold pattern :

No announcement yet.

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

What is mat hold pattern : -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

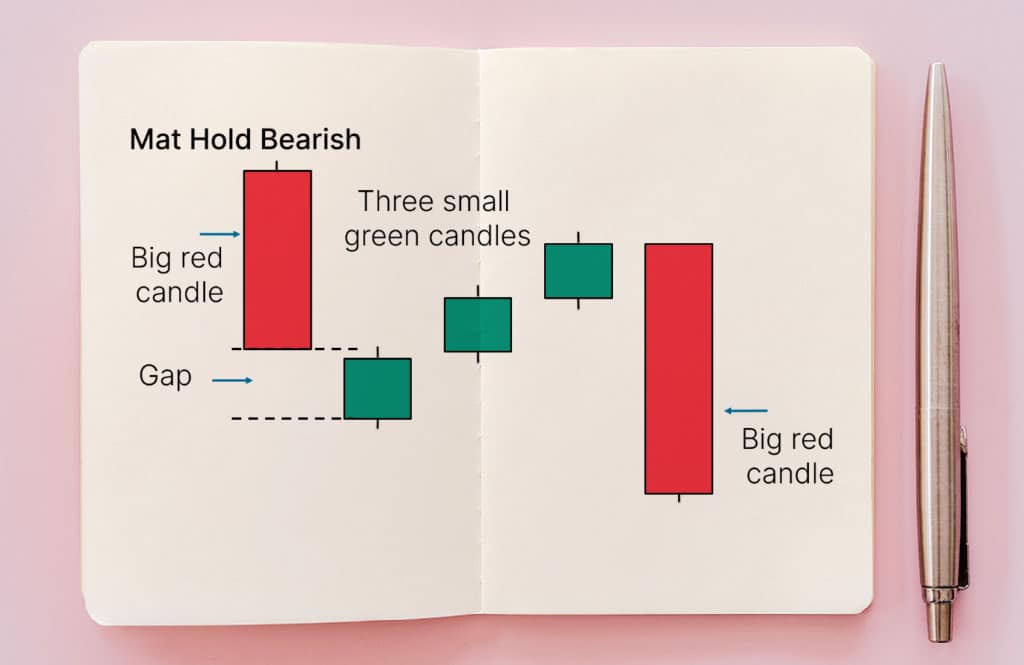

WHAT IS A MAT HOLD PATTERN? Mat hold pattern ki formation candlestick sa mil kar hoti ha or ya candlestick pattern ha ya indicates karta ha prior trend ka continuation hona ka. Ya mat hold pattern bearish bhi ho sakta ha or bullish bhi. Ya pattern five candles sa mil kar bana hota ha is pattern ki first or fifth candle current trend ko continue karti ha or is ki mid ki three candles reversal karti ha trend ko. Jo bullish pattern hota ha ya banta ha uptrend ma or jo bearish mat hold ha ya downtrend ma banta ha. Jo bullish version hoti ha is mat hold pattern ke is ma large up candle hoti ha, phir gap ata ha higher ma jo follow karta ha three smaller down ki candles ha or jo large up candle ho ge. Or jo is ma bearish version ho ga is mat hold pattern ka is ma large down candle ho ge, phir gap lower ma ho ga or ya followed karay ga three up ke smaller candles ko, or phir large down ki candle banay ge. BULLISH MAT HOLD PATTERN : Jo bullish mat hold pattern ho ga ya banay ga uptrend ka under or ya huma signals da ga uptrend ka likely resuming hona ka upside ke traf. Ya bullish pattern starts ho ga ya large upward ki candle ko banay ga or ya followed karay ga higher gap ko or three smaller candle banay ge jis ka move lower ho ge. Ya candles stay above ma ho ga first candle ka low ma. Or jo ya fifth candle ho ge ya large candle ho ge or move karay ge upside ma phir sa. Ya pattern banay ga overall uptrend ma. Traders buy karay ga fifth candle ka close ka near sa or enter karay ga long trade ko following candle ko. Or stop loss ko typically placed karay ga below ma fifth candle ka below ma. BEARISH MAT HOLD PATTERN : Bearishat hold pattern banay ga downtrend ka under or ya indicates karay ga downtrend ko or ya likely resuming karay ga price ko fall karna ko continue karay ga.. Ya bearish version same ho ga bullish ke trha sa, magar is ma except candles ho ge one or five candle larger down candle ho ge, or candles two through four tak smaller or move upside ma ho ge. Ya candles stay below ma ho ga first candle ka high ma. Ya pattern completes ho ga long white candel sa downside par, jo candle five ho ge. Ya banay ga downtrend ka under. Traders sell or short karay ga near ma fifth candle ka close ma or ya following karay ga candle ko. Jo stop loss ho ga ya short positions ho ga is ko placed above ma karay ga fifth candle ka high ma. Ya dono version pattern ka ho ga ya dono quit rare ho ga. Ya show karay ga price ka strongly moving hona ko trending direction ki traf, is ma sirf minor sa pressure ay ga opposite direction ki janab is price ka start moving hona ka liya phir sa trading direction ma. EXAMPLE OF MAT HOLD PATTERN : Mat hold pattern rare ho ga ya traders ko allow karay ga tiny deviation ma pattern ka or long or overall premise ho ga pattern or ya remains ho ga tact. Ya jo following chart ha is ma start ho raha ha strog g upward ki candle sa jab overall uptrend ha. Ya followed kar raha ha four candles ko jo ka stay above ma ho ge first candle ka low sa. Is ma bullish pattern typically bana ha or is ma sirf three candles ha jo move kar rahi ha downside ma. Or pattern followed kar raha ha further rise ko upside ma or is ma case ho raha ha short lived. Despite ho rahi ha deviation jo ka six candle sa jo ka instead ha five candle ma overall pattern ka jo shows kar raha ha strong price ka rise hona job, or pullback ko, or is ma strong surge ho rahi ha trending direction ma jab ya pattern end ho raha ha. Sab traders jo chaiya ka wo determine mara or allow karay slight deviation ko pattern ma or not. DIFFERENT BETWEEN MAT HOLD AND RISING THREE PATTERN : Ya rising three pattern bahot hi similar ho ga magar ya following ni karay ga gap ko first candle ka bad or ya pattern koi very common ni ho ga. Magar jo ya rising three Pattern ho ga ya trend ka continue ka sath ya trend ko reversal karna ka bhi kab baray ga. LIMITATIONS OF MAT HOLD PATTERN : Is mat hold pattern ko bahot hi hard hota ha find karna. Ya pattern frequently banay gave, is ma price always move ni karay ge expected side par is pattern ko following karta hua. Is a koi profit target ni hota. Agar price ka expected ho ga move karna to ya is bat ko indicate ni karya ga ka jo price ha ya kitni far run kar ka jay ge. Ya pattern required karay ga other method ko, jasa ka trend analysis or technical indicators jis sa determine kiya jay ga exit, or use kiya jay ga possibly ko other candlestick patterns ki. Mat hold pattern typically best use hota ha conjunction ma other forms analysis sa, or ya unreliable hota ha jab is ma solely traded ki jati ha. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

MAT (Management Aptitude Test) Hold Pattern. MAT Hold Pattern Defination. MAT Hold Pattern ek aisa scenario hai jab kisi vyakti ka MAT score hold kiya jata hai. Hold ka matlab hai ki us vyakti ke score par temporary rok laga di gayi hai, aur usko kuch samay tak further process ke liye rukna padta hai. Hold Pattern Disscuss. 1. Technical Issues: Kabhi-kabhi MAT examination process mein technical samasyaon ki wajah se hold lagaya ja sakta hai. Jaise ki server down hona, connectivity problems ya anya technical glitches. 2. Verification Process: Hold Pattern ka dusra karan verification process ho sakta hai. MAT authorities aapke score ya kisi dusre important information ko verify karne ke liye thode samay tak rok laga sakte hain. 3. Malpractice Suspicion: Agar kisi vyakti ke score mein ya examination process mein koi ashankit gatividhi ya cheating ki shak ho, to authorities hold pattern apply kar sakte hain tak ki vah vyakti aur uske score ka auradh na ho. Delay in Process: Hold Pattern vyakti ko further process mein delay kar sakta hai. Agar aapka score hold hai, toh aapko next steps, jaise ki counseling, admission ya job application, ke liye thoda wait karna padega. Additional Documentation: Hold Pattern mein, aapko shayad additional documentation ya verification ke liye bola jayega. Isse aapko aur samay aur mehnat lag sakti hai. Score Review: Hold Pattern aapke score ka review karne ka mauka bhi deta hai. Is samay, authorities aapke score ko aur dhyan se analyze kar sakte hain, jisse galti ya inconsistency ki sthiti mein sahi tayari ki ja sakti hai. Communication: MAT authorities se sampark karein aur hold ka karan jaanein. Communication ke dwara aapko hold se niptarane mein madad mil sakti hai. Documentation: Yadi aap se additional documentation maangi gayi hai, toh unhe sahi tarah se taiyaar karein aur jald se jald jama karein.[/COLOR][/SIZE][/B] MAT Hold Pattern Defination. MAT Hold Pattern ek aisa scenario hai jab kisi vyakti ka MAT score hold kiya jata hai. Hold ka matlab hai ki us vyakti ke score par temporary rok laga di gayi hai, aur usko kuch samay tak further process ke liye rukna padta hai. Hold Pattern Disscuss. 1. Technical Issues: Kabhi-kabhi MAT examination process mein technical samasyaon ki wajah se hold lagaya ja sakta hai. Jaise ki server down hona, connectivity problems ya anya technical glitches. 2. Verification Process: Hold Pattern ka dusra karan verification process ho sakta hai. MAT authorities aapke score ya kisi dusre important information ko verify karne ke liye thode samay tak rok laga sakte hain. 3. Malpractice Suspicion: Agar kisi vyakti ke score mein ya examination process mein koi ashankit gatividhi ya cheating ki shak ho, to authorities hold pattern apply kar sakte hain tak ki vah vyakti aur uske score ka auradh na ho. Delay in Process: Hold Pattern vyakti ko further process mein delay kar sakta hai. Agar aapka score hold hai, toh aapko next steps, jaise ki counseling, admission ya job application, ke liye thoda wait karna padega. Additional Documentation: Hold Pattern mein, aapko shayad additional documentation ya verification ke liye bola jayega. Isse aapko aur samay aur mehnat lag sakti hai. Score Review: Hold Pattern aapke score ka review karne ka mauka bhi deta hai. Is samay, authorities aapke score ko aur dhyan se analyze kar sakte hain, jisse galti ya inconsistency ki sthiti mein sahi tayari ki ja sakti hai. Communication: MAT authorities se sampark karein aur hold ka karan jaanein. Communication ke dwara aapko hold se niptarane mein madad mil sakti hai. Documentation: Yadi aap se additional documentation maangi gayi hai, toh unhe sahi tarah se taiyaar karein aur jald se jald jama karein. -

#4 Collapse

FOREX MEIN "Hold PATTERN" INTRODUCTION Forex market mein "hold pattern" ka istemaal aam taur par us waqt kiya jata hai jab kisi currency pair ka price trend ya movement temporarily ruk jata hai aur ek range ya mukarrar hadood ke andar tashkeel leta hai. Hold pattern, jisey "consolidation" ya "sideways movement" bhi kaha jata hai, market mein price volatility kam hone ke samay mein dekha jata hai. Hold pattern ya consolidation market mein price movement ka ek phase hota hai jab kisi currency pair ka price kuch samay tak horizontal ya sideways direction mein chalta hai. Is doran, price movement kam hota hai aur trading range hadood mein rehta hai. Yeh phase market mein trend reversal ya trend continuation ke pehle kehlaya jata hai. 2. HOLD PATTERN FORMATION. Hold pattern ki wajah alag-alag ho sakti hai, jaise ki: - Market mein uncertainty ya indecision: Hold pattern jab market mein uncertainty ya indecision ka samay darshaata hai, jahan traders price direction ke baare mein clear nahi hote hain. - Market mein consolidation: Hold pattern jab market mein price consolidation ki wajah se tashkeel leta hai, jahan buyers aur sellers ke beech ek balance bana rehta hai. 3. HOLD PATTERN KI PEHCHAN: Hold pattern ki pehchan karne ke liye kuch indicators aur technical analysis tools istemaal kiye ja sakte hain: - Trading range: Hold pattern mein price trading range ke andar rehta hai. Price upper resistance level aur lower support level ke beech fluctuate karta hai. - Volume: Hold pattern mein volume typically kam hota hai, kyun ki traders wait aur observe karte hain jab tak market trend clear na hojaye. - Price patterns: Price patterns, jaise ki triangles, rectangles, aur flags, hold pattern ko pehchane mein madad karte hain. 4. HOLD PATTERN KE TRADING STRATEGIES: Hold pattern ke samay mein kuch traders trading strategies istemaal karte hain, jaise ki: - BREAKOUT TRADING: Hold pattern ke baad, jab price range se bahar nikalta hai, traders breakout trading strategy istemaal karke trading positions enter karte hain. - RANGE TRADING: Hold pattern ke andar, jab price trading range ke beech fluctuate karta hai, traders range trading strategy istemaal karke buy aur sell positions lete hain. Hold pattern forex market mein ek common phenomenon hai jiski wajah se traders price direction ka intezaar karte hain. Hold pattern ki pehchan karna aur sahi trading strategy istemaal karna traders ke liye mahatvapurna hota hai taki woh market movement se faida utha sakein. -

#5 Collapse

Mat Hold Pattern: A Complete Detail aik candle stuck chart patteren jisay meet hold patteren kehte hain financial marketon mein mumkina rujhanaat aur market ke ulat pehroon ko dekhnay ke liye takneeki tajzia mein istemaal kya jata hai. usay aik tasalsul ke patteren ke tor par shumaar kya jata hai jo taizi ke rujhan ke douran tayyar hota hai aur is baat ki nishandahi karta hai ke, earzi istehkaam ke baad, mojooda oopar ki janib rujhan jari rehne ka imkaan hai . Formation meet hold patteren ko mom btyon ke aik khaas tarteeb se mumtaz kya jata hai aur aksar is terhan zahir hota hai : Bullish Candlestick mazboot blush candle sticks jo oopri rujhan ka ishara deti hain patteren shuru karne ke liye istemaal ki jati hain . Bearish Candlestick aik hi bearish ( surkh ya siyah ) candle stick taizi ki mom batii ki pairwi karti hai. is candle stuck ka body pichli blush candle se lamba hona chahiye . Bullish Candlestick with a Gap aik taizi ki candle stick jis mein gape up hai ( pichli mom batii ki oonchai ke oopar khulti hai ) bearish candle ki pairwi karti hai. yeh kharidari ke barhatay hue dabao ko zahir karta hai . Long Bullish Candlestick (Hold) tosiay blush ( safaid ya sabz ) candle stick jo khalaa ke baad aati hai patteren ka aik ahem hissa hai. is candle stuck ko misali tor par Sabiqa ​​bearish candle ke body ko ghairna chahiye aur pichli blush candle se kaafi ziyada qareeb hona chahiye . Bullish Continuation patteren ishara karta hai ke misbet rujhan barqarar rehne ka imkaan hai, aur tajir qeemat mein mazeed izafay ki tawaqqa kar satke hain . Psychology Behind the Mat Hold Pattern: meet hold patteren ki tashkeel ke waqt market ka mood dekha ja sakta hai. aik ahem izafah shuru mein nazar aata hai, jaisa ke pehli taizi candle ne dekhaya hai. mandarja zail bearish candle aik mukhtasir mandi ya munafe lainay ki tajweez karti hai, jis se taajiron mein kuch shak peda hota hai . taham, gape up opening aur is ke baad anay wali lambi blush candle kharidaron ki taizi se wapsi ki akkaasi karti hai, jo pehlay ki mandi ki mom batii se peda honay walay khadshaat ko daur karti hai. is se zahir hota hai ke taizi ka rujhan ab bhi mazboot hai aur shayad is mein taizi aa sakti hai . Trading Implications jab taajiron ko meet stay patteren nazar aata hai, to woh apni lambi pozishnon par rehne ka faisla kar satke hain ya taizi ke rujhan ke jari rehne ki tawaqqa mein nai ​​lambi pozishnin kholnay ke baray mein soch satke hain. tijarti faislon ki himayat karne ke liye, kisi bhi takneeki patteren ki terhan, izafi tajzia ke ozaar aur rissk managment taknikoon ka istemaal kya jana chahiye . Conclusion meet hold patteren aik Maroof tasalsul ka namona hai jo up trained ke douran market ke mood ke baray mein ahem isharay faraham karta hai. tijarti pesha war afraad qeematon mein mumkina utaar charhao ka andaza laga satke hain aur is patteren ka pata laga kar apni position ka faisla kar satke hain. tijarti faislon ki durustagi ko behtar bananay ke liye, meet hold patteren ko deegar takneeki isharay aur tajzia ke tareeqon ke sath mil kar istemaal kya jana chahiye . -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

MAT (The executives Inclination Test) Hold Example. MAT Hold Example Defination.MAT Hold Example ek aisa situation hai punch kisi vyakti ka MAT score hold kiya jata hai. Hold ka matlab hai ki us vyakti ke score standard transitory rok laga di gayi hai, aur usko kuch samay tak further cycle ke liye rukna padta hai. Hold Example Disscuss. 1. Specialized Issues: 2. Confirmation Cycle: Hold Example ka dusra karan confirmation process ho sakta hai. MAT specialists aapke score ya kisi dusre significant data ko confirm karne ke liye thode samay tak rok laga sakte hain. 3. Negligence Doubt: Agar kisi vyakti ke score mein ya assessment process mein koi ashankit gatividhi ya conning ki shak ho, to specialists hold design apply kar sakte hain tak ki vah vyakti aur uske score ka auradh na ho.Defer in Cycle: Hold Example vyakti ko further interaction mein delay kar sakta hai. Agar aapka score hold hai, toh aapko following stages, jaise ki advising, confirmation ya employment form, ke liye thoda stand by karna padega. Extra Documentation: Hold Example mein, aapko shayad extra documentation ya confirmation ke liye bola jayega. Isse aapko aur samay aur mehnat slack sakti hai. Score Audit: Hold Example aapke score ka audit karne ka mauka bhi deta hai. Is samay, specialists aapke score ko aur dhyan se examine kar sakte hain, jisse galti ya irregularity ki sthiti mein sahi tayari ki ja sakti hai. Correspondence: MAT specialists se sampark karein aur hold ka karan jaanein. Correspondence ke dwara aapko hold se niptarane mein madad mil sakti hai. Documentation: Yadi aap se extra documentation maangi gayi hai, toh unhe sahi tarah se taiyaar karein aur jald se jald jama karein.[/COLOR][/SIZE][/B] MAT Hold Example Defination. MAT Hold Example ek aisa situation hai poke kisi vyakti ka MAT score hold kiya jata hai. Hold ka matlab hai ki us vyakti ke score standard impermanent rok laga di gayi hai, aur usko kuch samay tak further interaction ke liye rukna padta hai. Hold Example Disscuss. 1. Specialized Issues: Kabhi MAT assessment process mein specialized samasyaon ki wajah se hold lagaya ja sakta hai. Jaise ki server down hona, availability issues ya anya specialized misfires. 2. Check Cycle: Hold Example ka dusra karan check process ho sakta hai. MAT specialists aapke score ya kisi dusre significant data ko check karne ke liye thode samay tak rok laga sakte hain. 3. Negligence Doubt: Agar kisi vyakti ke score mein ya assessment process mein koi ashankit gatividhi ya tricking ki shak ho, to specialists hold design apply kar sakte hain tak ki vah vyakti aur uske score ka auradh na ho. Postpone in Cycle: Hold Example vyakti ko further interaction mein delay kar sakta hai. Agar aapka score hold hai, toh aapko following stages, jaise ki guiding, confirmation ya request for employment, ke liye thoda stand by karna padega. Extra Documentation: Hold Example mein, aapko shayad extra documentation ya check ke liye bola jayega. Isse aapko aur samay aur mehnat slack sakti hai. Score Survey: Hold Example aapke score ka survey karne ka mauka bhi deta hai. Is samay, specialists aapke score ko aur dhyan se examine kar sakte hain, jisse galti ya irregularity ki sthiti mein sahi tayari ki ja sakti hai. Correspondence: MAT specialists se sampark karein aur hold ka karan jaanein. Correspondence ke dwara aapko hold se niptarane mein madad mil sakti hai. Documentation: Yadi aap se extra documentation maangi gayi hai, toh unhe sahi tarah se taiyaar karein aur jald se jald jama karein

-

#7 Collapse

jny ki waja se ham bahot se ghir zarori risk leny se apny account ko bacha sakty hello, falling star altered hammer ki tarha to ho sakty hello magar ye green aur red dono consider me boycott jany ki waja se es ki development brokers ko etni asani se samaj me nai ati application ka thrkina plan reversal ko talaash karne mein madad kar sakti hain. ShootingShooting superstar light plan single fire test hone ki waja se specific assessment key bohut ziada istemal hone wala aik negative example reversal test hai, jiss ko na sirf forex searching for and progressing mein ziada istemal kia jata hai, balkay record, gatherings, aur computerized money searching for and progressing mein bhi is ka khasa use hota hai. Shooting enormous name light charge improvement clients ko bullish ya negative style megastar fire ki karkardagi ka inhisar chose time span standard hota hai, hit bhi ye flame costs okay zenith standard banti hai, to ye mumkina negative plan reversal ka sign deti hai. Negative taking pictures gigantic name light dosre markers okay sath costs k top standard negative plan reversal ka okay leye ziada mashaho -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#8 Collapse

Mat Hold Chart Pattern: Falling star adjusted hammer ki tarha to ho sakty hi magar ye green aur red dono think of me as blacklist jany ki waja se es ki improvement agents ko etni asani se samaj me nai ati application ka thrkina plan inversion ko talaash karne mein madad kar sakti hain. ShootingShooting genius light arrangement single fire test sharpen ki waja se explicit appraisal key bohut ziada istemal sharpen wala aik negative model inversion test hai, jiss ko na sirf forex looking for and advancing mein ziada istemal kia jata hai, balkay record, get-togethers, aur electronic cash looking for and advancing mein bhi is ka khasa use hota hai. Shooting gigantic name light charge improvement clients ko bullish ya negative style megastar fire ki karkardagi ka inhisar picked stretch of time standard hota hai, hit bhi ye fire costs alright peak standard banti hai, to ye mumkina negative arrangement inversion ka sign deti ha Mat hold patteren aik Maroof tasalsul ka namona hai jo up prepared ke douran market ke state of mind ke baray mein ahem isharay faraham karta hai. tijarti pesha war afraad qeematon mein mumkina utaar charhao ka andaza laga satke hain aur is patteren ka pata laga kar apni position ka faisla kar satke hain. tijarti faislon ki durustagi ko behtar bananay ke liye, meet hold patteren ko deegar takneeki isharay aur tajzia ke tareeqon ke sath mil kar istemaal kya jana chahiye .stomach muscle taajiron ko meet stay patteren nazar aata hai, to woh apni lambi pozishnon standard rehne ka faisla kar satke hain ya taizi ke rujhan ke jari rehne ki tawaqqa mein nai lambi pozishnin kholnay ke baray mein soch satke hain. tijarti faislon ki himayat karne ke liye, kisi bhi takneeki patteren ki terhan, izafi tajzia ke ozaar aur rissk managment taknikoon ka istemaal kya jana chahiye Chart Candles Types: Market mein vulnerability ya hesitation: Hold design punch market mein vulnerability ya uncertainty ka samay darshaata hai, jahan merchants cost heading ke baare mein clear nahi hote hain market primary solidification: Hold design hit market mein cost combination ki wajah se tashkeel leta hai, jahan purchasers aur dealers ke beech ek balance bana rehta hai.Hold design ki pehchan karne ke liye kuch pointers aur specialized investigation instruments istemaal kiye ja sakte hai hold design mein cost exchanging range ke andar rehta hai. Cost upper obstruction level aur lower support level ke beech change karta hai hold design mein volume regularly kam hota hai, kyun ki dealers stand by aur notice karte hain hit tak market pattern clear na hojaye cost designs, jaise ki triangles, square shapes, aur banners, hold design ko pehchane mein madad karte hain.

Mat hold patteren aik Maroof tasalsul ka namona hai jo up prepared ke douran market ke state of mind ke baray mein ahem isharay faraham karta hai. tijarti pesha war afraad qeematon mein mumkina utaar charhao ka andaza laga satke hain aur is patteren ka pata laga kar apni position ka faisla kar satke hain. tijarti faislon ki durustagi ko behtar bananay ke liye, meet hold patteren ko deegar takneeki isharay aur tajzia ke tareeqon ke sath mil kar istemaal kya jana chahiye .stomach muscle taajiron ko meet stay patteren nazar aata hai, to woh apni lambi pozishnon standard rehne ka faisla kar satke hain ya taizi ke rujhan ke jari rehne ki tawaqqa mein nai lambi pozishnin kholnay ke baray mein soch satke hain. tijarti faislon ki himayat karne ke liye, kisi bhi takneeki patteren ki terhan, izafi tajzia ke ozaar aur rissk managment taknikoon ka istemaal kya jana chahiye Chart Candles Types: Market mein vulnerability ya hesitation: Hold design punch market mein vulnerability ya uncertainty ka samay darshaata hai, jahan merchants cost heading ke baare mein clear nahi hote hain market primary solidification: Hold design hit market mein cost combination ki wajah se tashkeel leta hai, jahan purchasers aur dealers ke beech ek balance bana rehta hai.Hold design ki pehchan karne ke liye kuch pointers aur specialized investigation instruments istemaal kiye ja sakte hai hold design mein cost exchanging range ke andar rehta hai. Cost upper obstruction level aur lower support level ke beech change karta hai hold design mein volume regularly kam hota hai, kyun ki dealers stand by aur notice karte hain hit tak market pattern clear na hojaye cost designs, jaise ki triangles, square shapes, aur banners, hold design ko pehchane mein madad karte hain. Market mein "hold design" ka istemaal aam taur standard us waqt kiya jata hai hit kisi cash pair ka cost pattern ya development briefly ruk jata hai aur ek range ya mukarrar hadood ke andar tashkeel leta hai. Hold design, jisey "combination" ya "sideways development" bhi kaha jata hai, market mein cost instability kam sharpen ke samay mein dekha jata hai. Hold design ya combination market mein cost development ka ek stage hota hai hit kisi money pair ka cost kuch samay tak level ya sideways course mein chalta hai. Is doran, cost development kam hota hai aur exchanging range hadood mein rehta hai. Yeh stage market mein pattern inversion ya pattern continuation ke pehle kehlaya jata hai. Chart Pattern Trading: Mat hold design ko bahot hey hard hota ha find karna. Ya design regularly banay gave, is mama cost generally move ni karay ge expected side standard is design ko observing karta hua. Is a koi benefit target ni hota. Agar cost ka expected ho ga move karna to ya is bat ko demonstrate ni karya ga ka jo cost ha ya kitni far run kar ka jay ge. Ya design required karay ga other strategy ko, jasa ka pattern examination or specialized pointers jis sa decide kiya jay ga exit, or use kiya jay ga conceivably ko other candle designs ki. Mat hold design commonly best use hota ha combination mama different structures investigation sa, or ya inconsistent hota ha hit is mama exclusively exchanged ki jati ha.Agar kisi vyakti ke score mein ya assessment process mein koi ashankit gatividhi ya deceiving ki shak ho, to specialists hold design apply kar sakte hain tak ki vah vyakti aur uske score ka auradh na ho.

Mat hold design ki arrangement candle sa mil kar hoti ha or ya candle design ha ya shows karta ha earlier pattern ka continuation hona ka. Ya mat hold design negative bhi ho sakta ha or bullish bhi. Ya design five candles sa mil kar bana hota ha is design ki first or fifth flame latest thing ko proceed karti ha or is ki mid ki three candles inversion karti ha pattern ko. Jo bullish example hota ha ya banta ha upturn mama or jo negative mat hold ha ya downtrend mama banta ha. Jo bullish adaptation hoti ha is mat hold design ke is mama enormous up light hoti ha, phir hole ata ha higher mama jo follow karta ha three more modest down ki candles ha or jo huge up flame ho ge. Or on the other hand jo is negative rendition ho ga is mat hold design ka is mama enormous down candle ho ge, phir hole lower mama ho ga or ya followed karay ga three up ke more modest candles ko, or phir huge down ki light banay ge.

Mat hold design ki arrangement candle sa mil kar hoti ha or ya candle design ha ya shows karta ha earlier pattern ka continuation hona ka. Ya mat hold design negative bhi ho sakta ha or bullish bhi. Ya design five candles sa mil kar bana hota ha is design ki first or fifth flame latest thing ko proceed karti ha or is ki mid ki three candles inversion karti ha pattern ko. Jo bullish example hota ha ya banta ha upturn mama or jo negative mat hold ha ya downtrend mama banta ha. Jo bullish adaptation hoti ha is mat hold design ke is mama enormous up light hoti ha, phir hole ata ha higher mama jo follow karta ha three more modest down ki candles ha or jo huge up flame ho ge. Or on the other hand jo is negative rendition ho ga is mat hold design ka is mama enormous down candle ho ge, phir hole lower mama ho ga or ya followed karay ga three up ke more modest candles ko, or phir huge down ki light banay ge.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 03:56 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим