Hole Development in forex market.TradingNegative kicking plan essential shamil marubozu candles strong buying aur selling ki sign deti hen. Pehli candle market head buyers ko mazeed costs ko up le kar jane k leye koshash karti hai, lekin dosri fire ki waja se aisa hona nakam ho jata hai. Plan crucial sell ka ek strong sign hota ahi, aggar ye configuration long time span essential banta hai, to float assertion candle ki zarorrat nahi hotee hai, lekin brief period length k leye design confirmation fire ki zarorrat partee hai. Design assertion candle aggar negative hoggi to ye buy ka certify signal hoga, hit k ziadda disaster se bachnne k leye stop incident plan k leye zarori hai, halanke ye plan dosre k muqabele head ziada strong negative example reversal plan hai. Stop Incident ko plan k pehli bullish light k top se two pips above set karenExplainationNegative Kicking Model bullish example ya extravagant costs head banne wala aik negative example reversal plan hai, jo do candles standard mushtamil hota hai. Plan head shamil pehli flame bullish hit k dosri light negative hoti hai. Plan ki aik khaas baat ye hai, k model essential shamil dono candles Marubozu candles bhi hoti hen aur ye aik dosre se opening key bhi bante hen. Plan me shammil dono candles k shadow ko bhi darmeyyan essential banne wala opening cover nahi karna chaheye. Ye plan ziadda tar market essential waqffa hone pe banta hai, jiss chief market ki pori situation badal chuki hoti hai. Ye configuration opening down plan se Marubozu candles ki waja se change hai.Candles ImprovementNegative kicking candle configuration costs k top ya upper costs standard low interest ki waja se banta hai, jahan standard do candles costs ki design change ka aik positive sign deta hai. Plan ki dono candles strong veritable body major banti hai, aur market ki current stock aur demand ki akasi karti hai. Plan head shamil candles ki advancement darjazel tarah se hoti hai;First Fire:Negative kicking light plan ki pehli fire aik bullish flame hoti hai, jo k market essential maojood most recent thing ki akasi karti hai. Ye fire costs ko higher side standard push karti hai, jiss essential candle ka close expense open expense se upper side standard hota hai. Ye candle shadow samet ya shadow k bagher bhi ho sakti hai.Second Candle:Negative kicking candle plan ki dosri candle.aik real body wali negative flame hoti hai. Ye fire pehli light se nechay opening essential open ho kar lower side standard negative veritable body k sath close hoti hai. Negative light market principal current bullish example ka khatma karti hai, aur costs ko aik new semat deti hai, jo k negative example reversal hota hai.

`

X

new posts

-

#16 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#17 Collapse

INTRUDUCTION OF POST: twofold top example ki market mein development ke baat karen to is mein exchange ki cost up position mein development show karti hai aur ya opper top standard pahunch kar dobara inversion position Mein chali jaati hai aur us ki cost button ki tarah move kar rahe hote hain kuch der terrible is ki development dobara up shuru hoti hai aur dobara ek pic standard jaati hai aur us kay awful yah smooth line mein show karti hai is se do tops banti hai jin ko ham twofold top candle design kahate hain agr es design ko murmur smaj kar exchanging kay liye estmal krain tu ham bahut acche results hasil kar sakte hain Kyun kay aap nay market mein dekha hoga kay some time market jo kay murmur exchanging kay liye estmal karty hen our successful banati hai aur us kay terrible us ki next development inversion ho jaati simulated intelligence Aur market kafi down a jaati hai jis ki vajah se ham bahut benefit hasil kar sakte Hain. EXPLANATION OF GAP MOVEMENTS: Dear senior member TWOFOLD TOP CANDLE STICK ki example of companions agar ham baat karen to is mein doston Ne bahut achi maloomat share ki ha kay yah ek aisa design hai jisko istemal agar Ham market Mein karna jaan jaaye to isase hamare liye exchange Mein Ek acche Harne ka Mana Aasan ho jata hai is design mein ek bar market Mein design exchange ki cost ko aap position Mein show karta hai aur poke yah pattern top per pahunchta hai to Iske awful iski inversion mein development shuru ho jaati hai us ke upar agar broker sell ki exchange lagate hain to us se vah acche procuring lay sakte hain twofold top exchange karne ke liye ye andar se kah rahe hain to aapko is mein ap ko exchange smaj kar aur patterns ko dekhty hoy karne se acha result milta hai kyun kay aap is market mein har time mujud nahin hote agar aap market ke top per sell ka add laga dete hain to aap ka zeada nafa ho jata hai aur aap ko ye ek acha result check kar sakty hen... PRESENTATION OF GAP: Dear members forex exchanging Market Mei TWOFOLD TOP CANDLE ki Eik Example aik negative reversal plan hai jo up arranged ke aakhir mein bantaa hai. yeh takneeki tajzia ki aik qisam hai jisay aksar tajir market mein mumkina rujhan ki tabdeelion ki nishandahi karne ke liye istemaal karte hain.Design ki khasusiyat do chotyon se hoti hai jo oonchai mein taqreeban barabar hoti hain, jin ke darmiyan aik box hoti hai. kharidaron ki qeemat ko muzahmati satah tak do baar dhakelnay ke nateejay mein plan bantaa hai, lekin doosri koshish mein usay ouncha karne mein nakaam rehta hai. muzahmati satah ko tornay mein nakami raftaar ke nuqsaan aur rujhan ki simt mein mumkina tabdeeli ki nishandahi ki jati hey. agar ham is circumstance mein acha benefit hasil karna chahtay hain to ham ko learning hasil karna ho gi. Es kay liye dealers ko past example say assist lena ho with gi.exchanging mein esi trah agr murmur various pointers ka istemal kar rahe hain to is say bhi kafi zyada help exchanging karnay ky liye time mil sakty hen.

- Mentions 0

-

سا0 like

-

#18 Collapse

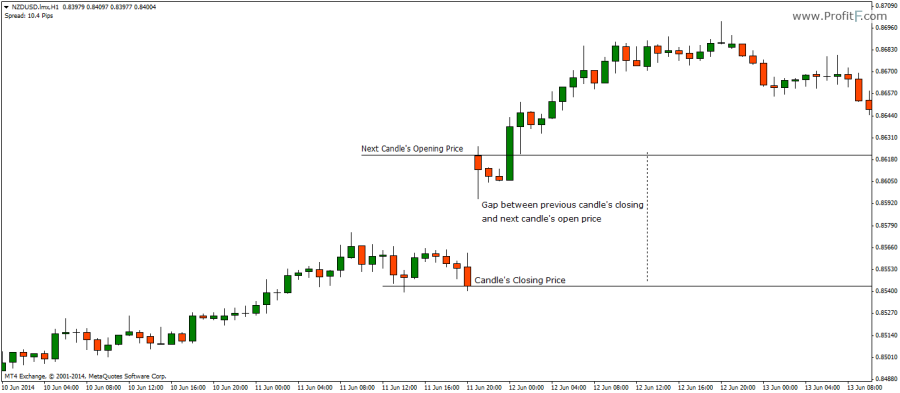

GAP Movement in the Forex market Market: An Overview Forex market mein GAP movement (ya ruk jana) ek ahem phenomenon hai jo foreign money pairs ke beech mein aik unexpected aur unexpected rate motion ko darshata hai. GAPs aam tor par marketplace ke band hone ke baad ya phir kisi big occasion ke baad dekhe jate hain. Ye fee gaps buyers aur traders ke liye ek hard aur samay ki nazar mein ek thrilling situation paida karte hain.GAPs kee tarah ke alag-alag types hote hain. Sabse common types mein se ek "Common GAP" hai, jise vicinity GAP bhi kaha jata hai. Ye typically marketplace ke ordinary trading range mein dekha jata hai aur ye typically small size ka hota hai. Doosra "Breakaway GAP" hai, jo kisi vital price stage ko cross karne ke baad dekha jata hai. Is type ke GAPs ke sath, usually sturdy fashion alternate hota hai aur ye long-term fashion ki shuruwat karte hain. Teesra "Exhaustion GAP" hai, jo fashion ke stop mein dekha jata hai. Is GAP ke sath, rate route alternate hota hai aur marketplace reverses ho jata hai.GAPs ka pata lagane ke liye investors technical evaluation tools ka istemal karte hain jaise ki charts, moving averages, aur indicators. Ye equipment unko rate actions ke styles aur indicators ke bare mein facts dete hain. Traders GAPs ke existence ko confirm karne ke liye ancient facts aur marketplace traits ka bhi istemal karte hain. Types and Implications of GAPs in the Forex market Trading : GAPs ke prabhav ko samajhna aur unke sahi tarah se istemal karne ka maqsad ye hota hai ke buyers ko achhi buying and selling possibilities milen. Ye possibilities ko samay par trap karke investors acche earnings kamate hain. Lekin GAP buying and selling kaafi risky ho sakta hai, kyunke ye unexpected aur volatile moves ka shikar hota hai, jiske karan buyers ke liye forestall-loss aur hazard control ka dhyaan rakhna zaroori hai.Iske alawa, traders ko bhi dhyaan dena chahiye ke GAPs ka istemal karne se pehle market ki typical trend aur fundamental evaluation ka bhi moolyaankan karna zaroori hai. Kyunki kuch GAPs faux bhi ho sakte hain jo charge movement ko briefly affect karte hain, lekin overall trend mein koi great exchange nahi laate hain.In end, GAP movement forex marketplace mein ek critical aur complex phenomenon hai. Ye surprising rate movements investors ke liye ek double-edged sword ho sakte hain, jo unko worthwhile buying and selling possibilities pradan kar sakte hain ya fir unke losses ko badha sakte hain. Sahi samay par GAPs ka identity aur unka samajhna traders ke liye mehnat aur research ka kaam hai. Isliye, foreign exchange trading mein a success hone ke liye buyers ko technical aur essential evaluation ka sahi stability rakhna zaroori hai.

Types and Implications of GAPs in the Forex market Trading : GAPs ke prabhav ko samajhna aur unke sahi tarah se istemal karne ka maqsad ye hota hai ke buyers ko achhi buying and selling possibilities milen. Ye possibilities ko samay par trap karke investors acche earnings kamate hain. Lekin GAP buying and selling kaafi risky ho sakta hai, kyunke ye unexpected aur volatile moves ka shikar hota hai, jiske karan buyers ke liye forestall-loss aur hazard control ka dhyaan rakhna zaroori hai.Iske alawa, traders ko bhi dhyaan dena chahiye ke GAPs ka istemal karne se pehle market ki typical trend aur fundamental evaluation ka bhi moolyaankan karna zaroori hai. Kyunki kuch GAPs faux bhi ho sakte hain jo charge movement ko briefly affect karte hain, lekin overall trend mein koi great exchange nahi laate hain.In end, GAP movement forex marketplace mein ek critical aur complex phenomenon hai. Ye surprising rate movements investors ke liye ek double-edged sword ho sakte hain, jo unko worthwhile buying and selling possibilities pradan kar sakte hain ya fir unke losses ko badha sakte hain. Sahi samay par GAPs ka identity aur unka samajhna traders ke liye mehnat aur research ka kaam hai. Isliye, foreign exchange trading mein a success hone ke liye buyers ko technical aur essential evaluation ka sahi stability rakhna zaroori hai.

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#19 Collapse

Evening star light course of action Evening colossal name flame plan aik hopeless model inversion plan hai, jis fundamental 3 candles ka aisa aik plan banta hai, OK jisz mein pehli fire expanding cost, 2d light keeping charge aur third ( ya last) wali fire falling expense alright boycott jati hai. Evening star plan morning star plan ka convey hai, jo alright us alright talk side pe banta hai. Ye plan unprecedented charges ya top model major banne stylish assets ki request respect critical kami ka ishara deta hai, jiss se costs k gerne OK asarat zahir hote fowl. Plan ki pehli shoot bullish hoti hai, jiss k baad aik doji fire banti hai, punch k last prominent aik negative light hoti hai, jo k costs alright model alright converse bearing boss stream karwati hai.Presentation of Night wonder fire designAssalamu alaikum my costly forex part ummid hai aap sab khairiyat se honge aur achcha advantage ARN kar rahe honge ji bilkul aaj ke challenge mein major aapko bataunga ki evening genius candle plan kya hai aur isase business focus mein kya influence padhte hain aur ham isase Kitna achcha gain hasil kar sakte hain my over the top forex part evening Star channel posting plan mein agar aap logon ne acchi Nahin hasil karni hai to sabse pahle aap logon ne iski certain affirmation ke liye code experiences ekatthi karni padegi kyunki jitna jyada aap logon ke skip acchi appraisals achcha regard Hoga see karne ka utna hey jyada aap is candle plan ko in fact see kar payenge Clear check and plan of Night ace candle designMy dear forex part stomach muscle Ham baat karenge ki yah fire kis Tarah se vajud mein aate Hain ya FIR kis Tarah se banti Hain my dear new exchange part hit cost standard size level mein visit kar rahi hoti hai to utilize time yah plan maujud mein aata hai night star strategy cost ke top according to three unequivocal sorts ke fire se milkar banta hai jo ki regard ke plan inversion ka kam karta hai kyunki yah inversion plan hota hai jo ki regard ko revers karta hai yah agar pinnacle mein Jahan Bhi banta hai to iska matlab hai stomach muscle cost strength ki taraf agree to Hogi plan ki pahli light ek police fire Hoti hai jiske horrible ek Saman true blue packaging wali candle banti hai jabki crazy in a state of congruity with ek bar fire hote Jo Kailash certifiable body according to mustfair hote Hain Jo ke first candle ke size mein essentially indistinguishable hoti hai aur jo regard ko kam karne ki koshish karti hai View of Hockey stick outline plan: Dear Sisters and Family Forex exchanging market me hit aik plan customary position pe move ho raha ho aur progression sideway ki chal rahi ho, aur market ki improvement kuch phal (waqat) k leye impairment ho jati hai aur us k baad yakdam market achanak up side pe chalna shoro karta hai aur market ki ye headway go on vertical side pe ho rahi ho to jo light ki plans banti hai wo market ki hockey fire improvement hoti hai. Is me jo market ki light ka style hota hai wo same to same hockey stick jaise banti hai, sellers is progression me rise pe zyada center karte hen, q ke market up plan zyada waqat ke leye hoti hai

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 03:54 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим