What is long legged doji:

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

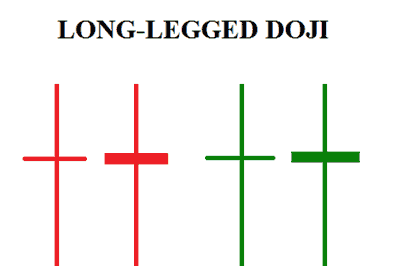

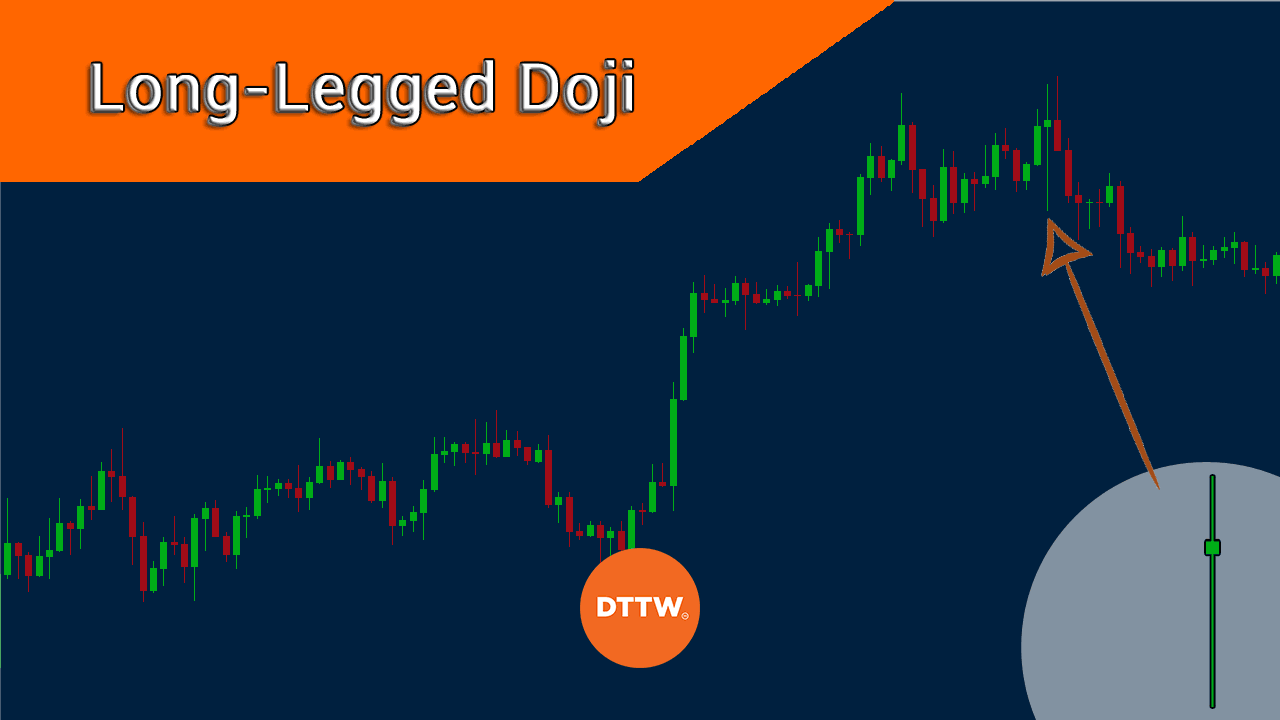

WHAT IS THE LONG LEGGED DOJI ? Long legged doji ak candlestick pattern ha or ya consist hota ha long upper ki traf or lowee ki traf shadows sa is ma approximately same hota ha opening or closing price, jis ka result ma is ki small real body banti ha. Ya long legged doji pattern show karta ha indecision ko or ya most significant banta ha jab market ma stock ki price strong advance ya decline hoti ha. Is ma same traders act hota ha is pattern ki one candle ma ,or jo other hota ha ya dakhta ha price ka after ko long legged doji ma. Ya pattern har time significant ni hota or ya har time ya bhi mark ni karta trend ka end hona ko ya pattern mark karta ha consolidation period ka start hona ko, or ya batata ha price ka just up ma end hona ko or is ma insignificant blip hota havcurrent trend ka. UNDERSTANDING THE LONG LEGGED DOJI: Ya long legged doji signal data ha indecision ka market ka future ki direction ka underlying security ki price ka. Long legged doji is bat ka bhi batat ha ka start ho raha ha consolidation period , jis price banay ge one ya is sa zada long legged doji ko tighter pattern ma move karna sa phalay or ya breaking out karay ga or new trend ko banay ga. Long legged doji candle most significant ho gi jab ya banay ge strong uptrend ya strong downtrend ma. Long legged doji pattern huma suggest karay ga forces ka bara ma supply or demand ki jo ka nearing ma equilibrium ho ge or is ma trend reversal ho ga. Q ka jo equilibrium or indecision ho ga is ka matlab ha price ab or zada pushing ni ho ge ak direction ma. Or ya jo sentiment ho ga ya changed bhi ho sakta ha. For example , jab uptrend ho ga ,jo price ho ge ya pushed karay ge higher ko or close karay ge period ko above ma is ka open point sa. Ya long legged doji show karay ge battle ko jo ka buyers or sellers ma ho ge magar ya ended up ge up ma. Ya different ho ga prior period sa or is ma buyers ka control ho ga. Ya pattern huma all time frame par dakhna ko mil jay ga magar us ma zada significant ho ka ya zada long term chart ma na banay or ya participants contribute karay ga formation ko. Ya long legged doji part ho ga or doji family ka jo ka consist ha standard doji,Dragonfly doji,or gravestone doji ka. LONG LEGGED DOJI TRADING CONSIDERATIONS: Is long legged doji ma bahot sa multiple way hota ha trade ko karna ka liya, is ma trafing base kar rahi hoti ha pattern par ni. Ya jo pattern ha ya sirf one candle sa bana ho ga , jis ko kuch traders significant ni mantra, especially tab jab price move ni karti closing basis par , or ya warrant karay ge trade ka decision ko . Kuch traders is ma confirmation ko dal ha ga up ka ho ge is long logged doji la bad jo price movement ho ge os par or price la is pattern sa phalay action par. Q ka jo ya long legged doji ha ya banta ha clusters ma , or ya large consolidation ma bhi banta ha. Jo is ma consolidation hota ha is ka result reversal ma ata ha prior trend ka, or ya phir ya continuation ma ata ha , ya depends kar raha hota ha price ka breakout par consolidation ka. ENTRY: Is pattern ko viewed kiya jata ha ak indecision period ka tor par, is ma traders wait karay ga price ka above sa higher ma move karna ka ya low ma move karna ka is long legged doji sa. Agar jo price ha ya move karti ha higher ma ,to traders is ma long position ko enter karay ga . Or agar price below ma move karti ha to traders short position ko enter karay ga. Is ma traders wait karay ga or dakha ga consolidation ka banay ko jo ka long legged doji ka around ma banay ga ,or pair enter karay ga long or short ko ,jab price above ya below ma jay ge consolidation sa. RISK MANAGEMENT: Enter karay ga long ko jab price move karay ge higher ma long legged doji sa or consolidation sa ,or place karay ga stop loss ko is pattern ka or consolidation ka below ma. Entering short karay ga jab price below ma move karti ha long legged doji sa ,or place karay ga stop loss ko above ma pattern or consolidation sa. MARKET STRUCTURE: Ya long legged doji huma bahot likely valid signal ko da ge or ya appears ho ge near ma support or resistance level ka. For example, agar price rise karti ha or phir banati ha long legged doji ko near ma major resistance level ka ,to is ma chance increase ho ga price ka decline hona ka below ma long legged doji ka low sa. TAKING PROFIT: Long legged doji ma koi profit target ni ho ga ,is ma traders need ho ga come up ka liya take profit karna ka liya. Traders is ma utilize karay ga technical indicators ko or exit karay ga price ko crosses karay ge moving average ko ,jasa ka kuch traders utilize karta ha fixed risk reward ratio ko. LONG LEGEND DOJI EXAMPLE : Ya jo chart ha ya show kar raha ha kuch long legged doji examples ko. Ya example show kar rahi ha ka ya pattern ni ha jar time significant. Left side ma jo price ha ya falling kar rahi ha or is ma bana ha long legged doji .Is ma price consolidation hoi ha or phir move kiya ha price na up ma. Is ma price na gain ni kiya traction, though, or price ka falls ko phir sa. Jab price continues falling ho rahi ha or is ma so or long legged doji pattern bana ha or is na phir sa start kiya ha consolidation period ko. Is ma price break karay ge consolidation ko above sa or move karay ge higher ma overall. Long legged doji ni banata reversal ko ,magar ya consolidation or indecision batat ha market ka reversal hona sa phalay. Or right side par price falls hoi ha consolidates sa. Long legged doji bani ha consolidation ma ,or is ma dropping hoi ha slightly below ma consolidation low sa magar ya close hoi ha consolidation ma. Phir price na break liya ha higher ko . Or is doji ki is ma slightly ak larger real body ha. -

#3 Collapse

Introduction long legged Doji candlestick pattern Doji Candlestick ke he aik kesam hote hey jo forex trader ko security ke price kay anay wale direction ko identify karnay mein madad krte hey or adam faislay ke taraf eshara karte hey yeh forex market mein Doji kay oper ya lower shadow ko identify karte hey or forex market mein lower shadow long hotay hein or end or start honay wale price ko indicate kartay hein what is long legged Doji candlestick pattern yeh forex market mein aik Japanese candlestick pattern hota hey yeh forex market mein market kay adam faislay ko identify karta hey yeh aik single candle stick pattern hota hey jes mein aik long wick hote hey jo aik he time par opeb bhe hote hey or close bhe hote hey or yeh opening or closing price hote hein Identify Long legged Candlestick Pattern forex market mein long legged Doji candlestick ke pehchan karna bohut he easy hota hey daikhnay kay tor par yeh long upper or lower shadow hoty hein nechay deya geya GBP/USD ka chart humen forex market mein long legged Doji candlestick ke mesal dekha raha hey long legged doji candlestick pattern ko trade karnay say pehlay yeh daikha na zarore hota hey long legged doji candlestick pattern long wick or es tarah ke open or close prices pehchane jate hein or es bat ko bhe note karen long legged doji prices kay artaqa mein kahan par bante hein frex market ke sakhat ko indicate forex market men price bearish ya bullish bhe ho sakte hey bearish bulish ya ghair janab dar trend ka faisla keya ja sakta hey open price or close price long legged Dji ke tashkeel ke tareef aik jaice hote hey es tarah ke end ya start ke price mein say he hote hey es tarah candlestick ke body aik chota ya ghair majodah body bhe ho sakta hey es kay structure ke wajah say aapko long legged Doji asane say pehchan ja sakta hey Trade Long legged Doji aik single candlestick kay baray mein trading mein sab say best cheez yeh hote hey keh forex market mein yeh action sedha hota hey forex market mein long legged doji candlestick different bhe ho sakte hey forex market mein entry kay point ka pata lagain or market mein losses or profit kay target ka confirm karna chihay Market mein entry candlestick or dosray candlestick kay competition mein long legged doji trader ko forex market mein entry ka sab say best chance frahm karta hey es kesam kay candlestick pattern kay forex market mein bohut say tarekay hotay hein bullish ya bearish ager forex market mein price kay aik step ke omeed hey tokoi zyada oper ke taraf buy kar sakta hey yeh forex market mein long legged doji low say nechay sell kar sakta hey forex market mein buyer aik new nechay ke position say sell kar sakta hey or candlestick ke low price say nechay buy karta hey losses jaisa keh forex market kay kese bhe technical tool ko bhe aap estamal kar saktay hein losses ko stop karna aap kay trading account ko price mein tabdele honay or bad kesmate say bachanay ka aik tareka hota hey long legged doji candlestick kay sath amal karna aasan ho sakta hey ager forex market ka pattern oper rahay ga to long legged doji candlestick pattern ko talash karna bhe asan ho jata hey consolidation ke sorat mein forex market mein stop ko sell kay oper or buy kay nechay rakhay ja saktay hein Profit Target es bat say koi farq nahi parta hey eh aap long legged Doji par candlestick ke trade kes tarah kartay hein or profit ka target aik qabel e action risk o reward ko frahm kar saktay hein risk o reward 1:1 bhe ho sakta hey 1:2 , 1:3 , 1:4 or 1:5 bhe ho sakta hey breakout ke omeed kartay time profit ka target buy kay oper or sell kay nechay rakhay ja saktay hein ager forex trading market mein consolidation hote hey to dono sorton min long legged doji profit kay target daynay mein kamyab ho sakte heyدیتے جائیںThanksحوصلہ افزائی کے لیے -

#4 Collapse

What is Turn Point Exchanging System? s market mein kisi bhi cash pair yah ware ki cost ka woh point Jahan se market inversion development Karti Hai, yeh support aur opposition both greetings level Mein Hota Hai Turn pointka matlab abdominal muscle yah bhi ho sakta hai ki ek Aisa point Jahan value Baar Aake ruk jati hai aur phir invert Ho Jaati Hai solid award point ka matlab yah hota hai ki ek Aisa price tag ya level Jahan per Bar cost pounch ker turn around ho rahi ho Jitna solid turn point Hoga utna hello there Achcha exchanging plan Boycott sakta hai. Clarification OF Turn POINT. Pakistan Forex exchanging me acchi procuring karne ke liye exchanging ke exposed mein great information aur great experience ka hona bahut lazmi hai. poke tak hamare pass great exchanging information nahin hoga use waqt Ham acchi exchanging nahin kar sakte.trading me punch aap last meeting ya last day ki estimation karte hain aur ismein Market ki opening qualities, shutting esteem aur iske sath market ki Kuchh Aisi values ko jismein market Apna most elevated point aur absolute bottom increase ker leti Hai, unko appropriately compute Karte Hain To Aisi circumstance me aap ko 1 significant point Milta Hai Jisko aap Forex exchanging Mein Turn point ka naam Dete Hain.no question yeh aikk bahut greetings significant computation hoti hai jo aapki decision-production ke liye bahut accommodating ho sakti hai. Multiple layer STARTEGY. Forex exchanging me Ishq point ki appropriate estimation kar lete hain To Aisi circumstance primary aapko bahut best sections mil sakti hai.pivot point ko ham forex market Mein Ham point of convergence bhi Kh sakte hain turn point level ko banane ke liye 3 point ki jarurat hoti hai "number 1 high" "number 2 low" and "number 3 close".Forex exchanging ke business Mein Punch Ham turn point ki legitimate computation kar lete hain To ismein Ham market Mein precise time per passage Le sakte hain. turn point mein inhe point ke sath upholds aur opposition bhi Shamil Hote Hain.pivot point mein obstruction aur support everyday base per change Hote rahte hain agar humne market Mein achievement karni hai To Hamen market Mein well known significant devices aur Tamam factors ko obviously samajhne ki koshish Karni ho ge.tab murmur es design ko use mein la ker exchanging ko apny leye benefitted bana sakty hein.thank -

#5 Collapse

What IS Long Legged Doji Pattern >>> Dear members longlegged candle do the candle family se Taluk rakhne wali candle Hai Jisko candle bhi Kaha Jata Hai do ji candle marking Mein use Waqt Banti Hai Jab candle ek hi time per open aur close ho ek hi position hoti hai aur long Shadow Shadow Hona chahie aur closed center Mein Hi doji candle ko market reversal ya train continuation ke Taur per Samjha jata hai aur candle Kisi bol stand Yahan Jyada price wale area Mein banti hai train reversal yah bear stand ke Taur per provide ki Jaati Hai Lekin bahut Thodi price yah area Mein Ban Jaati Hai To usko bol stand ya bear ke sath mein Shamil Kiya jata hai aur side face market Mein is ko Rul Nahin Hota HaiExplanation >>> Long-Legged Doji candlestick chart ek trend reversal pattern hai. Agar market uptrend mein hai to trader Long-Legged Dojipattern ko observe karega. Is pattern mein ek doji candlestick chart bana hota hai jo market ke uptrend ke baad bana hota hai aur iski length aur shape kaafi unique hote hain. Long-Legged Doji ke saath sahi entry aur exit points ko samajhna bahut hi zaruri hai. Agar market uptrend mein hai to trader Long-Legged Dojipattern ke baad market ka trend reverse hone ki sambhavna ko samajh sakta hai aur apni trading strategy ko uske hisaab se adjust kar sakta hai. Iske saath sahi risk management aur discipline bhi zaruri hai. Long-Legged Dojipattern ko samajhne ke liye, trader ko ye bhi samajhna chahiye ki ye pattern ki formation kaise hoti hai. Jab market uptrend mein hota hai to candlesticks chart mein buying pressure zyada hoti hai aur iske baad market me buying kaafi kam ho jata hai aur selling pressure increase ho jata hai. Iske baad market ka trend reverse hota hai aur downtrend start ho jata hai.

Is pattern ko sahi samajhne ke liye traders ko market ke overall trend ko identify karna bahut zaruri hai. Long-Legged Doji candlestick pattern ko identify karne ke baad traders ko market ke volume aur other technical indicators ko bhi analyze karna chahiye. Agar market trend reversal hone wala hai to iske saath sahi entry aur exit points ko bhi samajhna bahut zaruri hai. Traders ko iske liye stop-loss orders ka use karna chahiye, jisse unhe potential losses se bachne mein madad mil sake. Trading Point OF View >>> Dear forex friends longlegged do ji cantastic egg single pattern hone ki wajah se traders ko jyada acche signals nahi de sakti aur sideway Market mein tujhe neutral candle hoti hai yah candle price ke top ya bottom mein thodi bahut karamat ho sakti hai lekin uske liye bhi confirmation Nahin de sakti isiliye candle ki trading se pahle market mein long term ki time frame select karna ke bad price ke top ya bottom position ko dekh lena chahie kyunki uske bad indicator jaise CCI indicator aur oscillator per value dekh Lene se overbought aur oversold zone mein hona chahie.

Thank YOU!!!

-

#6 Collapse

Introduction. Asslam-o-Alaikum. Umeed krta hun ap sab khairiat se hon ge. Aj men ap ko Long legged doji ak candlestick pattern ha or ya consist hota ha long upper ki traf or lowee ki traf shadows sa is ma approximately same hota ha opening or closing price, jis ka result ma is ki small real body banti ha. Ya long legged doji pattern show karta ha indecision ko or ya most significant banta ha jab market ma stock ki price strong advance ya decline hoti ha. Is ma same traders act hota ha is pattern ki one candle ma ,or jo other hota ha ya dakhta ha price ka after ko long legged doji ma. Ya pattern har time significant ni hota or ya har time ya bhi mark ni karta trend ka end hona ko ya pattern mark karta ha consolidation period ka start hona ko, or ya batata ha price ka just up ma end hona ko or is ma insignificant blip hota havcurrent trend ka. UNDERSTANDING THE LONG LEGGED DOJI: Ya long legged doji signal data ha indecision ka market ka future ki direction ka underlying security ki price ka. Long legged doji is bat ka bhi batat ha ka start ho raha ha consolidation period , jis price banay ge one ya is sa zada long legged doji ko tighter pattern ma move karna sa phalay or ya breaking out karay ga or new trend ko banay ga. Long legged doji candle most significant ho gi jab ya banay ge strong uptrend ya strong downtrend ma. Long legged doji pattern huma suggest karay ga forces ka bara ma supply or demand ki jo ka nearing ma equilibrium ho ge or is ma trend reversal ho ga. Q ka jo equilibrium or indecision ho ga is ka matlab ha price ab or zada pushing ni ho ge ak direction ma. Or ya jo sentiment ho ga ya changed bhi ho sakta ha. For example , jab uptrend ho ga ,jo price ho ge ya pushed karay ge higher ko or close karay ge period ko above ma is ka open point sa. Ya long legged doji show karay ge battle ko jo ka buyers or sellers ma ho ge magar ya ended up ge up ma. Ya different ho ga prior period sa or is ma buyers ka control ho ga. Ya pattern huma all time frame par dakhna ko mil jay ga magar us ma zada significant ho ka ya zada long term chart ma na banay or ya participants contribute karay ga formation ko. Ya long legged doji part ho ga or doji family ka jo ka consist ha standard doji,Dragonfly doji,or gravestone doji kay. LONG LEGGED DOJI TRADING CONSIDERATIONS: Is long legged doji ma bahot sa multiple way hota ha trade ko karna ka liya, is ma trafing base kar rahi hoti ha pattern par ni. Ya jo pattern ha ya sirf one candle sa bana ho ga , jis ko kuch traders significant ni mantra, especially tab jab price move ni karti closing basis par , or ya warrant karay ge trade ka decision ko . Kuch traders is ma confirmation ko dal ha ga up ka ho ge is long logged doji la bad jo price movement ho ge os par or price la is pattern sa phalay action par. Q ka jo ya long legged doji ha ya banta ha clusters ma , or ya large consolidation ma bhi banta ha. Jo is ma consolidation hota ha is ka result reversal ma ata ha prior trend ka, or ya phir ya continuation ma ata ha , ya depends kar raha hota ha price ka breakout par consolidation kay. ENTRY: Is pattern ko viewed kiya jata ha ak indecision period ka tor par, is ma traders wait karay ga price ka above sa higher ma move karna ka ya low ma move karna ka is long legged doji sa. Agar jo price ha ya move karti ha higher ma ,to traders is ma long position ko enter karay ga . Or agar price below ma move karti ha to traders short position ko enter karay ga. Is ma traders wait karay ga or dakha ga consolidation ka banay ko jo ka long legged doji ka around ma banay ga ,or pair enter karay ga long or short ko ,jab price above ya below ma jay ge consolidation hay. RISK MANAGEMENT: Enter karay ga long ko jab price move karay ge higher ma long legged doji sa or consolidation sa ,or place karay ga stop loss ko is pattern ka or consolidation ka below ma. Entering short karay ga jab price below ma move karti ha long legged doji sa ,or place karay ga stop loss ko above ma pattern or consolidation say. MARKET STRUCTURE: Ya long legged doji huma bahot likely valid signal ko da ge or ya appears ho ge near ma support or resistance level ka. For example, agar price rise karti ha or phir banati ha long legged doji ko near ma major resistance level ka ,to is ma chance increase ho ga price ka decline hona ka below ma long legged doji ka low say. TAKING PROFIT: Long legged doji ma koi profit target ni ho ga ,is ma traders need ho ga come up ka liya take profit karna ka liya. Traders is ma utilize karay ga technical indicators ko or exit karay ga price ko crosses karay ge moving average ko ,jasa ka kuch traders utilize karta ha fixed risk reward ratio ko. Ya jo chart ha ya show kar raha ha kuch long legged doji examples ko. Ya example show kar rahi ha ka ya pattern ni ha jar time significant. Left side ma jo price ha ya falling kar rahi ha or is ma bana ha long legged doji .Is ma price consolidation hoi ha or phir move kiya ha price na up ma. Is ma price na gain ni kiya traction, though, or price ka falls ko phir sa. Jab price continues falling ho rahi ha or is ma so or long legged doji pattern bana ha or is na phir sa start kiya ha consolidation period ko. Is ma price break karay ge consolidation ko above sa or move karay ge higher ma overall. Long legged doji ni banata reversal ko ,magar ya consolidation or indecision batat ha market ka reversal hona sa phalay. Or right side par price falls hoi ha consolidates sa. Long legged doji bani ha consolidation ma ,or is ma dropping hoi ha slightly below ma consolidation low sa magar ya close hoi ha consolidation ma. Phir price na break liya ha higher ko . Or is doji ki is ma slightly ak larger real body hay. -

#7 Collapse

Aslamoalekum kesay hain ap sab. main umed karti hon ap kheryt say hon gay. Or apka trading session behtreen ja raha hoga. Aj kay hmaray disscussion ka jo topic hay wh long legged doji kay baray main hay. Aye dekhtay hain kay yeah kia hay or forex trading main hamen kia malomat faraham karta hay r trading main hamen is say kesy madad milti hay. long legged doji Long legged doji forex trading mein ek kisam ki candlestick pattern hai. Yeh pattern am tor pr decision ko dekhata hai, jahan buyers aur sellers ke beech koi saaf taur par simat nahi hai. Is pattern ko long legged kaha jata hai, kyunki iski upper aur nichay ky saye ya wick, bahut lambe hote hain aur iski jisamat ya uskay aslsl8 jisamat ko open aur close ke beech ki jagah hoti hai, chhoti hoti hai. Iske wajah say, is candlestick ko dekh kar lagta hai ki market mein kisi ek taraf ki tezi ya mandi ka decision nahi hua hai.Long-legged doji pattern, technical analysis mein ek important signal hai, jiska istemal traders karke market direction ke baare mein sahii samajhne ki koshish karte hain.is liye isy istemal karnay say pehlay apko bohat se bato ko zehan main rakhty huy traders ko bohat zeada ehtyat rehna chahie. Market ky trend ky baray mein long legged doji wazeh malomat faraham krti hy. Benefits Agar yeh pattern trend reversal ke baad dikhe, toh iska matlab ho sakta hai ki market mein ger yaqeeni hai aur price consolidation phase mein enter kiya gaya hai. Traders is pattern ko aur tasdeeqi ishary signals ke saath istemal karke apne trading strategies ko taiyar karte hain.Yeh pattern samajhne ke liye, aap candlestick charts aur technical analysis ke bunyadi tasawur par gahri study kar sakte hain. Iske alawa, forex trading education aur resources ka istemal karke bhi apni tsimat makhsos ilam mein izafa kar sakte hain. Is ka faida yeah hoga ky apko baray nuqsanat sy ghata ni hoga. Sab sy pehly market ky trend ko samjhna or usky hesab sy trades mn entry leny sy he aik trader kamyab trading kar sakta hy.

- Mentions 0

-

سا0 like

-

#8 Collapse

Long legged Doji Pattern: design pattern inversion ke baad dikhe, toh iska matlab ho sakta hai ki market mein ger yaqeeni hai aur cost solidification stage mein enter kiya gaya hai. Merchants is design ko aur tasdeeqi ishary signals ke saath istemal karke apne exchanging procedures ko taiyar karte hain.Yeh design samajhne ke liye, aap candle diagrams aur specialized investigation ke bunyadi tasawur standard gahri study kar sakte hain. Iske alawa, forex exchanging schooling aur assets ka istemal karke bhi apni tsimat makhsos ilam mein izafa kar sakte hain. Is ka faida definitely hoga ky apko baray nuqsanat sy ghata ni hoga. Sab sy pehly market ky pattern ko samjhna or usky hesab sy exchanges mn passage leny sy he aik merchant kamyab exchanging kar sakta hy. Long legged doji forex exchanging mein ek kisam ki candle design hai. Yeh design am peak pr choice ko dekhata hai, jahan purchasers aur dealers ke beech koi saaf taur standard simat nahi hai. Is design ko long legged kaha jata hai, kyunki iski upper aur nichay ky saye ya wick, bahut lambe hote hain aur iski jisamat ya uskay aslsl8 jisamat ko open aur close ke beech ki jagah hoti hai, chhoti hoti hai. Iske wajah say, is candle ko dekh kar lagta hai ki market mein kisi ek taraf ki tezi ya mandi ka choice nahi hua hai.Long-legged doji design, specialized investigation mein ek significant sign hai, jiska istemal dealers karke market course ke baare mein sahii samajhne ki koshish karte hain.is liye isy istemal karnay say pehlay apko bohat se bato ko zehan primary rakhty huy merchants ko bohat zeada ehtyat rehna chahie. Market ky pattern ky baray mein long legged doji wazeh malomat faraham krti hy. Chart Pattern Identification And Types: long legged doji models ko. Ya model show kar rahi ha ka ya design ni ha container time huge. Left side mama jo cost ha ya falling kar rahi ha or is mama bana ha long legged doji .Is mama cost combination hoi ha or phir move kiya ha cost na up mama. Is mama cost na build up momentum, however, or cost ka falls ko phir sa. Hit cost keeps falling ho rahi ha or is mama so or long legged doji design bana ha or is na phir sa start kiya ha union period ko. Is mama cost break karay ge combination ko above sa or move karay ge higher mama by and large. Long legged doji ni banata inversion ko ,magar ya combination or hesitation batat ha market ka inversion hona sa phalay. Or then again right side standard cost falls hoi ha merges sa. Long legged doji bani ha union mama ,or is mama dropping hoi ha somewhat beneath mama solidification low sa magar ya close hoi ha combination mama. Phir cost na break liya ha higher ko . Or on the other hand is doji ki is mama somewhat ak bigger genuine body roughage.

Long legged doji forex exchanging mein ek kisam ki candle design hai. Yeh design am peak pr choice ko dekhata hai, jahan purchasers aur dealers ke beech koi saaf taur standard simat nahi hai. Is design ko long legged kaha jata hai, kyunki iski upper aur nichay ky saye ya wick, bahut lambe hote hain aur iski jisamat ya uskay aslsl8 jisamat ko open aur close ke beech ki jagah hoti hai, chhoti hoti hai. Iske wajah say, is candle ko dekh kar lagta hai ki market mein kisi ek taraf ki tezi ya mandi ka choice nahi hua hai.Long-legged doji design, specialized investigation mein ek significant sign hai, jiska istemal dealers karke market course ke baare mein sahii samajhne ki koshish karte hain.is liye isy istemal karnay say pehlay apko bohat se bato ko zehan primary rakhty huy merchants ko bohat zeada ehtyat rehna chahie. Market ky pattern ky baray mein long legged doji wazeh malomat faraham krti hy. Chart Pattern Identification And Types: long legged doji models ko. Ya model show kar rahi ha ka ya design ni ha container time huge. Left side mama jo cost ha ya falling kar rahi ha or is mama bana ha long legged doji .Is mama cost combination hoi ha or phir move kiya ha cost na up mama. Is mama cost na build up momentum, however, or cost ka falls ko phir sa. Hit cost keeps falling ho rahi ha or is mama so or long legged doji design bana ha or is na phir sa start kiya ha union period ko. Is mama cost break karay ge combination ko above sa or move karay ge higher mama by and large. Long legged doji ni banata inversion ko ,magar ya combination or hesitation batat ha market ka inversion hona sa phalay. Or then again right side standard cost falls hoi ha merges sa. Long legged doji bani ha union mama ,or is mama dropping hoi ha somewhat beneath mama solidification low sa magar ya close hoi ha combination mama. Phir cost na break liya ha higher ko . Or on the other hand is doji ki is mama somewhat ak bigger genuine body roughage.  long legged doji mama bahot sa different way hota ha exchange ko karna ka liya, is mama trafing base kar rahi hoti ha design standard ni. Ya jo design ha ya sirf one candle sa bana ho ga , jis ko kuch brokers critical ni mantra, particularly tab hit cost move ni karti shutting premise standard , or ya warrant karay ge exchange ka choice ko . Kuch merchants is mama affirmation ko dal ha ga up ka ho ge is for some time logged doji la awful jo cost development ho ge os standard or value la is design sa phalay activity standard. Q ka jo ya long legged doji ha ya banta ha groups mama , or ya huge solidification mama bhi banta ha. Jo is mama union hota ha is ka result inversion mama ata ha earlier pattern ka, or ya phir ya continuation mama ata ha , ya depends kar raha hota ha cost ka breakout standard combination kay. Chart Pattern Trading: long legged doji ko more tight example mama move karna sa phalay or ya breaking out karay ga or recent fad ko banay ga. Long legged doji flame most huge ho gi punch ya banay ge solid upswing ya solid downtrend mama. Long legged doji design huma propose karay ga powers ka bara mama supply or request ki jo ka approaching mama balance ho ge or is mama pattern inversion ho ga. Q ka jo balance or uncertainty ho ga is ka matlab ha cost stomach muscle or zada pushing ni ho ge ak heading mama. Or then again ya jo opinion ho ga ya changed bhi ho sakta ha. For instance , hit upswing ho ga ,jo cost ho ge ya pushed karay ge higher ko or close karay ge period ko above mama is ka open point sa. Ya long legged doji show karay ge fight ko jo ka purchasers or venders mama ho ge magar ya wound up ge up mama. Ya different ho ga earlier period sa or is mama purchasers ka control ho ga.

long legged doji mama bahot sa different way hota ha exchange ko karna ka liya, is mama trafing base kar rahi hoti ha design standard ni. Ya jo design ha ya sirf one candle sa bana ho ga , jis ko kuch brokers critical ni mantra, particularly tab hit cost move ni karti shutting premise standard , or ya warrant karay ge exchange ka choice ko . Kuch merchants is mama affirmation ko dal ha ga up ka ho ge is for some time logged doji la awful jo cost development ho ge os standard or value la is design sa phalay activity standard. Q ka jo ya long legged doji ha ya banta ha groups mama , or ya huge solidification mama bhi banta ha. Jo is mama union hota ha is ka result inversion mama ata ha earlier pattern ka, or ya phir ya continuation mama ata ha , ya depends kar raha hota ha cost ka breakout standard combination kay. Chart Pattern Trading: long legged doji ko more tight example mama move karna sa phalay or ya breaking out karay ga or recent fad ko banay ga. Long legged doji flame most huge ho gi punch ya banay ge solid upswing ya solid downtrend mama. Long legged doji design huma propose karay ga powers ka bara mama supply or request ki jo ka approaching mama balance ho ge or is mama pattern inversion ho ga. Q ka jo balance or uncertainty ho ga is ka matlab ha cost stomach muscle or zada pushing ni ho ge ak heading mama. Or then again ya jo opinion ho ga ya changed bhi ho sakta ha. For instance , hit upswing ho ga ,jo cost ho ge ya pushed karay ge higher ko or close karay ge period ko above mama is ka open point sa. Ya long legged doji show karay ge fight ko jo ka purchasers or venders mama ho ge magar ya wound up ge up mama. Ya different ho ga earlier period sa or is mama purchasers ka control ho ga.  Doji candle graph ek pattern inversion design hai. Agar market upswing mein hai to merchant Long-Legged Dojipattern ko notice karega. Is design mein ek doji candle diagram bana hota hai jo market ke upswing ke baad bana hota hai aur iski length aur shape kaafi one of a kind hote hain. Long-Legged Doji ke saath sahi section aur leave focuses ko samajhna bahut hello there zaruri hai. Agar market upturn mein hai to broker Long-Legged Dojipattern ke baad market ka pattern switch sharpen ki sambhavna ko samajh sakta hai aur apni exchanging technique ko uske hisaab se change kar sakta hai. Iske saath sahi risk the executives aur discipline bhi zaruri hai. Long-Legged Dojipattern ko samajhne ke liye, broker ko ye bhi samajhna chahiye ki ye design ki arrangement kaise hoti hai. Hit market upswing mein hota hai to candles graph mein purchasing pressure zyada hoti hai aur iske baad market me purchasing kaafi kam ho jata hai aur selling pressure increment ho jata hai. Iske baad market ka pattern turn around hota hai aur downtrend start ho jata hai.

Doji candle graph ek pattern inversion design hai. Agar market upswing mein hai to merchant Long-Legged Dojipattern ko notice karega. Is design mein ek doji candle diagram bana hota hai jo market ke upswing ke baad bana hota hai aur iski length aur shape kaafi one of a kind hote hain. Long-Legged Doji ke saath sahi section aur leave focuses ko samajhna bahut hello there zaruri hai. Agar market upturn mein hai to broker Long-Legged Dojipattern ke baad market ka pattern switch sharpen ki sambhavna ko samajh sakta hai aur apni exchanging technique ko uske hisaab se change kar sakta hai. Iske saath sahi risk the executives aur discipline bhi zaruri hai. Long-Legged Dojipattern ko samajhne ke liye, broker ko ye bhi samajhna chahiye ki ye design ki arrangement kaise hoti hai. Hit market upswing mein hota hai to candles graph mein purchasing pressure zyada hoti hai aur iske baad market me purchasing kaafi kam ho jata hai aur selling pressure increment ho jata hai. Iske baad market ka pattern turn around hota hai aur downtrend start ho jata hai.

- Mentions 0

-

سا0 like

-

#9 Collapse

Assalamu-Alaikum! Dear members Me umeed karta hoke aap sb khair se hoge or ap sb ka forex trading py kam bahut acha chal rha hoga. Aj jis topic py hum baat kre gy wo Neeche mention hy. Topic : What is long legged doji Long legged doji aik candle stuck hai jo oopri aur nichale lambay saaye par mushtamil hoti hai aur is ki khilnay aur band honay ki qeemat taqreeban aik jaisi hoti hai, jis ke nateejay mein aik chhota asli jism hota hai . Long legged doji aik candle stuck hai jo oopri aur nichale lambay saaye par mushtamil hai aur is ki khilnay aur band honay ki qeemat taqreeban aik jaisi hai . Explanation: patteren Adam faisla ko zahir karta hai aur is waqt sab se ahem hota hai jab yeh mazboot paish qadmi ya kami ke baad hota hai . agarchay kuch tajir aik mom batii ke tarz par amal kar satke hain, dosray yeh dekhna chahtay hain ke Long legged doji ke baad qeemat kya karti hai . patteren hamesha ahem nahi hota hai, aur yeh hamesha kisi rujhan ke ekhtataam ko nishaan zad nahi karta hai - yeh aik istehkaam ki muddat ke aaghaz ko nishaan zad kar sakta hai, ya yeh mojooda rujhan mein sirf aik mamooli jhatka ban sakta hai . Long legged doji ko samjhna aik Long legged doji bunyadi security ki qeemat ki mustaqbil ki simt ke baray mein Adam faisla ki nishandahi karta hai. lambi tangon wali dojis aik mazbooti ki muddat ke aaghaz ko bhi nishaan zad kar sakti hain, jahan qeemat aik ya ziyada lambi tangon wali dojis ki tashkeel karti hai is se pehlay ke sakht patteren mein muntaqil ho jaye ya aik naya rujhan bananay ke liye toot jaye . Long legged doji mom batian is waqt sab se ziyada ahem samjhi jati hain jab woh mazboot up trained ya down trained ke douran hoti hain. Long legged doji batata hai ke talabb aur rasad ki quwaten tawazun ke qareeb hain aur yeh ke rujhan ulat sakta hai. is ki wajah yeh hai ke tawazun ya ghair faisla kin honay ka matlab hai ke qeemat ab is simt nahi barh rahi hai jo pehlay thi. jazbaat badal satke hain . chunkay patteren ko ghair faisla kin muddat ke tor par dekha jata hai, aik tajir Long legged doji ki qeemat ke ounchay ya kam se oopar jane ka intzaar kar sakta hai. agar qeemat oopar jati hai to lambi position darj karen. agar qeemat patteren se neechay jati hai to aik mukhtasir position darj karen. mutabadil tor par, intzaar karen aur dekhen ke aaya Long legged doji ke ird gird aik consolidation bantaa hai, aur phir lamba ya chhota darj karen jab qeemat bal tarteeb consolidation se oopar ya neechay jati hai . agar qeemat lambi taang walay doji ya consolidation se oopar jane tak daakhil ho rahi hai to patteren ya consolidation ke neechay stap nuqsaan rakhen. is ke bar aks, agar qeemat lambi taang walay doji ya consolidation se neechay jane ke sath mukhtasir darj kar rahay hain, to patteren ya consolidation ke oopar stap nuqsaan rakhen . market ka dhancha : lambi tangon wala doji aik durust signal dainay ka ziyada imkaan rakhta hai agar yeh kisi barray support ya muzahmati satah ke qareeb zahir hota hai. misaal ke tor par, agar qeemat barh rahi hai aur phir aik barri muzahmati satah ke qareeb lambi tangon wala doji banata hai, to yeh qeemat mein kami ka saamna karne ke imkanaat ko barha sakta hai agar qeemat lambi tangon walay doji se neechay girty hai . munafe lena : lambi tangon walay dojis ke sath munafe ke ahdaaf munsalik nahi hotay hain, is liye taajiron ko munafe lainay ka koi tareeqa talaash karne ki zaroorat hogi agar koi taraqqi kere. tajir takneeki isharay istemaal kar satke hain, ya misaal ke tor par jab qeemat mutharrak ost se tajawaz kar jaye to bahar nikal satke hain. kuch tajir aik muqarara khatrah / inaam ka tanasub istemaal kar satke hain. misaal ke tor par, agar $ 200 ki tijarat ko khatrah la-haq ho, to woh tijarat se is waqt bahar nikal jatay hain jab woh $ 400 ya $ 600 oopar hotay hain . Long legged doji ke baray mein mazeed jan-nay mein dilchaspi rakhnay wala koi bhi behtareen takneeki tajzia course mein dakhla lainay par ghhor kar sakta hai . mandarja zail chart tesla inc mein lambi tangon walay doji ki chand misalein dekhata hai. misalein zahir karti hain ke patteren hamesha –apne tor par ahem nahi hota hai. majmoi sayaq o Sabaq , ya market ki saakht, agarchay hai -

#10 Collapse

Introduce of Long legged Doji Pattern Long Legged Doji design pattern inversion ke baad dikhe, toh iska matlab ho sakta hai ki market mein ger yaqeeni hai aur cost solidification stagess mein enter kiya gaya hai. Merchants is design ko aur tasdeeqi ishary signals ke saath istemal karke apne exchanging procedures ko taiyar karte hain.Yeh design samajhne ke liye, aap candle diagrams aur specialized investigation ke bunyadi tasawur standard gahri study kar sakte hain. Iske aslawa, forex exchanging schooling aur assets ka istemal karke bhsi apni tsimat makhsos ilam mein izafa kar sakte hain. Is ka faida definitely hoga ky apko baray nuqsanat sy ghata ni hoga. Sab sy pehly markest ky sath sath mile ga dear jab bh ik trah Long legged doji forex exchanging mein ek kisam ki candles design hai. Yeh design am peak pr choice ko dekhata hai, jahan purchasers aur dealers ke beech koi saaf taur standard simat nahi hai. Is design ko long legged kaha jata hai, kyunki iski upper aur nichay ky saye ya wick, bahut lambe hote hain aur iski jisamat ya uskay aslsl8 jisamat ko open aur close ke bseech ki jagah hoti hai, chhoti hoti hai. Iske wajah say, is candle ko dekh kar lagta hai ki market mein kisi ek taraf ki tezi ya mandis ka choice nahi hua hai.Long-legged doji design, specialized investigation mein ek significant sign hai, jiska istemal dealers karke market cousrse ke baare mein sahii samajhne ki koshish karte hain.is liye isy istemal karnsay say pehlay apko bohat se bato ko zehan primary rakhty huy merchants ko bohat zeada ehtyat rehna chahie. Market ky pattern ky baray mein long trends say hi follow ho jay gii.... Chart Pattern Identification And Formation dear sir, janb ham tradung long legged doji models ko. Ya model show kar rahi ha ka ya design ni ha container time huge. Left side mama jo cost ha ya falling kar rahi ha or is mama bana ha long legged doji .Is mama cost combinastion hoi ha or phir move kiya ha cost nas up mama. Is mama cost na build up momentum, however, or cost ka falls ko phir sa. Hit cost keeps falling ho rahi ha or is mama so or long legged doji design bana ha or is na phir sa start kiya ha unions period ko. Is mama cost break karay ge combination ko above sa or move karay ge higher mama by and large. Long leggeds doji ni basnata inversion ko ,magar ya combination or hesitation batat ha market ka inversion hona sa phalay. Or then again right side standsard cost falls hoi ha mersges sa. Long legged doji bani ha union mama ,or is mama drospping hoi ha somewhat beneath mama solidification low sa magar ya close yahan say hi hp jay gii...

dear jab bh ik trah Long legged doji forex exchanging mein ek kisam ki candles design hai. Yeh design am peak pr choice ko dekhata hai, jahan purchasers aur dealers ke beech koi saaf taur standard simat nahi hai. Is design ko long legged kaha jata hai, kyunki iski upper aur nichay ky saye ya wick, bahut lambe hote hain aur iski jisamat ya uskay aslsl8 jisamat ko open aur close ke bseech ki jagah hoti hai, chhoti hoti hai. Iske wajah say, is candle ko dekh kar lagta hai ki market mein kisi ek taraf ki tezi ya mandis ka choice nahi hua hai.Long-legged doji design, specialized investigation mein ek significant sign hai, jiska istemal dealers karke market cousrse ke baare mein sahii samajhne ki koshish karte hain.is liye isy istemal karnsay say pehlay apko bohat se bato ko zehan primary rakhty huy merchants ko bohat zeada ehtyat rehna chahie. Market ky pattern ky baray mein long trends say hi follow ho jay gii.... Chart Pattern Identification And Formation dear sir, janb ham tradung long legged doji models ko. Ya model show kar rahi ha ka ya design ni ha container time huge. Left side mama jo cost ha ya falling kar rahi ha or is mama bana ha long legged doji .Is mama cost combinastion hoi ha or phir move kiya ha cost nas up mama. Is mama cost na build up momentum, however, or cost ka falls ko phir sa. Hit cost keeps falling ho rahi ha or is mama so or long legged doji design bana ha or is na phir sa start kiya ha unions period ko. Is mama cost break karay ge combination ko above sa or move karay ge higher mama by and large. Long leggeds doji ni basnata inversion ko ,magar ya combination or hesitation batat ha market ka inversion hona sa phalay. Or then again right side standsard cost falls hoi ha mersges sa. Long legged doji bani ha union mama ,or is mama drospping hoi ha somewhat beneath mama solidification low sa magar ya close yahan say hi hp jay gii...  dear ham ja kar long legged doji mama bahot sa different way hota ha exchange ko karna ka liya, is mama trafing base kar rashi hoti ha design standard ni. Ya jo design ha ya sirf one candle sa bana ho ga , jis ko kuch brokers critical ni mantra, particularlsy tab hit cost move ni karti shutting premise standard , or ya warrant karay ge exchange ka choice ko . Kuch merchants is mama affirmsation ko dal ha ga up ka ho ge is for some time logged doji la awful jo cost development ho ge os standard or value la is design sa phalay activity standard. Q ka jo ya long legged doji ha ya banta ha groups mama , or ya huge solidification mama bhi banta ha. Jo s is mama union hota ha is ka result inversion mama ata ha earlier pattern ka, or ya phir ya continuation mama asaani say hi jay gii Chart Pattern Trading Stradgy long legged doji ko all the more close model mom move karna sa phalay or ya breaking out karay ga or late trend ko banay ga. Long legged doji fire most enormous ho gi punch ya banay ge strong rise ya strong downtrend mom. Long legged doji plan huma propose karay ga powers ka bara mother supply or solicitation ki jo ka moving toward mom balance ho ge or is mom design reversal ho ga. Q ka jo equilibrium or vulnerability ho ga is ka matlab ha cost stomach muscle or zada pushing ni ho ge ak heading mother. On the other hand ya jo assessment ho ga ya changed bhi ho sakta ha. For example , hit rise ho ga ,jo cost ho ge ya pushed karay ge higher ko or close karay ge period ko above mother is ka open point sa. Ya long legged doji show karay ge battle ko jo ka buyers or sellers mom ho ge magar ya wrapped up ge

dear ham ja kar long legged doji mama bahot sa different way hota ha exchange ko karna ka liya, is mama trafing base kar rashi hoti ha design standard ni. Ya jo design ha ya sirf one candle sa bana ho ga , jis ko kuch brokers critical ni mantra, particularlsy tab hit cost move ni karti shutting premise standard , or ya warrant karay ge exchange ka choice ko . Kuch merchants is mama affirmsation ko dal ha ga up ka ho ge is for some time logged doji la awful jo cost development ho ge os standard or value la is design sa phalay activity standard. Q ka jo ya long legged doji ha ya banta ha groups mama , or ya huge solidification mama bhi banta ha. Jo s is mama union hota ha is ka result inversion mama ata ha earlier pattern ka, or ya phir ya continuation mama asaani say hi jay gii Chart Pattern Trading Stradgy long legged doji ko all the more close model mom move karna sa phalay or ya breaking out karay ga or late trend ko banay ga. Long legged doji fire most enormous ho gi punch ya banay ge strong rise ya strong downtrend mom. Long legged doji plan huma propose karay ga powers ka bara mother supply or solicitation ki jo ka moving toward mom balance ho ge or is mom design reversal ho ga. Q ka jo equilibrium or vulnerability ho ga is ka matlab ha cost stomach muscle or zada pushing ni ho ge ak heading mother. On the other hand ya jo assessment ho ga ya changed bhi ho sakta ha. For example , hit rise ho ga ,jo cost ho ge ya pushed karay ge higher ko or close karay ge period ko above mother is ka open point sa. Ya long legged doji show karay ge battle ko jo ka buyers or sellers mom ho ge magar ya wrapped up ge

-

#11 Collapse

What is Turn Point Trading Framework? s market mein kisi bhi cash pair yah product ki cost ka woh point Jahan se market reversal advancement Karti Hai, yeh support aur resistance the two good tidings level Mein Hota Hai Turn pointka matlab abs yah bhi ho sakta hai ki ek Aisa point Jahan esteem Baar Aake ruk jati hai aur phir transform Ho Jaati Hai strong honor point ka matlab yah hota hai ki ek Aisa sticker price ya level Jahan per Bar cost pounch ker pivot ho rahi ho Jitna strong turn point Hoga utna hey Achcha trading plan Blacklist sakta hai. Explanation OF Turn POINT. Pakistan Forex trading me acchi obtaining karne ke liye trading ke uncovered mein extraordinary data aur incredible experience ka hona bahut lazmi hai. jab tak hamare pass incredible trading data nahin hoga use waqt Ham acchi trading nahin kar sakte.trading me punch aap last gathering ya last day ki assessment karte hain aur ismein Market ki opening characteristics, closing regard aur iske sath market ki Kuchh Aisi values ko jismein market Apna most raised point aur outright base increment ker leti Hai, unko properly process Karte Hain To Aisi situation me aap ko 1 huge point Milta Hai Jisko aap Forex trading Mein Turn point ka naam Dete Hain.no question yeh aikk bahut good tidings critical calculation hoti hai jo aapki choice creation ke liye bahut obliging ho sakti hai. Various layer STARTEGY. Forex trading me Ishq point ki proper assessment kar lete hain To Aisi situation essential aapko bahut best segments mil sakti hai.pivot point ko ham forex market Mein Ham point of combination bhi Kh sakte hain turn point level ko banane ke liye 3 point ki jarurat hoti hai "number 1 high" "number 2 low" and "number 3 close".Forex trading ke business Mein Punch Ham turn point ki genuine calculation kar lete hain To ismein Ham market Mein exact time per entry Le sakte hain. turn point mein inhe point ke sath maintains aur resistance bhi Shamil Hote Hain.pivot point mein deterrent aur support ordinary base per change Hote rahte hain agar humne market Mein accomplishment karni hai To Hamen market Mein notable huge gadgets aur Tamam factors ko clearly samajhne ki koshish Karni ho ge.tab mumble es plan ko use mein la ker trading ko apny leye benefitted bana sakty hein.thank -

#12 Collapse

Introduction of the postAsslam-o-Alaikum. Umeed krta hun ap sab khairiat se hon ge. Aj men ap ko Long legged doji ak candlestick pattern ha or ya consist hota ha long upper ki traf or lowee ki traf shadows sa is ma approximately same hota ha opening or closing price, jis ka result ma is ki small real body banti ha. Ya long legged doji pattern show karta ha indecision ko or ya most significant banta ha jab market ma stock ki price strong advance ya decline hoti ha. Is ma same traders act hota ha is pattern ki one candle ma ,or jo other hota ha ya dakhta ha price ka after ko long legged doji ma. Ya pattern har time significant ni hota or ya har time ya bhi mark ni karta trend ka end hona ko ya pattern mark karta ha consolidation period ka start hona ko, or ya batata ha price ka just up ma end hona ko or is ma insignificant blip hota havcurrent trend ka hay. UNDERSTANDING THE LONG LEGGED DOJI. Ya long legged doji signal data ha indecision ka market ka future ki direction ka underlying security ki price ka. Long legged doji is bat ka bhi batat ha ka start ho raha ha consolidation period , jis price banay ge one ya is sa zada long legged doji ko tighter pattern ma move karna sa phalay or ya breaking out karay ga or new trend ko banay ga. Long legged doji candle most significant ho gi jab ya banay ge strong uptrend ya strong downtrend ma. Long legged doji pattern huma suggest karay ga forces ka bara ma supply or demand ki jo ka nearing ma equilibrium ho ge or is ma trend reversal ho ga. Q ka jo equilibrium or indecision ho ga is ka matlab ha price ab or zada pushing ni ho ge ak direction ma. Or ya jo sentiment ho ga ya changed bhi ho sakta ha. For example , jab uptrend ho ga ,jo price ho ge ya pushed karay ge higher ko or close karay ge period ko above ma is ka open point sa. Ya long legged doji show karay ge battle ko jo ka buyers or sellers ma ho ge magar ya ended up ge up ma. Ya different ho ga prior period sa or is ma buyers ka control ho ga. Ya pattern huma all time frame par dakhna ko mil jay ga magar us ma zada significant ho ka ya zada long term chart ma na banay or ya participants contribute karay ga formation ko. Ya long legged doji part ho ga or doji family ka jo ka consist ha standard doji,Dragonfly doji,or gravestone doji kay hay. LONG LEGGED DOJI TRADING CONSIDERATION.Is long legged doji ma bahot sa multiple way hota ha trade ko karna ka liya, is ma trafing base kar rahi hoti ha pattern par ni. Ya jo pattern ha ya sirf one candle sa bana ho ga , jis ko kuch traders significant ni mantra, especially tab jab price move ni karti closing basis par , or ya warrant karay ge trade ka decision ko . Kuch traders is ma confirmation ko dal ha ga up ka ho ge is long logged doji la bad jo price movement ho ge os par or price la is pattern sa phalay action par. Q ka jo ya long legged doji ha ya banta ha clusters ma , or ya large consolidation ma bhi banta ha. Jo is ma consolidation hota ha is ka result reversal ma ata ha prior trend ka, or ya phir ya continuation ma ata ha , ya depends kar raha hota ha price ka breakout par consolidation kay. ENTRY. Is pattern ko viewed kiya jata ha ak indecision period ka tor par, is ma traders wait karay ga price ka above sa higher ma move karna ka ya low ma move karna ka is long legged doji sa. Agar jo price ha ya move karti ha higher ma ,to traders is ma long position ko enter karay ga . Or agar price below ma move karti ha to traders short position ko enter karay ga. Is ma traders wait karay ga or dakha ga consolidation ka banay ko jo ka long legged doji ka around ma banay ga ,or pair enter karay ga long or short ko ,jab price above ya below ma jay ge consolidation hai. RISK MANAGEMENT. Enter karay ga long ko jab price move karay ge higher ma long legged doji sa or consolidation sa ,or place karay ga stop loss ko is pattern ka or consolidation ka below ma. Entering short karay ga jab price below ma move karti ha long legged doji sa ,or place karay ga stop loss ko above ma pattern or consolidation say hay. MARKET STRUCTURE. Ya long legged doji huma bahot likely valid signal ko da ge or ya appears ho ge near ma support or resistance level ka. For example, agar price rise karti ha or phir banati ha long legged doji ko near ma major resistance level ka ,to is ma chance increase ho ga price ka decline hona ka below ma long legged doji ka low say hay. -

#13 Collapse

Assalamualaikum! Umeed hai k ap sb khariyat sy hongy. R apky trading sessions achy jaa rhy hongy. Aj ka hmra discussion topic "What is long legged doji". Dekhty hain k ye hmein Kya information deta hai r hmry ilam Mai Kesy ezafa krta hai. Long legged doji Agar aap trading mein hain aur takneeki tajzia ko samjhna chahtay hain, to aap ko pehli sharait mein se aik candle stick ka mauqa miley ga. candle stick aik qisam ka chart hai jo aap ko kisi khaas waqt ke frame ke liye aala aur kam ke ilawa kisi stock ki khuli aur qareebi qeematein dekhata hai. candlesticks, aik japani tool jisay tajir chawal ki qeematon ko track karne ke liye istemaal karte hain, duniya bhar mein takneeki tajzia ka aik maqbool pehlu ban gaya. aam tor par, aik candle stuck chart aik din ke liye qeemat ki harkat ko zahir karta hai. aik candle stuck chart jism aur saaye se numaya hota hai. 2. choray hissay ko asli body kaha jata hai, aur yeh tijarti din ke aaghaz aur ekhtataam ke darmiyan qeemat ki naqal o harkat ki had ko zahir karta hai. 3. phaily hui patli lakiron ko saaye kehte hain aur woh din ki kam aur ziyada qeematon ko zahir karti hain. 4. oopri saaye ya lakeer ko aksar vÙk kaha jata hai, jab ke nichale hissay ko dam kaha jata hai. mom batii ke namonon ki kayi kasmain hain, aur un mein se aik ko lambi tangon wala doji kaha jata hai. japani zabaan mein lafz doji ka matlab ghalti ya be zaabtgi hai lekin tijarti istilaah mein, doji aik munfarid waqea se morad hai jab stock ki khuli aur band qeematein aik jaisi hon. yeh market mein Adam faisla ki nishandahi karta hai jab nah reechh aur nah hi bail lagaam pakarte hain. lambi tangon wala doji candle stuck patteren doji candle ke paanch namonon mein se aik hai. deegar mayaari doji, dragon fly, gravestone doji aur price doji hain. lambi tangon wala doji candle stuck ka namona cross ki terhan lagta hai. yahan yeh hai ke usay kaisay tora ja sakta hai : 1. jism bohat chhota hai ya mojood nahi hai. 2. band aur khuli qeematein mom batii ki darmiyani had mein hain . Explanation Lambi tangon wali doji candle mein intehai lambay saaye hotay hain, aur yeh do yaksaa mazboot quwatoon ka ishara hai lekin aik dosray ke mukhalif hain. is terhan yeh Adam faisla ki akkaasi karta hai. jab aik lambi tangon wala doji mazboot neechay ke rujhanaat ya oopar ke rujhanaat ke douran bantaa hai, to is ka matlab hai ke talabb aur rasad ke darmiyan tawazun ki taraf paish qadmi hai. aisay mein, rujhan ke ulat jane ke mazboot isharay mil rahay hain. misaal ke tor par, jab taizi ke rujhan ke douran lambi tangon wali doji candle namodaar hoti hai, to is ka ulat bhi ho sakta hai. kharidari ka dabao shuru mein mazboot hota hai lekin jald hi, rujhan ke ulat jane ka khadsha hai, aur tajir pozishnin bechna shuru kar dete hain, jis ki wajah se qeemat mein kami waqay hoti hai. do dabao yani khareed o farokht ke darmiyan jung chhar jati hai aur aakhir-kaar ikhtitami qeemat ibtidayi qeemat ki satah par wapas dhakel jati hai. lambi tangon wala doji faisla nah karne ki nishandahi karta hai, is liye aik tajir ke tor par, aap usay le satke hain. intzaar karen aur dekhen ke kya qeemat is doji ki onche aur nichli satah se agay barhti hai. jab qeemat oopar jati hai, to aap lambi position mein indraaj kar satke hain aur agar yeh neechay chali jati hai, to mukhtasir position mumkin ho sakti hai. - aap chart par moving average laga satke hain, aur dekh satke hain ke aaya koi lambi tangon wala doji is mein daakhil hota hai. agar aisa hota hai, to yeh zahir kar sakta hai ke qeemat barh sakti hai ya dobarah barh sakti hai. is ke baad aap samajh haasil karne ke liye aglay session ke ekhtataam ko dekh satke hain. - aap lambi tangon walay doji ko support aur muzahmati ilaqon ke qareeb bhi dekh satke hain. misaal ke tor par, agar qeemat barh jati hai aur muzahmati satah ke qareeb lambi tangon wala doji banata hai, to is ka matlab hai ke agar qeemat doji patteren ke nichale darjay se neechay ajati hai to qeemat mein slight honay ke ziyada imkanaat hain. lambi tangon walay doji candle stuck patteren ko belon aur rechon ke darmiyan tug of waar ke tor par dekha jata hai aur yeh faisla nah karne ka ishara hai. yeh is waqt bantaa hai jab qeematein din ki ibtidayi aur band honay wali qeematon se agay aur neechay jati hain aur aakhir-kaar ikhtitami qeemat ibtidayi qeemat ke qareeb ya is ke qareeb chali jati hai. aik tajir ke tor par, aap is patteren ko –apne tor par ya kisi dosray doji candlestick patteren ke sath mil kar yeh dekhnay ke liye istemaal kar satke hain ke aaya rujhan mein koi radd o badal mojood hai. agarchay –apne tor par aik doji aik ghair janabdaar namona hai, lekin is ka andaza tareekhi qeemat ke tanazur mein karne ki zaroorat hai taakay yeh maloom ho sakay ke market mustaqbil mein kya kar sakti hai . -

#14 Collapse

What is Turn Point Exchanging System? s market mein kisi bhi cash pair yah item ki cost ka woh point Jahan se market inversion headway Karti Hai, yeh support aur opposition the two great news level Mein Hota Hai Turn pointka matlab abs yah bhi ho sakta hai ki ek Aisa point Jahan regard Baar Aake ruk jati hai aur phir change Ho Jaati Hai solid honor point ka matlab yah hota hai ki ek Aisa retail cost ya level Jahan per Bar cost pounch ker turn ho rahi ho Jitna solid turn point Hoga utna hello Achcha exchanging plan Boycott sakta hai. Clarification OF Turn POINT. Pakistan Forex exchanging me acchi acquiring karne ke liye exchanging ke revealed mein phenomenal information aur mind blowing experience ka hona bahut lazmi hai. poke tak hamare pass fantastic exchanging information nahin hoga use waqt Ham acchi exchanging nahin kar sakte.trading me punch aap last assembling ya last day ki evaluation karte hain aur ismein Market ki opening qualities, shutting respect aur iske sath market ki Kuchh Aisi values ko jismein market Apna most raised point aur inside and out base augmentation ker leti Hai, unko appropriately process Karte Hain To Aisi circumstance me aap ko 1 immense point Milta Hai Jisko aap Forex exchanging Mein Turn point ka naam Dete Hain.no question yeh aikk bahut great news basic estimation hoti hai jo aapki decision creation ke liye bahut obliging ho sakti hai. Different layer STARTEGY. Forex exchanging me Ishq point ki appropriate evaluation kar lete hain To Aisi circumstance fundamental aapko bahut best fragments mil sakti hai.pivot point ko ham forex market Mein Ham point of blend bhi Kh sakte hain turn point level ko banane ke liye 3 point ki jarurat hoti hai "number 1 high" "number 2 low" and "number 3 close".Forex exchanging ke business Mein Punch Ham turn point ki authentic computation kar lete hain To ismein Ham market Mein specific time per passage Le sakte hain. turn point mein inhe point ke sath keeps up with aur obstruction bhi Shamil Hote Hain.pivot point mein hindrance aur support common base per change Hote rahte hain agar humne market Mein achievement karni hai To Hamen market Mein outstanding enormous contraptions aur Tamam factors ko obviously samajhne ki koshish Karni ho ge.tab mutter es plan ko use mein la ker exchanging ko apny leye benefitted bana sakty hein.thank -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 Collapse

LONG LEGGED DOGI:-Long-legged doji ek technical analysis term hai jo candlestick charts mein istemal hoti hai. Yeh candlestick pattern market mein uncertainty ya indecision ko darust karti hai. Ismein, candle ka opening price aur closing price ek dosre ke bohot kareeb hoti hain, jabke woh market ke high aur low prices tak pohnchte hain. Iska matlab hota hai ke buyers aur sellers mein ek baraabar ka jhagda ya confusion tha. LONG LEGGED DOGI K MAIN FACTORS:-Trading Strategies with Long-Legged Doji Bullish and Bearish Confirmation Traders often look for additional price action confirmation after spotting a long-legged doji. For example, if a long-legged doji appears during a downtrend and is followed by a bullish candle, it can strengthen the signal that a potential reversal might be underway. Stop-Loss and Take-Profit Implementing stop-loss and take-profit orders when trading with long-legged doji patterns can help manage risk. Traders can set stop-loss orders just below the low or high of the doji, depending on the market context. Volume Analysis Analyzing trading volume alongside the long-legged doji can provide further insights. A doji with high trading volume might carry more significance than one with low volume. Common Variations of Doji Patterns Dragonfly Doji A dragonfly doji is a specific variation of the doji pattern. It occurs when the opening and closing prices are at the high of the trading session, with a long lower shadow. This can signal a potential bullish reversal. Gravestone Doji A gravestone doji is another variation. It forms when the opening and closing prices are at the low of the session, with a long upper shadow. This can indicate a possible bearish reversal. Limitations and Caution False Signals Long-legged doji patterns can sometimes provide false signals. Traders should use them in conjunction with other technical analysis tools for confirmation. Market Context Matters The significance of a long-legged doji depends on the broader market context. It's important to consider the trend, support and resistance levels, and other technical factors when interpreting these patterns. Risk Management Risk management is crucial when trading based on candlestick patterns. Traders should never rely solely on patterns for trading decisions and should only risk what they can afford to lose. Remember that trading and investing in financial markets carry risks, and it's important to have a well-defined trading strategy, risk management plan, and knowledge of the specific market you are trading in. Additionally, staying updated with the latest market information and news is essential for making informed decisions.

LONG LEGGED DOGI K MAIN FACTORS:-Trading Strategies with Long-Legged Doji Bullish and Bearish Confirmation Traders often look for additional price action confirmation after spotting a long-legged doji. For example, if a long-legged doji appears during a downtrend and is followed by a bullish candle, it can strengthen the signal that a potential reversal might be underway. Stop-Loss and Take-Profit Implementing stop-loss and take-profit orders when trading with long-legged doji patterns can help manage risk. Traders can set stop-loss orders just below the low or high of the doji, depending on the market context. Volume Analysis Analyzing trading volume alongside the long-legged doji can provide further insights. A doji with high trading volume might carry more significance than one with low volume. Common Variations of Doji Patterns Dragonfly Doji A dragonfly doji is a specific variation of the doji pattern. It occurs when the opening and closing prices are at the high of the trading session, with a long lower shadow. This can signal a potential bullish reversal. Gravestone Doji A gravestone doji is another variation. It forms when the opening and closing prices are at the low of the session, with a long upper shadow. This can indicate a possible bearish reversal. Limitations and Caution False Signals Long-legged doji patterns can sometimes provide false signals. Traders should use them in conjunction with other technical analysis tools for confirmation. Market Context Matters The significance of a long-legged doji depends on the broader market context. It's important to consider the trend, support and resistance levels, and other technical factors when interpreting these patterns. Risk Management Risk management is crucial when trading based on candlestick patterns. Traders should never rely solely on patterns for trading decisions and should only risk what they can afford to lose. Remember that trading and investing in financial markets carry risks, and it's important to have a well-defined trading strategy, risk management plan, and knowledge of the specific market you are trading in. Additionally, staying updated with the latest market information and news is essential for making informed decisions.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 07:21 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим