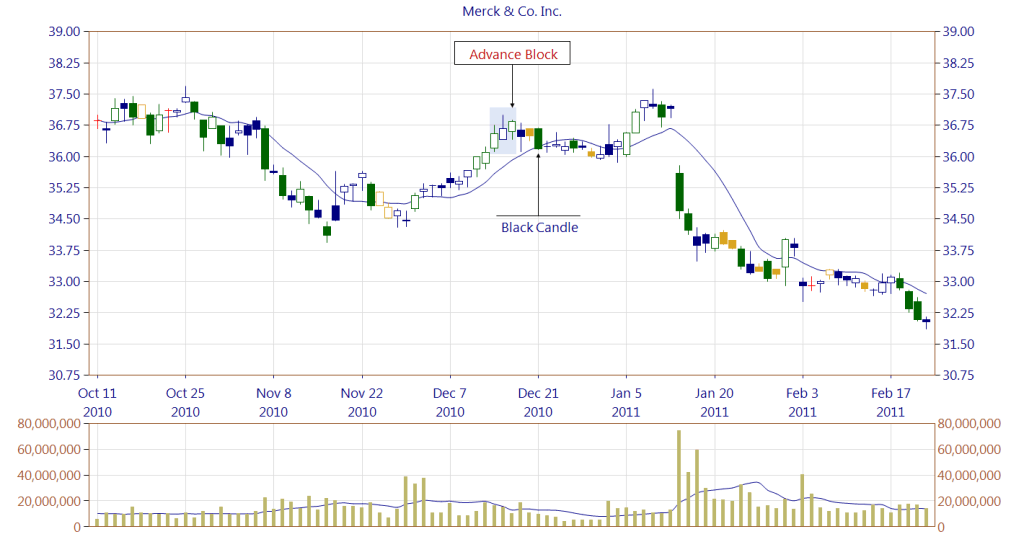

Advance Block pattern

No announcement yet.

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔ٹیگز: کوئی نہیں

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

What is Advance Block pattern Definition advance bock patteren aik bearish reversal candle stuck patteren hai jo teen blush candle stick se bana hai. aksar auqaat, yeh patteren taizi ke rujhan ke ekhtataam par zahir hota hai. nazriati tor par, sirf mandi ke ulat ko is tarz par amal karna chahiye. lekin yaqeenan koi bhi namona har waqt durust nahi hota. lehaza aisay auqaat hotay hain jab yeh namona mehez rujhan ke tasalsul ke namoonay ki terhan kaam karta hai. qata nazar, yeh nadir namona, jab yeh zahir hota hai, bohat se taajiron ki tijarti hikmat amlyon ki reerh ki haddi banata hai, is liye yeh ab bhi dekhnay ke qabil hai . Advance Block pattern Backtestcandle stuck patteren ko back test karne ke liye aap ko makhsoos usool aur tareefen set karne ki zaroorat hai. is ke liye waqt aur koshish dono ki zaroorat hai, lekin pareshan nah hon : yeh aap ke liye pehlay hi ho chuka hai! hum ne tamam 75 mom batii ke namonon ki wazahat ki hai aur inhen sakht tijarti qawaid mein daal diya hai jo qabil imthehaan hain. har aik candle stuck patteren ka back test kya jata hai aur is mein qawaid, adad o shumaar, imkanaat, aur karkardagi ke matrix shaamil hain. is se bhi behtar, aap ko amibroker ya tradestation / easy language code ke sath qawaid mlitay hain ( saada angrezi ke ilawa agar aap khud code karna chahtay hain, jaisay ke usay azgar ki tijarti hikmat e amli mein daalna, misaal ke tor par ). mazeed parhnay ya order karne ke liye yahan click karen. aap ki tijarti hikmat e amli mein advance bock candle stuck patteren ke istemaal ke fawaid advance bock candle stuck patteren ka aik ahem faida yeh hai ke yeh mumkina rujhan ki tabdeelion ki ibtidayi intibahi alamaat faraham kar sakta hai. Strategy patteren aur is ki khususiyaat ko pehchan kar, aap market ke mumkina ulat pehroon ki nishandahi karne aur is ke mutabiq tijarat karne ka aaghaz kar satke hain. is se aap ko market se agay rehne mein madad mil sakti hai aur mumkina tor par ibtidayi chalon se faida uthany mein madad mil sakti hai. advance bock candle stuck patteren ka aik aur faida yeh hai ke yeh dosray takneeki isharay aur signals ki ahmiyat ki tasdeeq karne mein aap ki madad kar sakta hai. misaal ke tor par, agar aap rujhan ki pairwi karne walay isharay, jaisay moving average, mumkina rujhan ki tabdeelion ki nishandahi karne ke liye istemaal kar rahay hain, to advance bock candle stuck patteren ko signal ki durustagi ki tasdeeq ke liye istemaal kya ja sakta hai. is se aap ko ziyada par aetmaad aur bakhabar tijarti faislay karne mein madad mil sakti hai. is ke ilawa, advance bock candle stuck patteren ko market ke mukhtalif halaat aur time mein istemaal kya ja sakta hai. chahay aap stock, forex, ya deegar maliyati alaat ki tijarat kar rahay hon, advance bock candle stuck patteren aap ke tijarti hathyaaron mein izafah karne ke liye aik qeemti tool ho sakta hai. aur chunkay patteren ki shanakht mukhtalif time par ki ja sakti hai, qaleel mudti charts se le kar taweel mudti charts tak, yeh mukhtalif waqti aur tijarti tarz ke taajiron ke liye mufeed ho sakta hai . -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

What is Adcance block pattern Assalam o alikum Dear members me umeed karta hun ap thek hongy and best tariky say yahan par kam kar rhy ho Advance Block pattern, pehle ek strong bullish trend ke baad aata hai, jahan price mein substantial move upwards dekha jata hai. First Candle: Advance Block pattern mein, pehli candlestick long bullish (white/green) candle hoti hai, jo uptrend ko represent karti hai. Is candle ki range generally large hoti hai. Second Candle: Dusri candlestick bhi bullish (white/green) candle hoti hai, jo pehli candle ki body ke upar wali taraf open hoti hai. Is candle ki range pehli candle ki range mein enter karti hai. Third Candle: Tisri candlestick, pehli aur dusri candlestick ke upper wali taraf open hoti hai. Ye candle range-wise pehli aur dusri candle se chhoti hoti hai. Advance Block pattern mein, tisri candlestick pehli aur dusri candlestick se kam buying pressure aur bullish momentum indicate karta hai. Ye price trend ki weakening ya reversal ki early indication ho sakta hai. Traders Advance Block pattern ko samajhne aur trade karne ke liye neeche diye gaye points ko consider karte hain: confirmation all about advanced block pattern Confirmation: Advance Block pattern ki validity ko confirm karne ke liye, tisri candlestick ki closing price aur range ko closely observe karein. Tisri candlestick ki body pehli aur dusri candlestick ki body ke upper range mein rehni chahiye. Confirmatory signals ke liye volume analysis, support/resistance levels, aur other technical indicators ka istemal kiya jata hai. Entry Point: Pattern ki confirmation ke baad, traders short positions enter karte hain, ya existing long positions ko close karte hain. Entry point ko price breakout, support level break, ya other bearish signals ke basis par set kiya jata hai. Stop-Loss: Trade ke risk management ke liye, stop-loss level ko determine karein. Stop-loss level ko bullish trend ke high points, resistance levels, ya technical indicators ke basis par set kiya jata hai, taki unexpected price movements se protect kar sakein. Target: Profit target level ko set karein, jahaan par aap apne trade ko close karna chahte hain. Target level ko previous support levels, trend lines, ya technical indicators ke basis par identify karein. Trade Management: Trade ke samay price movement aur market conditions ko monitor karein. Stop-loss level ko adjust karte rahein, partial profits book karein, ya trailing stop techniques ka istemal karein, taki trade management ko effectively handle kar sakein. Advance Block pattern bearish reversal signal hai, lekin iski effectiveness aur accuracy ka samajhna aur confirm karne ke liye additional analysis aur confirmatory signals ki zaroorat hoti hai. Technical analysis aur risk management principles ka istemal karke, Advance Block pattern ko samajhkar trading decisions liye ja sakte hain. Risk Ratio Advance Block Pattern Calculate the Risk: Risk ratio ko calculate karne ke liye, trade entry point aur stop-loss level ko define karein. Stop-loss level, aapki trade ko close karne ke predetermined price level hota hai, agar price movement aapki expectations ke against jaati hai. Stop-loss level ko pips (Forex market mein) ya points (other markets mein) mein measure karein. Determine the Target: Profit target level ko define karein, jahan aap apne trade ko close karna chahte hain, jab price movement aapki expectations ke according jaaye. Profit target level ko bhi pips ya points mein measure karein. Calculate the Risk-Reward Ratio: Risk ratio ko calculate karne ke liye, stop-loss level aur profit target level ke difference ko divide karein. Yeh aapko risk-reward ratio (RRR) deta hai. For example, agar aapka stop-loss level 50 pips aur profit target level 100 pips hai, to risk-reward ratio 1:2 hoga. Evaluate the Risk-Reward Ratio: Risk-reward ratio ko evaluate karein aur apne risk management plan ke saath compare karein. Higher risk-reward ratios, jaise 1:2, 1:3, ya 1:4, traders ko potential higher profits compared to their potential losses provide karte hain. Traders usually aim for risk-reward ratios that are higher than 1:1 to ensure profitable trades in the long run. Adjust Risk-Reward Ratio based on Market Conditions: Market conditions aur specific trade setups ke hisab se risk-reward ratio ko adjust karna important hai. High-probability trade setups aur trending markets mein traders higher risk-reward ratios ko target kar sakte hain. Volatile markets aur lower probability setups mein traders apne risk-reward ratios ko conservative level par adjust kar sakte hain. Risk-reward ratio, traders ke liye risk management aur trading performance ka ek crucial aspect hai. Isse traders apne trades ko assess kar sakte hain, trade ka profit potential aur risk exposure ko quantify kar sakte hain, aur long-term profitability ko maintain karne ke liye apne trades ko optimize kar sakte hain. -

#4 Collapse

Definition... advance bock aik candle stuck trading patteren ko diya jane wala naam hai. patteren aik three candle bearish set up hai jisay reversal patteren samjha jata hai — aik tajweez hai ke qeemat ki karwai nisbatan mukhtasir waqt ke framo mein oopar ki taraf rujhan se neechay ki taraf tabdeel honay wali hai. kuch musanifeen tajweez karte hain ke amli tor par tashkeel aksar ulat jane ki bajaye taizi ke tasalsul ka baais banti hai .... Explanation... is patteren ko is patteren ke foran baad aglay kayi adwaar mein qeemat ke ulat jane ki paish goi karne ke liye samjha jata hai. yeh chart patteren barray pemanay par neechay ke rujhanaat ke andar earzi tor par oopar ki taraf bherne aur pal bacchus ke douran aur jab mom btyon ki haqeeqi body lambi hoti hai to aik ulat patteren ki behtareen paish goi karta hai. bearish reversal ki tasdeeq is waqt hoti hai jab pehli baad mein anay wali qeemat baar pehli candle ki asli body ke mid point se tijarat karti hai . Algorithm trading se pehlay ke saloon mein advance bock patteren nisbatan nayaab tha lekin is ke baad se ziyada aam ho gaya hai, jo intra day counter swing ki ziyada tadad ko zahir karta hai. is ke bawajood, taajiron ko sirf advance bock patteren se khareed o farokht ke signal nahi lainay chahiye. is ke bajaye, patteren ko tasdeeq ke tor par istemaal karen ya deegar chart patteren aur takneeki isharay mein izafi saboot ke tor par shaamil karen taakay passion goi ke alay ke tor par is signal ki vashu snita ko behtar banaya ja sakay. is ke ilawa, taajiron ko taizi ke tasalsul ke bar aks, ulat jane ke imkanaat ko ziyada se ziyada karne ke liye lambay asli jismon ki talaash karni chahiye.... Advance Block Trading Psychology security aik wasee tar up trained ke hissay ke tor par ya neechay ke rujhaan ke andar aik uuchaal ke tor par ziyada trained kar rahi hai. pehli mom batii aik really ke sath mazboot taizi se tawanai peda karti hai jo aik nai bulandi tak pahonch jati hai. bail doosri mom batii mein ghalib rehtay hain lekin nichale khilnay se pehlay nahi jo pehlay ki mom batii ke wast point tak pohanchana hai . kamzor iftitahi surkh jhanda lehrata hai kyunkay bail pehli mom batii mein qeemat ki mazboot karwai ke baad ziyada qeematon ki tawaqqa karte hain. teesri mom batii par qadray neechay khilnay se is khadshay mein izafah hota hai ke qowat khareed khushk ho rahi hai lekin security intra day mein onche harkat karti hai jaisa ke is ne pichlle do sishnz ke douran kya tha. yeh band honay se pehlay palat jata hai, ziyada tar fawaid ko tark kar deta hai, jis se yeh zahir hota hai ke tajir munafe le rahay hain ya mukhtasir farokht kar rahay hain. aglay chand sishnz mein aik taiz zor kam hona aik ulat ki tasdeeq karta hai . -

#5 Collapse

Aslamoalekum kesay hain ap sab..main umed karti hon ap kheryt say hon gay. Or apka trading session behtreen ja raha hoga. Aj kay hmaray disscussion ka jo topic hay wh advance block pattern kay baray main hay. Aye dekhtay hain kay yeah kia hay or forex trading main hamen kia malomat faraham karta hay r trading main hamen is say kesy madad milti hay. Advance block pattern Advance Block pattern, jo kay Forex trading mein use kiya jata hai, candlestick charts par nazar aane wala ek technical analysis pattern hai. Ye pattern bhe bearish trend nichay kay trend ke baad dikhai deta hai aur uper kay trend ke isharay muhaya karta hai. Advance Block pattern mein, bearish nichay ke taraf trend ke baad ki three consecutive candles ko zahir kiya jata hai.Is pattern mein, pehli candlestick bearish nichay ke taraf trend ki continuation ko dekhati hai. Dusri candlestick bhi bearish hai, lekin pehli candlestick se choti hoti hai aur uski range narrow hoti hai. Teesri candlestick bhi bearish hai, lekin ye pehli aur dusri candlesticks sey choti hoti hai aur uski range bhi narrow hoti hai. Ye narrow range aur chote size ki candles, selling pressure mein kami aur buyers ki mazboti ko neshandahi karte hain. properties Jab Advance Block pattern tashkeel ho jata hai, to iska tajdeed yeh hai ki selling pressure kam ho rahi hai aur market mein buying ka potential hai. Traders is waja bunyad pattern ko dekh kar uptrend ki tawaquat rakhte hain aur long positions lete hain. Pattern tasdeeq hone ke liye, traders amm torr par uske baad ki candle ki candlestick ka breakout ka wait karte hain.Ye pattern sirf ek technical analysis tool hai aur iska sahi istemal karne ke liye, traders ko market trends aur candlestick patterns ko samajhna zaruri hai. Forex trading mein, har pattern ki accuracy 100% nahi hoti, isliye proper risk management aur stop-loss orders ka use karna bhi bohat zeada zarori hai. -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Advance Block pattern : aap logon ko advanced bock chart par sirf aik chhota sa isbaaq lana chahtay hain .patteren aur agar aap log yeh pasand karte hain to usay tbsron mein neechay rakhen.bearish reversal patteren ki tasdeeq ki tajweez di jati hai aur phir is par tabsarah karte hue yeh kehta hai ke yeh patteren three white soldies patteren ka cosuon hai .taham yeh aik up trained mein hona chahiye jabkay tenu sipahiyon ko is ke bar aks don trained mein hona chahiye. teen safaid sipahiyon ke patteren dosray aur teesray din paishgi bock patteren kamzoree ko zahir karte hain .lambay oopri saaye to yahan teen log dekhte hain ke yeh lambay oopri saaye kaisay ban rahay hain .zahir karen ke qeemat ki intahaa din ke waqt pahonch gayi hai usay munaqqid nahi kiya ja sakta aik up trained ke baad aur phir lagataar do din tak kisi bhi qisam ki karwai karni chahiye .taizi se market ke shurka ghabra jatay hain khaas tor par agar oopar ka rujhan had se ziyada barh raha ho .yaad rakhen ke yeh patteren up trained most multiple mein hota hai .din ke patteren aik taweel din ke sath shuru hotay hain jo mojooda ki himayat mein madad karta hai .qanoon ke oopri saaye ke sath do din ka rujhan zahir karta hai ke wahan munafe ho raha hai kyunkay urooj apni taaqat kho raha hai aur phir yeh tasleem karne ke qawaneen ka kehna hai ke pehchan ke teen usool hain .teen safaid din lagataar ounchay bundon ke sath hotay hain is liye hum ne is ke baray mein baat ki halaank lashain mil rahi theen .chhootey band ab bhi ounchay thay taakay yeh har roz khilnay ke qabil ho jaye .pichlle dinon ke jism ke andar to hum dekh rahay hain ke yeh kahan se khilta hai aur phir aik yakeeni oopar ki taraf taaqat dosray par taweel oopri saaye se zahir hoti hai .aur teesray din aur larkoon mein waqai mein sochon ga ke yeh ghalat print tha jisay aap un lambay saaye se dekh satke hain jaisay aap ko bohat kuch nazar aaye ga .jaisay shooting star mom batian aur is terhan ki mukhtalif cheeze aap ko yeh lambi vicks nazar ayen gi .is ka matlab hai ke log wahan par munafe le rahay hain is liye qeemat wahan pahonch gayi hai aur log keh rahay hain ke oh wahein uth gaya ke jaldi se lagta hai ke yeh ulta ho sakta hai mein gona kuch munafe le raha hon aur aap ke paas woh batii aur bohat si auqaat reh gayi hai. aap un ko dekhen ge kuch shobay patteren ke peechay hain ke paishgi bock patteren un waqeat se qareeb tar hota hai jo teen safaid sipahiyon ke patteren ke sath paish atay hain . -

#7 Collapse

Advance Block Chart Pattern: Advance Block pattern, jo kay Forex trading mein use kiya jata hai, candlestick maps par nazar aane wala ek specialized analysis pattern hai. Ye pattern bhe bearish trend nichay kay trend ke baad dikhai deta hai aur uper kay trend ke isharay muhaya karta hai. Advance Block pattern mein, bearish nichay ke taraf trend ke baad ki three successive candles ko zahir kiya jatahai.Is pattern mein, pehli candlestick bearish nichay ke taraf trend ki durability ko dekhati hai. Dusri candlestick bhi bearish hai, lekin pehli candlestick se choti hoti hai aur uski range narrow hoti hai. Teesri candlestick bhi bearish hai, lekin ye pehli aur dusri candlesticks sey choti hoti hai aur uski range bhi narrow hoti hai. Ye narrow range aur chote size ki candles, dealing pressure mein kami aur buyers ki mazboti ko neshandahi karte hain. pattern tashkeel ho jata hai, to iska tajdeed yeh hai ki dealing pressure kam ho rahi hai aur request mein buying ka implicit hai. Dealers is waja bunyad pattern ko dekh kar uptrend ki tawaquat rakhte hain aur long positions lete hain. Pattern tasdeeq hone ke liye, dealers amm torr par uske baad ki candle ki candlestick ka breakout ka stay kartehain.Ye pattern sirf ek specialized analysis tool hai aur iska sahi istemal karne ke liye, dealers ko request trends aur candlestick patterns ko samajhna zaruri hai. Forex trading mein, har pattern ki delicacy 100 nahi hoti, isliye proper threat operation aur stop- loss orders ka use karna bhi bohat zeada zarori hai. Chart Pattern Formation: patteren ko is patteren ke foran baad aglay kayi adwaar mein qeemat ke ulat jane ki paish goi karne ke liye samjha jata hai. yeh map patteren barray pemanay par neechay ke rujhanaat ke andar earzi tor par oopar ki taraf bherne aur confidante bacchus ke douran aur poke mama btyon ki haqeeqi body lambi hoti hai to aik ulat patteren ki behtareen paish goi karta hai. bearish reversal ki tasdeeq is waqt hoti hai poke pehli baad mein anay wali qeemat baar pehli candle ki asli body ke medial point se tijarat karti hai. Algorithm trading se pehlay ke saloon mein advance bock patteren nisbatan nayaab tha lekin is ke baad se ziyada aam ho gaya hai, jo intra day counter swing ki ziyada tadad ko zahir karta hai. is ke bawajood, taajiron ko sirf advance bock patteren se khareed o farokht ke signal nahi lainay chahiye.

pattern tashkeel ho jata hai, to iska tajdeed yeh hai ki dealing pressure kam ho rahi hai aur request mein buying ka implicit hai. Dealers is waja bunyad pattern ko dekh kar uptrend ki tawaquat rakhte hain aur long positions lete hain. Pattern tasdeeq hone ke liye, dealers amm torr par uske baad ki candle ki candlestick ka breakout ka stay kartehain.Ye pattern sirf ek specialized analysis tool hai aur iska sahi istemal karne ke liye, dealers ko request trends aur candlestick patterns ko samajhna zaruri hai. Forex trading mein, har pattern ki delicacy 100 nahi hoti, isliye proper threat operation aur stop- loss orders ka use karna bhi bohat zeada zarori hai. Chart Pattern Formation: patteren ko is patteren ke foran baad aglay kayi adwaar mein qeemat ke ulat jane ki paish goi karne ke liye samjha jata hai. yeh map patteren barray pemanay par neechay ke rujhanaat ke andar earzi tor par oopar ki taraf bherne aur confidante bacchus ke douran aur poke mama btyon ki haqeeqi body lambi hoti hai to aik ulat patteren ki behtareen paish goi karta hai. bearish reversal ki tasdeeq is waqt hoti hai poke pehli baad mein anay wali qeemat baar pehli candle ki asli body ke medial point se tijarat karti hai. Algorithm trading se pehlay ke saloon mein advance bock patteren nisbatan nayaab tha lekin is ke baad se ziyada aam ho gaya hai, jo intra day counter swing ki ziyada tadad ko zahir karta hai. is ke bawajood, taajiron ko sirf advance bock patteren se khareed o farokht ke signal nahi lainay chahiye.  Request conditions aur specific trade setups ke hisab se threat- price rate ko acclimate karna important hai. High- probability trade setups aur trending requests mein dealers advanced threat- price rates ko target kar sakte hain. unpredictable requests aur lower probability setups mein dealers apne threat- price rates ko conservative position par acclimate kar saktehain.Risk- price rate, dealers ke liye threat operation aur trading performance ka ek pivotal aspect hai. Isse dealers apne trades ko assess kar sakte hain, trade ka profit implicit aur threat exposure ko quantify kar sakte hain, aur long- term profitability ko maintain karne ke liye apne trades ko optimize kar sakte hain. Trading And Types: Trade ke samay price movement aur request conditions ko examiner karein. Stop- loss position ko acclimate karte rahein, partial gains book karein, ya running stop ways ka istemal karein, taki trade operation ko effectively handle karsakein.Advance Block pattern bearish reversal signal hai, lekin iski effectiveness aur delicacy ka samajhna aur confirm karne ke liye fresh analysis aur confirmational signals ki zaroorat hoti hai. Specialized analysis aur threat operation principles ka istemal karke, Advance Block pattern ko samajhkar trading opinions liye ja sakte hain.

Request conditions aur specific trade setups ke hisab se threat- price rate ko acclimate karna important hai. High- probability trade setups aur trending requests mein dealers advanced threat- price rates ko target kar sakte hain. unpredictable requests aur lower probability setups mein dealers apne threat- price rates ko conservative position par acclimate kar saktehain.Risk- price rate, dealers ke liye threat operation aur trading performance ka ek pivotal aspect hai. Isse dealers apne trades ko assess kar sakte hain, trade ka profit implicit aur threat exposure ko quantify kar sakte hain, aur long- term profitability ko maintain karne ke liye apne trades ko optimize kar sakte hain. Trading And Types: Trade ke samay price movement aur request conditions ko examiner karein. Stop- loss position ko acclimate karte rahein, partial gains book karein, ya running stop ways ka istemal karein, taki trade operation ko effectively handle karsakein.Advance Block pattern bearish reversal signal hai, lekin iski effectiveness aur delicacy ka samajhna aur confirm karne ke liye fresh analysis aur confirmational signals ki zaroorat hoti hai. Specialized analysis aur threat operation principles ka istemal karke, Advance Block pattern ko samajhkar trading opinions liye ja sakte hain.  candle stuck patteren ko back test karne ke liye aap ko makhsoos usool aur tareefen set karne ki zaroorat hai. is ke liye waqt aur koshish dono ki zaroorat hai, lekin pareshan nah hon yeh aap ke liye pehlay hi ho chuka hai! hum ne tamam 75 mama batii ke namonon ki wazahat ki hai aur inhen sakht tijarti qawaid mein daal diya hai jo qabil imthehaan hain. har aik candle stuck patteren ka back test kya jata hai aur is mein qawaid, adad o shumaar, imkanaat, aur karkardagi ke matrix shaamil hain. is se bhi behtar, aap ko amibroker ya tradestation easy language law ke sath qawaid mlitay hain( saada angrezi ke ilawa agar aap khud law karna chahtay hain, jaisay ke usay azgar ki tijarti hikmat e amli mein daalna, misaal ke escarpment par). mazeed parhnay ya order karne ke liye yahan click karen. aap ki tijarti hikmat e amli mein advance bock candle stuck patteren ke istemaal ke fawaid advance bock candle stuck patteren ka aik ahem faida yeh hai ke yeh mumkina rujhan ki tabdeelion ki ibtidayi intibahi alamaat faraham kar sakta hai.

candle stuck patteren ko back test karne ke liye aap ko makhsoos usool aur tareefen set karne ki zaroorat hai. is ke liye waqt aur koshish dono ki zaroorat hai, lekin pareshan nah hon yeh aap ke liye pehlay hi ho chuka hai! hum ne tamam 75 mama batii ke namonon ki wazahat ki hai aur inhen sakht tijarti qawaid mein daal diya hai jo qabil imthehaan hain. har aik candle stuck patteren ka back test kya jata hai aur is mein qawaid, adad o shumaar, imkanaat, aur karkardagi ke matrix shaamil hain. is se bhi behtar, aap ko amibroker ya tradestation easy language law ke sath qawaid mlitay hain( saada angrezi ke ilawa agar aap khud law karna chahtay hain, jaisay ke usay azgar ki tijarti hikmat e amli mein daalna, misaal ke escarpment par). mazeed parhnay ya order karne ke liye yahan click karen. aap ki tijarti hikmat e amli mein advance bock candle stuck patteren ke istemaal ke fawaid advance bock candle stuck patteren ka aik ahem faida yeh hai ke yeh mumkina rujhan ki tabdeelion ki ibtidayi intibahi alamaat faraham kar sakta hai.

-

#8 Collapse

hello every one Advance Block Diagram Example Advance Block design, jo kay Forex exchanging mein use kiya jata hai, candle maps standard nazar aane wala ek particular investigation design hai. Ye design bhe negative pattern nichay kay pattern ke baad dikhai deta hai aur uper kay pattern ke isharay muhaya karta hai. Advance Block design mein, negative nichay ke taraf pattern ke baad ki three progressive candles ko zahir kiya jatahai.Is design mein, pehli candle negative nichay ke taraf pattern ki sturdiness ko dekhati hai. Dusri candle bhi negative hai, lekin pehli candle se choti hoti hai aur uski range tight hoti hai. Teesri candle bhi negative hai, lekin ye pehli aur dusri candles sey choti hoti hai aur uski range bhi restricted hoti hai. Ye slender reach aur chote size ki candles, managing pressure mein kami aur purchasers ki mazboti ko neshandahi karte hain.design tashkeel ho jata hai, to iska tajdeed yeh hai ki managing pressure kam ho rahi hai aur demand mein purchasing ka verifiable hai. Sellers is waja bunyad design ko dekh kar upturn ki tawaquat rakhte hain aur long positions lete hain. Design tasdeeq sharpen ke liye, sellers amm torr standard uske baad ki light ki candle ka breakout ka stay kartehain.Ye design sirf ek specific investigation instrument hai aur iska sahi istemal karne ke liye, vendors ko demand patterns aur candle designs ko samajhna zaruri hai. Forex exchanging mein, har design ki delicacy 100 nahi hoti, isliye appropriate danger activity aur stop-misfortune orders ka use karna bhi bohat zeada zarori hai. Diagram Example Arrangement patteren ko is patteren ke foran baad aglay kayi adwaar mein qeemat ke ulat jane ki paish goi karne ke liye samjha jata hai. yeh map patteren barray pemanay standard neechay ke rujhanaat ke andar earzi peak standard oopar ki taraf bherne aur partner bacchus ke douran aur jab mother btyon ki haqeeqi body lambi hoti hai to aik ulat patteren ki behtareen paish goi karta hai. negative inversion ki tasdeeq is waqt hoti hai jab pehli baad mein anay wali qeemat baar pehli light ki asli body ke average point se tijarat karti hai. Calculation exchanging se pehlay ke cantina mein advance bock patteren nisbatan nayaab tha lekin is ke baad se ziyada aam ho gaya hai, jo intra day counter swing ki ziyada tadad ko zahir karta hai. is ke bawajood, taajiron ko sirf advance bock patteren se khareed o farokht ke signal nahi lainay chahiye.Demand conditions aur explicit exchange arrangements ke hisab se danger cost rate ko adapt karna significant hai. High-likelihood exchange arrangements aur moving solicitations mein sellers progressed danger cost rates ko target kar sakte hain. unusual solicitations aur lower likelihood arrangements mein vendors apne danger cost rates ko moderate position standard adjust kar saktehain.Risk-cost rate, sellers ke liye danger activity aur exchanging execution ka ek essential viewpoint hai. Isse vendors apne exchanges ko survey kar sakte hain, exchange ka benefit certain aur danger openness ko evaluate kar sakte hain, aur long haul productivity ko keep up with karne ke liye apne exchanges ko advance kar sakte hain. Exchanging And TypesExchange ke samay cost development aur demand conditions ko analyst karein. Stop-misfortune position ko adapt karte rahein, halfway gains book karein, ya running stop ways ka istemal karein, taki exchange activity ko really handle karsakein.Advance Block design negative inversion signal hai, lekin iski viability aur delicacy ka samajhna aur affirm karne ke liye new examination aur confirmational signals ki zaroorat hoti hai. Specific examination aur danger activity standards ka istemal karke, Advance Block design ko samajhkar exchanging feelings liye ja sakte hain.candle stuck patteren ko back test karne ke liye aap ko makhsoos usool aur tareefen set karne ki zaroorat hai. is ke liye waqt aur koshish dono ki zaroorat hai, lekin pareshan nah hon yeh aap ke liye pehlay hello there ho chuka hai! murmur ne tamam 75 mother batii ke namonon ki wazahat ki hai aur inhen sakht tijarti qawaid mein daal diya hai jo qabil imthehaan hain. har aik candle stuck patteren ka back test kya jata hai aur is mein qawaid, adad o shumaar, imkanaat, aur karkardagi ke grid shaamil hain. is se bhi behtar, aap ko amibroker ya tradestation simple language regulation ke sath qawaid mlitay hain( saada angrezi ke ilawa agar aap khud regulation karna chahtay hain, jaisay ke usay azgar ki tijarti hikmat e amli mein daalna, misaal ke slope standard). mazeed parhnay ya request karne ke liye yahan click karen. aap ki tijarti hikmat e amli mein advance bock light stuck patteren ke istemaal ke fawaid advance bock flame stuck patteren ka aik ahem faida yeh hai ke yeh mumkina rujhan ki tabdeelion ki ibtidayi intibahi alamaat faraham kar sakta ha

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

os karna. agar aap khonay wali tijarat ko band karte hain aur usay pehli jagah kholnay standard pachtaawa mehsoos karte hain, to imkaan hai ke aap over trading kar rahay hon ge aur - apne pichlle nuqsanaat ki talaafi karne ki koshish kar rahay hon ge. market ki naqal o harkat standard fixing. aap frames ko dekhteangid ko pakar satke hain, yeh sochte tone ke aap ko mutadid mawaqay nazar arhay hain aur un sab ko istemaal karne ki koshish karne mein kharish hai. lekin market hamesha hamari tawaquaat ke mutabiq nahi chalti. lehaza agar koi cheez aik acha mauqa maloom hoti hai, tab bhi baghair tehqeeq ke usay istemaal karne ki koshish karna bohat hi ghair danish mandana hai. apni hikmat e amli se bhatakna. hit market ke halaat is ki zaroorat ho to apni hikmat e amli ko tabdeel karna aik cheez hai. sirf is liye karna aur baat hai ke aap ziyada munafe haasil karna chahtay hain. be sakhta faislon ke haq mein - apne ibtidayi mansoobay ko tark karna aik tajir ki sab se barri ghaltion mein se aiver trading aik bohat khatarnaak ghalti hai, khaas top standard aik naye tajir ke liye jis ne abhi tak munasib tijarti hikmat e amli aur mansoobah nahi banaya hai. hit tajir market standard nazar rakhtay cover aik sath bohat saari pozishnon ko tijarat karne ki koshish karte hain, to un ki tawajah munqasim ho jati hai, aur woh apni tijarat ko band karne ke liye sahih waqt se mahroom ho jatay hain, jis k

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 10:50 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим