Trading at Piercing Line Candles Pattren

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

ng down TrendDear aapke is Line ki confirmation tab Hoti Hai Jab ab Ek strong cell wali candle hoti hai lekin Uske bad Ek buy candle banti hai lekin jo Baat wali candle hoti hai vah cell candle se Chhoti Hoti Hai Magar uska size 50% Hota Hai ke badg line pattern kerty hain aur jab yeh pattern complete hota hai tou usky bahd market ki hundred percent movement ka uptrend start ho jata hai aur wahan per buy ki trade open ker ky ham bahot achi earning ker sakty hain. market up jati hai aur Buy ka trend banta hai aur ismein aap market ko analysis lene ke baad buy Mein Apni trade ko perform kar sakte hain Jab Bhi Piercing candles pattern banta hai to aapki trade buy Main zarur jaati hai. Introduction of the post. iecing line pattern is waqat creat hota hai jab market continue downward movement kerty huey jah aik bearish candle completeieve ho sakta hai.Jab aap is situation Mein trade open kar lete hain to usmein aap take profit Hamesha resistance level per hi set karte hain aur agar aap stop class Lagana Chahte Hain To usmein aap ko last wali bike candle se thoda niche apni stop loss ki limit fix kar leni chahie. hony ky bahd next candle kuch gap ky sath down sy start ho ker bullish candle is terha sy creat ho ky last bearish candle ky more than fifty percent per close ho jaey tou aesy main jo pattern creat hota hai usko piercing line pattern kerty hain aur jab yeh pattern complete hota hai tou usky bahd market ki hundred percent movement ka uptrend start ho jata hai aur wahan per buy ki trade open ker ky ham bahot achi earning ker sakty hain. -

#3 Collapse

PIERCING LINE CANDLE FOREX INTRODUCTION: Forex market mein trading karne ke liye, traders ne alag-alag technical analysis tools ko istemal kiya hai. Ek aham tool jo candlestick patterns ke roop mein istemal hota hai, woh hai "Piercing Line Candles." Is article mein hum Piercing Line Candles ke baare mein tafseel se batayenge. Piercing Line Candles, candlestick charts par paye jane wale aik specific pattern hote hain. Yeh pattern usually downtrend ke baad dikhai deta hai aur price reversal ko suggest karta hai. Piercing Line Candles ko two candlesticks se define kiya jata hai: pehla candlestick bearish (girawat ki taraf jane wali) hai, jabki dusra candlestick bullish (badhne ki taraf jane wali) hoti hai. PIERCING LINE CANDL PATTERN Piercing Line Candles pattern, do candlesticks se banta hai. Neeche diye gaye hain iski tashkeel ki details: 1. PEHLA CANDLESTICK: - Yeh candlestick bearish (downward) trend mein dikhai deti hai. - Iski body ko shuruat se zyada niche close hoti hai. - Iski body ko aik lambi upper wick (shadow) bhi ho sakti hai. - Yeh candlestick price decline ko represent karti hai. 2. DUSRA CANDLESTICK: - Yeh candlestick pehle candlestick ke neeche open hoti hai. - Iski body pehli candlestick ki body se upper side open hoti hai. - Iski body ko shuruat se zyada oopar close hoti hai. - Yeh candlestick price increase ko represent karti hai. PIERCING LINE CANDLES STRATEGIES Jab Piercing Line Candles pattern ban jata hai, toh iska matlab hota hai ki bearish trend khatam ho gaya hai aur bullish trend shuru ho sakta hai. Is pattern ke istemal se traders ko buying opportunities mil sakti hain. Piercing Line Candles pattern ki tashkhees ke liye neeche diye gaye rules ka istemal kiya jata hai: 1. Pehli candlestick bearish trend mein ho. 2. Dusri candlestick pehli candlestick ki body ke andar open ho aur pehli candlestick ki body ke upar close ho. 3. Dusri candlestick ki body pehli candlestick ki body ke 50% se zyada cover kare. 4. Volume bhi confirmatory signal ke taur par dekha jata hai. Agar dusri candlestick ki volume pehli candlestick ki volume se zyada hai, toh iska bullish reversal signal mazboot hota hai.Piercing Line Candles forex market mein price reversal ko suggest karte hain. Jab bearish trend khatam hota hai aur bullish trend shuru hone ka indication hota hai, traders ko buying opportunities milti hain. Is pattern ki tashkhees volume aur candlestick ki body ke rules ke zariye ki ja sakti hai.

- Mentions 0

-

سا0 like

-

#4 Collapse

Trading dunya mein, chart patterns aur candlestick patterns ki bohat ziada importance hai. In mein se aik jo popular pattern hai wo hai Piercing Line Candlestick Pattern. Yeh pattern usually market ki trend reversal indicate karta hai aur yeh bullish signal hota hai. Piercing Line Candlestick Pattern aik bullish reversal pattern hai jo usually downtrend ke baad aata hai. Is pattern mein do candles hoti hain: pehli red candle jo bearish trend ko represent karti hai aur doosri green candle jo bullish reversal ko indicate karti hai. Piercing Line Pattern tab form hota hai jab doosri candle pehli candle ke body ke midpoint se zyada upar close hoti hai. Yeh pattern dekhnay mein similar hai bullish engulfing pattern se, lekin ismein doosri candle poori tarah se pehli candle ko engulf nahi karti, balkay pehli candle ke body ke midpoint tak close hoti hai.

Piercing Line Candlestick Pattern ke Components- Pehli Candle (Bearish Candle): Pehli candle red ya black hoti hai jo downtrend ko indicate karti hai. Iska open price high hota hai aur close price low hota hai, jo bearish sentiment ko show karta hai.

- Doosri Candle (Bullish Candle): Doosri candle green ya white hoti hai jo bullish reversal ko show karti hai. Iska open price pehli candle ke low ke neeche hota hai, lekin close price pehli candle ke body ke midpoint se upar hota hai.

Piercing Line Pattern tab form hota hai jab market downtrend mein hoti hai aur bearish sentiment dominant hota hai. Pehli candle bearish hoti hai jo yeh signal deti hai ke market abhi bhi neeche ja rahi hai. Phir doosri candle form hoti hai jo pehli candle ke low ke neeche open hoti hai, lekin trading session ke dauran bulls control le lete hain aur price ko pehli candle ke body ke midpoint se upar close kar dete hain. Yeh indicate karta hai ke bullish sentiment aagaya hai aur market uptrend ki taraf move karne wali hai.

Trading Piercing Line Pattern- Identify Pattern: Piercing Line Pattern ko pehchan-ne ke liye, trader ko pehle candlestick chart ko dekhna hota hai aur yeh ensure karna hota hai ke market downtrend mein thi. Phir wo yeh dekhte hain ke pehli bearish candle ke baad aik bullish candle form hui hai jo pehli candle ke body ke midpoint se zyada upar close hui hai.

- Confirmation: Piercing Line Pattern ke baad, trader usually additional confirmation indicators ka use karte hain jaise ke volume, moving averages ya RSI (Relative Strength Index) taake ensure kar sakein ke reversal genuine hai aur market ab uptrend ki taraf jaane wali hai.

- Entry Point: Jab pattern confirm ho jata hai, trader bullish position open karte hain. Entry point usually doosri bullish candle ke close ke baad hota hai.

- Stop Loss Placement: Risk management ke liye stop loss ka use karna zaroori hai. Stop loss usually pehli bearish candle ke low ke neeche place kiya jata hai taake agar market reverse ho jaye to loss limited ho.

- Target Setting: Profit target set karna bhi zaroori hai. Target usually recent resistance level pe set kiya jata hai ya phir traders multiple targets set kar sakte hain jese ke risk-reward ratio ko follow karte hue.

- Clear Reversal Signal: Piercing Line Pattern ek clear reversal signal deta hai jo downtrend ke baad bullish reversal ko indicate karta hai.

- Easy to Identify: Yeh pattern easily identify kiya ja sakta hai kisi bhi candlestick chart pe, jo isko traders ke liye accessible banata hai.

- High Probability Setup: Agar sahi tarah se confirm kiya jaye, toh yeh pattern high probability trading setup provide karta hai.

Piercing Line Pattern ke Limitations- False Signals: Har candlestick pattern ki tarah, Piercing Line Pattern bhi kabhi kabhi false signals de sakta hai. Is liye additional confirmation indicators ka use karna zaroori hai.

- Market Conditions: Har market condition mein yeh pattern work nahi karta. Sideways ya choppy markets mein yeh pattern reliable nahi hota.

- Short-term Nature: Yeh pattern short-term trading ke liye zyada useful hai. Long-term trends ke liye additional analysis ki zaroorat hoti hai.

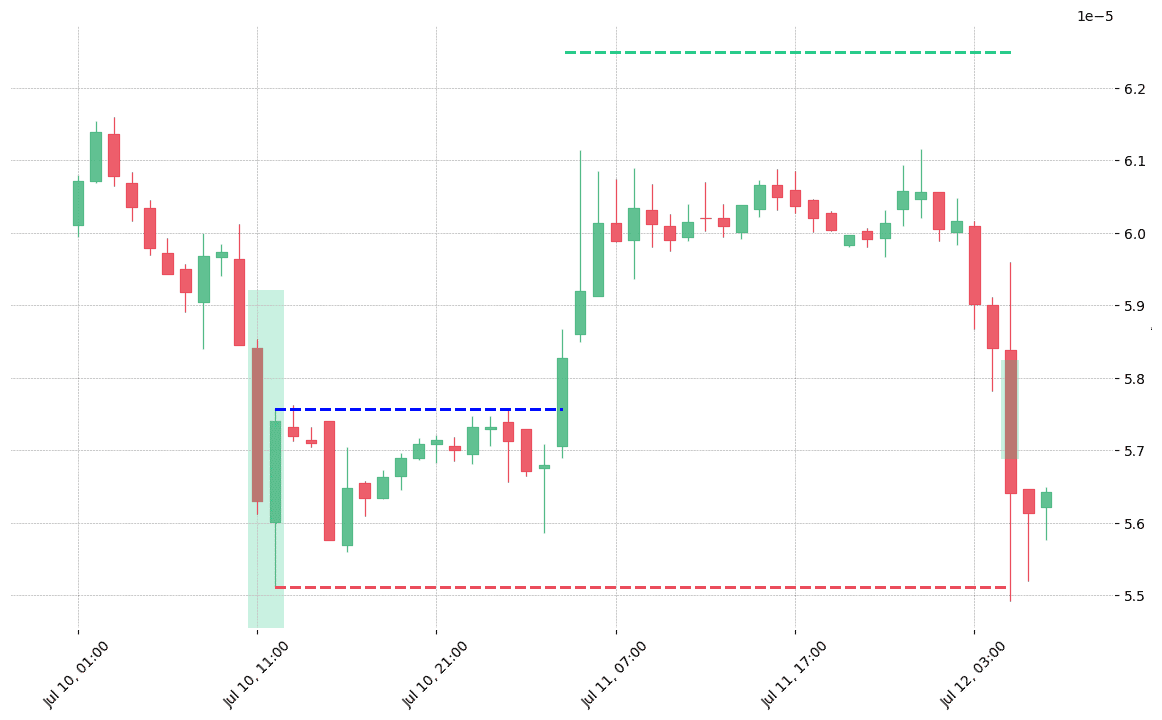

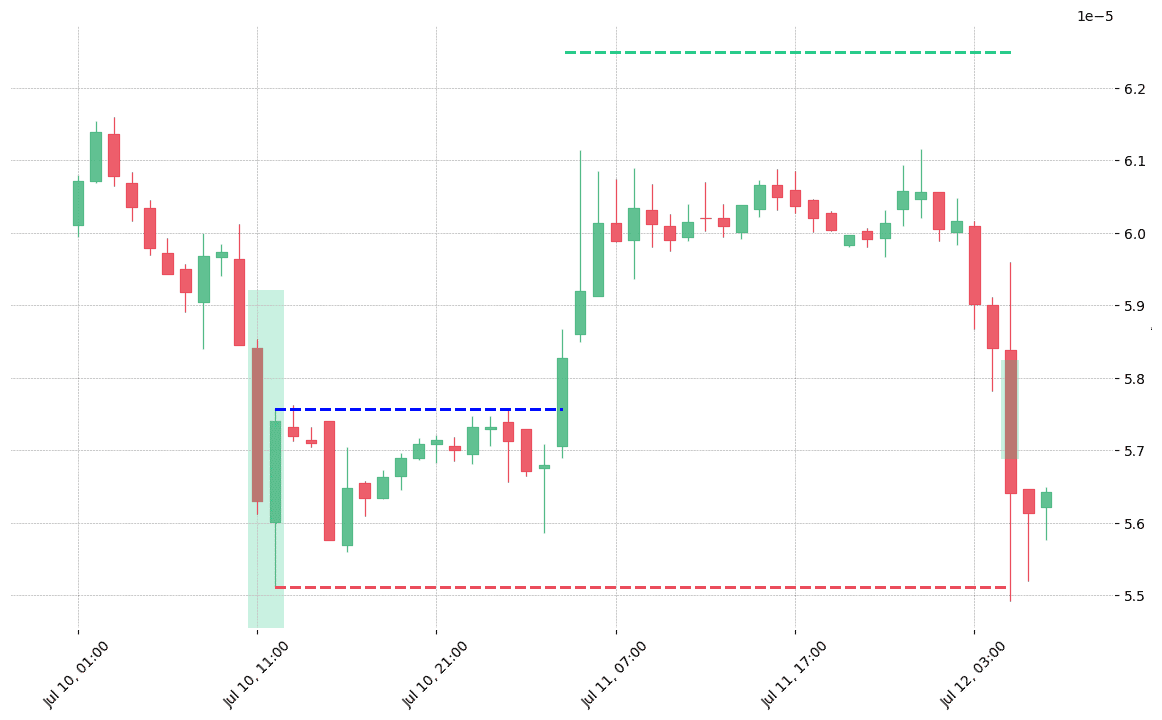

Piercing Line Pattern ka Practical Example

Ek example lete hain jahan Piercing Line Pattern ne ek successful trade signal diya.

Suppose karo aik stock ka price continuously downtrend mein tha aur phir aik din ek long bearish candle form hui jiska close price low tha. Agle din, market open hui aur price thoda neeche gaya lekin session ke dauran bulls ne control le liya aur price ko pehli candle ke midpoint se zyada upar close kar diya. Yeh ek clear Piercing Line Pattern tha jo bullish reversal ko indicate kar raha tha. Trader ne is pattern ko identify kiya aur doosri candle ke close hone ke baad bullish position open ki. Unhone stop loss pehli candle ke low ke neeche place kiya aur target recent resistance level pe set kiya. Market ne uptrend shuru kiya aur trader ka target hit hua jisse unko profit mila.

Piercing Line Candlestick Pattern aik powerful tool hai traders ke liye jo downtrend ke baad bullish reversal ko indicate karta hai. Is pattern ko identify karna aur sahi tarah se use karna trading mein successful results de sakta hai. Lekin, jaise har trading strategy mein, is pattern ko use karte waqt risk management aur additional confirmation indicators ka use karna zaroori hai. Har market condition mein yeh pattern reliable nahi hota, is liye traders ko hamesha market context aur broader trend analysis ko bhi dekhna chahiye. Trading Piercing Line Pattern ko samajhne aur effectively use karne se traders ko better decision making aur profitable trades mein madad milti hai.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#5 Collapse

Trading dunya mein, chart patterns aur candlestick patterns ki bohat ziada importance hai. In mein se aik jo popular pattern hai wo hai Piercing Line Candlestick Pattern. Yeh pattern usually market ki trend reversal indicate karta hai aur yeh bullish signal hota hai. Piercing Line Candlestick Pattern aik bullish reversal pattern hai jo usually downtrend ke baad aata hai. Is pattern mein do candles hoti hain: pehli red candle jo bearish trend ko represent karti hai aur doosri green candle jo bullish reversal ko indicate karti hai. Piercing Line Pattern tab form hota hai jab doosri candle pehli candle ke body ke midpoint se zyada upar close hoti hai. Yeh pattern dekhnay mein similar hai bullish engulfing pattern se, lekin ismein doosri candle poori tarah se pehli candle ko engulf nahi karti, balkay pehli candle ke body ke midpoint tak close hoti hai.

Piercing Line Candlestick Pattern ke Components- Pehli Candle (Bearish Candle): Pehli candle red ya black hoti hai jo downtrend ko indicate karti hai. Iska open price high hota hai aur close price low hota hai, jo bearish sentiment ko show karta hai.

- Doosri Candle (Bullish Candle): Doosri candle green ya white hoti hai jo bullish reversal ko show karti hai. Iska open price pehli candle ke low ke neeche hota hai, lekin close price pehli candle ke body ke midpoint se upar hota hai.

Piercing Line Pattern tab form hota hai jab market downtrend mein hoti hai aur bearish sentiment dominant hota hai. Pehli candle bearish hoti hai jo yeh signal deti hai ke market abhi bhi neeche ja rahi hai. Phir doosri candle form hoti hai jo pehli candle ke low ke neeche open hoti hai, lekin trading session ke dauran bulls control le lete hain aur price ko pehli candle ke body ke midpoint se upar close kar dete hain. Yeh indicate karta hai ke bullish sentiment aagaya hai aur market uptrend ki taraf move karne wali hai.

Trading Piercing Line Pattern- Identify Pattern: Piercing Line Pattern ko pehchan-ne ke liye, trader ko pehle candlestick chart ko dekhna hota hai aur yeh ensure karna hota hai ke market downtrend mein thi. Phir wo yeh dekhte hain ke pehli bearish candle ke baad aik bullish candle form hui hai jo pehli candle ke body ke midpoint se zyada upar close hui hai.

- Confirmation: Piercing Line Pattern ke baad, trader usually additional confirmation indicators ka use karte hain jaise ke volume, moving averages ya RSI (Relative Strength Index) taake ensure kar sakein ke reversal genuine hai aur market ab uptrend ki taraf jaane wali hai.

- Entry Point: Jab pattern confirm ho jata hai, trader bullish position open karte hain. Entry point usually doosri bullish candle ke close ke baad hota hai.

- Stop Loss Placement: Risk management ke liye stop loss ka use karna zaroori hai. Stop loss usually pehli bearish candle ke low ke neeche place kiya jata hai taake agar market reverse ho jaye to loss limited ho.

- Target Setting: Profit target set karna bhi zaroori hai. Target usually recent resistance level pe set kiya jata hai ya phir traders multiple targets set kar sakte hain jese ke risk-reward ratio ko follow karte hue.

- Clear Reversal Signal: Piercing Line Pattern ek clear reversal signal deta hai jo downtrend ke baad bullish reversal ko indicate karta hai.

- Easy to Identify: Yeh pattern easily identify kiya ja sakta hai kisi bhi candlestick chart pe, jo isko traders ke liye accessible banata hai.

- High Probability Setup: Agar sahi tarah se confirm kiya jaye, toh yeh pattern high probability trading setup provide karta hai.

Piercing Line Pattern ke Limitations- False Signals: Har candlestick pattern ki tarah, Piercing Line Pattern bhi kabhi kabhi false signals de sakta hai. Is liye additional confirmation indicators ka use karna zaroori hai.

- Market Conditions: Har market condition mein yeh pattern work nahi karta. Sideways ya choppy markets mein yeh pattern reliable nahi hota.

- Short-term Nature: Yeh pattern short-term trading ke liye zyada useful hai. Long-term trends ke liye additional analysis ki zaroorat hoti hai.

Piercing Line Pattern ka Practical Example

Ek example lete hain jahan Piercing Line Pattern ne ek successful trade signal diya.

Suppose karo aik stock ka price continuously downtrend mein tha aur phir aik din ek long bearish candle form hui jiska close price low tha. Agle din, market open hui aur price thoda neeche gaya lekin session ke dauran bulls ne control le liya aur price ko pehli candle ke midpoint se zyada upar close kar diya. Yeh ek clear Piercing Line Pattern tha jo bullish reversal ko indicate kar raha tha. Trader ne is pattern ko identify kiya aur doosri candle ke close hone ke baad bullish position open ki. Unhone stop loss pehli candle ke low ke neeche place kiya aur target recent resistance level pe set kiya. Market ne uptrend shuru kiya aur trader ka target hit hua jisse unko profit mila.

Piercing Line Candlestick Pattern aik powerful tool hai traders ke liye jo downtrend ke baad bullish reversal ko indicate karta hai. Is pattern ko identify karna aur sahi tarah se use karna trading mein successful results de sakta hai. Lekin, jaise har trading strategy mein, is pattern ko use karte waqt risk management aur additional confirmation indicators ka use karna zaroori hai. Har market condition mein yeh pattern reliable nahi hota, is liye traders ko hamesha market context aur broader trend analysis ko bhi dekhna chahiye. Trading Piercing Line Pattern ko samajhne aur effectively use karne se traders ko better decision making aur profitable trades mein madad milti h -

#6 Collapse

Introduction

Piercing Line Candlestick Pattern

ek bullish reversal pattern hai jo market me trend reversal ko indicate karta hai. Yeh pattern do candles ka combination hota hai, pehla bearish aur doosra bullish. Is pattern ko samajhna aur use karna forex trading me kaafi helpful ho sakta hai.

Formation of Piercing Line Pattern

Formation: Piercing Line Pattern tab banta hai jab ek bearish candle ke baad ek bullish candle close hoti hai jo pehle wali candle ke midpoint ke upar close ho. Pehli candle red hoti hai (bearish) aur doosri candle green hoti hai (bullish).

Key Characteristics

1. Pehla Candle (Bearish):- Yeh ek lambi bearish candle hoti hai jo downward trend ko follow karti hai.

- Yeh candle sellers ka pressure show karti hai.

2. Dusra Candle (Bullish):- Yeh candle pehle wali candle ke low se neeche open hoti hai aur uske body ke midpoint ke upar close hoti hai.

- Yeh buyers ke strong interest ko dikhata hai jo trend reversal ka indication hai.

Interpretation: Piercing Line Pattern ko dekh kar traders ko yeh samajhna chahiye ke market ka trend reverse hone wala hai. Pehla bearish candle sellers ke dominance ko dikhata hai, lekin doosra bullish candle buyers ke strong comeback ko show karta hai.

Trading Strategy Using Piercing Line Pattern

Entry Point:- Jab bullish candle previous bearish candle ke midpoint ke upar close ho, tab entry leni chahiye.

- Confirmation ke liye volume ko bhi check karna zaroori hai.

Stop-Loss:- Stop-loss ko bearish candle ke low ke neeche place karna chahiye.

- Yeh potential loss ko minimize karta hai agar trade galat ho jaye.

Take-Profit:- Take-profit ko previous resistance levels par place kar sakte hain.

- Fibonacci retracement levels bhi use kar sakte hain take-profit levels identify karne ke liye.

Example:- Suppose EUR/USD pair downward trend me hai aur ek lambi bearish candle form hoti hai.

- Agle din ek bullish candle form hoti hai jo previous bearish candle ke midpoint ke upar close hoti hai.

- Yeh Piercing Line Pattern ka formation hai, aur yahan entry point identify kar sakte hain.

Risk Management:- Proper risk management techniques use karna zaroori hai.

- Risk-reward ratio ko maintain karte hue trade lena chahiye.

- Position sizing aur stop-loss levels ko dhyan me rakhna chahiye.

Advantages:- Trend reversal ko early stage me identify karne me madad milti hai.

- High probability setup hota hai agar correct confirmation mil jaye.

Disadvantages:- False signals bhi generate ho sakte hain agar volume aur confirmation na ho.

- Sirf Piercing Line Pattern par rely karna risky ho sakta hai, doosre indicators ka use zaroori hai.

Combining with Other Indicators:- Moving Averages ke sath combine kar sakte hain taake trend confirmation mile.

- RSI (Relative Strength Index) ya MACD (Moving Average Convergence Divergence) indicators ke sath bhi use kar sakte hain.

Conclusion: Piercing Line Pattern ek useful bullish reversal pattern hai jo traders ko trend reversal identify karne me madad karta hai. Proper analysis aur risk management techniques ke sath use karne se yeh pattern profitable trading opportunities provide kar sakta hai. Hamesha volume aur doosre technical indicators ke sath confirmation lena zaroori hai taake false signals se bacha ja sake.

-

#7 Collapse

Trading at Piercing Line Candlestick Pattern

Piercing Line Candlestick Pattern kya hota hai?

Piercing Line Candlestick Pattern aik bullish reversal pattern hai jo do candles par mushtamil hota hai. Ye pattern tab banta hai jab market mein bearish trend ho aur phir aik significant bullish candle us trend ko reverse karein. Is pattern mein pehli candle bearish hoti hai jo market ko neeche le jati hai, aur doosri candle bullish hoti hai jo pehli candle ke halfway se zyada oopar close hoti hai.

Pattern ka structure:

1. Pehli Candle Ye bearish candle hoti h i jo neechay close hoti hai.

2. Doosri Candle Ye bullish candle hoti hai jo pehli candle ke halfway point se upar close hoti hai.

Trading Signals:

1. Entry Point: Jab doosri bullish candle pehli bearish candle ke halfway point se upar close ho, toh ye aik strong buying signal hota hai.

2. Stop Loss: Apna stop loss pehli bearish candle ke low ke neechay rakhein taake risk manage ho sake.

3. Take Profit: Take profit levels ko previous resistance levels par set karein ya phir risk-reward ratio ko follow karein.

Confirmations:

1. Volume: Volume ka increase hona bullish candle ke sath aik additional confirmation hota hai.

2. Trend Indicators: Moving averages ya RSI jaise indicators ka use karke confirmation hasil karein.

3. Support Levels: Support levels pe piercing line pattern ka banna, signal ko mazeed strengthen karta hai.

Example:

Agar aik stock $100 par trade kar raha hai aur pehli bearish candle $95 par close hoti hai, phir agle din bullish candle $96.50 ya is se oopar close hoti hai, toh ye aik piercing line pattern kehlata hai.

Conclusion:

Piercing Line Candlestick Pattern aik ahem bullish reversal pattern hai jo traders ko market reversal ko pehchan ne mein madad deta hai. Is pattern ko use karke profitable trading decisions liye ja sakte hain agar sahi tariqe se technical analysis aur risk management ka istamal kiya jaye.

Is pattern ko trade karte waqt hamesha market conditions aur additional confirmations ko madde nazar rakhein. -

#8 Collapse

Trading the Piercing Line Candlestick Pattern in Forex

Forex trading mein candlestick patterns ka use karke market trends aur price movements ko analyze karna ek common aur effective practice hai. Ek aisa hi candlestick pattern "Piercing Line" pattern hai. Ye pattern reversal signals ko identify karne mein madad karta hai aur traders ko profitable trading opportunities ka faida uthane mein help karta hai.

Understanding the Piercing Line Pattern

Piercing Line pattern ek bullish reversal pattern hai jo downtrend ke baad appear hota hai. Ye pattern do candles par mushtamil hota hain

1. First Candle

Pehli candle ek large bearish (red/black) candle hoti hai jo market downtrend ko represent karti hai.

2.Second Candle

Doosri candle ek large bullish (green/white) candle hoti hai jo pehli candle ke body ko almost halfway ya usse zyada engulf karte hue close hoti hai.

Ye pattern tab form hota hai jab pehli bearish candle ke baad market open hoti hai aur doosri bullish candle form hoti hai jo pehli candle ke body ke halfway mark ko cross karte hue close hoti hai.

Characteristics of the Piercing Line Pattern

Piercing Line pattern ko identify karne ke liye kuch specific characteristics hain jo dhyaan mein rakhne chahiye

1. Downtrend

Ye pattern tabhi valid hota hai jab market downtrend mein ho. Ye downtrend ek clear aur strong decline dikhana chahiye.

2. Gap Down Opening

Doosri bullish candle ka open hona pehli bearish candle ke close se neeche hona chahiye, jo gap down opening ko indicate karta hai.

3. Engulfing Body

Doosri bullish candle ka close hona pehli bearish candle ke halfway mark se zyada hona chahiye, jo engulfing body ka signal deta hai.

Significance of the Piercing Line Pattern

Piercing Line pattern ka significance ye hai ke ye market ke sentiment mein shift ka indication deta hai. Pehli bearish candle ke baad jab doosri bullish candle form hoti hai aur previous candle ke halfway mark ko cross karte hue close hoti hai, to ye buyers ke strong presence aur control ka indication hota hai. Ye pattern market reversal ke liye ek strong signal provide karta hai, jo potential buying opportunity ko indicate karta hai.

How to Trade the Piercing Line Pattern

Piercing Line pattern ko effectively trade karne ke liye kuch important steps hain jo aapko follow karne chahiye

1.Pattern Confirmation

Sabse pehle, pattern ko accurately identify karna zaroori hai. Ensure karein ke pehli candle ek strong bearish candle hai aur doosri candle ek large bullish candle hai jo pehli candle ke halfway mark ko cross karte hue close hoti hai.

2.Volume Analysis

Volume analysis bhi important hai. High volume ka hona pattern ke strength aur reversal ke likelihood ko confirm karta hai. Jab second bullish candle high volume ke sath close hoti hai, to ye buyers ke strong presence ka indication hota hai.

3.Entry Point

Piercing Line pattern identify karne ke baad, aap next candle ke open par buy order place kar sakte hain. Is entry point ko use karke aap market ke reversal se faida utha sakte hain.

4. Stop-Loss Placement

Stop-loss ko strategically place karna zaroori hai taake aapke losses limited hon. Stop-loss ko previous low ke neeche place karna chahiye taake aap apne capital ko protect kar sakein.

5.Profit Target

Profit target ko set karna bhi zaroori hai. Aap previous resistance levels ko use karke apna profit target determine kar sakte hain. Additionally, aap risk-reward ratio ko consider karte hue bhi apna profit target set kar sakte hain.

Example of Trading the Piercing Line Pattern

Ek real-life example Piercing Line pattern ko better samajhne mein madadgar ho sakta hai

1.Bullish Example

Assume karein ke EUR/USD pair ka chart analyze kar rahe hain aur aapko downtrend ke baad Piercing Line pattern nazar aata hai. Pehli candle ek large bearish candle hai aur doosri candle ek large bullish candle hai jo pehli candle ke halfway mark ko cross karte hue close hoti hai. Is point par, aap next candle ke open par buy order place kar sakte hain aur apna stop-loss previous low ke neeche set kar sakte hain. Aap apna profit target previous resistance level par set kar sakte hain.

Limitations of the Piercing Line Pattern

Har trading strategy ki tarah, Piercing Line pattern strategy ke bhi kuch limitations hain jo traders ko samajhna zaroori hai

1.False Signals

Kabhi kabhi pattern false signals generate kar sakta hai, specially jab market sideways move kar rahi ho. Is wajah se doosre confirmation tools ka use karna zaroori hai.

2. Market Conditions

Ye pattern trending markets mein zyada effective hota hai. Low volatility ya sideways markets mein iska effectiveness kam ho sakta hai.

3. Dependence on Time Frame

Different time frames par pattern ki reliability vary kar sakti hai. Is wajah se multiple time frames ko analyze karna helpful ho sakta hai.

Combining the Piercing Line Pattern with Other Indicators

Piercing Line pattern ko doosre indicators ke sath combine karke zyada accurate trading signals hasil kiya ja sakta hai. Kuch common combinations include:

1.Moving Averages

Piercing Line pattern ko moving averages ke sath combine karne se trend confirmation aur entry/exit points zyada accurately identify kiye ja sakte hain.

2.Relative Strength Index (RSI)

RSI ke sath combine karne se overbought aur oversold conditions ko better samjha ja sakta hai, jo Piercing Line ke signals ko confirm karne mein madad karta hai.

3.MACD

MACD ke sath combine karne se momentum aur trend strength ko analyze karna easier ho jata hai, jo Piercing Line ke signals ko strengthen kar sakta hai.

Note

Piercing Line candlestick pattern forex trading mein ek powerful tool hai jo traders ko market trends, price movements, aur potential reversal points ko accurately identify karne mein madad karta hai. Is pattern ko effectively use karne ke liye proper understanding aur practice zaroori hai. Jab aap Piercing Line pattern ko apni trading strategy mein incorporate karte hain aur doosre indicators ke sath combine karte hain, to aapko zyada accurate aur profitable trading decisions lene mein madad milti hai. Is pattern ka sahi use karne se aap market movements ko better predict kar sakte hain aur apni trading performance ko significantly improve kar sakte hain.

-

#9 Collapse

What is Piercing line candle pattern?

piercing line ka patteren do commotion candles ka stuck price ka patteren hai jo disadvantage se le kar upper side ki taraf move karta hai.

Importance Of The Pattern

Piercing line ka pattern two candles ka combination design hai jo down se upper

side pe move krnay ki expectation provide karta hai. yeh candle design aik aisa design most part a few days design ki continuety ka signal deta ha. es patteren ki (Three) qualities hain jis mein se pehlay neechay ki taraf pattern then aik hole aur patteren mein second candle ki against development incorporate ha .

The most effective method to Identify Piercing Line Pattern:

Piercing line design ki distinguished karnay k kuch rules hain jinko agar ham observe kartay hain to ham is design k sath market principle great trading kar skatay hain...

1

....Piercing line design ko perceive karnay k liye market fundamental pattern down ka hona chaye

2

...first large candle ki body cost ko drawback run karty huw nazar ani chaye

3

... first aur second candles ki bodies cost principle hole aur inversion ka show kar rahi hon

4

... Bullish aur Bearish candles ki bodies ka large hona bhi zaruri hai

agar traders chart ko aisay price design ka base say down start daikhain to ham outline pay isay penetrating line design ka name daitay huway exchanges kr skty hain...

Trading Planing For This Pattern...

apni trading ko kamyab bananay ke liye hamesha aise different sort ke designs ko follow Karte rehna chahie jitna jyada hamen aise designs ko samajhne aur in per kam karne ka mauka Milega to

ham apni exchanging ko solid bana sakte hain agar apne trading capacity aur abilities ko improve karna chahte hain to hamesha candle ke different type ke pattrens ko follow karte Raha karen aur unko samajhne ke liye markers ka use Kiya Karen Jitna zyada point ko use karte ek arranging ke sath apni trading ko perform karenge to aapko in candle design se acha result milega aur ap apni trade ko bahut aasani ke sath Kamyab bana sakte hain.....

-

#10 Collapse

**Trading at Piercing Line Candlestick Pattern:**

1. **Introduction to Piercing Line Pattern:**

- The Piercing Line is a bullish reversal pattern that appears in a downtrend.

- It consists of two candlesticks: the first is a bearish candle followed by a second bullish candle.

- The key feature of this pattern is that the second candle opens lower but closes above the midpoint of the first candle.

2. **Formation and Interpretation:**

- **First Candlestick (Bearish):** This candle is usually long and indicates a strong downtrend. It suggests that selling pressure was dominant.

- **Second Candlestick (Bullish):** This candle opens lower than the previous close but closes higher, ideally above the midpoint of the first candle. It indicates a shift in sentiment and a potential reversal.

3. **Significance:**

- **Reversal Signal:** The pattern suggests a potential reversal in the market direction from bearish to bullish.

- **Confirmation:** Traders often wait for additional confirmation, such as an increase in volume or a follow-up bullish candlestick, to validate the pattern.

4. **Trading Strategy:**

- **Entry Point:** Enter a long position when the price closes above the high of the Piercing Line pattern or after a confirming bullish candle.

- **Stop-Loss:** Place a stop-loss order below the low of the Piercing Line pattern to manage risk.

- **Profit Target:** Set a profit target based on recent price swings or use technical indicators like moving averages to determine potential exit points.

5. **Risk Management:**

- **Market Context:** Always consider the broader market context and trend before relying solely on the Piercing Line pattern.

- **Volume Analysis:** Confirm the pattern with increased trading volume to ensure it’s not a false signal.

- **Diversification:** Avoid putting all capital into one trade. Diversify to manage overall risk.

6. **Common Mistakes:**

- **Ignoring Confirmation:** Trading solely based on the Piercing Line without confirmation can lead to losses. Confirmation helps ensure that the reversal is likely to be genuine.

- **Overtrading:** Frequent trading based on patterns without proper analysis can lead to increased transaction costs and potential losses.

7. **Conclusion:**

- The Piercing Line pattern can be a valuable tool for identifying potential reversals and entering bullish trades.

- Effective trading requires not just recognizing the pattern but also implementing sound risk management strategies and confirming signals with additional analysis.

-

#11 Collapse

Piercing Line candle pattern ek bullish reversal pattern hai jo do candles par mushtamil hota hai. Yeh pattern market ke downtrend mein paaya jaata hai aur isse agla trend reversal ka indication milta hai. Tafseelat mein:

First Candle: Yeh ek bearish candle hoti hai (red or black) jo ke market ka downtrend show karti hai. Yeh candle significant body ke sath close hoti hai aur neechay close hoti hai.

Second Candle: Yeh bullish candle hoti hai (green or white) jo ke pehli candle ke low ke neeche open hoti hai, magar iski closing pehli candle ke body ke halfway mark ko cross kar deti hai. Iska matlab hai ke doosri candle pehli candle ke mid-point se upar close hoti hai.

Conditions for Piercing Line Pattern:

Downtrend: Pattern sirf downtrend mein hi effective hota hai.

First Candle: Bearish (red or black) candle honi chahiye.

Second Candle: Bullish (green or white) candle honi chahiye jo pehli candle ke low se neeche open hoti hai aur uske body ke halfway mark se upar close hoti hai.

Interpretation:

Piercing Line pattern signify karta hai ke buyers market mein control hasil kar rahe hain aur price lower level se recover ho rahi hai. Is pattern ke baad, market mein bullish trend expect kiya jata hai.

Example:

Downtrend chal raha hai.

Ek lambi bearish candle form hoti hai.

Agle din, market low open hoti hai, magar buyers price ko push karke pehli candle ke midpoint se upar close kar dete hain.

Yeh pattern ek strong bullish signal hai, magar isse confirm karne ke liye dusre technical indicators ko bhi dekha ja sakta hai jaise volume, support, aur resistance levels.

Piercing Line pattern ko samajhne aur effectively use karne ke liye mazeed kuch cheezon ka khayal rakhna zaroori hai:

Volume

Piercing Line pattern ki strength tab mazeed barh jati hai jab doosri (bullish) candle ke formation ke dauran trading volume zyada hoti hai. Yeh indicate karta hai ke buyers ne strong interest liya hai aur price reversal ko support kar rahe hain.

Context

Is pattern ko dekhte waqt broader market context ko bhi dekhna chahiye. Yeh pattern agar ek strong support level ke aas-paas banta hai, toh iska bullish signal aur bhi strong ho jata hai.

Confirmation

Piercing Line pattern ke baad ek aur bullish candle ka formation is pattern ko confirm kar sakta hai. Yeh confirmation traders ko zyada confidence deta hai ke market trend ab bullish side par move karne wala hai.

Limitations

Jese har candlestick pattern ke kuch limitations hote hain, waise hi Piercing Line pattern ke bhi hain:

False Signals: Yeh pattern kabhi kabhi false signals bhi de sakta hai, especially agar doosri candle ke volume kam ho.

Timeframe: Different timeframes par is pattern ki reliability change ho sakti hai. Longer timeframes par yeh pattern zyada reliable hota hai.

Practical Example

Suppose, aapke paas ek stock hai jo continuous downtrend mein hai:

Pehla din, stock ek lambi red candle banata hai jo strong bearish sentiment ko show karta hai.

Agle din, stock previous day ke low se neeche open hota hai, magar buying pressure ki wajah se stock mid-point se upar close hota hai, ek green candle banata hai.

Yeh Piercing Line pattern ka formation hua. Agar next day bhi stock ek green candle banata hai, toh yeh confirmation signal hota hai ke market ab bullish side par move karne ko tayaar hai.

Strategy

Entry Point: Piercing Line pattern ke baad agle trading session mein bullish confirmation milne par entry le sakte hain.

Stop Loss: Pehli (bearish) candle ke low ke neeche stop loss set kar sakte hain.

Target: Risk-reward ratio ko madde nazar rakhte hue apna profit target set kar sakte hain.

Is tarah Piercing Line pattern ko effectively use karke aap trading decisions le sakte hain aur apni trading strategy ko enhance kar sakte hain.

- CL

- Mentions 0

-

سا0 like

-

#12 Collapse

Trading at Piercing Line Candles pattern ek candlestick pattern hai jo typically downtrend ke baad reversal signal provide karta hai. Ye do candlesticks se bana hota hai:- First Candle: Ye ek bearish (girawat ki taraf jaane wala) candle hota hai jo downtrend ko reflect karta hai.

- Second Candle: Ye bullish (bhagwan ki taraf jaane wala) candle hota hai jo pehle candle ke neeche shuru hota hai aur uski kareeb half range mein close hota hai. Ye bullish candle, downtrend ke reversal ko indicate karta hai.

Is pattern ko istemal karne ke liye aap ye steps follow kar sakte hain:- Identify Downtrend: Pehle toh aapko ek clear downtrend identify karna hoga. Yeh pattern sirf downtrend ke baad effective hota hai.

- Look for Piercing Line Pattern: Jab aap downtrend identify kar lete hain, tab aapko ek Piercing Line pattern dhoondhna hoga. Iske liye second candle ka close pehle candle ke 50% se zyada upar hona chahiye.

- Confirmation: Trading decisions ko confirm karne ke liye, aap dusre indicators jaise ki volume, trend lines, aur oscillators ka bhi istemal kar sakte hain.

- Entry and Exit Points: Agar aapko Piercing Line pattern milta hai, toh aap long position enter kar sakte hain. Stop-loss order ko pehle candle ke low ke thoda neeche lagana chahiye aur profit target ko resistance levels ya dusre technical analysis tools se decide kar sakte hain.

Is tarah se, Piercing Line pattern ki madad se aap downtrend ke reversal points ko identify kar sakte hain aur trading strategies ko develop kar sakte hain.

Mujhe ummed ha ka ya malomat app ke liey helpfull Rahi hogi -

#13 Collapse

**Trading at Piercing Line Candlestick Pattern**

**Piercing Line** candlestick pattern ek bullish reversal pattern hai jo downtrend ke baad formation hota hai aur market mein upward reversal ka signal provide karta hai. Yeh pattern traders ko potential buying opportunities identify karne mein madad karta hai. Aayein, is pattern ki details aur trading strategy ko samjhte hain.

### **Piercing Line Candlestick Pattern Kya Hai?**

Piercing Line pattern do candlesticks se milkar banta hai:

1. **First Candlestick - Bearish Candle:**

- **Description:** Pehli candlestick ek strong bearish (red/black) candle hoti hai jo previous session mein lower close ke sath strong downward movement ko represent karti hai.

- **Characteristics:** Is candlestick ki body lambi hoti hai aur yeh market ke bearish sentiment ko dikhati hai.

2. **Second Candlestick - Bullish Candle:**

- **Description:** Dusri candlestick ek bullish (green/white) candle hoti hai jo pehli candlestick ke close price ke neeche open hoti hai aur iski closing price pehli candlestick ke body ke beech mein hoti hai.

- **Characteristics:** Is candlestick ka body pehli candlestick ke body ke approximately half se zyada cover karti hai. Yeh upward reversal aur buying pressure ko indicate karta hai.

### **Pattern Ki Pehchan:**

1. **Formation:**

Piercing Line pattern tab form hota hai jab pehli candlestick strong bearish movement ko dikhati hai aur dusri candlestick us bearish candle ko ek upward gap ke sath open hoti hai aur pehli candlestick ke half se zyada body ko cover karti hai.

2. **Market Sentiment:**

- **Bearish to Bullish Reversal:** Pehli candlestick bearish sentiment ko dikhati hai jabke dusri candlestick bullish sentiment ko represent karti hai. Is combination ka market mein reversal ka indication hota hai.

3. **Confirmation:**

- **Volume Analysis:** Volume analysis pattern ke confirmation ke liye zaroori hai. Agar dusri candlestick ke formation ke dauran volume high hai, to pattern ki reliability aur accuracy increase hoti hai.

- **Subsequent Movement:** Pattern ke formation ke baad, agar market bullish movement continue karti hai aur pehli candlestick ke high ko break karti hai, to pattern ka confirmation milta hai.

### **Trading Implications:**

1. **Entry Point:**

- **Post-Pattern Formation:** Entry point usually second candlestick ke closure ke baad hota hai. Jab second candlestick bullish closing price ke sath finish hoti hai aur market upward movement ko continue karti hai, to buy position initiate ki ja sakti hai.

2. **Stop-Loss:**

- Stop-loss ko pehli candlestick ke low ke thoda niche set karein. Yeh aapko potential false signals aur unexpected price movements se protect karega.

3. **Take-Profit:**

- Take-profit level ko pattern ke height ke equal distance par set karein. Yeh target aapko potential profits ko secure karne mein madad karta hai. Traders resistance levels aur previous highs ko bhi consider kar sakte hain.

4. **Volume Analysis:**

- High volume ke sath pattern ki formation aur confirmation pattern ki reliability ko enhance karta hai. Agar volume low hai, to pattern ke signal ki strength kam ho sakti hai.

### **Advantages aur Limitations:**

**Advantages:**

- Piercing Line pattern market ke potential bullish reversals ko accurately predict karta hai.

- Pattern clear entry aur exit points provide karta hai.

- Effective risk management aur profit-taking ko enable karta hai.

**Limitations:**

- Pattern false signals generate kar sakta hai agar market conditions volatile hain.

- Pattern ko accurately identify karna challenging ho sakta hai, especially jab market me consolidation ya choppy conditions hain.

- Over-reliance on single pattern trading performance ko negatively impact kar sakti hai.

### **Conclusion:**

Piercing Line candlestick pattern Forex aur financial markets mein ek valuable bullish reversal tool hai jo market ke potential upward trend ko indicate karta hai. Is pattern ko accurately identify karke aur effectively trade karke, traders high probability trades execute kar sakte hain aur potential profits ko maximize kar sakte hain. Proper risk management aur confirmation signals ka use karke, Piercing Line pattern aapki overall trading performance ko enhance kar sakta hai. Market conditions ka continuous review aur analysis zaroori hai taake aap pattern ki effectiveness ko best use kar sakein.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#14 Collapse

Trading at Piercing Line Candles Pattern

Trading mein bohot se candle patterns hain jo traders ko market ke sentiment aur potential price reversals ka signal dete hain. Unme se aik mashhoor pattern "Piercing Line" hai. Ye pattern bullish reversal ke signal ke tor par use hota hai aur mostly downtrend ke baad nazar aata hai.

Piercing Line Candle Pattern Kya Hai?

Piercing Line Candle Pattern do candles par mushtamil hota hai. Pehli candle bearish hoti hai jo ke niche close hoti hai. Dusri candle bullish hoti hai jo pehli candle ke low se niche open hoti hai magar uska close pehli candle ke body ke beech ke upar hota hai. Ye bullish candle agar pehli candle ke body ke 50% se zyada cover karay to ye pattern aur bhi strong mana jata hai.

Pattern Ka Formation

Is pattern ka formation kuch is tarah hota hai:- Pehli Candle: Pehli candle bearish hoti hai jo ke downtrend ko continue karti hai.

- Dusri Candle: Dusri candle pehli candle ke low se niche open hoti hai lekin uska close pehli candle ke body ke beech ya usse upar hota hai.

Piercing Line Candle Pattern Ka Signal

Ye pattern batata hai ke sellers apni strength kho rahe hain aur buyers market mein wapas aa rahe hain. Is pattern ka signal ye hota hai ke market downtrend se uptrend ki taraf move karne wala hai.

Trading Strategy

Piercing Line Candle Pattern ko trading mein use karte waqt kuch points ka khayal rakhna chahiye:- Confirmation: Hamesha confirmation ka intezar karein. Iska matlab hai ke agle din ki candle bullish honi chahiye.

- Stop Loss: Stop loss ko pehli candle ke low ke niche lagayein. Ye is liye zaroori hai taake agar market aapke against jaye to aapko bara nuksaan na ho.

- Entry Point: Entry point dusri candle ke close ke baad ho sakta hai. Agar confirmation mil jaye to entry us point par karein.

Risk Management

Risk management trading ka aik aham hissa hai. Piercing Line Candle Pattern ko follow karte waqt apne risk ko hamesha manage karna chahiye. Apne total capital ka aik chota hissa trade mein lagayein aur apne stop loss ko strictly follow karein.

Conclusion

Piercing Line Candle Pattern aik powerful bullish reversal pattern hai jo ke traders ko downtrend ke baad potential uptrend ke signal deta hai. Is pattern ko use karte waqt confirmation, proper entry aur risk management ka khayal rakhna zaroori hai. Trading mein hamesha market ka analysis karein aur apne trading plan par amal karein.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 05:16 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим