How to use net volume in trade

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

What a great many people di candle stick Badariya candlest Aam kya kar sakte hain kya ruzan badhta hai to Jyada jayaj Rahega lekin kya yah Aisi chijen Nahin Hai Jiska aap kimat Jaat se Najar Laga sakte hain matlab Khali Sujan aapko start ke ruzan ya zero Altaf break out ke Asal Niyat ki chunav karne mein madad karta hai agar Kuchh Bhi Hai To kimat ki karyvahi kon't understand is that there is an unfamiliar trade market - or 'Forex' for short - where you might possibly benefit from the development of these monetary standards. The most popular model is George Soros who made a billion bucks in a day by exchanging monetary standards. Know, notwithstanding, that money exchanging implies critical gamble and people can lose a significant piece of their venture. As advancements have improved, the Forex market has become more open bringing about a phenomenal development in web based exchanging. An extraordinary aspect regarding exchanging monetary standards presently is that you never again must be a major cash chief to exchange thi How to use net volume in trade e baray mein maloomat faraham karta loomat faraham karta hai. Agar net volume positive hai, toh iska matlab hai ke buyers dominate kar rahay hain aur market mein bullish trend hai. Jab net volume negative hai, toh iska matlab hai ke sellers dominate kar rahay hain aur market mein bearish trend hai.Net volume indicator, trading decisions mein madad kar sakta hai, lekin iska istemal kisi bhi trading strategy ke sath karne se pehle mukammal tajurba aur samajh hona chahiye.Forex me "Net Volume Indicator" ek aisa technical indicator hai jo market mein trade hote hue total buy aur sell volumes ka antar (difference) dikhata hai. Is indicator ki madad se aap market sentiment aur price movement ko samajh sakte hain.Net Volume Indicator ka upyog karke traders volume ke basis par trading decisions lete hain. Agar net volume positive hai, yani buy volumes sell volumes se adhik hain, toh iska matlab hai ki market mein uptrend ho sakta hai aur traders buy positions le sakte hain. Vaise hi, agar net volume negative hai, yani sell volumes buy volumes se adhik hain, toh iska matlab hai ki market mein downtrend ho sakta hai aur traders sell positions le sakte hain. Agar net volume positive hai, toh iska matlab hai ke purchasers rule kar rahay hain aur market mein bullish pattern hai. Poke net volume negative hai, toh iska matlab hai ke venders overwhelm kar rahay hain aur market mein negative pattern hai.Net volume marker, exchanging choices mein madad kar sakta hai, lekin iska istemal kisi bhi exchanging system ke sath karne se pehle mukammal tajurba aur samajh hona chahiye.Forex me "Net Volume Pointer" ek aisa specialized pointer hai jo market mein exchange hote tone all out purchase aur sell volumes ka antar (distinction) dikhata hai. Is marker ki madad se aap market feeling aur cost developm -

#3 Collapse

The most effective method to involve net volume in exchange What a considerable number individuals di candle Badariya candlest Aam kya kar sakte hain kya ruzan badhta hai to Jyada jayaj Rahega lekin kya yah Aisi chijen Nahin Hai Jiska aap kimat Jaat se Najar Laga sakte hain matlab Khali Sujan aapko start ke ruzan ya zero Altaf break out ke Asal Niyat ki chunav karne mein madad karta hai agar Kuchh Bhi Hai To kimat ki karyvahi kon't comprehend is that there is a new exchange market - or 'Forex' for short - where you could profit from the improvement of these money related principles. The most famous model is George Soros who made a billion bucks in a day by trading financial norms. Know, regardless, that cash trading infers basic bet and individuals can lose a huge piece of their endeavor. As progressions have improved, the Forex market has become more open achieving an extraordinary improvement in online trading. A remarkable viewpoint with respect to trading financial principles as of now is that you at absolutely no point in the future should be a significant money boss to trade thi The most effective method to involve net volume in exchange e baray mein maloomat faraham karta loomat faraham karta hai. Agar net volume positive hai, toh iska matlab hai ke purchasers rule kar rahay hain aur market mein bullish pattern hai. Poke net volume negative hai, toh iska matlab hai ke dealers overwhelm kar rahay hain aur market mein negative pattern hai.Net volume pointer, exchanging choices mein madad kar sakta hai, lekin iska istemal kisi bhi exchanging procedure ke sath karne se pehle mukammal tajurba aur samajh hona chahiye.Forex me "Net Volume Marker" ek aisa specialized marker hai jo market mein exchange hote tint all out purchase aur sell volumes ka antar (distinction) dikhata hai. Is marker ki madad se aap market opinion aur cost development ko samajh sakte hain.Net Volume Pointer ka upyog karke brokers volume ke premise standard exchanging choices lete hain. Agar net volume positive hai, yani purchase volumes sell volumes se adhik hain, toh iska matlab hai ki market mein upturn ho sakta hai aur merchants purchase positions le sakte hain. Vaise hey, agar net volume negative hai, yani sell volumes purchase volumes se adhik hain, toh iska matlab hai ki market mein downtrend ho sakta hai aur brokers sell positions le sakte hain. Agar net volume positive hai, toh iska matlab hai ke buyers rule kar rahay hain aur market mein bullish example hai. Jab net volume negative hai, toh iska matlab hai ke sellers overpower kar rahay hain aur market mein negative example hai.Net volume marker, trading decisions mein madad kar sakta hai, lekin iska istemal kisi bhi trading framework ke sath karne se pehle mukammal tajurba aur samajh hona chahiye.Forex me "Net Volume Pointer" ek aisa specific pointer hai jo market mein trade hote tone hard and fast buy aur sell volumes ka antar (qualification) dikhata hai. -

#4 Collapse

The best technique to include net volume in return What an extensive number people di flame Badariya candlest Aam kya kar sakte hain kya ruzan badhta hai to Jyada jayaj Rahega lekin kya yah Aisi chijen Nahin Hai Jiska aap kimat Jaat se Najar Laga sakte hain matlab Khali Sujan aapko start ke ruzan ya zero Altaf break out ke Asal Niyat ki chunav karne mein madad karta hai agar Kuchh Bhi Hai To kimat ki karyvahi kon't fathom is that there is another trade market - or 'Forex' for short - where you could benefit from the improvement of these cash related standards. The most well known model is George Soros who made a billion bucks in a day by exchanging monetary standards. Know, notwithstanding, that money exchanging induces essential bet and people can lose an enormous piece of their undertaking. As movements have improved, the Forex market has become more open accomplishing a phenomenal improvement in web based exchanging. A momentous perspective concerning exchanging monetary standards at this point is that you at definitely no point in the future ought to be a critical cash manager to exchange thi The best technique to include net volume in return e baray mein maloomat faraham karta loomat faraham karta hai. Agar net volume positive hai, toh iska matlab hai ke buyers rule kar rahay hain aur market mein bullish example hai. Jab net volume negative hai, toh iska matlab hai ke vendors overpower kar rahay hain aur market mein negative example hai.Net volume pointer, trading decisions mein madad kar sakta hai, lekin iska istemal kisi bhi trading technique ke sath karne se pehle mukammal tajurba aur samajh hona chahiye.Forex me "Net Volume Marker" ek aisa specific marker hai jo market mein trade hote color full scale buy aur sell volumes ka antar (differentiation) dikhata hai. Is marker ki madad se aap market assessment aur cost improvement ko samajh sakte hain.Net Volume Pointer ka upyog karke specialists volume ke premise standard trading decisions lete hain. Agar net volume positive hai, yani buy volumes sell volumes se adhik hain, toh iska matlab hai ki market mein upswing ho sakta hai aur traders buy positions le sakte hain. Vaise hello, agar net volume negative hai, yani sell volumes buy volumes se adhik hain, toh iska matlab hai ki market mein downtrend ho sakta hai aur intermediaries sell positions le sakte hain. Agar net volume positive hai, toh iska matlab hai ke purchasers rule kar rahay hain aur market mein bullish model hai. Punch net volume negative hai, toh iska matlab hai ke dealers overwhelm kar rahay hain aur market mein negative model hai.Net volume marker, exchanging choices mein madad kar sakta hai, lekin iska istemal kisi bhi exchanging structure ke sath karne se pehle mukammal tajurba aur samajh hona chahiye.Forex me "Net Volume Pointer" ek aisa explicit pointer hai jo market mein exchange hote tone firm purchase aur sell volumes ka antar (capability) dikhata hai. -

#5 Collapse

Assalamualaikum! Umeed hai k ap sb khariyat sy hongy. R apky trading sessions achy jaa rhy hongy.Aj ka hmra or discussion topic "Net volume in trade". Dekhty hain k ye hmein Kya information deta hai r hmry ilam Mai Kesy ezafa krta hai. Introduction net volume aik technical indicator hai jis ka hisaab aik sy makhsoos muddat mein security ke koi volume ko is ke to down tik volume se ghata kar kya jata hai. mayaari hajam ke bar aks, isharay farq karta hai ke aaya market ka jazba taizi ki taraf hai ya mandi ki taraf. khalis hajam ko aam tor par qeemat ke chart ke neechay plot kya jata hai jis mein har muddat ke liye salakhon ke sath is muddat ke liye to khalis hajam parhnay ki nishandahi hoti hai. Understanding net volume ko traders mayaari hajam ke istemaal se hatt kar market ke jazbaat ka andaza laganay ke liye istemaal karte hain. misbet khalis volume se pata chalta hai ke to security ko taizi se bherne ka saamna hai, jab ke manfi sy khalis volume batata hai ke security mein mandi ke utaar charhao ka saamna hai. misaal ke tor par, farz karen ke aik bareek tijarat shuda stock ne 200 hasas ke aik tukre par paanch neechay ki tijarat ka tajurbah kya, kal paanch feesad neechay, aur aik oopar ki tijarat 10, 000 hasas par, stock ko teen feesad oopar le gaya. stock do feesad kam ho sakta hai, lekin khalis hajam misbet 9, 000 hota, jis se andaza hota hai ke satah ke neechay waqai taizi rahi hai . Comparing Net volume khalis hajam bohat se dosray momentum andikitrz se koi milta jalta hai jo mukhtalif deegar awamil ke sath hajam ko bhi dekhte hain. un deegar isharay ke bar aks, khalis hajam khaas tor par aik hi time frame ke hajam par nazar aata hai. misaal ke tor par, khalis hajam money flow index se milta jalta hai, is mein dono takneeki isharay kisi di gayi security mein market ki dilchaspi ki pemaiesh karte hain, lekin mfi sirf hajam ko dekhnay ke bajaye khareed o koi to farokht ke dabao ki pemaiesh karne ke liye qeemat aur es hajam dono ka istemaal karta hai. net volume bhi balance volume se milta jalta hai, is mein dono takneeki isharay hajam ki tabdeelion ko dekhte hain, lekin obv kisi aik sy waqfay ko dekhnay ke bajaye waqt ke sath sath oopar sy walay dinon aur neechay walay dinon mein hajam mein sy izafah karta hai. deegar asharie, jaisay rishta daar taaqat ka asharih, baseerat faraham karne ke liye naffa ya koi to bhe to nuqsaan ki shiddat ko dekhte hain. bohat se tajir mawaqay ka tajzia karte waqt khalis hajam ke muqablay ziyada paicheeda raftaar ke isharay istemaal karte hain, lekin yeh ab bhi baaz sooraton mein kirdaar ada kar sakta hai jahan tajir sirf aik muddat ko dekhnay ki zaroorat hai . -

#6 Collapse

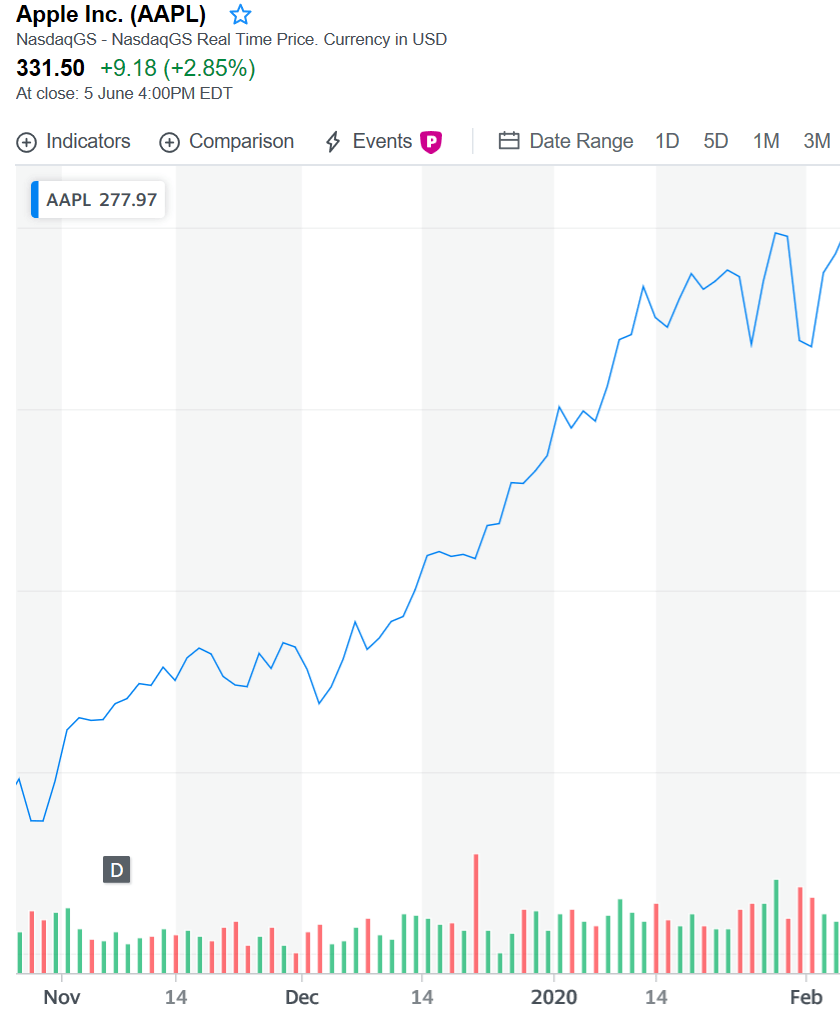

Assalamualaikum! Umeed hai k ap sb khariyat sy hongy. R apky trading sessions achy jaa rhy hongy.Aj ka hmra discussion topic "How to use net volume in trade". Dekhty hain k ye hmein Kya information deta hai r hmry ilam Mai Kesy ezafa krta hai. How to use net volume in trade Net volume aik technical indicator hai jis ka hisaab aik makhsoos muddat mein security ke optic volume ko is ke down tik volume se ghata kar kya jata hai. mayaari hajam ke bar aks, isharay farq karta hai ke aaya market ka jazba taizi ki taraf hai ya mandi ki taraf. khalis volume ko aam tor par qeemat ke chart ke neechay har muddat ke liye salakhon ke sath plot kya jata hai jo is muddat ke liye khalis hajam parhnay ki nishandahi karta hai. Explanation: Net volume ko traders mayaari hajam ke istemaal se hatt kar market ke jazbaat ka andaza laganay ke liye istemaal karte hain. misbet khalis volume se pata chalta hai ke security ko taizi se bherne ka saamna hai, jab ke manfi khalis volume batata hai ke security mein mandi ke utaar charhao ka saamna hai. misaal ke tor par, farz karen ke aik bareek tijarat shuda stock ne 200 hasas ke aik tukre par paanch neechay ki tijarat ka tajurbah kya, kal paanch feesad neechay, aur aik oopar ki tijarat 10, 000 hasas par, stock ko teen feesad oopar le gaya. stock do feesad kam ho sakta hai, lekin khalis hajam misbet 9, 000 hota, jis se andaza hota hai ke satah ke neechay waqai taizi rahi hai. khalis hajam ka hisaab kisi stock ke hajam mein izafay ( qeemat bherne par tijarat kiye jane walay hasas ki tadaad ) ko is ke hajam mein kami ( qeemat ke kam honay par tijarat kiye gaye hasas ki tadaad ) se ghata kar lagaya jata hai. khalis hajam ka hisaab aik makhsoos muddat mein kya jata hai. Usage: Tijarat mein khalis hajam ka istemaal kaisay karen? bohat se tajir mumkina mawaqay ki talaash mein takneeki isharay aur chart patteren samait takneeki tajzia ki deegar aqsam ke sath mil kar khalis hajam ka istemaal karte hain. misaal ke tor par, tajir is baat ka taayun kar satke hain ke stock aik ahem muzahmati satah se nikla hai aur phir khalis hajam ko dekh kar yeh taayun kar satke hain ke is iqdaam ke peechay khareed ka kitna dabao hai aur agar agay bherne mein kaafi raftaar hai. Example: Yahan khalis hajam dikhaane walay chart ki aik misaal hai: -

#7 Collapse

The most effective method to involve net volume in exchange What a large number individuals di candle Badariya candlest Aam kya kar sakte hain kya ruzan badhta hai to Jyada jayaj Rahega lekin kya yah Aisi chijen Nahin Hai Jiska aap kimat Jaat se Najar Laga sakte hain matlab Khali Sujan aapko start ke ruzan ya zero Altaf break out ke Asal Niyat ki chunav karne mein madad karta hai agar Kuchh Bhi Hai To kimat ki karyvahi kon't comprehend is that there is a new exchange market - or 'Forex' for short - where you could profit from the improvement of these money related guidelines. The most well known model is George Soros who made a billion bucks in a day by trading financial norms. Know, regardless, that cash trading infers basic bet and individuals can lose a huge piece of their endeavor. As headways have improved, the Forex market has become more open achieving an extraordinary advancement in online trading. An unprecedented perspective in regards to trading money related principles as of now is that you at absolutely no point in the future should be a significant money boss to trade thi The most effective method to involve net volume in exchange e baray mein maloomat faraham karta loomat faraham karta hai. Agar net volume positive hai, toh iska matlab hai ke purchasers overwhelm kar rahay hain aur market mein bullish pattern hai. Hit net volume negative hai, toh iska matlab hai ke dealers rule kar rahay hain aur market mein negative pattern hai.Net volume pointer, exchanging choices mein madad kar sakta hai, lekin iska istemal kisi bhi exchanging technique ke sath karne se pehle mukammal tajurba aur samajh hona chahiye.Forex me "Net Volume Marker" ek aisa specialized marker hai jo market mein exchange hote tone all out purchase aur sell volumes ka antar (distinction) dikhata hai. Is marker ki madad se aap market feeling aur cost development ko samajh sakte hain.Net Volume Pointer ka upyog karke brokers volume ke premise standard exchanging choices lete hain. Agar net volume positive hai, yani purchase volumes sell volumes se adhik hain, toh iska matlab hai ki market mein upturn ho sakta hai aur brokers purchase positions le sakte hain. Vaise hey, agar net volume negative hai, yani sell volumes purchase volumes se adhik hain, toh iska matlab hai ki market mein downtrend ho sakta hai aur merchants sell positions le sakte hain. Agar net volume positive hai, toh iska matlab hai ke buyers rule kar rahay hain aur market mein bullish example hai. Jab net volume negative hai, toh iska matlab hai ke sellers overpower kar rahay hain aur market mein negative example hai.Net volume marker, trading decisions mein madad kar sakta hai, lekin iska istemal kisi bhi trading framework ke sath karne se pehle mukammal tajurba aur samajh hona chahiye.Forex me "Net Volume Pointer" ek aisa specific pointer hai jo market mein trade hote tone hard and fast buy aur sell volumes ka antar (differentiation) dikhata hai. -

#8 Collapse

Definition of Net Volume in Forex:

Forex market mein, net volume woh puri raqam hai jo kisi khaas transaction mein khareedi jati hai aur bechi jati hai, jisme kisi bhi muqabil trade ko kam kiya jata hai. Ye metric forex market mein trading activity ka haqeeqi volume napa karnay ke liye istemal hota hai, jabkay gross volume dono khareedne aur bechne ki activity ko shamil karta hai.

Measuring Market Liquidity with Net Volume:

Net volume kai wajahon se aham hai. Pehle to, ye forex market mein haqeeqi trading activity ka zyada sahi tasawwur farahem karta hai. Gross volume gumraah kun ho sakta hai kyun ke isme khareedne aur bechne dono activities shamil hain, jiski wajah se haqeeqi trading activity ka sahi level maloom karna mushkil ho sakta hai. Jabke net volume dusri taraf haqeeqi rakam farahem karta hai jo currency ki asal trading mein mubadala hoti hai.

Dusri baat, net volume market ki liquidity ka faida mand indicator hai. Liquidity ye batati hai ke kisi cheez ko itna aasani se khareedna ya bechna kitna mumkin hai bina keemat par kisi bhi tarah ka asar daalay. Forex market mein, zyada net volume high liquidity ki taraf ishara karta hai, kyun ke yahan bahut se khareedar aur bechne wale ek diye gaye rate par trade karne ke liye tayyar hote hain. Ye traders ke liye asaan bana sakta hai ke woh apni positions mein dakhil ho saken ya nikal saken, kyun ke unhe kisi bhi aham price change ka khatra kam hota hai.

Teesri baat, net volume trading activity ke trends ko pehchanne ke liye istemal ho sakta hai. Maan lijiye, agar net volume waqtan-fa-waqt barh raha hai, to ye ishara ho sakta hai ke forex market mein trading activity bhi barh rahi hai. Ulti sthiti mein, agar net volume waqtan-fa-waqt kam ho raha hai, to ye ishara ho sakta hai ke trading activity mein kami ho rahi hai. Ye malumat traders ke liye faydemand ho sakti hai jo market mein trends ko pehchan kar apne trading strategies ke bare mein maqool faislay lene ki koshish kar rahe hain.

Chothi baat, net volume arbitrage ke liye potenital mauqay ko pehchanne ke liye istemal kiya ja sakta hai. Arbitrage ka matlab hota hai ek hi samay mein ek asset ko alag-alag markets mein khareedna aur bechna, taki keemat mein farq se munafa hasil ho. Forex market mein, arbitrageurs net volume data ka istemal kar sakte hain taake woh aise currency pairs ko pehchan saken jahan alag-alag markets mein net volume mein farq ho.

Panchvi baat, net volume forex market mein trading ke sath juri khatraat ko pehchanna ke liye istemal kiya ja sakta hai. Maan lijiye, agar kisi currency pair ke liye net volume hamesha kam rehta hai, to ye ishara ho sakta hai ke us market mein liquidity kam hai, jisse positions mein dakhil ho kar nikalna mushkil ho sakta hai aur price slippage ka khatra zyada ho sakta hai. Ulti sthiti mein, agar kisi currency pair ke liye net volume hamesha zyada rehta hai, to ye ishara ho sakta hai ke us market mein liquidity zyada hai, jisse positions mein dakhil ho kar nikalna asaan ho sakta hai aur price slippage ka khatra kam ho sakta hai.

EUR/USD Currency Pair and Net Volume:

In concepts ko ek example ke sath samajhne ke liye EUR/USD currency pair ko lete hain. Socho ek khaas din par, is currency pair ka gross volume $100 billion hai. Lekin maan lo ke is gross volume mein se $20 billion offsetting trades ko mubadala karte hain yaani, jab ek trader currency khareedta hai aur phir usko turant bechta hai. Is case mein, is currency pair ka net volume $80 billion hoga $100 billion - $20 billion. Ye gross volume se zyada haqeeqi trading activity ko darust dikhata hai.

Ab socho ke waqtan-fa-waqt hum dekhte hain ke is currency pair ka net volume hamesha barh raha hai. Ye ishara ho sakta hai ke is market mein trading activity bhi barh rahi hai. Ya phir, socho ke hum dekhte hain ke is currency pair ka net volume hamesha kam rehta hai. Ye ishara ho sakta hai ke is market mein liquidity kam hai aur is pair mein trading karne ke sath zyada khatra hai. Net volume data ko waqtan-fa-waqt moniter karte hue, traders apne trading strategies ke bare mein maqool faislay kar sakte hain aur forex market mein trading ke sath juri khatraat ko kam karne ka tareeqa tajaweez kar sakte hain.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#9 Collapse

INTRODUCTION

Forex trading mein, net volume ek particular pair ka buy aur sell orders ka total volume hota hai. Yah ek important metric hai jo traders ko market ki strength aur direction samajhne mein madad karta hai.

How to work

Net volume ko calculate karne ke liye, aap buy orders ka volume subtract karke sell orders ka volume karte hain. Agar net volume positive hai, to yah is baat ki nishan hai ki market mein buying pressure hai. Agar net volume negative hai, to yah is baat ki nishan hai ki market mein selling pressure hai.

Net volume ko forex charts mein bhi dekha ja sakta hai. Yahan, yah ek indicator ki tarah hota hai jo ek line mein represent kiya jata hai. Net volume indicator ki line ka direction market ki direction ko reflect karta hai.

Net volume ka use forex trading mein ek variety of purposes ke liye kiya ja sakta hai. Yah traders ko market mein entry aur exit points ko identify karne mein madad kar sakta hai. Yah traders ko market ki sentiment ko samajhne mein bhi madad kar sakta hai.

Yahan kuchh specific examples hain ki kaise net volume ka use forex trading mein kiya ja sakta hai:- Agar net volume increasing hai, to yah is baat ki nishan hai ki market mein buying pressure badh raha hai. Yahan, traders market mein long positions lena chah sakte hain.

- Agar net volume decreasing hai, to yah is baat ki nishan hai ki market mein selling pressure badh raha hai. Yahan, traders market mein short positions lena chah sakte hain.

- Agar net volume zero par hai, to yah is baat ki nishan hai ki market mein koi clear direction nahi hai. Yahan, traders market mein positions lena se bachna chah sakte hain.

Net volume ek powerful tool hai jo traders ko forex trading mein behtar decisions lene mein madad kar sakta hai. Agar aap forex trading mein serious hain, to aapko net volume ka use karna seekhna chahiye.

Yahan kuchh tips hain jo aapko forex mein net volume ka use karne mein madad kar sakti hain:- Net volume ko multiple time frames mein dekhen. Yah aapko market ki long-term aur short-term trends ko samajhne mein madad karega.

- Net volume ko other technical indicators ke sath use karen. Yah aapko behtar trading decisions lene mein madad karega.

- Net volume ko apne own trading style ke sath match karen. Yah aapko apne trading goals ko achieve karne mein madad karega.

Dear friends aaj ka hamara topic bahut jyada informitive tha ummid karta Hun ki aapko Mera topic bahut achcha Laga Hoga hamari koshish hoti hai ki Ham acche se achcha knowledge aap logon ke sath share Karen Taki aap trading mein achcha profit hasil kar sake -

#10 Collapse

How to use net volume in trade

Net Volume aur Tijarat Mein Iska Istemal

Net volume ek ahem maeeshat aur tijarat tanazur mein istemal hone wala ek muddat hai. Ye malumat aam taur par har ek tijarat karne wale ke liye zaroori hai taake woh apni transactions ko sahi taur par samajh sake aur behtar faislay kar sake. Is article mein, hum net volume ke tijarat mein istemal ki tafseelat par ghaur karenge aur samjhenge ke iska kya ahmiyat hai.

Net Volume Kya Hai?

Net volume ek business term hai jo tijarat mein mal o asbaab ki taadaad aur maayariyat ko darust karne mein istemal hoti hai. Ye term tijarat mein mal o asbaab ki fiqriyat aur tadad ko shumar karne ke liye istemal hota hai. Net volume ka tajziya karke, ek shakhs ya company apni kharid o farokht ki transactions ko behtar taur par samajh sakta hai.

Net Volume aur Tijarat

Tijarat mein, net volume ka istemal asal mal aur asbaab ki taadaad ko shumar karne ke liye hota hai. Har ek transaction mein, mal o asbaab ki muddat aur qeemat ka pata lagana zaroori hota hai. Net volume is muddat aur qeemat ka aik jumla hai jo ek specific waqt mein tijarat mein mojood mal o asbaab ko darust taur par darust karne mein madadgar hota hai.

Kharidari aur Farokht Mein Net Volume

Net volume ka istemal kharidari aur farokht ke doran hota hai. Jab koi shakhs kisi mal ya asbaab ko khareedta hai, to uski net volume maloom hoti hai jo usne khareeda. Isi tarah, jab koi mal ya asbaab bechta hai, to uski net volume woh mal ya asbaab hoti hai jo usne becha. Ye malumat tijarat mein saafhi aur safai ko barqarar rakhne mein madadgar hoti hai.

Net Volume aur Hisaab Kitab

Net volume ka istemal hisaab kitab mein bhi hota hai. Ek tijarat karne wale ko apni hisaab kitab ko behtar taur par chalane ke liye net volume ka tajziya karna chahiye. Iske zariye woh apne stock levels ko monitor kar sakta hai aur sahi waqt par sahi maal khareed sakta hai. Hisaab kitab mein net volume ki sahi darustagi, tijarat mein asani aur saafhi ko barqarar rakhne mein madadgar hoti hai.

Net Volume ka Ahmiyat

Net volume ka hona tijarat mein ek ahem hissa hai, aur iski ahmiyat kuch is tarah se hai:

1. Stock Management

Net volume ka tajziya karke tijarat karne wale apne stock levels ko behtar taur par manage kar sakte hain. Woh maloomat hasil kar sakte hain ke kitni quantity mein mal mojood hai aur kitni quantity mein mal khareedna ya bechna chahiye.

2. Risk Management

Net volume ki madad se, tijarat karne wale apne business mein hone wale risk ko samajh sakte hain. Agar unke paas zyada stock hai, toh woh samajh sakte hain ke kaise isko behtar taur par istemal kiya ja sakta hai.

3. Financial Planning

Net volume ke istemal se, financial planning mein asani hoti hai. Tijarat karne wale apne aane wale waqt ke liye sahi maal o asbaab ko arrange kar sakte hain aur apni tijarat mein behtar taur par nigrani rakh sakte hain.

4. Transactional Accuracy

Net volume ki sahi darustagi se, transactions mein hone wali ghalatiyon ka khatima hota hai. Tijarat mein hisaab kitab mein hone wale mistakes se bachne ke liye net volume ka istemal zaroori hai.

Net Volume ka Istemal Kaise Karein?

Net volume ka istemal karne ke liye, tijarat karne wale ko kuch steps follow karne chahiye:

1. Record Keeping

Tijarat karne wale ko har transaction ko darust taur par record rakhna chahiye. Ye record keeping kaam ke transactions ko monitor karne mein madad karti hai.

2. Regular Analysis

Net volume ko regular intervals par analyze karna chahiye. Isse tijarat karne wale apne business trends ko samajh sakte hain aur behtar faislay kar sakte hain.

3. Technology ka Istemal

Hisaab kitab aur net volume ko maintain karne mein technology ka istemal karna bhi ahem hai. Modern software aur tools ka istemal karke, tijarat karne wale apne data ko aasani se manage kar sakte hain.

Misali Tor Par Net Volume ka Istemal

Chaliye ek misali tor par samajhte hain ke net volume ka istemal kaise hota hai. Maan lijiye koi electronics store chala raha hai. Agar usne ek mahine mein 1000 mobile phones khareede hain aur 500 mobile phones beche hain, to uski net volume 500 hoga. Iska matlab hai ke uske paas abhi 500 mobile phones mojood hain jo bechne ke liye tayyar hain. Is net volume ko samajh kar woh apne stock levels ko monitor kar sakta hai aur agle mahine ke liye apne orders ko adjust kar sakta hai.

Khatima

Net volume ka sahi taur par istemal karna, tijarat mein asani aur saafhi ko barqarar rakhne mein madad karta hai. Tijarat karne wale ko apne mal o asbaab ki sahi darustagi ka khayal rakhna chahiye taake woh apne customers ko behtar taur par khidmat de sake aur apne business ko barqarar rakhe. Net volume ka istemal karke, tijarat mein hone wale transactions ko sahi taur par monitor karna mushkil nahi hota, aur is se unko behtar faislay karne mein madad milti hai.

- CL

- Mentions 0

-

سا4 likes

-

#11 Collapse

How to use net volume in trade

Net Volume aur Tijarat Mein Iska Istemal

Net volume ek ahem maeeshat aur tijarat tanazur mein istemal hone wala ek muddat hai. Ye malumat aam taur par har ek tijarat karne wale ke liye zaroori hai taake woh apni transactions ko sahi taur par samajh sake aur behtar faislay kar sake. Is article mein, hum net volume ke tijarat mein istemal ki tafseelat par ghaur karenge aur samjhenge ke iska kya ahmiyat hai.

Net Volume Kya Hai?

Net volume ek business term hai jo tijarat mein mal o asbaab ki taadaad aur maayariyat ko darust karne mein istemal hoti hai. Ye term tijarat mein mal o asbaab ki fiqriyat aur tadad ko shumar karne ke liye istemal hota hai. Net volume ka tajziya karke, ek shakhs ya company apni kharid o farokht ki transactions ko behtar taur par samajh sakta hai.

Net Volume aur Tijarat

Tijarat mein, net volume ka istemal asal mal aur asbaab ki taadaad ko shumar karne ke liye hota hai. Har ek transaction mein, mal o asbaab ki muddat aur qeemat ka pata lagana zaroori hota hai. Net volume is muddat aur qeemat ka aik jumla hai jo ek specific waqt mein tijarat mein mojood mal o asbaab ko darust taur par darust karne mein madadgar hota hai.

Kharidari aur Farokht Mein Net Volume

Net volume ka istemal kharidari aur farokht ke doran hota hai. Jab koi shakhs kisi mal ya asbaab ko khareedta hai, to uski net volume maloom hoti hai jo usne khareeda. Isi tarah, jab koi mal ya asbaab bechta hai, to uski net volume woh mal ya asbaab hoti hai jo usne becha. Ye malumat tijarat mein saafhi aur safai ko barqarar rakhne mein madadgar hoti hai.

Net Volume aur Hisaab Kitab

Net volume ka istemal hisaab kitab mein bhi hota hai. Ek tijarat karne wale ko apni hisaab kitab ko behtar taur par chalane ke liye net volume ka tajziya karna chahiye. Iske zariye woh apne stock levels ko monitor kar sakta hai aur sahi waqt par sahi maal khareed sakta hai. Hisaab kitab mein net volume ki sahi darustagi, tijarat mein asani aur saafhi ko barqarar rakhne mein madadgar hoti hai.

Net Volume ka Ahmiyat

Net volume ka hona tijarat mein ek ahem hissa hai, aur iski ahmiyat kuch is tarah se hai:

1. Stock Management

Net volume ka tajziya karke tijarat karne wale apne stock levels ko behtar taur par manage kar sakte hain. Woh maloomat hasil kar sakte hain ke kitni quantity mein mal mojood hai aur kitni quantity mein mal khareedna ya bechna chahiye.

2. Risk Management

Net volume ki madad se, tijarat karne wale apne business mein hone wale risk ko samajh sakte hain. Agar unke paas zyada stock hai, toh woh samajh sakte hain ke kaise isko behtar taur par istemal kiya ja sakta hai.

3. Financial Planning

Net volume ke istemal se, financial planning mein asani hoti hai. Tijarat karne wale apne aane wale waqt ke liye sahi maal o asbaab ko arrange kar sakte hain aur apni tijarat mein behtar taur par nigrani rakh sakte hain.

4. Transactional Accuracy

Net volume ki sahi darustagi se, transactions mein hone wali ghalatiyon ka khatima hota hai. Tijarat mein hisaab kitab mein hone wale mistakes se bachne ke liye net volume ka istemal zaroori hai.

Net Volume ka Istemal Kaise Karein?

Net volume ka istemal karne ke liye, tijarat karne wale ko kuch steps follow karne chahiye:

1. Record Keeping

Tijarat karne wale ko har transaction ko darust taur par record rakhna chahiye. Ye record keeping kaam ke transactions ko monitor karne mein madad karti hai.

2. Regular Analysis

Net volume ko regular intervals par analyze karna chahiye. Isse tijarat karne wale apne business trends ko samajh sakte hain aur behtar faislay kar sakte hain.

3. Technology ka Istemal

Hisaab kitab aur net volume ko maintain karne mein technology ka istemal karna bhi ahem hai. Modern software aur tools ka istemal karke, tijarat karne wale apne data ko aasani se manage kar sakte hain.

Misali Tor Par Net Volume ka Istemal

Chaliye ek misali tor par samajhte hain ke net volume ka istemal kaise hota hai. Maan lijiye koi electronics store chala raha hai. Agar usne ek mahine mein 1000 mobile phones khareede hain aur 500 mobile phones beche hain, to uski net volume 500 hoga. Iska matlab hai ke uske paas abhi 500 mobile phones mojood hain jo bechne ke liye tayyar hain. Is net volume ko samajh kar woh apne stock levels ko monitor kar sakta hai aur agle mahine ke liye apne orders ko adjust kar sakta hai.

Khatima

Net volume ka sahi taur par istemal karna, tijarat mein asani aur saafhi ko barqarar rakhne mein madad karta hai. Tijarat karne wale ko apne mal o asbaab ki sahi darustagi ka khayal rakhna chahiye taake woh apne customers ko behtar taur par khidmat de sake aur apne business ko barqarar rakhe. Net volume ka istemal karke, tijarat mein hone wale transactions ko sahi taur par monitor karna mushkil nahi hota, aur is se unko behtar faislay karne mein madad milti hai.

-

#12 Collapse

How to use net volume in tradeIntroductionNet Volume ek technical indicator hai jo ek security ki kharid aur bech mein farak ko nabz karta hai. Ise calculate karne ke liye, sell volume ko buy volume se subtract kiya jata hai.

Net Volume ka istemal

Net Volume ka istemal trade karne ke kai tarike hain. Ek tarika hai ki ise trend ko identify karne ke liye use karna. Jab Net Volume badhta hai, to yah iska arth hai ki market mein bullish sentiment hai aur price up ki taraf ja raha hai. Jab Net Volume kamta hai, to yah iska arth hai ki market mein bearish sentiment hai aur price down ki taraf ja raha hai.

Trade entry points

Net Volume ka istemal trade entry points ko identify karne ke liye bhi use kiya ja sakta hai. Jab Net Volume badhta hai, to yah ek bullish signal ho sakta hai ki price up ki taraf ja raha hai. Isliye, aap ek long position open kar sakte hain. Jab Net Volume kamta hai, to yah ek bearish signal ho sakta hai ki price down ki taraf ja raha hai. Isliye, aap ek short position open kar sakte hain.

Trade stop losses

Net Volume ka istemal trade stop losses ko set karne ke liye bhi use kiya ja sakta hai. Jab Net Volume badhta hai, to yah ek bullish signal ho sakta hai ki price up ki taraf ja raha hai. Isliye, aap apne stop loss ko price ki support level ke upar set kar sakte hain. Jab Net Volume kamta hai, to yah ek bearish signal ho sakta hai ki price down ki taraf ja raha hai. Isliye, aap apne stop loss ko price ki resistance level ke niche set kar sakte hain.

Net Volume ka istemal trade karne ke kuchh specific tarike- Net Volume Breakout: Jab Net Volume ek resistance level ko break karta hai, to yah ek bullish signal ho sakta hai ki price up ki taraf ja raha hai. Isliye, aap ek long position open kar sakte hain.

- Net Volume Reversal: Jab Net Volume ek support level ko break karta hai, to yah ek bearish signal ho sakta hai ki price down ki taraf ja raha hai. Isliye, aap ek short position open kar sakte hain.

- Net Volume Divergence: Jab Net Volume trend ke khilaf ja raha hai, to yah ek divergence signal hai. Yah ek bearish signal ho sakta hai ki trend reverse.

Net Volume ka istemal trade karne ke liye tips- Net Volume ko alag-alag time frames mein dekhen. Daily, weekly, aur monthly time frames mein Net Volume ko dekhne se aapko market mein trend ko better understand karne mein madad milegi.

- Net Volume ko alag-alag securities mein dekhen. Net Volume ka istemal alag-alag securities mein karke aapko market mein different opportunities identify karne mein madad milegi.

- Net Volume ko dusre technical indicators ke saath use karen. Net Volume ko dusre technical indicators ke saath use karke aapko trade karne mein aur bhi accurate decision mein madad milegi.

Net Volume ka istemal trade karne ke liye conclusion

Net Volume ek powerful technical indicator hai jo aapko trade karne mein madad kar sakta hai. Net Volume ko alag-alag tarikon se use karke aap market mein trend ko identify kar sakte hain, trade entry points identify kar sakte hain, aur stop losses set kar sakte hain. -

#13 Collapse

How to use net volume in trade

Net volume trading mein ek ahem concept hai jo ke kisi bhi maali asbaab, maslan stocks, commodities, ya currency, ki trading mein istemal hota hai. Yeh mairey ek muddat mein ki gayi trading volume ka farq hai jo ke khareedne aur bechne mein shamil hoti hai. Net volume ka istemal karte waqt traders ko overall market sentiment aur price movements ki mazbooti ka andaza hota hai.

Net Volume Ka Istemal Kaise Karein:- Net Volume Ka Samajhna:

- Net volume ka hisaab lagane ke liye aapko kisi muddat mein ki gayi poori khareedne aur bechne ki volume ka farq nikalna hoga. Agar yeh farq musbat hai toh iska matlab hai zyada khareedari ho rahi hai, jabke agar yeh manfi hai toh iska matlb hai zyada bechne ki activity hai.

- Price Trends Ki Tasdeeq:

- Net volume ka istemal price trend ki mazbooti ko tasdeeq karne ke liye kiya jaa sakta hai. Agar keemat barh rahi hai aur net volume musbat ya barh rahi hai, toh yeh ishara ho sakta hai ke uptrend ko khareedne ka jazba hai. Ulti halat mein, downtrend mein, manfi ya barhte hue net volume neche dikhaye ja sakte hain, jo bechne ki dabavat ko dikhata hai.

- Divergence Analysis:

- Traders aksar price movements aur net volume ke darmiyan farq dhundhte hain. For example, agar keemat naye urooj par hai lekin net volume kam ho rahi hai, toh yeh ishara ho sakta hai ke khareedari mein kamzori hai aur trend palat sakta hai. Issi tarah, downtrend mein, naye neeche hone wale prices ke doraan net volume mein kami, trend mein kamzori dikhane ka zariya ho sakta hai.

- Doosre Indicators Ke Saath Tasdeeq:

- Net volume ka istemal doosre technical indicators ke saath mila kar aur bhi asar daar hota hai. Net volume analysis ko moving averages, RSI (Relative Strength Index), ya MACD (Moving Average Convergence Divergence) jese tools ke saath mila kar istemal karke market ke haalat ka zyada comprehensive andaza lagaya ja sakta hai.

- Accumulation ya Distribution Ki Pehchan:

- Musbat net volume accumulation ko darust karta hai, jahan traders maal ikhatta kar rahe hain. Doosri taraf, manfi net volume distribution ko darust karta hai, jahan traders apne maal ko bech rahe hain.

- Timeframes Ki Tafseelat:

- Mukhtalif timeframes ka istemal net volume ki alag alag manazir dikhane mein madad karta hai. Intraday net volume chhota term trading ke faislay mein madadgar ho sakta hai, jabke lambi muddat ke charts asooli trends ko zahir kar sakte hain.

- Volume Profile Analysis:

- Traders aksar volume profiles ka istemal karte hain taake wo net volume ko mukhtalif keemat levels par analyze kar sakein. Yeh madad karta hai buland aur neeche dabaawat ke ilawa, sath hi support aur resistance zones ki pehchan mein bhi.

Net volume analysis ek trader ki toolkit mein ek aham tool hai, lekin isay doosre forms of analysis ke saath istemal karna chahiye aur is par pura bharosa na karna chahiye. Har ek trader apne trading approach mein net volume ko kaise shamil karna chahta hai, is par uska apna nazariya hota hai.

- Net Volume Ka Samajhna:

-

#14 Collapse

INTRODUCE OF NET VOLUME IN FOREX TRADING:

Dear Friends jab bh Net Volume Trading mein ek important concept hai jo ke kisi bhi maali asbaab, maslan stick's, commodities, ya currency's, ki Trading mein istemal hota hai. Yeh mairey ek muddat mein ki gayi Tradings Volume ka farq hai jo ke khareedne aur bechne mein shamil hoti hai. Net Volume ka Use karte waqt trader's ko overall market sentimental aur price movements ki mazbooti ka andaza hota hai.Net Volume ka hisaab lagane ke liye aap ko kisi waqt mein ki gayi poori khareedney aur bechne ki volume ka farq nikalna hoga. Agar yeh farq positive hai tho iska meaning hai zyada khareedari ho rahi hai, jabke agar yeh manfi hai toh iska matlb hai zyada bechne ki activity hai.Price ka Sath Trad ki Entry Len gy:

THE LIMITATIONS OF NET VOLUME IN FOREX TRADING:

Dear Friend's jab bh Net Volume ka sahi Taurus par istemal karna, tijarat mein asani aur saafhi ko barqarar rakhne mein help karta hai. Tijarat karne wale ko apne mal o asbaab ki sahi darustvkar ka khayal rakhna chahiye taake woh apne customers ko behtar taur par khidmat de sake aur apne business ko barqarar rakhe. Net volume ka Use karke, tijarat mein hone wale transactions ko sahi taur par monitors karna mushkil nahi hota, aur is se unko behtar faislay karne mein help milti hai.Net volume ko regularly intervals par analyze karna chahiye. Isse tijarat karne wale apne Businesses Trend's ko samajh sakte hain aur behtar faislay kar sakte hain aor Trad Len:

THE TYPES OF NET VOLUME IN FOREX TRADING:

Detail:

Friends jab bh Net Volume ek ahem maeeshat aur tijarat tanazur mein istemal hone wala ek waqt hai. Ye malumat simple taur par har ek tijarat karne wale ke liye zarori hai taake woh apni transaction's ko sahi taur par samajh sake aur behtar decide kar sake. Is article mein, hum net volume ke tijarat mein istemal ki detail par ghaur karenge aur samjhenge ke iska kya ahmiyat hai.Net Volume ek business term hai jo Tijarat mein mal o asbaab ki taadaad aur maayariyats ko darust karne mein istemal hoti hai. Ye term tijarat mein mal o asbaab ki fiqriyat aur trader's ko shumar karne ke liye istemal hota hai. Net volume ka tajziyea karke, ek shakhs ya company apni kharid o farokht ki transactions ko behtar taur par Samajhne kalye Zroori hy:

THE EXPLANATION OF NET VOLUME IN FOREX TRADING:

Net Volume decreasings hai, to Yahan is baat ki nishan hai ki market mein sellings pressured badh raha hai. Yah, trader's Market mein short position's lena chah sakte hain.

Ess Net volume zero par hai, to yah is Baat ki nishan hai ki Market mein koi clear directions nahi hai. Yahan, trader's market mein positions lena se hi Stop Los say Entry len.

TRADING STRATEGY WITH NET VOLUME:

Net Volume Ek particularly pair ka buying aur selling Order's ka total Volume hota hai. Yah ek important metric hai jo Trader's ko market ki strengthen aur direction samajhne mein help karta hai.Net Volume ko calculate karne ke liye, aap buy Order's ka volume subtract karke sell Order's ka volume karte hain. Agar net volume positive hai, to yah is baat ki nishan hai ki market mein Buying pressure hai. Agar net volume negative hai, to Yahan is baat ki nishan hai ki market mein selling pressure hai.Net volume ko Forex Market Mein chart's mein bhi dekha ja sakta hai. Yahan, yah ek indicator ki tarah hota hai jo ek line mein representative kiya jata hai. Net volume indicator ki line ka direction market ki direction ko reflection asaani Say Trad Mein ho gy.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 Collapse

What Is Net Volume?

aik takneeki isharay jo khalis hajam ke naam se jana jata hai aik makhsoos muddat mein security ke aptick volume ko is ke down tik volume se ghata kar haasil kya jata hai. baqaida hajam ke bar aks, isharay market ke jazbaat mein taizi aur manfi rujhan ke darmiyan farq bta sakta hai. khalis hajam aam tor par qeemat ke chart ke neechay zahir hota hai, Baraz har muddat ke khalis hajam ke liye parhnay ki nishandahi karti hain .

Understanding Net Volume

riwayati hajam ke ilawa, tajir market ke ravayye ka taayun karne ke liye khalis hajam ka istemaal karte hain. kisi khaas security ke liye misbet khalis hajam taizi ke izafay ki nishandahi karta hai, jab ke manfi khalis volume bearish down soyng ki nishandahi karta hai .aayiyae aik misaal letay hain jahan aik stak jis ki ziyada tijarat nahi hoti hai is ne aik tijarat dekhi hai jo 10, 000 hasas par gayi thi, jis mein stock mein 3 % izafah sun-hwa tha, aur paanch tijartain jo 200 hasas par neechay gayi theen, majmoi tor par stock mein 5 % ki kami hui thi. khalis hajam misbet 9, 000 hota halaank stock din mein 2 % kam hota, yeh tajweez karta hai ke bunyadi raftaar waqai bohat achi rahi hai .khalis hajam chart ki aik misaal mandarja zail hai :bohat se tajir mawaqay ki talaash mein, takneeki tajzia ki deegar aqsam, jaisay chart patteren aur takneeki isharay ke sath khalis hajam ko mila dete hain.

misaal ke tor par, is baat ka taayun karne ke baad ke stock aik barri muzahmati satah se toot gaya hai, tajir khalis hajam ko dekh kar yeh taayun kar satke hain ke khareed ka kitna dabao mojood hai aur aaya is iqdaam ko barqarar rakhnay ke liye kaafi raftaar mojood hai .

Comparing Net Volume

khalis hajam bohat se dosray momentum andikitrz se milta jalta hai jo dosray awamil ke ilawa hajam ko bhi mad e nazar rakhtay hain. un deegar matrix ke bar aks, khalis hajam sirf aik muqarara waqt ke liye hajam ko mad e nazar rakhta hai .misaal ke tor par, khalis hajam aur money flow index isi terhan ke takneeki isharay hain jo kisi makhsoos asasay mein market ki dilchaspi ki numaindagi karte hain. khalis hajam sirf hajam par ghhor karta hai, lekin money flow index ( mfi ) qeemat aur hajam dono ki bunyaad par khareed o farokht ke dabao ka andaza karta hai. hajam ke utaar charhao ko dono takneeki isharay ke hisaab se liya jata hai, is liye khalis hajam aur majmoi hajam aik jaisay hain. doosri taraf, obv aik makhsoos time frame par tawajah nahi deta hai. balkay, yeh poooray waqt ke hisaab se majmoi tor par oopar walay dinon aur neechay ke dinon mein hajam laita hai. kuch isharay, jaisay rishta daar taaqat ka asharih, –apne nataij ko faida ya nuqsaan ki shiddat par mabni karte hain .agarchay baaz sooraton mein tajir ko ab bhi aik hi muddat mein jaanch partaal karne ki zaroorat par sakti hai, bohat se tajir mawaqay ka tajzia karte waqt khalis hajam ke bajaye ziyada jadeed raftaar isharay istemaal karne ka intikhab karte hain .

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 07:12 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим