Important functions of Scalp Trading

`

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔ٹیگز: کوئی نہیں

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

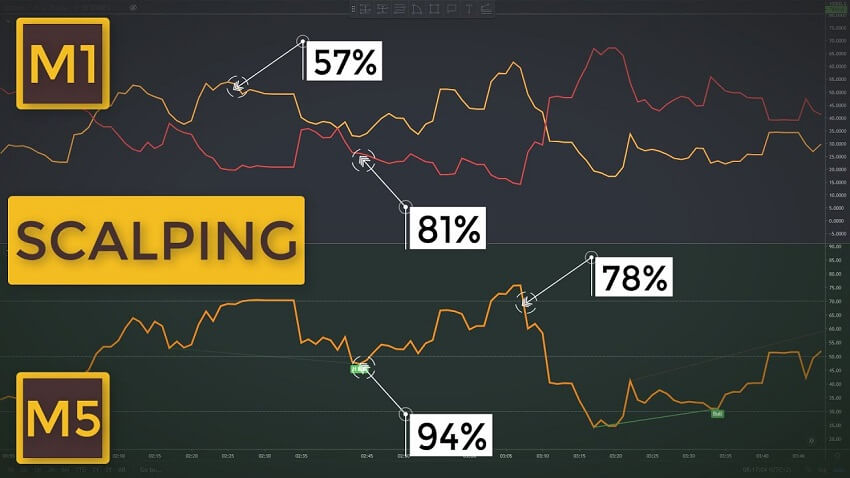

res hain, jaise ki:Chote Time Frames: Scalping trading mein traders chote time frames ka istemal karte hain, jaise ki 1-minute, 5-minute, ya 15-minute charts. Isse unhein chote price movements aur volatility ka fayda uthane ki suvidha milti hai.Jaldi Entry aur Exit: Scalping mein traders jaldi entry aur exit points dhoondhte hain. Woh koshstrict exit policey ko comply with krta hay ta Kay tamam small profits aik huge loss se wipe na ho jaien.Small traders ko maintain krna Kafi asan hota hay.Jesa Kay inventory Kay case main 1 se pass krna mushkil hota hay jab Kay agar alternate .01 se lagi ho to control aur manipulate krna easy hota hay.Smaller actions massive moves se zayada common hoti Hain Yahan tak Kay quiet markets primary bi scalp trader motion Nazar ATI Hain.Lakin mainly isko single use nai kia jata isko dosray technical indicator Kay sath Mila Kay istamal kia jata hay. Important functions of Scalp Trading Scalpinish karte hain ki unki trade jitni jaldi ho sakein, aur unhein profits mil jayein. Isliye, scalping traders jyada time tak ek trade hold nahi karte.Small Profits: Scalping strategy mein traders chote price movements se fayda uthane ki koshish karte hain. Unka lakshya hota hai chote profits kamane ka, lekin usse bahut se trades par accumulate karke overall profit banana.Tight Stop Loss: Scalping traders tight stop loss ka istemal karte hain taki woh apne losses ko minimize kar sakein. Isse woh apne trades ko closely monitor karte hain aur jaldi exit kar sakte hain, agar market against unke expectatited publicity ki waja se chance reduce hota hay dealer aik g Technique main aik assumptions li jati hay Kay maximum shares first level of motion Kay bd entire hn gay.Lakin is point se Kahan jaien gay ye unsure hay.Initial level Kay bd uch inventory improve capture kr detay Hain jab Kay dosray enhance motion keep krtay Hain.Aisay essential aik day trader scalp Technique ka istamal krtay huay jitna ho sakay small earnings earn krta hay.Ye approach number of winners predominant boom aur volume sacrifices ki Tarah kaam krti hay. Scalp Trading aisi trading strategy ko kehtay Hain Jis principal massive quantity of trades se small profits earn kia jata hay.Jis most important income margins set kr Kay change lagai jati hay aur sturdy exit policey undertake krtay Hain.Q Kay aik massive loss full day Kay small gains ko khatam kr sakta hay.Is trade Kay effectively honay Kay liay stay feed stamina for lots trades requir -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

What is over Exchanging Definition over exchanging aam peak standard is waqt hoti hai hit forex brokers harnay wali tijarat ke aik silsilay ke baad pareshan ho jatay hain. woh ziyada se ziyada pozishnin khol kar - apne nuqsaan ki talaafi karne ki koshish karte hain, har aik size aur hajam mein pichli position se bara hai. yeh bunyadi peak standard un ke munafe ke ahdaaf ko haasil karne ke liye kya jata hai. lekin un ki kamyabi ke imkanaat ko badhaane ke liye ziyada se ziyada pozishnin kholnay ki khwahish taajiron ke liye aqli faislay karna mushkil bana deti hai, jis ke nateejay mein tijarat ziyada kho jati hai. over exchanging ki alamaat kya hain? What are indication of over Exchanging over exchanging ki makhsoos alamaat hain jin se tamam taajiron ko aagah hona chahiye. mamool se ziyada kholna. mukhtalif taajiron ke mukhtalif tijarti andaaz aur maqasid hotay hain. taham, agar aap ka mayaari tijarti dorania taqreeban 30 band ke sath khatam hota hai aur aap khud ko achanak 100 standard zor dete shade mehsoos karte hain, to aap yakeeni pinnacle standard over exchanging kar rahay hain. nedamat mehsoos karna. agar aap khonay wali tijarat ko band karte hain aur usay pehli jagah kholnay standard pachtaawa mehsoos karte hain, to imkaan hai ke aap over exchanging kar rahay hon ge aur - apne pichlle nuqsanaat ki talaafi karne ki koshish kar rahay hon ge. market ki naqal o harkat standard fixing. aap outlines ko dekhte tint khud ko pakar satke hain, yeh sochte tone ke aap ko mutadid mawaqay nazar arhay hain aur un sab ko istemaal karne ki koshish karne mein kharish hai. lekin market hamesha hamari tawaquaat ke mutabiq nahi chalti. lehaza agar koi cheez aik acha mauqa maloom hoti hai, tab bhi baghair tehqeeq ke usay istemaal karne ki koshish karna bohat hello there ghair danish mandana hai. apni hikmat e amli se bhatakna. poke market ke halaat is ki zaroorat ho to apni hikmat e amli ko tabdeel karna aik cheez hai. sirf is liye karna aur baat hai ke aap ziyada munafe haasil karna chahtay hain. be sakhta faislon ke haq mein - apne ibtidayi mansoobay ko tark karna aik tajir ki sab se barri ghaltion mein se aik hai . Instance of overtrading over exchanging aik bohat khatarnaak ghalti hai, khaas peak standard aik naye tajir ke liye jis ne abhi tak munasib tijarti hikmat e amli aur mansoobah nahi banaya hai. hit tajir market standard nazar rakhtay shade aik sath bohat saari pozishnon ko tijarat karne ki koshish karte hain, to un ki tawajah munqasim ho jati hai, aur woh apni tijarat ko band karne ke liye sahih waqt se mahroom ho jatay hain, jis ki wajah se inhen kaafi raqam kharch karna padtee hai. yeh khaas peak standard un taajiron ke liye khatarnaak hai jo ziyada faida uthatay hain, jo un ke nuqsanaat ko barha sakta hai aur yahan tak ke un ke accounts ko mukammal pinnacle standard ura sakta hai. is ke ilawa, hit aap bohat ziyada tijarat karte hain, to aap ko spread aur commission ada karna parta hai. yeh akhrajaat bhi barh jatay hain aur is mumkina munafe se bhi ziyada ho satke hain jo aap over exchanging se haasil karne ka intizam karte hain. Step by step instructions to forestall Forex overtrading forex over exchanging ko kaisay roka jaye? stomach muscle hit ke murmur jantay hain ke over exchanging kitni khatarnaak hai, stomach muscle waqt agaya hai ke usay honay se roknay ke tareeqay sekhen. tijarti mansoobah tayyar karen. over exchanging se bachney ke liye sab se bunyadi cheez jo aap kar satke hain woh hai exchanging plan waza karna. tijarti mansoobay ke baghair, khud ko qaboo mein rakhna namumkin hai. is mein dakhlay aur bahar niklny ke kuch usool, aik muqarara muddat ke andar aap ki ziyada se ziyada tijarat aur khatray se bachao ke iqdamaat shaamil honay chahiye. lekin tijarti mansoobay ke bajaye munafe ke ahdaaf ka istemaal nah karen, warna aap nakami ke liye khud ko tarteeb day rahay hon ge. rissk managment ki aik achi hikmat e amli tayyar karen. koi bhi tajir munasib rissk managment plan ke baghair kamyaab nahi ho sakta. rissk managment mein woh usool aur rehnuma khutoot shaamil hain jo aap nakaam tijarat se - apne nuqsanaat ko kam karne ke liye banatay hain. yeh is raqam ki miqdaar ka hisaab laga kar kya ja sakta hai jo aap khonay mein aaraam se hain aur aap ke rissk reward ka tanasub, aap ki tijarat ke liye qeemat ke ahdaaf muqarrar kar ke, -

#4 Collapse

What is Hole in Forex Traiding make sense of? Consolation level ha ya 0.8916 prerequisites ha or is usd/chf ki cost ha ya is reaction or sponsorship level ka community mom move kar rahi ha agar is usd/chf ki cost less ke janab jati ha or lower my mom 0.8931 standard ha or is mother jo support level ha ya 0.8918 standard ha or is usd/chf ki the four hour time period is contradicting or supporting level ka place mom move The Matlab market predicts a recuperation sometime. Stomach muscle is bhi market USS level per aa chuki hai, and iss per nazer rakhnii hai, iss liye application logon nay powerful rehna hai. The market will probably be in a sell position when the contrary flame configuration shows up. Application logon nay trade lagani hai, Apnay account size ko dekhty hoi, Ye batt hameshaa yaad rakhin You're investigating something. That is the situation assuming your examination is fruitless. Continuously hotii is the head koi cheez in Dunya. Say janty hongay, "You have an application What is Hole in Forex Traiding make sense of? is ke beech My kuch nahi hai isi ko dread worth gaptaakay yeh marketon ko muaser tareeqay se dobarah mutawazan kar sakay agar aap yahan is expand ko dekhen to My usay yahan ghaseetnay ja raha hon aur phir aap dekhen ge ke kya sun-hwa market lafzi peak standard is expand di khatam kar ke neechay aa gaya aur apni simt mein agay barhta chala gaya. Mein Kehta Hon Ke Yeh Cheeze Itni Taaqatwar The town of Hain Kyunkay Jis Market Mein Usay Wapas Aana Ha Is Ka Koi Mutabadil nahi Hai Aap Ko Maloom Hai Ke Shayad Chandghanton Baad Aisha Nah Ho the examination of Yeh Waqai Aik Se Agay Barh Rahi and partners Hai And Market Ko Haqeeqat Mein Khud Ko Really do grow to "aap ko yeh bitanay ja raha ham ke yeh kaisay kaam an agreement hai" frame standard kyunkay agar aap misaal ke top prerequisites yahan diagram it is hissay ko le letay hain to theek hai hamaray paas yeh mother batii hai aur is ke oopar thori seems vÙk hai aur phir is vÙk ke darmiyan aur is ke baad grandma batii ki batii ke oopar yeh woh jagah hai jahan aap ke paas thora sa vÙk hai jo aap ne khareeda hai .Dabao theek hai aap ko koi farokht nahi hui hai aap ko wahan kuch bhi nahi mila hai aur is ke beech mein jahan bunyadi zenith prerequisites aik batii hai wahan aik batii hai is ke beech mein kuch nahi hai isi ko dIf aap yahan is extending ko dekhen to mein usay yahan ghaseetnay ja raha hon and phir aap dekhen ge ke kya sun-hwa market lafzi top norm, then, at that point, taakay yeh marketon ko muaser tareeqay itself dobarah mutawazan kar sakay what's more, apni simt mein agay barhta chala gaya, is extend ko khatam kar ke neechay aa gaya. Aap ko maloom hai ke shayad chand ghanton baad aisa nah ho mein kehta hon ke yeh cheeze itni taaqatwar hain kyunkay jis market mein usay wapas aana hai What is Opening in Forex Traiding get a handle on? r jo support level ha ya 0.8888 standard ha or is usd/chf ki four hour period of time is obstruction or sponsorship level ka local area mother move kar rahi ha agar is usd/chf ki cost lower ke janab jati ha or lower mother 0.8888 ka level ko is usd/chfapp earlier man raha ha ya 0.8931 standard ha or is mother jo support level ha ya 0.8916 standard ha or jo is usd/chf ki cost ha ya is opposition or sponsorship level ka place mother move kar rahi ha agar is usd/chf ki jo onr hour ke candles ha ya higher ke janab move karti hoi jati ha to murmur is mother stand by karay ga ka punch tak is usd/chf ki cost higher ke traf jati hoi hindrance level ko break ni kar lati hit is usd/chf ki cost higher mother jati hoi jo 1 hour ke light ha ya obstacle level 0.8931 ka check level ko break kar ka jo one hour ke fire ha ya is level sa high mother close hoti ha to sellers is ka break wali one hour ke candel ka high arket fundamental dekhin to application logon ko pata chlay ga, The market in Matlab says that it will recuperate eventually. Iss liye application logon nay novel rehna hai and iss per nazer rakhnii hai, stomach muscle bhi market USS level per aa chuki hai. Precisely when the Opposite light arrangement shows up, the market will apparently be in the sell position. Apnay account size ko dekhty hoi application logon nay exchange lagani hai, Hameshaa ye batt yaad rakhin You have an assessment. Tolerating your assessment misss the imprint, that will what is go on. when in doubt, Dunya fundamental koi cheez is hotii. Say janty hongay, Ye batt applica -

#5 Collapse

What is camerilla turn point Definition . behtareen camerilla exchanging hikmat e amli aik muqarara waqt standard market ke halaat standard munhasir hai. market ke yeh halaat kaam karne ke liye camerilla ki sab se munasib hikmat e amli tay karen ge. kisi bhi maliyati manndi mein tijarat karne ke liye mukhtalif camerilla exchanging point hikmat e amli hain. yeh mazmoon darj zail bunyadi tasawurat ka ihata kere ga : camerilla turn point ki tareef camerilla tijarti hikmat e amli camerilla focuses ke sath tijarat ke fawaid aur hudood camerilla point kya hai? Camerilla point old style/flour tridr turn point ki tosee hai jo taajiron ko kaleedi madad aur muzahmati satah faraham karta hai. Camerilla mein chaar support aur chaar rizstns levels shaamil hain, neez turn ke deegar tagayuraat ke muqablay mein kaafi qareeb tareen levels - neechay tasweer dekhen. yeh qurbat camerilla ko mukhtasir muddat ke taajiron ke liye misali banati hai . Camerilla turn point technique Turn point hikmat e amli ki kayi tknikin hain. zail mein is aasaan isharay ko istemaal karne walay taajiron ki taraf se istemaal kiye jane walay high schooler pasandeeda tareeqay hain. camerilla turn range ki hikmat e amli aik range ko side way market ke peak standard jana jata hai jis mein support aur muzahmat ki qaim linon ke darmiyan qeemat ki tijarat hoti hai. range ke tajir camarilla turns se bohat faida utha satke hain, kyunkay har roz isharay exchanging ke liye aik nai range paish kere ga. jaisa ke zail mein dekha gaya hai ke qaleel mudti range ke ulat jane walay taajiron ko bunyadi pinnacle standard s3 aur r3 mehwar ke darmiyan qeemat ki muntaqili standard tawajah deeni chahiye. is ilaqay ko rozana ki tijarat ki had ke pinnacle standard jana jata hai aur yeh range ke taajiron ko apni market ke andrajaat ki mansoobah bandi karne ke liye ilaqon ko saaf karne ki ijazat day sakta hai. riwayati pinnacle standard, range ko tabdeel karne walay tajir himayat ya muzahmat ke nuqta ki taraf bherne ke liye qeemat talaash karen ge. agar muzahmat range rakhti hai to tajir r3 mehwar ke qareeb mukhtasir position shuru karne ki koshish karen ge, qeemat ko support karne ke iraday ke sath. is ke bar aks, agar qeemat s3 camerilla turn ke oopar barqarar rehti hai, to go ke tajir s3 turn ke qareeb khareed standard mabni positions shuru karne ki koshish karen ge aur qeemat r3 muzahmati mehwar ki taraf wapas jane ke iraday se. taham, yeh yaad rakhna chahiye ke qeemat racket bhar had tak mehdood reh sakti hai. yeh hikmat e amli kam utaar charhao ke adwaar mein behtareen kaam karti hai jaisay asiayi tijarti meeting. ziyada utaar charhao walay waqton mein, tajir is hikmat e amli se hatt kar qeematon ki be tarteeb naqal o harkat ko shaamil karne ki koshish karen ge - zail mein hikmat e amli dekhen. aam camerilla turn set up camerilla break out aur range exchanging camerilla mehwar rujhan ki hikmat e amli rujhan aik mazboot iqdaam hai jo qeemat ko aik makhsoos muddat ke douran ziyada ya kam karta hai. Camerilla mehwar rujhan saaz baazaaron ke douran intehai mufeed saabit ho sakta hai, aur taajiron ko kaleedi indraaj, stap aur had ki satah faraham karta hai. tajir rujhan ki simt mein andrajaat ko shudder karen ge. agar market ka rujhan barh raha hai to, s3 standard kharidari ke mawaqay talaash karen, s4 standard rkin. agar market neechay chal rahi hai to r3 bechen aur r4 standard ruk jayen. neechay diya gaya graph up prepared mein aud/jpy outline dekhata hai. is baat ko zehen mein rakhtay tone, tajir s3 standard taweel andrajaat talaash karen ge jis mein s4 standard stops hon ge jaisa ke ishara kya gaya hai. take praft levels ki nishandahi karne ke mukhtalif tareeqay hain jaisay febonaci expansion/, cost activity ya deegar takneeki isharay. yeh faisla infiradi tajir ki swabdid standard hai . -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

what is crisscross example pply se ziyada maang hai, qeematein barh jati hain. aik waqt aaye ga hit qeematein barheen gi punch baichnay ki khwahish haasil karne ki khwahish se kahin ziyada hogi. aisa honay ki kayi wajohaat hain. yeh mumkin hai ke taajiron ne faisla kya ho ke qeemat bohat ziyada hai ya un ka hadaf poora ho gaya hai. yeh ho sakta hai ke khredar itni ziyada qeematon standard nai pozishnin shuru karne se gorezan hon. yeh mukhtalif wajohaat ki binaa standard ho sakta hai. phir bhi, aik tiknishn aasani se qeemat ke outline standard is nuqta ki nishandahi kar sakta hai jahan supply maang se ziyada hona shuru ho jati hai. yeh oppostion hai. yeh support ki terhan aik level ya zone ho sakta hai .hit kisi" zone" ya support ya muzahmat ke ilaqay ki nishandahi ki gayi hai, to qeemat ki yeh sthin mumkina dakhlay ya kharji maqamat ke top standard kaam kar sakti hain kyunkay, jaisay qeemat himayat ya muzahmat ki Sabiqa tak pahunchti hai, yeh ya to is satah se peechay hatt jaye gi ya khilaaf warzi kere gi. is satah standard aur mukhalif simt mein agay barhatay rahen - hit tak ke yeh support ya muzahmat ki agli satah tak nah pahonch jaye .kuch ka waqt is mafroozay ki bunyaad standard hota hai ke support aur muzahmat ki sthin nahi tooten gi. tajir qeemat ki simt standard" shart" laga satke hain aur taizi se is baat ka pata laga satke hain ke aaya woh durust hain, qata nazar is ke qeemat ko roka gaya hai ya support ya muzahmati satah se sound gaya hai. agar qeemat ghalat simt mein jati hai to arrange ko mamooli nuqsaan ke sath khatam what is crisscross example trading mn ek particular assessment gadget hy jiska istemaal market ke design ki symajhne ke liye kia jata hy. Yeh ek bohat hello renowned or strong mechanical assembly hy jo traders dwara routinely usy kia jata hy. Befuddle model ka naam isliye hy kyunki yeh market ki advancements ko confuse ki tarah represynt karta hy. Yeh contraption market mein high or discouraged spots ko perceive karne mein madad deta hy or phir un centers ko partner kar ke design lines make karta hy. Befuddle model ki madad sy specialists ko market ke design ki symajhne mn asyni hoti hy or iske istemaal sy shippers apny trading methods ko improve kar sakty hn. Confound model ke istemaal sy sellers market mn cost movement ko dekh sakty hn. Is instrument ki madad sy vendors high or discouraged spots ko actually recognize kar skty hn or phir is ki premise standard example lines make kar sakty hn. Yeh instrument ek bohat hi solid or trustworthy contraption hy jo sellers ke liye ek complete pack hy. Befuddle model ko usy karne ke liye, vendors ko sab sy pehle high or discouraged spots ko perceive karna hota hy. Iske baad, shippers in centers ko partner kar k example lines make kar sakty hn. Design lines ko make karne ke baad, agents market ke design ko recognize kar sakty hn or phir apne trading techniques ko iske premise standard arrangement kar sakty hn. WHAT IS Crisscross Example forex mein aik crisscross patteren prepared linon se bana hai jo qeemat ke outline mein ahem intahaa ko jorta hai, jo oopar aur neechay hain. lehaza, yeh namona, jo tijarti alay ke qeemat outline mein wazeh peak standard bayan kya gaya hai, rujhan ke ahem ulat lamhaat ki nishandahi karta hai. usay outline mein dekhnay ke l-brokers, tajir crisscross isharay ko takmeeli alay ke peak standard istemaal karte hain. yeh barah e raast qeemat ki energy goi ke liye istemaal nahi kya jata hai kyunkay yeh sirf ahem rujhan mehwar focuses ki nishandahi karta hai, ahem rujhan ke andar be tarteeb qeemat ki naqal o harkat ko khatam karta hai . -

#7 Collapse

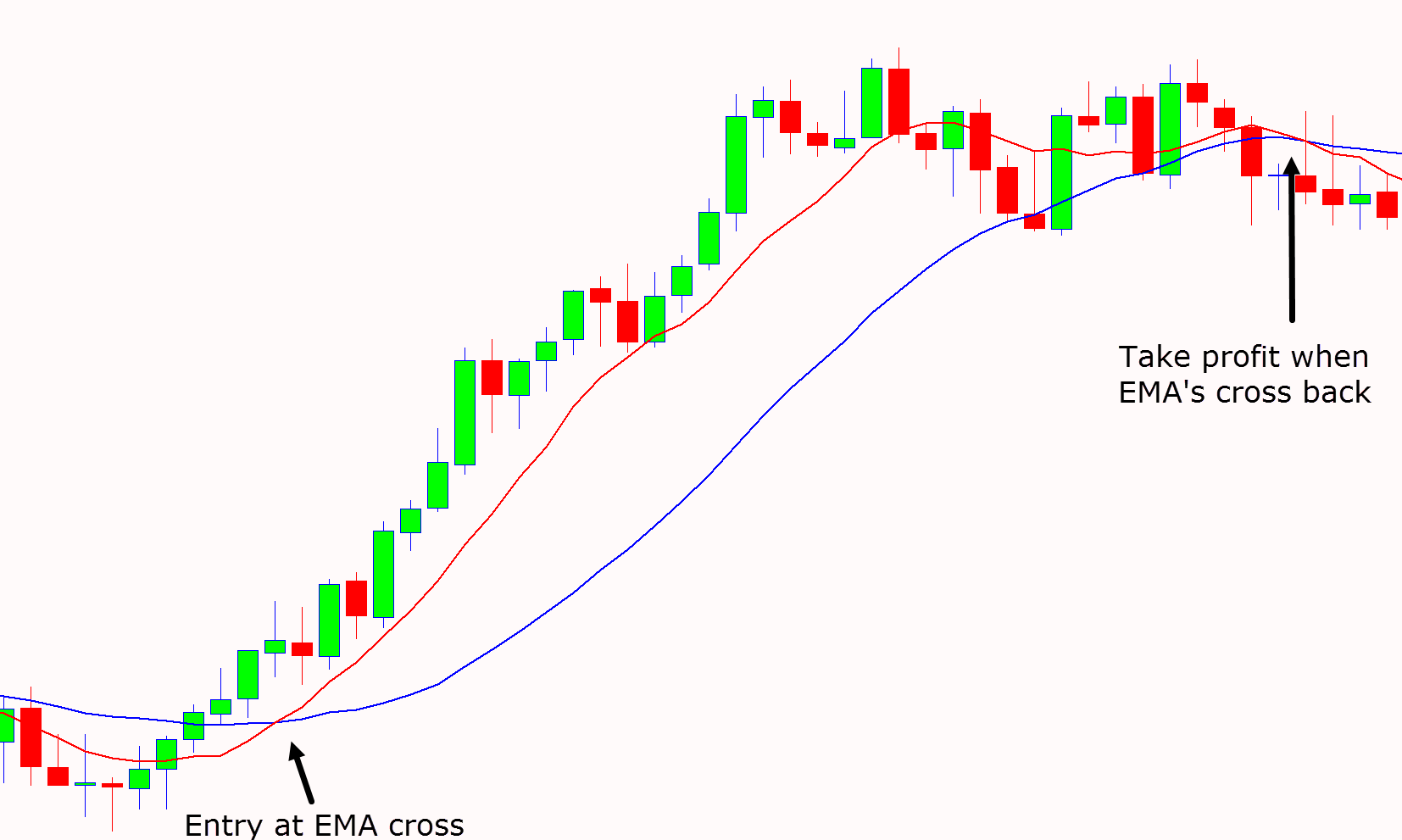

Assalamualaikum! Umeed hai k ap sb khariyat sy hongy. R apky trading sessions achy jaa rhy hongy. Aj ka hmra discussion topic "Important functions of scalping".Dekhty hain k ye hmein Kya information deta hai r hmry ilam Mai Kesy ezafa krta hai. Scalping in trading Scalping aik tijarti andaaz hai jo qeematon mein choti tabdeelion se faida uthany aur dobarah farokht par taizi se munafe kamanay mein mahaarat rakhta hai. day trading mein, scalping aik aisi istilaah hai jis ki hikmat e amli chhootey munafe par ziyada miqdaar kamanay ko tarjeeh deti hai. scalping ke liye aik tajir ko bahar niklny ki sakht hikmat e amli ki zaroorat hoti hai kyunkay aik bara nuqsaan un bohat se chhootey fawaid ko khatam kar sakta hai jo tajir ne haasil karne ke liye kaam kya tha. is terhan, is hikmat e amli ke kamyaab honay ke liye sahih tools ka hona — jaisay ke live feed, barah e raast rasai ka brokr, aur bohat saari tijaratein karne ki salahiyat — ka hona zaroori hai. is hikmat e amli ke baray mein mazeed jan-nay ke liye parheen, scalping ki mukhtalif aqsam, aur trading ke is andaaz ko istemaal karne ke tareeqay ke baray mein tajaweez. Scalping is mafroozay par mabni hai ke ziyada tar stock harkat ka pehla marhala mukammal karen ge. lekin yeh kahan se jata hai ghair yakeeni hai. is ibtidayi marhalay ke baad, kuch stock agay barhna band kar dete hain, jabkay dosray agay barhatay rehtay hain. aik discounter ziyada se ziyada chhootey munafe lainay ka iradah rakhta hai. yeh" –apne munafe ko chalne do" ki zehniat ke bar aks hai, jo jeetnay wali tijarat ke size ko barha kar misbet tijarti nataij ko behtar bananay ki koshish karti hai. yeh hikmat e amli jeetnay walon ki tadaad mein izafah karkay aur jeet ke size ko qurbaan karkay nataij haasil karti hai. yeh ghair mamooli baat nahi hai ke aik taweel waqt ke frame walay tajir ke liye apni tijaraton mein se sirf nisf, ya is se bhi kam, jeet kar misbet nataij haasil kiye jayin- yeh sirf yeh hai ke jeet nuqsanaat se bohat ziyada hai. aik kamyaab stock scalper taham, harnay walay tijarat ke muqablay jeetnay ka tanasub bohat ziyada hoga, jabkay munafe ko nuqsanaat se taqreeban barabar ya qadray bara rakhta hai . Functions and strategies of Scalping Jab scalper tijarat karte hain, to woh security ke boli mangnay ke phelao mein honay wali tabdeelion se faida uthana chahtay hain. yeh is qeemat mein farq hai jo aik brokr scalper se security khareeday ga ( boli ki qeemat ) aur is qeemat ke darmiyan jo brokr scalper ko farokht kere ga ( poochnay ki qeemat ). lehaza, scalper aik tang phelao ki talaash mein hai. lekin aam halaat mein, tijarat kaafi yaksaa hoti hai aur mustahkam munafe ki ijazat deti hai. is ki wajah yeh hai ke boli aur talabb ke darmiyan phelao bhi mustahkam hai ( sikyortiz ki talabb aur rasad mutawazan hai ). aik khalis scalper har roz mutadid tijarat kere shyd senkron mein. aik scalper ziyada tar tik, ya aik minute ke charts ka istemaal kere ga, kyunkay time frame chhota hai, aur inhen set up dekhnay ki zaroorat hai kyunkay woh mumkina had tak haqeeqi waqt ke qareeb shakal ikhtiyar karte hain. sportng systems jaisay direct ayksis trading ( dat ) aur level 2 quotation is qisam ki trading ke liye zaroori hain. orders ka khudkaar, fori amal aik scalper ke liye bohat zaroori hai, is liye barah e raast rasai brokr tarjeehi tareeqa hai. taweel mudti frame walay tajir scalping ko aik izafi nuqta nazar ke tor par istemaal kar saktay hain. sab se wazeh tareeqa yeh hai ke is ka istemaal is waqt kya jaye jab bazaar kata sun-hwa ho ya tang range mein band ho. jab lambay waqt ke frame mein koi rujhanaat nahi hotay hain, to aik mukhtasir waqt ke frame mein jane se mryi aur asthsali rujhanaat samnay asaktay hain, jo aik tajir ko khopdi ki talaash mein le ja satke hain. taweel mudti tijarat mein scalping ko shaamil karne ka aik aur tareeqa naam Nihaad " chhatri" tasawwur ke zariye hai. yeh nuqta nazar aik tajir ko apni laagat ki bunyaad ko behtar bananay aur ziyada se ziyada munafe haasil karne ki ijazat deta hai. chhatri ki tijarat mandarja zail tareeqay se ki jati hai : aik tajir taweel mudti tijarat ke liye position shuru karta hai. jab ke markazi tijarat taraqqi karti hai, aik tajir markazi tijarat ki simt mein aik mukhtasir waqt mein naye set up ki nishandahi karta hai, scalping ke usoolon ke mutabiq un mein daakhil hona aur bahar niklana. pehli qisam ki scalping ko" market making" kaha jata hai, jis ke tehat aik scalper back waqt aik boli aur makhsoos stock ke liye peshkash post karkay phelao se faida uthany ki koshish karta hai. zahir hai, yeh hikmat e amli sirf ziyada tar ghair mutharrak stock par kamyaab ho sakti hai jo baghair kisi haqeeqi qeemat mein tabdeeli ke barri miqdaar mein tijarat karte hain. is qisam ki scalping kamyabi se karna bohat mushkil hai kyunkay aik tajir ko boli aur peshkash dono par hasas ke liye market bananay walon se muqaabla karna chahiye. neez, munafe itna kam hai ke tajir ki position ke khilaaf koi bhi stock harkat un ke asal munafe ke hadaf se ziyada nuqsaan ki zamanat deti hai. deegar do trzin ziyada riwayati andaaz par mabni hain aur un ke liye aik mutharrak stock ki zaroorat hoti hai, jahan qeematein taizi se tabdeel hoti hain. un dono tarzo ke liye bhi aik durust hikmat e amli aur tehreek ko parhnay ka tareeqa darkaar hai . -

#8 Collapse

semat main move karne k baad wapis dosri semat main samll shadows hota hen. Shadow length main taqreeban same hote hen, jo buyers aur sellers ki barabari ko dekhati hai.Par isme iska price up and down bohot short hota hai prices ja up and down tou kam hota hai par iska bananay wala shadow kafi lamba hota hai kafi bara hota hai. Spinning top candle ke result mai price bohot minor khas faida mand ni sabit hota . Par spinning top ke douran bullish and bearish aty jaty hain jin mai kafi taiz changes be aaty hain. Bullish mai price kafi tezzi se up jaati hai aur bullish mai kafi taiz se down aati hain par at the end bullish and bearish again restore ho jaty hain.Japanese candles ko is wajah se trading ke dauran analysis mein zyada pasand kiya jata hai, kyunki ye candles single candle hone k bawajood bhi aik complete pattern tashkeel deti hai. Jab bhi ye single candlesticks prices k top ya bottom main paye jaati hai, to uss waqt ye trend reversal ka kaam karti hai. Single candle mein doji candles au : Important functions of Scalp Trading costs aik doosray ke qareeb hotay e pressure se push karte hen. Lekin kahani yahan khatam nahi hoti, bulke din k ikhtetam tak prices wapis apne aghaz wali position k qareeb a kar close ho jati hai. Iss soratehal main jo candle banti hai, wo Spinning top candle hoti hai. Ye candle bagher real body ki hoti hai, jiss main prices ka open aur close same point par nahi hota hai, jab k upper aur lower sides par sma, jis se chhota badan banta hai. Halanke, is dauran keemat mein tajarbay se izafah hota hai, jis se upper aur lower shadows ya wicks boycott jatay hain jo barabar lambay hote hain.2. Tashrih: Turning Top example market mein tasawwur paida karta hai keh na khareedne walay na bechne walay ka qaboo hai. Yah tashweesh, straight yaqeeni ya mojooda pattern mein palat jaye ya kamzor hojaye ka ishara hai.3. Bullish Turning Top: Poke Turning Top kisi downtrend mein nazar aata hai, to yeh mumkin pattern palatne ya negative force ki kamzori ki nishani ho sakti hai. Lekin, kisi bhi tajweez karne se pehle tasdeeq zaroori hai. Brokers baad mein bhadhne grain bullish cost activity ya dusre specialized pointers ko tasdeeq karne ke liye dekhte hain.4. Negative Turning Top: Poke Turning Top kisi upturn mein nazar aata hai, to yeh mumkin pattern palatne ya bullish energy ki kamzori ki ishara ho sakti hai. Bullish case ki tarah, tasdeeq ke liye mazeed markers ya negative cost activity ki zaroorat hoti hai.5. Faisla na karne aur jama sharpen ki haalat: Turning Top example market mein faisla na karne ki avastha ki nishani hai, jahan khareedne walay aur bechne walay barabar match hote hain. Yeh aam taur standard market solidification ke dauran ya poke ahem khabar ya maali occasions ki umeed hoti hai, nazar aata hai.6. Volume ki tafseel: Turning Top ex -

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

: Significant elements of Scalp Exchanging semat primary move karne k baad wapis dosri semat principal samll shadows hota hen. Shadow length primary taqreeban same hote hen, jo purchasers aur merchants ki barabari ko dekhati hai.Par isme iska value all over bohot short hota hai costs ja all over tou kam hota hai standard iska bananay wala shadow kafi lamba hota hai kafi bara hota hai. Turning top flame ke result mai cost bohot minor khas faida mand ni sabit hota . Standard turning top ke douran bullish and negative aty jaty hain jin mai kafi taiz changes be aaty hain. Bullish mai cost kafi tezzi se up jaati hai aur bullish mai kafi taiz se down aati hain standard toward the end bullish and negative again reestablish ho jaty hain.Japanese candles ko is wajah se exchanging ke dauran examination mein zyada pasand kiya jata hai, kyunki ye candles single flame sharpen k bawajood bhi aik complete example tashkeel deti hai. Punch bhi ye single candles costs k top ya base principal paye jaati hai, to uss waqt ye pattern inversion ka kaam karti hai. Single candle mein doji candles au : Significant elements of Scalp Exchanging costs aik doosray ke qareeb hotay e pressure se push karte hen. Lekin kahani yahan khatam nahi hoti, bulke noise k ikhtetam tak costs wapis apne aghaz wali position k qareeb a kar close ho jati hai. Iss soratehal primary jo flame banti hai, wo Turning top light hoti hai. Ye light bagher genuine body ki hoti hai, jiss fundamental costs ka open aur close same point standard nahi hota hai, poke k upper aur lower sides standard sma, jis se chhota badan banta hai. Halanke, is dauran keemat mein tajarbay se izafah hota hai, jis se upper aur lower shadows ya wicks blacklist jatay hain jo barabar lambay hote hain.2. Tashrih: Turning Top model market mein tasawwur paida karta hai keh na khareedne walay na bechne walay ka qaboo hai. Yah tashweesh, straight yaqeeni ya mojooda design mein palat jaye ya kamzor hojaye ka ishara hai.3. Bullish Turning Top: Jab Turning Top kisi downtrend mein nazar aata hai, to yeh mumkin design palatne ya negative power ki kamzori ki nishani ho sakti hai. Lekin, kisi bhi tajweez karne se pehle tasdeeq zaroori hai. Merchants baad mein bhadhne grain bullish expense action ya dusre particular pointers ko tasdeeq karne ke liye dekhte hain.4. Negative Turning Top: Jab Turning Top kisi upswing mein nazar aata hai, to yeh mumkin design palatne ya bullish energy ki kamzori ki ishara ho sakti hai. Bullish case ki tarah, tasdeeq ke liye mazeed markers ya negative expense action ki zaroorat hoti hai.5. Faisla na karne aur jama hone ki haalat: Turning Top model market mein faisla na karne ki avastha ki nishani hai, jahan khareedne walay aur bechne walay barabar match hote hain. Yeh aam taur standard market hardening ke dauran ya jab ahem khabar ya maali events ki umeed hoti hai, nazar aata hai.6. Volume ki tafseel: -

#10 Collapse

Assalamualaikum apky exchanging meetings throbbing jaa rhy hongy. Aj ka hmra conversation point "Significant elements of scalping".Dekhty hain k ye hmein Kya data deta hai r hmry ilam Mai Kesy ezafa krta hai. Scalping in exchanging Scalping aik tijarti andaaz hai jo qeematon mein choti tabdeelion se faida uthany aur dobarah farokht standard taizi se munafe kamanay mein mahaarat rakhta hai. day exchanging mein, scalping aik aisi istilaah hai jis ki hikmat e amli chhootey munafe standard ziyada miqdaar kamanay ko tarjeeh deti hai. scalping ke liye aik tajir ko bahar niklny ki sakht hikmat e amli ki zaroorat hoti hai kyunkay aik bara nuqsaan un bohat se chhootey fawaid ko khatam kar sakta hai jo tajir ne haasil karne ke liye kaam kya tha. is terhan, is hikmat e amli ke kamyaab honay ke liye sahih instruments ka hona — jaisay ke live feed, barah e raast rasai ka brokr, aur bohat saari tijaratein karne ki salahiyat — ka hona zaroori hai. is hikmat e amli ke baray mein mazeed jan-nay ke liye parheen, scalping ki mukhtalif aqsam, aur exchanging ke is andaaz ko istemaal karne ke tareeqay ke baray mein tajaweez. Scalping is mafroozay standard mabni hai ke ziyada tar stock harkat ka pehla marhala mukammal karen ge. lekin yeh kahan se jata hai ghair yakeeni hai. is ibtidayi marhalay ke baad, kuch stock agay barhna band kar dete hain, jabkay dosray agay barhatay rehtay hain. aik discounter ziyada se ziyada chhootey munafe lainay ka iradah rakhta hai. yeh" - apne munafe ko chalne do" ki zehniat ke bar aks hai, jo jeetnay wali tijarat ke size ko barha kar misbet tijarti nataij ko behtar bananay ki koshish karti hai. yeh hikmat e amli jeetnay walon ki tadaad mein izafah karkay aur jeet ke size ko qurbaan karkay nataij haasil karti hai. yeh ghair mamooli baat nahi hai ke aik taweel waqt ke outline walay tajir ke liye apni tijaraton mein se sirf nisf, ya is se bhi kam, jeet kar misbet nataij haasil kiye jayin-yeh sirf yeh hai ke jeet nuqsanaat se bohat ziyada hai. aik kamyaab stock hawker taham, harnay walay tijarat ke muqablay jeetnay ka tanasub bohat ziyada hoga, jabkay munafe ko nuqsanaat se taqreeban barabar ya qadray bara rakhta hai . Capabilities and systems of Scalping Punch hawker tijarat karte hain, to woh security ke boli mangnay ke phelao mein honay wali tabdeelion se faida uthana chahtay hain. yeh is qeemat mein farq hai jo aik brokr hawker se security khareeday ga ( boli ki qeemat ) aur is qeemat ke darmiyan jo brokr hawker ko farokht kere ga ( poochnay ki qeemat ). lehaza, hawker aik tang phelao ki talaash mein hai. lekin aam halaat mein, tijarat kaafi yaksaa hoti hai aur mustahkam munafe ki ijazat deti hai. is ki wajah yeh hai ke boli aur talabb ke darmiyan phelao bhi mustahkam hai ( sikyortiz ki talabb aur rasad mutawazan hai ). aik khalis hawker har roz mutadid tijarat kere shyd senkron mein. aik hawker ziyada tar tik, ya aik minute ke outlines ka istemaal kere ga, kyunkay time span chhota hai, aur inhen set up dekhnay ki zaroorat hai kyunkay woh mumkina had tak haqeeqi waqt ke qareeb shakal ikhtiyar karte hain. sportng frameworks jaisay direct ayksis exchanging ( dat ) aur level 2 citation is qisam ki exchanging ke liye zaroori hain. orders ka khudkaar, fori amal aik hawker ke liye bohat zaroori hai, is liye barah e raast rasai brokr tarjeehi tareeqa hai. taweel mudti outline walay tajir scalping ko aik izafi nuqta nazar ke peak standard istemaal kar saktay hain. sab se wazeh tareeqa yeh hai ke is ka istemaal is waqt kya jaye hit marketplace individualized structure sun-hwa ho ya tang range mein band ho. hit lambay waqt ke outline mein koi rujhanaat nahi hotay hain, to aik mukhtasir waqt ke outline mein jane se mryi aur asthsali rujhanaat samnay asaktay hain, jo aik tajir ko khopdi ki talaash mein le ja satke hain. taweel mudti tijarat mein scalping ko shaamil karne ka aik aur tareeqa naam Nihaad " chhatri" tasawwur ke zariye hai. yeh nuqta nazar aik tajir ko apni laagat ki bunyaad ko behtar bananay aur ziyada se ziyada munafe haasil karne ki ijazat deta hai. chhatri ki tijarat mandarja zail tareeqay se ki jati hai : aik tajir taweel mudti tijarat ke liye position shuru karta hai. punch ke markazi tijarat taraqqi karti hai, aik tajir markazi tijarat ki simt mein aik mukhtasir waqt mein naye set up ki nishandahi karta hai, scalping ke usoolon ke mutabiq un mein daakhil hona aur bahar niklana. pehli qisam ki scalping ko" market making" kaha jata hai, jis ke tehat aik hawker back waqt aik boli aur makhsoos stock ke liye peshkash post karkay phelao se faida uthany ki koshish karta hai. zahir hai, yeh hikmat e amli sirf ziyada tar ghair mutharrak stock standard kamyaab ho sakti hai jo baghair kisi haqeeqi qeemat mein tabdeeli ke barri miqdaar mein tijarat karte hain. is qisam ki scalping kamyabi se karna bohat mushkil hai kyunkay aik tajir ko boli aur peshkash dono standard hasas ke liye market bananay walon se muqaabla karna chahiye. neez, munafe itna kam hai ke tajir ki position ke khilaaf koi bhi stock harkat un ke asal munafe ke hadaf se ziyada nuqsaan ki zamanat deti hai. deegar do trzin ziyada riwayati andaaz standard mabni hain aur un ke liye aik mutharrak stock ki zaroorat hoti hai, jahan qeematein taizi se tabdeel hoti hain. un dono tarzo ke liye bhi aik durust hikmat e amli aur tehreek ko parhnay ka tareeqa darkaar hai -

#11 Collapse

V trehoti hai, phir oopar ki taraf palat jati hai. In the event that mother batii ki bunyaad standard tijarat karte hain, yeh hamain fori exchange principal section nahi chaiye belke. Is kay awful poke pattern inversion start ho jaye to at least two negative candles kay terrible sell ki exchange lagain jis kay liye hamain specialized pointers ka use krna hota roughage jis say hamain pattern ki inversion or continuation ka signal mil sakay.Is stage principal boycott janay wali candles kay hesitant conduct ko show karti feed ye batati roughage keh market primary the two bears and bulls yes to sahi laikin exit bhi ho gaye yani woh kisi result standard nai puhnchy.Spinning Top Candle Example is emphatically bullish/negative. Companions, identify pattern inversion ke liye bahut hey valuable example hai. Companions, market cost key up ya down moving ka idea laga sakty hain turning tops can -

#12 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Huge components of Scalp Trading semat essential move karne k baad wapis dosri semat head samll shadows hota hen. Shadow length essential taqreeban same hote hen, jo buyers aur shippers ki barabari ko dekhati hai.Par isme iska esteem all over bohot short hota hai costs ja all over tou kam hota hai standard iska bananay wala shadow kafi lamba hota hai kafi bara hota hai. Turning top fire ke result mai cost bohot minor khas faida mand ni sabit hota . Standard turning top ke douran bullish and negative aty jaty hain jin mai kafi taiz changes be aaty hain. Bullish mai cost kafi tezzi se up jaati hai aur bullish mai kafi taiz se down aati hain standard close to the end bullish and negative again restore ho jaty hain.Japanese candles ko is wajah se trading ke dauran assessment mein zyada pasand kiya jata hai, kyunki ye candles single fire hone k bawajood bhi aik complete model tashkeel deti hai. Punch bhi ye single candles costs k top ya base head paye jaati hai, to uss waqt ye design reversal ka kaam karti hai. Single candle mein doji candles au : Huge components of Scalp Trading costs aik doosray ke qareeb hotay e pressure se push karte hen. Lekin kahani yahan khatam nahi hoti, bulke commotion k ikhtetam tak costs wapis apne aghaz wali position k qareeb a kar close ho jati hai. Iss soratehal essential jo fire banti hai, wo Turning top light hoti hai. Ye light bagher certifiable body ki hoti hai, jiss key costs ka open aur close same point standard nahi hota hai, jab k upper aur lower sides standard sma, jis se chhota badan banta hai. Halanke, is dauran keemat mein tajarbay se izafah hota hai, jis se upper aur lower shadows ya wicks boycott jatay hain jo barabar lambay hote hain.2. Tashrih: Turning Top model market mein tasawwur paida karta hai keh na khareedne walay na bechne walay ka qaboo hai. Yah tashweesh, straight yaqeeni ya mojooda plan mein palat jaye ya kamzor hojaye ka ishara hai.3. Bullish Turning Top: Punch Turning Top kisi downtrend mein nazar aata hai, to yeh mumkin plan palatne ya negative power ki kamzori ki nishani ho sakti hai. Lekin, kisi bhi tajweez karne se pehle tasdeeq zaroori hai. Shippers baad mein bhadhne grain bullish cost activity ya dusre specific pointers ko tasdeeq karne ke liye dekhte hain.4. Negative Turning Top: Poke Turning Top kisi rise mein nazar aata hai, to yeh mumkin plan palatne ya bullish energy ki kamzori ki ishara ho sakti hai. Bullish case ki tarah, tasdeeq ke liye mazeed markers ya negative cost activity ki zaroorat hoti hai.5. Faisla na karne aur jama sharpen ki haalat: Turning Top model market mein faisla na karne ki avastha ki nishani hai, jahan khareedne walay aur bechne walay barabar match hote hain. Yeh aam taur standard market solidifying ke dauran ya hit ahem khabar ya maali occasions ki umeed hoti hai, nazar aata hai.6. Volume ki tafseel: -

#13 Collapse

Market Quick Price Fluctuations : Scalp Trading, yaani sar ke beech mein tijarat, ek trading method hai jo stock market mein istemaal hoti hai. Is tarike se buying and selling mein, kisi trader ko short time frames jaise ke seconds, mins ya hours ke andar chhoti chhoti rate movements par awareness karna hota hai. Scalp buying and selling mein mukhtalif tarah ke important capabilities hote hain jo iski ehmiyat ko samjhte hain.Pehla aur sabse ahem characteristic hai, market ke short aur chhoti fee fluctuations ka fayda uthana. Scalp traders chhoti fee moves par exchange karte hain, isliye unhein market ki volatility ka tayari se samna karna padta hai. Volatile marketplace mein, fees tezi se upar ya neeche badalte hain, aur scalp traders in badlavon mein buying and selling kar ke munafa kamate hain.Dosra function hai, jald aur sastay offers karna. Scalp trading mein, investors positions ko kuch hi waqt ke liye open karte hain, jisse unhein kam brokerage fees pay karni padti hai. Isse traders ko jyada profit ho sakta hai, kyunki wo common trades kar sakte hain aur chhoti rate movements par bhi munafa kamate hain.Teesra characteristic hai, threat control ka dhyaan rakhna. Scalp buying and selling mein, positions ko chhoti durations ke liye keep kiya jata hai, isse investors ko kam danger hota hai. Lekin phir bhi, kisi bhi change mein nuksan ka khatra hota hai, isliye scalp traders ko stop loss orders ka istemaal karna zaroori hota hai. Stop loss order lagakar, investors apne nuksan ko manipulate kar sakte hain. Risk Management and Quick Deals in Scalp Trading : Chautha characteristic hai, market intensity aur liquidity ka evaluation karna. Scalp traders ko market mein hone wali sports ko samajhna aur uski intensity ko dekhna zaroori hota hai. Liquidity ka dhyaan rakhna bhi mahatvapurna hai, kyunki agar marketplace mein liquidity kam hai toh trades ko execute karne mein dikkat ho sakti hai.Paanchwa function hai, technical analysis ka istemaal karna. Scalp buyers technical evaluation tools jaise ki transferring averages, Bollinger bands, aur RSI ka istemaal karke marketplace traits aur price moves ko samajhte hain. In gear ki madad se, buyers marketplace ke potential entry aur exit points ko samajhte hain.In features ke alawa bhi, Scalp Trading mein buyers ko dhyaan dena hota hai marketplace news aur monetary occasions ki. Kyunki quick term trading hai, isliye kisi bhi unexpected news ya occasion ka jald se jald asar hota hai, jisse traders ko tayari rakhni hoti hai.In sab functions ko samajh kar aur sahi tarike se istemaal karke, Scalp buyers steady aur a hit buying and selling kar sakte hain. Lekin yaad rahe, marketplace mein buying and selling karne mein hamesha threat hota hai, isliye investors ko apni studies aur expertise ko hamesha update rakhna chahiye.

Risk Management and Quick Deals in Scalp Trading : Chautha characteristic hai, market intensity aur liquidity ka evaluation karna. Scalp traders ko market mein hone wali sports ko samajhna aur uski intensity ko dekhna zaroori hota hai. Liquidity ka dhyaan rakhna bhi mahatvapurna hai, kyunki agar marketplace mein liquidity kam hai toh trades ko execute karne mein dikkat ho sakti hai.Paanchwa function hai, technical analysis ka istemaal karna. Scalp buyers technical evaluation tools jaise ki transferring averages, Bollinger bands, aur RSI ka istemaal karke marketplace traits aur price moves ko samajhte hain. In gear ki madad se, buyers marketplace ke potential entry aur exit points ko samajhte hain.In features ke alawa bhi, Scalp Trading mein buyers ko dhyaan dena hota hai marketplace news aur monetary occasions ki. Kyunki quick term trading hai, isliye kisi bhi unexpected news ya occasion ka jald se jald asar hota hai, jisse traders ko tayari rakhni hoti hai.In sab functions ko samajh kar aur sahi tarike se istemaal karke, Scalp buyers steady aur a hit buying and selling kar sakte hain. Lekin yaad rahe, marketplace mein buying and selling karne mein hamesha threat hota hai, isliye investors ko apni studies aur expertise ko hamesha update rakhna chahiye.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#14 Collapse

semat primary move karne k baad wapis dosri semat fundamental samll shadows hota hen. Shadow length primary taqreeban same hote hen, jo purchasers aur venders ki barabari ko dekhati hai.Par isme iska value all over bohot short hota hai costs ja all over tou kam hota hai standard iska bananay wala shadow kafi lamba hota hai kafi bara hota hai. Turning top flame ke result mai cost bohot minor khas faida mand ni sabit hota . Standard turning top ke douran bullish and negative aty jaty hain jin mai kafi taiz changes be aaty hain. Bullish mai cost kafi tezzi se up jaati hai aur bullish mai kafi taiz se down aati hain standard toward the end bullish and negative again reestablish ho jaty hain.Japanese candles ko is wajah se exchanging ke dauran examination mein zyada pasand kiya jata hai, kyunki ye candles single light sharpen k bawajood bhi aik complete example tashkeel deti hai. Poke bhi ye single candles costs k top ya base fundamental paye jaati hai, to uss waqt ye pattern inversion ka kaam karti hai. Single candle mein doji candles au : Significant elements of Scalp Exchanging costs aik doosray ke qareeb hotay e pressure se push karte hen. Lekin kahani yahan khatam nahi hoti, bulke noise k ikhtetam tak costs wapis apne aghaz wali position k qareeb a kar close ho jati hai. Iss soratehal primary jo light banti hai, wo Turning top flame hoti hai. Ye light bagher genuine body ki hoti hai, jiss primary costs ka open aur close same point standard nahi hota hai, hit k upper aur lower sides standard sma, jis se chhota badan banta hai. Halanke, is dauran keemat mein tajarbay se izafah hota hai, jis se upper aur lower shadows ya wicks blacklist jatay hain jo barabar lambay hote hain.2. Tashrih: Turning Top model market mein tasawwur paida karta hai keh na khareedne walay na bechne walay ka qaboo hai. Yah tashweesh, straight yaqeeni ya mojooda design mein palat jaye ya kamzor hojaye ka ishara hai.3. Bullish Turning Top: Jab Turning Top kisi downtrend mein nazar aata hai, to yeh mumkin design palatne ya negative power ki kamzori ki nishani ho sakti hai. Lekin, kisi bhi tajweez karne se pehle tasdeeq zaroori hai. Merchants baad mein bhadhne grain bullish expense action ya dusre particular pointers ko tasdeeq karne ke liye dekhte hain.4. Negative Turning Top: Jab Turning Top kisi upswing mein nazar aata hai, to yeh mumkin design palatne ya bullish energy ki kamzori ki ishara ho sakti hai. Bullish case ki tarah, tasdeeq ke liye mazeed markers ya negative expense action ki zaroorat hoti hai.5. Faisla na karne aur jama hone ki haalat: Turning Top model market mein faisla na karne ki avastha ki nishani hai, jahan khareedne walay aur bechne walay barabar match hote hain. Yeh aam taur standard market hardening ke dauran ya jab ahem khabar ya maali events ki umeed hoti hai, nazar aata hai.6. Volume ki tafseel: Turning Top ex

- Mentions 0

-

سا0 like

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 09:35 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим