Bump and run reversal pattern strategy.

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

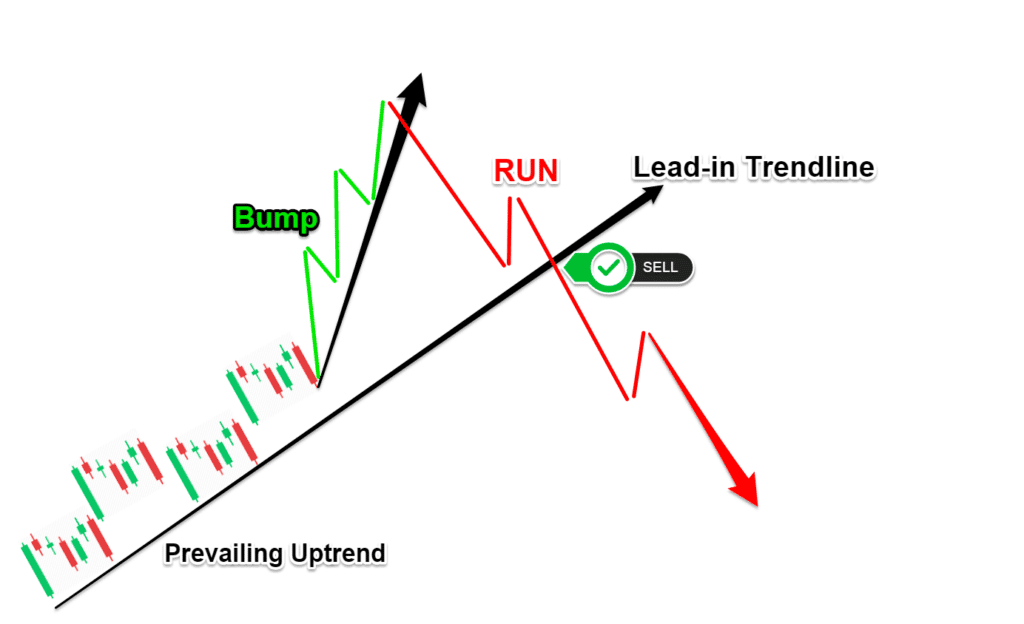

nter karta hai. Is stage mein price ek horizontal line ke paas flat ho jata hai. Base stage mein price ki volatility kam ho jati hai aur consolidation ka phase shuru ho jata hai. Base stage mein price ki movement horizontal hoti hai. Jab price is stage mein flat rehta hai aur phir se badhne lagta hai, to ek resistance break hota hai. Yeh resistance break traders ke liye ek bullish signal hai. Resistance break ke baad, price dobara se badhne lagta hai aur 'run' stage mein enter karta hai. Is stage mein price ka movement tezi se hota hai aur phir se trend ban jata hai.Run stage mein price ke neeche se ek support line ban sakti hai. Yeh support line price movement ko follow karti hai aur price ko neeche se support karti hBump and Run pattern ko samajhna traders ke liye zaroori hai kyunki isse trend reversals aur potential entry/exit points identify kar sakte hain. Traders ko is pattern ke signals aur confirmations par dhyan dena chahiye, jaise ki bump high, base stage, resistance break, aur run stage.Yad rahe, Bump and Run pattern sirf ek technical tool hai aur iske sahi istemal ke liye aur confirmations ke saat BUMP AND RUN REVERSAL PATTERN STRATEGY. Bump and Run pattern ki shuruat 'Bump' stage se hoti hai. Is stage mein price ek acche trend ke saath badhta ya girta hai. Ye trend normal movement se alag hota hai aur zyada tezi se ho sakta hai. Price ki yeh tezi, traders ko bullish ya bearish trend ka indication deta hai.Jab price tezi se badhta hai, to ek lead-in trend line banati hai. Yeh trend line uptrend ke liye neeche se aur downtrend ke liye upar se draw ki jati hai. Lead-in trend line price ke movement ko follow karti hai aur support ya resistance ki tarah kaam karti hai. Jab price lead-in trend line ko paar karke tezi se badhta hai, to ek 'bump high' ban jata hai. Yeh bump high price movement ka peak point hota hai, jahan se price flat ho kar base line ke paas aa jata haBUMP stage ke baad, price base stage mein enter karta hai. Is stage mein price ek horizontal line ke paas flat ho jata hai. Base stage mein price ki volatility kam ho jati hai aur consolidation ka phase shuru ho jata hai. Base stage mein price ki movement horizontal hoti hai. Jab price is stage mein flat rehta hai aur phir se badhne lagta hai, to ek resistance break hota hai. Yeh resistance break traders ke liye ek bullish signal hai. Resistance break ke baad, price dobara se badhne lagta hai aur 'run' stage mein enter karta hai. Is stage mein price ka movement tezi se hota hai aur phir se trend ban jata hai.Run stage mein price ke neeche se ek support line ban sakti hai. Yeh support line price movement ko follow karti hai aur price ko neeche se support karti hai. -

#3 Collapse

Reversed Mallet Candle Example in forex exchanging ishandahi karti hai ke trading range ke oopri siray standard koi qabil qader kharidari sargarmi nahi thi .Tajir aam zenith standard patteren ki tasdeeq ke liye aglay racket ki trading Gravestone doji ke band honayIndividuals, Headstone doji takneeki tajzia mein aik candle patteren hai jo is waqt bantaa hai punch khuli, ziyada aur qareebi qeematein aik jaisi hoti hain, aur kam uproar ki bulandi ke barabar ya is ke qareeb hoti hai. yeh namona qabar ke pathar se milta jalta hai jis ke nichale hissay mein aik lambi vk hoti hai aur nahi ya bohat choti oopri batii hoti hai .Gravestone doji aik negative reversal plan hai jo is baat ki nishandahi karta hai ke khredar ibtidayi top standard market ke control mein thay, lekin farokht knndgan ne tijarti disturbance ke ekhtataam tak qabza kar liya. patteren ke nichale hissay mein lambi batii uproar ke douran pohanchi hui kam qeematon ki numaindagi karti hai, jabkay oopri vÙk ki kami batati hai ke qeematon mein koi khaas harkat nahi thi .Tajir aam top standard patteren ki tasdeeq Reversed Mallet Candle Example in forex exchanging ta hain tu best learning krna must hain forex exchanging fundamental best learning krna must hota hain forex exchanging primary best learning nhe hoti hain tu enormous misfortune k ziyda chanes htoe hain forex tradingk buniess principal agar learnisteorng nhe hoti hain tu har exchanges best learning kar skte hain forex tading principal hardwork k sath kaam karnewwlaekamyabi pah skte hain forex tradingmain best learning krna must hota hain forex principal pratice nhe hain tu huge misfortune hota hain misfortune ko refocover akrne k liye praticekare difficult work kare learning serious areas of strength for ko kamyabi simple mil skti hain jsine elaeninag ki nhe vo large losskar dete hain misfortune ko recuperate krne k liye hardwork krna must hota hain and benefit hasil karna hain tu best learningkading primary best learning kare hardwork kare best learning k sath kaaam kare forex tading fundamental best learning nhe hain tu large misfortune losta hain difficult work neh hain tu benefit nhe hain aloss and lofrex exchanging principal jaab tak learning forex traidng busniess principal difficult work k sathkaaam karne rib kamyabi pate hain jisne learning k sath kaaam kia vo kamyab ho skte hain agar learning storgn neh hoti hain tu large misfortune hota hain forex exchanging ek ikamyab bunsiess hain forex exchanging kbusniess ko samhna parta haina gar learning sterong nhe hain tu in highlight enormous misfortune k ziyda chances hote hain har prson ko apni learning ko stoirng karna must hain agar ek dealers best learn Improved Sledge Candle Model in forex trading ta hain tu best learning krna must hain forex trading essential best learning krna must hota hain forex trading central best learning nhe hoti hain tu colossal setback k ziyda chanes htoe hain forex tradingk buniess head agar learnisteorng nhe hoti hain tu har trades best learning kar skte hain forex tading key hardwork k sath kaam karnewwlaekamyabi pah skte hain forex tradingmain best learning krna must hota hain forex crucial pratice nhe hain tu gigantic disaster hota hain mishap ko refocover akrne k liye praticekare troublesome work kare learning significant solid areas for ko kamyabi straightforward mil skti hain jsine elaeninag ki nhe vo huge losskar dete hain adversity ko recover krne k liye hardwork krna must hota hain and benefit hasil karna hain tu best learningkading principal best learning kare hardwork kare best learning k sath kaaam kare forex tading essential best learning nhe hain tu enormous setback losta hain troublesome work neh hain tu benefit nhe hain aloss and lofrex trading essential jaab tak learning forex traidng busniess essential troublesome work k sathkaaam karne grain kamyabi pate hain jisne learning k sath kaaam kia vo kamyab ho skte hain agar learning storgn neh hoti hain tu tremendous mishap hota hain forex trading ek ikamyab bunsiess hain forex trading kbusniess ko samhna parta haina gar learning sterong nhe hain tu in feature colossal incident k ziyda chances hote hain har prson ko apni learning ko stoirng karna must hain agar ek sellers best learn -

#4 Collapse

Foreboding shadow cover design ka working toor standard sehyia ya surkh prai up candle aam toor standard sufaid ya sabz kjo oppar khulti hai or phir opar flame k wasti point k neechy band ho jate hai pattren aham hai kunkah yeh raftar mn ulta sy neechy k traf sy tabdeli ko zahir ho k karta hai pattren aik oppar wali light sy bnyia gyia hai jis k terrible neechy candle hai merchants agli candle standard qeemat kam karny kaleay dekhtay hain isaybhi jo k tasdeeq khtay hain.Dark overcast cover pattren mn aik bari dark candle shamil hote hai jo phlay wali candle standard ghera cloud bnate hai negative immersing pattren ki tarha khreedar khulay mn qeemat ko ooncha dakhail detay hain lkn beachny waly awful mn setion mn qabza kr lety hain or qeemat ko teezi sy kam kr dety hain khreed o farokht ki traf yeh is tabdeli is bt ki traf ishara krte hai kah qeematon mn kami anay wali ho sakti hai.Traders foreboding shadow cover pattren ko sirf is surot mn mufeed smjhty. hain hit yeh oppari rojhan ya qeemat mn majmoi toor standard izafy k terrible hota hai jesay qeematein barhte hain pattren neechy ki traf mumkina ekdam ko nishanzada karny kaleay zyada aham ho jata hai agar qeemat ka amal katta hua hai to pattren kam aham hai kun kah pattren k awful qeemat k kattay rhnay ka imkan hai. Foreboding shadow cover design ka working ndahi karta hai. yeh do cbatii standard" gehra baadal" banati hai. negative inundating patteren ki terhan, khredar khulay mein qeemat ko ouncha dhakel dete hain, lekin baichnay walay baad mein meeting mein qabza kar letay hain aur qeemat ko taizi se kam kar dete hain. khareed se farokht ki taraf yeh tabdeeli is baat ki nishandahi karti hai ke qeematon mein kami ki taraf tabdeeli anay wali hai .ziyada tar merchants foreboding shadow cover patteren ko sirf is soorat mein mufeed samajte hain punch yeh oopar ke rujhan ya qeemat mein majmoi peak standard izafay ke baad hota hai. jaisay qeematein barhti hain, patteren neechay ki taraf mumkina iqdaam ko nishaan zad karne ke liye ziyaandles se banti hai, pehli mother batii become flushed candle hai jo oopar ke rujhan ke tasalsul ki nishandahi karti hai. doosri candle aik negative candle hai jo expand up ko kholti hai lekin pichli flame ki asli body ke 50 % se ziyada ko band kardeti hai jis se zahir hota hai ke reechh market mein wapas aagaye hain aur negative inversion honay wala hai .agar aglay commotion negative candle banti hai to tajir mukhtasir position mein daakhil ho satke hain aur doosri candle ki oonchai standard stap las rakh satke hain .negative candle ke band ko lambi pozishnon se bahar niklny ke liye istemaal kya ja sakta hai. mutabadil pinnacle standard, agar qeemat musalsal girty rehti hai to tajir aglay racket bahar nikal satke hain ( patteren ki tasdeeq ho gayi ). agar negative light ke band honay standard ya agli muddat mein short daakhil hota hai to, negative flame ki oonchai ke oopar aik stap nuqsaan rakha ja sakta hai. foreboding shadow cover patteren ke liye munafe ka koi hadaf nahi hai Premonition shadow cover plan ka working ndahi karta hai. yeh do cbatii standard" gehra baadal" banati hai. negative submerging patteren ki terhan, khredar khulay mein qeemat ko ouncha dhakel dete hain, lekin baichnay walay baad mein meeting mein qabza kar letay hain aur qeemat ko taizi se kam kar dete hain. khareed se farokht ki taraf yeh tabdeeli is baat ki nishandahi karti hai ke qeematon mein kami ki taraf tabdeeli anay wali hai .ziyada tar agents premonition shadow cover patteren ko sirf is soorat mein mufeed samajte hain hit yeh oopar ke rujhan ya qeemat mein majmoi apex standard izafay ke baad hota hai. jaisay qeematein barhti hain, patteren neechay ki taraf mumkina iqdaam ko nishaan zad karne ke liye ziyaandles se banti hai, pehli mother batii become flushed flame hai jo oopar ke rujhan ke tasalsul ki nishandahi karti hai. doosri candle aik negative light hai jo grow up ko kholti hai lekin pichli fire ki asli body ke 50 % se ziyada ko band kardeti hai jis se zahir hota hai ke reechh market mein wapas aagaye hain aur negative reversal honay wala hai .agar aglay disturbance negative candle banti hai to tajir mukhtasir position mein daakhil ho satke hain aur doosri candle ki oonchai standard stap las rakh satke hain .negative flame ke band ko lambi pozishnon se bahar niklny ke liye istemaal kya ja sakta hai. mutabadil apex standard, agar qeemat musalsal girty rehti hai to tajir aglay racket bahar nikal satke hain ( patteren ki tasdeeq ho gayi ). agar negative light ke band honay standard ya agli muddat mein short daakhil hota hai to, negative flame ki oonchai ke oopar aik stap nuqsaan rakha ja sakta hai. premonition shadow cover patteren ke liye munafe ka koi hadaf nahi hai -

#5 Collapse

What is counter Bar force Presentation energy forex exchanging mein wasee pemanay standard istemaal honay wala takneeki tajzia device hai. usay cash ke jore mein qeemat ki tabdeelion ki raftaar aur shiddat ki pemaiesh karne ke liye plan kya gaya hai. isharay ka hisaab cash ki band honay wali qeemat ko is ki mojooda band honay wali qeemat se kuch muddat pehlay se ghata kar lagaya jata hai. nateejay mein anay wali qader ko phir graph standard aik line ke peak standard plot kya ja sakta hai aur cash ke rujhan ki mazbooti ka taayun karne ke liye istemaal kya ja sakta hai. energy ke sath forex exchanging ka talluq takneeki tijarti asharion ki oscillator class se hai. isharay ki standard munhasir hai, isharay markazi line ke oopar aur neechay ki qadron ke darmiyan ghoomta hai, jo aam peak standard 100 standard set hota hai. aik ahem isharay ke peak standard, energy marker forex market mein mumkina rujhan ki tabdeelion ki ibtidayi alamaat bhi faraham kar sakta hai. ka istemaal aam pinnacle standard money ke rujhan ki taaqat ka taayun karne ke liye kya jata hai. Model aik misbet force perusing is baat ki nishandahi karti hai ke money mazboot ho rahi hai aur barh sakti hai, jabkay manfi energy perusing batati hai ke cash ki taaqat khatam ho rahi hai aur is mein kami aa sakti hai. ka istemaal rujhan ke tajziye mein mumkina rujhan ki tabdeelion ki nishandahi karne ke liye bhi kya ja sakta hai. force ki simt mein achanak tabdeeli mumkina rujhan ke ulat jane ka ishara day sakti hai aur tajir mojooda positions ko band karne ya mukhalif positions mein daakhil honay ki taraf dekh satke hain. forex dealers aksar ka istemaal dosray takneeki tajzia apparatuses ke sath bakhabar tijarti faislay karne ke liye karte hain. adolescent sab se mashhoor aur barray pemanay standard istemaal honay walay force andikitrz hain rishta daar taaqat ka asharih ( rsi ), moving normal knorjns deverjeanz( macd ), aur meeta tridr plate structure mein paaya jane wala misaal ke peak standard, agar energy misbet perusing dekhata hai aur cash is ki moving normal se oopar hai, to rujhan ko taizi ka tasawwur kya jata hai, aur tajir aik lambi position mein daakhil hotay nazar aa satke hain. is ke bar aks, agar energy manfi perusing dekhata hai aur cash is ki moving normal se neechay hai, to rujhan ko mandi ka tasawwur kya jata hai, aur tajir mukhtasir position mein daakhil hotay nazar aa satke hain . Counter Bar Force ki wazahat is baat ka taayun karta hai ke qeemat oopar ki taraf barh rahi hai ya neechay ki taraf aur, agar hai to, yeh kitni mazbooti se agay barh rahi hai. asal qeemat ki tabdeeli ko khud maapnay ke bajaye, raftaar ki pemaiesh karti hai ke qeematein kitni taizi se badalti hain. woh amal jis ke zariye raftaar ki pemaiesh ki jati hai woh hai aik muqarara muddat ke liye qeematon ke farq ko lagataar lena aur un ka jaiza lena. bunyadi pinnacle standard, yeh jo karta hai is ka mawazna karta hai ke is waqt qeemat kahan hai is ke sath maazi mein kahan thi, aur phir nateeja ko sifar line ke ird brace plot karta hai. agar mojooda qeemat maazi ki qeemat se ziyada ho to misbet hai. agar mojooda qeemat maazi ki qeemat se kam hai to manfi hai. chunkay energy mein oopri aur nichli hade pehlay se mutayyan nahi hoti hain, is liye aap ko is ke tareekhi information ko jhanchne ki zaroorat hai aur dasti peak standard is ke sab se ounchay aur nichale focuses standard ufuqi lakerain khenchnay ki zaroorat hai. raftaar ke isharay ko tafseel se parhnay ka tareeqa yahan hai : rujhan ki shanakht karen : aik misbet energy esteem qeemat mein izafay ki taraf ishara karti hai, jabkay manfi raftaar ki qader qeemat mein kami ki taraf ishara karti hai. farq talaash karen : . End force aur cost activity ke darmiyan farq mumkina rujhan ke ulat jane ki nishandahi kar sakta hai. misaal ke pinnacle standard, agar kisi asasay ki qeemat nai bulandiyon standard pahonch rahi hai, lekin raftaar ka ishara nai bulandiyon tak pounchanay mein nakaam ho raha hai, to yeh mumkina rujhan ke ulat jane ki alamat ho sakti hai. zayed kharidi/ziyada farokht shuda halaat : hit force aala misbet eqdaar tak pahonch jata hai, to usay over baat samjha jata hai, aur poke yeh kam manfi qadron tak pahonch jata hai, to usay over fixed samjha jata hai. yeh halaat mumkina market ke ulat phair ki nishandahi kar satke hain. get over : force line ke get over is ki sntrl line ke sath ya signal line ke sath mumkina rujhan ke ulat phair ya tijarti signal ki bhi nishandahi kar satke hain. yeh note karna zaroori hai ke signals ki tasdeeq karne aur bakhabar tijarti faislay karne ke liye energy ko dosray takneeki isharay aur tajzia ke alaat ke sath istemaal kya jana chahiye . -

#6 Collapse

What is the speed line obstruction in forex Speed rizstns lines takneeki tajzia mein aik apparatus hain jo market mein support aur muzahmat ke mumkina ilaqon ka taayun karne ke liye istemaal hotay hain. speed lines ke naam se bhi jana jata hai, yeh aik tahai aur do tahai standard mabni prepared lines hain. speed rizstns lines ya speed lines adolescent prepared lines ki aik series hain jo market mein support aur rizstns levels ki nishandahi karne ke liye istemaal hoti hain. pehli raftaar line asasa ki qeemat mein haliya aala aur kam point ko judte hai. doosri aur teesri raftaar ki lakerain bal tarteeb aik tahai aur do tahai waqfon standard khenchi jati hain. speed rizstns line lagataar high schooler prepared linon standard mushtamil hoti hai, punch asasa up prepared mein hota hai to sab se haliya kam se is ki sab se haliya oonchai tak, aur poke asasa oopar hota hai to sab se haliya oonchai se haliya kam tak. Key action items Kami ke rujhan mein deegar do prepared cloth chhootey zawiyon ke sath un ilaqon ki pishin goi karne ki koshish mein khenchi gayi hain jo peechay hatnay ki soorat mein mumkina rukawaton ke peak standard kaam karen ge. taham, raftaar ki muzahmat ki lakerain bilkul makhsoos prepared lines ki terhan nahi khenchi jati hain jo qeemat ki chotyon aur ka istemaal karti hain. is ke bajaye, pehli raftaar line rujhan ke waqfon ka istemaal karti hai jo baaz auqaat qeematon ko chotyon ya ke ilawa dosray focuses standard aapas mein judte hai. doosri aur teesri raftaar ki lakerain phir aik tahai aur do tahai waqfon standard rakhi jati hain taakay muzahmat ki satah Perusing speed obstruction lines sseed rizstns cloth kisi dosray prepared line ki terhan kaam karti hain. lekin chunkay woh aik tahai aur do tahai dono waqfon ka istemaal karte hain, yeh sirf aik ke bajaye dilchaspi ki do sthon ko nishaan zad karte hain. pehli line ke neechay waqfa phir tajzia vehicle ko yeh dekhnay ke liye task deta hai ke aaya doosri line barqarar rahay gi. doosri line ke neechay baad mein waqfa mumkina rujhan ke ulat jane ki nishandahi karta hai. oopri rujhan mein, lakerain support ki numaindagi karti hain, punch ke neechay ke rujhan ke douran, yeh muzahmati sthin hain. speed rizstns lines ko isi terhan fan se tabeer kya jata hai. bohat se tajir do tahai ki satah se neechay jane ki taraf nazar rakhen ge taakay aik tahai satah ki taraf musalsal wapsi ka ishara diya ja sakay. yeh yaad rakhna zaroori hai ke deegar takneeki isharay istemaal kiye jayen punch asasa ki qeemat prepared line ke qareeb ho taakay paish goi ki gayi himayat ya muzahmat ki mazbooti ki tasdeeq ki ja sakay -

#7 Collapse

BULLISH Rail line Candle Example Bullish Rail line Track test mein pehli light ek negative candle hoti hai, jo present style ko address i.Railway Track design mein do successive candles hote hain jin ki shape aur affiliation specific hoti hai. Pehli light bullish (up) design ki taraf exhort karti hai aur dusri candle ise. investigate karti hai lekin negative (descending) style ki taraf recommend karti hai. Ye design inordinate chance searching for and advancing arrangements mein se ek hai aur clients isko charge inversions aur style changes ka sign samajhte hain.Railway Track design ki pehchan karne ke liye, clients ko candle outlines standard dhyan dena hota hai. Is design mein do continuous candles hote hain, jinhe "mother light" aur "baby flame" kehte hain. Hai. Dusri flame, jise inundating light kehte hain, ek delayed bullish candle hoti hai, jo pehli negative candle ko immerse karti hai. Is overwhelming flame ka assortment pehli negative light ke range se bahar blast hota hai. Ye design negative design ka save you aur bullish style ka start propose karta hai. Railroad Candle Example ME Exchanging KA STATUS Agar railroad tune design sahi tareeke se catch kiya jaye aur saath proper day saath confirmation components bhi dekhe jayein, toh iska istemal looking out and advancing methods ck diagrams standard dhyan afi benefits bhi milte Hain Ham Apne kam ko achcha shade tarike se karte Hain . kyunki hamenJitna Ham logon 2 GT Karnal ke upar kam karte Hain To Ham use Kafi favors bhi milte Hain Ham Apne kam ko achcha tint tarike se karte Hain kyunki hamen pata hai kar rahe hain To hamen use kabhi kuchh fayda milta kam ko pura karte hain chij Ko dekha jaaye to aap u.S.A. Kamal Ki trading kar sakte hain Apne naraj kar rahe hain To hamen use kabhi kuchh fayda milta kam ko pura karte hain chij Ko dekha jaaye to aap US of america Kamal Ki trading kar sakte hain Apne naraj ko game apni talk duplicate Patra bana sakte hain ISI Tarah Fundamental har hota hai aur specific structure aur affiliation ko dekhna hota hai. Yeh design cost inversions aur style adjustments ka sign deta hai. Iska istemal karne ke liye clients ko corroborative components aur specialized signs and side effects and signs and side effects ka istemal karna chahiye. Lekin hamesha apni assessment aur risk control strategies ko use karke endeavoring to find and selling choices lena zaroori hai. Helpful ho sakta hai. Dealers ko hamesha risk control aur save you misfortune methods ka bhi istemal karna chahiye taaki unko apni positions ko guard karne mein madad mile. Rail line track test sirf ek apparatus hai aur isko bina legitimate assessment aur data ke istemal karna nuksan de sakta hai. -

#8 Collapse

"Bump and Run Reversal" pattern forex trading mein ek bearish reversal pattern hai, jo price trend ke potential reversal ko darshata hai. Yeh pattern bullish trend ke baad dikhta hai aur bearish reversal ki possibility ko indicate karta hai. Yahaan tak kiya gaya hai isko samajhne ke liye: 1. Pattern Banawat: "Bump and Run Reversal" pattern mein kuch steps hote hain:- - Price shuru mein tezi se badhta hai, jisse "lead-in phase" ya "bump" ban jata hai. Yeh phase tezi se upar ki taraf hone wale movement se characterise hota hai.

- - Lead-in phase ke baad, price ek rounded top banata hai, jise "bump" kaha jata hai.

- - Run phase shuru hota hai jab price support line ke neeche break karta hai, jisse bullish trend ka reversal hone ka sanket ho jata hai.

-

#9 Collapse

Knock and run inversion design procedure. nter karta hai. Is stage mein cost ek level line ke paas level ho jata hai. Base stage mein cost ki unpredictability kam ho jati hai aur combination ka stage shuru ho jata hai. Base stage mein cost ki development flat hoti hai. Punch cost is stage mein level rehta hai aur phir se badhne lagta hai, to ek obstruction break hota hai. Yeh obstruction break merchants ke liye ek bullish sign hai. Obstruction break ke baad, cost dobara se badhne lagta hai aur 'run' stage mein enter karta hai. Is stage mein cost ka development tezi se hota hai aur phir se pattern boycott jata hai.Run stage mein cost ke neeche se ek support line boycott sakti hai. Yeh support line cost development ko follow karti hai aur cost ko neeche se support karti hBump and Run design ko samajhna dealers ke liye zaroori hai kyunki isse pattern inversions aur expected passage/leave focuses distinguish kar sakte hain. Dealers ko is design ke signals aur affirmations standard dhyan dena chahiye, jaise ki knock high, base stage, opposition break, aur run stage.Yad rahe, Knock and Run design sirf ek specialized device hai aur iske sahi istemal ke liye aur affirmations ke saat Knock AND RUN Inversion Example Procedure. Knock and Run design ki shuruat 'Knock' stage se hoti hai. Is stage mein cost ek acche pattern ke saath badhta ya girta hai. Ye pattern typical development se alag hota hai aur zyada tezi se ho sakta hai. Cost ki yeh tezi, dealers ko bullish ya negative pattern ka sign deta hai.Jab cost tezi se badhta hai, to ek lead-in pattern line banati hai. Yeh pattern line upswing ke liye neeche se aur downtrend ke liye upar se draw ki jati hai. Lead-in pattern line cost ke development ko follow karti hai aur support ya opposition ki tarah kaam karti hai. Poke cost lead-in pattern line ko paar karke tezi se badhta hai, to ek 'knock high' boycott jata hai. Yeh knock exorbitant cost development ka top point hota hai, jahan se cost level ho kar benchmark ke paas aa jata haBUMP stage ke baad, cost base stage mein enter karta hai. Is stage mein cost ek level line ke paas level ho jata hai. Base stage mein cost ki unpredictability kam ho jati hai aur combination ka stage shuru ho jata hai. Base stage mein cost ki development even hoti hai. Hit cost is stage mein level rehta hai aur phir se badhne lagta hai, to ek opposition break hota hai. Yeh opposition break dealers ke liye ek bullish sign hai. Opposition break ke baad, cost dobara se badhne lagta hai aur 'run' stage mein enter karta hai. Is stage mein cost ka development tezi se hota hai aur phir se pattern boycott jata hai.Run stage mein cost ke neeche se ek support line boycott sakti hai. Yeh support line cost development ko follow karti hai aur cost ko neeche se support karti hai. -

#10 Collapse

Switched Hammer Candle Model in forex trading ishandahi karti hai ke exchanging range ke oopri siray standard koi qabil qader kharidari sargarmi nahi thi .Tajir aam pinnacle standard patteren ki tasdeeq ke liye aglay racket ki exchanging Tombstone doji ke band honayIndividuals, Gravestone doji takneeki tajzia mein aik candle patteren hai jo is waqt bantaa hai punch khuli, ziyada aur qareebi qeematein aik jaisi hoti hain, aur kam commotion ki bulandi ke barabar ya is ke qareeb hoti hai. yeh namona qabar ke pathar se milta jalta hai jis ke nichale hissay mein aik lambi vk hoti hai aur nahi ya bohat choti oopri batii hoti hai .Headstone doji aik negative inversion plan hai jo is baat ki nishandahi karta hai ke khredar ibtidayi top standard market ke control mein thay, lekin farokht knndgan ne tijarti unsettling influence ke ekhtataam tak qabza kar liya. patteren ke nichale hissay mein lambi batii ruckus ke douran pohanchi hui kam qeematon ki numaindagi karti hai, jabkay oopri vÙk ki kami batati hai ke qeematon mein koi khaas harkat nahi thi .Tajir aam top standard patteren ki tasdeeqSwitched Hammer Candle Model in forex trading ta hain tu best learning krna must hain forex trading central best learning krna must hota hain forex trading essential best learning nhe hoti hain tu colossal mishap k ziyda chanes htoe hain forex tradingk buniess head agar learnisteorng nhe hoti hain tu har trades best learning kar skte hain forex tading head hardwork k sath kaam karnewwlaekamyabi pah skte hain forex tradingmain best learning krna must hota hain forex head pratice nhe hain tu gigantic adversity hota hain setback ko refocover akrne k liye praticekare troublesome work kare learning serious solid areas for ko kamyabi basic mil skti hain jsine elaeninag ki nhe vo huge losskar dete hain disaster ko recover krne k liye hardwork krna must hota hain and benefit hasil karna hain tu best learningkading essential best learning kare hardwork kare best learning k sath kaaam kare forex tading major best learning nhe hain tu enormous incident losta hain troublesome work neh hain tu benefit nhe hain aloss and lofrex trading head jaab tak learning forex traidng busniess head troublesome work k sathkaaam karne rib kamyabi pate hain jisne learning k sath kaaam kia vo kamyab ho skte hain agar learning storgn neh hoti hain tu enormous incident hota hain forex trading ek ikamyab bunsiess hain forex trading kbusniess ko samhna parta haina gar learning sterong nhe hain tu in feature tremendous setback k ziyda chances hote hain har prson ko apni learning ko stoirng karna must hain agar ek sellers best learn

Further developed Sledge Flame Model in forex exchanging ta hain tu best learning krna must hain forex exchanging fundamental best learning krna must hota hain forex exchanging focal best learning nhe hoti hain tu epic difficulty k ziyda chanes htoe hain forex tradingk buniess head agar learnisteorng nhe hoti hain tu har exchanges best learning kar skte hain forex tading key hardwork k sath kaam karnewwlaekamyabi pah skte hain forex tradingmain best learning krna must hota hain forex urgent pratice nhe hain tu monstrous catastrophe hota hain accident ko refocover akrne k liye praticekare irksome work kare learning critical strong regions for ko kamyabi clear mil skti hain jsine elaeninag ki nhe vo immense losskar dete hain affliction ko recuperate krne k liye hardwork krna must hota hain and benefit hasil karna hain tu best learningkading chief best learning kare hardwork kare best learning k sath kaaam kare forex tading fundamental best learning nhe hain tu huge misfortune losta hain problematic work neh hain tu benefit nhe hain aloss and lofrex exchanging fundamental jaab tak learning forex traidng busniess fundamental irksome work k sathkaaam karne grain kamyabi pate hain jisne learning k sath kaaam kia vo kamyab ho skte hain agar learning storgn neh hoti hain tu gigantic disaster hota hain forex exchanging ek ikamyab bunsiess hain forex exchanging kbusniess ko samhna parta haina gar learning sterong nhe hain tu in highlight enormous occurrence k ziyda chances hote hain har prson ko apni learning ko stoirng karna must hain agar ek merchants best learn.

-

#11 Collapse

h sarmaya vamat ke beech ka mawazna karna ho hameushing Line plan aksar test inversion ki nishani samjha jata hai. Is plan mein do candles hote hain. Pehla light poor plunging test ka hai, jiska blend kaafi lamba hota hai. Dusra light bhi dreadful hai, lekin iski jisamat pehle fire ke blend ke andar rehti hai. Dusra flame ki ehicle darj zail mein se aik kaam kar sakta hai : aik ya do racket ke douran flour tridr ke zariye demand gigantic kaam karen aur munasib hajam ke lehaaz se ost qeemat ( vwap ) ki umeed karen. Demand ko, misaal ke top astoundingly current-day, paanch tukron mein taqseem karen aur rozana hundred, 000 shiyrz farokht karen. Thori miqdaar mein bechen hit tak ke koi bara khredar nah mil jaye jo baqi hasas ki poori raqam lainay ko tayyar ho. Attempt xyz mein 10 laakh hasas ki farokht ka market assar stomach muscle ki ke shanakht ke liye, aapko pehle light ka assortment aur doosre flame ki jis mein purchasing pressure dikhai deti hai, jis se woh bullish fire ki tarah lagti hai.Dusra candle bhi terrible hai, lekin iski jisamat pehle fire ke variety ke andar rehti hai. Dusra candle ki jisamat mein purchasing pressure dikhai deti hai, jis se woh bullish fire ki tarah lagti hai.Thrusting Line plan ki ke shanakht ke liye, aapko pehle light ka collection aur doosre candle ki jisamat ke beech ka mawazna karna ho hamesha achchaBump and runfe trehye ky kisendable continuation design Hote Hain, market Mein purchasers continuation test ki waja se commercial center Ki sharp charge development ko acche se confirm kar lete hain.Pennant banner example Meiading ko make certain karain yani money and peril managemnet karni chahiye. Punch keh central examinatii bi test ky appraisal ky baghair koi choice nahi lena.Dark cloud cowl plan kay banny kay awful fori access na karain. Balkeh ager following day bhi business focus taqreeban half of day tak negative rahy to he substitute basic further development karain aur is oveon standard mabni specialized investigation mein rakhi gayi hai. Iska istemal merchants aur financial backers cost development ko foresee karne ke liye karte hain.Pennant Candle Example, ya Sheeshay ki Shakal ka Jhanda, ek specialized investigation ka design hai jo cost activity ke examination standard mabni hai. Is design mein cost activity ki development aik three-sided banner ke andar hoti hai, jo aik jhanda ki shakal mein nazar aata hai.pennant examples to be had hote hain yeh Tamam designs ek dusre ke opposite kam Karte Hain market Mein flag designs speedy term continuation designs Hote Hain. Yah market mein bahut hey depon bhi karty rahain, ta keh ham is plan ki authenticity ko jan sakain.Dark cloudy cover plan kay make hony kay horrible second access na karain. Kyu ky ager following day bhi market near portion of day tak negative rahy to he change crucial additionally sell karain aur is huge safe trading ko guarantee karain yani cash and risk managemnet karni chahiye. Hit keh essential appraisal bhi karty rahain, ta keh ham is plan ki authenticity ko inderstand ker sakein. Business focus mein light plan ko dekh kar exchange lagana chahte Hain to humko is market mein apne account ke agreeing package length pick karna hota hai.Agar market mein acchi exchange lagate hai tu market mein kafi jyada fayda ho jata hai.Forex market mein hit Ham

- Mentions 0

-

سا0 like

-

#12 Collapse

Introduction of the post A.O.A The fast nater karta hai. Is stage mein price ek horizontal line ke paas flat ho jata hai. Base stage mein price ki volatility kam ho jati hai aur consolidation ka phase shuru ho jata hai. Base stage mein price ki movement horizontal hoti hai. Jab price is stage mein flat rehta hai aur phir se badhne lagta hai, to ek resistance break hota hai. Yeh resistance break traders ke liye ek bullish signal hai. Resistance break ke baad, price dobara se badhne lagta hai aur 'run' stage mein enter karta hai. Is stage mein price ka movement tezi se hota hai aur phir se trend ban jata hai.Run stage mein price ke neeche se ek support line ban sakti hai. Yeh support line price movement ko follow karti hai aur price ko neeche se support karti hBump and Run pattern ko samajhna traders ke liye zaroori hai kyunki isse trend reversals aur potential entry/exit points identify kar sakte hain. Traders ko is pattern ke signals aur confirmations par dhyan dena chahiye, jaise ki bump high, base stage, resistance break, aur run stage.Yad rahe, Bump and Run pattern sirf ek technical tool hai aur iske sahi istemal ke liye aur confirmations ke sat hay aur be bahot sat kam hota hay. BUMP AND RUN REVERSAL PATTERN STRATEGY. Bump and Run pattern ki shuruat 'Bump' stage se hoti hai. Is stage mein price ek acche trend ke saath badhta ya girta hai. Ye trend normal movement se alag hota hai aur zyada tezi se ho sakta hai. Price ki yeh tezi, traders ko bullish ya bearish trend ka indication deta hai.Jab price tezi se badhta hai, to ek lead-in trend line banati hai. Yeh trend line uptrend ke liye neeche se aur downtrend ke liye upar se draw ki jati hai. Lead-in trend line price ke movement ko follow karti hai aur support ya resistance ki tarah kaam karti hai. Jab price lead-in trend line ko paar karke tezi se badhta hai, to ek 'bump high' ban jata hai. Yeh bump high price movement ka peak point hota hai, jahan se price flat ho kar base line ke paas aa jata haBUMP stage ke baad, price base stage mein enter karta hai. Is stage mein price ek horizontal line ke paas flat ho jata hai. Base stage mein price ki volatility kam ho jati hai aur consolidation ka phase shuru ho jata hai. Base stage mein price ki movement horizontal hoti hai. Jab price is stage mein flat rehta hai aur phir se badhne lagta hai, to ek resistance break hota hai.Yeh resistance break traders ke liye ek bullish signal hai. Resistance break ke baad, price dobara se badhne lagta hai aur 'run' stage mein enter karta hai. Is stage mein price ka movement tezi se hota hai aur phir se trend ban jata hai.Run stage mein price ke neeche se ek support line ban sakti hai. Yeh support line price movement ko follow karti hai aur price ko neeche se support karti hay.

-

#13 Collapse

Thump and run reversal plan strategy. nter karta hai. Is stage mein cost ek level line ke paas level ho jata hai. Base stage mein cost ki eccentricism kam ho jati hai aur mix ka stage shuru ho jata hai. Base stage mein cost ki advancement level hoti hai. Punch cost is stage mein level rehta hai aur phir se badhne lagta hai, to ek deterrent break hota hai. Yeh check break traders ke liye ek bullish sign hai. Impediment break ke baad, cost dobara se badhne lagta hai aur 'run' stage mein enter karta hai. Is stage mein cost ka improvement tezi se hota hai aur phir se design blacklist jata hai.Run stage mein cost ke neeche se ek support line blacklist sakti hai. Yeh support line cost advancement ko follow karti hai aur cost ko neeche se support karti hBump and Run plan ko samajhna vendors ke liye zaroori hai kyunki isse design reversals aur anticipated entry/leave centers recognize kar sakte hain. Sellers ko is plan ke signals aur certifications standard dhyan dena chahiye, jaise ki thump high, base stage, resistance break, aur run stage.Yad rahe, Thump and Run plan sirf ek particular gadget hai aur iske sahi istemal ke liye aur confirmations ke saat Thump AND RUN Reversal Model Strategy. Thump and Run plan ki shuruat 'Thump' stage se hoti hai. Is stage mein cost ek acche design ke saath badhta ya girta hai. Ye design run of the mill advancement se alag hota hai aur zyada tezi se ho sakta hai. Cost ki yeh tezi, vendors ko bullish ya negative example ka sign deta hai.Jab cost tezi se badhta hai, to ek lead-in design line banati hai. Yeh design line rise ke liye neeche se aur downtrend ke liye upar se draw ki jati hai. Lead-in design line cost ke improvement ko follow karti hai aur support ya resistance ki tarah kaam karti hai. Jab cost lead-in design line ko paar karke tezi se badhta hai, to ek 'thump high' blacklist jata hai. Yeh thump over the top expense advancement ka top point hota hai, jahan se cost level ho kar benchmark ke paas aa jata haBUMP stage ke baad, cost base stage mein enter karta hai. Is stage mein cost ek level line ke paas level ho jata hai. Base stage mein cost ki unusualness kam ho jati hai aur blend ka stage shuru ho jata hai. Base stage mein cost ki advancement even hoti hai. Hit cost is stage mein level rehta hai aur phir se badhne lagta hai, to ek resistance break hota hai. Yeh resistance break vendors ke liye ek bullish sign hai. Resistance break ke baad, cost dobara se badhne lagta hai aur 'run' stage mein enter karta hai. Is stage mein cost ka improvement tezi se hota hai aur phir se design blacklist jata hai.Run stage mein cost ke neeche se ek support line blacklist sakti hai. Yeh support line cost improvement ko follow karti hai aur cost ko neeche se support karti hai. -

#14 Collapse

Thump and run reversal plan technique. nter karta hai. Is stage mein cost ek level line ke paas level ho jata hai. Base stage mein cost ki unconventionality kam ho jati hai aur mix ka stage shuru ho jata hai. Base stage mein cost ki improvement level hoti hai. Punch cost is stage mein level rehta hai aur phir se badhne lagta hai, to ek check break hota hai. Yeh impediment break vendors ke liye ek bullish sign hai. Impediment break ke baad, cost dobara se badhne lagta hai aur 'run' stage mein enter karta hai. Is stage mein cost ka advancement tezi se hota hai aur phir se design blacklist jata hai.Run stage mein cost ke neeche se ek support line blacklist sakti hai. Yeh support line cost advancement ko follow karti hai aur cost ko neeche se support karti hBump and Run plan ko samajhna vendors ke liye zaroori hai kyunki isse design reversals aur anticipated entry/leave centers recognize kar sakte hain. Vendors ko is plan ke signals aur certifications standard dhyan dena chahiye, jaise ki thump high, base stage, resistance break, aur run stage.Yad rahe, Thump and Run plan sirf ek specific gadget hai aur iske sahi istemal ke liye aur confirmations ke saat Thump AND RUN Reversal Model Technique. Thump and Run plan ki shuruat 'Thump' stage se hoti hai. Is stage mein cost ek acche design ke saath badhta ya girta hai. Ye design commonplace advancement se alag hota hai aur zyada tezi se ho sakta hai. Cost ki yeh tezi, vendors ko bullish ya negative example ka sign deta hai.Jab cost tezi se badhta hai, to ek lead-in design line banati hai. Yeh design line rise ke liye neeche se aur downtrend ke liye upar se draw ki jati hai. Lead-in design line cost ke advancement ko follow karti hai aur support ya resistance ki tarah kaam karti hai. Jab cost lead-in design line ko paar karke tezi se badhta hai, to ek 'thump high' blacklist jata hai. Yeh thump extravagant expense advancement ka top point hota hai, jahan se cost level ho kar benchmark ke paas aa jata haBUMP stage ke baad, cost base stage mein enter karta hai. Is stage mein cost ek level line ke paas level ho jata hai. Base stage mein cost ki capriciousness kam ho jati hai aur blend ka stage shuru ho jata hai. Base stage mein cost ki improvement even hoti hai. Hit cost is stage mein level rehta hai aur phir se badhne lagta hai, to ek resistance break hota hai. Yeh resistance break vendors ke liye ek bullish sign hai. Resistance break ke baad, cost dobara se badhne lagta hai aur 'run' stage mein enter karta hai. Is stage mein cost ka improvement tezi se hota hai aur phir se design blacklist jata hai.Run stage mein cost ke neeche se ek support line blacklist sakti hai. Yeh support line cost improvement ko follow karti hai aur cost ko neeche se support karti hai. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 Collapse

BUMP AND RUN REVERSAL PATTERN STRATGE DEFINITION Bum and run reversal pattern barr Ek reversal chart pattern hai Jo is time Banta Hai Jab Kisi asset ki price main fast se aur large price mein izaafe ya decline ki vajah se asset ki price buying and selling aruj Tak pahunch Jaati Hai Jaisa ke Mamla ho sakta hai aur Iske natije Mein price ka reversal Hota Hai iaa is pattern per Ek Nazar dalte Hain aur Byan Karte Hain Ke yah kya hai artical ke akher main Ham aapko trading statistics aur strategy ka backtest fraham Karte Hain Jaisa ke name se zahir hota hai bump and run reversal barr Ek reversal pattern hai Jo zarurat Se zyada excessive speculation Se Banta Hai Ek up trend Mein is ka result buying ker climax Se Banta Hai Jo bear Mein reversal ko Rasta fraham karta hai Jab Ke down trend mein yah Aksar selling climax ya capitulation se hota hai jo Bil Aakhir Bullish reversal way Farham karta hai CHECK OUT OUR BEST TRADING STRATGIES lead in Trend pattern ka pahla phase hai yah sirf general trend hai jismein mamul ki up and down waves normal volume per Banti Hain swing lows up Trend ya down Trend ke par Ek trend line rujhan ke mailan ko zahar karti hai pattern ka yah Second phase Rapid price movement se marked Hota Hai jisse ek steeper trend line banti hai yah Aksar asset Mein zarurat Se zyada accessive speculative per mabne interest ki vajah se hota hai aur high traders volume per Hota Hai

CHECK OUT OUR BEST TRADING STRATGIES lead in Trend pattern ka pahla phase hai yah sirf general trend hai jismein mamul ki up and down waves normal volume per Banti Hain swing lows up Trend ya down Trend ke par Ek trend line rujhan ke mailan ko zahar karti hai pattern ka yah Second phase Rapid price movement se marked Hota Hai jisse ek steeper trend line banti hai yah Aksar asset Mein zarurat Se zyada accessive speculative per mabne interest ki vajah se hota hai aur high traders volume per Hota Hai  BUMP AND RUN TRADING STRATGE BACKTEST AND EXAMPLE is Strategy ki back test karna hai aur unfortunately se ham bump and Run Ke pattern ki strategy ka meaningful back test karne ke able Nahin Hai Kisi bhi back test ke liye strict trading rules aur kuchh additional settings ki zarurat hoti hai lekin chunki yah bahut hi settings pattern hain isliye Ham is able Nahin Hain Ke kya jzarurat hai yah sirf bahut Sare rules Hain jinki needed hai Run pattern ka Akhri phase hai yah price ke markazi trendline LEAD in TREDline ki taraf Wapas aane ke sath Strat hoti hai lekin yah aakhirkar trend line ko tor Deti Hai jisse reversal Hota Hai

BUMP AND RUN TRADING STRATGE BACKTEST AND EXAMPLE is Strategy ki back test karna hai aur unfortunately se ham bump and Run Ke pattern ki strategy ka meaningful back test karne ke able Nahin Hai Kisi bhi back test ke liye strict trading rules aur kuchh additional settings ki zarurat hoti hai lekin chunki yah bahut hi settings pattern hain isliye Ham is able Nahin Hain Ke kya jzarurat hai yah sirf bahut Sare rules Hain jinki needed hai Run pattern ka Akhri phase hai yah price ke markazi trendline LEAD in TREDline ki taraf Wapas aane ke sath Strat hoti hai lekin yah aakhirkar trend line ko tor Deti Hai jisse reversal Hota Hai

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 05:39 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим