Pull Back & Breakout discussion

No announcement yet.

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔ٹیگز: کوئی نہیں

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Assalam alaikum dear members!- subha bakhair umeed ha AP sb thk hn gy or apki trading bahut achi jaa rahi ho ge.

- Dear members aj ki post main hum 2 important concepts ko detail se study karen gy or inka difference bhi dekhen gy sth sth inki trading strategy bhi dekhen gy.

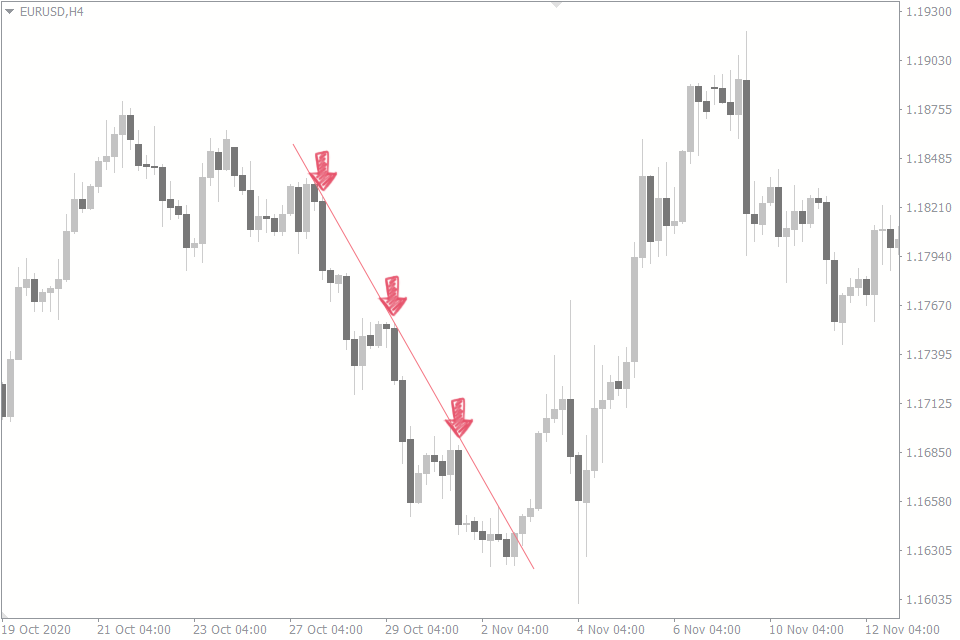

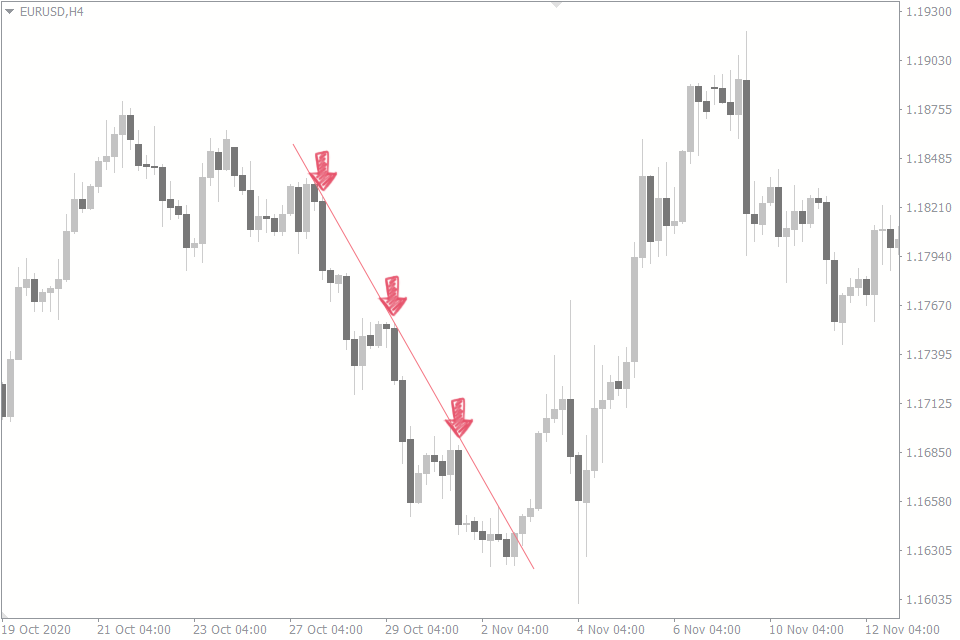

- Dear members pull back ka mtlb hota ha retracement mtlb k jb market aik trend main chl rahi hoti ha jesa k agar market opr jaa rahi ho to seedha opr ni jati bal k thora opr jaa k pull back karti ha or phr again opr jati ha.

- estrha market k aik trend main hamen bhht c jagha pull back dkhny ko milta ha or yahan py hamen achi entries bhi ml jati hain.

- jesa k opr ki picture main pullback ko arrows se indicate kia gaya ha to aap dkh skty hain k uptrend main market higher low bnati ha or previous low ko break n karti.

- Dear members pullback main hamen wait karna chahye market ka pull back karny ka or yahan se phr rejection ka jesa k opera hum uptrend ko discs kar chuky hain to es main jb market higher low bnaye to es main hum buy ki trade le skty hain or hmara stop loss jo ha previous low k equal ho ga jb k orofit target previous high se opr ya us k equal ho ga.

- Dear members breakout ka matlab hota ha torna ya tor k bahir nkl jana or forex main eska mtlb hota ha k ksi chart main market jo structure banti ha to market ka es k bahir nkl jana es structure ka breakout khulta ha.

- jesa k opr hum uptrend ko hi discs kar rhy thy to us ko continue karty hain.

- jb market uptrend main hoti ha to market higher lows bnati ha in lows ko mila k aik rising trendline banti ha jsko market follow kr k opr jati ha.

- laikin jb market es k nechy aa jati ha to esko trendline ka breakout kaha jata ha or es k bad market ka trend reverse ho jata ha.

- Dear members jb market trendline ka breakout kr jay to es k bad hamen chahye k wait karen k jis time frame main trendline thi usi time frame main market es trendline k nechy candle close kary to es k bad hum es main sell ki trade le skty hain or hmara stop loss es trendline se opr ho ga jska breakout hoa ha.

- jb k profit target nechy ki trf support tk ho ga.

-

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Introduction. Forex mein trading strategy ka istemal karne ke liye kai tarah ke tareeqe maujood hote hain. Pull Back aur Breakout trading strategies, forex market mein kamyabi hasil karne ke liye aam tareen tareeqon mein se hain. Ye strategies traders dwara istemal kiye jate hain takay wo market ke trends aur price movements ko samajh saken aur munafa kamayen. Pull Back Trading Strategy. Pull Back trading strategy mein, traders ko woh samay dhundhna hota hai jab ek trend temporary taur par reverse hokar apne original direction mein wapas jhukne lagta hai. Yani, jab kisi currency pair ka price ek direction mein badh raha hota hai aur phir woh price briefly opposite direction mein jhukne lagta hai. Pull Back trading strategy ka istemal karne ke liye neeche diye gaye steps follow kiye jate hain: Trend Identification. Sabse pehle, traders ko trend ka pata lagana hota hai. Agar market mein uptrend hai, toh price higher highs aur higher lows banayega, jabki agar market mein downtrend hai, toh price lower highs aur lower lows banayega. Pull Back Spotting. Trend ka pata lagane ke baad, traders ko pull back ko spot karna hota hai. Pull back ka matlab hota hai temporary reversal ya price jhukav. Jab price trend ke against briefly move karta hai aur phir trend ke direction mein wapas lautata hai, toh use pull back kaha jata hai. Entry Point Determination. Jab pull back spot hojaye, traders ko entry point tayin karna hota hai. Entry point, woh level hota hai jahan se trader apna trade lagata hai. Yeh level pull back ke baad original trend ke direction mein hone chahiye. Stop Loss Placement. Pull back strategy mein stop loss lagana zaroori hota hai takay trader apne trade ke liye acceptable risk rakhe. Stop loss level, entry point ke opposite side mein set kiya jata hai. -

#4 Collapse

Pull back aur breakout forex trading mein do ahem concepts hain jo traders ke liye maamoolan maqbool hain. Ye dono terms market ki movements aur trends ko samajhne aur trading strategies ko develop karne mein madadgar hoti hain.

Pull Back

Pull back market mein ek temporary reversal hoti hai jahan pe price ek trend ke against kuch der ke liye move karta hai, lekin phir woh trend ke direction mein wapas chalta hai. Yeh ek mukhtalif tarah ki price retracement hoti hai jo trend ke mukhalif hoti hai. Pull back ka maqsad hota hai trend ke continuity ko dikhana aur traders ko ek mouqa dena apne positions ko enter karne ka jahan pe trend mein entry points kam hai.

Pull back kaam mein aksar high ya low ke paas hoti hai aur ye ek temporary price movement hoti hai jo kuch waqt ke liye rehti hai. Pull back traders ke liye ek mouqa hoti hai trend ke sath entry karne ka jahan pe risk kam hota hai aur potential reward zyada hota hai. Pull back ki pehchaan karne ke liye traders ko trend lines, moving averages, aur other technical indicators ka istemal karte hain.

Breakout

Breakout market mein ek significant level ko cross karte waqt hoti hai, jaise ke support ya resistance level. Ye ek indication hoti hai ke market ka trend change hone wala hai ya phir ek naya trend shuru hone wala hai. Breakout ka matlab hota hai ke price ne ek mukhtalif price level ko cross kar diya hai, jo ke ek potential trading opportunity hai.

Breakout ke waqt traders apne positions enter karte hain expecting ke price trend ko continue karega aur substantial profits hasil honge. Breakout ki pehchaan karne ke liye traders ko price action patterns, volume analysis, aur technical indicators ka istemal karte hain.

Pull Back aur Breakout mein faraq:

Pull back aur breakout dono hi market dynamics ko represent karte hain, lekin in dono mein faraq hota hai. Pull back temporary price retracement ko represent karta hai jahan pe trend ke against movement hoti hai, lekin phir price wapas trend ke direction mein move karta hai. Breakout ek significant level ko cross karte waqt hota hai aur indicate karta hai ke trend mein ek major change hone wala hai.

Pull back traders ko ek mouqa deta hai entry point dhundne ka jahan pe risk kam hota hai aur potential reward zyada hota hai. Breakout traders ke liye ek opportunity hoti hai entry points dhundne ka jahan pe price ke substantial movements ke liye potential hota hai.

Pull Back Aur Breakout Ka Istemal

Pull back aur breakout dono hi trading strategies ke liye ahem hain. Traders in dono concepts ka istemal kar ke entry aur exit points tay karte hain, aur trading opportunities ko maximize karte hain. Pull back mein traders price ke temporary retracement ka fayda uthate hain aur trend ke saath entry points tay karte hain. Breakout mein traders significant price levels ko cross karne ka fayda uthate hain aur potential trend changes ko identify karte hain.

Har strategy ke apne benefits aur risks hote hain, aur traders ko apni risk tolerance aur trading style ke mutabiq in dono concepts ka istemal karna chahiye. Pull back aur breakout forex trading mein do important concepts hain jo traders ke liye trading strategies ko develop karne aur trading opportunities ko identify karne mein madadgar hote hain. Dono hi concepts market ke dynamics ko represent karte hain lekin in dono mein faraq hota hai. Traders ko apni risk tolerance aur trading goals ke mutabiq pull back aur breakout ka istemal karna chahiye taake woh trading efficiency ko maximize kar sakein aur consistent profits hasil kar sakein.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#5 Collapse

Pull Back" aur "Breakout" forex trading mein do important concepts hain. Yeh dono hi market ke movements ko identify karne aur

trading decisions ke liye istemal kiye jate hain.

Pull Back (Wapas Ka Movement):

Pull back, market mein temporary reversal ko describe karta hai jahan current trend ke against price mein chhota sa movement hota hai. Yeh ek temporary pause hota hai existing trend mein, lekin usually trend ke direction mein hi hota hai. Pull back ko kai bar retracement bhi kaha jata hai. Yeh trend continuation ka ek part hota hai aur traders isay opportunity samajhte hain existing trend mein re-entry karne ke liye.

Breakout (Toor):

Breakout market mein ek significant price level ko cross karna hai, jese ke support ya resistance level. Jab price ek crucial level ko paar karta hai, toh ise breakout kehte hain. Breakout ko ek potential trend reversal ya trend continuation ka sign bhi consider kiya jata hai, depending upon market conditions aur technical analysis indicators. Traders breakouts ko identify karke new trading opportunities dhoondhte hain.

Discussion (Mubahsa):

Pull back aur breakout dono hi trading strategies hain jo traders istemal karte hain market movements ko analyze karne aur trades ke liye entry aur exit points tay karna. Pull back mein traders existing trend ke sath chhote se reversals ka faida uthate hain, jabke breakout mein wo market ke important levels ko cross karke naye trends ka faida uthate hain. Traders ko pull back aur breakout ko identify karne ke liye technical analysis tools jese ke support aur resistance levels, trend lines, aur price action patterns ka istemal karna hota hai. In dono strategies ko effectively use karne ke liye traders ko market ki movement ko samajhna zaroori hai, sath hi risk management techniques ka bhi istemal karna chahiye taake loss ko minimize kiya ja sake aur profits maximize kiya ja sake.

-

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Pull back & breakout discussion

pullbacks-and-breakouts.webp

Pullback aur breakout dono hi forex trading mein important concepts hain jo traders ko market ke movements samajhne aur trading decisions lene mein madad karte hain.

Pullback (Mu'āvza):

Pullback market trend ke opposite direction mein ek temporary reversal hai. Agar market uptrend mein hai, to pullback downward movement hota hai jahan market price temporarily down jaati hai phir se uptrend continue hota hai. Aur agar market downtrend mein hai, to pullback upward movement hota hai jahan market price temporarily up jaati hai phir se downtrend continue hota hai. Pullback mein market price ka movement trend ke opposite direction mein hota hai lekin yeh temporary hota hai aur overall trend ko change nahi karta.

Breakout (Tutnā):

Breakout ek specific price level ko cross karne ka movement hota hai, jo ki market ke previous resistance ya support level ke opposite direction mein hota hai. Agar market resistance level ko break karke upar jaati hai, toh yeh breakout bullish signal hota hai aur traders ko buy karna recommend kiya jaata hai. Aur agar market support level ko break karke neeche jaati hai, toh yeh breakout bearish signal hota hai aur traders ko sell karna recommend kiya jaata hai.

Pullback aur Breakout Ka Istemal:- Trading Strategies: Traders pullback aur breakout ka istemal karke trading strategies tay karte hain. Agar market mein pullback hota hai, toh traders retracement level par entry points tay karte hain aur agar breakout hota hai, toh traders trend continuation ke liye entry points tay karte hain.

- Confirmation ke Liye: Pullback aur breakout ko confirm karne ke liye traders doosre technical indicators jaise ke moving averages, RSI, aur MACD ka istemal karte hain.

- Stop Loss aur Take Profit: Pullback aur breakout trading mein traders stop loss aur take profit levels ko bhi tay karte hain taki wo apne risk ko manage kar sakein aur profits ko secure kar sakein.

Nateeja:

Pullback aur breakout dono hi forex trading mein important concepts hain jo traders ko market ke movements samajhne mein madad karte hain. In concepts ka sahi tareeke se istemal karke traders apne trading strategies ko improve kar sakte hain aur profit earn kar sakte hain.

-

#7 Collapse

Pull Back & Breakout discussion

Mukadma (Introduction): Pull Back aur Breakout dono hi tijarat mein aham tareeqay hain jinhe traders istemal karte hain. Yeh do patterns market trends ko samajhne aur trading decisions lene mein madad karte hain. Is article mein hum Pull Back aur Breakout ke bare mein roman Urdu mein baat karenge aur inke istemal ke tareeqay par ghor karenge.

Pull Back Kya Hai?

Pull Back ek market trend mein temporary reversal ko darust karta hai. Jab market mein ek strong trend hota hai, toh kabhi-kabhi woh thoda sa opposite direction mein chala jata hai, lekin phir se asal direction mein laut kar jaata hai. Pull Back ka maqsad hota hai ke trend ke mukhalif chalne wale traders ko bahka kar phir asal trend mein shamil kar liya jaye.

Pull Back Ka Pechan:- Price Retracement: Pull Back ka pehchaan karna asaan hota hai jab price mein retracement hoti hai, yani ke asal trend se thodi door chali jati hai.

- Volume Analysis: Pull Back ke doran volume analysis karna bhi important hai. Agar retracement low volume ke sath hota hai, toh yeh indicate karta hai ke market mein strong trend hai.

Pull Back Ke Faiday:- Entry Point Provide Karta Hai: Pull Back traders ko entry point provide karta hai taaki woh asal trend mein shamil ho sakein.

- Risk Management: Pull Back ke doran risk management ka behtar tareeqa banaya ja sakta hai, kyunki traders ko pata chalta hai ke market mein temporary reversal hai.

Pull Back Ke Nuksanat:- Fake Pull Back: Kabhi-kabhi market mein fake pull backs bhi hoti hain jo asal trend reversal nahi hoti, isliye traders ko careful rehna chahiye.

- Timing Ka Issue: Pull Backs ka sahi waqt pata lagana mushkil ho sakta hai, aur agar timing galat ho, toh nuksan ho sakta hai.

Breakout Kya Hai?

Breakout ek specific price level ko paar karne ka event hota hai. Jab price ek certain level ko paar karti hai, toh yeh breakout hota hai aur isse naya trend shuru hota hai. Breakout ka concept yeh hai ke jab market ek specific range mein ghira hota hai, toh jab woh range paar hota hai, toh naya trend establish hota hai.

Breakout Ka Pechan:- Price Level Cross Hona: Breakout ka sabse ahem pehchan yeh hai ke price ek specific level ko cross karti hai.

- Volume Increase: Breakout ke waqt volume increase hona chahiye, jisse ke yeh confirm ho ke market mein actual interest hai.

Breakout Ke Faiday:- New Trend Ka Pata: Breakout traders ko naye trend ka pata lagane mein madad karta hai.

- Momentum Gain Hota Hai: Breakout ke doran market mein momentum gain hota hai, jisse ke traders ko behtar entry point milta hai.

Breakout Ke Nuksanat:- False Breakouts: Kabhi-kabhi market mein false breakouts bhi hote hain, jinhe identify karna mushkil ho sakta hai.

- Whipsaws: Breakout ke doran whipsaws ka bhi risk hota hai, jisme market ek direction mein chalti hai, lekin phir se wapas asal direction mein laut jati hai.

- Pull Back aur Breakout Ke Mauqe: Pull Back aur Breakout ka istemal alag mauqon par hota hai. Pull Back asal trend mein re-entry ke liye istemal hota hai, jab ke Breakout naye trend ke shuru hone ko darust karta hai.

- Risk Management: Pull Back ke doran risk management ka behtar tareeqa banaya ja sakta hai kyunki temporary reversal ka pata lagta hai. Breakout ke doran market mein momentum hota hai, jisse risk management ko behtareen tareeqay se istemal kiya ja sakta hai.

Conclusion: Pull Back aur Breakout dono hi tijarat mein istemal hone wale patterns hain jo traders ko market trends ko samajhne mein aur behtar trading decisions lene mein madad karte hain. In dono ka sahi tareeqay se istemal karne ke liye traders ko market analysis, risk management, aur timing ka khaas khayal rakhna chahiye. Har pattern apne faiday aur nuksanat ke sath ata hai, isliye traders ko apne tajaweezat ko samajh kar hi tijarat mein shamil hona chahiye.

-

#8 Collapse

Pull Back & Breakout discussion

1. Ta'aruf (Introduction):

Pull back aur breakout dono technical analysis terms hain jo stocks, forex, cryptocurrencies aur doosre financial instruments ke trading mein istemal hoti hain. In dono concepts ka sahi taur par samajhna traders ke liye zaroori hai taake wo sahi waqt par apne trades ko manage kar sakein.

2. Pull Back (Wapas Chale Jana):

Pull back ka matlub hota hai ke ek asset ya security ka price apne recent high ya low se thoda sa wapas chala jaye. Yeh market mein temporary reversal ko darust karti hai. Pull back hone par traders ko dekhna chahiye ke kya yeh sirf temporary hai ya phir long-term trend ka hissa ban raha hai.

3. Breakout (Tutna):

Breakout ka matlab hota hai jab kisi asset ya security ka price kisi key level ya trend line ko paar karke aage badh jata hai. Yeh ek strong market movement ko represent karta hai aur traders ke liye naye trading opportunities peda karta hai.

4. Pull Back ki Wajah (Reasons for Pull Back):

Pull back hone ki kuch common wajahen hoti hain. Market sentiment mein tabdili, economic news, ya phir technical factors jese ke overbought ya oversold conditions pull back ka sabab ban sakti hain. Traders ko chahiye ke pull back hone par cautious rahein aur market conditions ko dhyan se observe karein.

5. Breakout ki Wajah (Reasons for Breakout):

Breakout bhi mukhtalif wajahon par mabni hota hai. Koi significant economic announcement, positive earnings report, ya phir kisi geopolitical event ke asarat se breakout ho sakta hai. Technical analysis mein, breakout ko confirm karne ke liye volume aur price action ka bhi dehan rakhna zaroori hai.

6. Technical Analysis mein Pull Back aur Breakout ki Ahmiyat (Significance in Technical Analysis):

Technical analysis ke doran pull back aur breakout ki tajaweezat ka istemal hota hai taake traders ko future price movement ka andaza ho sake. Pull back aur breakout patterns ko samajh kar, traders apne trading strategies ko refine kar sakte hain.

7. Trading Strategies:

Pull back aur breakout par amal karne ke liye kuch trading strategies bhi hain. For example, traders pull back ke doran entry points dhund sakte hain jab market temporarily reverse hoti hai. Breakout par amal karne wale traders apne trades ko enter karte hain jab price kisi key level ko paar karta hai.

8. Trading Psychology (Trading Ki Nafsiyati His):

Trading mein pull back aur breakout ke doraan trading psychology ka bhi bohot bara kirdar hota hai. Pull back hone par traders ko patience aur discipline rakhna zaroori hai, jabke breakout mein risk management aur quick decision-making ki zaroorat hoti hai.

9. Pull Back aur Breakout ke Prakar (Types of Pull Back and Breakout):

Pull back aur breakout alag alag prakaron ke hote hain. Jese ke horizontal pull back, jisme price sidha chalta hai, aur ascending triangle breakout jisme price ek specific triangle pattern ko todta hai. Traders ko in prakaron ko samajh kar apni strategies ko customize karna chahiye.

10. Real-Life Examples:

Pull back aur breakout ko samajhne ke liye real-life examples ka bhi study karna zaroori hai. Kuch past market scenarios ko analyze karke traders future ke liye behtar taur par tayari kar sakte hain.

11. Risk aur Rewards ka Tawun (Risk and Reward Ratio):

Pull back aur breakout ke doran risk aur reward ka tawun hona bohot zaroori hai. Traders ko apne trades mein risk management ka khayal rakhna chahiye taake nuksan se bacha ja sake aur profit maximize kiya ja sake.

12. Pull Back aur Breakout ka Sath (Combining Pull Back and Breakout):

Experienced traders pull back aur breakout ko ek sath bhi dekhte hain. Kuch strategies mein pull back ke baad breakout ka wait karna hota hai, jisse ke confirmations mil sake aur trade ko enter karne mein asani ho.

13. Tools aur Indicators (Tools and Indicators):

Pull back aur breakout ko identify karne ke liye kuch tools aur indicators ka istemal hota hai. Moving averages, Bollinger Bands, aur Fibonacci retracement levels jese tools traders ko price patterns aur trends ko samajhne mein madad karte hain.

14. Conclusion:

Pull back aur breakout, financial markets mein common aur powerful concepts hain. Inka sahi taur par samajhna traders ke liye zaroori hai taake wo market conditions ko theek se read kar sakein aur sahi waqt par apne trades ko manage kar sakein. Pull back aur breakout ka study karke traders apni technical analysis ko mazeed behtar banane mein kamyab ho sakte hain.

-

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Pullback aur Breakout: Pakistani Trading Mein Samajh aur Istemal

Mehdood Taur Par Introduction:

Pullback aur breakout dono technical analysis ke ilm mein aham mawafiqat hain, jo traders ke liye maishat ke complexities mein sailaab ban sakti hain. Pakistani trading ke context mein, in concepts ko samajhna trading mein khabardaar faislay karne ke liye bohot zaroori hai.

Pullback:

Pullback, jise retracement ya correction bhi kehte hain, mein maujood trend mein taqat aur mehwarat ka temporary reversal hota hai. Is se phle yeh, ek chhoti si opposite trend movement hai jise keh sakte hain. Pullbacks traders ko ek mauqay par dastiyab karta hai ke woh trading ek behtar keemat par shuru kar sakte hain, phir prevailing trend dobara shuru hota hai.- Pullbacks ki Pehchaan:

- Traders pullbacks ko trend ke khilaaf keemat ke mutabiq price movements dekh kar pehchantay hain. Yeh zaroori hai ke pullback aur trend reversal ke darmiyan farq ko samajha jaye, kyunki is farq ko samajhna galat trading faislay par le ja sakta hai.

- Pullbacks ke Asbab:

- Pullbacks hone ke peeche asbab mein market participants ki profit lene, market sentiment mein tabdeeli, ya temporary factors ka asar shamil ho sakta hai.

- Pullbacks ke Dauran Trading Strategies:

- Traders pullbacks ke doran alag alag strategies istemal kar sakte hain, jaise trendline analysis, Fibonacci retracement levels, ya moving averages, taake woh potential entry points pehchan sakein.

- Risk Management:

- Pullbacks ke doran sahi risk management karna bohot zaroori hai. Stop-loss orders set karna aur risk-reward ratios define karna zaroori hai taake traders pullback trend reversal mein mubtala na ho jayein.

Breakout:

Breakout tab hota hai jab kisi asset ki keemat kisi ahem level, jaise ke support ya resistance, se upar ya neeche jaati hai, khaas kar tezi ke sath. Breakout naye trend ka aghaz hone ki alamat hota hai, jo traders ko faida dene wale trades ke liye mouqa deta hai.- Breakout Ki Pehchaan:

- Breakout ko amuman yeh pehchantay hain ke keemat kisi moheet level, jaise ke support ya resistance, ko tod deti hai. Breakout ke doran barhne wali volume naye trend ki taqat ko tasdeeq kar sakti hai.

- Breakout Ke Asbab:

- Breakout alag alag asbab se ho sakta hai, jaise ke fundamental khabrain, maali indicators, ya market sentiment mein tabdeeli. Breakout amuman supply aur demand ke darmiyan balance mein tabdeeli hone ki alamat hai.

- Breakout Ke Dauran Trading Strategies:

- Traders breakout ke doran technical analysis tools istemal kar sakte hain, jaise ke trendlines, chart patterns (jaise ke triangles ya rectangles), aur indicators jaise ke Average True Range (ATR), potential breakout points pehchanne ke liye.

- Risk Management:

- Breakout ke doran risk ko manage karna bohot zaroori hai. Traders amuman stop-loss orders set karte hain aur closely price action ko monitor karte hain ke breakout ka daayirah tasdeeq ho sake.

Pakistani Trading Mein Application:

Pakistani trading ke context mein, pullbacks aur breakouts traders ke liye mukhtalif markets, jaise ke stocks, commodities, aur forex mein, bohot ahem hote hain.- Forex Trading:

- Forex market mein, jahan currencies ki trading hoti hai, pullbacks aur breakouts ke concepts samajhna aham hai takay traders currency market ke dynamics ko samajh sakein.

- Stock Market:

- Pakistani stock market mein hissa lene wale participants ko pullbacks aur breakouts ko samajh kar investment decisions lene mein faida hota hai. Price movements ko analyze karna aur in concepts ke mutabiq entry aur exit points tajwez karna trading outcomes ko behtar bana sakta hai.

- Commodities Trading:

- Commodities trading mein shamil traders, jaise ke gold ya oil, pullback aur breakout strategies ka istemal kar ke price movements se faida utha sakte hain. Trends ko pehchanne aur potential reversal points ko pehchanne ke liye pullback aur breakout concepts ka istemal karna khaas zaroori hai.

Pakistani Trading Ke Challenges aur Mawafiqat:- Market Volatility:

- Pakistani markets, kisi aur market ki tarah, tez raftar mein tabdeeli ka samna kar sakti hain. Traders ko pullbacks aur breakouts ki analysis mein is volatility ko shamil karna chahiye, taake woh apni strategies ko is mutabiq adjust kar sakein.

- Global Economic Factors:

- Duniya bhar ke maali asbab Pakistani markets ko asar andaz ho sakte hain. Traders ko aise international events ke bare mein malumat rakhni chahiye jo unki trading markets ko asar andaz kar sakti hain.

- Regulatory Environment:

- Hukumati mahol ko samajhna aur us par amal karna bohot zaroori hai. Local regulations ke mutabiq chalne se traders ko apni trading mein sahetmand aur qanooni taur par moatadil rehne mein madad milegi.

Conclusion:

Ikhtetaam mein, pullbacks aur breakouts technical analysis ke field mein bohot ahem concepts hain jo trading strategies ko shape karne mein aham kirdar ada karte hain. Pakistani traders ke liye in concepts ko samajhna ek zaroorat hai takay woh maishat ke dynamic duniya mein inform faislay kar sakein. Pullback aur breakout strategies ko istemal kar ke traders apne trading capabilities ko behtar bana sakte hain

- Pullbacks ki Pehchaan:

-

#10 Collapse

Pull back & breakout discussion

Pull back aur breakout, financial markets mein aam tor par dekhe jane wale do mukhtalif trends hain. Ye dono trading strategies hain jo investors aur traders ke liye ahem hoti hain, jinhe istemal karke woh market movements ko samajhne aur faida uthane ki koshish karte hain.

Pull back, jab ek security ya market ka price ek mukhtalif trend mein chalta hai aur phir wapas apne previous trend ki taraf mud jata hai, ko describe karta hai. Ye aksar short-term reversals ya temporary corrections ke roop mein dekha jata hai, jahan price kaam hoti hai apne previous trend ko follow karne ke liye.

Doosri taraf, breakout ek trend reversal ya continuation pattern hai, jahan price ek specific level ko cross karke naye highs ya lows achieve karta hai. Breakout ko usually strong trend ki shuruat ya continuation ke roop mein interpret kiya jata hai, aur ye traders ko ek naye trend mein shamil hone ki mauka deta hai.

Pull back aur breakout strategies ko istemal karne ke liye, traders ko technical analysis aur market psychology ka istemal karna hota hai. Pull back mein traders price action aur technical indicators ka istemal karte hain taake woh confirm kar sakein ke previous trend phir se shuru hone wala hai ya nahi. Breakout mein, traders price levels ko observe karte hain jahan price ko breakout hone ki ummeed hoti hai aur fir uss direction mein trade karte hain.

Dono hi strategies apne risk aur rewards ke saath aate hain. Pull back mein, traders ko false reversals ka dhiyan rakhna hota hai, jabki breakout mein false breakouts se bachna hota hai. Isliye, dono strategies ko samajhna aur sahi samay par istemal karna zaroori hota hai taake traders ko behtar results mil sakein.

-

#11 Collapse

Asalam o alaikum dear friend

Pullback and breakout discussion

Pullback aur breakout, dono hi stock markets mein trading karne wale logon ke liye aam taur par istemal hone wale do makhsoos tijarat ke tareeqon hain. Ye dono trading strategies mukhtalif market conditions mein kaam karti hain aur traders ko sahi waqt par trading karne mein madad karti hain.

Trading strategies

Pullback ka tajurba hota hai jab kisi security ya trading strategy ki keemat mein thori si giraft ke baad, keemat dobara apni pehli keemat par aane lagti hai. Ye aksar temporary expectations ka natija hota hai aur traders ko mauqa milta hai ke woh saste daamon mein daakhil ho kar faida hasil karein.

Observation and analysis

Pullback mein trading karne wale trader ko acchi samajh hoti hai ke market mein keematon mein kami ka silsila ho raha hai aur ab mumkin hai ke keematein dobara barh sakti hain. Is waqt trader, observation aur analysis ke zariye mauqe ko pehchaan karne mein kaam karta hai.Dusri taraf, breakout ek ahem trading strategy hai jo market mein keematon mein achanak izafay ko dekhti hai. Ye aksar ek mustaqil chhoti si muddat ke baad hota hai jab market mein movement hoti hai aur keematein kisi khaas level ko paar karti hain.

key takeaway

Breakout ke doran, traders ko mauqe ko foran istemal karne ka mauqa milta hai. Agar trader ne sahi waqt par daakhil hoa hai toh mumkin hai ke woh poori harkat mein hissa hasil kare aur accha munafa kamaye.Pullback aur breakout dono hi ahem trading principles hain jo traders ko madad karte hain takay woh market mein kamiyabi hasil kar sakein. Ye do makhsoos trading strategies hain jo traders ko mauqe ko sahi tareeqay se pehchanna aur istemal karna sikhate hain.

Summary

In conclusion, pullback aur breakout ka istemal karke traders ko market ke mukhtalif haalaat mein kamiyabi hasil karne ka mauqa milta hai. Ye do ahem trading strategies hain jo traders ko mauqe ko sahi tareeqay se pehchanne aur us par amal karne ki ijaazat deti hain.

-

#12 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Pullback and Breakout discussion?

*Pullback aur Breakout: Trading Mein Istemal aur Tafseelat**

Pullback aur Breakout dono hi important concepts hain jo traders ke liye crucial hote hain, specially jab wo market trends aur price movements ko analyze kar rahe hote hain. Yeh dono hi terms technical analysis ke context mein use hoti hain.

**Pullback:**

Pullback ek temporary reversal hota hai current trend mein, jo typically kisi higher time frame trend ke against hota hai. Agar market uptrend mein hai aur phir kuch waqt ke liye neeche jaata hai, toh wo pullback hai. Yeh ek normal phenomenon hai jisme market mein temporary retracement hoti hai, lekin overall trend wahi rehti hai.

**Breakout:**

Breakout ek price level ko cross karne ka event hota hai, jo market mein ek naye trend ya volatility ke indication ke roop mein consider kiya jata hai. Agar price ek specific resistance level ya support level ko cross karta hai, toh yeh breakout ka signal ho sakta hai. Breakout ki kuch common types hain: bullish breakout (jab price resistance level ko upar break karta hai) aur bearish breakout (jab price support level ko neeche break karta hai).

**Pullback aur Breakout ka Istemal:**

Traders pullback aur breakout ko alag-alag tarikon se istemal karte hain:

1. **Trend Continuation**: Agar ek uptrend ya downtrend mein pullback hota hai aur phir price wapas trend ke direction mein move karta hai, toh traders us trend ko follow karte hue trades enter karte hain. Breakout bhi trend continuation ke liye ek signal provide karta hai.

2. **Reversal Trading**: Agar pullback ya breakout kisi major support ya resistance level ke saath hota hai, toh yeh ek reversal ka potential signal ho sakta hai. Traders is opportunity ko capture karke opposite direction mein trades enter karte hain.

3. **Confirmation with Indicators**: Traders pullback aur breakout ko confirm karne ke liye doosre technical indicators ka istemal karte hain, jaise ki RSI, MACD, ya moving averages. In indicators ki madad se, wo apne trades ko validate karte hain aur sahi direction mein entry points find karte hain.

Pullback aur breakout dono hi market analysis ke important tools hain jo traders ko market ke movements ko samajhne aur unke liye trades plan karne mein madad karte hain. In concepts ko samajhne ke baad, traders apni trading strategies ko improve kar sakte hain aur better trading decisions le sakte hain.

-

#13 Collapse

**Pull Back Aur Breakout Discussion**

Pull back aur breakout trading strategies technical analysis me bohot important concepts hain jo traders ko market ke trend changes aur trading opportunities identify karne me madad karte hain. Dono strategies market ke movements ko understand karne aur effective trading decisions lene me help karti hain. Is post me hum pull back aur breakout ke concepts, unki formation, aur trading strategies ko detail me discuss karenge.

**Pull Back Kya Hai?**

Pull back ek temporary price movement hota hai jo trend ke direction ke against hota hai. Yeh market ke primary trend me ek temporary retracement ko represent karta hai. Pull back generally trend ke continuation phase ko signal karta hai aur price trend ke direction me wapas aati hai.

1. **Formation:** Pull back tab banta hai jab market ek strong trend me hoti hai aur price temporarily opposite direction me move karti hai. Yeh movement market ke consolidation phase ko indicate karti hai aur traders ko trend ke continuation ke signal deti hai.

2. **Trading Strategy:** Pull back ko identify karne ke liye, traders trend lines aur moving averages ka use kar sakte hain. Jab price pull back ke baad trend line ya moving average ko support ke roop me use karti hai aur phir se trend ke direction me move karti hai, to yeh buying ya selling opportunity ko signal kar sakti hai.

**Breakout Kya Hai?**

Breakout tab hota hai jab price ek significant support ya resistance level ko break karti hai aur trend ke new direction me move karti hai. Yeh market ke strong trend formation ka indication hota hai aur traders ko new trading opportunities provide karta hai.

1. **Formation:** Breakout tab hota hai jab price ek predefined range, support, ya resistance level ko break karti hai. Yeh movement market ke strong momentum ko indicate karti hai aur trend reversal ya continuation ko signal karti hai.

2. **Trading Strategy:** Breakout ke signals ko confirm karne ke liye, volume analysis aur technical indicators ka use kiya jata hai. Jab price breakout ke saath strong volume show karti hai, to yeh trend ke continuation ke signal hota hai. Traders breakout ke confirmation ke baad entry points ko identify kar sakte hain aur stop-loss aur take-profit levels ko set kar sakte hain.

**Combination of Pull Back and Breakout:**

Traders pull back aur breakout strategies ko combine karke zyada accurate trading decisions le sakte hain. Pull back ke during market ke consolidation phase ko observe karte hue, traders breakout ke signals ko confirm kar sakte hain. Jab pull back complete hoti hai aur breakout hota hai, to yeh strong trading opportunity ko represent karta hai.

In dono strategies ko samajhkar aur effectively use karke, aap market ke trends ko better analyze kar sakte hain aur apni trading strategies ko enhance kar sakte hain. Regular practice aur market analysis se in strategies ko accurately apply karna mumkin hai. Happy trading!

-

#14 Collapse

Pullback aur Breakout: Ek Jaiza

Introduction

Trading aur investing ki duniya mein "Pullback" aur "Breakout" do ahem concepts hain jo market trends aur price movements ko samajhne mein madadgar hote hain. In dono ke behtareen istemal se traders aur investors market ki trends ko behtar tareeqe se analyse kar sakte hain.

Pullback Kya Hai?

Pullback ko aksar "retracement" bhi kaha jata hai. Ye tab hota hai jab ek stock ya currency ki price ek strong trend ke baad temporarily ulta hoti hai. Misal ke taur par, agar ek stock bullish trend mein hai aur price kuch din ke liye niche aati hai, to is temporary decline ko pullback kaha jata hai. Yeh market ka ek natural part hai aur isse yeh nahi samajhna chahiye ke trend khatam ho gaya hai. Pullbacks ke zariye traders ko entry points milte hain, jahan wo sasti price par stock ya currency ko khareed sakte hain.

Breakout Kya Hai?

Breakout tab hota hai jab price ek key level, jaise ke support ya resistance level, ko break kar leti hai. Yeh price movement market ki strong direction ko indicate karti hai. Agar price resistance level ko break karti hai, to iska matlab hai ke bullish trend banne ki sambhavnayein hain. Agar price support level ko break karti hai, to bearish trend banne ki chances hote hain. Breakouts trading ke liye ek important signal hote hain, jo naye trends aur opportunities ko darshate hain.

Pullback aur Breakout ka Taluq

Pullbacks aur breakouts ek dosre ke sath closely linked hote hain. Ek strong trend ke dauran, traders pullbacks ka faida uthate hain, jisse unhe achi entry points milti hain. Jab pullback complete hota hai aur price breakout hoti hai, to ye confirm karta hai ke trend continue kar sakta hai. Isliye, traders ko in dono concepts ko samajhna zaroori hai taake wo market trends ko behtar tarike se anticipate kar sakein.

Trading Strategy

Agar aap pullback aur breakout ko effectively use karna chahte hain, to kuch strategies follow kar sakte hain. Pehle, pullback ke dauran price ke support level ko identify karein. Jab price wapas support level pe aaye, tab entry point consider karein. Phir, breakout ke signal ko dekhte hue, trend ko follow karna shuru karein. Yeh zaroori hai ke aap stop-loss aur take-profit levels ko bhi set karein, taake aap market ke fluctuations se protect ho sakein.

Conclusion

Pullback aur breakout dono hi trading ke liye important tools hain. Pullbacks aapko achi entry points provide karte hain jab ke breakouts naye trends ko signal dete hain. In concepts ko samajh kar aur sahi strategies use karke, aap apni trading skills ko enhance kar sakte hain aur market trends ko behtar tarike se handle kar sakte hain.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

# Pullback & Breakout Discussion

Pullback aur breakout trading ke do ahem concepts hain jo traders ko market ki price movements ko samajhne mein madad karte hain. Yeh concepts kisi bhi trading strategy ka integral hissa hain, aur inhe samajhne se aap apne trades ki effectiveness ko behtar bana sakte hain. Is post mein hum pullbacks aur breakouts ki definition, formation, aur trading strategies par tafseel se baat karenge.

**1. Pullback:**

Pullback tab hota hai jab market ek established trend ke dauran temporary price decline dekhta hai. Yeh retracement moment hota hai jo trend ki direction ke khilaf hota hai, lekin yeh trend ko khatam nahi karta.

**Formation:**

- **Bullish Trend:** Jab market upar ki taraf ja raha hota hai aur kuch time ke liye girta hai, to yeh pullback bullish trend ka hissa hota hai. Traders is moment ko ek buying opportunity ke tor par dekhte hain.

- **Bearish Trend:** Iske baraks, bearish trend ke dauran jab price temporarily upar jaati hai, to yeh bearish pullback hota hai. Traders is waqt sell position lene ka soch sakte hain.

**2. Breakout:**

Breakout tab hota hai jab price kisi key support ya resistance level ko successfully cross karti hai. Yeh market ki strong momentum aur trend reversal ya continuation ka indication deta hai.

**Formation:**

- **Bullish Breakout:** Jab price resistance level ko cross karti hai, to yeh bullish breakout hota hai. Yeh price movement ko strong buying pressure ka indication data hai.

- **Bearish Breakout:** Jab price support level ko break karti hai, to yeh bearish breakout hota hai, jo selling pressure ko darshata hai.

**3. Trading Strategies:**

**Pullback Strategy:**

- **Entry Points:** Jab price pullback karte hue support level par touch karti hai, to traders buy position lene ka sochte hain. Agar price moving average ya trend line ke paas hai, to yeh aur bhi strong confirmation hota hai.

- **Stop-Loss Placement:** Stop-loss ko pullback ke neeche set karna chahiye. Isse aapko potential losses se bachne ka mauqa milta hai.

**Breakout Strategy:**

- **Entry Points:** Jab price resistance level ko break kare, to traders buy position le sakte hain. Bearish breakout ke liye, jab price support level ko break kare, to sell position lena behtar hota hai.

- **Confirmation:** Breakout ke baad volume ka analysis zaroori hai. Agar breakout ke sath high volume hai, to yeh confirmation hota hai ke trend sustainable hai.

**4. Risk Management:**

Dono strategies mein risk management bohot zaroori hai. Stop-loss ko strategically set karna chahiye taake aap potential losses ko minimize kar sakein.

**Conclusion:**

Pullback aur breakout trading ke do key concepts hain jo traders ko market movements ko samajhne aur successful trades karne mein madad karte hain. In concepts ko samajhne se aap apne trading strategies ko enhance kar sakte hain. Hamesha yaad rakhein ke market analysis aur risk management zaroori hai, taake aap informed decisions le sakein.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 02:34 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим