Dark cloud cover candlestick pattern

No announcement yet.

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔ٹیگز: کوئی نہیں

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

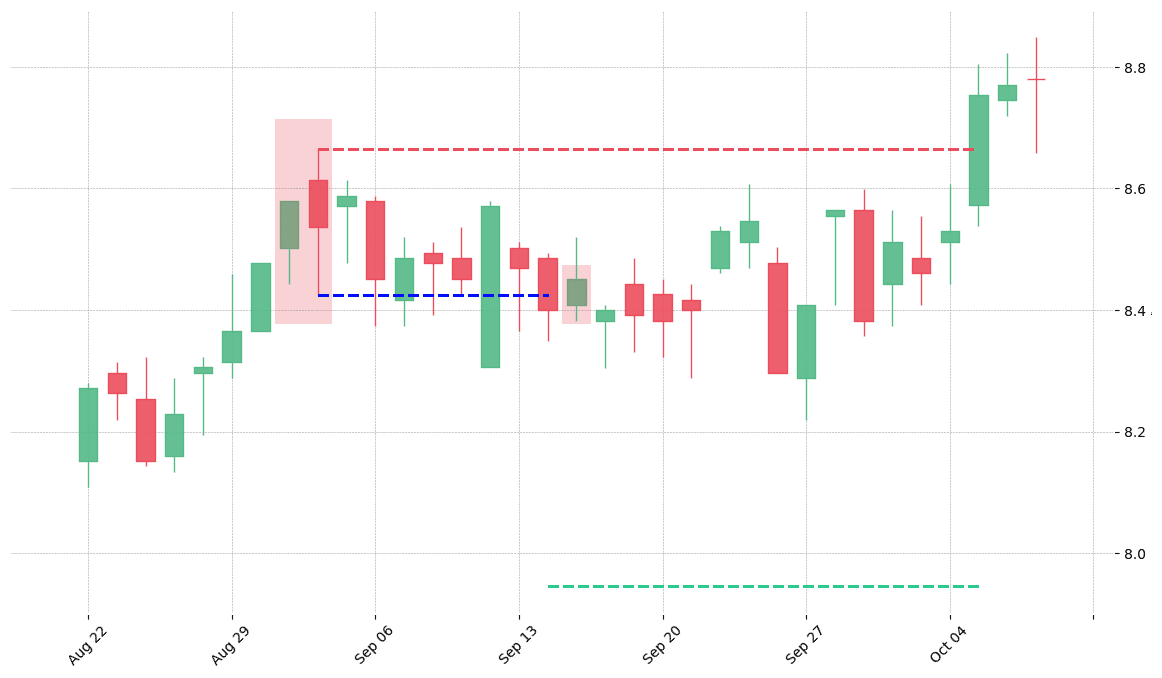

Dark cloud cover candlestick pattern dark cloud cover aik bearish candle stuck patteren hai jahan neechay candle ( aam tor par siyah ya surkh ) parai up candle ( aam tor par safaid ya sabz ) ke oopar khulti hai aur phir oopar candle ke wast point ke neechay band hojati hai . patteren ahem hai kyunkay yeh raftaar mein ulta se neechay ki taraf tabdeeli ko zahir karta hai. patteren aik oopar ki mom batii se banaya gaya hai jis ke baad neechay candle hai. tajir agli ( teesri ) mom batii par qeemat kam karne ke liye dekhte hain. usay tasdeeq kehte ha Key takeways dark cloud cover aik candle stuck patteren hai jo qeemat mein izafay ke baad kami ki taraf momentum mein tabdeeli ko zahir karta hai . patteren aik bearish candle par mushtamil hai jo oopar khulti hai lekin phir parai blush candle ke wast point ke neechay band hojati hai . dono mom batian nisbatan barri honi chahiye, jo taajiron aur sarmaya karon ki mazboot shirkat ko zahir karti hain. jab patteren choti mom btyon ke sath hota hai to yeh aam tor par kam ahem hota hai . tajir aam tor par dekhte hain ke kya bearish candle ke baad anay wali candle bhi qeematon mein kami ko zahir karti hai. bearish candle ke baad qeemat mein mazeed kami ko tasdeeq kehte hain Understanding dark cloud cover patteren mein aik barri kaali mom batii shaamil hoti hai jo pehlay wali mom batii par" gehra baadal" banati hai. bearish اینگلÙÙ†Ú¯ patteren ki terhan, khredar khulay mein qeemat ko ouncha dhakel dete hain, lekin baichnay walay baad mein session mein qabza kar letay hain aur qeemat ko taizi se kam kar dete hain. khareed o farokht ki taraf yeh tabdeeli is baat ki taraf ishara karti hai ke qeematon mein kami anay wali ho sakti hai . ziyada tar traders dark cloud cover patteren ko sirf is soorat mein mufeed samajte hain jab yeh oopar ke rujhan ya qeemat mein majmoi tor par izafay ke baad hota hai. jaisay jaisay qeematein barhti hain, patteren neechay ki taraf mumkina iqdaam ko nishaan zad karne ke liye ziyada ahem ho jata hai. agar qeemat ka amal kata sun-hwa hai to patteren kam ahem hai kyunkay patteren ke baad qeemat ke katay rehne ka imkaan hai . Example of dark cloud candlestick pattern mandarja zail chart velocityshares daily 2x vix short term etn ( tvix ) mein dark cloud cover patteren ki aik misaal dekhata hai : chart jo gehray baadal ke ihata ka namona dikha raha hai . gehray baadal cover ka patteren. stockcharts. com is misaal mein, dark cloud cover is waqt hota hai jab teesri blush candle ke baad aik bearish candle aati hai jo aakhri blush candle ke wast point se neechay khulti aur band hoti hai. patteren ne kamyabi ke sath aglay session mein mandi ki paish goi ki jahan qeemat taqreeban saat feesad kam hogayi. is session ne tasdeeq faraham ki . woh tajir jo lambay arsay se thay woh bearish candle ke qareeb ya aglay din ( tasdeeq ke din ) jab qeemat musalsal gir rahi thi bahar niklny par ghhor kar satke hain. tajir un mourr par bhi mukhtasir pozishnon mein daakhil ho satke hain . agar mukhtasir darj kya jaye to, ibtidayi stap nuqsaan bearish candle ki oonchai se oopar rakha ja sakta hai. tasdeeqi din ke baad, is muamlay mein stap nuqsaan ko tasdeeqi din se bilkul oopar tak giraya ja sakta hai. is ke baad tajir manfi munafe ka hadaf qaim karen ge, ya agar qeemat girty rehti hai to –apne stap nuqsaan ko kam karna jari rakhen ge . -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Dark Cloud Cover candlestick pattern aik bearish reversal pattern hai jo trading mein bohot important samjha jata hai. Yeh pattern tab banta hai jab market mein ek uptrend chal raha hota hai aur us uptrend ke baad ek bearish candle form hoti hai, jo ke pehle wali bullish candle ke body ko cover karti hai. Yeh pattern traders ko yeh signal deta hai ke market ka trend ab reverse ho sakta hai, yaani ke uptrend se downtrend ki taraf move karne wala hai. Is pattern ka samajhna aur iska sahih istimaal karna trading mein profit kamanay ke liye bohot zaroori hota hai. Dark Cloud Cover pattern do candles par mabni hota hai. Pehli candle ek strong bullish candle hoti hai, jo ke green ya white color mein show hoti hai. Is candle ka strong hona zaroori hota hai kyun ke yeh market ke strong uptrend ko reflect karta hai. Dusri candle bearish hoti hai, jo ke red ya black color mein show hoti hai. Yeh bearish candle pehli bullish candle ke high se start hoti hai, lekin uske closing price ke neeche close hoti hai, is tarah se ke uski body pehli candle ke body ke halfway point se neeche tak aa jati hai.

Dark Cloud Cover pattern ko samajhne ke liye pehle aapko candlestick chart ka samajh hona zaroori hai. Candlestick chart mein har candle ek specific time period ke price movement ko represent karti hai. Yeh time period koi bhi ho sakta hai, jaise ke 1 minute, 5 minute, 1 ghanta, ya ek din. Candlestick chart mein candle ka body aur wick (shadow) hota hai. Body open aur close price ko represent karta hai, jab ke wick high aur low price ko represent karta hai.

Dark Cloud Cover Pattern Ki Shakal

Dark Cloud Cover pattern tab banata hai jab market mein pehle ek strong uptrend hota hai aur uske baad ek bearish reversal candle form hoti hai. Is pattern ko samajhne ke liye pehle aapko yeh dekhna hota hai ke pehli candle ek strong bullish candle honi chahiye. Uske baad jo candle banti hai, woh bearish honi chahiye aur uska open price pehli candle ke high se upar hona chahiye, lekin close price pehli candle ke halfway point se neeche hona chahiye. Is tarah se yeh candle pehli candle ke body ka major hissa cover kar leti hai, jo ke bearish signal hota hai.

Dark Cloud Cover Pattern Ki Formation

Is pattern ki formation kuch is tarah se hoti hai:- Pehli Candle (Bullish Candle): Yeh candle uptrend mein banti hai aur market ke strong bullish sentiment ko show karti hai. Is candle ka body strong hota hai, yaani ke open aur close price mein khaasa difference hota hai. Is candle ka close price din ka highest point ke qareeb hota hai, jo ke market ke bulls ke control ko reflect karta hai.

- Dusri Candle (Bearish Candle): Yeh candle pehli candle ke high se upar open hoti hai, lekin uske baad market mein selling pressure aata hai, aur yeh candle neeche close hoti hai. Is candle ka close price pehli candle ke body ke halfway point se neeche hota hai, jo ke bearish sentiment ko dikhata hai. Yeh is baat ki nishani hoti hai ke market mein bears ne control hasil kar liya hai.

- Gaps aur Shadows: Kabhi kabhi dusri candle ka open price pehli candle ke high se gap ke saath bhi start hota hai. Yeh gap market ke overbought condition ko show karta hai, aur jab dusri candle neeche close hoti hai, toh yeh gap fill hota hai. Yeh gap filling bhi bearish signal ko aur mazid reinforce karti hai.

Dark Cloud Cover pattern ki importance iss baat mein hai ke yeh ek reliable bearish reversal pattern hai. Is pattern ka banta market mein trend reversal ki nishani hoti hai. Yeh pattern specially tab important hota hai jab market mein bohot lamba aur strong uptrend chal raha ho, kyun ke yeh uptrend ke baad market mein profit booking ya selling pressure ko indicate karta hai.

Is pattern ko identify karna aur samajhna traders ke liye bohot zaroori hai, kyun ke is pattern ke baad market mein selling ka trend start ho sakta hai. Bohot se traders is pattern ko use karte hain short selling ya new bearish positions lene ke liye. Yeh pattern market ke sentiment ko bhi reflect karta hai, jahan pehle bulls ka control hota hai, lekin phir bears market ko apne qaboo mein le lete hain.

Dark Cloud Cover Pattern Ka Analysis

Dark Cloud Cover pattern ka analysis karte waqt kuch specific points ko dekhna bohot zaroori hota hai:- Trend ka Analysis: Sabse pehle aapko market ka overall trend dekhna hota hai. Dark Cloud Cover pattern tabhi kaam karega jab market mein pehle se ek uptrend chal raha ho. Agar market sideways ya downtrend mein ho, toh is pattern ka valid hona mushkil ho jata hai.

- Candlestick Size: Pattern mein shamil dono candles ka size dekhna bohot zaroori hota hai. Pehli candle ka body strong hona chahiye, jo ke market ke strong uptrend ko show kare. Dusri candle ka body bhi significant hona chahiye, aur uska close pehli candle ke halfway point se neeche hona chahiye. Yeh size ka difference bearish sentiment ko aur zyada emphasize karta hai.

- Volume: Volume analysis bhi bohot important hai. Agar dusri bearish candle banne ke waqt volume zyada hota hai, toh yeh is baat ki nishani hoti hai ke market mein selling pressure bohot zyada hai, aur yeh pattern zyada reliable hoga.

- Confirmation: Dark Cloud Cover pattern ke baad confirmation ka wait karna bhi zaroori hota hai. Aksar traders is pattern ke baad ek aur bearish candle ka wait karte hain jo ke is pattern ko confirm kare. Yeh confirmation trading mein risk ko kam karne mein madadgar hoti hai.

Dark Cloud Cover pattern ko trading mein use karne ke liye kuch khas strategies ka hona zaroori hai. Aap in strategies ko follow karke apni trading mein better decisions le sakte hain.- Entry Point: Dark Cloud Cover pattern ke baad entry tab leni chahiye jab dusri bearish candle close ho jaye. Entry ka point usually dusri candle ke close ke qareeb hota hai. Aap market ke momentum ko dekhte hue entry le sakte hain, specially agar volume zyada ho.

- Stop Loss: Stop loss ka set karna bohot zaroori hai. Is pattern mein stop loss usually pehli candle ke high se thoda upar set kiya jata hai. Yeh is baat ka insurance hota hai ke agar market wapas bullish ho jaye, toh aapke losses limited rahen.

- Take Profit: Take profit ka point market ke overall trend aur support levels par depend karta hai. Aap multiple support levels dekh kar apna take profit decide kar sakte hain. Aksar traders first major support level par apna profit book karte hain.

- Risk Management: Dark Cloud Cover pattern mein trading karte waqt risk management ko bohot ehmiyat deni chahiye. Aapko apni position size ko apni risk appetite ke mutabiq adjust karna chahiye. High leverage se guraiz karna chahiye kyun ke yeh aapke losses ko zyada kar sakta hai agar trade aapke against chala jaye.

- Multiple Time Frame Analysis: Yeh strategy tab zyada kaam aati hai jab aap multiple time frames par Dark Cloud Cover pattern ko dekhte hain. Agar yeh pattern multiple time frames par form ho raha ho, toh iski significance aur zyada badh jati hai.

Jese ke har candlestick pattern ke faide aur nuqsanat hote hain, waise hi Dark Cloud Cover pattern ke bhi kuch khas faide aur nuqsanat hain.

Faide- Trend Reversal Ka Strong Signal: Yeh pattern ek strong signal hai ke market mein trend reverse hone wala hai. Yeh specially tab important hota hai jab market ek lambi bullish rally ke baad thoda overbought condition mein ho.

- Clear Entry Aur Exit Points: Is pattern se aapko clear entry aur exit points milte hain, jo ke trading mein decision making ko asaan banate hain.

- Multiple Markets Mein Istemaal: Dark Cloud Cover pattern ko aap different markets mein use kar sakte hain, chaahe woh stocks hoon, forex ho ya commodities. Yeh pattern universal hai aur har jagah kaam karta hai.

- False Signals: Kabhi kabhi yeh pattern false signals bhi generate kar sakta hai, specially agar market mein high volatility ho ya koi significant news event ho. Isliye confirmation ka wait karna zaroori hota hai.

- Stop Loss Trigger Hona: Agar aapka stop loss bohot tight ho, toh market ke small movements ki wajah se aapka stop loss trigger ho sakta hai. Yeh tab hota hai jab market mein thodi volatility hoti hai aur price momentarily upar ya neeche jaati hai. Isliye stop loss ko carefully set karna zaroori hota hai.

- Limited Applicability in Sideways Markets: Dark Cloud Cover pattern sirf trending markets mein zyada effective hota hai. Agar market sideways ho, yaani ke price ek narrow range mein move kar rahi ho, toh is pattern ka signal reliable nahi hota. Sideways market mein yeh pattern false signals de sakta hai, jo traders ke liye losses ka sabab ban sakte hain.

- Advanced Charting Skills Ki Zaroorat: Yeh pattern identify karne ke liye aapko candlestick charts ka acha knowledge hona chahiye. Beginners ke liye yeh pattern samajhna thoda mushkil ho sakta hai, specially agar aapko candlestick analysis ka experience na ho.

Dark Cloud Cover pattern ko real-world trading mein kaise apply kiya jaye, isko samajhna bhi bohot zaroori hai. Is pattern ka successful istimaal tab hota hai jab aap isko apni overall trading strategy ke saath integrate karte hain.

Example

Misaal ke taur par, suppose karein ke aap stock market mein XYZ Company ka stock trade kar rahe hain. Market mein kaafi dinon se ek uptrend chal raha hai aur stock ke prices barh rahe hain. Aap daily chart par dekhte hain ke aik strong bullish candle form hoti hai, jo uptrend ko continue kar rahi hai. Agle din aap dekhte hain ke ek bearish candle form hoti hai jo pehli bullish candle ke high se open hoti hai lekin neeche close hoti hai, aur uske body ka significant portion pehli candle ke body ko cover kar leta hai.

Is situation mein aap yeh identify kar sakte hain ke Dark Cloud Cover pattern form ho raha hai, jo yeh signal de raha hai ke market mein reversal aasakta hai. Aap yahan short sell position open kar sakte hain, ya apni existing long positions ko close kar sakte hain, aur apna stop loss pehli candle ke high par set kar sakte hain. Agar market aapke analysis ke mutabiq move karta hai, toh aapko significant profit ho sakta hai jab market neeche ki taraf move kare. Is example se yeh samajh aata hai ke Dark Cloud Cover pattern ko real-world mein kaise use kiya ja sakta hai. Yeh pattern traders ko ek structured approach deta hai jisse woh market ke potential reversals ko predict kar sakte hain aur apni trading strategy ko accordingly adjust kar sakte hain.

Dark Cloud Cover candlestick pattern trading mein ek bohot ahem bearish reversal pattern hai jo traders ko market ke trend reversal ke signals provide karta hai. Yeh pattern specially uptrend ke baad form hota hai aur yeh signal deta hai ke market ab bearish hone wala hai. Is pattern ko samajhna aur isko effectively apply karna traders ke liye bohot faidemand ho sakta hai, lekin iske liye aapko candlestick charts ka acha knowledge hona chahiye. Dark Cloud Cover pattern ke kuch khas faide hain, jese ke yeh aapko clear entry aur exit points deta hai aur trend reversal ke signals provide karta hai. Lekin is pattern ke kuch nuqsanat bhi hain, jese ke yeh sideways markets mein kaam nahi karta aur kabhi kabhi false signals bhi generate kar sakta hai. Isliye is pattern ko trading mein use karte waqt hamesha confirmation ka wait karna chahiye aur risk management ko madde nazar rakhna chahiye.

Dark Cloud Cover pattern ko apni overall trading strategy ke saath integrate karna chahiye, taake aap better trading decisions le sakein aur market ke potential reversals ka faida utha sakein. Trading mein successful hone ke liye is pattern ka sahih istimaal bohot zaroori hai, aur iske liye aapko regular practice aur analysis karna hoga. Is pattern ka samajh aur uska accurate istimaal aapko financial markets mein significant profits kama karne mein madad de sakta hai.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#4 Collapse

Dark Cloud Cover Candlestick Pattern Kya Hai?

Dark Cloud Cover candlestick pattern ek bearish reversal pattern hai jo trading mein bohot ahamiyat rakhta hai. Yeh pattern aksar tab banta hai jab market mein uptrend ho rahi hoti hai aur phir achanak se market ke sentiments change ho jate hain. Yeh pattern trader ko ye signal deta hai ke market ab bearish hone wali hai, yani ke prices girne wali hain. Is pattern ka samajhna aur isay theek tareeqe se identify karna bohot zaroori hai, khaaskar un traders ke liye jo short selling karna chahte hain.

Dark Cloud Cover Pattern Ki Pehchan

Yeh pattern do candlesticks par mabni hota hai. Pehli candlestick bullish hoti hai, yani ke green ya white color ki hoti hai, jo ke market ke uptrend ko darshati hai. Dusri candlestick bearish hoti hai, yani ke red ya black color ki hoti hai, jo ke pehli candlestick ke high point ke bohot kareeb open hoti hai, lekin close pehli candlestick ke body ke beech mein hoti hai.

Iska matlab yeh hai ke market mein ab kharidari ke bajaye bikri zyada ho rahi hai aur ab market mein bearish trend dominate kar raha hai. Dusri candlestick ki closing price agar pehli candlestick ki opening price ke neeche hoti hai, toh yeh ek bohot strong signal hai ke market mein ab bearish trend start ho gaya hai.

Dark Cloud Cover Pattern Ka Mahfi Kya Hai?

Is pattern ka asal mahfi yeh hota hai ke market mein uptrend chal rahi thi, lekin dusri candlestick ne ye signal diya ke bulls (buyers) ab thak gaye hain aur bears (sellers) market mein ghus rahe hain. Yeh pattern aksar tab banta hai jab market mein ek resistance level par aake ruk jata hai. Is pattern ka dekhna ye batata hai ke ab market ke andar selling pressure barh raha hai aur prices neeche ja sakti hain.

Dark Cloud Cover Pattern Ka Istemaal Trading Mein Kaise Karein?

Agar aap yeh pattern identify karte hain, toh yeh ek achi trading opportunity ho sakti hai short selling ya phir apni existing long position ko close karne ke liye. Magar yeh zaroor yaad rakhein ke kisi bhi pattern ko use karne se pehle aapko doosre technical indicators jaise ke RSI, MACD, ya moving averages ko bhi dekhna chahiye taake aapko zyada strong confirmation mil sake.

Khulasah

Dark Cloud Cover candlestick pattern ek bohot hi important bearish reversal pattern hai jo ke aapko yeh batata hai ke market mein uptrend khatam hone wala hai aur ab ek naya bearish trend start ho sakta hai. Is pattern ko identify karna aur theek tareeqe se use karna trading mein bohot zaroori hai taake aap apne trades ko zyada profitable bana sakein. -

#5 Collapse

WHAT IS DARK CLOUD COVER CANDLESTICK PATTERN.

Yeh pattern typically uptrend ke baad dikhai deta hey aur bearish reversal signal provide karta hey. Ess pattern ko samajhna traders ke liye zaroori hey, ta kay woh sahi time par apne trades ko manage kar sakein. Dark cloud cover candlestick pattern eik powerful tool hey jo traders ko market trend ki changes ko samajhne mein helpout karta hey. Ess pattern ko samajh kar traders apni trading strategies ko improve kar sakte hain aur better risk management ko organize kar sakte hain. Yeh pattern traders ko ye batata hey ke bullish trend ka end ho sakta hey aur ab market bearish trend mein ja sakta hey. Isko dekhte hue traders apni long positions ko close kar sakte hain ya phir short positions enter kar sakte hain. Jis trading benefits hasil kiye ja sakty hein.

DESCRIPTIVE INFORMATION.

Market mein available kisi bi pattern ki complete identification au ross ki formation ki detail traders kay leye important role play ker sakti hay. Ess pattern mein first candle uptrend mein lamba bullish candle hota hey. Yeh candle market mein strong buying pressure ka pointer hota hey. Traders ko iss candle ki length, volume aur price range par deyan deni chahiye. Ess candle ki strength aur momentum ka analysis kar kay traders ko bearish reversal ki possibilities ka pata lag sakta hey. Second candle first candle ki upper half mein open hota hey jo bullish trend ka continuation indicate karta hey. Jab kay second candle ka close first candle kay close sey neeche hota hey, jo bearish pressure ki presence ko indicate karta hey. Ess candle ki body ki size aur location traders ke liye important factors hoti hey.

CONCLUSION.

Trading mein most importantly traders ko dark cloud cover pattern ko identify karne ki proficiency develop karne ke liye practice aur experience hasil karna chahiye taa kay woh ess pattern ka sahi use kar sakein aur trading performance ko improve kar sakein. Yeh pattern traders ke liye market mein hone wale changes ko identify kerny aur un par act upon karne ka aik source hey. Confirmation ke liye traders ko doosri candle ki range aur volume ko bhi dekhte rehna chahiye. Agar volume mein increase aur price action mein bearish signals nazar aayein tou yeh confirmation ko mazeed strength dete hain. Jis sey trading kay results increase ho sakty hein.

-

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

**Kabhi Kabhi Nakami Hamari Kamyabi Ka Bais Banti Hai:**

1. **Nakami Ka Samna:**

- Nakami ek aisi cheez hai jo har kisi ki zindagi mein aati hai, chahe wo trading ho, business ho ya personal life.

- Nakami ko samajhna aur uska samna karna zaroori hota hai, kyunki ye hamari growth aur development ka ek hissa hoti hai.

2. **Seekhne Ka Mauka:**

- **Lessons Learned:** Nakami hamesha ek seekhne ka mauka deti hai. Har failure se hum naye lessons seekhte hain jo future mein successful hone ke liye madadgar hote hain.

- **Self-Reflection:** Nakami ke baad self-reflection karna aur apni mistakes ko samajhna zaroori hota hai. Ye process hume apne strengths aur weaknesses ko identify karne mein madad karta hai.

3. **Motivation Aur Resilience:**

- **Increased Motivation:** Nakami ke baad successful hone ki aag aur bhi tez ho jati hai. Jo log nakami se gir kar dubara uthne ki koshish karte hain, wo zyada motivated aur focused hote hain.

- **Resilience:** Nakami se overcome karna resilience ko develop karta hai. Ye mental strength aur emotional stability ko enhance karta hai, jo future challenges ka samna karne mein madad karta hai.

4. **Strategy Ka Evaluation:**

- **Improvement:** Nakami ke baad apni strategies ko evaluate karna zaroori hai. Jo cheezen galat thi unhe sudhar karna aur naye strategies ko implement karna success ke chances ko barhata hai.

- **Adaptation:** Market aur situations ke hisaab se apni strategies ko adapt karna successful outcomes achieve karne mein madad karta hai.

5. **Positive Mindset:**

- **Optimism:** Nakami ko positive mindset ke sath dekhna chahiye. Ye ek temporary setback hai aur iska samna karke hum zyada strong aur prepared ho sakte hain.

- **Long-Term Vision:** Nakami ko short-term failure ke nazariye se dekhna chahiye aur long-term success ke liye apni planning aur efforts ko focus karna chahiye.

6. **Support System:**

- **Guidance:** Nakami ke dauran ek strong support system ki zaroorat hoti hai. Friends, family, aur mentors ka support aur guidance hamari confidence ko boost karte hain aur hume direction dete hain.

- **Encouragement:** Positive reinforcement aur encouragement nakami se overcome karne ke liye motivational source hota hai.

7. **Risk Management:**

- **Strategic Risks:** Nakami se seekh kar hum apne risk management strategies ko improve kar sakte hain. Market aur personal decisions mein risks ko samajhna aur unhe manage karna zaroori hai.

- **Risk Assessment:** Future risks ko assess karna aur unke solutions ko plan karna successful decision-making mein help karta hai.

8. **Conclusion:**

- Nakami ek natural part hai jo hamari kamyabi ki raah mein aati hai. Iska samna karke aur isse seekh kar hum apni skills aur strategies ko enhance kar sakte hain.

- Positive mindset, effective strategies, aur strong support system ke sath, nakami ko overcome karke hum apni long-term success ko ensure kar sakte hain.

-

#7 Collapse

**Dark Cloud Cover Candlestick Pattern**

Dark Cloud Cover ek bearish candlestick pattern hai jo trading mein negative reversal signal deta hai. Yeh pattern market ki bullish momentum ke baad uske bearish honay ki nishandahi karta hai. Is pattern ka asar tab zyada hota hai jab yeh kisi uptrend ke end par ya resistance level par banta hai.

Dark Cloud Cover pattern do candlesticks par mushtamil hota hai. Pehli candlestick bullish hoti hai jo ek strong upward move ko dikhati hai. Iske baad aane wali dusri candlestick bearish hoti hai jo pehli candlestick ke high ke upar open hoti hai, magar uski body pehli candlestick ki body ke middle se neeche close hoti hai. Yeh is baat ki taraf ishara karta hai ke market mein buying pressure kam ho gaya hai aur selling pressure barh raha hai.

Is pattern ki tasdeeq ke liye kuch aur factors ko madde nazar rakhna chahiye, jaise ke trading volume aur previous trend. Agar Dark Cloud Cover pattern high volume ke sath banta hai to is pattern ki reliability barh jati hai. Yeh bhi dekhna chahiye ke yeh pattern kisi significant resistance level par banta hai ya nahi. Agar yeh kisi strong resistance level par banta hai, to yeh signal aur bhi mazid solid ho jata hai.

Dark Cloud Cover pattern ka use karte waqt traders ko kuch important baaton ka khayal rakhna chahiye. Pehli baat yeh ke yeh pattern sirf ek reversal signal hai aur hamesha 100% accurate nahi hota. Is liye isko doosri technical indicators ke sath mila kar dekhna chahiye, jaise ke moving averages, RSI ya MACD. Is pattern ke baad agar market neechay jata hai to trade me entry karna chahiye. Stop loss ko pehli candlestick ke high ke upar rakhna chahiye taake risk ko manage kiya ja sake.

Is pattern ka exit point waise to market ke move par depend karta hai, magar general rule ke tor par aap is waqt exit kar sakte hain jab market ka trend phir se bullish hone lage ya phir aapko lagay ke price apne target tak pohanch gayi hai.

Aakhri baat yeh ke Dark Cloud Cover pattern ko trading strategy mein add karne se pehle practice zaroor karein. Isko backtest kar ke dekhain aur apni strategy mein adjust karein taake aapko iska best use maloom ho sake. Trading mein har pattern aur strategy ko sahi tareeke se samajhna aur use karna bohot zaroori hai.

-

#8 Collapse

**Dark Cloud Cover Candlestick Pattern**

1. **Pattern Ka Ta'aruf**

- Dark Cloud Cover ek bearish candlestick pattern hai jo uptrend ke baad banta hai aur potential trend reversal ko indicate karta hai.

- Yeh pattern do candlesticks par based hota hai: ek bullish candlestick aur ek bearish candlestick jo pehle ki candlestick ki body ko cover karta hai.

2. **Pattern Ki Formation**

- **First Candlestick:** Pattern ka pehla candle ek long bullish candlestick hota hai, jo strong uptrend aur buying pressure ko indicate karta hai.

- **Second Candlestick:** Dusra candle ek long bearish candlestick hota hai jo pehle ki bullish candlestick ki body ke half ya zyada portion ko cover karta hai. Iska closing price pehle candle ke midpoint se neeche hota hai.

- **Gap:** Doosre candle ka opening price pehle candle ke closing price ke upar gap ke sath hota hai, jo pattern ko bullish trend ke reversal ka signal deta hai.

3. **Trading Signals**

- **Entry Point:** Dark Cloud Cover pattern ke formation ke baad sell position enter ki jati hai, specially agar pattern ek strong uptrend ke baad bana ho.

- **Stop-Loss:** Stop-loss ko pattern ke high ke thoda upar set kiya jata hai taake unexpected price movements se protection mil sake.

- **Profit Target:** Profit targets ko previous support levels ya pattern ke height ke hisaab se set kiya jata hai, jo potential gains ko maximize karne mein madad karta hai.

4. **Faidey**

- **Trend Reversal Identification:** Dark Cloud Cover pattern traders ko trend reversal ke potential points ko identify karne mein madad karta hai, jo trading decisions ko refine karta hai.

- **Market Sentiment:** Yeh pattern market ke bearish sentiment ko reflect karta hai, jo selling opportunities ko explore karne mein madad karta hai.

5. **Limitations**

- **False Signals:** Dark Cloud Cover pattern kabhi kabhi false signals generate kar sakta hai, isliye additional confirmation tools ka use zaroori hai.

- **Pattern Context:** Pattern ka effectiveness market context aur trend ke hisaab se vary kar sakta hai, isliye isolated pattern analysis sufficient nahi hota.

6. **Confirmation Tools**

- **Additional Indicators:** Pattern ke signals ko confirm karne ke liye other indicators jaise Moving Averages, RSI, ya MACD ka use kiya jata hai. Yeh additional tools trend ke strength aur potential reversal ko verify karte hain.

- **Volume Analysis:** Pattern formation ke dauran volume ka analysis bhi kiya jata hai. High volume bearish candlestick ke formation ko confirm karta hai aur trend reversal ke signal ko strengthen karta hai.

7. **Practical Application**

- **Risk Management:** Risk management ke liye Dark Cloud Cover pattern ko stop-loss aur profit targets ke sath combine kiya jata hai, jo overall trading strategy ko enhance karta hai.

- **Pattern Analysis:** Traders pattern analysis ke sath market conditions aur price action ko consider karte hain taake trading decisions ki accuracy ko improve kiya ja sake.

Dark Cloud Cover candlestick pattern forex trading mein bearish reversal aur selling opportunities ko analyze karne ke liye ek valuable tool hai. Effective use ke liye pattern ko additional indicators aur market analysis ke sath combine karna zaroori hai.

- CL

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

### Dark Cloud Cover Candlestick Pattern

Dark Cloud Cover ek bearish candlestick pattern hai jo market ki reversal ya downtrend ke shuru hone ki nishani hota hai. Yeh pattern khas taur par bullish trend ke baad banta hai aur traders ke liye selling opportunities provide karta hai. Is post mein hum Dark Cloud Cover pattern ki definition, characteristics, aur trading strategies par baat karenge.

**1. Pattern Ki Definition**

Dark Cloud Cover tab banta hai jab pehli candlestick bullish hoti hai, yani uska close previous close se upar hota hai. Iske baad, doosri candlestick bearish hoti hai, jo pehli candlestick ke body se shuru hoti hai lekin uska close pehli candlestick ke body ke half se neeche hota hai. Yeh pattern market mein reversal ki nishani darshata hai, jo bullish se bearish trend ki taraf badal raha hai.

**2. Characteristics**

Dark Cloud Cover pattern ki kuch khasiyat yeh hain:

- **Bullish Trend Se Reversal**: Yeh pattern aksar bullish trend ke baad banta hai, jo is baat ka izhar karta hai ke buyers ka control kam ho raha hai aur sellers ka pressure barh raha hai.

- **Do Candlesticks**: Is pattern mein do candlesticks hoti hain. Pehli candlestick green (bullish) hoti hai, jabke doosri red (bearish) hoti hai.

- **Close Position**: Doosri candlestick ka close pehli candlestick ki body ke half se neeche hona chahiye, taake yeh pattern valid rahe.

**3. Trading Strategies**

Dark Cloud Cover pattern ka istemal karte waqt kuch trading strategies par amal karna zaroori hai:

- **Entry Point**: Traders is pattern ko dekh kar doosri candlestick ke close hone par selling position le sakte hain. Is se aap market ki reversal se faida utha sakte hain.

- **Stop-Loss Orders**: Risk management ke liye stop-loss orders ka istemal karna bohot zaroori hai. Aap stop-loss ko pehli candlestick ke high ke upar set kar sakte hain, taake agar market aapke against jaye to nuksan control mein rahe.

- **Confirmation Indicators**: Dark Cloud Cover pattern ki validity ko confirm karne ke liye aap additional indicators jaise RSI (Relative Strength Index) ya MACD (Moving Average Convergence Divergence) ka istemal kar sakte hain. Agar yeh indicators bhi bearish signals de rahe hain, to yeh entry ki confirmation hoti hai.

**4. Limitations**

Har trading pattern ki tarah, Dark Cloud Cover bhi kuch limitations rakhta hai:

- **False Signals**: Kabhi kabhi yeh pattern false signals de sakta hai, khaas taur par agar market volatile hai. Isliye, hamesha confirmation indicators ka istemal karein.

- **Market Conditions**: Economic news ya events ki wajah se market movements unpredictable ho sakti hain. In situations mein, aapko caution se kaam lena hoga.

**Conclusion**

Dark Cloud Cover candlestick pattern ek important tool hai jo traders ko market ki reversal ki nishani darshata hai. Yeh bearish trend ki taraf shift ka izhar karta hai aur selling opportunities dhoondhne mein madad karta hai. Is pattern ko samajhne aur effectively istemal karne se aap apne trading skills ko behtar bana sakte hain. Hamesha risk management ka khayal rakhein aur market ki volatility ko samajhne ki koshish karein, taake aap successful trading decisions le sakein.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 08:40 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим