Tasuki Gap candle stick pattern

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

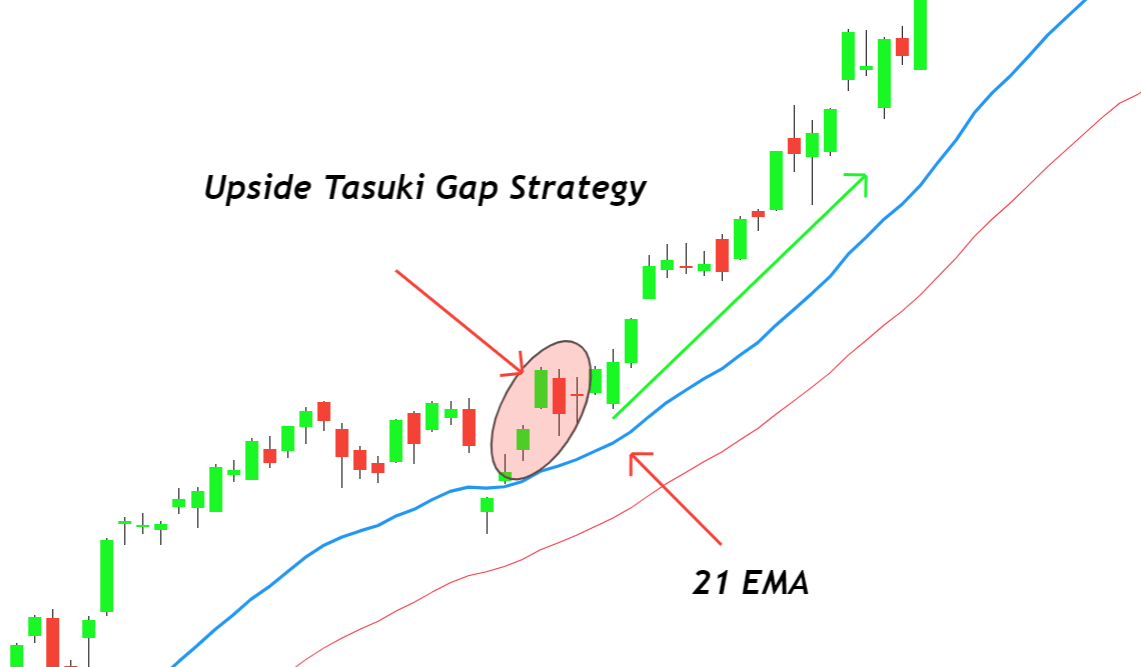

Tasuki Gap candle stick Introduction aik tasuki gape teen baar ki candle stuck ki tashkeel hai jo aam tor par mojooda rujhan ke tasalsul ko zahir karne ke liye istemaal hoti hai. pehli baar aik tay shuda up trained ke andar aik barri safaid / sabz mom batii hai. doosri baar aik aur safaid / sabz mom batii hai jis ki ibtidayi qeemat hai jo pichli baar ke band honay se oopar hai. teesri baar aik siyah / surkh candle stick hai jo pehli do salakhon ke darmiyan farq ko juzwi tor par band karti hai. ahem take ways upside tasuki Gap gape teen baar ki candle stuck ki tashkeel hai jo mojooda up trained ke tasalsul ka ishara deti hai. Upside tasuki Gap gape ki teesri mom batii pehli do salakhon ke darmiyan farq ko juzwi tor par band karti hai. tajir aksar qeematon mein taizi ke amal ki tasdeeq ke liye upside tasuki Gap gape ke sath dosray gape patteren ka istemaal karte hain . How to identify the tasuki Gap candle Tasuki gape candle stuck ki saakht ko samajhney ke liye, darj zail rehnuma khutoot par amal karen. pehli candle stuck aik ahem taizi ki candle stuck hogi jo kharidaron ki zabardast raftaar aur qeemat mein taizi ke rujhan ki numaindagi karti hai. doosri candle stuck pichli candle stuck ki range ke oopar aur bahar aik gape ke sath khulay gi. is ki bandish ki qeemat ziyada hogi aur mom batii ka size chhota hoga. teesri candle stick bearish hogi. usay pichli candle stuck ki had ke andar khilna chahiye aur pehli candle stuck ki band honay wali qeemat se oopar band hona chahiye. ulta tasuki gape candle stuck yeh mandarja baala teen taqazay hain jin ki aap ko qeemat ke chart par oopar walay tasuki gape candle stuck patteren ki tasdeeq karne ke liye jhanchne ki zaroorat hai . How to trade an tasuki Gap aik trained candle stuck patteren hai jo trading mein dosray takneeki tajzia tools jaisay trained line ya moving average ke sangam ke sath istemaal hota hai. ulta tasuki gape ki misaal saada ema tijarti hikmat e amli chart par 21 ema aur 38 ema plot karen. phir rujhan ki simt ki tasdeeq karen, aur yeh taiz hona zaroori hai. agar mom batii chalti ost line se oopar banti hai to qeemat mein taizi aaye gi. up trained ke douran khareed order kholeen jab aik oopar wala tasuki patteren ban jaye ga aur moving average line se neechay stap las lagaye ga. tijarat ko is waqt tak rokay rakhen jab tak ke ost cross over ki harkat mandi ki simt mein nah ho. ulta tasuki farq ki hikmat e amli yeh aik saada hikmat e amli hai, lekin aap usay mazeed durust bananay ke liye deegar takneeki tajzia ke ozaar shaamil kar satke hain. Conclusion nateeja tasuki candle stuck patteren bunyadi tor par stock aur index ke chart mein istemaal hota hai. forex mein, اcandle stuck ya pan baar candle ahem candle hain. yeh hamesha sifarish ki jati hai ke sirf aik shama par bharosa nah karen. aik behtareen tijarti hikmat e amli bananay ke liye aap ko dosray takneeki ozaar shaamil karne chahiye. live account par trading karne se pehlay, yakeeni banayen ke tijarti hikmat e amli ko sahih tareeqay se jachen -

#3 Collapse

Assalamu Alaikum Dosto!Downside Tasuki Gap Candlestick PatternDownside tasuki gap patteren aik bearish trend continuation pattern hai, lekin baaz dafa iss ko double market sentiment analysis k leye jani jati hai, pehli aik bearish impulsive lehar hai, aur doosri bullish price ki trend reversal hai. Yeh pattern aam tawar par supply and demand mein bearish trend ka tasalsul pattern hai. Downside tasuki gap patteren main do bearish candlestick is baat ki numaindagi karte hen k sellers walay market k ooper mukammal control mein hen, jiss se price ki qader mein musalsal kami waqea ho rahi hai. Prices ka wese bhi bhi basic trend bearish ka hota hai, jo lower low levels ko tashkeel deta hai. Downside tasuki gap patteren k leye prices ka bearish trend ka hona aham hai, q k ye prices ko mazeed nechay ki taraf push karte hen.Candles FormationDownside tasuki gap pattern k leye prices ko downward semat ka hona zarori hai. Ye pattern teen candles par mushtamil hota hai, jiss main pehli do candles bearish hoti hai, aur last wali candle bullish hoti hai. Pattern main shamil candles ki formation darjazzel tarah se hoti hai;- First Candle: Downside tasuki gap pattern ki pehli candle aik bearish candle hoti hai, jo k normal real body main banti hai. Ye candle prices ka bearish trend ko zahir karti hai. Ye candle shadow ya shadow k bagher bhi ho sakti hai, lekin lazmi bearish candle honi chaheye.

- Second Candle: Downside tasuki gap pattern ki dosri candle bhi same pehli candle ki tarah aik bearish candle hoti hai, jo k pehli candle se nechay gap main banti hai. Candle ka close open price se lazmi nechay hona chaheye, jab k iss ka gap bhi pehli candle se wazih aur clear hona chaheye.

- Third Candle: Downside tasuki gap pattern ki teesri candle aik bullish candle hoti hai, jo k dosri candle k close point se ooper open ho kar pehli aur dosri candles k gap main close hoti hai. Ye candle dono bearish candles k darmeyan banne wale gap ko mukamal cover nahi karti hai. Ye candle shadow ya shadow k bagher bhi ho sakti hai, lekin real body ka lazmi bullish honi chaheye.

ExplainationDownside tasuki gap pattern prices main sellers ki market main strong hold ki sorat main banta hai, jiss main prices bearish trend k tasalsul ko barqarar rakhti hai. Pattern teen candles par mushtamil hota hai, jiss main pehli do candles bearish aur akhari aik bullish candle hoti hai. Bearish candles k darmeyan downside par aik wazih gap hota hai, jo k aik qisam ka bearish candles ka kicking pattern dekhaye deta hai. Pattern ki dono bearish candles real body main lazmi honi chaheye, jab k candles k darmeyan banne waley gap ko koi candle (bashamole shadow) cover na kare. Pattern ki akahri candle aik bullish candle hoti hai, jo k dosri candle k closing point se thora sa above open ho kar pehli aur dosri candles k gap main close hoti hai.TradingDownside tasuki gap pattern prices ko mazeed nechay push karne k leye jana jata hai, q k ye aik bearish trend continuation pattern hai, jo trend reversal pattern se ziada reliable aur accurate signals deta hai. Pattern ki teesri bullish candle ziada strong nahi banti hai, jiss se market main trend reversal ki koshash nakam ho jati hai. Pattern par trade entry karne se pehle aik bearish confirmation candle ki zarorat hoti hai, jo k real body main bearish honi chaheye. Jab k pattern k baad bullish candle banne par pattern khatam tasar hoga. CCI indicator aur stochastic oscillator par reading 50% se nechay honi chaheye. Stop Loss pattern k sab se upper position ya pehli candle k top se two pips above set karen.

- Mentions 0

-

سا0 like

-

#4 Collapse

Introduce of Downside Tasuki Gap Candlestick Pattern Aoa Ummid karta hon Ap Sab khariat Say Hon gy AJ Downsides tasuki gap patteren aik bearish trend continuations pattern hai, lekin baaz dafa iss ko doubles market sentiment analysis k leye jani jati hai, pehli aik bearish impulsive lehar hai, aur doosri Bullishness price ki trend reversal hai. Yeh pattern aam tawar par supply and demanding mein bearish trend ka tasalsul pattern hai. Downside tasuki gap patteren main do bearish candlestick is baat ki numaindagi karte hen k sellers walay market k ooper mukammal control mein hen, jiss se price ki qader mein musalsal kami waqea ho rahi hai. Prices ka wese bhi bhi basically trend bearish ka hota hai, jo lowered low levels ko tashkeel deta hai. Downsides tasuki gap patteren k leye prices ka bearish trend ka hona aham hai, qun Keh Stopeloss use ho gy The Explanation of Downside Tasuki Gap Pattern Dear Jab bh Downsides tasuki gap pattern k leye prices ko downwards semat ka hona zarori hai. Ye pattern teen CANDLES par mushtamil hota hai, jiss main pehli do candles bearish hoti hai, aur last wali candle bullish hoti hai. PATTERN main shamil candles ki formation lazmi ho gy aor Ess Downsides Tasuki Gap pattern ki pehli candles aik bearish candle hoti hai, jo k normally real body main banti hai. Ye candle prices ka bearish trend ko zahir karti hai. Ye candles shadow's ya shadow k bagher bhi ho sakti hai, lekin lazmi bearish candle honi chahye gy Downside tasuki gap PATTERN ki dosri candle bhi same pehli candle ki tarah aik bearish candles hoti hai, jo k pehli candle se Neechay gap main banti hai. Candles ka closed Open price se lazmi Neechay hona chaheye, Trading Stradgy Dear Jab bh Downsides tasuki gap pattern prices main sellers ki market main Strong hold ki sorat main banta hai, jiss main prices bearish trend k tasalsul ko barqarar rakhti hai. Pattern teen candles par mushtamil hota hai, jiss main pehli do candles BEARISH aur akhari aik bullish candle hoti hai. BEARISH candles k darmeyan downside par aik wazih gap hota hai, jo k aik qisam ka bearish CANDLES ka kicking pattern dekhaye deta hai. Pattern ki dono bearish CANDLES real body main lazmi honi chaheye, jab k candles k darmeyan banne waley gap ko koi candle (bashamole shadow's) Cover na kare. PATTERN ki akahri candle aik Bullish candles hoti hai, jo k dosri candle k closing point se thora sa above Open ho kar pehli aur dosri candles k gap Mein ho gyEss Downsides tasuki gap pattern prices ko mazeed nechay push karne k leye jana jata hai, q k ye aik bearish Trending continuation pattern hai, jo Trending reversal pattern se ziada reliable aur accurate signals deta hai. Pattern ki teesri bullish candle ziada strong nahi banti hai, jiss se market main trend reversal ki koshash nakam ho jati hai. PATTERN par trade entry karne se pehle aik BEARISH confirmation candle ki zarorat hoti hai, jo k real body main BEARISH honi chaheye gy. Jab k PATTERN k baad Bullishness candle banne par pattern khatam tasar hoga. CCI indicator aur stochastic oscillator par reading 50% se Neechay honi Chahahye g -

#5 Collapse

Introduction: Asalam o Alikum Dosto Umeed Krta Hun Kah ap Sub Khariyat Sy Hun Gy Wesy to Forex me trading bht mushkil Hai lekin yhn BT hum tasuki gap Ke Bary me akry Gy or es Ke Bary me jany Gy es ko samjhy Gy Kah ye kia Hai or es Ke bary me Details Sy discuss Kry Gy Define Tasuki Gap candlestick: Dear friends tasuki gape teen baar ki candle stuck ki tashkeel hai jo aam tor par mojooda rujhan ke tasalsul ko zahir karne ke liye istimaal hoti hai pehli baar aik tay shuda up trained ke andar aik barri sufaid sabz mom batii hai doosri baar aik aur safaid sabz mom batii hai jis ki ibtidayi qeemat hai jo pichli baar ke band hony se upar hai teesri baar aik siyah surkh candle stick hai jo pehli do salakhon ke darmiyan farq ko juzwi tor par band karti hai ahem take ways upside tasuki Gap gape teen baar ki candle stuck ki tashkeel hai jo mooda up trained ke tasalsul ka ishara deti hai Upside tasuki Gap gape ki teesri mom batii pehli do salakhon ke darmiyan farq ko juzwi tor par band karti hai Identification of Tasuki Gap candlestick pattern: Dear friends Tasuki gape candle stuck ki saakht ko samajhney ke liye darj zail rehnuma khutoot par amal karen pehli candle stuck aik ahem taizi ki candle stuck hogi jo kharidaron ki zabardast raftaar aur qeemat mein taizi ke rujhan ki numaindagi karti hai doosri candle stuck pichli candle stuck ki range ke oopar aur bahar aik gape ke sath khulay gi is ki bandish ki qeemat ziyada hogi aur mom batii ka size chhota hoga teesri candle stick bearish hogi usy pichli candle stuck ki had ke andar khilna chahiye aur pehli candle stuck ki band hony wali qeemat se opar band hona chahiye ulta tasuki gape candle stuck yeh mandarja baala teen taqazay hain jin ki aap ko qeemat ke chart par upar walay tasuki gape candle stuck pattern ki tasdeeq karne ke liye jhanchny ki zaroorat hai Trading with Tasuki Gap candlestick: Dear friends aik trained candle stuck pattern hai jo trading mein dosray takneeki tajzia tools jaisay trained line ya moving average ke sangam ke sath istimaal hota hai ulta tasuki gape ki misaal saada ema tijarti hikmat e amli chart par 21 ema aur 38 ema plot karen phir rujhan ki simt ki tasdeeq karen aur yeh taiz hona zaroori hai agar mom bati chalti ost line se upar banti hai to qeemat mein taizi aaye gi up trained ke douran khareed order kholeen jab aik oopar wala tasuki pattern ban jaye ga aur moving average line se neechay step las lagay ga tijarat ko is waqt tak rokay rakhen jab tak ke ost cross over ki harkat mandi ki simt mein nah ho ulta tasuki farq ki hikmat e amli yeh aik saada hikmat e amli hai lekin aap usy mazeed durust bananay ke liye deegar takneeki tajzia ke ozaar shaamil kar sakty Hai -

#6 Collapse

Introduction aik tasuki gape youngster baar ki candle caught ki tashkeel hai jo aam tor par mojooda rujhan ke tasalsul ko zahir karne ke liye istemaal hoti hai. Pehli baar aik tay shuda up educated ke andar aik barri safaid / sabz mom batii hai. Doosri baar aik aur safaid / sabz mom batii hai jis ki ibtidayi qeemat hai jo pichli baar ke band honay se oopar hai. Teesri baar aik siyah / surkh candle stick hai jo pehli do salakhon ke darmiyan farq ko juzwi tor par band karti hai. Ahem take ways upside tasuki Gap gape teenager baar ki candle caught ki tashkeel hai jo mojooda up trained ke tasalsul ka ishara deti hai. Upside tasuki Gap gape ki teesri mom batii pehli do salakhon ke darmiyan farq ko juzwi tor par band karti hai. Tajir aksar qeematon mein taizi ke amal ki tasdeeq ke liye upside tasuki Gap gape ke sath dosray gape patteren ka istemaal karte hain .Identify the tasuki; Tasuki gape candle caught ki saakht ko samajhney ke liye, darj zail rehnuma khutoot par amal karen. Pehli candle stuck aik ahem taizi ki candle stuck hogi jo kharidaron ki zabardast raftaar aur qeemat mein taizi ke rujhan ki numaindagi karti hai. Doosri candle stuck pichli candle caught ki range ke oopar aur bahar aik gape ke sath khulay gi. Is ki bandish ki qeemat ziyada hogi aur mother batii ka length chhota hoga. Teesri candle stick bearish hogi. Usay pichli candle stuck ki had ke andar khilna chahiye aur pehli candle stuck ki band honay wali qeemat se oopar band hona chahiye. Ulta tasuki gape candle stuck yeh mandarja baala teen taqazay hain jin ki aap ko qeemat ke chart par oopar walay tasuki gape candle caught patteren ki tasdeeq karne ke liye jhanchne ki zaroorat hai . Candlestick Pattern Downside tasuki hole patteren aik bearish fashion continuation sample hai, lekin baaz dafa iss ko double marketplace sentiment analysis okay leye jani jati hai, pehli aik bearish impulsive lehar hai, aur doosri bullish fee ki trend reversal hai. Yeh pattern aam tawar par deliver and call for mein bearish trend ka tasalsul sample hai. Downside tasuki hole patteren predominant do bearish candlestick is baat ki numaindagi karte hen k sellers walay market ok ooper mukammal manipulate mein chook, jiss se price ki qader mein musalsal kami waqea ho rahi hai. Prices ka wese bhi bhi primary trend bearish ka hota hai, jo lower low levels ko tashkeel deta hai. Downside tasuki gap patteren ok leye prices ka bearish trend ka hona aham hai, q ok ye charges ko mazeed nechay ki taraf push karte fowl. Explaination Downside tasuki gap pattern expenses predominant dealers ki marketplace major strong hold ki sorat fundamental banta hai, jiss foremost charges bearish fashion okay tasalsul ko barqarar rakhti hai. Pattern teen candles par mushtamil hota hai, jiss most important pehli do candles bearish aur akhari aik bullish candle hoti hai. Bearish candles okay darmeyan disadvantage par aik wazih hole hota hai, jo okay aik qisam ka bearish candles ka kicking pattern dekhaye deta hai. Pattern ki dono bearish candles actual frame important lazmi honi chaheye, jab ok candles okay darmeyan banne waley gap ko koi candle (bashamole shadow) cowl na kare. Pattern ki akahri candle aik bullish candle hoti hai, jo k dosri candle ok last point se thora sa above open ho kar pehli aur dosri candles okay hole important close hoti hai. Jab ok pattern k baad bullish candle banne par pattern khatam tasar hoga. CCI indicator aur stochastic oscillator par analyzing 50% se nechay honi chaheye. Stop Loss sample ok sab se upper position ya pehli candle okay pinnacle se pips above set karen.

-

#7 Collapse

TASUKI GAP CANDLSTICK PATTERN:"-Tasuki Gap Candlestick Pattern, ek candlestick chart pattern hai jo traders aur technical analysts use karte hain market ke future price movements ko predict karne ke liye. Ye pattern primarily trend reversal ko indicate karta hai, aur iska interpretation candlestick patterns aur market context par depend karta hai. Tasuki Gap pattern usually ek bearish trend ke baad ya ek bullish trend ke baad aata hai. Is pattern ko samajhne ke liye, aapko candlestick charts aur candlestick patterns ki basic understanding honi chahiye. Tasuki Gap pattern do consecutive candles par depend karta hai, aur yeh kaise form hota hai, isko samajhne ke liye niche diye gaye steps follow karen: TASUKI GAP CANDLSTICK PATTERN KY STEPS:"-Pehli Candle: Pehli candle ek established trend (bearish ya bullish) ke roop mein form hoti hai. Agar trend bearish hai, to pehli candlestick bearish (red ya black) hoti hai, aur agar trend bullish hai, to pehli candlestick bullish (green ya white) hoti hai. Is candle ki length aur body size bhi important hoti hai. Doosri Candle: Doosri candle, pehli candle ke opposite direction mein open hoti hai, yaani agar pehli candle bearish thi to doosri candle bullish open hoti hai, aur agar pehli candle bullish thi to doosri candle bearish open hoti hai. Doosri candle ki range pehli candle ki range ke andar hoti hai, lekin iska close price pehli candle ki range ke bahar hota hai. Tasuki Gap: Doosri candle ki opening price aur pehli candle ki closing price ke beech mein gap hota hai, lekin closing price pehli candle ki range ke bahar hota hai. Is gap ko "Tasuki Gap" kehte hain. Confirmation: Pattern ko confirm karne ke liye, agla candle dekha jata hai. Agar agla candle pattern ke direction mein move karta hai, to isse pattern ki validity badh jati hai. Agar pattern bearish trend ke baad aata hai, to ye bearish reversal signal deta hai, aur traders sell ki taraf move kar sakte hain. Agar pattern bullish trend ke baad aata hai, to ye bullish reversal signal deta hai, aur traders buy ki taraf move kar sakte hain. Pattern ki success rate aur reliability market conditions aur dusre factors par depend karti hai, isliye ise dusre technical indicators aur analysis ke saath combine karna behtar hota hai. Kabhi bhi trading decisions lene se pehle thorough research aur risk management ka use karein.

TASUKI GAP CANDLSTICK PATTERN KY STEPS:"-Pehli Candle: Pehli candle ek established trend (bearish ya bullish) ke roop mein form hoti hai. Agar trend bearish hai, to pehli candlestick bearish (red ya black) hoti hai, aur agar trend bullish hai, to pehli candlestick bullish (green ya white) hoti hai. Is candle ki length aur body size bhi important hoti hai. Doosri Candle: Doosri candle, pehli candle ke opposite direction mein open hoti hai, yaani agar pehli candle bearish thi to doosri candle bullish open hoti hai, aur agar pehli candle bullish thi to doosri candle bearish open hoti hai. Doosri candle ki range pehli candle ki range ke andar hoti hai, lekin iska close price pehli candle ki range ke bahar hota hai. Tasuki Gap: Doosri candle ki opening price aur pehli candle ki closing price ke beech mein gap hota hai, lekin closing price pehli candle ki range ke bahar hota hai. Is gap ko "Tasuki Gap" kehte hain. Confirmation: Pattern ko confirm karne ke liye, agla candle dekha jata hai. Agar agla candle pattern ke direction mein move karta hai, to isse pattern ki validity badh jati hai. Agar pattern bearish trend ke baad aata hai, to ye bearish reversal signal deta hai, aur traders sell ki taraf move kar sakte hain. Agar pattern bullish trend ke baad aata hai, to ye bullish reversal signal deta hai, aur traders buy ki taraf move kar sakte hain. Pattern ki success rate aur reliability market conditions aur dusre factors par depend karti hai, isliye ise dusre technical indicators aur analysis ke saath combine karna behtar hota hai. Kabhi bhi trading decisions lene se pehle thorough research aur risk management ka use karein. -

#8 Collapse

Introduction Of the post. A.o.A Me omeed kartta ho apsab khareyat say ho gay aj me ap ko auk naey aik tasuki gape teen baar ki candle stuck ki tashkeel hai jo aam tor par mojooda rujhan ke tasalsul ko zahir karne ke liye istemaal hoti hai. pehli baar aik tay shuda up trained ke andar aik barri safaid / sabz mom batii hai. doosri baar aik aur safaid / sabz mom batii hai jis ki ibtidayi qeemat hai jo pichli baar ke band honay se oopar hai. teesri baar aik siyah / surkh candle stick hai jo pehli do salakhon ke darmiyan farq ko juzwi tor par band karti hai. ahem take ways upside tasuki Gap gape teen baar ki candle stuck ki tashkeel hai jo mojooda up trained ke tasalsul ka ishara deti hai. Upside tasuki Gap gape ki teesri mom batii pehli do salakhon ke darmiyan farq ko juzwi tor par band karti hai. tajir aksar qeematon mein taizi ke amal ki tasdeeq ke liye upside tasuki Gap gape ke sath dosray gape patteren ka istemaal karte hay. How to identify the tasuki Gap CandlesticksTasuki gape candle stuck ki saakht ko samajhney ke liye, darj zail rehnuma khutoot par amal karen. pehli candle stuck aik ahem taizi ki candle stuck hogi jo kharidaron ki zabardast raftaar aur qeemat mein taizi ke rujhan ki numaindagi karti hai. doosri candle stuck pichli candle stuck ki range ke oopar aur bahar aik gape ke sath khulay gi. is ki bandish ki qeemat ziyada hogi aur mom batii ka size chhota hoga. teesri candle stick bearish hogi. usay pichli candle stuck ki had ke andar khilna chahiye aur pehli candle stuck ki band honay wali qeemat se oopar band hona chahiye. ulta tasuki gape candle stuck yeh mandarja baala teen taqazay hain jin ki aap ko qeemat ke chart par oopar walay tasuki gape candle stuck patteren ki tasdeeq karne ke liye jhanchne ki zaroorat hay. How to trade an tasuki GapAik trained candle stuck patteren hai jo trading mein dosray takneeki tajzia tools jaisay trained line ya moving average ke sangam ke sath istemaal hota hai. ulta tasuki gape ki misaal saada ema tijarti hikmat e amli chart par 21 ema aur 38 ema plot karen. phir rujhan ki simt ki tasdeeq karen, aur yeh taiz hona zaroori hai. agar mom batii chalti ost line se oopar banti hai to qeemat mein taizi aaye gi. up trained ke douran khareed order kholeen jab aik oopar wala tasuki patteren ban jaye ga aur moving average line se neechay stap las lagaye ga. tijarat ko is waqt tak rokay rakhen jab tak ke ost cross over ki harkat mandi ki simt mein nah ho. ulta tasuki farq ki hikmat e amli yeh aik saada hikmat e amli hai, lekin aap usay mazeed durust bananay ke liye deegar takneeki tajzia ke ozaar shaamil kar satke hay. Conclusion nateeja tasuki candle stuck patteren bunyadi tor par stock aur index ke chart mein istemaal hota hai. forex mein, اcandle stuck ya pan baar candle ahem candle hain. yeh hamesha sifarish ki jati hai ke sirf aik shama par bharosa nah karen. aik behtareen tijarti hikmat e amli bananay ke liye aap ko dosray takneeki ozaar shaamil karne chahiye. live account par trading karne se pehlay, yakeeni banayen ke tijarti hikmat e amli ko sahih tareeqay se Pachene gay. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#9 Collapse

EN Ye 2 consective candles k middle mein aur un k shadow ko mila k bnta ha but agr candles mein middle gap ho un k shadows apas mein touch ho rahay hon to usay ham window nhi kahain gay, window k liay shadows k middle lazmi gap hona chaiay, is tarah rising window ko bullish aur falling window ko bearish kahain gay, pattern ko completekarnay k liay window k baad 2 candles ki hi zarurat hoti ha, ye candlesticks window ko band ya gap ko poora nhi kar sakain gi,window ko follow karnay wali pehli candle bullish rising candlestick ho gi and dusri aik dark bearish hogi, jo pichli candles ki real body mein open ho gi, duari candle pehli ki real body k neechay close hogi aur window ko band nhi honay da gi,ye candle window ya candlestick ko close kar da gi to pattern wrongho ga, rising window ko ham support consider karain gay, next2 session ki window k close honay aur support k against janay ka signal market ki taizi ka sabab bnay ga aur market ki bearish nature is saray pattern k against ho gi jo window k close aur resistance k par ho gi, ye pattern up trend aur down trend dono mein achi indication haWHAT IS TASUKI GAP CANDLESTICK PATTERNTRAGING STATERGYPehli candle ek established trend bearish ya bullish mein form hoti hai. Agar trend bearish hai, to pehli candlestick bearish red ya black hoti hai, aur agar trend bullish hai, to pehli candlestick bullish green ya white hoti hai. Is candle ki length aur body size bhi important hoti hai.Doosri candle, pehli candle ke opposite direction mein open hoti hai, yaani agar pehli candle bearish thi to doosri candle bullish open hoti hai, aur agar pehli candle bullish thi to doosri candle bearish open hoti hai. Doosri candle ki range pehli candle ki range ke andar hoti hai,isk a close price pehli candle ki range ke bahar hota hai.Doosri candle ki opening price aur pehli candle ki closing price ke middle mein gap hota hai, but closing price pehli candle ki range ke bahar hota hai. Is gap ko "Tasuki Gap" kehte hain.Pattern ko confirm karne ke liye,next candle dekha jata hai. Agar next candle pattern ke direction mein move karta hai, to is se pattern ki validity zyada ho jati hai.MORE INFORMATIONTasuki patent Itna zyada familiar nahin hai bahut zyada log is pattern se completely benefits Hasil nahin kar sakte bcz is pattern sa related maximum members ko zyada information Nahin Hoti Jis ki vajah se un ko problem ho ti hain,market patterns Mein 3 different candlesticks hoti hain jin ko aap day time frame per observe karte hue analysis karte hain aur jab yah candlestick banti hai to market Mein acchi entry Hasil kar sakte hain is mein 1sr aur 2nd candlestick bullish hoti hai,market pattern per trading karte hain to ap ko stop loss ki limit aur take profit ki limit daily time frame ki basis per hi select karna chahie bcz Jab aap timeframe select Karte Hain To us mein ap ki account balance Bhi zyada Hona chahie aur ap ki selected limits bhi increased honi chahie.ji sy aap ko trading mein help bi mil sakti hy.

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 01:32 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим