What is Master Candle in Forex trading.

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

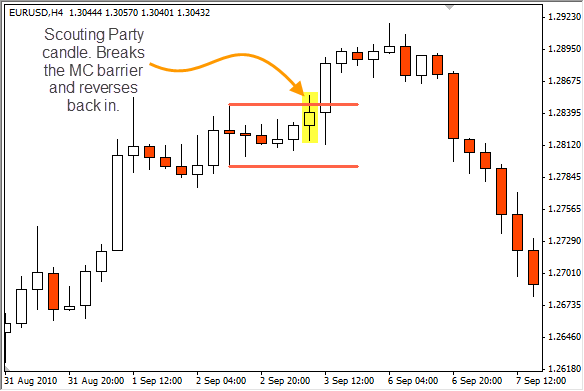

MASTER CANDLE IN FOREX MARKET 1. Master Candle Forex ek trading strategy hai jo Forex market mein istemal ki jati hai. Is strategy mein traders master candles ko istemal karke price action ko analyze karte hain. Price action analysis, price charts aur candlestick patterns ko dekh kar future price movements lagane ki technique hai. Master Candle ek aisa candlestick pattern hai jo do ya zyada candles se bana hota hai. Ye pattern usually volatility aur market consolidation ki periods mein dekha jata hai. Master Candle ek dominant candle hota hai jo uski surrounding candles ko engulf karta hai. 2. MASTER CANDLE IDENTIFICATION Master Candle ki pehchan karne ke liye aapko price charts par dhyan dena hoga. Agar aap dekhte hain ki ek candle doosre candles ko engulf kar rahi hai aur uske aspaas ki candles uski range ke andar rehti hain, toh aapko samajh lena chahiye ki aapke samne Master Candle hai. 3. MASTER CANDLE STRATEGY IN TRAIDING Master Candle strategy mein traders Master Candle ki high aur low levels ko identify karte hain. Agar Master Candle ki high level break hoti hai, toh ye ek bullish signal hai aur traders long positions le sakte hain. Aur agar Master Candle ki low level break hoti hai, toh ye ek bearish signal hai aur traders short positions le sakte hain. 4. STOP LOSS AND TARGET Master Candle strategy mein stop loss aur target levels ko set karna bahut zaroori hai. Stop loss level aapko protection provide karta hai agar trade against direction move kare. Target level aapko profit booking karne mein madad karta hai. Stop loss aur target levels ko trade ki risk-reward ratio ke hisab se set karna chahiye. 5. MASTER CANDLE STRATEGY LIMITATIONS Master Candle strategy ke istemal mein kuch limitations bhi hain. Ye strategy sirf specific market conditions mein hi kaam karti hai aur har trade mein successful nahi hoti hai. Isliye, proper analysis, risk management, aur trading discipline ka istemal karna bahut zaroori hai. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

"Master Candle" Forex trading mein ek candlestick pattern hai, jo multiple smaller candlesticks ko surround karta hai. Is pattern mein ek large-sized candlestick, smaller-sized candlesticks ke andar rehti hain. Master Candle pattern consolidation phases ko represent karta hai, jahan price range narrow hota hai. Yeh pattern traders ko market direction aur breakout opportunities ko samajhne mein madadgar hota hai. Master Candle pattern ki characteristics: 1. Pattern Formation: Master Candle pattern mein ek large-sized candlestick (master candle) smaller-sized candlesticks se surround hoti hai. Smaller candlesticks master candle ke high aur low levels ke andar rehti hain. 2. Consolidation Phase: Master Candle pattern consolidation phase ko darshata hai, jahan price range narrow hota hai aur market direction unclear ho sakti hai. Yeh indecision aur market ko sametne ki koshish dikhai deti hai. 3. Breakout Opportunities: Master Candle pattern breakout opportunities ko indicate karta hai. Jab price master candle ke high ya low level se bahar nikalta hai, toh woh breakout signal provide karta hai aur trend direction ke liye confirmation deta hai. 4. Stop-Loss Placement: Traders master candle pattern ka istemal karke stop-loss levels ko set kar sakte hain. Stop-loss levels master candle ke high ya low level ke just beyond placed kiya jate hain, takay false breakouts se bacha ja sake. Master Candle pattern ka interpretation: 1. Market Consolidation: Master Candle pattern consolidation phases ko highlight karta hai, jahan price range narrow hota hai. Yeh indecision aur market ko sametne ki koshish ko darshata hai. 2. Breakout Confirmation: Master Candle pattern breakout opportunities ko confirm karta hai. Jab price master candle ke high ya low level se bahar nikalta hai, toh woh breakout signal provide karta hai aur trend direction ke liye confirmation deta hai. Conclusion: Master Candle pattern traders ko market consolidation phases aur potential breakouts ki samajh mein madadgar hota hai. Isse traders market direction aur trading opportunities ko samajh sakte hain. Lekin, traders ko master candle pattern ko sahi tareeke se interpret karna aur dusre technical tools ka istemal karke confirm karna zaroori hai, takay sahi trading decisions liye ja sake. Importantly, master candle pattern ko validate karne ke liye additional analysis aur confirmation ki zaroorat hoti hai, jaise ki support aur resistance levels, trend lines, aur dusre technical indicators. -

#4 Collapse

$$$Forex Trading me Master Candle$$$

Forex trading me "Master Candle" ek technical analysis concept hai jo price action based trading strategies me istemal hota hai. Master Candle ka concept ye hai ki ek specific candle, jo market me significant price movement ko represent karta hai, ko identify karke uske around trading decisions liye jaate hain.

Master Candle trading strategy me, traders Master Candle ke breakout ya reversal par focus karte hain. Agar Master Candle ke high ya low ko break karta hai, toh ye ek strong signal provide karta hai. Kuch traders isko trend continuation ke liye use karte hain jabki kuch ise trend reversal indicator ke roop me dekhte hain.

Yeh important hai ki traders Master Candle strategy ko dusre technical indicators aur analysis ke saath combine karein aur risk management ka dhyan rakhein.

$$$Forex Trading me Master Candle$$$

Master Candle strategy ka istemal karne ke liye kuch important points hain:- Identification: Master Candle ko identify karna important hai. Iske liye, traders ek candle ko dekhte hain jiska high aur low, uske preceding aur succeeding candles ke high aur low ke beech me fit hota hai.

- Confirmation: Master Candle ke breakout ya reversal ko confirm karne ke liye, traders dusre technical indicators ka istemal karte hain jaise ki moving averages, RSI (Relative Strength Index), aur support/resistance levels.

- Risk Management: Har trading strategy me risk management ka hona bahut zaroori hai. Traders ko apne trades ke liye stop-loss orders place karna chahiye taki unka nuksan control me rahe.

- Time Frame Selection: Master Candle strategy ko implement karte waqt, traders ko sahi time frame select karna bhi important hai. Different time frames par Master Candle ka impact alag ho sakta hai.

- Market Conditions: Market conditions ko samajhna bhi zaroori hai. High volatility wale market conditions me Master Candle strategy ka istemal karna risky ho sakta hai, isliye market conditions ke mutabiq apni strategy adjust karna important hai.

- Backtesting and Demo Trading: Har new strategy ko pehle demo trading account ya backtesting ke through test karna chahiye. Isse aapko strategy ka effectiveness aur weaknesses ka pata chalega.

- Learning and Adaptation: Market dynamics hamesha change hote hain, isliye traders ko apni strategy ko regularly update karna aur market ki latest trends aur conditions ke hisab se adjust karna important hai.

Yeh zaroori hai ki traders Master Candle strategy ko ek tool ke roop me dekhein, aur ise apne overall trading plan me integrate karein. Har strategy ki tarah, Master Candle bhi sirf ek indicator hai aur khud me complete trading plan nahi hai.

-

#5 Collapse

Introduction of the MASTER CANDLE .

I hope my frind aj Master Candle Forex ek trading strategy hai jo Forex market mein istemal ki jati hai. Is strategy mein traders master candles ko istemal karke price action ko analyze karte hain. Price action analysis, price charts aur candlestick patterns ko dekh kar future price movements lagane ki technique hai. Master Candle ek aisa candlestick pattern hai jo do ya zyada candles se bana hota hai. Ye pattern usually volatility aur market consolidation ki periods mein dekha jata hai. Master Candle ek dominant candle hota hai jo uski surrounding candles ko engulf karta hay.

2. MASTER CANDLE IDENTIFICATION

Master Candle ki pehchan karne ke liye aapko price charts par dhyan dena hoga. Agar aap dekhte hain ki ek candle doosre candles ko engulf kar rahi hai aur uske aspaas ki candles uski range ke andar rehti hain, toh aapko samajh lena chahiye ki aapke samne Master Candle hay.

3. MASTER CANDLE STRATEGY IN TRAIDING .

Master Candle strategy mein traders Master Candle ki high aur low levels ko identify karte hain. Agar Master Candle ki high level break hoti hai, toh ye ek bullish signal hai aur traders long positions le sakte hain. Aur agar Master Candle ki low level break hoti hai, toh ye ek bearish signal hai aur traders short positions le sakte hay.

4. STOP LOSS AND TARGET CPI.

Master Candle strategy mein stop loss aur target levels ko set karna bahut zaroori hai. Stop loss level aapko protection provide karta hai agar trade against direction move kare. Target level aapko profit booking karne mein madad karta hai. Stop loss aur target levels ko trade ki risk-reward ratio ke hisab se set karna chahiye.

5.MASTER CANDLE STRATEGY LIMITATIONS

Master Candle strategy ke istemal mein kuch limitations bhi hain. Ye strategy sirf specific market conditions mein hi kaam karti hai aur har trade mein successful nahi hoti hai. Isliye, proper analysis, risk management, aur trading discipline ka istemal karna bahut zaroori hay. -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Master Candlesticks Pattern kya hay?

Forex mein Master Candle sticks ek aisi candlestick pattern hai jo traders ko market ki trend mein badlav ki pehchan karne mein madad karti hai. Ye pattern tab banta hai jab ek badi candle agale char candlesticks ki range ko apne mein sama let hai.

Master Candle sticks

ki khasiyat:- Ismein ek badi body hoti hai jo agale char candlesticks ki range ko cover karti hai.

- Iski wicks chhoti ya ghair maujud ho sakti hain.

- Ye pattern kisi bhi timeframe mein ban sakta hai, lekin yeh higher timeframes mein zyada mazbooti se kam karta hai.

Master Candle sticks

se trading kaise karen:- Trend ki pahchan karen: Master Candle sticks ka istemal trend ki pahchan karne ke liye kiya ja sakta hai. Agar Master Candle ek uptrend mein banta hai, to yeh is baat ka ishara hai ki trend jari rah sakta hai. Agar Master Candle ek downtrend mein banta hai, to yeh is baat ka ishara hai ki trend khatam ho sakta hai.

- Entry aur exit points ki pahchan karen: Master Candle sticks ka istemal entry aur exit points ki pahchan karne ke liye bhi kiya ja sakta hai. Agar Master Candle ek uptrend mein banta hai, to aap agale candlestick ke open per long position le sakte hain. Agar Master Candle ek downtrend mein banta hai, to aap agale candlestick ke open per short position le sakte hain.

- Stop loss aur take profit orders ka istemal karen: Kisi bhi trading strategy mein stop loss aur take profit orders ka istemal karna zaroori hai. Master Candle sticks se trading karte samay bhi aapko aisa hi karna chahiye.

Master Candle sticks ek mazabut trading pattern hai, lekin yeh 100% sahi nahin hai. Is pattern ka istemal karte waqat aapko hamesha risk management ka khayal rakhna chahiye.

Master Candle sticks se

trading ke kuchh tips:- Master Candle sticks ka istemal higher timeframes mein karen.

- Master Candle sticks ka istemal trend ki pahchan karne ke liye karen.

- Master Candle sticks ka istemal entry aur exit points ki pahchan karne ke liye karen.

- Stop loss aur take profit orders ka istemal karen.

Master Candle sticks ek mazabut trading pattern hai, lekin yeh 100% sahi nahin hai. Is pattern ka istemal karte time aapko hamesha risk management ka khayal rakhna chahiye.

Thank you for your attention -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#7 Collapse

What is Master Candle in Forex trading

Master Candle Kya Hota Hai?

Master Candle ek large candlestick hai jo doosri smaller candles ko engulf karta hai. Iska matlab hai ke master candle ke range mein do ya zyada small candles hote hain jo uski range ke andar fit hote hain

Master Candle ka Significance:

Master Candle ki significance yeh hoti hai ke jab ek master candle form hota hai, toh yeh indicate karta hai ke market mein ek potential shift ho sakta hai. Agar master candle bullish trend ke beech form hota hai, toh yeh ek bullish reversal ki indication ho sakti hai aur agar bearish trend mein form hota hai, toh yeh bearish reversal ki indication ho sakti hai. Iske alawa, master candle market mein consolidation periods ko bhi indicate kar sakta hai, jahan price range bound hoti hai.

Master Candle ka Istemal:

Master Candle ko istemal karke traders apne trading strategies ko refine kar sakte hain. Agar ek master candle form hota hai, toh traders apne entry aur exit points ko adjust kar sakte hain. Agar ek bullish master candle form hota hai, toh traders long positions le sakte hain, aur agar bearish master candle form hota hai, toh traders short positions le sakte hain.

Master Candle ki Confirmation:

Master Candle ki importance ko confirm karne ke liye, traders ko dusre technical indicators aur price action signals ko bhi consider karna chahiye. Yeh include karte hain trend lines, support aur resistance levels, aur oscillators jaise RSI ya MACD.

Master Candle ka Risk Management:

Master Candle ka istemal karke traders apni risk management strategies ko bhi improve kar sakte hain. Yeh unhein clear entry aur exit points provide karta hai, jisse unka risk controlled rahta hai. Iske alawa, traders stop loss aur take profit levels ko bhi master candle ke around set kar sakte hain, jisse unka risk aur reward ratio maintain ho.

Implementation aur Further Analysis:

Master Candle ki confirmation ke liye, traders ko candlestick patterns aur price action signals ko aur closely observe karna chahiye. Iske alawa, volume analysis bhi important hai, kyunki higher volume ek strong confirmation provide karta hai.

Master Candle ka Use in Different Timeframes:

Master Candle ka use traders ko different timeframes par bhi kar sakte hain, jaise ki daily, hourly, ya phir shorter timeframes. Har timeframe par master candle ki significance alag ho sakti hai, aur iske through traders multiple trading opportunities ko identify kar sakte hain.

Master Candle ki Strategy Development:

Master Candle ko base bana kar traders apni khud ki trading strategies develop kar sakte hain. Ismein include ho sakte hain entry aur exit rules, risk management techniques, aur position sizing strategies. Har trader apne preferences aur risk tolerance ke according apni strategy customize kar sakta hai.

Master Candle ka Backtesting aur Optimization:

Master Candle ko backtesting aur optimization ke through traders apni strategies ko test kar sakte hain. Historical data par master candle patterns ko analyze karke traders apni strategy ko refine aur improve kar sakte hain, jisse real-time trading mein better performance mile.

Master Candle ka Educational Resources:

Master Candle ke concept ko samajhne aur implement karne ke liye traders ko available educational resources ka bhi istemal karna chahiye. Yeh include karte hain books, online courses, aur trading forums jahan experienced traders apna knowledge share karte hain.

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 11:29 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим