What is Potential gain Hole Three Strategies Candle Pattren

`

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔ٹیگز: کوئی نہیں

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

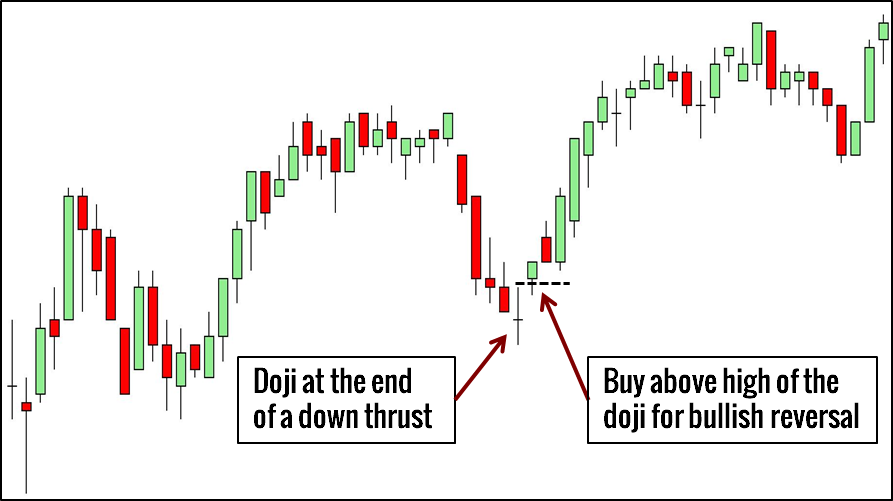

Hole three strategy *Asalam o alaikum* individuals, Ummid hai aap sab khairiyat se Honge. Punch aap is market Mein Apni working ko complete karna chahte hain to aapko various variables per study karna hoti hai aur ek throb information ke sath kam karna hota hai agar aap ismein Cash the board ke sath kam karte hain aur rules guideline ko adhere to karke exchanging karte hain to aapko is market Mein best outcome mil raha hota hai isliye aapko Hamesha zyada difficult work karna chahie aur Chhoti Si Chhoti botches Ka Khyal Rakhna chahie. agar aap ismein choti si bhi galti kar dete Hain To aapke liye bahut bara nuksan ho sakta hai koi bhi business Ho usmein difficult work to karna hota hai jo difficult work per depend karta Forex BA Kaisa business hai jo difficult work per depend karta hai isliye aapko koshish Karni Hogi kya aap ismein zyada Se zyada difficult work Karen. principal aaj aapse bahut greetings significant data share karungi jo aapki exchanging ko productive banaa sakti hai to Mera point hai up side hole three strategies candle design for every kesy exchanging krty hain. The Hole Three Strategy The Hole Three Strategies is a three-bar Japanese candle design that demonstrates a continuation of the latest thing. It is a variation of the Potential gain Tasuki Hole design, yet the third light totally shuts the hole between the initial two candles. Forex exchanging Mein potential gain hole three strategies cost outline Mein banne wala 13 candles ka negative pattern inversion design hai jo k Bullish pattern ya exorbitant cost region Mein banta hai candle graph Ek specialized apparatus hai jo dealers ko bahut Pattern ke Hawale se data Dete Hain. Candle ka cash pair ke specialized examination ke liye bahut significant hai jisse dealers na sirf Unka use dusre markers ke sath mila kar karte hain balki ye Akele Bhi mostally Ek proactive factors ka kam karte hain. candle Se bullish side hole 3 techniques ke design Mein quick aur second flame ja ke last wali candle Ek negative hoti hai jo ki train inversion ka kam karti hai aap to side hole three strategies ke inverse heading Mein cost ke base per bullish pattern inversion ke liye drawback hole three strategy banta hai. Subtleties Forex exchanging Mein potential gain hole 3 strategy cost ke top Mein banne wali design Tashu ki hole aapse Milta julta Hai jismein cost same Bullish pattern Mein tasalsul Jari rakhti Hai. Potential gain hole 3 techniques adolescent candles for each mushtamail Hota Hai jis mein first light Ek long genuine body wali bullish flame Hoti Hai Jiska close cost open value Se zyada hota hai design ki second candle bhi Bullish candal hoti hai jo ke quick candle se upar hole Mein Banti Hai first aur second candles Ke Darmiyan banne wala hole ya Hona chahie yani donon candles ke Shadow mein Nahin Hona chahie design ki third candle Ek negative candal hoti hai jo ki second candles ke genuine body mein open hokar first pattern ke genuine body Mein close Hoti Hai negative Candle first aur second candles Ke Darmiyan banne wala hole ko cover karti hai. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

WHAT IS POTENTIAL GAIN HOLE THREE CANDLE PATTERN DEFINITION Teen Bahir Upar aur 3 outside down 3 candle reversal pattern hain Jo candlestick chart per zahar Hote Hain pattern ko ek specifies sequence mein banne ke liye teen candle darkar hoti hain Jis Se showing Hota Hai ke current trend ne Speed Kho Di Hai Aur ya current trend ke reversal ka signal de sakta hai khas Taur per pattern is time banta hai jab ek bearish candlstick Jo opend se unche closes Ho Jaati Hai ya uske braks hote hai teen bahir aur teen bahir niche ka movazna teen ke ander uper ya niche candle se kiya ja sakta hai security Pehli candle ki Had Se Upar ki price ko barhate hue day ke bahar ki candlestick ke bahar bullish ko completing karte hue favaid post karna continuous Rakhe hue hain WHAT IS A THREE OUTSIDE UP/DOWN Pahle candle market ke trend ko continues rakhti Hai open se kam Kareeb ke sath strong selling ki interest ki indicating karti hai Jab ke bear ke confidence Mein increasing Hota Hai second candle lower down hai lakin reversal hai Bull power ke display Mein opening tick se Guzarti hai price Ki yey kaarvayi Ek Red flag uthati hai jo bear ko profit Lene ya stop ko tighten karne ke liye kahati hai Kyonke reversal possible hai security losses ko post karna continuous rakhti hai iski price Pahli candle ki Had Se niche girti Hui seeing ker Day Ke out side ki candlestick mein market ko complete karti hai isase Bear ka confidence barhta hai aur selling signal start Hote Hain

WHAT IS A THREE OUTSIDE UP/DOWN Pahle candle market ke trend ko continues rakhti Hai open se kam Kareeb ke sath strong selling ki interest ki indicating karti hai Jab ke bear ke confidence Mein increasing Hota Hai second candle lower down hai lakin reversal hai Bull power ke display Mein opening tick se Guzarti hai price Ki yey kaarvayi Ek Red flag uthati hai jo bear ko profit Lene ya stop ko tighten karne ke liye kahati hai Kyonke reversal possible hai security losses ko post karna continuous rakhti hai iski price Pahli candle ki Had Se niche girti Hui seeing ker Day Ke out side ki candlestick mein market ko complete karti hai isase Bear ka confidence barhta hai aur selling signal start Hote Hain  OUTSIDE UP TRADE PSYCOLOGY Investpedia tax investment ya financial services aur advice provide nahi karta hai information investment objective risk tolerance ya Kisi specifies invest Karke financial circumstance per Ghor kiye bagair pesh ki Jaati Hai aur ho sakta hai ke Tamam investors Ke Liye might Na Ho investing mein risk Shamil Hai including principal ka possible loss Hota Hai vah pahli candle prevalling Trend Ke end Ke beginning ki maloomat Karti Hai Kyonke second candle pahli candle ko ingulf kar Leti Hai 3 candle Iske bad reversal ki reftar ko marks kerte hai

OUTSIDE UP TRADE PSYCOLOGY Investpedia tax investment ya financial services aur advice provide nahi karta hai information investment objective risk tolerance ya Kisi specifies invest Karke financial circumstance per Ghor kiye bagair pesh ki Jaati Hai aur ho sakta hai ke Tamam investors Ke Liye might Na Ho investing mein risk Shamil Hai including principal ka possible loss Hota Hai vah pahli candle prevalling Trend Ke end Ke beginning ki maloomat Karti Hai Kyonke second candle pahli candle ko ingulf kar Leti Hai 3 candle Iske bad reversal ki reftar ko marks kerte hai

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#4 Collapse

Opening three procedure *Asalam o alaikum* people, Ummid hai aap sab khairiyat se Honge. Punch aap is market Mein Apni working ko complete karna chahte hain to aapko different factors per study karna hoti hai aur ek pulsate data ke sath kam karna hota hai agar aap ismein Money the board ke sath kam karte hain aur rules rule ko comply with karke trading karte hain to aapko is market Mein best result mil raha hota hai isliye aapko Hamesha zyada troublesome work karna chahie aur Chhoti Si Chhoti bungles Ka Khyal Rakhna chahie. agar aap ismein choti si bhi galti kar dete Hain To aapke liye bahut bara nuksan ho sakta hai koi bhi business Ho usmein troublesome work to karna hota hai jo troublesome work per depend karta Forex BA Kaisa business hai jo troublesome work per depend karta hai isliye aapko koshish Karni Hogi kya aap ismein zyada Se zyada troublesome work Karen. head aaj aapse bahut good tidings huge information share karungi jo aapki trading ko useful banaa sakti hai to Mera point hai up side opening three methodologies light plan for each kesy trading krty hain. The Opening Three Procedure The Opening Three Procedures is a three-bar Japanese candle plan that exhibits a continuation of the most recent thing. It is a variety of the Potential increase Tasuki Opening plan, yet the third light thoroughly closes the opening between the underlying two candles. Forex trading Mein potential increase opening three systems cost frame Mein banne wala 13 candles ka negative example reversal plan hai jo k Bullish example ya extravagant expense district Mein banta hai flame chart Ek particular mechanical assembly hai jo vendors ko bahut Example ke Hawale se information Dete Hain. Light ka cash pair ke specific assessment ke liye bahut huge hai jisse vendors na sirf Unka use dusre markers ke sath mila kar karte hain balki ye Akele Bhi mostally Ek proactive variables ka kam karte hain. candle Se bullish side opening 3 methods ke plan Mein fast aur second fire ja ke last wali flame Ek negative hoti hai jo ki train reversal ka kam karti hai aap to side opening three techniques ke backwards heading Mein cost ke base per bullish example reversal ke liye disadvantage opening three system banta hai. Nuances Forex trading Mein potential addition opening 3 procedure cost ke top Mein banne wali plan Tashu ki opening aapse Milta julta Hai jismein cost same Bullish example Mein tasalsul Jari rakhti Hai. Potential increase opening 3 strategies young adult candles for each mushtamail Hota Hai jis mein first light Ek long certifiable body wali bullish fire Hoti Hai Jiska close expense open worth Se zyada hota hai plan ki second candle bhi Bullish candal hoti hai jo ke fast flame se upar opening Mein Banti Hai first aur second candles Ke Darmiyan banne wala opening ya Hona chahie yani donon candles ke Shadow mein Nahin Hona chahie plan ki third candle Ek negative candal hoti hai jo ki second candles ke authentic body mein open hokar first example ke veritable body Mein close Hoti Hai negative Candle first aur second candles Ke Darmiyan banne wala opening ko cover karti hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 05:46 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим