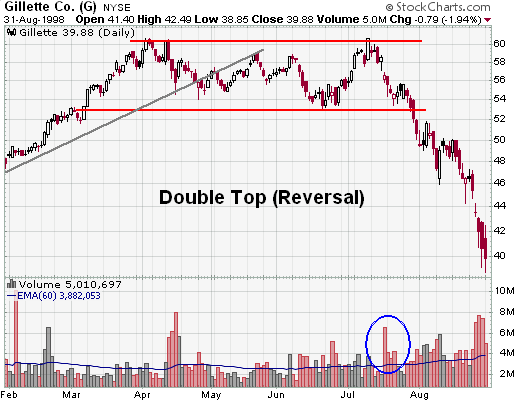

Double top candlestick chart patterns:

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

umeed ha ap sb khairait se hn gy or apki trading bhht achi jaa rahi ho ge. dear members aj ki post ka topic ha double top chart pattern or hum aj esko study karen gy or esko trade karny ka tareka bhi dekhen gy. What is double top chart pattern? Dear members double top chart pattern aik bearish reversal chart pattern ha mtlb k ye pattern bn jay to es k bad market bearish hoti ha. or ye pattern bullish trend k end main bnta ha or us k bad bearish trend start hota ha. How it is formed? dear members jb market up trend main hoti ha to market kafi opr jaa k aik resistance se takrati ha or apna high bnati ha js k bad wapis ati ha market thora sa retrace ho kr or aik support se takra kar wapis opr previous resistance se tkrati hanor wps ati ha. estrha opr wali resistance ko market 2 bar touch karti ha or esi ko double top kha jata ha. Neckline: dear members jb market apni phli top bna k js support ki trf ati ha or wapis apni previous resistance ki trf jati ha to es support line ko neckline kaha jara ha. Breakout of neckline: Dear members double top chart pattern main trade karny k lye hamen pattern k complete hony or neckline k breakout ka wait karna chahye. neckline ka breakout tb hota ha jb market double top pattern ki neckline ko cross kr k es k nechy jati ha or js time frame main ye pattern bnta ha usi time frame main market neckline k nechy candle close kary ye breakout ki confirmation hoti ha or es k bad hum sell ki trade le skty hain. or es main hmara stop loss neckline se thora opr ho ga jb k profit tarhet top se neckline ki height k equal nechy ki taraf ho ga. -

#3 Collapse

Presentation modified hammer candle aik patteren hai jo diagram standard zahir hota hai poke stock ki qeemat ko oopar ki taraf dhakelnay ke liye khredar ka dabao hota hai. yeh aik inversion candle stuck patteren hai jo neechay ke rujhan ke neechay zahir hota hai aur mumkina taizi ke ulat jane ka ishara deta hai. is flame stuck patteren ka naam haqeeqi zindagi mein aik ultay hathoray se para hai. is flame stuck patteren ke oopar aik lamba saya hai aur neechay koi saya nahi hai. lambay saaye ki lambai aam peak standard candle ke asli jism ki oonchai se dugna hoti hai upset hammer neechay ke rujhan ke baad taizi ke ulat jane ka ishara hai. yeh taajiron ko batata hai ke bail stomach muscle girty hui qeematon standard stock kharidne ke liye tayyar hain. kami ke baad market mein kharidaron ki janib se stock ki qeematein badhaane ka dabao hai. yeh market mein farokht knndgan se bahar niklny ko kehta hai kyunkay woh taizi se tabdeel ho satke hain aur kharidaron se kehta hai ke woh apni kharidari ki position mein daakhil ho jayen kyunkay taizi ka rujhan shuru honay wala hai. lekin yaad rakhen ke dosray takneeki isharay ke sath is signal ki tasdeeq karen kyunkay yeh baaz auqaat signal gir sakta hai. aap taizi ke rujhan ke aaghaz ki tasdeeq ke liye aglay tijarti noise ka bhi intzaar kar satke hain. agar aglay tijarti meeting mein iftitahi qeemat ulti himr light stuck ki ikhtitami qeemat se ziyada hai to aap khareed position mein daakhil ho satke hain . Exchanging punch murmur is ultay hathoray flame stuck patteren ka istemaal karte shade stock ka tajzia karna shuru karte hain, to kuch aisay pehlu hain jin ki hamein talaash karni chahiye. zail mein chand pehlu hain jo aap ko ulti himr candle stuck patteren ke sath tijarat karne mein madad karen ge . 1 affirm the example kuch tasdeeqi mayarat hain jin standard taajiron ko modified himr flame stuck ka istemaal karte shade tijarat karte waqt ghhor karna chahiye. tajir ko pehlay is baat ki tasdeeq karni chahiye ke oopri saaye ki lambai asli body se do gina ziyada hai. agar rearranged hammers ki tashkeel pichlle commotion ki flame stuck se neechay ke waqfay ke sath hoti hai, to ulat jane ke imkanaat ziyada mazboot hotay hain. upset hammer candle patteren ki tashkeel ke noise exchanging mein hajam ziyada hona chahiye. ziyada volume is baat ki nishandahi karta hai ke khredar market mein daakhil shade hain aur stock ki qeemat mein izafay standard dabao daal rahay hain. agar qeemat ziyada khulti hai to aglay clamor kharidari ki position mein daakhil hona behtar hai. tijarat mein daakhil ho ay se pehlay, tajir ko ulta himr ki taraf se diye gaye become flushed inversion signal ki tasdeeq ke liye mandarja baala miyaar standard ghhor karna chahiye . 2 don't mistook for other candle pehlay ka rujhan neechay ka rujhan hona chahiye jis ka matlab hai ke qeematein kam ho rahi hon aur baichnay walon ki taraf se qeemat ko giranay ke liye farokht ka dabao hona chahiye. punch yeh mother batii banti hai, to yeh zahir karta hai ke bail dobarah market mein aagaye hain aur qeematon mein izafay ke liye kharidari ka dabao daalna shuru kar diya hai aur reechh qeemat ko neechay laane se qassar hain. agar qeemat aglay exchanging meeting mein bhi apni mazbooti barqarar rakhti hai, to koi bhi khareed position mein daakhil ho sakta hai. lekin aik note karna chahiye ke ulta hathora down prepared ke baad hota hai jabkay shooting ka aaghaz oopar ke rujhan ke baad hota hai . -

#4 Collapse

Boss Assessments Ka Istamaal Jaisa ki aap kis chij Ko acche tarike se jante Hain Kya save account lete hain yaar uske upar kam karte Hain To hamen use Kafi ko chha sabhi hota hai aur ham fundamentalJaisa ki aap kis chij Ko acche tarike se jante Hain Kya store account lete hain yaar uske upar kam karte Hain To hamen use Kafi ko chha sabhi hota hai aur ham essential record ko usko soch samajh Kar kam mein lagakar aur aap se Kafi kuchh hasya vi kar sakte hain hamen Ko dekha jaaye To Ham Apne kam ko prapt tarike se kar sakte hain aur usko soch samajh Kar kam mein lagakar aur aap se Kafi kuchh hasya vi kar sakte hain hamen Ko dekha jaaye To Ham Apne kam ko prapt tarike se kar sakte hain aur hamesha n si Di je kobita banaya jata bhi aapko use kuch hassil kar sakte hain agar boss record aapane acche se break down kiya hai to aapko say fitting benefit bhi game kar sakte n si Di je kobita banaya jata bhi aapko use kuch hassil kar sakte hain agar boss record aapane acche se examine kiya hai to aapko say genuine benefit bhi game kar sakte hkar Aisa separate ko Ham prapt Shri kaise karte hain kyunki hamen se Kafi sare benefits bhi milte Hain aur ham isko achcha banaa sakte hain agar ham engine ko engine ko acche tarike isase jyada hasil Hoga aur apne kam ko beta banaa sakte hain hamen har chij ko stay aware of rakhna Hoga tabhi aap kamyab ho sakte hain agar isase jyada hasil Hoga aur apne kam ko beta banaa sakte hain hamen har chij ko stay aware of rakhna Hoga tabhi aap kamyab ho sakte hain agar mehnat to aap apne kam ko bhi acche se jaan sakte hain Ham Apne work ko dekh bol kar karna hoga head assessment Jo log karte hain to aap apne kam ko bhi acche se jaan sakte hain Ham Apne work ko dekh bol kar karna hoga key assessment Jo log karte hain vah bhi hasil karte hain aur apne kam ko foundation kaise karte hain hamen in se Kafi Kochi paida hasil hota hai jo ki hamen kamyabi ki taraf bhi hasil karte hain aur apne kam ko starter kaise karte hain hamen in se Kafi Kochi paida hasil hota hai jo ki hamen kamyabi ki tara Director Appraisals Ka Istamaal Jaisa ki aap kis chij Ko acche tarike se jante Hain Kya save account lete hain yaar uske upar kam karte Hain To hamen use Kafi ko chha sabhi hota hai aur ham fundamentalJaisa ki aap kis chij Ko acche tarike se jante Hain Kya store account lete hain yaar uske upar kam karte Hain To hamen use Kafi ko chha sabhi hota hai aur ham fundamental record ko usko soch samajh Kar kam mein lagakar aur aap se Kafi kuchh hasya vi kar sakte hain hamen Ko dekha jaaye To Ham Apne kam ko prapt tarike se kar sakte hain aur usko soch samajh Kar kam mein lagakar aur aap se Kafi kuchh hasya vi kar sakte hain hamen Ko dekha jaaye To Ham Apne kam ko prapt tarike se kar sakte hain aur hamesha n si Di je kobita banaya jata bhi aapko use kuch hassil kar sakte hain agar administrator record aapane acche se break down kiya hai to aapko say fitting advantage bhi game kar sakte n si Di je kobita banaya jata bhi aapko use kuch hassil kar sakte hain agar supervisor record aapane acche se research kiya hai to aapko say certified benefit bhi game kar sakte hkar wat is matching low candle design forex market mein matching low candle design aik bullish pattern inversion candle design hota hello jo keh forex market mein 2 negative candle design standard moshtamel hota hello or forex market mein candle kay lower hesay standard koi shadow nahi hota hello yeh zyada tar stock or file market mein paya jata hello yeh forex market mein new bullish pattern kay start ke taraf eshara karta hy or yeh forex market mein negative continuation design kay pinnacle standard kam karta hello laken zyada tar moamlaat mein yeh pattern ko tabdel karnay kay design kay peak standard kam karta hello -

#5 Collapse

Temporary, false recovery" Temporary, false recovery " aik istilaah hai jo fnans aur sarmaya kaari mein istemaal hoti hai jis mein kisi stock ya dosray maliyati asasay ki qeemat mein earzi, qaleel mudti bahaali ko bayan kya jata hai jis mein zabardast kami waqay hui hai. yeh istilaah aksar aisay halaat ko bayan karne ke liye istemaal hoti hai jahan sarmaya vehicle ya tajir taizi se girnay walay stock mein kharedtay hain, hit qeemat wapas lautade hai to fori munafe haasil karne ki umeed mein, sirf yeh maloom karne ke liye ke bounce back mukhtasir muddat ke liye hai aur stock mein musalsal kami hoti hai. ." Temporary, false recovery " ka naam is khayaal se aaya hai ke aik murda billi bhi uuchaal day gi agar woh bohat oonchai se giray. dosray lafzon mein, market aik taweel mudti kami ke rujhan mein bhi aik mukhtasir oopar ki harkat ka tajurbah kar sakti hai, lekin yeh laazmi peak standard majmoi rujhan ke ulat jane ki nishandahi nahi karta hai .yeh istilaah aam peak standard sarmaya karon ko qaleel mudti market ki naqal o harkat standard mabni zabardast faislay karne se khabardaar karne aur un ki hosla afzai karne ke liye ki jati hai ke woh un companiyon ke bunyadi usoolon standard ghhor karen jin mein woh sarmaya kaari kar rahay hain .Reason for Fleeting, false recovery" Temporary, false recovery " ki istilaah ka maqsad kisi stock ya dosray maliyati asasay ki qeemat mein aik earzi, qaleel mudti bahaali ko bayan karna hai jis mein zabardast kami waqay hui hai. yeh istilaah un halaat ko bayan karne ke liye istemaal ki jati hai jahan sarmaya vehicle ya tajir taizi se girnay walay stock ko kharidne ke liye lalach mein aa satke hain, is umeed mein ke hit qeemat wapas lautade hai to fori munafe kama sakti hai, lekin agar bounce back qaleel muddat ke liye ho to paisa zaya ho jata hai. stock mein kami jari hai .Is istilaah ka maqsad sarmaya karon aur taajiron ko yaad dilana hai ke qaleel mudti qeemat ki naqal o harkat aksar ghair mutawaqqa hoti hai aur sarmaya kaari ke faislay karne ke liye un standard inhisaar nahi kya jana chahiye. is ke bajaye, sarmaya karon ko sarmaya kaari ke bakhabar faislay karne ke liye un companiyon ke bunyadi usoolon standard tawajah markooz karni chahiye jin mein woh sarmaya kaari kar rahay hain, jaisay ke un ki maali sehat, intizami miyaar, aur market mein musabiqati position. is se sarmaya karon ko qaleel mudti market ki naqal o harkat standard mabni zabardast faislay karne se bachney mein madad mil sakti hai aur market mein un ki taweel mudti kamyabi ke imkanaat barh satke hain .the most effective method to exchange on Pullback forex exchanging market:forex exchanging principal jaab tak ek dealers k pas learning nhe hoti hain tu kabi b kisi b tara vo forex exchanging ki move ko neh samjh skte hain agar learning major areas of strength for ko hain tu difficult work kare agar learning primary increeess karna hain tu fofrex exchanging ko samjhna parta hain agar difficult work kiya tu kamyabi hain agar difficult work kbina kaam kiya tu benefit mil jata hain forex exchanging ka busniess karne say phly achi tara forex exchanging fundamental pratice karna must hota hain Pullback kuch counterfeit b hote hain qk kabi market primary agar learning solid nhe hoti hain tu in highlight large misfortune ka samna karna parta hain is liyey pratice kare merket principal examination kare market fundamental learning areas of strength for ko market principal difficult work kare market principal praticekare demo account principal pullback ki learning ko achi tara solid kare -

#6 Collapse

Presentation Jaisa ki aap kis chij Ko acche tarike se jante Hain Kya save account lete hain yaar uske upar kam karte Hain To hamen use Kafi ko chha sabhi hota hai aur ham fundamentalJaisa ki aap kis chij Ko acche tarike se jante Hain Kya store account lete hain yaar uske upar kam karte Hain To hamen use Kafi ko chha sabhi hota hai aur ham fundamental record ko usko soch samajh Kar kam mein lagakar aur aap se Kafi kuchh hasya vi kar sakte hain hamen Ko dekha jaaye To Ham Apne kam ko prapt tarike se kar sakte hain aur usko soch samajh Kar kam mein lagakar aur aap se Kafi kuchh hasya vi kar sakte hain hamen Ko dekha jaaye To Ham Apne kam ko prapt tarike se kar sakte hain aur hamesha n si Di je kobita banaya jata bhi aapko use kuch hassil kar sakte hain agar supervisor record aapane acche se break down kiya hai to aapko say fitting advantage bhi game kar sakte n si Di je kobita banaya jata bhi aapko use kuch hassil kar sakte hain agar manager record aapane acche se analyze kiya hai to aapko say veritable advantage bhi game kar sakte hkarAisa separate ko Ham prapt Shri kaise karte hain kyunki hamen se Kafi sare benefits bhi milte Hain aur ham isko achcha banaa sakte hain agar ham motor ko motor ko acche tarike isase jyada hasil Hoga aur apne kam ko beta banaa sakte hain hamen har chij ko stay mindful of rakhna Hoga tabhi aap kamyab ho sakte hain agar isase jyada hasil Hoga aur apne kam ko beta banaa sakte hain hamen har chij ko stay mindful of rakhna Hoga tabhi aap kamyab ho sakte hain agar mehnat to aap apne kam ko bhi acche se jaan sakte hain Ham Apne work ko dekh bol kar karna hoga head appraisal Jo log karte hain to aap apne kam ko bhi acche se jaan sakte hain Ham Apne work ko dekh bol kar karna hoga key evaluation Jo log karte hain vah bhi hasil karte hain aur apne kam ko establishment kaise karte hain hamen in se Kafi Kochi paida hasil hota hai jo ki hamen kamyabi ki taraf bhi hasil karte hain aur apne kam ko starter kaise karte hain hamen in se Kafi Kochi paida hasil hota hai jo ki hamen kamyabi ki taraChief Examinations Ka Istamaal Jaisa ki aap kis chij Ko acche tarike se jante Hain Kya save account lete hain yaar uske upar kam karte Hain To hamen use Kafi ko chha sabhi hota hai aur ham fundamentalJaisa ki aap kis chij Ko acche tarike se jante Hain Kya store account lete hain yaar uske upar kam karte Hain To hamen use Kafi ko chha sabhi hota hai aur ham basic record ko usko soch samajh Kar kam mein lagakar aur aap se Kafi kuchh hasya vi kar sakte hain hamen Ko dekha jaaye To Ham Apne kam ko prapt tarike se kar sakte hain aur usko soch samajh Kar kam mein lagakar aur aap se Kafi kuchh hasya vi kar sakte hain hamen Ko dekha jaaye To Ham Apne kam ko prapt tarike se kar sakte hain aur hamesha n si Di je kobita banaya jata bhi aapko use kuch hassil kar sakte hain agar overseer record aapane acche se break down kiya hai to aapko say fitting benefit bhi game kar sakte n si Di je kobita banaya jata bhi aapko use kuch hassil kar sakte hain agar manager record aapane acche se research kiya hai to aapko say affirmed benefit bhi game kar sakte hkar

what is double top light plan forex market mein matching low light plan aik bullish example reversal flame plan hota hi jo keh forex market mein 2 negative candle plan standard moshtamel hota hi or forex market mein candle kay lower hesay standard koi shadow nahi hota.

what is double top light plan forex market mein matching low light plan aik bullish example reversal flame plan hota hi jo keh forex market mein 2 negative candle plan standard moshtamel hota hi or forex market mein candle kay lower hesay standard koi shadow nahi hota.  hi yeh zyada tar stock or document market mein paya jata hi yeh forex market mein new bullish example kay start ke taraf eshara karta hy or yeh forex market mein negative continuation plan kay apex standard kam karta hi laken zyada tar moamlaat mein yeh design ko tabdel karnay kay plan kay top standard kam karta hi

hi yeh zyada tar stock or document market mein paya jata hi yeh forex market mein new bullish example kay start ke taraf eshara karta hy or yeh forex market mein negative continuation plan kay apex standard kam karta hi laken zyada tar moamlaat mein yeh design ko tabdel karnay kay plan kay top standard kam karta hi

-

#7 Collapse

Define Double Top Pattern: Pattern bunyadi tor par double taap patteren ke mukhalif hain. je tarz ke nataij ke bar aks nataij hain. single gole neechay ke patteren ke baad aik double neechay bantaa hai jo mumkina ulat jane ki pehli alamat bhi ho sakta hai. gole neechay ke patteren aam tor par aik tosiay mandi ke rujhan ke ekhtataam par waqay hon ge. do lagataar bottom se banai gayi double Bottomfarmission se yeh bhi andaza lagaya ja sakta hai ke sarmaya car support level ki taraf –apne aakhri dhakkay se faida uthany ke liye security ki pairwi kar rahay hain. aik double neechay aam tor par taizi ke ulat jane ki nishandahi kere ga jo sarmaya karon ko taizi ki really se munafe haasil karne ka mauqa faraham karta hai. double nichale hissay ke baad, mushtarqa tijarti hikmat amlyon mein lambi pozishnin shaamil hain jo security ki barhti hui qeemat se faida uthayen gi .Explanation: 1. Uptrend: Pehle step mein price uptrend mein hota hai, jismein price higher highs banata hai. 2. First Peak: Price ek high point (peak) par reach karta hai, jo ek resistance level ban sakta hai. Isse price downward movement shuru karta hai aur ek trough (bottom) banata hai. 3. Pullback: Price ek pullback karta hai aur firse upar ki taraf move karta hai, lekin pehle peak ki level ko cross nahi kar pata. Yeh pullback second top ki formation ke liye opportunity provide karta hai. 4. Second Peak: Price phirse upar jata hai aur ek second high point (second peak) banata hai, jo pehle peak ki level ke aas-paas hota hai. Is point par price downward movement shuru karta hai aur support level ko break karta hai.

Trading Points: Double Top chart patteren aik downtrend ke ekhtataam par paaya jata hai aur khat" w" ki terhan hai ( neechay chart dekhen ). qeemat aik nai kam par gir jata hai aur phir naye kam par wapas anay se pehlay thora sa ziyada rilyon. qeemat ko neechay ki taraf jari rakhnay ke liye aik nai kam kam qeemat par dhaka dainay mein nakaam, baichnay walay is ilaqay se taizi se chore dete hain aur qeemat achhalte hain. taizi ki tasdeeq' neechay' muzahmat ki satah ( gardan ) ke darmiyan aala nuqta par waqay ahem qeemat ki satah mein aik waqfay ki taraf se bayan kya jata hai . chart mein double bottom patteren ka matlab jald hi rujhan ulat hai. is ka matlab yeh hai ke down trained thaka dainay wala hai, aur kharidari ka dabao barh raha hai .

qeemat support level se wapas aani chahiye. barri khridaryon se qeematon mein mazeed izafay ki hosla afzai hoti hai . support aur muzahmat ki satah ke darmiyan zone mein lambi pozishnon ko jama karna taizi se raftaar faraham karta hai, aur qeemat w patteren ki gardan ko toar deti hai. tootay hue satah se oopar qeemat ki istehkaam aik taweel tijarat mein daakhil honay ka ishara hai .Thank YOU

-

#8 Collapse

Forex mein Double Top Candlestick:- Double top candlestick pattern forex trading mein ek mukhtasar chart pattern hai jo bullish trend ke bad baat karne ke liye istemal hota hai. Is pattern mein price chart par do consecutive high points (tops) hote hain, jinhe ek particular resistance level ke paas banaya jata hai. Ye pattern usually uptrend ke end ya reversal ki indication deta hai. Is article mein hum Double Top Candlestick pattern ke bare mein roman Urdu mein tafseel se samjhenge. Introduction:- Double Top Candlestick pattern chart analysis ka ek important hissa hai. Is pattern ko samajhna aur pehchan laga kar traders apne trading strategies ko improve kar sakte hain. Ye pattern market mein trend reversal ka indication deta hai, jahan se traders selling positions open kar sakte hain. Double Top Pattern:- Double Top pattern mein price chart par do consecutive high points (tops) banate hain. Dono tops ek particular resistance level ke paas hote hain. Pehla top banta hai jab price bullish trend mein hota hai aur resistance level par pahunchta hai. Price phir se neeche jata hai, lekin phir se ek aur bullish movement hota hai jo pehle se banaye gaye resistance level tak pahunchta hai, yani doosra top banata hai. Iske baad price usually neeche chala jata hai, jisse trend reversal ki indication hoti hai. Candlestick Analysis:- Double Top pattern ki tashrih karne ke liye candlestick analysis ki zaroorat hoti hai. Is pattern ke formation mein do consecutive high points (tops) hote hain. Ye tops usually small to medium-sized bearish candlesticks ke sath banate hain. Jab doosra top banata hai, toh uske pehle wale top se lamba nahi hota hai. Iske baad price usually neeche jata hai aur bearish candlesticks ke sath trend reversal hota hai. Entry and Exit Points:- Double Top pattern ko identify karne ke baad, traders entry aur exit points tay kar sakte hain. Entry point usually pehle wale top ke neeche wale support level ke break ke baad hota hai. Traders selling positions open kar sakte hain jab price neeche jata hai aur trend reversal ki indication milti hai. Stop-loss order ko resistance level ke above place kiya jata hai aur profit target support level ke paas tay kiya jata hai. Risk Management:- Double Top pattern mein risk management bahut zaroori hai. Stop-loss order ko resistance level ke above place kiya jata hai, taaki agar price resistance level ko break karta hai, toh traders apne positions ko close kar sake aur losses ko minimize kar sake. Profit target support level ke paas tay kiya jata hai, jisse traders apne profits ko secure kar sakte hain. Conclusion:- Double Top pattern forex trading mein ek useful tool hai trend reversal ko identify karne ke liye. Is pattern ko samajhna aur tashrih karne se traders apne trading strategies ko improve kar sakte hain. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#9 Collapse

"Double top" candlestick pattern ek popular technical analysis pattern hai jo stock market aur forex market mein trend reversal ko indicate karta hai. Yeh pattern typically bullish trend ke baad dikhta hai aur bearish reversal signal hai. Chaliye is pattern ko tafsiliyat se samjhein: 1. Formation: Double top pattern mein, price ek resistance level ke paas do baar similar ya nearly same level par pahunchta hai, lekin usse upar nahi jaata hai. Iske result mein price action mein ek "M" shape ban jata hai. Yeh do price peaks, jise tops kaha jata hai, formation ki mukhya pehchan hai. 2. Resistance Level: Double top pattern mein resistance level bahut important hota hai. Price dono tops ke beech mein resistance level tak pahunchta hai, lekin usse break karke upar move nahi karta hai. Yeh level support aur resistance lines, trend lines, moving averages, ya previous price levels se identify kiya ja sakta hai. 3. Volume: Volume pattern ke saath dekha jata hai. Double top pattern ke formation ke samay, volume typically decrease karta hai. Jab price resistance level par second time se reverse hota hai, tab volume increase ho sakta hai, indicating selling pressure aur bearish sentiment. 4. Neckline Break: Double top pattern ki confirmation ke liye, traders neckline break ka wait karte hain. Neckline, jo support level ke roop mein kaam karta hai, do tops ke bottoms ko connect karta hai. Jab price neckline level ko break karke neeche move karta hai, tab pattern ki validity confirm hoti hai. 5. Target: Double top pattern ke target ko calculate karne ke liye, traders neckline level se pattern ke low point tak ki distance ko measure karte hain. Is distance ko neckline level se neeche subtract karke potential target level hasil kiya jata hai. Double top pattern bearish trend reversal ka signal deta hai, jiske baad price neeche ki taraf move karta hai. Lekin pattern ki sahi identification aur confirmation ke liye, traders ko candlestick patterns, support-resistance levels, trend lines, aur volume analysis ki acchi samajh honi chahiye. Is pattern ke istemal ke saath saath, traders ko bhi risk management principles ka dhyan dena chahiye. Stop loss levels aur position sizing ko properly define karna zaroori hai. Yad rahe, technical analysis tools ke istemal se trading decisions lene se pehle, ek acche trading plan aur risk management strategy ka istemal karna zaroori hai. Iske alawa, ek experienced financial advisor se salah lena bhi madadgar ho sakta hai jo aapko specific market conditions aur trading goals ke hisab se guidance de sake.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 10:26 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим