What's is the Din cover Mists pattern

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

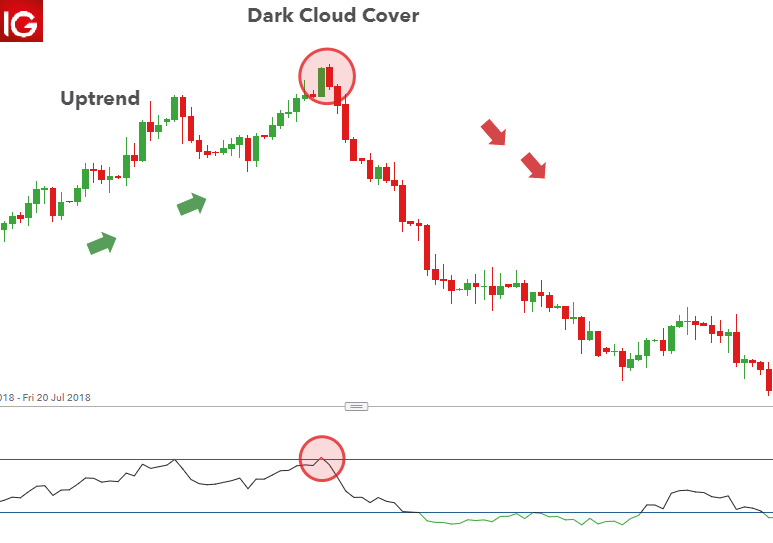

Dim Cover Mists pattern Premonition shadow cover aik negative reversal candle plan hai jhn neechy light prai up fire k oppar khulti hai or phir oppar flame k waast point k neechy band hoti hai plan aham hai kunkah yeh raftar mn ulta sy neechy ki traf tabdeli ko zahir krta hai.pattern aik oppar candle sy bnayia gyia hai jis k horrible neechy candle hai Tajir agali candle standard qeemat kam krny kaleay dekhty hain Isay tasdeeq khty hain.Zyada tar dealer premonition shadow cover plan ka sirf is sorat mn istamal krty hain punch yeh oppar k rojhan ya qeemat mn majmoe toor standard ezafy k dreadful hota hai.jesay jesay qeematein barhti hn plan neechy ki traf mumkina ekdaam ko nishan zaada krny kaleay zyada aham ho jata hai agar qeemat ka amal katta hua hai to plan kam aham hai kunkah plan k awful qeemat kaleay rhny ka imkan hai. Dim Cover Mists pattern Example Bullish abandoned youngster canand bullish light white or green assortment ki hoti hai. Yeh flame up sey open hoti hai and a short time later us light ki up point standard close hojati hai. Yeh aik boht he huge patternYeh is bat ki taraf ishara karti hai k expenses mein kami ahny wali hai. For the most part sellers premonition shadow cover mother huma dakhna ko mil jay ga or ya plan check level ka near mom blacklist kar market ke cost ko unequivocally reversal karna ka kam kara ga or ya jo resistance level ho ga ya market ka plummeting ke traf ana ka design ko increase kara changes ko show karta hai. Yeh plan up ki light sey banaya geya hai. Generally vendors light ki cost kam krny k liye check karty hein and uski assertion karty hein.Dark cloudy cover flame plan ha or ya premonition shadow cover patteor ya market ka top mother ak express progression mom blacklist kar market ke cost ko sliding ke traf reversal karna ka kam kara ge. Is Premonition shadow cover plan ke jdle standard trading karne se market ki achhi tareeqay se assessment karna zarori hai. Ye plan ziada tar negative area essential hona chaheye jo k mumkina bullish example reversal ka zarya banti hai. Plan k bullish fire k baad aik design attestation flame ka banna zarori hai, jo k market essential buy ki section ki position hoti hai. Design certification marker se bhi ki ja sakti hai lekin uss k leye zarori hai k costs base locale ya negative example essential hon. Stop Incident plan k sab se lower position jahan doji light ki lower wick hoti standard se aik do pips underneath set karen. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

I. Introductions: Dim Cover Mists Pattern Ki Pehchan Dim Cover Mists ek mashhur Forex trading pattern hai jo charts ki analysis par tawajjah deti hai. Ye pattern candlestick chart par nazar aata hai, jahan ek specific saakht ki wajah se dusre patterns ki tarah nazar nahi aata. Is pattern ka istemaal traders dwara price action aur trend ki tashkeel aur pehchan karne ke liye kia jata hai. II. Saakht: Dim Cover Mists Pattern Ki Shanal Dim Cover Mists pattern do candlesticks se mil kar banta hai. Pehle candlestick ko "dim" candle aur dusre candlestick ko "cover mists" candle kaha jata hai. 1. Dim Candle: Ye candlestick bearish (girawat ki taraf) hoti hai. Iski body market ke uparayen se choti hoti hai. Woh price range, jahan se price open hota hai, us range se neechay close hota hai. 2. Cover Mists Candle: Ye candlestick dim candle ki taraf se girne wali trend ko continue karta hai. Iski body dim candle ke andar hoti hai. Price range, jahan se price open hota hai, us range se uparayen ke taraf close hota hai. III. Istemaal: Dim Cover Mists Pattern Ka Istemaal Dim Cover Mists pattern ka istemaal trend reversal aur trend continuation ki pehchan karne ke liye kia jata hai. 1. Trend Reversal: Agar Dim Cover Mists pattern bearish trend ke baad dikhayi deta hai, toh ye ek potential bullish (baarh ki taraf) trend reversal ki nishani ho sakti hai. Traders is pattern ki madad se trend ka badalne ka samay aur price ki ummid ka andaza laga sakte hain. 2. Trend Continuation: Agar Dim Cover Mists pattern bullish trend ke baad dikhayi deta hai, toh ye ek potential bullish trend continuation ki tashkeel kar sakta hai. Traders is pattern ko dekh kar uparayen trend ki strength aur trading opportunities ka faisla kar sakte hain. IV. Faiday: Dim Cover Mists Pattern Ke Faiday 1. Price Action Tashkeel: Ye pattern price action ki tashkeel karne mein madad karta hai. Traders ko trend ki pehchan karne mein asani hoti hai aur potential reversals aur continuations ki tashkeel bhi ho jati hai. 2. Entry aur Exit Points: Dim Cover Mists pattern traders ko entry aur exit points ka faisla karne mein madad karta hai. Is pattern ki madad se traders trend ke sath entry kar sakte hain aur trend reversal ki pehchan karke trade ko exit kar sakte hain. 3. Risk aur Reward: Is pattern ka istemaal karke traders apni trade ki risk aur reward ko samajh sakte hain. Trend reversal aur continuation ki tashkeel karne se traders apne trades ko better risk management ke saath plan kar sakte hain. V. Nigrani: Dim Cover Mists Pattern Ki Nigrani Dim Cover Mists pattern ka istemaal karne se pehle, traders ko is pattern ki sahi tashkeel aur sahi waqt par istemaal karne ki practice karni chahiye. Yeh pattern dusre technical indicators aur tools ke saath istemaal karke confirm karna bhi zaroori hai. Conclusion: Dim Cover Mists Pattern Ki Tashreeh Dim Cover Mists pattern Forex trading mein trend reversal aur trend continuation ki tashkeel karne ke liye ek mahirana tool hai. Iski sahi samajh aur istemaal se traders trend ke sath entry aur exit points ko behtar tarike se tay kar sakte hain. Is pattern ka istemaal karne se pehle, traders ko iski tashkeel aur sahi samay ki pahchan ki practice karni chahiye. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#4 Collapse

the Din cover Mists pattern:.- Dark Cloud Cover:

Yahan tak ke Dark Cloud Cover pattern ke kuch key characteristics aur tashrih is tarah hain:

- Candlestick Structure: Dark Cloud Cover pattern mein do candles involved hoti hain. Pehli candle bullish hoti hai aur dusri candle bearish hoti hai. Pehli candle ki range lambi hoti hai aur bullish trend ki continuation ko darshati hai. Dusri candle ki range pehli candle ke ooper tak extend hoti hai aur iski closing pehli candle ki upper half mein hoti hai.

- Location: Dark Cloud Cover pattern aam taur par resistance level ya trend ke top par dekha jata hai. Ye batata hai ke bechnay wale market ko neecha le jane ki koshish kar rahe hain aur bullish trend ko reverse karne ki possibility hai.

- Reversal Signal: Dark Cloud Cover pattern bearish reversal signal hai. Iska matlab hota hai ke bechnay wale ki taraf pressure barh rahi hai aur bullish sentiment ko bearish mein badalne ki indication hai.

- Confirmation: Dark Cloud Cover pattern ki credibility aur reliability ko barhane ke liye, traders doosre technical indicators aur patterns se confirmations ki talash karte hain. Jaise ke wo trend lines, support and resistance levels, ya doosre bearish reversal patterns jaise ki Bearish Engulfing pattern ya Shooting Star dekh sakte hain.

Traders Dark Cloud Cover pattern ke trading strategies mein aksar ye tariqe istemal karte hain:

- Short Entry: Dark Cloud Cover pattern banne ke baad traders short positions ya sell orders initiate kar sakte hain. Wo ummeed karte hain ke price giray ga jab bechnay wale control mein aate hain. Entry point Dark Cloud Cover pattern ki low se neechay set kar sakte hain.

- Stop Loss: Traders typically apne stop loss orders Dark Cloud Cover pattern ki high se ooper set karte hain. Ye level potential resistance ka kaam karta hai aur agar price is se ooper nikal jaye to ye bearish signal ko invalid kar sakta hai.

- Take Profit: Traders profit targets support levels, previous price swings ya doosre technical analysis tools ke basis par set kar sakte hain. Unka maqsad downside movement capture karna hota hai.

Hamesha yaad rakhein:

ke koi bhi pattern 100% accurate nahi hota aur false signals ho sakte hain. Traders ko overall market context ko samajhna chahiye, munasib risk management techniques istemal karni chahiye, aur Dark Cloud Cover pattern ko doosre technical analysis tools ke saath istemal karne se trade ke successful hone ke chances barh sakte hain.

To conclude:

Dark Cloud Cover pattern bearish reversal signal hai jo traders ko selling opportunities pehchaanne mein madad deta hai. Isko samajhne ke saath aur doosre analysis techniques ke saath istemal karke traders informed trading decisions le sakte hain aur behtar downside price movement se munafa kama sakte hain.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 12:09 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим