What's is Aroon oscillator

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

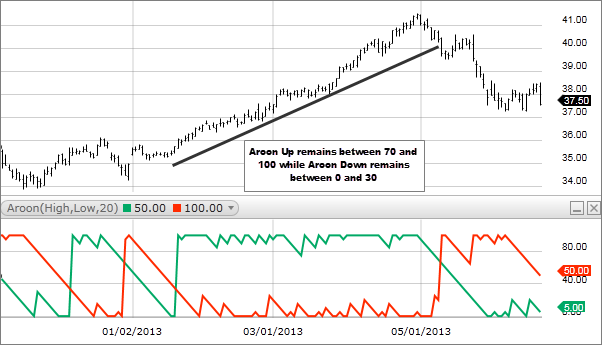

Assalamualaikum Introduction Companions kya haal hai aapke ummid karta hun aap sab khairiyat se honge Jahan Rahe Khush rahen aur mahfuj rahen front x exchanging mein acchi exchange karte tint achcha benefit hasil Karen aaj jis theme per principal aapse Apne information ko share karna chahta hun vah hai Aroon oscillator punch Ham Apne exchange mein use karte hain ya Apne exchanging outline mein use karte hain to yah hamen kaise signal produce karta hai aur kis level per yah hamen exact sign give karta hai aaj usko Ham study karenge aur isko comprehend Karke Apne exchanging diagram mein use karne ki koshish karenge aur practis karenge Taki Ham ise acchi Tarah use Karke achcha benefit hasil kar saken. Subtleties OF AROON OSCILLATOR Aroon oscillator ek second coordinated hota Hai ek bahut hello troublesome integrator hai isliye hamen isko acchi Tarah se learn Karke Apne kam start karna chahie agar hamen is pointer mein Koi chij samajh nahin aati to uske liye hamen isko samajhna bahut significant Hai hit tak aap isko totally comprehend Nahin karte aapko yah oscillator use nahin karna chahie Aroon oscillator ka use market ki over sold aur overbought condition ko distinguish karne ke liye bhi use Kiya jata hai use Kiya jata hai aur oscillator incorporated hai jo market mein oversold aur baat ki position batata hai isase careful set ka pata chal jata hai. Step by step instructions to Utilize AROON OSCILLATOR Yah marker 2 lines for every depend karta hai ek Hoti Hai Arun disconnected jo aap pattern ko find karne mein use hoti hai aur ek Arun downline hoti hai jo down pattern ko city chairman karne ke liye issues Hoti Hai Arun pointer entryway ke 25 periods ko use karta hai aur yah batata hai ki kitni period high aur lo the in 25 time frames mein se poke Arun stomach muscle Arun down se upar ho to yah bole show karta hai aur hit down around up se upper Hai To yah down pattern signal show karta Hai Arun pointer me two lines plot Hoti Hai jinko Arun down kahate Hain Arun abdominal muscle zero aur hundred ke darmiyan ek esteem hai jo yah jahar karti hai ki 25 commotion ki high aur high ko Kitna arsa pahle set Kiya gaya tha aaj agar high 25 ho Gai to yah 100 hoga aur zero de Hoga punch 25 noise pahle yah I Thi Is Tarah Ham kah sakte hain. -

#3 Collapse

Exchanging stratigy at MACD. Companions MACD pointer fundamental market place line ko cross ker chuki ho tou hamain past pattern ky inversion principal exchange open ker leni Chahiay ky poke market MFI primary oversold Ho jaey tou market primary converse pattern shuru hota hai tou sath hello MACD marker primary market community line ko cross ker ky upper side per record increment hona shoru ho jati hai tou hamain aesy time per market principal exchange purchase primary open ker leni Chahiay ky hamain market principal purchase ki exchange principal benefit hasil ho jata hai ky hit market oversold hony ky bahd turn around request fundamental exchange open kerty hain tou market bhi her surat purchase fundamental chalna shoru ker deti hai tou hamain purchase primary exchange open kerny per acha benefit hasil ho jata hai isi ky berux punch market upturn fundamental development kerty huey MFI principal overbought position primary ponch jati hai tou aesy time per MACD principal bhi market upper side sy cross ker ky lower side per strength increment hona shoru ho jati hai tou aesy time per hamain market fundamental sell ki exchange lgani chahyie. Step by step instructions to Utilize MACD pointer. Companions MACD pointer ko use karte hain to murmur ko is market mein kafi jyada benefit Mil jata hai kyunki is market mein Ham acchi tarike se kam karte Hain to Ham is market mein fayda ho jata hai forex market mein mscd marker pointer ka use karte hain to humko is market mein kafi jyada fayda ho jata hai forex market mein humko acche tarike se kam karne per fayda tha bahut greetings jafar miss market mein is pointer ko use karke achcha plan lete hain forex market mein Ham agar marker ko use karte hain to humko is market mein fayda tab hota hai poke Ham is market mein acche tarike se fayda hasrat hai punch Ham is market mein fayda hota hai Japanese market mein acchi tarike se kam karte hain fayda tab hota hai hit hamesha market mein acche tarike se kam kar sakte hain. MACD pointer. Companions MACD pointer aik moving normal combination and dissimilarity marker bhi aik driving specialized pointer roughage jo cost activity per kam karta feed ye previous period ki moving normal per computations karta roughage aur in kay zariye aik aisa signal give karta roughage jiski base per ham pattern ka tayun kar kay exchange primary enter ho sakty hain. MACD pointer kai tariqon say work karta feed laikin ziada tar hybrid, dissimilarity aur fast ascent/fall hain Step by step instructions to come by improved results From MACD. Dear companions MACD aur RSI markers ko agar use kia jaye to dono ka blend best outcome de sakta roughage aur brokers counterfeit pattern aur development se bach sakty hello, dono greetings pointers terminal me as of now majood hoty hello es key ley merchants ko pointers show me jana ho ga aur dono pointers ko dynamic kar lena chaye agar es ka experience demo account me hasil ho jaye to zeyada behtar feed.

- Mentions 0

-

سا0 like

-

#4 Collapse

Trendlines in Specialized Examination rjhan ke lkeron ko smjhna aor a ko khenchnay kay qabl hona mfed roughage keonkh qemt kay nmonay lkeron ya mnhne khtot kay tslsl ka astamal krtay hoe'ay pae'ay jatay hen۔ tkneke tjzeh kar qemt kay diagram pr sport aor mzahmt kay shabon ke nshandhe krnay kay leay pattern lae'nz ka astamal krtay hen۔ nzol ke choteon (aonchae'eon) ya chrrhtay hoe'ay grton ka tslsl aek pattern lae'n bnanay kay leay jrra hoa hay، jo outline pr aek sedhe lker hay۔ (nechay) Continuation Examples aek tslsl kay petrn ko mojodh rjhan ke smt men oqfay kay pinnacle pr dekha ja skta hay۔ aopre rhjan men، yh as oqt hota feed jb bel rktay hen، aor nechay kay rjhan men، yh tb hota roughage jb rechh oqfh letay hen۔ yh peshen goe'e krnay ka koe'e treqh nhen roughage kh aaea koe'e rjhan brqrar rhay ga ya qemt ka nmonh tear honay kay doran alt jae'ay ga۔ lhٰza، a pattern lae'nz pr pore tojh dena zrore feed jo qemt ka nmonh bnanay kay leay astamal ke ge'e then aor sath he as bat pr bhe kh qemt tslsl kay zon kay aopr ya nechay totte roughage ya nhen۔ tkneke tjzeh kar aam peak pr yh qeas krnay ka mshorh detay hen kh koe'e rjhan as oqt tk qae'm rhay ga jb tk yh sabt nh ho jae'ay kh as ka alt hona sabt nhen ho jata۔ Stock Outline Examples Stock outline Pattren eik sada Pattren hoty hen our stock diagram Pattren do hari shaklon Mei hoty hen. Stock outline Pattren apny intruduce ky liye tradings Mei istemaal kiya jata hello our Market Mei is ko istemaal karny ky liye Stylishness ko uesd kiya jaata hello. stock graph Pattren aesa Pattren hello jo ziyada tar forex Mei exchanges lagany ky liye our favored examination ko follow kiya jaata hello our aesy Pattren forex Mei bhot ziyada istemaal hoty hen.kiyon ky Stock outline Pattren ka forex exchanging advertising Mei bhot ziyada zarori hota Hai. Our is Pattren ko slowed down candle design bhi kehty hei. Slowed down candle example to Hamin ye btata hy ky stock diagram Pattren Candlictick Mei istemaal kiyon nhi hota Hai our ye Pattren bhot productive hota Hai. Stock outline Pattren ye woh mukhtalif Pattren hello jo graph standard hifazti shaklon ki waja sy paida hoty hen. Our takneki tajziye ki bunyad hoty hen, eik Pattren ki shnakhat eik line bna kar kii jati Hei ky yeh Pattren kiss tarh ismatl hoga jo aam ki Valued Mei ashya ko jorti Hein. Our point ko milati hello jo eik mudat ky daroran valued ka bataty Hei ky cost kam hogi ya ziyada hogi. Our yeh cost ka andaza lgaty Hein kis wakt keemat kam hogi ya ziyada hoti hello, our stock graph Pattren apni mukhtalif Pattren shape Mei maojod hoty hen our ye sada shaklon Mei pay jaty hen.ye eik investigation ki tarh work karty hen our securities exchange Mei Popularity belt karty hen, hit bhi market open hoti hello our woh opr ka candle bnati hello to stock diagram Pattren hamin Educational karty hen.our punch Market nechy candle bnati Hei to stock outline Pattren bhi nechy ki flame bnati hello. Exchanging Technique with Stock Diagram Example Stock outline Pattren eik takneki tajziye Mei Popularity kiyon kemtoon ky namony ki shanakht ky liye Point ya eik makhsos khtoot ky zarye stock graph Pattren ko itmal kiya jata Hei. Is liye Stylishness ki lines ko samjna bhot asan ho jata Hei, our stock outline Pattren on line ko khenchny Mei madad gar sabit hota Hai our tajziye karoon ko Cost eik diagram standard show karwaty Hein. Our Stylishness eik sheet standard mukhats karty hen. Stylishness eik sedhi lines hoti hello jo Moving compensation sedhi otarti Hei kabhi opr pattern bnati Hei our nechy ka light bhi bnati hello. Market Mei otar charao hota Hai ye graph hamesha barhty howy ya girty howy Popularity ki darmyan jo rujhan banta hello oska ishara dety hein ye ky flame ka rujhan opr ki tarf hy ya nechy ka candle hello our hit cost ka rujhan tabdel hota Hai too ye outline semet change kar leta Hei our onky darmyan rabta qaim karta Hai -

#5 Collapse

Aroon oscillator:- Aroon Oscillator:

main maqsad:

Aroon Up Line:

Aroon Down Line:

Aroon Oscillator ki interpretation aur uska istemal kuch aham points par based hota hai:

- Trend Strength: Aroon Oscillator trend ki strength ko measure karta hai. Jab yeh indicator positive values mein hai, toh bullish trend ki strength indicate karta hai. Jab yeh indicator negative values mein hai, toh bearish trend ki strength indicate karta hai.

- Trend Reversal: Jab Aroon Oscillator extreme values (near +100 or -100) tak pahunchta hai, toh yeh trend reversal ka signal bhi de sakta hai. Jab positive values se negative values ya negative values se positive values par switch hota hai, toh trend reversal hone ka indication hota hai.

- Divergence: Aroon Oscillator ki divergence analysis bhi ki ja sakti hai. Jab price higher highs banati hai lekin Aroon Oscillator lower highs banata hai, ya jab price lower lows banati hai lekin Aroon Oscillator higher lows banata hai, toh yeh divergence hai. Divergence trend reversal ka potential signal ho sakta hai.

Aroon Oscillator ke kuch limitations aur considerations bhi hain:

- Choppy Markets: Aroon Oscillator choppy markets mein accurate results nahi de sakta hai. Jab market range-bound hai aur koi clear trend nahi hai, toh yeh indicator misleading signals generate kar sakta hai.

- Lagging Indicator: Aroon Oscillator trend ke baad aata hai, isliye iska istemal trend ki shuruat par nahi kiya ja sakta. Yeh indicator trend ke continuation aur reversal ki confirmation ke liye istemal hota hai.

- Confirmation Tools: Aroon Oscillator ko dusre technical indicators aur analysis tools ke saath istemal karna zaruri hai. Sirf is indicator par rely karna kafi risky ho sakta hai.

NOTE:

Is tarah se Aroon Oscillator forex market mein trend ke strength aur direction ko assess karne ke liye istemal hota hai. Yeh traders ko trend identification aur potential reversals ke liye valuable information provide karta hai. Lekin is indicator ko sahi tareeqe se samajhna aur interpret karna zaruri hai, sath hi dusre technical analysis tools aur market context ka bhi istemal karna chahiye. -

#6 Collapse

Assalamualaikum I need to accept that every one of you are fine and succeeding on forex trading.Aj head ap key Sath logical SAR Marker key bary mein data share krun gi. Illustrative SAR Marker Forex people Metaphorical Respite And Inverse aek design following marker feed. Ju kay cost reversal ko maloom karny kay leay use kiya jaata roughage.. Agar koi vendor Illustrative SAR ko sahi tarha sy use karna jaanta roughage. Tu ess sy traders ko design ke simt ka thought hota roughage. Aur no question matket essential entry aur leave centers kay liey hlep karta ha. Es ka sath better accept it following stops ko place karny head bhe madad karta feed. Dear people is essential dekh sakty hain ky jis point standard SAR dosri side standard banna start hoty hain to is baat ka infers hota roughage. ky design tabdeel ho raha roughage. Aur no question wakt behtareen hota feed. ky apni long positions ko close kar diya jaay. Oper aap dekh sakty hain. ky rise kesy khatam hua hit neechy waly spots sy influence hwa. Jsa ky baki tamam pointers ko cash the leaders sy use karty hain. is pointer k sign ko bhi bhout warily use kiya jey tb good tidings hmy torment filled benefits hasil ho sakty hain. Bits of this Model: SAR ko dekhny kay leay frame standard ap ko series of bits ya runs nazar aain ge. no doubt • ya runs aapko cost action kay oper ya neechy design kay mutabik nazar aain ge. Punch most certainly dono cross karty hain. To es ka matlab hota roughage. kay design khatam hony kay imkanaat hain . Mumble apni positions ko band kar sakty hain. The best technique to Framework Assessment Cycle: Dear Forex people Jo series of spots aapko chart per nazar aaty hain. Wo chartbpe cost sy thora neechy kahsoos fasly standard hoty hain. Jab market rise essential hoti feed. Asi tarha punch market downtrend essential hoty roughage. Tu bits aapko cost action kay oper nazar aaty hain. Working With This Model: Dear people Jesa kay humhain maloom feed. kay har design ka end zaroor hota feed. R design tabdeel hota feed. Jesy he marjet cost reversal kay qareeb jaati roughage. Illustrative SAR cost movement kay nazdeek chali jaati feed. Punch cost action aur logical SAR kay darmiyaan opening km ho jaata hay.to es baat kay chances hoty hain kay design badalny wala roughage. -

#7 Collapse

Presentation Colleagues kya haal hai aapke ummid karta hun aap sab khairiyat se honge Jahan Rahe Khush rahen aur mahfuj rahen front x trading mein acchi trade karte color achcha benefit hasil Karen aaj jis subject per head aapse Apne data ko share karna chahta hun vah hai Aroon oscillator punch Ham Apne trade mein use karte hain ya Apne trading frame mein use karte hain to yah hamen kaise signal produce karta hai aur kis level per yah hamen precise sign give karta hai aaj usko Ham study karenge aur isko grasp Karke Apne trading outline mein use karne ki koshish karenge aur practis karenge Taki Ham ise acchi Tarah use Karke achcha benefit hasil kar saken. Nuances OF AROON OSCILLATOR Aroon oscillator ek second planned hota Hai ek bahut hi problematic integrator hai isliye hamen isko acchi Tarah se learn Karke Apne kam start karna chahie agar hamen is pointer mein Koi chij samajh nahin aati to uske liye hamen isko samajhna bahut huge Hai hit tak aap isko thoroughly fathom Nahin karte aapko yah oscillator use nahin karna chahie Aroon oscillator ka use market ki over sold aur overbought condition ko recognize karne ke liye bhi use Kiya jata hai use Kiya jata hai aur oscillator consolidated hai jo market mein oversold aur baat ki position batata hai isase cautious set ka pata chal jata hai. Bit by bit guidelines to Use AROON OSCILLATOR Yah marker 2 lines for each depend karta hai ek Hoti Hai Arun disengaged jo aap design ko find karne mein use hoti hai aur ek Arun downline hoti hai jo down design ko city executive karne ke liye issues Hoti Hai Arun pointer doorway ke 25 periods ko use karta hai aur yah batata hai ki kitni period high aur lo the in 25 time periods mein se jab Arun stomach muscle Arun down se upar ho to yah bole show karta hai aur hit down around up se upper Hai To yah down design signal show karta Hai Arun pointer me two lines plot Hoti Hai jinko Arun down kahate Hain Arun muscular strength zero aur hundred ke darmiyan ek regard hai jo yah jahar karti hai ki 25 disturbance ki high aur high ko Kitna arsa pahle set Kiya gaya tha aaj agar high 25 ho Gai to yah 100 hoga aur zero de Hoga punch 25 clamor pahle yah I Thi Is Tarah Ham kah sakte hain. -

#8 Collapse

Presentation Partners kya haal hai aapke ummid karta hun aap sab khairiyat se honge Jahan Rahe Khush rahen aur mahfuj rahen front x trading mein acchi trade karte color achcha benefit hasil Karen aaj jis subject per head aapse Apne data ko share karna chahta hun vah hai Aroon oscillator punch Ham Apne trade mein use karte hain ya Apne trading frame mein use karte hain to yah hamen kaise signal produce karta hai aur kis level per yah hamen careful sign give karta hai aaj usko Ham study karenge aur isko fathom Karke Apne trading chart mein use karne ki koshish karenge aur practis karenge Taki Ham ise acchi Tarah use Karke achcha benefit hasil kar saken. Nuances OF AROON OSCILLATOR Aroon oscillator ek second organized hota Hai ek bahut hi irksome integrator hai isliye hamen isko acchi Tarah se learn Karke Apne kam start karna chahie agar hamen is pointer mein Koi chij samajh nahin aati to uske liye hamen isko samajhna bahut critical Hai hit tak aap isko thoroughly fathom Nahin karte aapko yah oscillator use nahin karna chahie Aroon oscillator ka use market ki over sold aur overbought condition ko recognize karne ke liye bhi use Kiya jata hai use Kiya jata hai aur oscillator consolidated hai jo market mein oversold aur baat ki position batata hai isase cautious set ka pata chal jata hai. Bit by bit directions to Use AROON OSCILLATOR Yah marker 2 lines for each depend karta hai ek Hoti Hai Arun disengaged jo aap design ko find karne mein use hoti hai aur ek Arun downline hoti hai jo down design ko city director karne ke liye issues Hoti Hai Arun pointer entrance ke 25 periods ko use karta hai aur yah batata hai ki kitni period high aur lo the in 25 time spans mein se jab Arun stomach muscle Arun down se upar ho to yah bole show karta hai aur hit down around up se upper Hai To yah down design signal show karta Hai Arun pointer me two lines plot Hoti Hai jinko Arun down kahate Hain Arun muscular strength zero aur hundred ke darmiyan ek regard hai jo yah jahar karti hai ki 25 disturbance ki high aur high ko Kitna arsa pahle set Kiya gaya tha aaj agar high 25 ho Gai to yah 100 hoga aur zero de Hoga punch 25 clamor pahle yah I Thi Is Tarah Ham kah sakte hain. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#9 Collapse

Aslamoalekum kesay hain ap sab..main umed karti hon ap kheryt say hon gay. Or apka trading session behtreen ja raha hoga. Aj kay hmaray disscussion ka jo topic hay wh aroon ossiclator kay baray main hay. Aye dekhtay hain kay yeah kia hay or forex trading main hamen kia malomat faraham karta hay r trading main hamen is say kesy madad milti hay. aroon ossiclator Aroon Oscillator forex trading mein ek technici tajziyati ishara hai jo trend ke mazboti aur simat ko parakhny karne ke liye istemal hota hai. Ye indicator to Aroon indicator ki bunyad par banaya gaya hai.Aroon Oscillator ko calculation karne ke liye aapko Aroon Up aur Aroon Down lines ka use karna hota hai. Esy he Aroon-Up line indicate karta hai ki recent highs kitne waqat pehle banaye gaye the, jabki Aroon-Down line recent lows ko measure karta hai.Aroon-Up aur to or Aroon-Down lines ko use karke Aroon Oscillator calculate kiya jata hai: Aroon-Up = ((Number of periods) - (Number of periods since the highest high)) / (Number of periods) * 100 Aroon-Down = ((Number of periods) - (Number of periods since the lowest low)) / (Number of periods) * 100 Aroon Oscillator = Aroon-Up - Aroon-Down explanation Aroon Oscillator -100 se +100 range mein hota hai. Jab Aroon Oscillator +100 cross karta hai, yani jab Aroon-Up line Aroon-Down line ko upar se cross karti hai tab bullish trend ki strength indicate hoti hai. Jab Aroon Oscillator -100 cross karta hai, yani jab Aroon-Down line Aroon-Up line ko upar se cross karti hai to tab bearish trend ki strength indicate hoti hai.Aroon Oscillator ka use karke traders trend ke changes ko shanakht kar sakte hain. Jab Aroon Oscillator values positive hote huy hain, tab trend bullish hota hai aur jab negative hote hain, tab trend bearish hota hai. Traders is indicator ko trend reversals, trend strength, aur entry/exit points ko daryaft karne ke liye istemal karte hain.Yeh indicator market ke conditions aur trader ke tarjeehat par inhasar karta hai. Isliye, iska istemal karne se pehle aapko iski study karna chahiye aur apne trading strategy ke saath iska istemal karna chahiye.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 03:19 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим