Dark cloud cover pattern

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

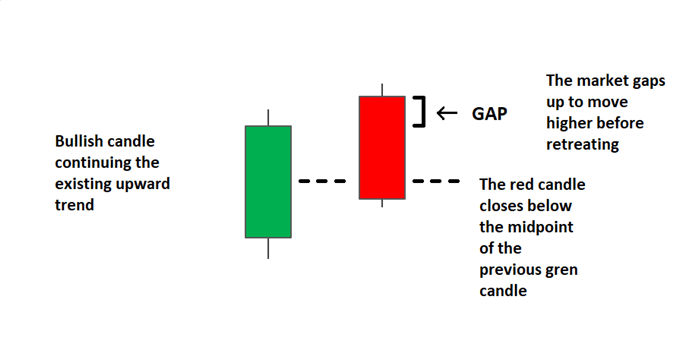

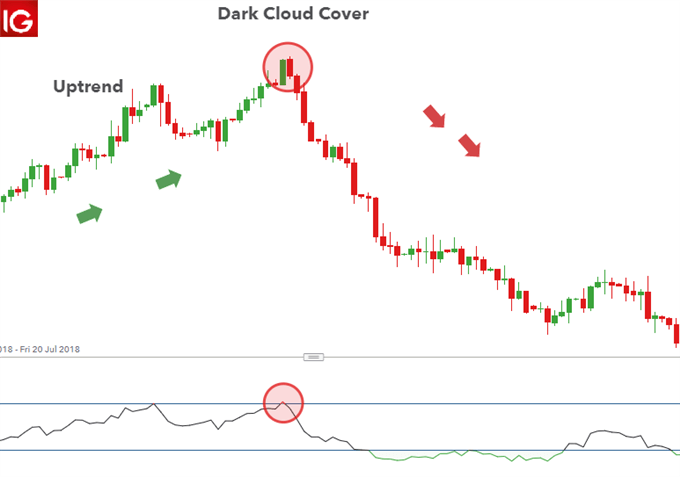

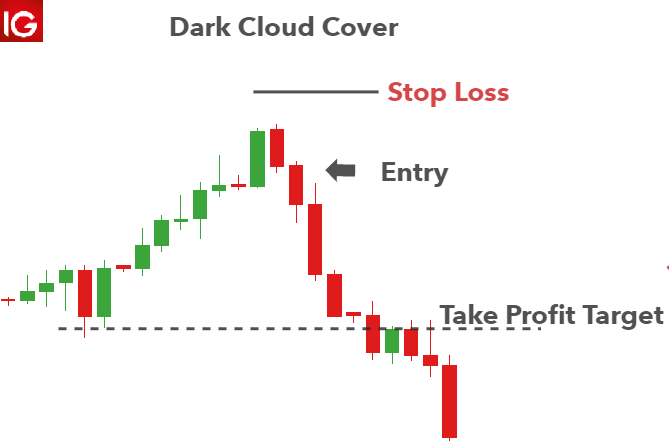

AOA Introduction Companions kya haal hai aapke fundamental u need karta hun aap khairiyat se Honge Aaj Jis theme ko Ham talk about Karenge vah Hai foreboding shadow cover design Ham iski ID light developments exchanging per examine Karenge Taki Hit yah design Hamen Najar Aaye To Ham iski assist se with promoting Se zada Se zada benefit Hasil kar rahe hain Subtleties Of Foreboding shadow Cover Pattert Foreboding shadow cover design use Waqt Forex trading diagram per Banta Hai Hit purchasers cost ko bahut zada up side per Push kar ty Hain Jiske terrible purchasers ka market mein dilchaspi khatm Ho Jaati Hai yah design 2 days light for each mushtamil Hota Hai jismein first candle ordinary negative pattern ki aur second flame use above hole mein open hokar first candle ki mid point se specialty jakar close Hoti Hai foreboding shadow cover design mein pahle racket ki candle Ek long genuine body wali bullish candle hoti hai jo ke cost ka top ya bullish pattern ka signal Deta Hai Hit Ke Uske awful Ek negative candle banti hai Jiska open cost to bullish candle upper side per hole Mein Hota Hai Poke Ke close cost bulish candle Ke Darmiyan se underneath hota hai matlab yah ke Jis Tarah meeting line design Mein second candle first candle ke close point per band Hoti Hai is design Mein yah mid point se beneath jakar close hoti hai. Flame Arrangement Dark cloud cover pattern zada tar top cost region ya bullish pattern Mein banta hai jo ki 2 days candles for every mushtamil hota hai design ke liye cost ka high Hona significant hai stomach muscle ham flame development per talk about Karenge first candle Dark cloud cover pattern bullish pattern mein Banta Hai Is vajah Se design ki first candle Ek long bullish candle hoti hai jo ki bullish Pattern ke mazbuti zahar Karti Hai yah light variety Mein white ya green hoti hai second candle Dark cloud cover pattern ki second areas of strength for flame hoti hai aur yah light takriban size mein first candle sy zada Hoti Hai foreboding shadow cover design Mein second candle first candle se above hole mein open hokar Uske Darmiyan se underneath close Hoti Hai yah candle variety Mein dark ya red Hogi. Treading Dark cloud cover pattern ke 2 candles ke opening value Ke Darmiyan Ek Bara hole Hota Hai jo aam taur per Negative flame ke genuine body ki vajah se Najar Nahin Aata Hai foreboding shadow cover design Agar cost ke up pattern ya upper region mein Paya Jaaye to yah exchanging ke liye Sel ka signal produce Karta Hai foreboding shadow cover design Mein cost candle ko up side per hole mein open karti hai jo ki mazbote hoti hai lekin market Mein venders ke solid wapasi ki vajah se cost negative shift Ho Jaati Hai yah design typical cost outline Mein banne ki bajay end of the week ya market Mein Uncovered hole ke awful banta hai foreboding shadow cover design per trading opening negative data candle ke terrible Hoga Jiska close candle Mein Hona chahie Jiska close point bullish light Mein Hona chahie. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Assalamu Alaikum Dosto!Dark Cloud Cover Candlestick PatternDark cloud cover candlestick pattern price chart par banne wala aik two days ka bearish trend reversal pattern hai, jo k high price area ya bullish trend k dowran banta hai. Pattern ki pehli candle bullish jab k dosri candle aik bearish candle hoti hai. Pattern ki dosri bearish candle k open price pehli candle se oopar gap main honi chahiye, lekin ye bohut ziada zarori nahi hai, bulkeh dosri candle pehli candle k close price k qareeb bhi open ho sakti hai. Pattern ki dosri candle ka close price pehli candle k wast point se nechay hona chahiye, lekin iss k close price k ooper aur open price k nechay nahi hona chaheye. Pattern ki dono candles real body main lazmi honi chaheye, jab k candles k shadow ka hona ya na hona zarori nahi hai.Candles FormationDark cloud cover candlestick pattern k leye zarori hai, k prices ka top ya bullish trend ho. Pattern k top prices se reversal k chances ziada hote hen. Dark cloud cover candlestick pattern do mukhalif candles ka hota hai, jiss main candles ki formation darjazzel tarah se hoti hai;- First Candle: Dark cloud cover candlestick pattern ki pehli candle aik long real body main bullish candle banti hai. Ye candle prices k top par ya high prices area main buyers ki dilchaspi dekhati hai, jo prices ko upper side par push karti hai. Ye candle white ya green color main hoti hai, jo k beal body k sath hoti hai.

- Second Candle: Dark cloud cover candlestick pattern ki dosri candle bearish trend wali candle hoti hai, jo k prices k direction ko badal deti hai. Ye candle aik long real body main banti hai, jiss ka open pehli candle k top par gap main hota hai, jab k close ussi candle k real body k centre se nechay hota hai.

ExplainationDark cloud cover candlestick pattern two days candles ka trend reversal pattern hai, jiss main pehli candle aik normal bullish candle hoti hai, jo prices main bullish trend aur buying pressure zahir karti hai. Ye candle shadow samet ya shadow k bagher bhi ho sakti hai, jab k pattern ki dosri candle aik bearish candle hoti hai, jo k pehli candle k top gap main open ho kar pehli candle k darmeyan se nechay close hoti hai. Ye candle market main selling control ko zahir karti hai, jo prices k sabeqa trend k khatemay par banta hai. Ye pattern dekhne aur candles ki formation same bearish belt-hold line candlestick pattern ki tarah hota hai, aur dono same bearish trend reversal k leye istemal hote hen, lekin dosri candle ki thori si tabdeeli ki waja se dono aik dosre se mukhtalef bante hen.TradingDark cloud cover candlestick pattern prices k top par banne ki waja se market main sellers ziada active ho jate hen. Pattern ki dosri candle prices ko bullish trend k leye resistance zone banati hai, jiss k baad prices teezi k sath downfall karti hai. Pattern par trade enter karne se pehle aik confirmation candle ka hona zarori hai, jiss ka open price apne close price k ooper hona chaheye aur dosri candle k lower par close honi chaheye. Lekin agar confirmation candle ki jagah agar bullish candle banti hai, to ye pattern invalid ho kayega, jiss par trade entry nahi karni chaheye. Indicators par value lazmi overbought zone main honi chaheye, jiss ki confirmation lazmi hai. Stop Loss pattern k sab se top position jo k dosri candle ka high price banta hai, se two pips above set karen. -

#4 Collapse

-

#5 Collapse

Assalamualaikum! Introduction: Dark and Cloud pattern, technical analysis mein ek bearish (girawat ki taraf) trend reversal pattern hai, jo candlestick chart par dikhai deta hai. Ye pattern generally uptrend ke baad dikhta hai aur bearish trend ke aane ka sanket deta hai.Dark cloud cover pattern kia h? Dark and Cloud pattern do candlesticks se banta hai. Pehla candlestick bullish (badhne ki taraf) trend mein hota hai, jise positive candlestick kehte hain. Dusra candlestick ise follow karta hai, lekin bearish trend mein hota hai, jise negative candlestick kehte hain. Dono candlesticks ko combine karne se Dark and Cloud pattern banta hai.Positive candlestick ya pehla candlestick, generally long (lamba) hai aur iska close price higher (adhik) hota hai compared to open price. Ye candlestick positive momentum ko dikhata hai. Agar pehla candlestick ki range lambi hoti hai, toh iska impact Dark and Cloud pattern par bhi jyada hota hai.Negative candlestick ya dusra candlestick, long (lamba) ya short (chota) ho sakta hai, lekin iska close price pehle candlestick ki body ke andar rehta hai. Negative candlestick bearish sentiment ko dikhata hai aur uptrend ka potential reversal indicate karta hai. Explanation and Formation: Dark and Cloud pattern ka formation ek specific set of rules par based hota hai. Jab pehla positive candlestick form ho jata hai, uske baad negative candlestick ke open price pehle candlestick ke close price se upar hona chahiye. Negative candlestick ka close price pehle candlestick ke high price se neeche hona chahiye. Agar ye rules follow hote hain, toh Dark and Cloud pattern confirm ho jata hai.Dark and Cloud pattern bearish trend ke aane ka indication deta hai aur traders ko selling opportunities provide karta hai. Is pattern ke baad market mein bearish pressure badh sakti hai. Traders is pattern ko use karke short positions le sakte hain ya existing long positions ko close kar sakte hain.Dark and Cloud pattern ke sath confirmation ke liye, traders aur technical analysts dusre indicators aur patterns ka bhi use karte hain, jaise ki support and resistance levels, trendlines, aur other candlestick patterns. In sab factors ka combination karke trading decisions liye jaate hain.Dark and Cloud pattern ek popular bearish reversal pattern hai, lekin iska 100% accuracy guarantee nahi hota hai. Traders ko hamesha risk management ka dhyan rakhna chahiye aur dusre technical analysis tools ka bhi use karna chahiye pattern ki validity ko confirm karne ke liye. Upar diye gaye explanation se aap samajh gaye honge ki Dark and Cloud pattern kya hota hai aur iska kya significance hai bearish trend reversal mein. Ye pattern traders aur technical analysts ke liye important tool hai market analysis aur trading strategies ke liye. Thanks for your guys. -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Dark cloud cover pattern kya hy candlestick pattern price chart par banne wala aik two days ka bearish trend reversal pattern hai, jo k high price area ya bullish trend k dowran banta hai. Pattern ki pehli candle bullish jab k dosri candle aik bearish candle hoti hai. Pattern ki dosri bearish candle k open price pehli candle se oopar gap main honi chahiye, lekin ye bohut ziada zarori nahi hai, bulkeh dosri candle pehli candle k close price k qareeb bhi open ho sakti hai. Pattern ki dosri candle ka close price pehli candle k wast point se nechay hona chahiye, lekin iss k close price k ooper aur open price k nechay nahi hona chaheye. Pattern ki dono candles real body main lazmi honi chaheye, Dark cloud cover pattern ki Phchan ky hy candlestick pattern two days candles ka trend reversal pattern hai, jiss main pehli candle aik normal bullish candle hoti hai, jo prices main bullish trend aur buying pressure zahir karti hai. Ye candle shadow samet ya shadow k bagher bhi ho sakti hai, jab k pattern ki dosri candle aik bearish candle hoti hai, jo k pehli candle k top gap main open ho kar pehli candle k darmeyan se nechay close hoti hai. Ye candle market main selling control ko zahir karti hai, jo prices k sabeqa trend k khatemay par banta hai. Ye pattern dekhne aur candles ki formation same bearish belt-hold line candlestick pattern ki tarah hota hai,

Dark cloud cover pattern ki Phchan ky hy candlestick pattern two days candles ka trend reversal pattern hai, jiss main pehli candle aik normal bullish candle hoti hai, jo prices main bullish trend aur buying pressure zahir karti hai. Ye candle shadow samet ya shadow k bagher bhi ho sakti hai, jab k pattern ki dosri candle aik bearish candle hoti hai, jo k pehli candle k top gap main open ho kar pehli candle k darmeyan se nechay close hoti hai. Ye candle market main selling control ko zahir karti hai, jo prices k sabeqa trend k khatemay par banta hai. Ye pattern dekhne aur candles ki formation same bearish belt-hold line candlestick pattern ki tarah hota hai,  Dark cloud cover pattern min Tread ky Benifitscandlestick pattern prices k top par banne ki waja se market main sellers ziada active ho jate hen. Pattern ki dosri candle prices ko bullish trend k leye resistance zone banati hai, jiss k baad prices teezi k sath downfall karti hai. Pattern par trade enter karne se pehle aik confirmation candle ka hona zarori hai, jiss ka open price apne close price k ooper hona chaheye aur dosri candle k lower par close honi chaheye. Lekin agar confirmation candle ki jagah agar bullish candle banti hai, to ye pattern invalid ho kayega, jiss par trade entry nahi karni chaheye. Indicators par value lazmi overbought zone main honi chaheye, jiss ki confirmation lazmi hai.

Dark cloud cover pattern min Tread ky Benifitscandlestick pattern prices k top par banne ki waja se market main sellers ziada active ho jate hen. Pattern ki dosri candle prices ko bullish trend k leye resistance zone banati hai, jiss k baad prices teezi k sath downfall karti hai. Pattern par trade enter karne se pehle aik confirmation candle ka hona zarori hai, jiss ka open price apne close price k ooper hona chaheye aur dosri candle k lower par close honi chaheye. Lekin agar confirmation candle ki jagah agar bullish candle banti hai, to ye pattern invalid ho kayega, jiss par trade entry nahi karni chaheye. Indicators par value lazmi overbought zone main honi chaheye, jiss ki confirmation lazmi hai.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#7 Collapse

Asslam-O-Alaikum! Dear members Me ummed kerti hoke ap sb ka forex trading py kam bht acha chl rha hoga. Aj jis topic py hum baat kre gy wo Neeche mention hy. Topic : Dark Cover Cloud Pattern dark cloud cover aik bearish reversal candle stuck patteren hai jo is waqt bantaa hai jab aik taizi ki mom batii ke baad aik bearish candle aati hai jo pichlle din ki high se oopar khulti hai aur pichlle din ki candle ke wast point se neechay band hoti hai. patteren mojooda up trained ke mumkina mandi ke ulat jane ki tajweez karta hai . Explanation : dark cloud cover patteren do mom btyon par mushtamil hai, sab se pehlay aik blush candle hai jo mazboot up trained ki nishandahi karti hai. doosri candle aik bearish candle hai jo pichlle din ki candle ki oonchai par khulti hai, lekin phir pichlle din ki candle ke wast point se neechay band ho jati hai. is se zahir hota hai ke reacho ne qaboo pa liya hai aur rujhan ke ulat jane ka imkaan hai . dark cloud cover patteren ki tijarat karte waqt, tajir doosri candle ke ekhtataam par short positions mein daakhil hotay nazar atay hain, jis mein doosri mom batii ki oonchai se stap nuqsaan hota hai. patteren ki bearish tasdeeq teesri candle ki soorat mein aati hai jo doosri candle se kam band hoti hai, jo qeemat mein mazeed kami ka ishara day sakti hai . yeh note karna zaroori hai ke tijarti faislay karne se pehlay dark cloud cover patteren ki tasdeeq deegar takneeki tajzia tools aur isharay se ki jani chahiye. taajiron ko market ke majmoi rujhan aur deegar awamil par bhi ghhor karna chahiye jo tijarat ki ja rahi security ki qeemat ko mutasir kar satke hain . bearish gehray baadalon ka ihata is waqt shuru hota hai jab kisi asasa ki qeemat mein kuch arsay se izafah hota hai lekin achanak aik mourr aata hai aur girna shuru ho jata hai. yeh bearish reversal hai. yeh ihata shuru karne mein ghalib hai. stak market mein tabdeeli ka matlab asasa ki qeemat ki simt mein tabdeeli hai. bearish reversal ka matlab hai ke qeemat shuru mein oopar ki taraf barh rahi thi lekin simt badal kar girna shuru ho gayi . doosri zaroorat kam az kam do gehray cloud cover candle steaks ki hai – aik oopar candle aur neechay candle. mom btyon ka aik haqeeqi jism aur saya hota hai. asli body zahir karti hai ke aaya ikhtitami qeemat ibtidayi qeemat se ziyada thi ya kam. saaye aik din mein sab se ziyada aur sab se kam qeemat ko zahir karte hain. is liye, gehray baadal ke ihata mein aik lamba jism aur chhootey saaye munasib samjhay jatay hain. is ke ilawa, jism ka size ulat jane ki shiddat ki nishandahi karta hai . asli body iftitahi aur ikhtitami qeematon ki bunyaad par mukhtalif rangon ko farz kar sakti hai. misaal ke tor par, agar ikhtitami qeemat ibtidayi qeemat se ziyada hai, to asli body safaid ya sabz ho sakti hai. usay up candle ya blush candle kaha jata hai, kyunkay din ke ekhtataam par qeemat ziyada hoti hai. is ke bar aks, agar iftitahi qeemat ziyada hai, to asli body siyah ya surkh ho sakti hai. yeh neechay candle ya bearish candle hai .

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 05:37 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим