Pip Top aur Line Base Candle

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

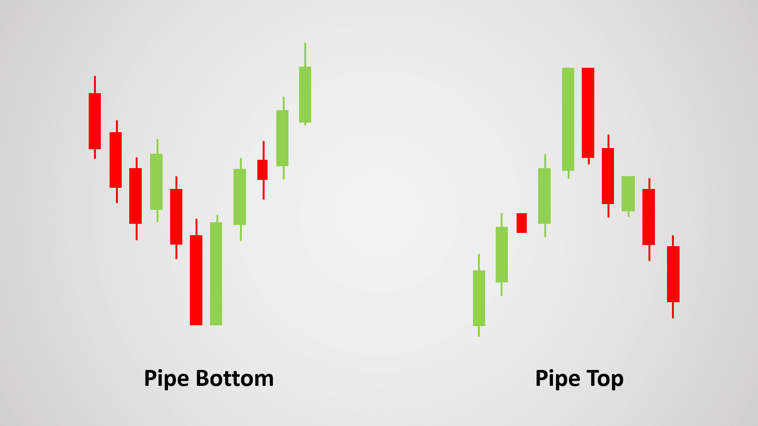

Introduction Pip Top aur Line Base Candle, Japanese candlestick charting technique ka ek hissa hai, jo stock market analysis mein istemal hota hai. Pip Top Candle Design: Pip Top Candle, bullish (upward) trend ke indicate karne ke liye use hota hai.Is candle ka body (range between open and close) chhota hota hai aur upper wick (shadow) lambe hote hain. Upper wick ki length, trend ke strength aur reversal ke potential ko dzahir karta hai.Pip Top Candle, bullish trend ke continuation ya reversal ka indication provide karta hai. Line Base Candle Design: Line Base Candle, bearish (downward) trend ke indicate karne ke liye use hota hai.Is candle ka body bahut chhota hota hai aur lower wick (shadow) lambe hote hain.Lower wick ki length, trend ke strength aur reversal ke potential ko darshata hai.Line Base Candle, bearish trend ke continuation ya reversal ka indication provide karta hai. Yahan kuch hidayat hain jo Pip Top aur Line Base Candle design ke liye upyogi ho sakte hain: Market Trend Analysis: Pip Top aur Line Base Candles ko samajhne ke liye market trend analysis karna zaroori hai. Trend ko identify kare, jaise ki bullish (upward) trend ya bearish (downward) trend. Candlestick Patterns: Candlestick patterns ko study kare aur identify kare, jaise ki Doji, Hammer, Hanging Man, Shooting Star, etc. In patterns ke sath Pip Top aur Line Base Candles ka istemal karke confirmations check kare. Timeframes: Different timeframes par analysis kare. Short-term aur long-term timeframes mein Pip Top aur Line Base Candles ka istemal karke trend confirm kare. Support aur Resistance Levels: Support aur resistance levels ko identify kare. Pip Top aur Line Base Candles in levels ke near hone par strong reversal signals provide kar sakte hain. Volume Analysis: Volume analysis bhi important hai. Pip Top aur Line Base Candles ke sath high volume ya low volume ka correlation dekhe. High volume ke sath reversal signals strong hote hain. Stop Loss aur Target Levels: Apne trades ke liye stop loss aur target levels set kare. Pip Top aur Line Base Candles ke sath apne entry aur exit points define kare. Note Yeh hidayat aapko Pip Top aur Line Base Candle design ke liye madad karegi. Hamesha market ke current conditions aur apne risk appetite ke sath trading decisions lena zaroori hai. Market ke volatality aur risk ko samjhe aur apne trades ko manage kare.Thank you for your attention -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Pip Top aur Line Base Candle:.- Pip Top Line Base Candle:

Pip Top:

Line Base Candle:

- In patterns ka istemal trading strategy mein kiya ja sakta hai. Agar trader ko pip top pattern dikhta hai, to uska matlab hai ke bullish momentum ho sakta hai aur wo long position enter kar sakta hai. Line base candle pattern ko dekh kar trader bearish momentum ka andaza laga sakta hai aur wo short position enter kar sakta hai.

In patterns ke kuch fayde aur nuksan hain:- Fayde:

- In patterns ki madad se traders price movements ka analysis kar sakte hain aur market trends ka pata laga sakte hain.

- Ye patterns entry aur exit points ka selection karne mein madadgar hote hain.

- In patterns ki madad se traders risk ko manage kar sakte hain aur stop loss levels ka tayyun kar sakte hain.

Nuksan:

- Ye patterns sirf ek indicator hai aur dusre technical analysis tools ke saath mila kar istemal hona chahiye. Sirf in patterns par rely kar ke trading karna risky ho sakta hai.

- Ye patterns kabhi kabhi false signals bhi de sakte hain, isliye traders ko dusre confirming factors ka istemal karna chahiye.

In conclusion:

Pip Top aur Line Base Candle patterns traders ko price movements ke bare mein jankari dete hain aur unhe trading decisions lene mein madad karte hain. Lekin, in patterns par rely karne se pehle traders ko dusre technical analysis tools ka istemal karna chahiye aur risk management ka khayal rakhna chahiye. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#4 Collapse

Pip top or line base candle in forex, jise "pip top" ya "line base candle" kehte hain, ek specific type ka candlestick pattern hai jo price action analysis mein istemal hota hai. Ye pattern price movement ke trend ke reversal ya continuation ka indication deta hai. Pip top pattern ka formation kuch is tarah hota hai: 1. Price Movement: Pehle to price chart par ek strong move hota hai, either uptrend ya downtrend ki taraf. Ye move kisi specific range tak jata hai. 2. Reversal or Consolidation: Price jab apne extreme point tak pahunchta hai, to uske baad reversal ya consolidation phase start hota hai. Price apne extreme point se thoda shift karta hai aur phir us point tak wapis aata hai. Is phase mein, pip top pattern form hone lagta hai. 3. Candlestick Pattern: Pip top pattern mein, ek ya multiple candlesticks ke upper wicks (shadows) ko observe kiya jata hai. Ye wicks price action ko represent karte hain. Pip top pattern mein, upper wicks lambe hote hain aur body (range between open and close) chota hota hai. Ye pattern bull market mein dekha jata hai. Pip top or line base candle pattern ke characteristics aur benefits kuch is tarah hote hain: 1. Reversal Signal: Pip top pattern bull market mein trend reversal ka signal deta hai. Jab ye pattern form hota hai, to ye indicate karta hai ke uptrend weak ho raha hai aur bearish reversal hone ki possibility hai. 2. Entry Points: Pip top pattern traders ko sell positions ke entry points ka idea deta hai. Is pattern ke form hone par, traders apni sell positions enter kar sakte hain. Stop loss aur take profit levels is pattern ke based set kiye ja sakte hain. 3. Risk Management: Pip top pattern traders ko risk management mein madad karta hai. Is pattern ki identification se traders apni trading strategies ko adjust kar sakte hain aur risk ko minimize karne ke liye appropriate stop loss levels set kar sakte hain. 4. Confirmation with Other Indicators: Pip top pattern ko dusre technical indicators ke saath combine karke aur confirmation ke liye istemal kiya ja sakta hai. Jaise ki trend lines, moving averages, ya oscillators. Isse traders ko aur confidence milta hai apni trading decisions mein. Is tarah se, pip top ya line base candle pattern forex market mein trend reversal ka signal deta hai. Is pattern ke formation mein, upper wicks lambe hote hain aur body chota hota hai. Ye pattern bull market mein dekha jata hai aur traders isko sell positions ke entry points ke taur par istemal kar sakte hain. Pip top pattern ko dusre indicators ke saath combine karke aur confirmation ke liye istemal kiya ja sakta hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 05:42 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим