Price action strategy kia h??

No announcement yet.

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔ٹیگز: کوئی نہیں

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

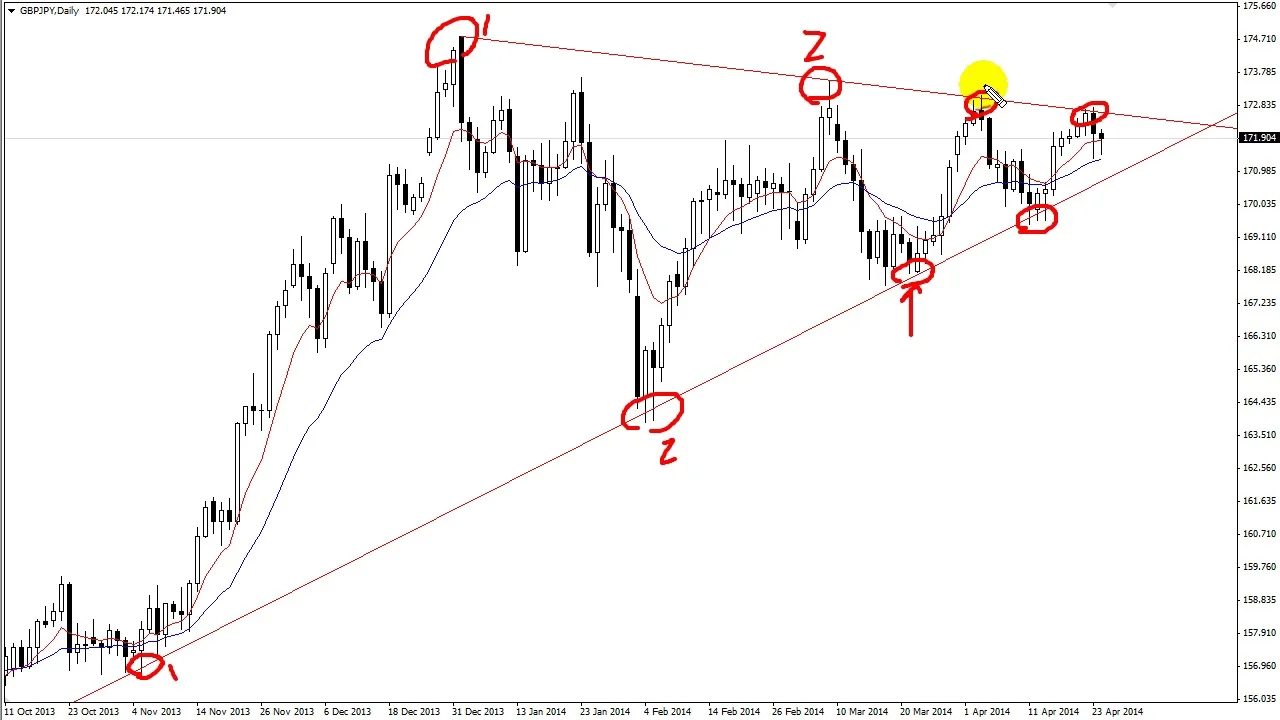

Assalam alaikum dear forex members! umeed karta hn k aap sb thk thaak hn gy or pak forex forum se knowledge gain kar rhy hn gy. dear members aj ki post main hum price action ko study karen gy or dekhen gy ye kia hota ha or es se trading main kesy help milti ha. WHAT is Price Action? Dear members price action ka lafzi mtlb ha k qeemton ka utar chrhao. Or forex market main ye hamen chart ki shakal main dkhaya jata ha. Candle stick charts main price action aik candle ki shakal main hamen dkhaya jata ha. price action basically technical analysis ki base ha q k stf price action ko use kr k market ko analyse karna or es main koe technical indicator use na krna pure price action khlata ha or tqrbn mostly traders es py rely karty hain. Price action k differen components hain jo k nechy bayan kiye gaye hain. Support & resistance Trend line Demand & supply zone Channels and patterns Dear members in sb components ko nechy tafseel se bayan kia gaya ha. Support & Resistance: Dear members support forex market main use area ya price ko khty hain jo k market ko nechy girny se rokta ha or support karta ha. agr ye area aik se zada prices py mushtamil ho to esy support zone kaha jata ha. support zone market main qeemton ko mazeed nechy girny se rokta ha or yahan se qeemten barhny ki expectations hoti hain support se rejection k bad hum buy ki trade lety hain or es main hmara stop loss support ya us se nechy hota ha. jb k resistance wo area ya price hoti ha jo k market main qeemton ko mazeed barhny se rokti ha. jb bhi qeemten ksi resistance se takrati hain to reject ho k wapis nechy aa jati hain. agr resistance aik se zada prices py mushtamil ho to esy resistance zone kaha jata ha. resistance se rejection k bad hum market main sell ki trade lyty hain or es main hmara stop loss resistance ya us se opr ki price hoti ha. Trendline: Dear members jb market ksi trend main opr ya nechy move karti ha to market seedha opr ya seedha nechy ni jati bl k market rally ki shakal main opr jati ha or ohr nechy thori retracement le k base bnati ha or phr opr jati ha. estraha uptrend main market higher highs or higher lows bnati ha agr lows ko lows se mlaya jay to aik rising trend line banti ha jesa k nechy picture main dekha jaa skta ha. Or jb market apni trendline ko touch karti ha to hum yahan se buy karty hain or hmara stop loss trendline k nechy hota ha estrha jb tk market apna trend continue rkhti ha to market trend line ko follow karti ha or jb trendline ka breakout ho to trend reverse ho jata ha or hum sell ki trade lyty hain. Demand & Supply Zone:dear memebrs demand wo area hota ha jahan py bhht sary buyers market ka wait kar rhy hoty hain or jb market wahan phnchti hai to wahan se buy orders lgty hain jski waja se market aik dm shoot kar jati ha. es area ko order block b kaha jata ha. demand zone se hum buy ki tradr lety hain or hmara stop loss demand zone ya us se nechy hota ha. jb k supply zone wo price ya area hota ha jahan py bht se supplier wait kar rhy hoty hain or jesy hi market wahan phnchti ha to bhht se sell k orders lgty hain jski waja se qeemten aik dm kafi nechy chli jaati hain. es area ko order block bhi kaha jata ha. Yahan se hum rejection ki confirmation k bad sell ki trade lyty hain or hmara stop loss supply zone ya us se opr hota ha. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Price action trading ek tareeqa hai jo pehle ki keemat ke harkat ka jayezah lekar, mustaqbil ki keemat ke harkat ka andaza lagane par mabni hai. Ye is aqeedah par mabni hai ke tamam ehmiyat daar maloomat keemat mein zahir hoti hai, aur keemat ke patterns ko mutalia karke, traders market ki jazbat aur rukh ka andaza laga sakte hain.

Indicator par mabni strategies ke khilaaf jo keemat par aitebaar hai, price action trading subjective aur manfi hai. Ye traders ko market dynamics aur insani psychology ke samajh ke mabain keemat ki harkaton ko tashreeh karna chahiye. Alag alag levels aur patterns ke tajziya karke keemat kaam hai, traders buland probability trading opportunities pehchan sakte hain.

Key Principles of Price Action Trading- Market Structure: Price action traders amooman market structure ka jayezah karte hain, jo keemat par bulandiyan, gireban, aur ahem support aur resistance levels par mabni hoti hai. Ahem keemat ke levels ko pehchan karne se, traders karobar ka amoomi rukh aur mukhalif rukh ka andaza laga sakte hain.

- Candlestick Patterns: Candlestick patterns price action trading mein ahem kirdar ada karte hain. Traders khaas formations jaise pin bars, engulfing patterns, aur andar se bars ko talash karte hain ke market rukh ki mutabiq rahne ka signal ho. Ye patterns market ki jazbat aur khareedne walon aur farokht karne walon ke darmiyan maujooda tarteeb ke bare mein ehmiyat dar maloomat faraham karte hain.

- Trend Analysis: Price action traders rukh aur rukh ki palat ke nishano par tawajjo dete hain. Unhe rukh ke jari harkat ya thakan ke nishano ka intezar hota hai jaise uptrend mein bulandiyan aur nichli bulandiyan ki silsila, ya downtrend mein nichli bulandiyan aur bulandiyan ki silsila. Bunyadi rukh samajhne se traders androni aur baahri daakhilay ke bare mein mutalla kaar sakte hain.

- Support and Resistance: Support aur resistance levels woh areas hain jahan keemat ka maamoolan rokawat aati hai. Price action traders in levels ko pehchanne ke liye istemal karte hain taake potential entry aur exit points ko pehchan sakein. Jab keemat ek support level ke qareeb hoti hai, traders bullish price action signals ke liye long jane ke liye dekhte hain, jab ke resistance levels par, woh bearish signals ko farokht karne ke liye dekhte hain.

- Risk Management: Asar aawar risk management price action trading mein ahem hai. Traders ko apni risk bardasht karne ki hadd aur munasib stop-loss levels tay karna chahiye. Risk ko behtar taur par manane se, traders apne trading account ko bacha sakte hain aur haarne wale douron se guzar sakte hain.

- Breakout Trading: Breakout trading ek mashhoor price action strategy hai jo ek trade mein dakhil hone ka intezar karta hai jab keemat kisi ahem support ya resistance level ko paar karta hai. Traders breakout ka tasdeeq karte hain, aam toor par aik mazboot candlestick close ya trading volume mein izafa, trade mein dakhil hone se pehle.

- Pullback Trading: Pullback trading, jo ke retracement trading ke naam se bhi mashhoor hai, ek temporary reversal ya retracement ke baad maujooda rukh ki taraf trade mein dakhil hone ka intezar karta hai. Traders keemat ko ek ahem support ya resistance level tak dobara le jaane ka intezar karte hain, ummeed hoti hai ke rukh phir se jaari hoga.

- Trend Reversal Trading: Trend reversal trading ek contrarian approach hai jahan traders dekhte hain ke maujooda rukh palatne ka nishaan hai. Ye strategy trend ki badalne ke patterns jaise double tops, double bottoms, aur head and shoulders patterns ko pehchanna shaamil karta hai, jo market ki jazbat mein tabdili ki isharaat hain.

- Range Trading: Range trading markets ke liye maqbool hai jo ke saaf rukh ki kami mein hote hain aur ahem support aur resistance levels ke darmiyan mehdood hadood mein trade karte hain. Traders ahem support level ke qareeb khareedne aur resistance level ke qareeb farokht karne ka intezar karte hain, range ke andar keemat ke oscillations ka faida uthane ke liye.

- Chart Analysis: Price action traders zaroori taur par indicators ya oscillators ke bina charts ka istemal karte hain. Woh candlestick patterns, trendlines, aur support/resistance levels ka istemal karte hain keemat ke potential trading opportunities ko pehchanne ke liye.

- Patience and Discipline: Kamiyabi hasil karne ke liye price action trading mein sabr aur nizam ki zaroorat hoti hai. Traders ko buland probability ke setups ka intezaar karna chahiye aur emotions par bina control ke dharne se bachna chahiye. Apne trading plan ko mazbooti se follow karke aur nizam ka amal karke, traders overtrading se bach sakte hain aur nuqsan ko kam kar sakte hain.

- Trade Management: Ek trade mein dakhil hone ke baad, moassar trade management ahem hai. Price action traders aksar trailing stop-loss orders ka istemal karte hain takay faida bacha sakein aur asar aawar harkat mein zyada faida utha sakein. Woh positions se bahar nikalne ya apne stop-loss levels ko keemat ke harkat par tabdeel karne ka bhi istemal karte hain.

- Continuous Learning: Price action trading ek maharat hai jo musalsal seekhne aur behtar hone ki zaroorat rakhti hai. Traders ko apni trades ko baar baar mutalla karna chahiye, apni ghaltiyon ka jaiza lena chahiye, aur apni mazeed taleem aur farahami mein behtari ke liye farahim kar sakte hain.

- Adaptability: Marketen dynamic hain aur hamesha tabdeel ho rahi hain, isliye price action traders ko apne approach mein adaptable aur lachar hona chahiye. Woh apne strategies ko badalne ke liye tayyar hona chahiye maujooda market ke shara'it ke mutabiq aur naye trading ideas aur techniques ko qubool karne ke liye

- Simplicity: Price action trading indicators par mabni strategies ke mukable mein asaan hai. Traders sirf keemat ki harkaton par tawajjo dete hain, jo ke saaf aur seedha faislay karne mein madadgar ho sakta hai.

- Real-Time Analysis: Price action trading traders ko haqiqi tafseeli mein market ka jaiza lenay ki anumati deta hai, bina kisi muakharat indicators ya der se signals ke liye. Ye haqiqi tafseeli un traders ko jald az jald changing market shara'it par tawajjo denay ki anumati deta hai aur naye opportunities ka faida uthane ki izazat deta hai.

- Versatility: Price action trading mukhtalif maali marketon mein laagu kiya ja sakta hai, jaise ke forex, stocks, commodities, aur cryptocurrencies. Price action ke asool mukhtalif marketon mein eik jaise rehnay ke barabar hain, jo traders ko ek mujmur aur mubahis approach faraham karta hai.

- Higher Probability Setups: Price action signals aur patterns par tawajjo diye bina, traders apne kamiyabi ke chances barha sakte hain aur lambay arsay tak mustaqil nafa haasil kar sakte hain.

- Emphasis on Market Psychology: Price action trading market psychology aur jazbat par tawajjo dena par mabni hai. Keemat ki harkaton aur candlestick patterns ko samajhne se, traders market mein mojood buyers aur sellers ke asli jazbat ke bare mein ahem maloomat hasil karte hain.

- Subjectivity: Price action trading subjective hai aur traders keemat ki harkaton ka tawajjo denay par mabni hai. Alag alag traders ek hi chart ka jaiza lenge aur mukhtalif nateeje par pahunchenge, jo trading decisions mein farq la sakta hai.

- Lack of Quantitative Data: Indicator par mabni strategies ke mukable mein price action trading mein quantity data aur riyazi hisaab ki zaroorat nahi hoti. Traders ko apne intehaiyat aur tajurba ke tajziya ko qeemti hawa hasil karne ke liye intizar karna padta hai.

- Psychological Challenges: Price action trading mazboot nizam aur jazbat ka control talab karta hai. Traders ka samna challenges jaise khauf, lalach, aur rukhsati se ho sakta hai, jo impulsive trading decisions aur nuqsan ka bais ban sakta hai.

- False Signals: Price action signals infallible nahi hote hain, aur traders ko ghalat signals ya whipsaws ka samna ho sakta hai, khaaskar ghumavdar ya range-bound markets mein. Traders ko apne trading account ko bachane ke liye munasib risk management techniques ka istemal karna chahiye.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#4 Collapse

Price action strategy aik aham aur asaan tareeqa hai jo tajziye aur mawafiqat ke zariye kisi bhi market mein trading karne ke liye istemal hota hai. Is tareeqay mein, traders sirf market ke qeemat ki tasweer se amal karte hain, bila kisi technical indicators ya oscillators ke istemal ke. Is tareeqay ko samajhna aur istemal karna kisi bhi trader ke liye zaroori hai jo asal aur sada trading tareeqay ko pasand karta hai.

Price action strategy ka asal maqsad market ki movement ko samajhna hai. Is tareeqay mein, traders market ki tasweer ko dekhte hain, jese ke candlestick patterns, support aur resistance levels, aur trend lines, taake wo future price movement ka andaza lagasakain.

Is tareeqay ke kuch faiday hain jo isay dusre trading strategies se behtar banate hain:- Asani se samajhna: Price action strategy ko samajhna asaan hai, khaas tor par naye traders ke liye. Ismein complicated technical indicators ka istemal nahi hota, jo naye traders ke liye confusing ho sakta hai.

- Kam indicators ka istemal: Is tareeqay mein kam indicators ka istemal hota hai ya bilkul bhi nahi hota, jo traders ko market ki asal movement par focus karne mein madad karta hai.

- Trendon ka pata lagana: Price action strategy traders ko market ke trends ko samajhne mein madad karta hai, jo unhein successful trades karne mein madadgar hota hai.

- Flexible approach: Price action strategy ko apne trading style ke mutabiq customize kiya ja sakta hai. Har trader apni marzi ke mutabiq is tareeqay ko istemal karke apne trading plan ko develop kar sakta hai.

Lekin, price action strategy istemal karte waqt kuch mushkilat bhi ho sakti hain:- Subjective analysis: Price action strategy ki analysis subjective hoti hai, yaani har trader apni apni interpretation de sakta hai, jo kisi bhi doosre trader ki interpretation se mukhtalif ho sakti hai.

- Emotional control: Is tareeqay mein traders ko apni jazbat par qaboo rakhna zaroori hai, kyunke sirf price action ko dekhte hue trading karne mein kai martabah unka jazbaat unki faisla warishat ko mutasir kar sakta hai.

- Time consuming: Price action strategy ko istemal karna waqt aur mehnat ka kaam hai. Market ki tasweer ko samajhne aur analysis karne ke liye zyada waqt chahiye hota hai.

In tamam mushkilat ke bawajood, price action strategy ek mufeed aur asan tareeqa hai trading ke liye, khaas tor par un traders ke liye jo technical indicators aur oscillators ka istemal pasand nahi karte. Is tareeqay ko samajhne aur istemal karne ke liye, traders ko patience, practice aur consistent learning ki zaroorat hoti hai.

-

#5 Collapse

Price action strategy" ek trading approach hai jisme traders price charts aur historical price movements ka istemal karte hain trading decisions banane ke liye. Yeh strategy indicators aur oscillators ki bajaye price patterns, candlestick formations, aur support/resistance levels par focus karta hai. Neechay Price Action Strategy ke mukammal points Roman Urdu mein diye gaye hain:

Price Action Strategy (Keemat Amal Tareeqa):

Muddeh:

Price action strategy mein, traders sirf price charts aur unki movements par focus karte hain, indicators aur oscillators ka istemal kam ya na kar ke.

Key Points:

Candlestick Patterns:

Candlestick patterns, jese ki doji, engulfing, aur harami, ka istemal kiya jata hai price reversals aur trends ko pehchanne ke liye.

Support aur Resistance Levels:

Support aur resistance levels ko identify karke traders entry aur exit points ke taur par istemal karte hain.

Trend Analysis:

Trend ki direction ko samajh kar traders trend-following ya trend-reversal trades ka faisla karte hain.

Price Action Signals:

Price action signals, jese ki pin bars, inside bars, aur outside bars, ko interpret kar ke traders trade entries aur exits decide karte hain.

Risk Management:

Har trade mein risk management ko zaroori samjha jata hai, jisme stop-loss aur position sizing shamil hota hai.

Multiple Time Frame Analysis:

Different time frames par price action analysis kiya jata hai takay trading signals ki confirmation mil sake.

Trading Strategy:

Price action strategy mein, traders price patterns aur support/resistance levels ke based par entries aur exits karte hain. Candlestick patterns aur price action signals ko confirm karne ke liye, traders aur bhi factors jese ke trend direction aur volume ka istemal karte hain. Har trade mein risk ko manage karna zaroori hota hai, jese ke stop-loss orders ka istemal karke. Price action strategy ke tahat, traders ko price movements ko samajhne aur unpar tawajju dena hota hai, jisse unki trading decisions improve hoti hain. -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Har ek trader ki khuwahish hoti hai ke woh market ke tez aur ghareebat mein barabar tareeqay se sahi faisle kar sake. Keemat amal tareeqa ya price action strategy, ek aise tareeqa hai jo traders ko market ke tabdiliyon ko samajhne aur un par amal karne mein madad karta hai.

Keemat Amal Tareeqa Kya Hai?

Keemat amal tareeqa ek aise tajziya ka naam hai jisme traders sirf security ke qeemat ki gardish par amal karte hain, woh ke indicators ya oscillators ki madad se naa ke. Is tareeqay mein, traders qeemat ki harkat, chart patterns, aur candlestick formations ke zariye market ke tabdiliyon ko tajziya karte hain.

Keemat Amal Tareeqa Ka Faaida- Asaan Tareeqa: Keemat amal tareeqa aam tareen traders ke liye asaan hota hai, kyun ke is mein kisi khaas indicator ya formula ki zaroorat nahi hoti.

- Zyada Mawafiq Faisle: Price action strategy istemal karne se traders ko market ke asli halaat ka behtar andaza hota hai aur woh mawafiq faisle karne mein kamyab hote hain.

- Mukhtasir Mehsoolat: Keemat amal tareeqa mein traders sirf chart patterns aur candlestick formations par tawajju dete hain, is liye yeh un ke liye mukhtasir mehsoolat hasil karne ka ek asan tareeqa hai.

Keemat Amal Tareeqa Ka Istemal- Candlestick Formations: Candlestick formations, jese ke dojis, engulfing patterns, aur hammers, keemat amal tareeqa mein ahem hain. In formations ki madad se traders market ke mukhtalif mawaqe ko samajh sakte hain.

- Chart Patterns: Chart patterns, jese ke head and shoulders, triangles, aur rectangles, bhi keemat amal tareeqa mein istemal hote hain. In patterns ki madad se traders market ke trends aur reversals ko pehchan sakte hain.

- Support aur Resistance Levels: Keemat amal tareeqa mein support aur resistance levels bhi ahem hote hain. In levels ki madad se traders qeemat ki harkat ko samajhte hain aur mawafiq faisle karte hain.

Mukhtalif Keemat Amal Tareeqay- Rejection Candles: Rejection candles, ya phir pin bars, market ke mukhtalif levels par aam tor par paye jate hain aur traders ko trend reversals ke baray mein maloomat faraham karte hain.

- Inside Bars: Inside bars, market ke trend ke doran paye jate hain aur yeh trend ki jaari rahay gi ya phir reversals ki taraf ishara karte hain.

- Trend Lines: Trend lines, market ke trends ko samajhne aur un par amal karne mein madad karte hain. In lines ko istemal karke traders trend ke doran mawafiq mawaqe par dakhil ho sakte hain.

Nateeja

Keemat amal tareeqa ek powerful trading tareeqa hai jo traders ko market ke asli halaat ko samajhne aur un par amal karne mein madad karta hai. Is tareeqay ko istemal karke, traders apne trading ko behtar bana sakte hain aur zyada kamyabi haasil kar sakte hain. Magar yad rahe ke har trading tareeqa ki tarah, keemat amal tareeqa bhi apni marzi aur tajurbaat ke mutabiq istemal kiya jana chahiye.

- Mentions 0

-

سا0 like

-

#7 Collapse

Price action strategy" ek trading approach hai jisme traders price charts aur historical price movements ka istemal karte hain trading decisions banane ke liye. Yeh strategy indicators aur oscillators ki bajaye price patterns, candlestick formations, aur support/resistance levels par focus karta hai. Neechay Price Action Strategy ke mukammal points Roman Urdu mein diye gaye hain:

Price Action Strategy (Keemat Amal Tareeqa):

Muddeh:

Price action strategy mein, traders sirf price charts aur unki movements par focus karte hain, indicators aur oscillators ka istemal kam ya na kar ke.

Key Points:

Candlestick Patterns:

Candlestick patterns, jese ki doji, engulfing, aur harami, ka istemal kiya jata hai price reversals aur trends ko pehchanne ke liye.

Support aur Resistance Levels:

Support aur resistance levels ko identify karke traders entry aur exit points ke taur par istemal karte hain.

Trend Analysis:

Trend ki direction ko samajh kar traders trend-following ya trend-reversal trades ka faisla karte hain.

Price Action Signals:

Price action signals, jese ki pin bars, inside bars, aur outside bars, ko interpret kar ke traders trade entries aur exits decide karte hain.

Risk Management:

Har trade mein risk management ko zaroori samjha jata hai, jisme stop-loss aur position sizing shamil hota hai.

Multiple Time Frame Analysis:

Different time frames par price action analysis kiya jata hai takay trading signals ki confirmation mil sake.

Trading Strategy:

Price action strategy mein, traders price patterns aur support/resistance levels ke based par entries aur exits karte hain. Candlestick patterns aur price action signals ko confirm karne ke liye, traders aur bhi factors jese ke trend direction aur volume ka istemal karte hain. Har trade mein risk ko manage karna zaroori hota hai, jese ke stop-loss orders ka istemal karke. Price action strategy ke tahat, traders ko price movements ko samajhne aur unpar tawajju dena hota hai, jisse unki trading decisions improve hoti hain. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#8 Collapse

**Price Action Strategy Kya Hai?**

Forex aur stock trading mein, technical analysis aur indicators trading decisions ko guide karne mein madadgar hote hain. Lekin, ek aisi strategy jo traders ko market ke fundamental price movements ko samajhne aur analyze karne mein madad karti hai, wo hai "Price Action Strategy." Aaj hum is strategy ki wazahat karenge aur dekhenge ke yeh trading mein kaise madadgar ho sakti hai.

**Price Action Strategy Kya Hai?**

Price Action Strategy ek trading approach hai jo market ke price movements aur patterns ko analyze kar ke trading decisions banata hai. Is strategy mein technical indicators ka use kam ya nahi ke barabar hota hai. Instead, traders price movements, candlestick patterns, aur chart formations ko focus karte hain. Iska main idea yeh hai ke market ki price hi sab kuch keh deti hai, aur usse hi trading signals milte hain.

**Key Components**

1. **Candlestick Patterns**: Price Action Strategy mein candlestick patterns bohot ahmiyat rakhte hain. Traders in patterns ka use market ke potential reversals aur trend changes ko identify karne ke liye karte hain. Common patterns mein Pin Bar, Doji, Engulfing, aur Hammer shamil hain.

2. **Support Aur Resistance Levels**: Is strategy ke under, traders market ke support aur resistance levels ko identify karte hain. Yeh levels market ke crucial points hote hain jahan price zyada tar reverse hoti hai. Traders in levels ko apne trading decisions mein use karte hain.

3. **Trend Lines Aur Chart Patterns**: Trend lines aur chart patterns, jaise ke Head and Shoulders, Double Top/Bottom, aur Flags, bhi Price Action Strategy mein important hote hain. Yeh patterns market ke trend aur price movement ki direction ko samajhne mein madad dete hain.

**Price Action Strategy Ka Faida**

1. **Simplicity**: Price Action Strategy ka main faida yeh hai ke yeh simple aur straightforward hai. Traders ko complex indicators ki zaroorat nahi hoti, bas price movements aur patterns ko samajhna hota hai.

2. **Real-Time Analysis**: Is strategy ke zariye, traders real-time price action ko analyze karte hain. Yeh unhe current market conditions ko samajhne aur timely trading decisions lene mein madad karta hai.

3. **Flexibility**: Price Action Strategy ko kisi bhi financial market, chahe wo Forex ho, stocks ho ya commodities, mein use kiya ja sakta hai. Yeh strategy market ke kisi bhi condition mein effective hoti hai.

**Conclusion**

Price Action Strategy ek powerful aur versatile trading approach hai jo traders ko market ke price movements aur patterns ko analyze karne mein madad karti hai. Is strategy ko samajhkar aur effectively use karke, traders informed trading decisions le sakte hain aur market ki dynamics ko behtar samajh sakte hain. Price action strategy ko apne trading toolkit mein shamil karke, aap apni trading success ko enhance kar sakte hain.

- CL

- Mentions 0

-

سا0 like

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 05:23 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим