What is Pinbar Candlestick in the Forex market

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

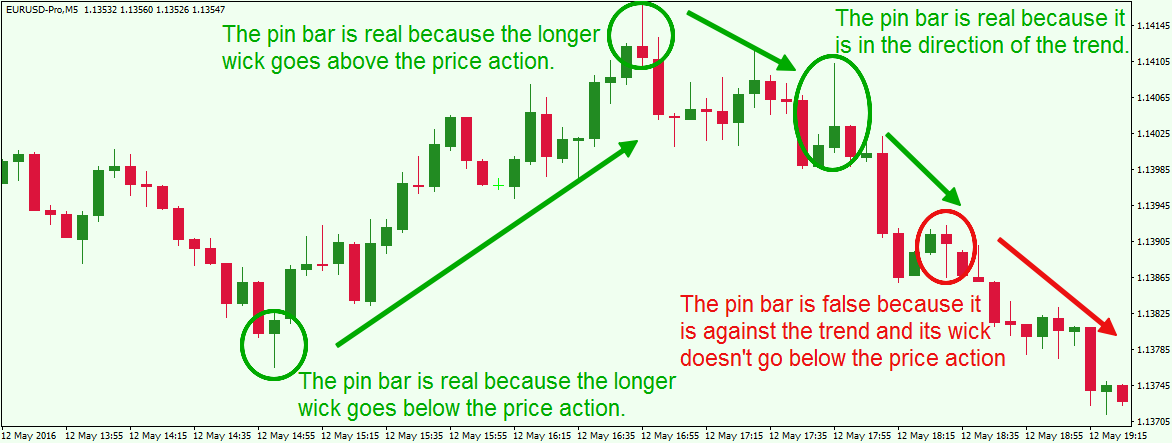

Pinbar CandlestickHello Everyone kesy hn sub log . I hope so ok sub Theak hun gy or learning good enough sath incomes bhi kr rahy hn gy , to dosto hum aik Topic start kia tha Price motion buyers in step withti faislay karne ke liye hamesha takneeki tajzia ke alaat ke sath sath bunyadi tajzia aur market ke ilm ka. istemaal karna chahiye . Yeh notice karna zaroori hai ke pibar candle stick patteren ko tanhai mein tijarti sign ke tor par istemaal nahi kya jana chahiye, aur is par deegar takneeki tajzia ke alaat aur marketplace ke isharay ke tanazur mein ghhor kya jana chahiye. Taajiron ko yeh bhi maloom. hona chahiye ke ghalat indic or Technical analysis in line with or is series mn hum the big apple parha good enough fashion k baad jo cheez sub sy important hy wo hy candlestick sample. Candlestick pattern mn hum aaj baat kren gy pinbar candle ki. Buyers mainly pinbar ko fashion reversal pattern or style contitinues pattern ko turn out to be aware of krny ok ley use krty hr.To dosto jesa k ap dekh sakty hn ok pinbar candle hoti kesi hy or bearish pinbar or bullish pinbar mn differnce kia hy .Ye candle prolonged wick k sath or choti body ok sath hoti hy or is ki frame k higher bhi aik choti si wick hoti hy usi wick ki waja sy is candle ko pinbar kehty hn q k wo bilkul pin ki trah ki hoti hy.Traders pinbar ko aik sign ok tor pr istmal krty hn jo k ye btata hy ok ab marketplace ka fashion alternate hony wala hy. What is Pinbar Candlestick in the Forex market ​

Pibar candlestick pattern ki aik qisam hai jo aam tor par foreign exchange trading mein istemaal hoti hai. Yeh aik wahid candle stuck patteren hai jo is waqt bantaa hai jab foreign money ke jore ya deegar maliyati asasay ki qeemat kisi khaas muddat ke douran taizi se oopar ya neechay ki taraf . barh jati hai, lekin phir simt ko tabdeel kar ke ibtidayi qeemat ke qareeb band ho jati hai .Pinbar candlestick aik chhota sa jism aur aik lambi batii ya saaye se numaya hai. Batii ya saya ya to mother batii ke jism ke oopar ya neechay ho sakta hai, aur yeh is ilaqay ki numaindagi karta hai jahan is. ki simt ulat jane se pehlay qeemat ko mustard kar diya gaya tha. Mother batii ka jism taizi ya mandi ka ho sakta hai, lekin yeh aam tor par batii ya saaye ki lambai ke lehaaz se chhota hota hai .Tajir aksar pinbar candle stick patteren ki tashreeh mumkina qeemat ke ulat jane ke sign ke tor par karte hain. Lengthy vÙokay ya shadow zahir karta hai ke qeematon mein numaya radday amal tha, aur haqeeqat yeh hai ke qeemat ibtidayi qeemat ke qareeb band ho gayi hai yeh batata hai ke kharidaron aur baichnay walon ke darmiyan kashmakash thi. Dosray lafzon mein, Pinbar candlestick pattern marketplace mein ghair faisla kinfolk honay ki nishandahi karta hai aur yeh is baat ki alamat ho sakta hai ke pichla rujhan apni raftaar kho raha hai ya ho sakta hai ke rivers honay wala ho .

-

#3 Collapse

Assalamu Alaikum Dosto!Pin Bar Candlestick Strategy

Pin bar candlestick, jo kay technical analysis mein bohat ahmiyat ki aik candlestick hai, ek aisa chart pattern hai jisay traders apni trading decisions banane ke liye istemal karte hain. Ye candlestick pattern trend reversal ki indication deta hai. Iska naam is liye "Pin Bar" hai kyunki iski body wazeh taur par ek "pin" ki tarah hoti hai, jis mein choti si body hoti hai aur is se lambi tail hoti hai.

Pin bar candlestick mein tail aksar upper ya lower shadow ki shakal mein hoti hai. Agar tail upper shadow ki shakal mein hai to yeh bearish reversal ki indication deta hai aur agar tail lower shadow ki shakal mein hai to yeh bullish reversal ki indication deta hai. Iske ilawa, iski body bahut choti hoti hai aur doosri candlesticks se chhote size ki hoti hai.

Pin bar candlestick ko identify karne ke liye traders tail ko body se kafi zyada lamba dekhenge, iski wajah se yeh candlestick pattern kafi recognizable hai. Yeh candlestick pattern aik powerful tool hai jisay traders apni trading strategies ko improve karne ke liye istemal karte hain.

Pin bar candlestick ka use kai trading strategies mein kiya jata hai. Iska istemal trend reversal ki indication dene ke liye hota hai. Agar market ki trend bullish hai aur Pin Bar candlestick ka appearance bearish reversal ki indication deta hai, to traders selling position ko lenge. Aur agar market ki trend bearish hai aur Pin Bar candlestick ka appearance bullish reversal ki indication deta hai, to traders buying position ko lenge.

Pin bar candlestick ka use entry aur exit points ko define karne ke liye bhi kiya jata hai. Agar traders ki trading strategy ka maqsad hai kisi specific price level par enter karna to woh Pin Bar candlestick ka use kar ke entry point ko identify kar sakte hain. Iske ilawa, traders Pin Bar candlestick ka use kar ke stop loss aur target price level bhi set kar sakte hain.

Ek important point yeh hai ke pin bar candlestick ka appearance kisi specific time frame par depend karta hai. Agar trader kisi specific time frame par pin bar candlestick ko identify karta hai to woh us time frame ke hisab se trading decision lega. Iske ilawa, iski shakal bhi time frame ke hisab se different ho sakti hai.

Pinbar Identification

Aik pin bar forex trading mein aik candlestick pattern hai jo price ka tez ulta waqtanumaan aur inkar ko dikhata hai. Is mein aik lambi tail hoti hai, jo ke "shadow" ya "wick" ke tor par bhi kaha jata hai, aur aik chhota asal jism hota hai. Pin bar ki tail wo area dikhata hai jahan price ko inkar kiya gaya tha, aur iska matlb hai ke price tail ki taraf opposite direction mein chalne wala hai. Is tarah, aik bearish pin bar signal aik aesi hai jo ke aik lambi upper tail ke saath hoti hai, jo ke uchay prices ko inkar karta hai jiska matlb hai ke price qareebi waqt mein giray ga, jabke aik bullish pin bar signal mein aik lambi lower tail hoti hai, jo ke neechay ke prices ko inkar karta hai jiska matlb hai ke price qareebi waqt mein barh jaye ga.

Pin bars ko mukhtalif tareeqon mein trade kiya ja sakta hai, jaise ke market par dakhil ho, pin bar ka 50% retrace par dakhil ho ya phir ek on-stop dakhil par jo pin bar ke low ke neeche ya high ke oopar rakha gaya ho. Behtareen pin bars taqreeban strong trends ke baad ya trend ke andar support ya resistance ke retrace se ya phir ek kisi important chart level se aate hain.

Pin bars price ke qareebi aur kabhi kabhi lambay arsay tak ki direction ko paish karte hain (turning points) market mein. Ye aam tor par har financial markets mein nazar aate hain, khaas tor par jo zyada volatile hotay hain, jaise ke forex, cryptocurrencies, aur stocks.

Pin bars ko trade karte waqt, sahi financial instrument ka intikhab karna aur risk ko efektiv taur par manage karne ke liye online trading platform ko samajhna ahem hai. Pin bar trading rules pin bar formation ko aik reversal setup ke tor par istemal karte hain, jahan dakhil hone ki mumkinatain shamil hain jaise ke market entry ya stop entry. Yaad rakna zaroori hai ke aik sell stop order ab waqtanumaan qeemat ke neeche, jo ke spread ko shamil karta hai, aur aik buy stop order waqtanumaan qeemat ke oopar, jo ke spread ko shamil karta hai, hona chahiye.

Pin bars forex traders ke liye aik qeemti tool hain, jo market ke reversals aur continuations ke potential mein izafa karte hain. Pin bar trading ke bunyadi tareeqon ko samajhne aur mojooda trading strategies ko istemal karne se traders apni munafa ko barha sakte hain aur apna risk kam kar sakte hain.

Pinbar aur Other Single Candlesticks mein Differences

Pin bar aur single candlestick patterns financial markets, including forex trading mein istemal hone wale ahem technical indicators hain. Halankeh dono hi pin bars aur single candlesticks ahem hain, lekin in mein kuch farq hai.

Pin bar ek khaas qisam ka candlestick pattern hai jo ek lambi wick ya shadow aur chota sa jism rakhta hai. Lambi wick ya shadow price range ko darust karti hai, jabke chota jism opening aur closing prices ko darust karta hai. Pin bars ko market mein mukhtalif reversals ke points ko pehchanne ke liye istemal kiya jata hai, aur ye bullish ya bearish ho sakte hain. Aik bullish pin bar ke paas ek lambi wick ya shadow hoti hai jo jism ke neeche hoti hai, is se yeh maloom hota hai ke market ne neeche ke prices ko test kiya hai lekin closing price ko opening price ke qareeb band kiya hai. Aik bearish pin bar ke paas ek lambi wick ya shadow hoti hai jo jism ke oopar hoti hai, is se yeh maloom hota hai ke market ne oopar ke prices ko test kiya hai lekin closing price ko opening price ke qareeb band kiya hai.

Dusri taraf, aik single candlestick bas aik single candlestick pattern hai jo bullish ya bearish ho sakta hai. Aik bullish single candlestick mein closing price opening price se zyada hoti hai, jabke aik bearish single candlestick mein closing price opening price se kam hoti hai. Single candlesticks ko market mein mukhtalif trends ko pehchanne ke liye istemal kiya jata hai, aur ye doosre technical indicators ko tasdiq ya rad karne ke liye istemal kiya ja sakta hai.

Pin bars aur single candlesticks dono hi financial markets mein istemal hone wale ahem technical indicators hain. Pin bars ko market mein reversals ke potential points ko pehchanne ke liye istemal kiya jata hai, jabke single candlesticks ko market mein trends ke potential points ko pehchanne ke liye istemal kiya jata hai. Pin bars ke paas lambi wick ya shadow aur chota jism hota hai, jabke single candlesticks bas aik single candlestick pattern hote hain.

Bullish Pin Bar Candle

Bullish pin bar candlestick, market mein bullish trend ki indication deta hai. Iski shakal choti si body aur lambi tail hoti hai, jis ki tail upper shadow ki shakal mein hoti hai. Agar market ki trend bullish hai aur bullish pin bar candlestick appear hota hai to iska matlab hai ke market ke sellers market se bahar ja rahe hain aur buyers market mein dakhil ho rahe hain. Iska istemal traders entry aur exit points ko define karne ke liye karte hain. Bullish pin bar candlestick ko identify karne ke liye traders tail ko body se kafi zyada lamba dekhenge, iski wajah se yeh candlestick pattern kafi recognizable hai. Agar Bullish pin bar candlestick kisi specific price level par appear karta hai to iski wajah se traders apni long position ko enter kar sakte hain. Iske ilawa, iski shakal aur appearance kisi specific time frame par depend karta hai, isliye traders ko iski shakal aur appearance ki sahi tarah se samajhna zaroori hai.

Bearish Pin Bar Candle

Bearish pin bar candlestick, market mein bearish trend ki indication deta hai. Iski shakal bhi bullish pin bar candlestick ki tarah hoti hai, jis mein choti si body aur lambi tail hoti hai, lekin iski tail lower shadow ki shakal mein hoti hai. Agar market ki trend bearish hai aur bearish pin bar candlestick appear hota hai to iska matlab hai ke market ke buyers market se bahar ja rahe hain aur sellers market mein dakhil ho rahe hain. Iska istemal traders entry aur exit points ko define karne ke liye karte hain. Bearish pin bar candlestick ko identify karne ke liye traders tail ko body se kafi zyada lamba dekhenge, iski wajah se yeh candlestick pattern kafi recognizable hai. Agar bearish pin bar candlestick kisi specific price level par appear karta hai to iski wajah se traders apni short position ko enter kar sakte hain. Iske ilawa, iski shakal aur appearance kisi specific time frame par depend karta hai, isliye traders ko iski shakal aur appearance ki sahi tarah se samajhna zaroori hai.

Trading

Pin bar candle trading techniques technical analysis mein kafi popular hain. Yeh techniques traders ko market ki trend ki indication dene ke sath sath, entry aur exit points ko define karne mein madad dete hain. Agar traders is technique ko sahi se samajh lete hain to woh apni trading decisions ko improve kar sakte hain.

Pin bar candle trading techniques ko use karne ke liye traders ko pin bar candlestick pattern ko recognize karna zaroori hai. Pin Bar candlestick pattern bullish aur bearish dono trend ke liye use kiya jata hai. Bullish pin bar candlestick pattern bullish trend ki indication deta hai jab ke bearish pin bar candlestick pattern bearish trend ki indication deta hai.

Pin bar candle trading techniques ko use karne ke liye traders ko apne charts par pin bar candlestick pattern ko identify karna hota hai. Agar traders ko pin bar candlestick pattern identify ho jata hai to woh apni long ya short position ko enter kar sakte hain, aur stop loss aur target price level ko set kar sakte hain.

Pin bar candle trading techniques ka use stop loss aur target price level ko set karne ke liye bhi kia jata hai. Agar traders ko yeh candlestick pattern identify ho jata hai to woh apni stop loss ko kuch pips ke andar hi set kar sakte hain aur apna target price level bhi sahi se set kar sakte hain, jis se unhein zyada profits mil sakte hain.

Agar traders pin bar candlestick pattern ko identify karte waqt inki size aur appearance ki sahi tarah se samajh lete hain to woh is technique ko sahi se use kar sakte hain. Iske ilawa, yeh technique kisi specific time frame par depend nahi karta hai, isliye traders ko iski shakal aur appearance ki sahi tarah se samajhna zaroori hai.

Traders ko pin bars ko potential entry aur exit points ka pata lagane ke liye market mein mukhtalif patterns aur contexts ko dekh kar istemal kar sakte hain. Pin bars candlestick patterns hote hain jo price action mein potential reversals ya continuations ko dikhate hain. Yahan par traders kaise pin bars ko dakhil aur kharij points ke liye istemal kar sakte hain uska tazkirah hai:- Potential Entry Points Identification:

- Breakout par Dakhil: Traders pin bar ke breakout par trade mein dakhil ho sakte hain. Aik bullish pin bar ke liye, dakhil high ke break par kiya ja sakta hai, jabke aik bearish pin bar ke liye, dakhil low ke break par kiya ja sakta hai.

- Retracement par Dakhil: Ek aur tareeqa hai ke traders pin bar banane ke baad retracement par dakhil ho. Yeh approach traders ko ek pullback ka intezar karne deta hai pehle trade mein dakhil hone se pehle.

- Contextual Analysis: Pin bar ke ird gird price action ko tajziya karna ahem hai. Pin bar ke aas-paas ke context, jaise ke mojooda trend aur key levels, behtareen dakhil point ko tay karnay mein madad gar sabit ho sakta hai.

- Potential Exit Points Identification:

- Tasdiq par Kharij: Traders ko pin bar banane ke baad aur tasdiq ke intezar par dakhil hona chahiye. Yeh tasdiq agli candlesticks se mil sakti hai jo pin bar signal ke mutabiq hotay hain.

- Maqsood Wazeh Karna: Pin bar pattern aur trade ka context ke mabainat par mazboot maqsood wazeh karna zar

- Pin Bars ke Sath Doosre Tools Ka Istemal: Pin bars ko doosre technical analysis tools ke saath istemal karna chahiye taake successful trades ke imkanat zyada ho.

- Risk Management: Sahi risk management ka amal karna zaroori hai aur sirf pin bars par trading faislon par bharosa na karna chahiye. Traders ko apne maali halaat, risk bardasht karne ki salahiyat, aur liquidity ki zarooriyat ko madde nazar rakhte hue har trade se pehle ghor se sochna chahiye.

Pin bars ko market ke context mein dhyan se analyze karke, traders potential dakhil aur kharij points ko efektiv taur par pehchan sakte hain, apni trading strategies ko behtar banate hue aur faislon ke processes ko behtar banate hue.

Pinbar Support aur Resistance Levels

Pin bars ko forex trading mein support aur resistance levels ka pata lagane ke liye istemal kiya ja sakta hai jab inhe woh jagahon par banaya gaya hai ya inke qareeban banaya gaya hai. Pin bar ek candlestick pattern hai jo market mein reversal ko dikhata hai, lambi tail ya shadow jo price ke inkar ka area dikhata hai. Jab aik pin bar support ya resistance level par banata hai ya inke qareeban banata hai, to yeh ishara deta hai ke market ne us level ko test kiya hai aur isay inkar kiya hai, jo ke market direction mein ek potential reversal ko dikhata hai.

Pin bars ko support aur resistance levels ka pata lagane ke liye traders ko chart par pehle ki gayi highs ya lows ko dekhte hue key levels of support ya resistance ko pehchanne ki zarurat hoti hai. Jab aik pin bar in levels ke qareeb banata hai ya inke qareeban banata hai, to yeh ek mazboot signal hai ke market direction mein badalne wala hai.

Traders pin bar signal ke base par market mein dakhil ho sakte hain jab pin bar khatam ho jata hai aur phir dakhil ho sakte hain. Misal ke taur par, agar aik bullish pin bar support level par banta hai, to traders jab market pin bar ke high ke upar break karta hai, to wo ek lambi position mein dakhil ho sakte hain. Mutabiq agar aik bearish pin bar resistance level par banta hai, to traders jab market pin bar ke low ke neeche break karta hai, to wo ek short position mein dakhil ho sakte hain.

Yaad rakna zaroori hai ke sab pin bars baraabar nahin hote, aur kuch zyada mojooda hotay hain. Behtareen pin bars mein lambi tails ya shadows aur chhotay asal jism hote hain, jo ke support ya resistance level par price ka mazboot inkar dikhata hai. Mazeed is baat ka khyal rakhna zaroori hai ke jo pin bars trend ke context mein bantay hain, woh un choppy ya range-bound markets mein bantay hain se zyada reliable ho sakte hain.

Pin bars forex trading mein support aur resistance levels ka pata lagane ke liye aik qeemti tool ho sakte hain. Pin bars ko support ya resistance levels ke qareeb banane wale pin bars ko dhoondh kar, traders market mein potential reversal points ko pehchan sakte hain aur in signals ke base par trades mein dakhil ho sakte hain. Halaanke, har pin bar signal ko dhan se tajziya karna aur market ke context ko ghor se dekhna zaroori hai taake yeh signal reliable ho aur kamyabi ke zyada imkanat ho sakein. - Potential Entry Points Identification:

-

#4 Collapse

Pin Bar Candlestick Pattern

Pin Bar Candlestick Pattern ek technical analysis tool hai jo traders use karte hain price action ko analyze karne ke liye. Ye pattern single candlestick se bana hota hai aur usually trend reversal ko indicate karta hai.

Definition:

Pin Bar Candlestick Pattern ek single candlestick pattern hai jo commonly reversal signals provide karta hai. Ye pattern market ke trend ke reversal ko indicate karta hai, ya phir market ke direction mein sharp change ko represent karta hai. Ismein typically ek lambi wick hoti hai jo candle ki body se bahut zyada lambi hoti hai, aur doosri taraf choti si body hoti hai.

Characteristics:- Long Wick: Pin bar mein candle ki body se comparison mein wick bohot zyada lambi hoti hai.

- Small Body: Candle ki body choti hoti hai jo ki typically opposite direction mein open aur close ke beech mein hoti hai.

- Location: Ye pattern commonly support aur resistance levels par dekha jaata hai.

- Color: Pin bar ki body ka color kabhi kabhi important hota hai, lekin reversal signal ko identify karne ke liye wick ki length aur position zyada important hoti hai.

Types:- Bullish Pin Bar: Ye pattern bearish trend ke reversal ko indicate karta hai. Ismein candle ki body neeche hoti hai aur upper wick lambi hoti hai.

- Bearish Pin Bar: Ye pattern bullish trend ke reversal ko indicate karta hai. Ismein candle ki body upar hoti hai aur lower wick lambi hoti hai.

Trading Strategy:

Pin Bar Candlestick Pattern ko trading strategy mein incorporate karne ke liye traders ye steps follow kar sakte hain:- Identify Pin Bar: Pehle traders ko pin bar pattern ko identify karna hota hai charts par.

- Confirm with Price Action: Traders ko confirm karna hota hai ke pin bar ke appearance ke saath price action kya hai, jaise ki support aur resistance levels.

- Wait for Confirmation: Traders ko pin bar ko confirm karne ke liye ek aur candlestick pattern ka wait karna hota hai jo pin bar ke opposite direction mein ho.

- Entry Point: Agar confirmatory candlestick pattern mil gaya hai, to traders entry point decide karte hain aur trade execute karte hain.

- Risk Management: Har trade ke saath risk management important hota hai, jaise stop loss aur take profit levels set karna.

Istemal aur Explanation:

Pin Bar Candlestick Pattern ko istemal karke traders market ke reversals ko anticipate karte hain. Ye pattern unhe entry aur exit points provide karta hai trading mein. Jab ek pin bar pattern form hota hai, traders ye samajhte hain ke market mein sentiment change hone wala hai aur woh apne trading strategy ko adjust karte hain. Is pattern ko samajhna aur istemal karna traders ke liye important hai kyunki isse unhe market ke potential reversals ka pata chalta hai.

Benefits:- Reversal Signals: Pin Bar Candlestick Pattern market ke reversals ko indicate karta hai, jo traders ke liye valuable information hoti hai.

- Simple to Identify: Ye pattern relatively simple hai identify karne ke liye aur iska istemal karna traders ke liye easy hota hai.

- High Probability: Agar pin bar sahi location par aur sahi context mein form hota hai, to iska probability high hota hai ki market mein reversal hone wala hai.

- Versatility: Pin bar pattern sabhi time frames aur financial instruments par istemal kiya ja sakta hai, jaise ki stocks, forex, aur commodities.

Conclusion:

Pin Bar Candlestick Pattern ek important technical analysis tool hai jo traders ko market ke reversals ko identify karne mein madad karta hai. Iske characteristics, types, trading strategy, istemal aur benefits ko samajh kar, traders apni trading decisions ko improve kar sakte hain.

-

#5 Collapse

Forex Market Mein Pinbar Candlestick Kya Hai?

Forex market mein trading karte waqt, traders ko mukhtalif candlestick patterns ka istemal karna hota hai taake market ki movement ko samjha ja sake aur trading decisions liye ja sake. Ek aham candlestick pattern jo traders ke liye useful hota hai wo hai "Pinbar".

1. Pinbar Candlestick: Introduction

Pinbar ek powerful candlestick pattern hai jo market ke reversals ko indicate karta hai. Ye traders ko price action analysis mein madad karta hai.

Pinbar, jo ki "Pinocchio Bar" ke naam se bhi jaana jaata hai, ek reversal candlestick pattern hai jo traders ko market sentiment ke changes ko detect karne mein madad karta hai. Ye pattern commonly short-term reversals ko indicate karta hai aur traders ko potential entry aur exit points provide karta hai.

Pinbar candlestick pattern ka mukhtalif components hote hain jaise ki body, tail, aur nose. In components ki understanding pinbar ko samajhne mein madadgar hoti hai.

2. Components of a Pinbar

Pinbar mein teen mukhtalif parts hote hain: body, tail, aur nose. In components ki understanding pinbar ko samajhne mein madadgar hoti hai.

Body of Pinbar

Pinbar ka body chhota hota hai aur ye price range ko represent karta hai jahan par opening aur closing prices mein difference hota hai. Agar ek bullish pinbar hai toh opening price closing price se neeche hoti hai aur agar bearish pinbar hai toh opening price closing price se upar hoti hai.

Tail of Pinbar

Pinbar ka tail body ke opposite direction mein extend hota hai aur ye indicate karta hai ke market ne ek specific direction mein movement kiya tha lekin phir wapas reverse hua. Tail ka length body ke length se bada hota hai aur ye reversal strength ko indicate karta hai. Agar tail lamba hai toh reversal ki possibility bhi zyada hoti hai.

Nose of Pinbar

Nose wo part hai jahan par opening aur closing price close to each other hoti hai. Ye ek strong reversal signal provide karta hai. Nose ke length aur shape bhi reversal strength ko indicate karta hai.

3. Types of Pinbars

Kuch mukhtalif types ke pinbars hote hain, jaise ki Bullish Pinbar, Bearish Pinbar, aur Inside Bar + Pinbar Combo.

Bullish Pinbar

Bullish Pinbar jab market mein bearish trend ke bad ek bullish reversal ko indicate karta hai. Ye pattern typically neeche wale wick ke saath ek small body aur upper wick ke saath ek long tail ke saath dikhta hai. Iska matlab hai ke sellers initially control mein hote hain lekin phir buyers market ko control karte hain.

Bearish Pinbar

Bearish Pinbar jab market mein bullish trend ke bad ek bearish reversal ko indicate karta hai. Ye pattern typically upper wick ke saath ek small body aur neeche wale wick ke saath ek long tail ke saath dikhta hai. Iska matlab hai ke buyers initially control mein hote hain lekin phir sellers market ko control karte hain.

Inside Bar + Pinbar Combo

Ye ek powerful reversal signal hai jo ek inside bar ke saath ek pinbar ko combine karta hai. Inside bar ek range-bound market ko indicate karta hai jabki pinbar ek potential reversal ko indicate karta hai. Jab ye dono patterns combine hote hain toh ye ek strong trading opportunity provide karte hain.

4. Importance of Pinbar in Forex Trading

Pinbar ko samajhna aur recognize karna kisi bhi trader ke liye zaroori hai kyunki ye ek strong reversal signal provide karta hai. Iske istemal se traders apne trading decisions ko improve kar sakte hain aur better entry aur exit points decide kar sakte hain.

5. Pinbar Trading Strategies

Pinbar ko trading strategies mein integrate karke traders apne trading decisions ko improve kar sakte hain. Kuch popular pinbar trading strategies mein include hoti hain:- Pinbar ki confirmation ke liye kisi aur technical indicator ka istemal karna, jaise ki moving averages ya RSI.

- Pinbar ke ek break ke baad entry ya exit ka wait karna taake false signals se bacha ja sake.

- Multiple timeframes ka istemal karna taake confirm kia ja sake ke pinbar ke signals strong hain ya nahi.

6. Pinbar ka Istemal Kaise Karein

Pinbar ko istemal karne ke liye traders ko market ka context aur price action ko samajhna zaroori hai. Kuch important points hain jo traders ko dhyan mein rakhna chahiye:- Pinbar ko sirf strong support aur resistance levels ke paas ya fir trendlines ke paas dekhna chahiye.

- Confirmatory indicators ka istemal karna taake pinbar ke signals ko verify kiya ja sake.

- Stop loss aur take profit levels ko define karna taake risk management kiya ja sake.

7. Conclusion

Pinbar ek important candlestick pattern hai jo traders ko market ke reversals ko identify karne mein madad deta hai aur trading decisions lene mein help karta hai. Isliye, har ek trader ko pinbar ka istemal seekhna chahiye. Pinbar ke istemal se traders apne trading accuracy ko improve kar sakte hain aur better trading results achieve kar sakte hain.

Is tarah, pinbar candlestick pattern forex trading mein ek mahatvapurna tool hai jo traders ko market ke reversals ko samajhne mein madad karta hai. Pinbar ko samajhna aur recognize karna zaroori hai taake traders apne trading strategies ko aur bhi effective bana sakein. Pinbar ke sahi istemal se traders apne trading accuracy ko improve kar sakte hain aur apne trading results ko enhance kar sakte hain.

Ek acchi trading strategy ka hona pinbar ke signals ko samajhne aur un par amal karne mein madad karta hai. Pinbar ke signals ko confirm karne ke liye traders ko dusre technical indicators ka bhi istemal karna chahiye aur stop loss aur take profit levels ko define karna chahiye taake risk management kiya ja sake.

Pinbar ke alawa bhi kai aur candlestick patterns hote hain jo traders ke liye useful hote hain, lekin pinbar ki simplicity aur effectiveness ise ek popular choice banati hai. Traders ko pinbar ke signals ko samajhne ka practice karna chahiye taake wo market ke movements ko better understand kar sakein aur successful trading decisions le sakein.

Ant mein, pinbar candlestick pattern ek powerful tool hai jo traders ko market ke reversals ko identify karne mein madad karta hai. Iske sahi istemal se traders apne trading strategies ko aur bhi effective bana sakte hain aur consistent profits generate kar sakte hain.

Pinbar ke istemal mein consistency aur patience ka hona bhi zaroori hai. Market mein har waqt pinbar signals available nahi hote hain, isliye traders ko sabar se wait karna padta hai jab tak ek strong pinbar setup na mil jaye.

Market conditions aur context ko samajhna bhi pinbar trading mein crucial hai. Kabhi kabhi market volatility ya news events ki wajah se pinbar signals false ho sakte hain, isliye traders ko market ki overall situation ko bhi dhyan mein rakhna chahiye.

Pinbar ke signals ko validate karne ke liye dusre technical analysis tools ka bhi istemal kiya ja sakta hai. Moving averages, trendlines, ya price patterns jaise tools pinbar signals ko confirm karne mein madadgar ho sakte hain.

Iske alawa, traders ko apne risk management ke principles ko bhi follow karna chahiye. Har trade mein appropriate stop loss aur take profit levels set karna aur risk-reward ratio ka dhyan rakhna zaroori hai.

Overall, pinbar candlestick pattern ek powerful aur versatile tool hai jo traders ko market ke reversals ko identify karne mein madad karta hai. Lekin, iska istemal karne se pehle traders ko pinbar pattern ko samajhna, uske components ko recognize karna, aur sahi context mein uska istemal karna sikha hona chahiye. Jaise jaise traders pinbar pattern ko better samajhte hain, unki trading accuracy aur profitability bhi improve hoti hai. -

#6 Collapse

Pinbar candlestick, ya jo hum urdu mein pinbar mumtazah sham'aa kehtay hain, forex market mein aik ahem technical analysis tool hai jo traders ko market ke trend aur price action ka andaza lagane mein madad deta hai. Yeh candlestick pattern charting techniques mein istemal hota hai aur traders ke liye ahem indicators mein shumar hota hai. Pinbar candlestick ko dekh kar traders ko market ke future direction ka idea mil sakta hai.

Pinbar candlestick ko identify karne ke liye, traders ko chart par aik specific pattern dhoondna hota hai jo doosri candles ke muqablay mein aik lambi tail ya shadow aur choti body wali candle ke sath aata hai. Is tarah ke pattern ko 'pinbar' ya 'hammer' bhi kaha jata hai. Pinbar candlestick bullish aur bearish trend dono ki indications de sakta hai, lekin iska interpretation context aur surrounding market conditions par depend karta hai.

Pinbar candlestick ke mukhtalif components ko samajhne ke liye, yeh zaroori hai ke hum kuch ahem key notes par ghoor karen:- Tail (Shadow): Pinbar candlestick ka sab se ahem hissa tail ya shadow hota hai. Tail candle ke body se ooncha ya neecha hota hai aur iska lambai traders ke liye ahem hai. Lambi tail bullish ya bearish reversal ka indication de sakti hai.

- Body: Pinbar candlestick ka body chota hota hai aur tail ke darmiyan paya jata hai. Iski size relative hoti hai aur doosri candles ke muqablay mein choti hoti hai. Body ki color bhi important hoti hai, kyun ke green body bullish trend aur red body bearish trend indicate kar sakti hai.

- Location: Pinbar candlestick ka location bhi ahem hai. Agar yeh kisi strong support ya resistance level ke qareeb paya jaye, to iska interpretation aur ziada significant hota hai. Isi tarah, agar pinbar kisi trend line ke qareeb paya jaye, to iska interpretation aur important ho sakta hai.

- Context: Pinbar candlestick ka interpretation surrounding market conditions aur context par depend karta hai. Agar pinbar kisi strong trend ke against paya jaye, to yeh reversal ka indication ho sakta hai. Lekin agar market choppy hai ya consolidation phase mein hai, to pinbar ka interpretation mushkil ho sakta hai.

- Confirmation: Pinbar candlestick ko sirf ek indicator ke tor par istemal nahi kiya jata. Traders ko isko confirm karne ke liye doosre technical indicators aur price action analysis bhi istemal karna chahiye. Misal ke tor par, pinbar ke bad ek confirmatory candlestick pattern ya momentum indicators ka istemal kiya ja sakta hai.

- Risk Management: Pinbar candlestick ka istemal karne se pehle, traders ko apni risk management strategy ko bhi mad e nazar rakhna chahiye. Stop loss aur take profit levels ko set karna zaroori hai taki agar trade ulta chal jaye to nuksan se bacha ja sake.

- Practice and Experience: Pinbar candlestick ko sahi se interpret karne ke liye practice aur experience ki zaroorat hoti hai. New traders ko sabar aur mehnat se kaam lena chahiye taki woh is technical analysis tool ko behtar taur par samajh sakein.

Pinbar candlestick forex trading mein ek powerful tool hai jo traders ko market ke trend aur price action ka andaza lagane mein madad deta hai. Lekin, isko sahi taur par interpret karne ke liye, traders ko market conditions ko samajhna aur doosre technical analysis tools ka istemal karna zaroori hai. Iske ilawa, risk management ko bhi ahem tor par mad e nazar rakhna zaroori hai taake trading mein nuksan se bacha ja sake.

-

#7 Collapse

Forex Market Mein Pinbar Candlestick:>:>:>:

Pinbar candlestick typically ek long upper ya lower wick ke saath aata hai aur ek chhota body hota hai. Ye body upper wick aur lower wick ke beech mein hoti hai. Agar pinbar ki upper wick lambi hoti hai, to iska matlab hai ki price ne ek certain level pe upar gaya aur phir wapas niche aaya hai.

Forex Market Mein Pinbar Candlestick:>:>:>:

Pinbar candlesticks ko samajhne ke liye kuch aur important points hain:- Long Wick: Pinbar candlestick ki sabse prominent feature long upper ya lower wick hoti hai, jo indicate karta hai ki price ne ek certain level pe jaane ki koshish ki thi, lekin phir wapas reverse ho gaya.

- Small Body: Pinbar candlestick ke body chhota hota hai, jo indicate karta hai ki price movement bahut kam tha aur buyers aur sellers ke beech mein kafi struggle tha.

- Location: Pinbar candlesticks ki significance location pe depend karti hai. Agar pinbar ek major support ya resistance level ke near form hota hai, to uska significance aur zyada hota hai.

- Confirmation: Pinbar candlestick ko sirf ek candlestick pattern ke roop mein dekhna chahiye, balki iske sath confirmation signals bhi dekhe jaate hain jaise ki next candlestick ka behavior, volume analysis, aur dusre technical indicators ka istemal.

- Different Types: Pinbar candlesticks ke kai prakar hote hain, jaise ki bullish pinbar (jis mein long lower wick hoti hai), bearish pinbar (jis mein long upper wick hoti hai), aur doji pinbar (jis mein upper aur lower wick barabar hote hain).

- Risk Management: Pinbar candlesticks ko trading mein istemal karte samay, risk management ka dhyan rakhna zaroori hai. Stop loss placement aur position sizing ko dhyan mein rakhte hue trade karna chahiye.

-

#8 Collapse

What is Pinbar Candlestick in the Forex market

Pinbar, ya Pinocchio bar, ek ahem candlestick pattern hai jo traders ko potential price reversal ke signals provide karta hai. Ye pattern ek single candlestick se bana hota hai aur market ke sentiment ko indicate karta hai. Chaliye, hum pinbar candlestick ke bullish aur bearish versions ke tafseelat par ghour karte hain:

1. Pinbar Ki Pehchan:- Bullish Pinbar: Bullish pinbar candlestick pattern mein, candlestick ki body chhoti hoti hai aur uski tail (lower shadow) lambi hoti hai. Bullish pinbar ko isliye "bullish" kaha jata hai kyunki iska formation downtrend ke baad hota hai aur ye bullish reversal ka signal provide karta hai. Is pattern mein, price initially niche girta hai lekin phir upward movement hota hai aur candlestick ka closing price opening price se oopar hota hai.

- Bearish Pinbar: Bearish pinbar candlestick pattern mein, candlestick ki body bhi chhoti hoti hai lekin iska tail (upper shadow) lambi hoti hai. Bearish pinbar ko isliye "bearish" kaha jata hai kyunki iska formation uptrend ke baad hota hai aur ye bearish reversal ka signal provide karta hai. Is pattern mein, price initially upar jaata hai lekin phir downward movement hota hai aur candlestick ka closing price opening price se neeche hota hai.

2. Bullish Pinbar Ke Characteristics:- Chhoti Body: Bullish pinbar mein candlestick ki body chhoti hoti hai, jo indicate karta hai ke buyers aur sellers ke darmiyan ke balance ka shift hone laga hai.

- Lambi Tail (Lower Shadow): Bullish pinbar mein lambi tail (lower shadow) hoti hai, jo indicate karta hai ke price initially niche gaya tha lekin phir buyers ne control le liya aur price ko upar le gaya.

3. Bearish Pinbar Ke Characteristics:- Chhoti Body: Bearish pinbar mein bhi candlestick ki body chhoti hoti hai, jo indicate karta hai ke buyers aur sellers ke darmiyan ke balance ka shift hone laga hai.

- Lambi Tail (Upper Shadow): Bearish pinbar mein lambi tail (upper shadow) hoti hai, jo indicate karta hai ke price initially upar gaya tha lekin phir sellers ne control le liya aur price ko neeche le gaya.

4. Trading Strategies:- Bullish Pinbar Trading Strategy: Agar bullish pinbar formation downtrend ke baad dekha jata hai, to traders long positions le sakte hain. Entry point candlestick ka high aur stop loss candlestick ka low par set kiya ja sakta hai. Take profit level ko resistance level ke paas rakha ja sakta hai.

- Bearish Pinbar Trading Strategy: Agar bearish pinbar formation uptrend ke baad dekha jata hai, to traders short positions le sakte hain. Entry point candlestick ka low aur stop loss candlestick ka high par set kiya ja sakta hai. Take profit level ko support level ke paas rakha ja sakta hai.

Pinbar candlestick pattern ek powerful tool hai jo traders ko price reversal ke potential signals provide karta hai. Zaroori hai ke traders is pattern ko samajh kar sahi tareeqe se istemal karein aur dusri technical indicators aur price action analysis ke saath mila kar trading decisions lein.

-

#9 Collapse

What is Pinbar Candlestick in the Forex market?

**Forex Market Mein Pinbar Candlestick: Roman Urdu**

Pinbar candlestick forex market mein ek ahem technical analysis tool hai jo traders ko potential trend reversals aur market sentiment ka pata lagane mein madad deta hai. Chaliye is mudday ko Roman Urdu mein tafseel se samajhte hain, mukhtalif headings ke zariye.

**1. Pinbar Candlestick Ki Tareef**

Pinbar candlestick ek single candlestick pattern hai jo price chart par nazar aata hai. Iski khasiyat hoti hai ek lambi tail (ya shadow) aur choti body, jo market sentiment ka reversal indicate karti hai.

**2. Pinbar Candlestick Ka Pehchan**

Pinbar candlestick ko pehchanne ke liye traders ek candle par dhyan dete hain jo lambi tail ke saath ek choti body ke saath hota hai. Tail ki taraf price movement, yaani upper tail bearish pinbar mein aur lower tail bullish pinbar mein hoti hai.

**3. Bullish Aur Bearish Pinbar**

Bullish pinbar ek candle hai jismein price initially neeche girte hue bad mein upar uth kar close hota hai, jabke bearish pinbar mein price initially upar jata hai lekin bad mein neeche gir kar close hota hai.

**4. Pinbar Ka Matlab**

Pinbar candlestick ka matlab hota hai ke market mein trend reversal ya price rejection hone ki sambhavna hai. Agar bullish pinbar downtrend ke baad appear hota hai, toh yeh bullish reversal ka sign hai, aur agar bearish pinbar uptrend ke baad appear hota hai, toh yeh bearish reversal ka sign hai.

**5. Pinbar Ka Istemal**

Pinbar candlestick ko confirm karne ke liye, traders doosre technical indicators aur price action ko bhi dekhte hain. Agar pinbar ko doosri confirmatory signals ke saath dekha jata hai, toh iski validity aur reliability barh jati hai.

**6. Pinbar Ki Tafteesh**

Pinbar candlestick ko tafteesh karne ke liye, traders candlestick patterns aur price action analysis ka istemal karte hain. Isse unhe market ke sentiment aur potential trend reversals ka pata lagta hai.

**7. Pinbar Aur Trading Strategies**

Pinbar candlestick ko apni trading strategies mein shamil karke, traders apne entry aur exit points ko improve kar sakte hain. Iske istemal se woh market ke movements ko behtar samajh sakte hain aur trading performance ko enhance kar sakte hain.

**8. Pinbar Aur Risk Management**

Pinbar candlestick ke istemal mein, risk management ka ahem kirdar hota hai. Traders ko apne stop-loss orders aur position sizes ko adjust karke apne risk ko manage karna zaroori hota hai.

**Akhri Alfaaz**

Pinbar candlestick forex market mein trend reversal aur price rejection ko detect karne mein madadgar hai. Iski samajh aur istemal se traders apni trading decisions ko improve kar sakte hain aur market ke movements ko behtar taur par anticipate kar sakte hain.

-

#10 Collapse

What is Pinbar Candlestick in the Forex market

Pinbar Candlestick, Forex market mein ek common aur powerful reversal signal hai jo traders ke liye useful hota hai. Pinbar Candlestick, apne unique shape aur structure ke liye mashhoor hai aur bullish ya bearish reversals ko indicate kar sakta hai.

Pinbar Candlestick ek single candlestick pattern hota hai jo typically doosri candles ke comparison mein zyada prominent hota hai. Iska shape ek small body ke saath ek lambi shadow (wick) hoti hai, jo price ki ek sharp reversal ko represent karta hai.

Pinbar Candlestick ke kuch key characteristics hain:- Small Body: Pinbar Candlestick ki body chhoti hoti hai, jo indicate karta hai ke price movement kam hua hai ya price mein confusion hai.

- Long Upper or Lower Shadow (Wick): Pinbar Candlestick mein ek ya doosri taraf lambi shadow (wick) hoti hai, jo indicate karta hai ke price ne ek direction mein jaane ki koshish ki, lekin phir reversal hua.

- Reversal Signal: Pinbar Candlestick bullish ya bearish trend ke against ek reversal signal provide karta hai. Agar pinbar bullish trend ke baad form hota hai, to yeh bearish reversal signal hai aur agar bearish trend ke baad form hota hai, to yeh bullish reversal signal hai.

Pinbar Candlestick ko interpret karne ka tareeqa:- Bullish Pinbar: Agar pinbar candlestick ke bottom mein lambi lower shadow (wick) hai aur chhoti upper shadow hai, to yeh bullish pinbar hai. Yeh bullish reversal ko indicate karta hai, khaaskar agar iske baad price upward move karta hai.

- Bearish Pinbar: Agar pinbar candlestick ke top mein lambi upper shadow (wick) hai aur chhoti lower shadow hai, to yeh bearish pinbar hai. Yeh bearish reversal ko indicate karta hai, khaaskar agar iske baad price downward move karta hai.

Traders pinbar candlestick ko dekhte hain taake potential reversals ko identify kar sakein aur trading decisions banayein. Yeh ek mukhtasir aur effective technical analysis tool hai jo market ke price action ko samajhne mein madad karta hai.

-

#11 Collapse

What is Pin bar candlestick pattern in forex trading.

Pin bar candlestick pattern ek prasiddh price action pattern hai jo forex trading mein istemal hota hai. Yeh ek single candlestick se milta hai jo ek chhota sharir aur ek lamba wick ya shadow ek taraf se rakhta hai. Chhota sharir ek chhote price range ko darshata hai jismein open aur close ke beech mein kam farak hota hai, jabki lamba wick darshata hai ki trading avadhi mein mahatvapurna price rejection ya reversal hua hai. Traders aksar pin bar ko ek sambhavna reversal signal ke roop mein vyakhya karte hain, vishesh roop se jab yeh kisi mahatvapurna support ya resistance ke star par banta hai.

Analysis of pin bar candlestick pattern in forex trading.

Pin bar candlestick pattern ka analysis forex trading mein mahatvapurna hota hai aur traders iska istemal market reversals ka pata lagane ke liye karte hain. Pin bar ek single candlestick pattern hai jo ek chhota sharir aur ek lambi wick ya shadow ke saath hota hai. Chhota sharir kam price range ko darshata hai, jismein open aur close ke beech mein kam farak hota hai, jabki lambi wick price rejection ya reversal ko darshata hai. Jab pin bar mahatvapurna support ya resistance ke pass ya ek trend ke ant mein banata hai, tab yeh ek sambhavna reversal signal ke roop mein dekha jata hai. Agar ek bullish pin bar support level par banata hai, to yeh bullish reversal ki sambhavna ko darshata hai aur traders long positions mein pravesh kar sakte hain. Vahi agar ek bearish pin bar resistance level par banata hai, to yeh bearish reversal ki sambhavna ko darshata hai aur traders short positions mein pravesh kar sakte hain. Halaanki, pin bar strategy ka safal istemal market ke context, anya technical indicators ke saath sahayakata, aur aage ki price action se confirmation ke saath kiya jana chahiye. Yah ek vyapak trading strategy ka hissa hona chahiye aur traders ko pin bar ke signals par nirdeshit nahin hona chahiye, balki ek vyapak trading plan ke saath iska istemal karna chahiye.

Trading strategy with pin bar candlestick pattern in forex trading.

Pin bar candlestick pattern ek popular price action signal hai jo traders ko potential trend reversals ya continuations ke liye point karta hai. Jab ek pin bar candlestick form hoti hai, ye typically ek strong rejection signal deta hai. Agar pin bar candlestick pattern ko sahi tareeke se interpret kiya jaye, toh ye traders ko high probability trades ke liye opportunities provide kar sakta hai.

Ek typical bullish pin bar candlestick pattern mein, price ek downtrend ke baad ek long wick ke saath niche jaata hai, jisse indicate hota hai ki sellers initially control mein the, lekin phir price recover karke close near the high of the candle kar leta hai. Is situation mein, traders long position enter kar sakte hain, with a stop-loss order below the low of the pin bar candlestick. Target level usually previous resistance level ya trend line ke near hota hai.

Ek typical bearish pin bar candlestick pattern mein, price ek uptrend ke baad ek long wick ke saath upar jaata hai, jisse indicate hota hai ki buyers initially control mein the, lekin phir price decline karke close near the low of the candle kar leta hai. Is situation mein, traders short position enter kar sakte hain, with a stop-loss order above the high of the pin bar candlestick. Target level usually previous support level ya trend line ke near hota hai.

Traders ko pin bar candlestick pattern ko confirm karne ke liye volume aur price action ke signals ko bhi dekhna chahiye. Overall, pin bar candlestick pattern ek powerful tool hai jo traders ko potential reversals ya continuations ka indication deta hai, lekin saath hi saath proper risk management aur confirmation ke saath iska istemal zaroori hai.

example:

- CL

- Mentions 0

-

سا0 like

-

#12 Collapse

Forex Market Mein Pinbar Candlestick:

Pinbar candlestick ek ahem technical analysis tool hai jo forex market mein price action ko samajhne aur potential reversals ya trend continuations ko identify karne mein madad karta hai. Is article mein hum pinbar candlestick ke roman Urdu mein tafseeli jaiza karenge, jismein hum pinbar candlestick ka tareeqa e kaam, alamaat, aur trading strategies ko explore karenge.

1. Pinbar Candlestick Kya Hai?

Pinbar candlestick ek single candlestick pattern hai jo typically reversal signals ko represent karta hai. Is pattern mein candle ki body chhoti hoti hai aur wick (ya shadow) lambi hoti hai, jisse ek pin jaisa appearance milta hai. Pinbar candlestick bullish aur bearish formations mein dekha ja sakta hai.

2. Pinbar Candlestick Ke Mukhtalif Parts:- Upper Wick (Ya Upper Shadow): Upper wick candle ki upper side ki lambi line ko represent karta hai. Yeh price ka high level indicate karta hai.

- Lower Wick (Ya Lower Shadow): Lower wick candle ki lower side ki lambi line ko represent karta hai. Yeh price ka low level indicate karta hai.

- Body: Candle ka body woh area hai jo opening price aur closing price ke darmiyan hota hai. Agar candle bullish hai, to body typically upper side mein hoti hai, aur agar bearish hai, to body typically lower side mein hoti hai.

3. Pinbar Candlestick Ki Alamaat:

Pinbar candlestick ko pehchanne ke liye kuch ahem alamaat hain:- Long Wick: Pinbar candlestick ka sabse ahem feature long wicks hote hain, jo candle ki body se bahar extend hote hain.

- Small Body: Candle ki body chhoti hoti hai aur wicks se chhoti hoti hai.

- Location: Pinbar candlestick ko support aur resistance levels par dekha jata hai, aur price ke opposite direction mein develop hota hai.

- Previous Price Action: Agar pinbar candlestick previous price action ke against develop hota hai, to ye reversal signal ko confirm karta hai.

4. Pinbar Candlestick Ki Types:- Bullish Pinbar: Bullish pinbar candlestick bearish trend ke doran develop hota hai aur potential bullish reversal ko indicate karta hai. Ismein candle ka body candle ki lower side par hota hai aur upper wick candle ki upper side par extend hoti hai.

- Bearish Pinbar: Bearish pinbar candlestick bullish trend ke doran develop hota hai aur potential bearish reversal ko indicate karta hai. Ismein candle ka body candle ki upper side par hota hai aur lower wick candle ki lower side par extend hoti hai.

5. Pinbar Candlestick Ka Istemal:

Pinbar candlestick ka istemal kar ke traders market ke potential reversals ko identify karte hain aur trading decisions lete hain. Kuch common strategies pinbar candlestick ka istemal ke hain:- Reversal Trading: Pinbar candlestick ko reversal trading strategy mein istemal kiya jata hai jahan traders trend reversals ko anticipate karte hain aur opposite direction mein trading karte hain.

- Support aur Resistance Levels: Pinbar candlestick ko support aur resistance levels ke qareeb dekha jata hai, aur iske istemal se traders ko support aur resistance levels ko confirm karne mein madad milti hai.

6. Pinbar Candlestick Ke Masail:- False Signals: Kabhi kabhi pinbar candlestick false signals generate kar sakta hai, jis se traders ko nuqsan ho sakta hai.

- Confirmation: Pinbar candlestick signals ko doosre technical indicators aur price action ke saath confirm kiya jana zaroori hai takay false signals ka khatra kam ho.

Pinbar candlestick ek powerful tool hai jo forex traders ko market ke potential reversals aur trend continuations ke signals provide karta hai. Is pattern ko samajhna aur sahi tareeqe se istemal karna traders ke liye ahem hai, magar jese har trading tool ki tarah, pinbar candlestick ka bhi apna limitations aur challenges hota hai, aur traders ko iska istemal karne se pehle uske implications aur masail ka tajziya karna zaroori hai.

- CL

- Mentions 0

-

سا0 like

-

#13 Collapse

Pinbar Candlestick: Forex Market Mein Ek Ahem Technical Analysis Tool

Forex trading mein, pinbar candlestick ek ahem technical analysis tool hai jo market trends ko samajhne aur trading opportunities ko identify karne mein madad karta hai. Is article mein, hum pinbar candlestick ke roman Urdu mein tafseel se jaiza karenge, iske maqsad aur characteristics ko samjheinge, aur iska trading mein istemal ke tareeqay ko explore karenge.

1. Pinbar Candlestick Kya Hai?

Pinbar candlestick ek single candlestick pattern hai jo market ke price action ko represent karta hai. Ye pattern typically reversal ya continuation signals provide karta hai, aur traders ise market ke potential turning points ko identify karne ke liye istemal karte hain. Pinbar candlestick ko dekh kar, traders ko market ke sentiment aur price direction ka idea milta hai.

2. Pinbar Candlestick Ke Khasiyat:- Long Wick: Pinbar candlestick ka sab se prominent feature uski long wick hai jo body se bahar extend hoti hai. Ye wick price ka extreme level represent karta hai aur market ke sentiment ko indicate karta hai.

- Small Body: Pinbar candlestick ka body typically chhota hota hai, aur iska open aur close price body ke darmiyan hota hai.

- Opposite Wick: Pinbar candlestick mein body ke opposite side par ek lambi wick hoti hai, jo price ka extreme level ko indicate karta hai.

3. Bullish Pinbar aur Bearish Pinbar:- Bullish Pinbar: Bullish pinbar candlestick pattern jab market ke neeche se upper direction mein dekha jata hai. Ismein price initially neeche jaata hai lekin phir rebound kar ke upper side par close karta hai. Ye bullish reversal ka indication ho sakta hai.

- Bearish Pinbar: Bearish pinbar candlestick pattern jab market ke upper direction se neeche dekha jata hai. Ismein price initially upper jaata hai lekin phir rebound kar ke neeche side par close karta hai. Ye bearish reversal ka indication ho sakta hai.

4. Pinbar Candlestick Ka Istemal:- Reversal Signals: Pinbar candlestick patterns reversal signals provide karta hai. Agar bullish pinbar downtrend ke baad dekha jata hai, to ye bullish reversal ka indication ho sakta hai, aur agar bearish pinbar uptrend ke baad dekha jata hai, to ye bearish reversal ka indication ho sakta hai.

- Entry aur Exit Points: Traders pinbar candlestick ko dekh kar entry aur exit points tay karte hain. Agar bullish pinbar dekha jata hai, to traders long positions le sakte hain, aur agar bearish pinbar dekha jata hai, to traders short positions le sakte hain.

5. Pinbar Candlestick Trading Strategies:- Confirmation ke Sath Entry: Traders pinbar candlestick ko confirm karne ke liye doosre indicators ya price action ka istemal karte hain. Agar pinbar ke sath doosre signals bhi match karte hain, to ye trading decision ko aur strong banata hai.

- Risk aur Reward Ratio: Traders apne positions ke liye appropriate risk aur reward ratio tay karte hain. Stop loss aur target levels ko pinbar ke location aur market conditions ke hisab se adjust kiya jata hai.

Pinbar candlestick forex trading mein ek powerful technical analysis tool hai jo traders ko market ke potential turning points ko identify karne mein madad karta hai. Is pattern ko samajh kar aur sahi tareeqe se istemal kar ke, traders market ke movements ko predict kar sakte hain aur profits earn kar sakte hain. Magar, pinbar candlestick ka istemal karne se pehle, traders ko market ke complexities aur risks ka tajziya karna zaroori hai aur sahi risk management ke sath trading decisions lena chahiye.

-

#14 Collapse

Aslamo alaikum Dosto

Forex Market Mein Pinbar Candlestick Kya Hai

Forex market mein trading karte waqt, traders ko mukhtalif tarah ke technical analysis tools aur indicators ka istemal karna hota hai taake woh sahi trading decisions le sakein. Ek aham technical analysis tool jo traders istemal karte hain, woh hai candlestick patterns. In patterns mein se ek popular aur useful pattern hai "Pinbar candlestick". Is article mein hum Pinbar candlestick ke bare mein mukhtasir taur par baat karenge.

Pinbar Candlestick Kya Hai?

Pinbar candlestick, jise pin bar ya pinocchio bar bhi kaha jata hai, ek single candlestick pattern hai jo market trend ko identify karne aur reversals ko anticipate karne ke liye istemal hota hai. Pinbar candlestick ek lamba tail (ya shadow) aur chhota body ke saath hota hai. Iski body ke dono ends tail se bahar nikalte hain.

Pinbar Ki Types

Pinbar candlesticks do prakar ki hoti hain:- Bullish Pinbar: Bullish pinbar pattern jab market mein bearish trend ke baad hoti hai aur price mein reversal hone ki possibility hoti hai. Ismein candle ki body niche ki taraf hoti hai aur lamba tail upper side mein extend hota hai.

- Bearish Pinbar: Bearish pinbar pattern jab market mein bullish trend ke baad hoti hai aur price mein reversal hone ki possibility hoti hai. Ismein candle ki body upper side mein hoti hai aur lamba tail niche ki taraf extend hota hai.

Pinbar Candlestick Ka Istemal

Pinbar candlestick ka istemal market trends aur reversals ko identify karne ke liye hota hai. Jab traders pinbar ko dekhte hain, toh woh market sentiment ko samajhte hain aur future price movements ka idea lete hain. Agar pinbar bullish trend ke baad aati hai, toh yeh bullish reversal ki indication ho sakti hai aur agar bearish trend ke baad aati hai, toh yeh bearish reversal ki indication ho sakti hai.

Pinbar Candlestick Ka Istemal Kaise Karein?

Pinbar candlestick ka istemal karne ke liye, traders ko kuch points ka dhyan rakhna zaroori hai:- Confirmation: Pinbar ki validity ke liye, traders ko confirmation ki zaroorat hoti hai. Yeh confirmation doosre technical indicators aur price action patterns ke saath mil kar aati hai.

- Volume Analysis: Pinbar candlestick ki validity ko confirm karne ke liye, traders ko volume analysis bhi karna chahiye. Agar pinbar high volume ke saath aati hai, toh uski validity aur zyada hoti hai.

- Risk Management: Pinbar ko sirf ek indicator ki tarah istemal karna chahiye aur ispar puri tarah rely nahi karna chahiye. Traders ko risk management aur stop-loss orders ka istemal karna chahiye.

- Practice and Experience: Pinbar candlestick patterns ko samajhne aur sahi taur par istemal karne ke liye, traders ko practice aur experience ki zaroorat hoti hai.

Conclusion

Pinbar candlestick, forex market mein trading ke liye ek ahem technical analysis tool hai jo market trends aur reversals ko identify karne mein madad karta hai. Iska sahi istemal karke traders apne trading decisions ko improve kar sakte hain. Lekin, pinbar ko sirf ek indicator ki tarah istemal kiya jana chahiye aur ispar puri tarah rely nahi karna chahiye. Trading mein success paane ke liye, traders ko market ko samajhne aur proper risk management ka istemal karna zaroori hai. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 Collapse

Pinbar Candlestick in Forex Market:

Forex market mein pinbar candlestick ek ahem technical analysis tool hai jo traders ko potential reversals aur trend changes ke signals provide karta hai. Ye candlestick pattern ek single candle se bana hota hai aur market sentiment ko indicate karta hai. Is article mein, hum pinbar candlestick ke roman Urdu mein tafseel se jaiza karenge, uske characteristics, types, aur trading strategies ko explore karenge.

1. Pinbar Candlestick Kya Hai?- Pinbar candlestick ek single candlestick pattern hai jo price chart par dekha ja sakta hai. Ye candlestick typically short-term reversals ya trend changes ko indicate karta hai.

- Pinbar candlestick ko "Pinocchio bar" ya "Pin bar" bhi kaha jata hai, kyunke ye candlestick ek lambi tail ya shadow ke saath ek chhoti body ke sath hota hai, jaise Pinocchio ki nose.

2. Pinbar Candlestick Ke Khasiyat:- Long Tail or Shadow: Pinbar candlestick ka sabse prominent feature uski lambi tail ya shadow hoti hai jo candle ki body se bahar extend hoti hai. Ye tail ya shadow price ke sudden reversal ya rejection ko indicate karta hai.

- Small Body: Pinbar candlestick ki body chhoti hoti hai aur usually range ke darmiyan hoti hai. Iska matlab hai ke opening aur closing prices kafi close hote hain.

- Location: Pinbar candlestick typically key support ya resistance levels par form hota hai, indicating ke market ke sentiment mein sudden change ho raha hai.

3. Pinbar Candlestick Ke Types:- Bullish Pinbar: Bullish pinbar candlestick ek downtrend ke doran form hota hai aur ye bullish reversal ka indication deta hai. Isme candle ki tail ya shadow neeche ki taraf extend hoti hai aur body upper side mein hoti hai.

- Bearish Pinbar: Bearish pinbar candlestick ek uptrend ke doran form hota hai aur ye bearish reversal ka indication deta hai. Isme candle ki tail ya shadow upper side mein extend hoti hai aur body neeche ki taraf hoti hai.

4. Pinbar Candlestick Trading Strategies:- Reversal Confirmation: Pinbar candlestick ka istemal trend reversals ko confirm karne ke liye kiya jata hai. Agar bullish pinbar downtrend ke baad form hota hai, to ye bullish reversal ka indication hai. Agar bearish pinbar uptrend ke baad form hota hai, to ye bearish reversal ka indication hai.

- Entry Points: Pinbar candlestick ko dekh kar traders entry points tay karte hain. Agar bullish pinbar form hota hai, to traders long positions le sakte hain, jabke agar bearish pinbar form hota hai, to traders short positions le sakte hain.

5. Pinbar Candlestick Ka Istemal:- Stop Loss aur Target Levels: Traders apne positions ke liye stop loss aur target levels tay karte hain. Stop loss typically pinbar ke opposite side par rakha jata hai, jabke target levels previous trend ke continuation ke hisab se tay kiye jate hain.

Pinbar candlestick forex trading mein ahem technical analysis tool hai jo traders ko potential reversals aur trend changes ke signals provide karta hai. Is candlestick pattern ko samajh kar aur sahi tareeqe se istemal karke, traders market ke movements ko predict kar sakte hain aur profitable trades kar sakte hain. Magar, traders ko bhi yaad rakhna chahiye ke har trading strategy ka apna risk aur rewards hota hai, aur market ke complexities ko samajh kar sahi tareeqe se trading decisions lena zaroori hai.

- CL

- Mentions 0

-

سا0 like

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 09:33 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим