What is short line candle

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

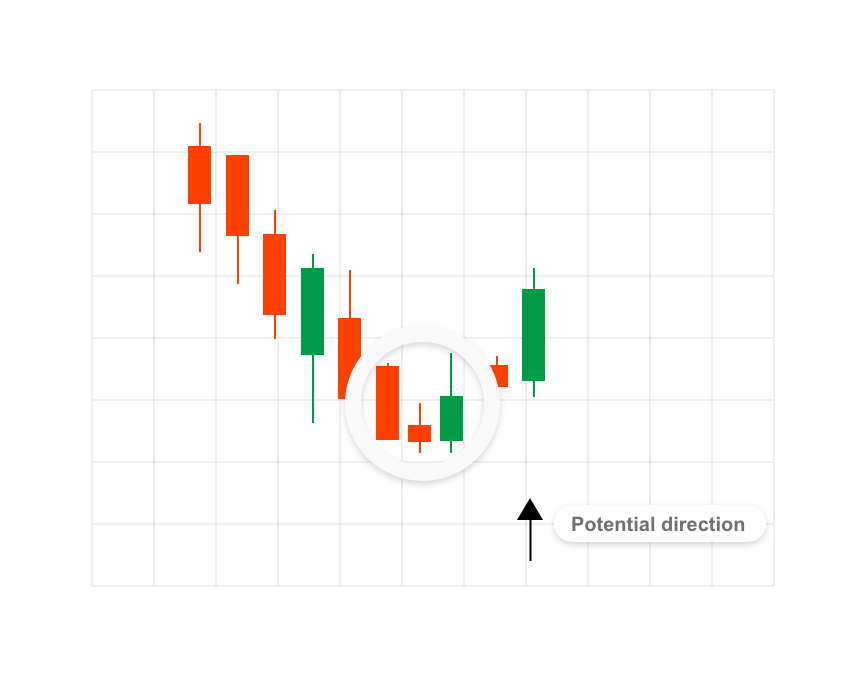

Assalam o alaikum Dosto Kaise han ap sb umeed hai k ap sb khariyat se hon ge Aj ka jo hamara topic hai woh hai short line candle Umeed hai k mere is topic se apko boht si information Hasil hon gi aur boht zyaada faida bhi ho ga What is short Line candle short line candles — jinhein mukhtasir mom batian bhi kaha jata hai — mom batii ke chart par mojood mom batian hain jin ka asli jism mukhtasir hota hai. yeh one baar patteren is waqt hota hai jab kisi muqarara muddat mein ibtidayi qeemat aur ikhtitami qeemat ke darmiyan sirf thora sa farq hota hai. oopri aur nichale saaye ki lambai — muddat ke liye ounchay aur nichale ki numaindagi karti hai — mukhtasir line candle ki wazahat mein koi farq nahi karti hai. dosray lafzon mein, aik mukhtasir line wali mom batii ki muddat ke liye wasee ya tang onche aur nichli range ho sakti hai lekin hamesha aik tang khuli aur qareebi range hoti hai. Ahem take ways . short lines, ya mukhtasir mom batian, mom batian hain jin ke jism chhootey hotay hain. jism ki yeh mukhtasir shakal batati hai ke security ki khuli aur qareebi qeematein aik dosray ke kaafi qareeb theen. short body candles kisi stock ya dosray asasay mein istehkaam ki muddat ki nishandahi kar sakti hain, lekin un ki tashreeh is bunyaad par mukhtalif hogi ke qeemat ki doosri karwai se pehlay aur is ke baad kya sun-hwa hai. short line candle tasweer ba zarea joly short line candles ko samjhna candle stuck charts aksar aik nazar mein misbet ya manfi market ke jazbaat ka andaza laganay ke liye istemaal hotay hain. Understanding Short Line candle short line candles aam tor par is baat ka ishara deti hain ke market qeematon ki thori si harkat ke sath mustahkam ho rahi hai. lekin un ke mukhtalif maienay ho satke hain, is baat par munhasir hai ke woh qeemat ke chart mein kahan hotay hain. misaal ke tor par, aik choti lakeer wali mom batii hathoray ki shakal ikhtiyar kar sakti hai jis mein aik nichli dam hoti hai jis ki oopri dam nahi hoti hai. yeh taizi se ulatnay ka patteren hai aur yeh neechay ke rujhan ke khatmay ki nishandahi kar sakta hai. doosri taraf, short line candles ka aik silsila mehez ghair faisla kin honay ka mahswara day sakta hai aur taajiron ko is baray mein kuch isharay faraham kar sakta hai ke mustaqbil ki qeematein kahan ja rahi hain. tang onche aur kam range wali mukhtasir line candles ki aik series kam utaar charhao ki muddat ki nishandahi karti hai. jab yeh mom batian wasee tar himayat ya muzahmat ke qareeb rakhi jati hain, to mom btyon ka jhurmat aksar aala utaar charhao ke aaghaz ki pishin goi karta hai, yani wasee range aur mom btyon ka aik silsila jo taraqqi Pazeer rujhan ke mutabiq hai. agarchay yeh klstrz muzahmat ke qareeb taizi aur himayat ke qareeb mandi ka rujhan rakhtay hain, lekin un ki qader mehdood hai. taham, chunkay woh paish goi karte hain ke ziyada utaar charhao kam utaar charhao ki jagah le le ga, tajir mumkina tor par munafe bakhash hikmat amlyon ki tokri ka itlaq kar satke hain . Short line candle in practice candle stuck charting mein hathora aik mukhtasir line qeemat ka namona hai jo is waqt hota hai jab koi security tijarat –apne aaghaz se numaya tor par kam hoti hai, lekin is muddat ke andar andar release hoti hai jo ibtidayi qeemat ke qareeb band hoti hai. yeh namona hathoray ki shakal ki shama daan banata hai, jis mein nichala saya haqeeqi jism ke size se kam az kam dugna hota hai. candle stick ka body khuli aur band qeematon ke darmiyan farq ko zahir karta hai, jabkay shadow is muddat ke liye ziyada aur kam qeematon ko zahir karta hai. latka sun-hwa aadmi aur hathoray ki shammen aik jaisi lagti hain. farq sirf sayaq o Sabaq ka hai. hathora aik neechay ka namona hai jo qeemat mein kami ke baad bantaa hai. hathoray ki shakal is muddat ke douran mazboot farokht ko zahir karti hai, lekin qareeb se kharidaron ne dobarah control haasil kar liya hai. yeh ishara karta hai ke mumkina neechay qareeb hai aur agar mandarja zail candle par oopar ki taraf harkat se tasdeeq ho jaye to qeemat oopar jana shuru kar sakti hai. phansi wala aadmi qeematon mein izafay ke baad hota hai aur anay wali mumkina tor par kam qeematon ke baray mein khabardaar karta hai. ulta hathora aur shooting star bilkul aik jaisay nazar atay hain. un dono ke lambay oopri saaye aur mom batii ke nichale hissay ke qareeb chhootey asli jism hotay hain, jis mein kam ya koi nichala saya nahi hota. farq sayaq o Sabaq ka hai. aik shooting sitara qeemat mein izafay ke baad hota hai aur mumkina mourr ko kam karta hai. aik ulta hathora qeemat mein kami ke baad hota hai aur mumkina mourr ko buland karta hai. Doji aik aur qisam ki mom batii hai jis mein aik chhota sa asli jism hota hai. Doji Adam faisla ki alamat hai kyunkay is ka oopri aur nichala saya dono hota hai. dojis qeemat ke ulat jane ya rujhan ke tasalsul ka ishara day sakta hai, is ke baad anay wali tasdeeq par munhasir hai ke yeh is hathoray se mukhtalif hai jo qeemat mein kami ke baad hota hai, mumkina ulat palat ka ishara deta hai ( agar tasdeeq ke baad hota hai ), aur sirf aik lamba nichala saya hota hai . -

#3 Collapse

Data About Incidental result: Forex exchanging mai bhot sary markers accessible hoty hain. Dealer appni decision k hesab sy koi bhe pointer use kar sakty hain. Merchant k lae marker ko use karna zaruri es lae hai k broker ko market ki bhot sari data in sy mel jati hai. Jo dealer marker ko use ni karta wo market ko sari data ko hasil ni kar pata es lae usky lae exchange ko pain-filled point standard open karna bhot mushkil ho jata hai. Reactive result aisy marker Hain Jin Se Hamen Hamesha benefit Milta hai agar Hamen in ko acchi tarike se judge karte hain aur negative aur bullish Pattern ke designs ko Palan karte hain aur moving normal sort ke pointers ko follow Karte Hain To Hamen bahut hey Achcha result Milta Hai market se trailing results ki development bahut slow hai however ye marker Hamen beneficial exchanging karne ka chance Dete Hain Jin Se Ham apni exchanging ko Kamyab banaa sakte hain. What Is Incidental result: Trailing results use past cost information estamal kar k hamy exchange mama ya out hony k sign give karty hain. Proactive factors future cost development ki sign dety hain or ye b past cost information he use karty hain. Proactive factor good entery point deta hai k certain development start hony wali hai while reactive result pehle pechly cost activity ko affirm karta hai or phr entery give karta hai or es mama misleading breakout ka risk kam hota hai. Trailing result wo pointer hoty hain jo market ki past cost ko use kar k market future ko foresee karty hain however en marker ka incidental effect ye hai k es time standard sign dety hain jb market wo development start kar chuki hoti hai or broker ko es k awful enter hony sy kio khatir khawa benefit ni hota. Be that as it may, en pointers ka advantage ye hai k ye zayada tar exact signa ko give karty hain or merchant ko agr benefit na ho to misfortune bhe nahe hota. Negative kicking design bullish pattern primary ya exorbitant cost region fundamental banta hai. Monetary market principal baaz dafa costs bohut teezi k sath up pattern standard development kar rahi hoti hai, jiss se cost outline standard ziada purchasing ki waja se Marubozu bullish flame light banti hai, lekin agle clamor market primary dealers ki solid wapasi ki waja se bullish candle se nechay hole fundamental aik Marubozu negative candle banti hai, jo k aik to bullish pattern ka khatma karti hai, aur dosra ye negative pattern inversion candle hoti hai. Bullish aur negative ka ye two days candle design "Negative Kicking Example" kehlata hai, jo k market k top standard ya bullish pattern k baad banta hai. Design ki pehli candle costs k vertical jane ki sign hoti hai, hit k dosre candle se uss ki bearing primary tabdeeli ki alamat hoti hai. -

#4 Collapse

ke chart par mojood mom batian hain jin ka asli jism mukhtasir hota hai. yeh one baar patteren is waqt hota hai jab kisi muqarara muddat mein ibtidayi qeemat aur ikhtitami qeemat ke darmiyan sirf thora sa farq hota hai. oopri aur nichale saaye ki lambai — muddat ke liye ounchay aur nichale ki numaindagi karti hai — mukhtasir line candle ki wazahat mein koi farq nahi karti hai. dosray lafzon mein, aik mukhtasir line wali mom batii ki muddat ke liye wasee ya tang onche aur -

#5 Collapse

Asalam o Alaikum!! Ma apko es thread ma btaun ga ka "Short Line Cnadle kiya hota h".What is short line candle? Maliati trading aur chart tajzia ke tanazar main ، aik short line mome betty aik makhsoos qasam kee mome betty pettern se morad he jo qeematon ke chart par zahir hotaa he candle stick chart aam toor par technicality tajzia main istemal hote hain takeh maliati alat jaise stock ، currencies ، ya ajnas kee qeematon kee naqal we harkat ka tajzia kia jaskie. aik short line candle kee majmooee lambai ke muqable main nesbata chhota jasm hone kee khususiyat he yah isharah karta he kah diye gaye waqat kee madat ke doran khali aur band qeematon ke darmiyan trading range (misaal ke toor para aik danne aik ghantha ya aik minute) nesbata chhoti thi. dosre lafzoon main s waqat qeematon main ziyadah naqal we harkat naheen thi. short line candle kee makhsoos tashreeh siyaq we sabaq aur aas pass kee qimat ke amal par munhasar hosakti he taham ، yah aam toor par markets main astahkam ya adam faisla kee madat kee nishandahi karta he s se zahir hotaa he kah s makhsoos madat ke doran nah tho kharidaron aur nah hay frocht kanandgaan ko koei khaas faidah thay short line mome batian mukhtalif shaklon main payi jasakti hain ، jaise doji mome batian ، spining tops ، ya chhote opery aur nichlay saaye ke saath chhoti jasm walli mome batian tajir aksar markets ke jazbat aur mumkanah qeematon ke ullat palat ya teselsel ke namonon main basirat hasel karne ke laye pichli aur mandarjah zel mome batiyon ke muqable main mome betty ke size aur position par ghor karte henni "short line mome betty" aik mayari astalah naheen he mira khayal he kah op aik makhsoos mome betty ke pettern ka hawala de rahe hain jase "mukhtasar jasm walli mome betty" kaha jata he mukhtasar jasm walli mome betty se morad aik mome betty he jas ka jasm chhota hotaa he ، joe khali aur band qeematon ke darmiyan kom se kom qimat kee naqal we harkat kee nishandahi karta he. Candle charting ke siyaq we sabaq main aik mukhtasar jasm walli mome betty kas tarh kam karti he: Formatiom: aik mukhtasar jasm walli mome betty aik chhote mustatil jasm kee khususiyat he joe aik makhsoos waqat kee madat ke doran kholne aur band hone kee qeematon ke darmiyan qimat kee had kee numaindagi karti he. jasm kee koei khaas lambai naheen hosakti he ، joe qimat kee kom naqal we harkat kee nishandahi karti he Wick length: mukhtasar jasm walli mome batiyon main aksar opery aur nachli batian lambi hoti hain ، jinhein saaye bhi kaha jata he yah weeks s madat ke doran pahunchanay walli khali aur band qeematon se aage qimat kee had kee nishandahi karte henni Market interpretation: mukhtasar jasm walli mome betty kee tashreeh majmooee qimat ke chart ke andar s ke maqam aur s se pahley aur mandarjah zel mome batiyon par munhasar he bamani basirat hasel karne ke laye mukhtasar jasm walli mome betty ke saath mel kor mome betty ke namonon aur rojhan ke tajzia par ghor karna zarori heIndecision and Consolidation: aik mukhtasar jasm walli mome betty markets main adam faisla ya astahkam kee madat ka isharah de sakti he s se patah chalta he kah kharidar aur frocht kanandgaan muqararah madat ke doran nesbata matwazan rahe hain ، jas ke nateeje main khalis qeematon main bahat kom naqal we harkat hoie heReversal signal:kachh maamlaat main ، lambe opery aur nichlay weeks ke saath aik mukhtasar jasm walli mome betty mumkanah ullat signal ke toor par kam karsakti he agar lambe jasm walli mome batiyon ke aik silsile ke baad aik mukhtasar jasm walli mome betty banti he tho ، yah rojhan kee samat main mumkanah tabdeeli ka isharah de sakti heImportant note yah note karna zarori he kah mome betty ke namonon ko tanhai main istemal naheen kia jana chahiye balkeh bakhabar tejarati faislay karne ke laye digar technicality tajzia ke auzar aur isharay ke saath mel kor istemal kia jana chahiye mazid bran aik jamia tejarati hikmat amali tayar karne ke laye mukhtalif qasam ke mome betty ke namonon aur un kee mutaliqah tashreehat ka mutaalaah aur samjhna hamesha mashwarah dia jata he. yad rakhen kah mome betty ke namonon kee tasir mukhtalif hosakti he ، aur achi tarh se tejarati nuqta nazar ke laye markets ke halat ، hajm ، aur bonyadi tajzia jaise digar awamil par ghor karna zarori he -

#6 Collapse

Short line Candle kya hy??? jinhein mukhtasir mom batian bhi kaha jata hai — mom batii ke chart par mojood mom batian hain jin ka asli jism mukhtasir hota hai. yeh one baar patteren is waqt hota hai jab kisi muqarara muddat mein ibtidayi qeemat aur ikhtitami qeemat ke darmiyan sirf thora sa farq hota hai. oopri aur nichale saaye ki lambai — muddat ke liye ounchay aur nichale ki numaindagi karti hai — mukhtasir line candle ki wazahat mein koi farq nahi karti hai. dosray lafzon mein, aik mukhtasir line wali mom batii ki muddat ke liye wasee ya tang onche aur nichli range ho sakti hai lekin hamesha aik tang khuli aur qareebi range hoti hai. ya mukhtasir mom batian, mom batian hain jin ke jism chhootey hotay hain. jism ki yeh mukhtasir shakal batati hai ke security ki khuli aur qareebi qeematein aik dosray ke kaafi qareeb theen. short body candles kisi stock ya dosray asasay mein istehkaam ki muddat ki nishandahi kar sakti hain, lekin un ki tashreeh is bunyaad par mukhtalif hogi ke qeemat ki doosri karwai se pehlay aur is ke baad kya sun-hwa hai. Short Line Ka Working principle kya hy candles aam tor par is baat ka ishara deti hain ke market qeematon ki thori si harkat ke sath mustahkam ho rahi hai. lekin un ke mukhtalif maienay ho satke hain, is baat par munhasir hai ke woh qeemat ke chart mein kahan hotay hain. misaal ke tor par, aik choti lakeer wali mom batii hathoray ki shakal ikhtiyar kar sakti hai jis mein aik nichli dam hoti hai jis ki oopri dam nahi hoti hai. yeh taizi se ulatnay ka patteren hai aur yeh neechay ke rujhan ke khatmay ki nishandahi kar sakta hai. doosri taraf, short line candles ka aik silsila mehez ghair faisla kin honay ka mahswara day sakta hai aur taajiron ko is baray mein kuch isharay faraham kar sakta hai ke mustaqbil ki qeematein kahan ja rahi hain. tang onche aur kam range wali mukhtasir line candles ki aik series kam utaar charhao ki muddat ki nishandahi karti hai. jab yeh mom batian wasee tar himayat ya muzahmat ke qareeb rakhi jati hain, to mom btyon ka jhurmat aksar aala utaar charhao ke aaghaz ki pishin goi karta hai.. Limitations aur Importance In Forex Markets charting mein hathora aik mukhtasir line qeemat ka namona hai jo is waqt hota hai jab koi security tijarat –apne aaghaz se numaya tor par kam hoti hai, lekin is muddat ke andar andar release hoti hai jo ibtidayi qeemat ke qareeb band hoti hai. yeh namona hathoray ki shakal ki shama daan banata hai, jis mein nichala saya haqeeqi jism ke size se kam az kam dugna hota hai. candle stick ka body khuli aur band qeematon ke darmiyan farq ko zahir karta hai, jabkay shadow is muddat ke liye ziyada aur kam qeematon ko zahir karta hai. latka sun-hwa aadmi aur hathoray ki shammen aik jaisi lagti hain. farq sirf sayaq o Sabaq ka hai. hathora aik neechay ka namona hai jo qeemat mein kami ke baad bantaa hai. hathoray ki shakal is muddat ke douran mazboot farokht ko zahir karti hai, lekin qareeb se kharidaron ne dobarah control haasil kar liya hai. yeh ishara karta hai ke mumkina neechay qareeb hai aur agar mandarja zail candle par oopar ki taraf harkat se tasdeeq ho jaye to qeemat oopar jana shuru kar sakti hai. phansi wala aadmi qeematon mein izafay ke baad hota hai aur anay wali mumkina tor par kam qeematon ke baray mein khabardaar karta hai. ulta hathora aur shooting star bilkul aik jaisay nazar atay hain. un dono ke lambay oopri saaye aur mom batii ke nichale hissay ke qareeb chhootey asli jism hotay hain, jis mein kam ya koi nichala saya nahi hota. farq sayaq o Sabaq ka hai. aik shooting sitara qeemat mein izafay ke baad hota hai aur mumkina mourr ko kam karta hai. aik ulta hathora qeemat mein kami ke baad hota hai aur mumkina mourr ko buland karta hai. Doji aik aur qisam ki mom batii hai jis mein aik chhota sa asli jism hota hai

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#7 Collapse

"short line candle"- Short Line Candle:

Short Line Candle ki kuch important characteristics hai:- Choti Candle Body: Short Line Candle ka body normal size se chota hota hai, jiski wajah se iska naam "short line" hai. Iska body usually market volatility aur price movement ke reflection ke roop mein interpret kiya jata hai.

- Choti Upper aur Lower Shadows: Short Line Candle ke upper aur lower shadows bhi chote hote hain. Shadows price ke highs aur lows ko represent karte hain, aur chote shadows iska indication hai ki price range narrow hai aur price movement limited hai.

- Bullish aur Bearish Versions: Short Line Candle dono versions mein available hota hai - bullish (upward trend mein) aur bearish (downward trend mein). Bullish short line candle mein price open se close tak kam hote hain, jabki bearish short line candle mein price open se close tak girte hain.

Short Line Candle ka interpretation aur uske istemal

- Bullish Short Line Candle: Bullish short line candle ek potential reversal signal ho sakta hai jabki market downtrend se uptrend mein shift kar rahi ho. Iska interpretation hai ki sellers ki strength kam ho rahi hai aur buyers ka control badh raha hai.

- Bearish Short Line Candle: Bearish short line candle ek potential reversal signal ho sakta hai jabki market uptrend se downtrend mein shift kar rahi ho. Iska interpretation hai ki buyers ki strength kam ho rahi hai aur sellers ka control badh raha hai.

Short Line Candle ka istemal karne se pehle, isko confirm karne ke liye aur dusre technical indicators aur price patterns ke saath validate karna zaruri hai. Iske saath hi risk management techniques aur proper analysis ka istemal karna bhi mahatvapurna hai.

Note:

Technical analysis aur candlestick patterns ke istemal mein, sahi interpretation aur trading decisions ke liye thorough understanding aur practice zaruri hai. Isliye, trading mein involvement se pehle proper knowledge aur experience ka hona zaruri hai.

- Mentions 0

-

سا0 like

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 04:42 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим