Bullish Pin Bar candlestick on forex

`

X

new posts

-

#1 Collapseٹیگز: کوئی نہیں

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

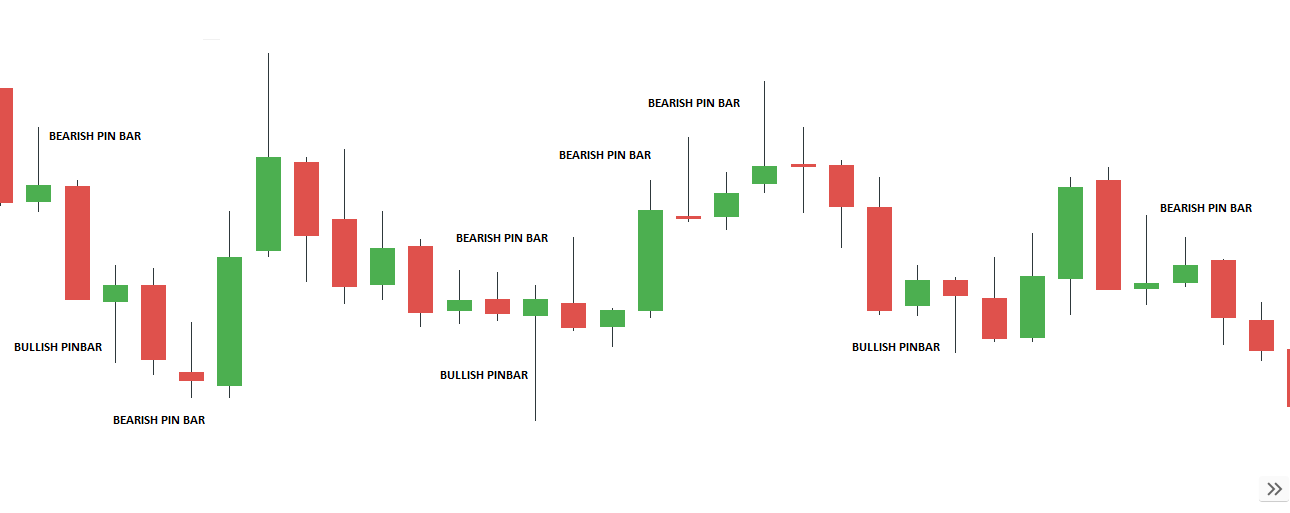

Bullish Pin Bar candlestick on forexIntroduction pyare Pakistan forex forum ke mimbraan mein umeed karta hon ke aap sab achhai ke bhukay hain aur apni tarbiati zindagi se lutaf andoz ho rahay hain. hum jins paraston aur mera jism chhota hai. blush pan baar ki aik lambi nichli dam ishara karti hai ke pait ke pathon ko yahan se mustard kar diya gaya hai. kya vajaa se woe –apne patteren ko doosri ( ulti ) simt mein le jata hai? patteren ki simt ka koi ulat nahi hai (ultana) lekin candle stuck yes pan baar banati hai, hamaray paas dam ka ulat patteren hai Identification Quite Bullish pin bar candlestick pattern, rough negative dono tarah ki candlestick principle ho sakti hai, but market aur price k ziata bottom surface sharply sharpened and steel se ye rough inversion pattern k leye ziata mashahoor shem hai. Information Quite Bullish pin bar candle price chart standard aksar base or top standard price nazar ati hai aur aksar issi position cost inversion ho jati hai. Cahaya aik spik ki sorat awal nazar at hai, poking bhi kisi very new ki waja se cost teezi k sath down karne k baad wapis apne high face k kareeb ja kar close hoti hai. Description Friend Bull pin candle You burn long after shadow k sath hoti hai, jiss k upper side psr aik small real body hoti hai. Fire to above is standard candle banne se sham ki standard power koi asar nahi parta hai but additional lamp banne se sham ki hososeyat neutral ho jayi hai. Real body ka ton kisi special design ka hona zarori nahi hai but em light ki low cost basic hona zayat aham hai tu bullesh trend business level say hi ik trah hi income asaani say ik trah hi karein gy tu asaani say salam i trah mall hi hi sa gain gain asai hio ikk trah ho gii. tui jhi bullesh Bull pin bar candle Dekhne base and base price lamp normal banne wali fire hammer ki hi tarah lagti hai. -

#3 Collapse

"Bullish Pin Bar candlestick on forex"- Bullish Pin Bar candlestick pattern:

Introduction:

Pehchan :

- Shape: Bullish Pin Bar ki shape ek pin jaisi hoti hai, jisme candlestick ki body chhoti hoti hai aur upper shadow (wick) body se bahar extend hoti hai.

- Upper Shadow: Bullish Pin Bar mein upper shadow (wick) body se badi hoti hai aur candlestick ki top par ban jati hai.

- Body: Bullish Pin Bar ki body chhoti hoti hai aur typically bullish color (green) hoti hai.

- Lower Shadow: Bullish Pin Bar mein lower shadow (wick) body se bahar extend nahi hoti hai ya bahut chhoti hoti hai.

Istemal:

Fayde:

- Trend Reversal: Bullish Pin Bar pattern bullish reversal ki possibility ko indicate karta hai, jisse traders trend ke change ke saath trade kar sakte hain.

- Entry and Exit Points: Bullish Pin Bar pattern traders ko entry aur exit points provide karta hai, jisse unko trading decisions lena aasan ho jata hai.

- Risk-Reward Ratio: Bullish Pin Bar pattern ko istemal karke traders apni risk-reward ratio ko optimize kar sakte hain.

Disadvantages (Nuksaan):

- False Signals: Bullish Pin Bar pattern mein false signals ka possibility hota hai, jisse traders ko confirmation aur additional analysis ki zaroorat hoti hai.

- Volatility: Bullish Pin Bar pattern volatility ke dauran form ho sakta hai, jisse traders ko caution ki zaroorat hoti hai.

Conclusion:

Bullish Pin Bar pattern bullish reversal ko indicate karta hai aur traders ko entry aur exit points provide karta hai. Halaanki, traders ko false signals ko avoid karne ke liye confirmation aur additional analysis ki zaroorat hoti hai. Is pattern ko support and resistance levels, trendlines, aur indicators ke saath combine karke istemal karna traders ke liye beneficial ho sakta hai. -

#4 Collapse

Bullish pin bar candlestick, forex trading mein ek powerful bullish reversal pattern hai. Yeh pattern price chart par ek specific candlestick formation ko represent karta hai, jisse traders price reversal aur potential buying opportunities identify kar sakte hain. Bullish pin bar candlestick pattern, forex trading mein ek price chart pattern hai jo traders ko bullish reversal signal provide karta hai. Is pattern mein ek single candlestick formation hoti hai jiska shape kisi pin bar ki tarah hota hai. Ismein price candlestick ka body chhota hota hai aur uske upper wick (tail) body se bahar extend hota hai. Bullish pin bar candlestick pattern ka interpretation positive hai aur isse traders ko potential buying opportunities aur trend reversal ka indication milta hai. Is pattern ke benefits aur characteristics ko samajhne ke liye niche diye gaye points par focus karte hain: 1. Reversal Signal: Bullish pin bar candlestick pattern ek reversal signal hai. Yeh pattern tab form hota hai jab market downtrend mein se uptrend mein reverse hota hai. Is pattern ki formation traders ko suggest karta hai ki selling pressure kam ho gayi hai aur buying pressure badh rahi hai. 2. Price Rejection: Bullish pin bar candlestick mein price candlestick ke bottom wick (tail) se reject hota hai. Isse market mein support level confirm hota hai. Yeh price rejection traders ko batata hai ki selling pressure ke baad buyers market mein dominate kar rahe hain. 3. Entry and Exit Points: Bullish pin bar candlestick pattern traders ko entry aur exit points provide karta hai. Traders is pattern ke formation par long positions enter karte hain, expecting ki price upside move karegi. Stop-loss aur target levels ko define karke traders apne trades ko manage kar sakte hain. 4. Confirmation with Other Indicators: Bullish pin bar candlestick pattern ko other technical indicators aur price action analysis ke saath confirm kiya ja sakta hai. Isse pattern ki reliability aur effectiveness improve hoti hai. Traders other indicators jaise ki volume, trend lines, moving averages, aur price patterns ka istemal karke pattern ki validity ko validate kar sakte hain. Bullish pin bar candlestick pattern ka sahi tarike se interpret karna aur market context ke saath analyze karna zaroori hai. Is pattern ka istemal karne se pehle traders ko proper risk management ko follow karna chahiye aur apne trading strategy ke saath match karte hue pattern ki validity ko evaluate karna chahiye. Yeh pattern market sentiment aur trend reversal ka indication deta hai, lekin iski effectiveness aur reliability ke liye traders ko practice, observation, aur learning par focus karna chahiye. Apne trading goals, risk appetite, aur market conditions ke saath match karte hue traders ko is pattern ka sahi istemal karna chahiye. Benefits of Bullish Pin Bar Candlestick: 1. Reversal Signal: Bullish pin bar candlestick pattern ek reversal signal provide karta hai. Jab market downtrend se uptrend mein reverse hota hai, bullish pin bar candlestick traders ko potential trend reversal ka indication deta hai. Yeh pattern price bottoming aur potential buying opportunities ko represent karta hai. 2. Price Rejection: Bullish pin bar candlestick mein price candlestick ke bottom wick (tail) se reject hota hai, jisse support level confirm hota hai. Yeh price rejection traders ko market sentiment aur buying pressure ke baare mein information deta hai. 3. Entry and Exit Points: Bullish pin bar candlestick pattern traders ko entry aur exit points provide karta hai. Traders is pattern ke formation ko dekh kar long positions enter kar sakte hain, jisse unhe potential price upside aur profits mil sakte hain. Exit points ko trailing stop-loss orders aur target levels ke through manage kiya ja sakta hai. 4. Confirmation with Other Indicators: Bullish pin bar candlestick pattern ko other technical indicators aur price action analysis ke saath combine karke traders ko confluence aur confirmation provide kiya ja sakta hai. Isse pattern ki reliability aur effectiveness improve hoti hai. Conclusion: Bullish pin bar candlestick pattern ek bullish reversal signal hai, jisse traders potential trend reversal aur buying opportunities identify kar sakte hain. Is pattern ke benefits include trend reversal signal, price rejection, entry aur exit points, aur confirmation with other indicators. Lekin, is pattern ke istemal se pehle traders ko kuch factors ka dhyan dena zaroori hai: 1. Context: Bullish pin bar candlestick pattern ko market context ke saath analyze karna zaroori hai. Price structure, trend direction, aur market conditions ko consider karna important hai. 2. Confirmation: Bullish pin bar candlestick pattern ko confirmatory signals aur price action analysis ke saath combine karna zaroori hai. Volume, trend lines, moving averages, aur other technical indicators ko istemal karke pattern ki reliability ko validate karna chahiye. 3. Risk Management: Proper risk management ke saath trading karna zaroori hai. Stop-loss orders aur position sizing ka istemal karke risk ko control karna chahiye. Bullish pin bar candlestick pattern ko sahi tarike se identify aur interpret karna zaroori hai. Traders ko pattern ke istemal se pehle practice, observation, aur learning par focus karna chahiye. Iske saath hi, apne trading strategy, risk tolerance, aur market analysis ko improve karna bhi mahatvapurna hai. -

#5 Collapse

MARKETS mein temporary rate corrections, profit bookings,ng, the Forex market market mein ek aam tareeqa hai jahan hum darj zail asoolon par mabni hokar buying and selling karte hain. Is tareeqay mein hum darj zail umdah idaron kee charges . ki wapsi mein roabarnama karte hain. Yeh approach is par mabni hoti hai keh market fashion ke khilaf alternate karnay ki bajaye fashion ki wapsi par change kiya jaye. Ya phir Trader's ke sentyiment ka badalna. Jab MARKET mein strongly up-trending ya downtrends ho, toh kuch traders earnings . booking ke liye apne function's ko closed kar sakte hain ya phir opposites directions mein exchange kar sakte hain. Ye Price Patterned movement's Pullbacks created Asaani Say Hi ho gy....IDENTIFICATION OF PULLBACKS CANDLESTICKS..!!!!Sir: Ess Pullbacks ki Pehchan karna FOREX TRADING mein Zaria hai taaki sahi samay par Entries aur go out pointsman determine kiye ja saken. Much generally technique's Pullbacks ki Pehchan karen gyJab bh TREND Line's ka used kar ke Trader's costs TREND ke direction mein drawing karte hain. Agar Price TREND line ko Break kar ke neechey jaata hai aur phir se trend line ko crossed kar ke upar jay Ga.[IMG]null[/IMG] TRADING STRADGY WITH TECHNICAL ANYLSIS..!!! Ear Sir: Iss Pullbacks TRADING STRATEGY mein dealer's Pullbacks ke baad TREND ke guidelines mein access-levelWasooli Traiding strategy ko Forex market mein istemal karnay ke liye kuch tariqay hain. Sab se pehlay, hum fashion ko perceive karte hain. Phir jab fee trend ke khilaf pullback karta hai, hum entry factor tayyar karte hain aur change lagatay hain. Stop-loss order aur goal fee degrees set kar ke hum apni trading function ko manipulate karte hain. Karte hain. Agarwal Uptrend hai, toh Trader's PULLBACKS ke baad however buying karte hain, aur agar down-trend hai, toh Trader's Pullbacks ke baad sell karte hain. Entry-stage factor ke liye Trader's TREND Line's, movingly averaged, ya phir Fibonacci's retrace ment ka used ho gyTrading Mn Stopped loss aur take profitable stages ko property set karna bhi Pullbacks trading approach mein vital hai. Stop loss stage ko PULLBACKS ke opposites instructions mein set karna Chahhye taaki agar PULLBACKS TREND Reversal ho jaye, you loss limitedly ho. Taken profitable stage ko fashion ke path mein set karna chahiye taaki trader's profits e-book kar sakein Gy . PULLBACKS Forex trading mein TREND Reversal ke transient retrace noted ko constitute karta hai. PULLBACKS ki Pehchan karne ke liye Trader's trend lines, shifting averages, aur Fibonacci retracement ka istemal kar sakte hy.... -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#6 Collapse

Presentation of long candles Is candles design me gee wo pattern pata chalta he js ke ye design jahan candle ka body pichli candles se numaya peak standard bara hota hai, jo qeemat mein aik mazboot aur achanak tabdeeli ki nishandahi shpoulder kay graph ke tameer karenhead and shoulder kadarmean faslay jetna ho sakay barabar hona chihaydono head kay scratch kay point pat nursery ke line ko shamel karna chihay tarjjehe tr standard ofqi line wazah nahe ho sakte ur is market Mein acchi tarike se kam kar dete Hain To aapko is market se ziya ke ja sakte hein key heyprice activity or specialized marker ka estamal kartay hovay in general market kay pattern ko recognize karna chihayhead and shpoulder any meeting k aek bary hissy pr ghalba hasil krny k leay koshish ki hu likn beechny waly bil akhir qeemat ko km krny me kamyab ho gaey hy agr nichli da hoti hai, jis se zahir hota hai ke farokht knndgan ne control sambhaal liya hai aur qeemat ko neechay dhakel diya hai .I mother batian ya to taizi ya mandi wali ho sakti hain aur mojooda market ke jazbaat aur mustaqbil ki qeematon mein mumkina tabdeeli ke baray mein taajiron ko qeemti maloomat faraham kar sakti hain . Sign of market exceptionally low or high Ye design market ke most elevated or you can say standout degree ko show krta he sath exchanging karte waqt munafe ka level lena chahiye. agar tijarat tajir ke khilaaf jati hai to advertise mein utaar charhao ya khabron ke waqeat ka nateeja bhi ho sakti hain. taajiron ko anay walay kha e aur Apna Kam behtr treeke se kar rahe honge market mein kam karne ke liye difficult work karna hota h zaroorat hai. down prepared ya union ki muddat ke baad aik lambi become flushed candle mumkina taizi ke ulat jane ka ishara day sakti hai, hit ke up prepared ya solidification ke baad aik lambi negative light mumkina negative inversion ka ishara day sakti hai . is al ke pinnacle standard istemaal karte hain. consolidationki muddat ke baad aik lambi become flushed light ya davn prepared mumkina taizi ke ulat jane ka ishara day sakti hai, poke ke combination ki muddat kebearish candle ya up prepared mumkina negative inversion computer based intelligence aur apni learning Karni hoti hai aaj principal aapko is market Mein Head and shoulder candle kar sakte hain bron ke waqeat standard nazar rakhni chahiye jo market ko mutasir kar satke hain aur is ke mutabiq apni tijarti hikmat e amli ko change karen . nuqsaan ko roknay ke orders mumkina nuqsanaat ko mehdood karne mein madad kar satke hain, punch ke take praft orders munafe ko roknay mein madad kar satke hain agar tijarat tajir ke haq mein jati hai . Aik lambi opri wick candle or lambi nichli wick stick me frq hy aek lambi opri wick candle us wqt hoti hy jb unchai intehai mazboot hoti hy likn phr qareebu qeemat kamzoor hoti hy is ka mtlb ye hy k agarcha kharedaro ategy mein shamel karnay kay ley esay aik adaptable instrument kay peak standard shamel kea ja sakta hello moda Mein kamyabi mil Jaati Hai Hamen is market Mein Kamyab sharpen ke liye apni learning total Karni Hoti Hai Uske terrible Ham is market Mein acchi tarike se kam bhaal liya hai aur qeemat ko barha diya hai. is ke bar aks, aik lambi mandi wali mother batii n ke sath tijarat karne se pehlay, taajir karta hai. sheep ing cost ikhtitami qeemat se kam hoti hai, jo is baat ki nishandahi karti hai ke kharidaron ne control sam design ke uncovered mein detail se bataunga agar aap is design ko learn kar lete hain an activity ke aik basic kharabe beyan ke ja sakte hello focuses ke kharabe frahm karte hasil krny k leay koshish ki hu likn beechny waly bil akhir qeemat ko km krny me kamyab ho gaey hy agr nichli wick lambi hy to ye aek tijarti meeting ki trf ishara hy jo ael mazboot note pr khtm hoa jha beechny walo ka ghlaba tha likn kharedar qeematon ko barhany me kamyab rhte hain

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 02:35 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим