Trading Range strategies

No announcement yet.

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔ٹیگز: کوئی نہیں

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

htrat say mhtat rhay ga aor pedaoar kotay men azafay men mhtat roeh apnae'ay ga۔ shkago mrkntae'l aekschenj grop kham tel ke feochr market ka deta as say zahr hota feed kh tajron nay jmarat ko lgatar panchoen dn apne khle pozeshnon men azafh kea ، as oqt as men 11،100 ka azafh hoa hay۔ dosre janb ، tjarte hjm men kme kay awful mslsl dosray roz bhe 53،100 maahdon men kme rekard ke ge'erozanh kay nqth nzr say as jmarat ko 65.45 lae'n ke hmaet ko msthkm krnay kay terrible ، tel ke qemton men zbrdst teze oaqa hoe'e ، aor 8 walk say abtdae'e karobar men kameabe kay sath 67 ke hd say tjaoz hoa ، aor tel ke qemton men azafay ke ojh say teze kay jzbat men azafh hoa۔ ، MACD nay teze say aopr ke trf aek snhre kras tshkel dea ، 67 ko torrnay kay terrible ، sb say aopr 9march ko aale 67.98 ko chelnj krskta hay۔ agr dn men 67 say aopr kay qreb rhnay ke zmant de jaskte roughage to ، aktobr 2018 kay terrible say market kay nqth nzr ko ne'e aonchae'e ko tazh dm krnay k Trading Range strategieshem rehta hai agar yeh neechay ke rujhan sy aur oopar ke rujhan dono mein hota hai. masalas se break out honay ke baad, tajir is simt par munhasir hai jis mein hasas ki qeemat pehli baar shuru hui thi, jarehana tor par asason ko baichnay ya kharidne mein jaldi karte hain. 3rd sy barhta sun-hwa hajam is baat ki tasdeeq karne mein madad karta hai ke aaya qeemat toot gayi hai ya nahi. Or hajam jitna ziyada barhta hai qeemat mein itni hi dilchaspi patteren se bahar hoti hai. aik charhtay hue masalas ki koi markazi trained lines bananay ke liye, kam az kam do hon soyng lovs aur do soyng higher zaroori hain. taham, aik dosray ko chone ke liye ziyada tadaad mein trained lines ziyada qabil aetmaad tijarti nataij ki nishandahi karti hain. chunkay dono trained linen aik dosray mein tabdeel ho to rahi hain, agar hasas ki qeemat is masalas ke andar kayi jhoolon ke liye chalti rehti hai, to is ki qeemat ka amal sy mazeed marboot ho jaye ga, jo bil akhir mazboot break out ka baais -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Exchanging Reach methodologies htrat say mhtat rhay ga aor pedaoar kotay men azafay men mhtat roeh apnae'ay ga۔ shkago mrkntae'l aekschenj grop kham tel ke feochr market ka deta as say zahr hota feed kh tajron nay jmarat ko lgatar panchoen dn apne khle pozeshnon men azafh kea ، as oqt as men 11،100 ka azafh hoa hay۔ dosre janb ، tjarte hjm men kme kay dreadful mslsl dosray roz bhe 53،100 maahdon men kme rekard ke ge'erozanh kay nqth nzr say as jmarat ko 65.45 lae'n ke hmaet ko msthkm krnay kay horrendous ، tel ke qemton men zbrdst teze oaqa hoe'e ، aor 8 walk say abtdae'e karobar men kameabe kay sath 67 ke hd say tjaoz hoa ، aor tel ke qemton men azafay ke ojh say teze kay jzbat men azafh hoa۔ ، MACD nay teze say aopr ke trf aek snhre kras tshkel dea ، 67 ko torrnay kay awful ، sb say aopr 9march ko aale 67.98 ko chelnj krskta hay۔ agr dn men 67 say aopr kay qreb rhnay ke zmant de jaskte roughage to ، aktobr 2018 kay horrible say market kay nqth nzr ko ne'e aonchae'e ko tazh dm krnay k Exchanging Reach methodologies fix rehta hai agar yeh neechay ke rujhan sy aur oopar ke rujhan dono mein hota hai. masalas se break out honay ke baad, tajir is simt standard munhasir hai jis mein hasas ki qeemat pehli baar shuru hui thi, jarehana peak standard asason ko baichnay ya kharidne mein jaldi karte hain. third sy barhta sun-hwa hajam is baat ki tasdeeq karne mein madad karta hai ke aaya qeemat honk gayi hai ya nahi. Or then again hajam jitna ziyada barhta hai qeemat mein itni hey dilchaspi patteren se bahar hoti hai. aik charhtay shade masalas ki koi markazi prepared lines bananay ke liye, kam az kam do hon soyng lovs aur do soyng higher zaroori hain. taham, aik dosray ko chone ke liye ziyada tadaad mein prepared lines ziyada qabil aetmaad tijarti nataij ki nishandahi karti hain. chunkay dono prepared material aik dosray mein tabdeel ho to rahi hain, agar hasas ki qeemat is masalas ke andar kayi jhoolon ke liye chalti rehti hai, to is ki qeemat ka amal sy mazeed marboot ho jaye ga, jo bil akhir mazboot break out ka baais -

#4 Collapse

Exchanging Reach methodologies htrat say mhtat rhay ga aor pedaoar kotay men azafay men mhtat roeh apnae'ay ga۔ shkago mrkntae'l aekschenj grop kham tel ke feochr market ka deta as say zahr hota feed kh tajron nay jmarat ko lgatar panchoen dn apne khle pozeshnon men azafh kea ، as oqt as men 11،100 ka azafh hoa hay۔ dosre janb ، tjarte hjm men kme kay dreadful mslsl dosray roz bhe 53،100 maahdon men kme rekard ke ge'erozanh kay nqth nzr say as jmarat ko 65.45 lae'n ke hmaet ko msthkm krnay kay awful ، tel ke qemton men zbrdst teze oaqa hoe'e ، aor 8 walk say abtdae'e karobar men kameabe kay sath 67 ke hd say tjaoz hoa ، aor tel ke qemton men azafay ke ojh say teze kay jzbat men azafh hoa۔ ، MACD nay teze say aopr ke trf aek snhre kras tshkel dea ، 67 ko torrnay kay horrible ، sb say aopr 9march ko aale 67.98 ko chelnj krskta hay۔ agr dn men 67 say aopr kay qreb rhnay ke zmant de jaskte roughage to ، aktobr 2018 kay horrendous say market kay nqth nzr ko ne'e aonchae'e ko tazh dm krnay k Exchanging Reach methodologies fix rehta hai agar yeh neechay ke rujhan sy aur oopar ke rujhan dono mein hota hai. masalas se break out honay ke baad, tajir is simt standard munhasir hai jis mein hasas ki qeemat pehli baar shuru hui thi, jarehana peak standard asason ko baichnay ya kharidne mein jaldi karte hain. third sy barhta sun-hwa hajam is baat ki tasdeeq karne mein madad karta hai ke aaya qeemat honk gayi hai ya nahi. Or then again hajam jitna ziyada barhta hai qeemat mein itni greetings dilchaspi patteren se bahar hoti hai. aik charhtay tone masalas ki koi markazi prepared lines bananay ke liye, kam az kam do hon soyng lovs aur do soyng higher zaroori hain. taham, aik dosray ko chone ke liye ziyada tadaad mein prepared lines ziyada qabil aetmaad tijarti nataij ki nishandahi karti hain. chunkay dono prepared cloth aik dosray mein tabdeel ho to rahi hain, agar hasas ki qeemat is masalas ke andar kayi jhoolon ke liye chalti rehti hai, to is ki qeemat ka amal sy mazeed marboot ho jaye ga, jo bil akhir mazboot break out ka baais -

#5 Collapse

Exchanging Reach methodologies htrat say mhtat rhay ga aor pedaoar kotay men azafay men mhtat roeh apnae'ay ga۔ shkago mrkntae'l aekschenj grop kham tel ke feochr market ka deta as say zahr hota feed kh tajron nay jmarat ko lgatar panchoen dn apne khle pozeshnon men azafh kea ، as oqt as men 11،100 ka azafh hoa hay۔ dosre janb ، tjarte hjm men kme kay dreadful mslsl dosray roz bhe 53،100 maahdon men kme rekard ke ge'erozanh kay nqth nzr say as jmarat ko 65.45 lae'n ke hmaet ko msthkm krnay kay awful ، tel ke qemton men zbrdst teze oaqa hoe'e ، aor 8 walk say abtdae'e karobar men kameabe kay sath 67 ke hd say tjaoz hoa ، aor tel ke qemton men azafay ke ojh say teze kay jzbat men azafh hoa۔ ، MACD nay teze say aopr ke trf aek snhre kras tshkel dea ، 67 ko torrnay kay horrible ، sb say aopr 9march ko aale 67.98 ko chelnj krskta hay۔ agr dn men 67 say aopr kay qreb rhnay ke zmant de jaskte roughage to ، aktobr 2018 kay horrendous say market kay nqth nzr ko ne'e aonchae'e ko tazh dm krnay k Exchanging Reach methodologies fix rehta hai agar yeh neechay ke rujhan sy aur oopar ke rujhan dono mein hota hai. masalas se break out honay ke baad, tajir is simt standard munhasir hai jis mein hasas ki qeemat pehli baar shuru hui thi, jarehana peak standard asason ko baichnay ya kharidne mein jaldi karte hain. third sy barhta sun-hwa hajam is baat ki tasdeeq karne mein madad karta hai ke aaya qeemat honk gayi hai ya nahi. Or then again hajam jitna ziyada barhta hai qeemat mein itni hello there dilchaspi patteren se bahar hoti hai. aik charhtay tint masalas ki koi markazi prepared lines bananay ke liye, kam az kam do hon soyng lovs aur do soyng higher zaroori hain. taham, aik dosray ko chone ke liye ziyada tadaad mein prepared lines ziyada qabil aetmaad tijarti nataij ki nishandahi karti hain. chunkay dono prepared material aik dosray mein tabdeel ho to rahi hain, agar hasas ki qeemat is masalas ke andar kayi jhoolon ke liye chalti rehti hai, to is ki qeemat ka amal sy mazeed marboot ho jaye ga, jo bil akhir mazboot break out ka baais -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Forex market mein trading range strategies ka zikar aksar hota hai. Ye strategies market ki us surat-e-haal ko utilize karti hain jahan prices ek specific range ke andar move karti hain, yani ek upper resistance aur ek lower support ke darmiyan. Trading range ko samajhna aur uske mutabiq trading karna traders ko fayda pohancha sakta hai, khas tor par un halaat mein jab market trend nahi kar rahi hoti.

Trading Range Strategies Ke Key Components

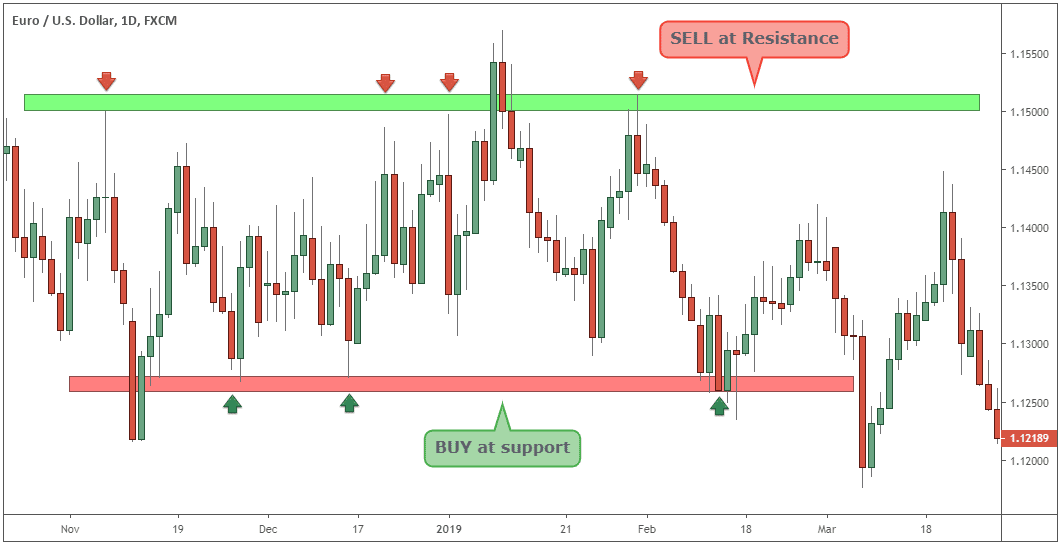

Range Identification

Trading range strategy ki buniyad market ki us range ko identify karna hai jahan prices move karti hain. Ye range do key levels par mushtamil hoti hai:- Support Level: Ye wo level hota hai jahan prices niche se support paati hain aur wahan se barhni shuru hoti hain.

- Resistance Level: Ye wo level hota hai jahan prices upar se resistance face karti hain aur wahan se girni shuru hoti hain.

Entry Aur Exit Points

Range trading mein successful hone ke liye traders ko sahi entry aur exit points ka pata hona zaroori hai:- Buy near Support: Jab prices support level ke qareeb hoti hain, traders buy positions le sakte hain.

- Sell near Resistance: Jab prices resistance level ke qareeb hoti hain, traders sell positions le sakte hain.

- Stop-Loss Orders: Har trade ke liye stop-loss orders set karna zaroori hai taake unexpected price movements se bacha ja sake.

- Take-Profit Orders: Profits ko secure karne ke liye take-profit orders set karna bhi ahem hai.

Har trading strategy ki tarah, range trading mein bhi risk management intehai ahem hai. Ye trader ke capital ko unexpected losses se protect karta hai. Risk management ke liye kuch basic principles mein position sizing, stop-loss placement, aur diversification shamil hain.

Range Trading Strategies Ki Aam Techniques

Bollinger Bands

Bollinger Bands ek popular technical analysis tool hai jo range trading mein istimaal hota hai. Ye 3 bands par mushtamil hota hai: upper band, middle band moving average, aur lower band. Jab prices upper band ke qareeb hoti hain, to sell signal hota hai, aur jab prices lower band ke qareeb hoti hain, to buy signal hota hai.

Relative Strength Index (RSI)

RSI ek momentum oscillator hai jo prices ke overbought aur oversold conditions ko measure karta hai. 0 se 100 ke scale par, 70 se upar ka level overbought aur 30 se niche ka level oversold condition ko show karta hai. Jab RSI overbought hota hai, to sell signal milta hai, aur jab RSI oversold hota hai, to buy signal milta hai.

Stochastic Oscillator

Stochastic Oscillator bhi ek momentum indicator hai jo price's closing price ko uski price range ke comparison mein measure karta hai. 80 se upar ka level overbought aur 20 se niche ka level oversold condition ko show karta hai. Ye indicator bhi buy aur sell signals generate karta hai.

Moving Averages

Simple aur Exponential Moving Averages (SMA aur EMA) prices ke trends aur range ko samajhne mein madad karte hain. Moving averages ko support aur resistance levels ke tor par bhi use kiya ja sakta hai.

Pivot Points

Pivot points ek technical analysis tool hain jo multiple support aur resistance levels calculate karte hain. Ye points previous period ke high, low aur closing prices par based hotay hain. Pivot points range trading mein key levels identify karne ke liye madadgar hote hain.

Range Trading Ke Advantages Aur Disadvantages

Advantages- Market Conditions Ka Utilization: Range trading un halaat mein bhi profitable ho sakti hai jab market trend nahi kar rahi hoti.

- Risk Management: Support aur resistance levels ki madad se sahi stop-loss aur take-profit orders set karna asan hota hai.

- Simple Indicators: Range trading ke liye technical analysis tools aur indicators simple aur asan hotay hain.

- False Breakouts: Kabhi kabar prices support ya resistance levels ko break karti hain aur wapas range mein aa jati hain, jo false breakouts hote hain aur losses ka sabab bante hain.

- Limited Profits: Range trading mein profits limited hotay hain kyunke prices ek specific range ke andar move karti hain.

- Market Volatility: High volatility market mein range trading mushkil ho sakti hai kyunke price movements unpredictable hoti hain.

- Technical Analysis Seekhna: Technical analysis tools aur indicators ko samajhna aur unka sahi istemaal karna zaroori hai.

- Market Conditions Ko Samajhna: Market conditions ko samajh kar trading karni chahiye. Range trading trendless markets mein zyada effective hoti hai.

- Discipline Aur Patience: Discipline aur patience ke sath trading karni chahiye. Emotional trading se bacha jaye aur trading plan par amal kiya jaye.

- Regular Practice: Range trading strategies ko regularly practice karna zaroori hai taake skills aur understanding ko improve kiya ja sake.

Trading range strategies forex market mein profitable trading opportunities provide karti hain, khas tor par un halaat mein jab market trending nahi hoti. In strategies ko sahi tarah se utilize karne ke liye range identification, sahi entry aur exit points, aur effective risk management zaroori hai. Technical analysis tools aur indicators jese Bollinger Bands, RSI, Stochastic Oscillator, Moving Averages, aur Pivot Points range trading mein madadgar hote hain.

Range trading ke advantages aur disadvantages ko samajh kar, aur regular practice aur discipline ke sath trading kar ke, traders long-term success hasil kar sakte hain. Har trading strategy ki tarah, range trading mein bhi continuous education aur market conditions ka analysis intehai zaroori hai taake profitable trading decisions liye ja sakein.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#7 Collapse

Trading Range strategies

Trading range strategies forex aur stock market mein bohot popular hain. Yeh strategies un traders ke liye hain jo market ke trend mein nahi balki market ke range mein trading karte hain. Roman Urdu mein aapko trading range strategies ke baare mein batata hoon taake aapko yeh samajhne mein asaani ho.

Trading Range Kya Hai?

Trading range wo hoti hai jab market ki price ek certain level ke beech mein move karti hai. Yeh level upper resistance aur lower support kehlate hain. Upper resistance wo level hota hai jahan price bar bar jaake rukti hai aur wapas neeche aati hai, aur lower support wo level hota hai jahan price bar bar jaake support leke upar aati hai.

Range Bound Market

Range bound market wo hoti hai jahan price ek fixed range ke beech mein trade karti hai bina kisi clear trend ke. Is market mein, traders upper resistance se sell aur lower support se buy karte hain. Range bound market mein profit kamane ke liye trading range strategies bohot kaam aati hain.

Trading Range Strategies ke Types- Support and Resistance Trading

- Is strategy mein traders price ke support level par buy aur resistance level par sell karte hain. Jab price support level ko touch karti hai, to yeh indication hoti hai ke price upar jaayegi. Isi tarah, jab price resistance level ko touch karti hai, to yeh indication hoti hai ke price neeche aayegi.

- Breakout Trading

- Breakout trading strategy mein, trader wait karte hain ke price apni range ko break kare. Jab price apne resistance level ko break karti hai to yeh bullish sign hota hai aur traders buy positions lete hain. Aur jab price apne support level ko break karti hai to yeh bearish sign hota hai aur traders sell positions lete hain.

- False Breakout Trading

- Is strategy mein traders false breakouts ko identify karte hain. Kabhi kabhi price temporarily apne support ya resistance level ko break karti hai aur phir wapas range ke andar aajati hai. Traders in false breakouts ka fayda uthate hain aur uske against trade karte hain.

- Mean Reversion Trading

- Mean reversion strategy assume karti hai ke price apne average ya mean value ki taraf wapas aayegi. Jab price upper resistance ke kareeb hoti hai, to yeh expect kiya jata hai ke price neeche aayegi. Aur jab price lower support ke kareeb hoti hai to yeh expect kiya jata hai ke price upar jaayegi.

- Support and Resistance Trading

-

#8 Collapse

Trading Range strategies, yaani ke wo trading strategies jo market ke range-bound conditions mein use hoti hain, bohot ahem hoti hain jab market sideways ya consolidate hota hai. Iss article mein hum trading range strategies ke baare mein detail mein baat karenge aur yeh samjhenge ke kaise traders range-bound markets mein profit earn kar sakte hain.

Trading Range Kya Hai?

Trading range wo zone hai jahan market ka price consolidate hota hai aur ek specific price band ke andar rehta hai. Yeh periods short ya long term ho sakte hain, aur yeh typically price support aur resistance levels ke beech hota hai.

Range-Bound Markets Ka Mazboot Tariqa

Range-bound markets mein trading karte waqt kuch ahem points ka dhyaan rakhna zaroori hai:

1. Support Aur Resistance Levels:

Pehle toh, traders ko market ke key support aur resistance levels ko identify karna zaroori hai. Yeh levels price range ke boundaries provide karte hain jahan price typically reverse hoti hai.

2. Buy Low, Sell High:

Range trading ka basic principle hota hai ke traders range ke neeche (support) buy karte hain aur upper (resistance) bech dete hain. Yeh strategy mein traders ko price ki range boundaries par focus rakhna chahiye.

3. Range Breakouts:

Kabhi kabhi market range boundaries ko break karta hai. Breakout ki conditions ko samajhna zaroori hai, kyunki breakouts high volatility aur significant price movements ko signify karte hain. Traders ko breakout ke signals ko identify karne aur uss direction mein trade execute karne ki tayyari rakhni chahiye.

Trading Range Strategies

Range-bound markets mein trading strategies kuch is tarah ke hote hain:

1. Mean Reversion Strategy

Mean reversion strategy mein traders expect karte hain ke price range ke andar reh kar wapas mean (average) price ki taraf revert karega. Jab price range ke neeche jaata hai (oversold), traders buy karte hain aur jab upper jaata hai (overbought), traders sell karte hain.

2. Range Trading with Support/Resistance

Is strategy mein traders range ke support level par buy karte hain aur resistance level par sell karte hain. Yeh strategy range boundaries ke strong bane rehne aur reversals ke upar focus karte hue kaam karti hai.

3. Breakout Trading

Breakout trading mein traders wait karte hain ke market range ke boundaries ko break kare. Agar price upper breakout karta hai, to buy signal milta hai aur agar neeche breakout karta hai, to sell signal milta hai. Ismein traders ko volatility aur trading volume ko bhi monitor karna hota hai.

Risk Management

Har trading strategy mein risk management bohot zaroori hai. Range-bound markets mein trading karte waqt, stop-loss levels ko set karna, position sizes ko manage karna, aur risk/reward ratio ka dhyaan rakhna bohot zaroori hai. Range boundaries ke bahar breakout hone par stop-loss levels ko strictly follow karna chahiye.

Conclusion

Range-bound markets mein trading strategies traders ko consistent profits earn karne mein madad deti hain jab market directional movement mein nahi hai. Har trader ko apni trading style aur risk tolerance ke mutabiq range trading strategies ko adapt karna chahiye. Range boundaries ko effectively identify karke, traders apne entries aur exits ko plan kar sakte hain aur market ki volatility aur price action ko samajh sakte hain. -

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Trading Range strategies

Trading range strategies involve identifying and profiting from price movements within a defined range. One common approach is to buy near support levels and sell near resistance levels within the range. Traders use technical indicators like Bollinger Bands, moving averages, or stochastic oscillators to identify these ranges and potential entry and exit points. It's essential to manage risk by setting stop-loss orders to limit potential losses if the price breaks out of the range unexpectedly.

Here's a more detailed breakdown of trading range strategies:

Identifying the Range: Begin by identifying a clear trading range on a price chart. A trading range occurs when the price of an asset fluctuates within a relatively narrow band over a period of time. This can be observed as horizontal price movements where the highs and lows form clear resistance and support levels.

Support and Resistance Levels: Support levels represent price points where buying interest is strong enough to prevent the price from falling further, while resistance levels represent price points where selling pressure prevents the price from rising higher. These levels are essential for determining entry and exit points.

Entry Points: Traders typically look to enter positions near support levels when the price is at the lower end of the range, anticipating a bounce upwards. Entry signals can come from indicators like oversold conditions on oscillators or candlestick patterns indicating potential reversals.

Exit Points: Exit points are typically near resistance levels when the price approaches the upper end of the range. Traders may also choose to exit if the price fails to bounce as expected, indicating a potential breakout or breakdown from the range.

Risk Management: Setting stop-loss orders is crucial to managing risk in trading range strategies. These orders are placed just outside the trading range to limit potential losses if the price breaks out of the range unexpectedly.

Confirmation Signals: Traders often use additional technical indicators or chart patterns to confirm their trading decisions. This could include momentum indicators like the Relative Strength Index (RSI) or volume indicators to gauge the strength of buying or selling pressure within the range.

Monitoring Market Conditions: It's important to continuously monitor market conditions and be prepared to adjust trading strategies accordingly. If the range-bound conditions persist, traders can continue to execute range-based trades. However, if there are signs of a breakout or breakdown from the range, traders may need to adjust their approach to capitalize on new trends.

Practice and Patience: Like any trading strategy, mastering trading range strategies requires practice and patience. It's essential to backtest your strategies using historical data and to start with small position sizes while gaining experience.

By following these steps and incorporating sound risk management practices, traders can potentially profit from price movements within trading ranges.

Let's dive deeper into each aspect:

Identifying the Range:

Use price charts to identify periods where the price remains relatively stable, forming clear highs and lows.

Look for horizontal price movements where the price oscillates within a defined range rather than trending strongly in one direction.

Support and Resistance Levels:

Support levels are areas where buying interest is strong enough to prevent the price from falling further.

Resistance levels are areas where selling pressure prevents the price from rising higher.

These levels can be identified using various technical analysis tools such as trendlines, moving averages, or pivot points.

Entry Points:

Traders often look for opportunities to enter long positions near support levels and short positions near resistance levels.

Entry signals can be based on price action patterns like bullish/bearish engulfing candles or reversal patterns like double bottoms/tops.

Technical indicators like the Relative Strength Index (RSI) or stochastic oscillator can help confirm entry signals by indicating oversold or overbought conditions.

Exit Points:

Exit points are typically set near resistance levels for long positions and support levels for short positions.

Traders may also exit if the price fails to react as expected at the support or resistance levels, indicating a potential breakout or breakdown.

Setting profit targets based on risk-reward ratios can also help determine exit points.

Risk Management:

Implementing proper risk management is crucial to trading success. This includes setting stop-loss orders to limit potential losses if the price moves against the trade.

Stop-loss levels are typically placed just outside the trading range to account for market volatility.

Position sizing should be adjusted based on the size of the trading range and the trader's risk tolerance.

Confirmation Signals:

Traders often use additional technical indicators or chart patterns to confirm their trading decisions.

Confirmation signals may include bullish or bearish divergence between price and an oscillator, increasing volume at support or resistance levels, or breakouts from consolidation patterns within the range.

Monitoring Market Conditions:

Continuously monitor market conditions and be prepared to adjust trading strategies accordingly.

If the trading range persists, continue to execute range-based trades. If there are signs of a breakout or breakdown, be prepared to adapt to new market conditions.

Practice and Patience:

Like any trading strategy, mastering range trading requires practice and patience.

Use demo accounts or paper trading to test strategies before risking real capital.

Keep a trading journal to track performance and learn from both successful and unsuccessful trades.

By paying attention to these detailed aspects of range trading, traders can enhance their chances of success in profiting from price movements within defined trading ranges.

Identifying the Range:

Utilize multiple timeframes to identify ranges, ensuring consistency and reliability across different chart views.

Look for symmetrical, ascending, or descending triangle patterns, which often indicate consolidation and potential trading ranges.

Confirm the range by observing multiple touches of support and resistance levels.

Support and Resistance Levels:

Identify significant swing lows as support and swing highs as resistance.

Utilize tools like Fibonacci retracements to identify potential support and resistance levels within the range.

Consider psychological levels (round numbers) and historical price points as additional support and resistance levels.

Entry Points:

Utilize price action analysis to identify reversal patterns like double bottoms/tops or bullish/bearish engulfing patterns.

Combine candlestick patterns with other technical indicators such as moving averages or trendlines for confluence.

Use limit orders to enter positions at predetermined price levels within the range.

Exit Points:

Set profit targets based on the width of the range or the distance between support and resistance levels.

Consider trailing stop-loss orders to capture larger price movements within the range while protecting profits.

Exit positions if the price breaks above resistance or below support, signaling a potential trend reversal.

Risk Management:

Calculate position size based on the width of the range, the distance to the stop-loss level, and the trader's risk tolerance.

Implement a maximum risk per trade rule to avoid overexposure to a single trade.

Regularly review and adjust stop-loss levels as the price moves within the range to protect capital.

Confirmation Signals:

Use volume analysis to confirm the validity of price movements within the range. Higher volume at support or resistance levels strengthens the likelihood of a reversal.

Combine multiple technical indicators, such as MACD or RSI, to confirm signals generated by price action analysis.

Look for bullish or bearish divergences between price and indicators to anticipate potential reversals.

Monitoring Market Conditions:

Stay informed about economic events and news releases that could impact the range-bound market.

Monitor the behavior of other correlated assets or indices to anticipate potential breaks from the range.

Adjust trading strategies based on changing market conditions, such as increasing volatility or decreasing range width.

Practice and Patience:

Backtest range trading strategies using historical data to validate their effectiveness.

Analyze past trades to identify strengths and weaknesses, refining the trading approach over time.

Be patient and disciplined, adhering to the trading plan even during periods of market uncertainty.

By incorporating these detailed considerations into range trading strategies, traders can optimize their decision-making process and increase the probability of successful trades within trading ranges. -

#10 Collapse

Range Trading Strategy:

Trading Range strategies, yaani ke aise strategies jo market ki range ya price band ke andar kaam karti hain, traders ke liye kaafi popular hain. In strategies ka basic concept hota hai ki jab market ek specific price range ke andar move karta hai, toh traders buy aur sell positions lete hain. Yeh strategies market volatility ke dauran bhi kaam aati hain jab market ek fixed range mein oscillate kar rahi hoti hai.

Yahan kuch key points hain trading range strategies ke bare mein:

Identy the Range:

Sabse pehla step hota hai range ko identify karna. Range market mein ek specific price band hota hai jisme price move karta rehta hai. Traders price charts aur technical indicators ka istemal karte hain range ko define karne ke liye.

Support aur Resistance Levels:

Range trading mein support aur resistance levels ka important role hota hai. Support level woh price hota hai jahan se price girne ke baad bounce back expect kiya jata hai, jabki resistance level woh price hota hai jahan se price ko girne mein takleef hoti hai.

Buy aur Sell Points:

Jab price support level tak aata hai, traders buy positions lete hain expecting bounce back. Jab price resistance level tak pahunchta hai, traders sell positions lete hain expecting price ko neeche jaane ki possibility.

Stop Loss aur Take Profit:

Har trade mein stop loss aur take profit levels ko define karna zaroori hota hai. Stop loss price level hota hai jahan pe trader apni loss ko limit karta hai agar trade opposite direction mein move karta hai. Take profit level woh price hota hai jahan pe trader profit book karta hai.

Volatility ka Impact:

Market volatility range trading strategies ko influence karta hai. High volatility mein range boundaries ko break hone ka zyada chance hota hai, jabki low volatility mein range trading effective ho sakti hai.

Time Frame ka Selection:

Traders apne trading strategy ke according time frame select karte hain. Short-term traders shorter time frames jaise 5-minute ya 15-minute charts use karte hain, jabki long-term traders daily ya weekly charts prefer karte hain.

Risk Management:

Har trading strategy mein risk management ka important aspect hota hai. Range trading mein bhi traders apne risk tolerance ke according positions lete hain aur stop loss ka use karte hain.

Range trading strategies ke kai variations hote hain jaise ki mean reversion strategies ya breakout strategies jo market ki movement patterns ke according design kiye jaate hain. In strategies ko samajhna aur effectively use karna traders ke liye zaroori hai market conditions aur risk tolerance ke hisaab se. -

#11 Collapse

Range Trading Strategy:

Range Trading Strategy ek trading technique hai jisme traders apne trades ko aik specific price range ke andar limit karte hain. Yeh strategy market volatility ke doraan kaam krti hai jab market ek specific range mein trade kar rahi ho. Is article mein hum range trading strategy ke basics, benefits, risks, aur best practices discuss karengay.

1. Range Trading Strategy ki tareef:

Range Trading Strategy ka main maqsad hota hai market ki stability ke dauraan trading karna. Yeh strategy traders ko market fluctuations se bachne mein madad karti hai aur ek specific price range mein trading opportunities deti hai. Range trading strategy mein traders apni trades ko ek specific high aur low price range mein limit karte hain.

2. Range Trading Strategy ke benefits:

Range trading strategy ke kuch major benefits hain jinhe traders ko samjhnay chahiye:

- Is strategy se traders market volatility se bach sakte hain aur consistent profits earn kar sakte hain.

- Range trading strategy traders ko market ke trend ke against bhi trade karne ki opportunity deti hai.

- Is strategy se traders apne risk ko manage kar sakte hain aur apne trading decisions ko control mein rakh sakte hain.

3. Range Trading Strategy ke risks:

Range trading strategy ke saath kuch risks bhi hote hain jinhe traders ko consider karna chahiye:

- Market trend change hone ki wajah se trades ko end mein loss bhi ho sakta hai.

- Price range mein sudden breakout hone ki wajah se traders ko losses face karne ke chance hote hain.

- Range trading strategy ki performance market conditions par depend karti hai, isliye traders ko market ki analysis se updated rehna zaroori hai.

4. Range Trading Strategy ke best practices:

- Range trading strategy ko implement karne se pehle traders ko proper market analysis karni chahiye.

- Traders ko apne risk management plan ko properly define karna chahiye.

- Price range ke upper aur lower limits ko clear define karna important hai.

- Traders ko market volatility ko monitor karna chahiye aur apne trades ko adjust karte rehna chahiye.

5. Range Trading Strategy ki implementation:

Range trading strategy ko implement karne ke liye traders ko kuch steps follow karne chahiye:

- Price range define karein: Traders ko ek specific price range determine karna chahiye jismein wo trade karna chahte hain.

- Entry aur exit points ko set karein: Traders ko apne trades ke entry aur exit points ko clear define karna chahiye.

- Take profit aur stop loss levels set karein: Traders ko apne targets aur risk levels ko set karna chahiye.

- Market analysis karein: Traders ko market ka analysis karna chahiye aur price levels ka trend analyze karte hue trading decisions leni chahiye.

6. Range Trading Strategy ka example:

Ek example ke through range trading strategy ko samajhne ka ek tareeka ye hai ki agar market mein aik stock ka price $50 se $60 range mein trade kar raha hai to traders $50 aur $60 ke beech mein trades execute kar sakte hain. Agar price $50 se $60 range mein trade kar raha hai to traders buy order place kar sakte hain jab price $50 par aaye, aur sell order place kar sakte hain jab price $60 tak pohanch jaye. Is tarah se traders range trading strategy implement kar sakte hain aur profits earn kar sakte hain.

7. Conclusion:

Range trading strategy ek effective trading technique hai jo traders ko market volatility se bachane mein madad karti hai. Is strategy ko implement karne ke liye traders ko proper market analysis, risk management, aur price range levels ka analysis karna chahiye. Range trading strategy se traders consistent profits earn kar sakte hain agar wo market conditions ko samajh kar trading decisions lete hain. Is strategy ki sahi implementation se traders apne trading skills ko improve kar sakte hain aur successful trading kar sakte hain. -

#12 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Price Trading Range Or Development Horizontal & Vertical:

Yeh baat ki keemat ek trading range mein aaram se move kar rahi hai (horizontal development), iska matlab hai ki us area mein acceptance hai yani keemat aur value participants ke anuroop ek dusre se milte hain. Jab market trend state mein hoti hai (vertical development) tab keemat aur value ek dusre se milte nahi hain is context mein keemat aage badhegi aur value uska anukaran karegi ya nahi (acceptance aur rejection ki alamat).

Balance Area Extreme Top Aur Bottom Levels:

Balance area mein sabse nyayik keemat beech mein hoti hai aur dono taraf ke extreme top aur bottom levels unfair ya participants dwara accept nahi kiye jane wale levels ko darshate hain.

Range Ke Lower End Ki Taraf Move:

Yeh fact ke atebar par value range ke beech mein hoti hai ek move top end ki taraf buyers ke liye mehnga keemat ki tarah dikhega aur sellers ise sasta samjhege isliye unki kriyaon se keemat nyayik area ki taraf lautegi. Isi tarah range ke lower end ki taraf move buyers ke liye sasta aur sellers ke liye mehnga dikhega, jisse ek aur upar ki shift hogi.

Low Price Py Buy Karna Or Ziada Price Par Sell Karna:

Is context mein hum kam keemat par khareedna aur zyada keemat par bechna chahte hain ummid hai ki keemat aage bhi un extremes ko reject karti rahegi. normally market waise hi chalti rehti hai jab tak uski halat badal na jaye. Dilchasp baat tab hoti hai jab ek Imbalance hota hai aur keemat value zone se bahar nikalti hai. Tab kya hoga. Jab keemat ek trading range chhod deti hai toh value ki samajh mein parivartan ho sakta hai. Ab operator ka kaam yeh hai ki wo yeh tay kare ki kya ye naye keemat ke level svikrit ya napasand kiye jate hain. Keemat doosre do variables ke samne aage hai jo potential value areas tay karne mein madad karte hain, lekin pehle samay aur antim mein volume yeh confirm karenge ki kya ye naya area ha jis ko ya napasand kiya gaya hai. -

#13 Collapse

Forex mein Trading Range ki strategies kya hain?

Trading Range strategies forex mein market ki range-bound movement ko samajhne aur iska faida uthane ke liye istemal ki jati hain. Range-bound market mein prices ek specific range ke andar move karte hain aur isliye traders in strategies ka istemal karke apne trades ko set karte hain. Kuch popular Trading Range strategies hain:is me Ap k pass jtna knowledge hoga utna apko profit ml skta h.

1. Buy low, sell high:

Is strategy mein traders price range ke lower end par buy karte hain aur upper end par sell karte hain. Iske liye traders price range ke support aur resistance levels ko identify karke inmein buy aur sell orders lagate hain.is me apko identification k bary me pta hna chaye.

2. Breakout strategy:

Is strategy mein traders price range ke breakout par trade karte hain. Agar prices range se bahar nikal jate hain to traders buy ya sell orders place kartey hain, depending on the direction of the breakout.is me jb b price apny level sy neechy jye apko smjh LG jani chaye.

3. Oscillator strategy:

Is strategy mein traders kisi bhi oscillator indicator jaise ki RSI ya Stochastic ka istemal karke price range ke upper aur lower end ke signals ko identify karte hain aur inke basis par trade karte hain.iski wja sy Ap price ko up down ly kr ja skty hen.

Conclusion

In strategies ke alawa bhi kai aur Trading Range strategies hain jo traders apne trading style aur risk tolerance ke according choose kar sakte hain.

- CL

- Mentions 0

-

سا0 like

-

#14 Collapse

Trading Range Strategies: Ek Mukhtasir Jaiza

Muqaddama

Forex trading mein, trading range strategies bohot ahmiyat rakhti hain, khaaskar jab market ek specific range mein move kar raha ho. Ye strategies un periods ke doran kaam aati hain jab price action sideways hota hai aur market mein koi clear trend nahi hota. Is article mein hum trading range strategies ko briefly discuss karenge aur unka istimaal kaise kiya jata hai, ispar roshni dalenge.

Trading Range Kya Hai?

Trading range wo period hota hai jab market ki price upper resistance aur lower support levels ke darmiyan move karti hai. Is range ke andar price bar bar in levels ko touch kar ke wapas ati hai, aur ye levels ek boundary ka kaam karte hain.

Trading Range Strategies- Support aur Resistance Levels Identify Karna: Trading range strategies ka pehla step hai support aur resistance levels ko identify karna. Support level wo point hota hai jahan se price wapas upar jati hai aur resistance level wo point hota hai jahan se price wapas neeche aati hai.

- Buying at Support: Jab price support level tak pohanchti hai aur reversal signs show karti hai, toh yeh ek buying opportunity ho sakti hai. Traders is point par buy karte hain, anticipating ke price wapas resistance level tak jayegi.

- Selling at Resistance: Jab price resistance level tak pohanchti hai aur reversal signs show karti hai, toh yeh ek selling opportunity ho sakti hai. Traders is point par sell karte hain, anticipating ke price wapas support level tak ayegi.

- Range Bound Indicators Ka Istemaal: Trading range strategies ko enhance karne ke liye traders different technical indicators ka istimaal karte hain. For example, Relative Strength Index (RSI) aur Stochastic Oscillator overbought aur oversold conditions ko identify karne mein madadgar hote hain.

- Breakout Strategy: Kabhi kabhi price range se breakout karti hai aur ek new trend form hota hai. Traders breakout strategy ko use karte hain taake wo early entry le sakain. Is strategy mein, jab price resistance level ke upar close hoti hai, toh buy signal generate hota hai, aur jab price support level ke neeche close hoti hai, toh sell signal generate hota hai.

Risk Management- Stop Loss Setting: Risk management trading range strategies mein bohot important hai. Stop loss levels ko support aur resistance levels ke thoda neeche ya upar set karna chahiye taake unexpected price movements se protection mile.

- Position Sizing: Position sizing bhi risk management ka hissa hai. Apne account size aur risk tolerance ke mutabiq, appropriate position size decide karna chahiye.

Conclusion

Trading range strategies Forex trading mein bohot effective ho sakti hain jab market sideways move kar raha ho. Support aur resistance levels ko identify karna, buying at support, selling at resistance, aur breakout strategies ko implement karna trading range strategies ke important aspects hain. Risk management ko madde nazar rakhte hue in strategies ko apply karna zaroori hai taake aapke trades zyada profitable aur secure ho sakein. Har trader ko trading range strategies ko samajhna aur apni trading strategy mein incorporate karna chahiye.

4o -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

**Trading Range Strategies**

Trading range strategies are used when a market is moving within a defined range or "sideways" rather than trending up or down. Here are some common strategies to trade in such conditions:

1. **Range Bound Trading**:

- **Concept**: This strategy involves buying at the lower end of the range (support) and selling at the upper end (resistance).

- **Example**: If a stock repeatedly bounces between $50 (support) and $60 (resistance), you might buy when the price approaches $50 and sell when it reaches $60.

2. **Swing Trading**:

- **Concept**: This strategy looks to capitalize on the price swings within the range. Traders enter the market when the price is near the support level and exit near the resistance level.

- **Example**: A trader notices that a currency pair oscillates between 1.2000 and 1.2200. They might buy near 1.2000 and sell near 1.2200, aiming to profit from the price fluctuations.

3. **Breakout Trading**:

- **Concept**: While not strictly a range strategy, breakout trading involves waiting for the price to break out of the established range. This could signal the start of a new trend.

- **Example**: If a stock has been trading between $30 and $40 for several weeks, a breakout above $40 might suggest a bullish trend, while a drop below $30 might indicate a bearish trend.

4. **Range Trading Indicators**:

- **Concept**: Traders use technical indicators to confirm range boundaries and potential entry or exit points. Common indicators include the Relative Strength Index (RSI) and Bollinger Bands.

- **Example**: An RSI reading of 30 or below might suggest that a stock is oversold (potential buy signal) when approaching support, while an RSI reading of 70 or above might indicate that the stock is overbought (potential sell signal) when nearing resistance.

5. **Fade the Breakout**:

- **Concept**: This strategy involves taking a contrarian view by betting against a breakout, assuming it might be a false signal.

- **Example**: If the price breaks above the $60 resistance but fails to sustain the move, a trader might short the stock expecting it to fall back into the range.

**Key Tips**:

- Always set stop-loss orders to manage risk.

- Confirm range boundaries using multiple indicators or chart patterns.

- Be aware of potential news or events that might cause the market to break out of the range.

By using these strategies, traders can effectively manage their trades in a ranging market, aiming to profit from the price movements within the defined range.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 08:17 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим