Forex trading using divergence

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

FOREX TRADING THROUGH DIVERGENCEIntroduction Divergence, trading mein aik aham concept hai. Divergence ka matlab hota hai jab kisi asset ya indicator ki movement price action se alag hojati hai. Ye trader ke liye ek signal hai ke market mein reversal ya trend change ho sakta hai. Market trend, jab asset ki price mein sustained movement hoti hai, upar ya neeche, tab banta hai. Agar price continuously upar ki taraf move kar rahi hai, toh trend bullish kehlata hai. Aur agar price continuously neeche ki taraf move kar rahi hai, toh trend bearish kehlata hai. Price action, market mein asset ki movement ko samajhne ke liye use kiya jata hai. Jab asset ki price mein changes, patterns aur trends observe kiye jate hain, tab price action analysis ki jati hai. Divergence trading strategy: Divergence strategy mein, hum divergence ki indications ka istemal karte hain. Divergence, price action aur kisi technical indicator ke beech ka tafawut hota hai. Agar asset ki price upar ki taraf move kar rahi hai, lekin indicator ki line neeche ki taraf ja rahi hai, toh ye bearish divergence hai. Yani asset ke price ka movement indicator ke sath match nahi kar raha hai. Agar asset ki price neeche ki taraf move kar rahi hai, lekin indicator ki line upar ki taraf ja rahi hai, toh ye bullish divergence hai. Yani asset ke price ka movement indicator ke sath match nahi kar raha hai. Trend identification: Pehle market trend ko identify karna zaroori hai. Agar trend upar ki taraf hai, toh hum bearish divergence search karenge. Aur agar trend neeche ki taraf hai, toh hum bullish divergence search karenge. Indicator selection: Divergence detect karne ke liye, ek suitable indicator select karna zaroori hai. Popular indicators, jaise ki MACD, RSI, aur Stochastic, divergence identify karne mein madad karte hain. Divergence search: Price action aur indicator ke beech ka tafawut search karna hai. Agar trend upar ki taraf hai, toh hum asset ke higher highs aur indicator ke lower highs ki tafawut ko dhundenge. Agar trend neeche ki taraf hai, toh hum asset ke lower lows aur indicator ke higher lows ki tafawut ko dhundenge. Confirmation: Divergence identify karne ke baad, ek aur confirming factor dhundna zaroori hai. Iske liye, humein price pattern ya koi aur technical indicator ka istemal karna hota hai. Ye humein divergence signal ki validity ko confirm karta hai. Entry aur exit points: Jab divergence confirm hojaye, toh entry aur exit points tayyar karna hai. Entry point par trade enter karte waqt, stop-loss aur target levels tayyar karna zaroori hai. Stop-loss level, trade ki safety ke liye rakha jata hai aur target level, trade ko profitable banane ka goal hota hai. Risk management: Har trading strategy mein risk management zaroori hota hai. Divergence strategy mein bhi apna risk manage karna zaroori hai. Risk-reward ratio ko consider karte hue, position size aur stop-loss level sahi tareeke se set karna zaroori hai. Word of Advise Divergence strategy ko samajhna aur istemal karna practice aur experience ki zaroorat hai. Market analysis aur technical indicators ki samajh ko develop karne ke liye, demo trading account ka istemal karna helpful ho sakta hai. Trading mein success ke liye, consistent practice, discipline, aur knowledge ka hona zaroori hai. -

#3 Collapse

Assalamu Alaikum Dosto!Divergence

Divergence ka matlab hai jab aik currency pair ka price aik direction mein move karta hai jabke trend indicator opposite direction mein move karta hai. Divergence ke saath, positive aur negative signals ho sakte hain.

Jab divergence hota hai to ye is liye hota hai ke koi wazeh directional trends nahi hote aur traders divergence ko aik signal ke tor par istemal karte hain, aam tor par har taraf trade lena ke positions ke saath.

Divergence ke bare mein aur ziada explore karne ke liye, chaliye jaane ke divergence kya hai, divergence ko dhoondhne ke liye kis tarah ke indicators istemal kiye jaate hain, aur forex traders kis tarah se isko apni trades mein istemal karte hain.

Apni sab se basic surat mein, divergence tab hoti hai jab aap dekh rahe hain ke forex pair ka price aapki charts pe moujooda technical indicators se phail gaya hai.

Misal ke tor par, wo price jo chart pe aap dekh rahe hain ab ek naya higher high banata hai, lekin indicator ne ek lower high banaya hai. Ye divergence kehlata hai.

Log divergence ko dhoondhne ke liye kis tarah ke technical indicators istemal karte hain?

Divergence dhoondhne ke liye sab se behtareen qisam ke indicators oscillators hote hain.

Divergence pehchaan ne ke liye sab se commonly used oscillators mein shamil hain:- Stochastics

- Relative Strength Index (RSI)

- MACD

- Williams Percent R

Hum oscillators ko istemal karte hain kyunke ye 0 aur 100 ke darmiyan range karte hain aur humein charts pe overbought aur oversold levels ko pehchanne mein madad karte hain. Neeche aik screenshot hai MT4 ke andar Oscillators folder mein moujood tamam oscillator indicators ka.

Forex divergence aapko kya batata hai?

Forex divergence price action aur aik khaas indicator (aam tor par - aik oscillator) ke movement ko compare karne ke baare mein hoti hai.

Aksar waqt, agar price higher highs pe pohanch rahi hai, to oscillator bhi usi ke saath higher highs banayega. Vice-versa, agar price lower lows post kar rahi hai, to oscillator bhi usi ke saath lower lows banayega.

Lekin agar ye nahi hota, to iska matlab hai ke price aur oscillator aapas mein diverge ho rahe hain.

Isko aik acha entry signal ke liye kaise istemal kiya ja sakta hai?

Divergence aik sab se taqatwar reversal signal hai jo aap pa sakte hain. Lekin yaad rakhein, ye aik reversal trading strategy hai jismein aap moujooda trend ke khilaaf ja rahe hain.

Aap notice karenge ke price ne ek higher high banaya hai, lekin indicator ne ek lower high banaya hai.

Ye ek classic bearish divergence signal hai.

Forex divergence ko entry signal ke tor pe istemal nahi kiya jana chahiye. Lekin, ye aapke mojooda strategy mein aik qeemati addition ban sakti hai.

For example, agar aapki strategy aapko batati hai ke currency pair ko aik major resistance level pe bechne ke liye, to aap divergence pattern ko apne plan mein ek additional confirmation signal ke tor pe shamil kar sakte hain. Agar for example EUR/USD major resistance level pe ruka hai, aur usi waqt bearish divergence bhi hai, to reversal ke chances barh jaate hain.

Forex trading mein divergence ke liye top tips

Forex divergence ke trading ke bare mein kuch top tips shamil hain:- Monitor karein trading instrument ka general trend.

- Draw karein key support aur resistance lines, aur divergence ko highs/lows dekh kar pehchanein.

- Jab aap divergence ko spot karte hain, to define karein ke ye kis taraf ishara kar raha hai (for example, bearish divergence ye suggest karega ke instrument reversal aur decline dekhne wala hai).

- Apni strategy ko wait karein ke wo aapko appropriate entry signal de (for example, agar aapka strategy breakout strategy hai, to aap wait kar sakte hain jab price key support line ke neeche gira hai jise aap monitor kar rahe the).

Divergence aur confirmation mein kya farq hai?

Farq ko spot karna bohot simple hai. Confirmation tab hoti hai jab indicator price ke saath ek hi direction mein move karta hai. Uthte hue prices ke saath ek indicator bhi uth raha hai. Vice versa, agar price neeche ja rahi hai, to indicator bhi uske saath neeche ja raha hai.

Divergence ke types

Divergence ko live price chart pe spot karna asaan hota hai lekin kabhi kabhi confusing ho sakta hai ke aap kis type ki divergence dekh rahe hain. Forex trading mein, hum aksar divergences ko regular, hidden, ya extended mein divide karte hain.

Regular divergence aik strong trend reversal signal suggest karta hai. Regular divergence ko do hisson mein taqseem kiya jaata hai:- Regular bullish divergence

- Regular bearish divergence

Hidden divergence regular divergence ke opposite hai, aur ye suggest karta hai ke trend continue ho raha hai. Hidden divergence ko do hisson mein taqseem kiya jaata hai:- Hidden bullish divergence

- Hidden bearish divergence

Extended divergence teesra type hai aur ye hidden divergence ke kuch hadd tak similar hai. Kuch traders isay itna strong signal nahi mante kyunke ye kai martaba basic rules for divergence ko follow nahi karta aur kabhi kabhi sideways trends mein hota hai. Extended divergence ko do hisson mein taqseem kiya jaata hai:- Extended bullish divergence

- Extended bearish divergence

Regular divergence kaise trade karein

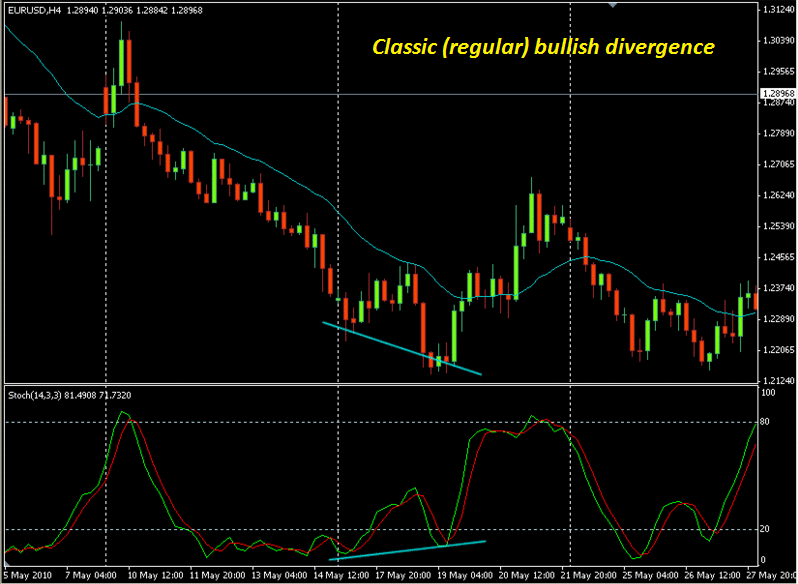

A regular bullish divergence tab hoti hai jab price lower lows banata hai, lekin oscillator higher lows post kar raha hota hai. Ye aik trend reversal signal ho sakta hai aur ye indicate kar sakta hai ke ek recovery ho sakti hai.

A regular bearish divergence tab dekhi ja sakti hai jab price ek higher high banata hai, lekin oscillator lower high post kar raha hota hai. Ye ye indicate kar sakta hai ke mojooda uptrend momentum khatam ho gaya hai aur ek retracement aane wala hai.

Hidden divergence kaise trade karein

Divergence ek potential trend continuation ko bhi signal kar sakta hai. Chaliye hidden divergence dekhte hain.

A hidden bullish divergence tab hoti hai jab pair uptrend mein hota hai, price higher lows banata hai, lekin indicator ek lower lows post kar raha hota hai. Ye ye indicate kar sakta hai ke uptrend ka continuation hone wala hai.

Doosri taraf, a hidden bearish divergence downtrend mein nazar aayegi jab price lower highs banata hai, lekin oscillator usi waqt higher highs banata hai. Ye ye indicate kar sakta hai ke downtrend phir se shuru hone wala hai.

Pehla example US500 mein regular bearish divergence ka hai. Index early August mein upar ja raha tha, lekin breakout ke baad 4450 resistance level ko price aur RSI indicator diverge karne lage.

4450 level breakout ke baad aik key support level ban gaya, aur traders ne breakout ke neeche enter hone ka signal istemal kiya. Bearish divergence ke saath, ye ek powerful combination thi, aur jaise hum dekh sakte hain, US500 ne breakout ke baad 100 points se zyada gir gaya.

US Dollar Index pe ek aur powerful bearish divergence signal.

Phir se dekhein ke price ek new short-term higher high banata hai jabki stochastics ek lower high banate hain.

Ye aksar signal hota hai ke market ki taqat khatam ho gayi hai, aur potential ek solid risk-reward reversal trade ke liye set ho gayi hai.

Nahi sirf market short-term high se pull back hui, lekin dollar index ne ek new short-term lower low banaya.

Humari teesri misaal ke liye, humein aik signal dikhana tha jo behtareen halat mein, aap ne kisi nuqsaan mein aakehri kar diya.

Jee haan, ye sach hai. Har trade profit mein nahi jaati.

Aap notice karenge ke chart ek new short-term lower low banata hai, lekin stochastic oscillator ek higher high banata hai. Ye classic bullish divergence trading signal hai.

Lekin chaliye maan lete hain ke aap is trade ko long kar lete hain confirmation milne ke baad jab aapko signal milta hai. Aapko lagbhag paanch ghanton ki uljhan thi jahan aapki pehli position nuqsaan mein thi. Agar aap ek aur din hold karte, to aap nuqsaan mein aur aapko is trade pe nuqsaan ho sakta tha.

Isliye experienced traders divergence trading mein apni normal position size ka aadha hissa test karte hain pehle apne poore position ko trade pe lagate hain.

Aapko test karna chahiye, test karna, aur phir aur bhi test karna chahiye. Testing ke zariye apni technique pe bharosa banayein aur dekhein ke kya aap ise apni trading toolkit mein shaamil kar sakte hain.

Forex divergence ko test karne ke agle qadam

Aik free demo account kholen, kuch charts kholen, aur apne pasandida oscillator ko lagayen.

Waqt ke peeche jaayen aur 10 instances of divergence ko 5 mukhtalif charts pe identify karein. Ye aapko 50 examples milenge including wins aur losses dono.

Jab aap confident ho jaayein ke aap divergence ko pehchanne aur trade karne ke liye tayyar hain, to ye principles apne live forex account pe real time mein bhi apply karein.

Conclusion

Agar divergence aapki trading strategy ka hissa nahi hai, to isay ankhon mein rakhen kyunke ye additional confirmation signals ke tor pe kaam kar sakta hai. Lekin, ye aapki mojooda strategy ko complement karne ke liye behtareen istemal kiye jaate hain, aur na ke apni khud ki trading signal ke tor pe. -

#4 Collapse

what is Divergence in forex market

forex market mein kabhi kabhi price action ke movement opposite direction mein chale jate hey jo keh forex market ka assert ya moving ka analysis kar rahay hotay hein on kay ley divergence bohut best hota hey yeh forex market ke direction ko price tabdel kanay ke taraf lay jate hey

divergence positive bhe ho sakte he or negative bhe ho sakte hey positive divergence es bat ke taraf eshara karte hey keh forex market mein assert ke price high point ke taraf bhe ja sakte hey jab keh negative divrgence es bat ke taraf eshara karte hey keh forex market ke price down trend ke taraf movement kar sakte hey

:max_bytes(150000):strip_icc():format(webp)/dotdash_INV-final-Divergence-Definition-and-Uses-Apr-2021-01-41d9b314d3a645118a911367acce55a7.jpg)

Understanding Divergence in forex market

forex market kay technical analysis mein divergence positive bhe ho sakte hey or negative bhe ho sakte hey forex market mein positive divergence os time bante hey jab kese assert ke price new lows ho jate hey jabkeh forex market ka aik indicator je tarah say price ka bahao kar sakta hey es kay opposite forex market mein negative divergence bhe ho sakte hey jab kese assert ke price up side mein movement kar rehe hote hey jabkeh indicator estamal low side ketaraf movement ho jate hey

forex trader kese bhe assert ke raftar ka andaza laganay kay ley es ka estamal kar saktay hein mesal kay tor par forex market kay investor price ke movement ko oscillator kay tor par bhe estamal kar saktay hein relative strength index bhe forex market kay reversal trend ka confirm karnay kay ley estamal keya jata hy ager forex market ka stock barah raha hota hey to forex market mein new lows bana raha hota hey mesal kay tor par RSI new peaks tak chala jata hey forex market mein prices mein ezafa to yeh esbat kay ley arns kar sakta heykeh price mein abkame bhe ho sakte hey es kay bad es bat ke taraf eshara ho sakta hey keh aya woh prices mein low honay ke sorat mein stop loss set kar sakta hey

Trading signal with Divergence

hum nay yeh point of daikhnay kay ley keh forex market ke mokhtalef kesam ke trading mein divergence signal bhe daikh saktay hein

Regular Bearish Divergence

forex market ke trend ke omed par forex market mein aik kesam ka signal ban jata hey jo keh bearish divergence ka he hota hey trader zyada tar forex market kay aam hallat mein aisa he kar saktay hein kunkeh forex market ka trend thaka daynay walla hota hey

Regular Bullish Divergence

forex market mein bullish divergence bhe perfect keam kay signal day sakta hey bearish divergence ke tarah humen trend line breakout kay ley entry point ko bhe identify karna chihay

bhali kay badlay bhali

bhali kay badlay bhali

-

#5 Collapse

WHAT IS FOREX TRADING USING DIVERGENCE 👇👇

INTRODUCTION 👇👇

Assalamu Alaikum dear main ummid karta hun aap sab khairiyat se Honge aur Achcha kam kar rahe Honge ham es fore forum main koi bhe asey baat na karay jo es ka releated na ho agr ham koi bhe asey baat karty hain post main ya threads main to hamrey vho delete ho jati hy foran to asey main ham ko bs jo bhe post ya tthreadsx karani hy souch samjh kar forex sa releated baat karni chaheya Ham Ko is market Mein inter hone ke liye ek acche mind ke sath kam karna chahie Dear buddies asalamo alykum kesay hain ap sab umeed hay ap sab tek hon gay aur aap ka trading week bhi acha ja rha ho ga.yeh pattern*aur indicator humari trading main bht important role play karty hain.yeh humain profit delany main bht madad karty hain. Hum agr in ki learning nai krain gy or in ko fazool samjyn gy to kbi b kamyabi humary kadam ni choomy gi aaj hum jis topic per bat krain gay Agar Ham ismein Apna mind open karke Koi kam vagaira Karte Hain To Humko ismein Achcha Kam Karne Ko Dil Karta Hai Agar Ham ismein apne aap ko mayus karke ismein kam karte hain to hamare Se Koi Kam Nahin Hoga ismein Kam karna Ek bahut hi Achcha hai Hamen ismein time Dena chahie Jitna Ham time Denge Hamen utna Hi ismein Kam Karne Se fayda Hoga aur ham Agar ismein thread karne se pahle Hamen post ko acchi Tarah Se read karna chahie Agar Ham post ko acchi Tarah se padh Lenge To Ham uska jawab De Sakenge isliye Ham Aaj is topic per baat kar rahe hain aur jisse Humko bahut Achcha fayda hota hai agar Ham thread ko read Karke use topic per baat karte hain to hamare knowledge mein izaafa hota hai aur Hamara experience Bhi Jyada ho jata hai hamara experience aur knowledge aise hi badhta hai agar Ham thread ko uski topic ko acchi Tarah se padh

Divergence trading strategy:

Divergence strategy mein, hum divergence ki indications ka istemal karte hain. Divergence, price action aur kisi technical indicator ke beech ka tafawut hota hai. Agar asset ki price upar ki taraf move kar rahi hai, lekin indicator ki line neeche ki taraf ja rahi hai, toh ye bearish divergence hai. Yani asset ke price ka movement indicator ke sath match nahi kar raha hai. Agar asset ki price neeche ki taraf move kar rahi hai, lekin indicator ki line upar ki taraf ja rahi hai, toh yeforex market mein kabhi kabhi price action ke movement opposite direction mein chale jate hey jo keh forex market ka assert ya moving ka analysis kar rahay hotay hein on kay ley divergence bohut best hota hey yeh forex market ke direction ko price tabdel kanay ke taraf lay jate hey

divergence positive bhe ho sakte he or negative bhe ho sakte hey positive divergence es bat ke taraf eshara karte hey keh forex market mein assert ke price high point ke taraf bhe ja sakte hey jab keh negative divrgence es bat ke taraf eshara karte hey keh forex market ke price down trend ke taraf movement kar sakte hey

:max_bytes(150000):strip_icc():format(webp)/dotdash_INV-final-Divergence-Definition-and-Uses-Apr-2021-01-41d9b314d3a645118a911367acce55a7.jpg)

Understanding Divergence in forex market

forex market kay technical analysis mein divergence positive bhe ho sakte hey or negative bhe ho sakte hey forex market mein positive divergence os time bante hey jab kese assert ke price new lows ho jate hey jabkeh forex market ka aik indicator je tarah say price ka bahao kar sakta hey es kay opposite forex market mein negative divergence bhe ho sakte hey jab kese assert ke price up side mein movement kar rehe hote hey jabkeh indicator estamal low side ketaraf movement ho jate hey

forex trader kese bhe assert ke raftar ka andaza laganay kay ley es ka estamal kar saktay hein mesal kay tor par forex market kay investor price ke movement ko oscillator kay tor par bhe estamal kar saktay hein relative strength index bhe forex market kay reversal trend ka confirm karnay kay ley estamal keya jata hy ager forex market ka stock barah raha hota he bullish divergence hai. Yani asset ke price ka Lenge To Ham uska jawab De Sakenge isliye Ham Aaj thread Ka Jawab de rahe hain aur jo bhi Humko ismein Koi kam hota hai aur introduction Nahin Hoti Hai Agar Ham Iske hisab se Ham ismein thread per introduction karte hain Puri detail ke sath aur identify Karte Hain To Hamen hi Achcha fayda hota hai aur dusron ko bhi achcha fayda hota hai isliye Hamen Soch samajhkar ismein kam karna chahie Jaise Hamare knowledge mein bhi izaafa ho aur dusron ke knowledge mein bhi jyada hoLike tu banta hay ik🙏 -

#6 Collapse

Divergence tab hoti hai jab price action aur ek technical indicator, jaise ke RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), ya Stochastic Oscillator, ek dusre se opposite direction mein move karte hain. Yeh divergence indicate kar sakti hai ke current trend weak ho raha hai aur ek reversal ya pullback aanay wala hai. Divergence trading ka maqsad yeh hai ke trend reversal ko pehchan kar trade ko ussi hisaab se place kiya jaye.

Divergence trading ke do main types hain:- Regular Divergence: Yeh divergence indicate karti hai ke price trend jaldi hi reverse hone wala hai. Yeh bullish ya bearish ho sakti hai.

- Hidden Divergence: Yeh divergence indicate karti hai ke current trend continue rahega. Yeh bhi bullish ya bearish ho sakti hai.

Regular divergence ka matlab hota hai jab price aur indicator opposite direction mein move karte hain. Yeh bullish aur bearish dono ho sakti hai.- Bullish Regular Divergence: Yeh tab hoti hai jab price lower low bana rahi ho lekin indicator higher low dikha raha ho. Iska matlab hai ke price downward trend mein hai lekin selling pressure kam ho raha hai, aur ek bullish reversal ho sakta hai. Yeh ek acha buying signal hota hai.

Example: Agar price chart peh lower lows dekhai de rahe hain lekin RSI indicator higher lows dikha raha hai, toh yeh bullish regular divergence hai. Yeh indicate karta hai ke price downtrend se nikal ke uptrend ki taraf ja sakti hai. - Bearish Regular Divergence: Yeh tab hoti hai jab price higher high bana rahi ho lekin indicator lower high dikha raha ho. Iska matlab hai ke price upward trend mein hai lekin buying pressure kam ho raha hai, aur ek bearish reversal ho sakta hai. Yeh ek acha selling signal hota hai.

Example: Agar price chart peh higher highs dekhai de rahe hain lekin MACD indicator lower highs dikha raha hai, toh yeh bearish regular divergence hai. Yeh indicate karta hai ke price uptrend se nikal ke downtrend ki taraf ja sakti hai.

Hidden divergence ek aisi divergence hoti hai jo indicate karti hai ke current trend continue rahega. Yeh bhi bullish aur bearish dono ho sakti hai.- Bullish Hidden Divergence: Yeh tab hoti hai jab price higher low bana rahi ho lekin indicator lower low dikha raha ho. Yeh indicate karta hai ke market uptrend mein hai aur price zyada high pe ja sakti hai. Yeh trend continuation signal hota hai.

Example: Agar price chart peh higher lows dekhai de rahe hain lekin RSI ya Stochastic indicator lower lows dikha raha hai, toh yeh bullish hidden divergence hai. Yeh indicate karta hai ke uptrend strong hai aur price aur upar jaane ki potential rakhti hai. - Bearish Hidden Divergence: Yeh tab hoti hai jab price lower high bana rahi ho lekin indicator higher high dikha raha ho. Yeh indicate karta hai ke market downtrend mein hai aur price zyada low pe ja sakti hai. Yeh bhi trend continuation signal hota hai.

Example: Agar price chart peh lower highs dekhai de rahe hain lekin MACD indicator higher highs dikha raha hai, toh yeh bearish hidden divergence hai. Yeh indicate karta hai ke downtrend strong hai aur price aur neeche jaane ki potential rakhti hai.

Divergence trading ke liye kuch popular indicators hain jinhe traders use karte hain:- RSI (Relative Strength Index): Yeh ek momentum oscillator hai jo 0 se 100 ke scale pe hota hai. Agar RSI 70 se upar ho toh market overbought hota hai aur agar 30 se neeche ho toh market oversold hota hai. Divergence tab hoti hai jab price aur RSI different direction mein move karte hain.

- MACD (Moving Average Convergence Divergence): Yeh ek trend-following momentum indicator hai jo do moving averages ke beech ke difference ko show karta hai. Divergence tab hoti hai jab price aur MACD line opposite direction mein move karte hain.

- Stochastic Oscillator: Yeh bhi ek momentum indicator hai jo price range ke mutabiq close price ki position ko measure karta hai. Yeh 0 se 100 ke scale pe hota hai, jahan 80 se upar overbought aur 20 se neeche oversold hota hai. Divergence tab hoti hai jab price aur Stochastic Oscillator different direction mein move karte hain.

Divergence trading ko apply karne ke liye kuch steps hain jo traders follow karte hain:- Trend Identification: Sab se pehle trend ko identify karein. Yeh zaroori hai ke aapko pata ho ke market uptrend mein hai ya downtrend mein. Yeh aap moving averages, trendlines, ya price action analysis ke zariye kar sakte hain.

- Indicator Selection: Ek reliable indicator select karein jo aapki trading strategy ke saath match karta ho. RSI, MACD, aur Stochastic Oscillator commonly used indicators hain.

- Divergence Detection: Price action aur indicator ke beech divergence ko detect karein. Yeh divergence price chart aur indicator chart ko side-by-side compare kar ke detect ki ja sakti hai.

- Confirmation: Divergence detect karne ke baad confirmation ka wait karein. Yeh confirmation ek trendline breakout, support ya resistance level ka break hona, ya candlestick pattern se aa sakta hai.

- Entry: Confirmation milne ke baad trade enter karein. Agar bullish regular divergence hai toh buy position lein aur agar bearish regular divergence hai toh sell position lein.

- Stop Loss and Take Profit: Stop loss aur take profit levels set karein. Yeh zaroori hai taake risk management ho sake aur unexpected market moves se bachaa ja sake.

- Monitoring and Adjustment: Market ko monitor karein aur apne stop loss aur take profit levels ko adjust karein agar zaroorat ho.

Divergence trading ek powerful strategy hai lekin iske kuch limitations bhi hain:- False Signals: Divergence trading mein false signals kaafi common hain, jahan divergence indicate karti hai ke trend reverse hoga lekin aisa hota nahi. Is liye, hamesha multiple confirmations ka wait karein.

- Lagging Indicators: Indicators jaise ke RSI, MACD, aur Stochastic Oscillator lagging indicators hain, matlab yeh price action ke baad react karte hain. Is liye, kabhi kabhi divergence late detect hoti hai aur market ne pehle hi move kar liya hota hai.

- Choppy Markets: Divergence trading choppy aur sideways markets mein kaam nahi karti kyun ke yahan trend clear nahi hota. Yeh strategy trending markets ke liye best hai.

- Experience Required: Divergence ko accurately detect karna aur uske mutabiq trade place karna ek experienced trader ke liye asaan hota hai. Beginners ke liye yeh confusing ho sakti hai.

Divergence Trading Tips for Beginners- Basic Knowledge: Pehle Forex market aur technical analysis ke basic concepts ko samjhein. Divergence trading advanced level ka concept hai, is liye strong foundation zaroori hai.

- Practice on Demo Accounts: Live trading mein jump karne se pehle demo accounts par practice karein. Yeh aapko real market conditions mein bina risk ke experience dega.

- Use Multiple Indicators: Kabhi bhi sirf ek indicator ke basis par trade na karein. Multiple indicators ko use karein taake aapke trade ki confirmation aur strong ho.

- Risk Management: Risk management ka hamesha khayal rakhein. Apni trading capital ka sirf ek chota hissa risk mein dalein aur stop loss hamesha set karein.

- Stay Updated: Market news aur economic events ko follow karein. Yeh events market ko sudden moves de sakte hain jo aapke trade ko affect kar sakte hain.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#7 Collapse

Forex Trading Mein Divergence Ka Istemaal

Forex trading mein divergence ka istemaal ek aham tareeqa hai jisay traders apni trading strategies mein shamil karte hain. Divergence ki sahi samajh se traders ko market ki harkaton ko samajhne mein madad milti hai aur is say traders apni trades ko improve kar saktay hain.is me Ap market ki movement Bary me pta kr skty hen k Kia rate chl rha h aur khan Up down ho skti h.

Price action value

Divergence ka matlab hota hai jab price action aur technical indicators mein koi farq hota hai. Jab koi price action trend ki taraf jata hai aur koi technical indicator trend ki taraf nahi jata to isay divergence kaha jata hai.ye b indicatoin k ki trah kam kr skta h.

Technical indication

Divergence ko do tarah ka hota hai: bullish divergence aur bearish divergence. Bullish divergence mein price action ki taraf trend up hota hai jabki koi technical indicator trend down hota hai. Iska matlab hota hai koi price action trend ki taraf jata hai jabki technical indicators trend ki taraf nahi jata. Bearish divergence mein price action ki taraf trend down hota hai jabki koi technical indicator trend up hota hai.

Conclusion

Divergence ka istemal traders ki trading strategies mein bahut important hota hai. Traders isay market ki harkaton ko samajhne aur trades ko improve karne ke liye istemaal karte hain. Agar koi trader divergence ko sahi tareeqay se samajhta hai to woh market ki harkaton ko samajhne mein behtar ho jata hai aur apni trades ko sahi tareqay se place kr saktay hain.

- CL

- Mentions 0

-

سا0 like

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 11:28 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим