What's the dealing disk in forex

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Introduction Hi assalamu alaikum, kaise hain forex structure ki part, principal bilkul theek hun ummid hai aap bhi theek honge, Managing Work area keya hai, takriban managing work area ke exposed mein Kisi Ko Nahin pata, iske uncovered mein bahut khubsurat se aapko bataunga, Aur iske exposed mein aapko mukmmal samajh a jayegi. Definition Friends,aik working work area woh hai jahan market bananay walay maliyati alaat jaisay ke forex, aykoyti, choices, wares aur deegar maliyati asasay banatay aur tijarat karte hain. Key Focus points A:Dear companions, connection work area woh jagah hai jahan market bananay walay maliyati alaat jaisay ke forex, aykoyti, choices, items aur deegar maliyati asasay banatay aur tijarat karte hain. B:Dear friends,tajir apne gahkon ki janib se mazeed tijarat karne ke liye mojood hain aur woh bator head ya specialist kaam kar satke hain. C:Dear companions, head ke pinnacle standard kaam karte waqt sales rep client ke kaarobar ka dosra rukh ikhtiyar karta hai. D:Dear companions ,aik specialist ke peak standard kaam karte waqt, tajir sanwi market mein dastyab raqam kama kar client ke request ka intizam kere ga aur client ko wohi qeematein masool hon gi jo baichnay walay ne jari ki hain. Figuring out Managing Work area Dear friends,ghair mulki cash ki mandiyon mein, tranzikshn work area woh jagah hai jahan bank ya maliyati idaray mein forex brokers rehtay hain. forex market commotion raat khulay rehne ke sath, bohat se idaron ke paas work area mojood hain jo poori duniya mein kaam karte hain. sikyortiz aur deegar maliyati masnoaat ki tijarat ke liye taawun standard mabni work area ghair mulki zar e mubadla ki mandiyon, jaisay bankon aur maliyati idaron se bahar mil satke hain. Managing work area forex tak mehdood nahi hain. woh bohat se maliyati asasay istemaal karte hain jaisay value, etfs, ikhtiyarat, aur asasay . Dear friends,lafz" work area" aik ghalat naam ho sakta hai, is ki tareef kuch dukandaron ko tafweez kardah table ke paish e nazar. barray maliyati idaron ke paas aksar aisay wasail hotay hain jo bohat se brokrz aur market bananay walay istemaal karte hain. aik barri tanzeem mein, barri krnsyon, jaisay euro aur yan, mein mutadid exchanging work area ho satke hain jin mein chand tajir khaas peak standard un krnsyon standard kaam karte hain . -

#3 Collapse

Assalamualaikum! Dealing Desk in Forex Aik dealing desk brokers ke zareya chalaye jati hai jo market bananay walon ke tor par kaam karte hain aur aam tor par spreads aur/ya charge kiye jane walay commission se paisa kamate hain. Dealing desk broker ki execution policy ke lehaaz se orders ke nifaz mein mudakhlat kar sakta hai. Dealing desk ko “market maker†bhi kaha jata hai, yeh aik aisa idaara hai jo taajiron ko currencies ki khareed o farokht ke zariye aik muqarara qeemat par liquidity faraham karta hai. Woh taajiron ke lain deen mein hum mansab ke tor par kaam karte hain, jis ka matlab hai ke woh tijarat ka mukhalif rukh ikhtiyar karte hain. Misaal ke tor par, agar koi tajir EUR/USD khareedna chahta hai, to dealing desk inhen EUR/USD farokht karega. Un ke paas taajiron ki aik team hai jo market ki nigrani karti hai aur un qeematon ka taayun karti hai jis par woh currencies ki khareed o farokht ke liye tayyar hain. Yeh qeematein “bid†aur “ask prices†ke naam se jani jati hain. “Bid†ki qeemat woh qeemat hai jis par dealing desk currency kharidne ke liye tayyar hai, jab ke “ask price†woh qeemat hai jis par woh usay farokht karne ke liye tayyar hai. Dealing desk brokers kam khareedkar aur ziyada beechkar, aur bid aur qeemat ke darmiyan spread ka faida utha kar munafe kamate hain. Ziada tar mamlaat mein, dealing desk brokers tijarat ko mehfooz tareeqay se apne liquidity pool mein rakhtay hain aur inhen bairooni liquidity provider ki zaroorat nahi hoti hai. Jabkay kuch ka khayaal hai ke is qisam ki brokerage se tajir ko faida hota hai, bohat se tajir fixed spread ko behtar samajhte hain. Dealing desk positions bananay ka bhi intikhab kar sakta hai kyunkay woh aksar un retail taajiron ka muqaabla karte hain jo micro lot mein deal kar rahay hotay hain. Jab un ki standard position hoti hai, aam tor par kam az kam 1 mukammal lot, to woh liquidity provider ki qeemat ke muqablay mein position ko band karne ka faisla kar satke hain. Ziyada tar liquidity faraham karne walay interbank market ke liye FX qeematon ka hawala day rahay hain aur 100k se kam ya is ke multiples mein tijarat karne ke liye tayyar nahi hote hain. Lehaza, dealing desk broker jo retail taajiron ko liquidity faraham kar raha hai, usay apne clients ki tijarat ka dosra rukh ikhtiyar karna hoga agar woh chhote hon, jab tak ke is ke paas itni barri position nah ho ke woh apne liquidity provider mein se kisi ke sath kaam kar sakay. Oopar wala chart dealing desk walay broker mein qeemat ka flow dekhata hai. Liquidity provider ki qeematein bid/ask price (black arrow) bananay ke liye istemaal ki jati hain, broker phir apne client (grey arrow) ko retouched prices bhejta hai. Client STP ka istemaal karte hue un qeematon (blue arrow) par aam tor par electronic tor par tijarat kar sakta hai. Is ke baad broker platform tijarat ko dealing desk (green arrow) tak pohanchata hai. Is ke baad dealing desk faisla kere ga ke tijarat ka intizam kaisay kiya jaye. Yeh tijarat par baith sakta hai, position ko barha sakta hai, ya is mein itni miqdaar ho sakti hai ke woh apne liquidity provider (orange arrows) ke sath directly position se bahar nikal sakay. Dealing desk apni qeematein bhi dikha sakta hai kyunkay yeh khud position rakhta hai, yeh qeematein is ke clients (red arrow) ya is ke liquidity provider (yellow arrow) ke hawalay se jayengi. Umeed hai yeh information aapke liye helpful saabit ho. -

#4 Collapse

Assalamu Alaikum Dosto!Forex Dealing Desk

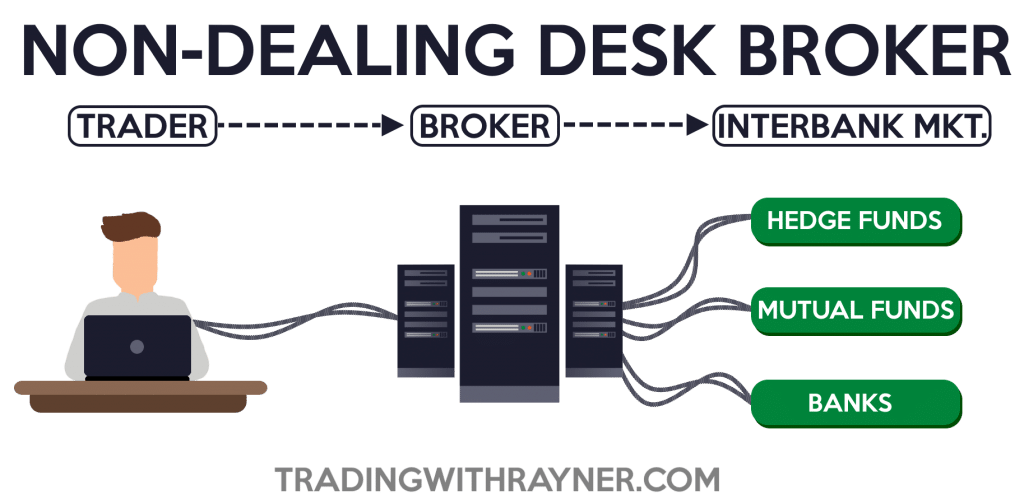

Ek dealing desk (DD) forex broker ek trader ke trades ka samna karne wala hissa banata hai, apni currencies ke apne inventory se orders ko bharta hai. Wo trade ka khatra uthate hain aur bid aur ask prices ke darmiyan farq se faida uthate hain. Doosri taraf, a no dealing desk (NDD) forex broker trades ko seedha liquidity providers ke saath execute karta hai, bina kisi broker ke intervention ke. Ye model bazaar ki halat ke baray mein zyada wazehgi deta hai aur potential conflicts of interest ko khatam karta hai, lekin zyada volatility aur mukhtalif spreads ke doran limited liquidity ho sakti hai. DD brokers mafaed jaise ke liquidity ke aasan pohanch, fixed spreads, aur guaranteed execution dete hain, lekin unke nuqsan jaise ke potential conflict of interest, limited transparency, aur slippage bhi hote hain. NDD brokers mafaed jaise ke transparency, koi conflict of interest, aur tighter spreads dete hain, lekin unke nuqsan jaise ke limited liquidity, variable spreads, aur execution risk bhi hote hain.

Forex Dealing Desk, forex market mein ek aham hissa hai. Yeh ek trading desk hota hai jahan se traders buy aur sell kiye jane wale transactions ka manage kiya jata hai. Dealing desk, ek bank ya broker ke through chalaya jata hai aur iska kaam hota hai traders ke orders ko execute karna aur forex market mein liquidity provide karna.

Forex Dealing Desk ka matlab hota hai ek trading desk ya department jo ki forex broker ke andar hota hai aur ye un traders ko support karta hai jo ki forex market mein apni trades execute karna chahte hain. Dealing desk ke through traders ko liquidity provide ki jati hai aur unke trades ko execute karne ke liye support kiya jata hai. Is article mein hum Forex Dealing Desk ki mukamal tafseel par baat karenge.

Dealing desk ki services ke liye, broker ya bank traders se spread charge karta hai. Spread, bid aur ask price ke difference ko represent karta hai. Bid price wo price hoti hai jis par traders currency pair sell karte hain aur ask price wo price hoti hai jis par traders currency pair buy karte hain. Spread ki value different brokers aur banks ke liye alag alag hoti hai aur ye ek important factor hai jis par traders broker ya bank ko choose karte hain.

Dealing Desk Types

Forex Dealing Desk mein do types ke transactions execute kiye jate hain: dealing desk execution aur no dealing desk execution. Dealing desk execution mein, traders ka order dealing desk ke through execute kiya jata hai. Jabki no dealing desk execution mein, traders ke orders ko direct market ke through execute kiya jata hai.- Dealing desk execution:Dealing desk execution ka matlab hota hai ki jab traders apna order place karte hain, order dealing desk ke through execute kiya jata hai. Dealing desk ke pass multiple liquidity providers hote hain jinse wo quotes receive karta hai aur traders ko un quotes ke according price provide karta hai. Is tarah, dealing desk ke through traders ko ek fixed spread provide kiya jata hai. Fixed spread, market conditions se unaffected hota hai aur isliye traders ko ek consistent spread provide kiya jata hai.

- No dealing desk execution:No dealing desk execution ka matlab hota hai ki jab traders apna order place karte hain, order direct market ke through execute kiya jata hai. No dealing desk execution mein, traders ke orders ko direct market ke through execute kiya jata hai aur isliye traders ko market spreads provide kiye jate hain. Market spread, market conditions ke according change hota hai aur isliye traders ko ek consistent spread provide karna possible nahi hota hai.

Dealing desk execution aur no dealing desk execution dono mein apne advantages aur disadvantages hote hain. Dealing desk execution mein, traders ko ek fixed spread provide kiya jata hai aur isliye ye traders ke liye ek consistent trading environment create karta hai. Lekin, dealing desk execution mein conflict of interest ki possibility hoti hai kyunki dealing desk bhi apni earnings ke liye spread charge karta hai.

No dealing desk execution mein, traders ko market spreads provide kiye jate hain aur isliye ye traders ke liye ek transparent trading environment create karta hai. Lekin, market conditions ke according spreads change hote hain aur isliye ye traders ke liye ek unpredictable trading environment create karta hai.

Dealing Desk kese Kamm karta hai

Forex Dealing Desk ki primary responsibility hai trades ko execute karna, jismein wo trader ki taraf se diye gaye instructions ko follow karta hai. Ye dealing desk trading platform ke through trades execute karta hai aur liquidity provide karne ke liye bank aur financial institutions se connect hota hai. Forex Dealing Desk ke through traders ke trades ko execute karne ke liye market mein available price quotes ko track kiya jata hai, jo ki bid-ask spread ke roop mein display kiya jata hai.

Forex Dealing Desk ki liquidity kisi bhi financial institution se aati hai jiske through wo market mein available prices ko track karta hai. Liquidity providers banks aur other financial institutions ho sakte hain jinse dealing desk connect hota hai. Ye liquidity providers dealing desk ko prices provide karte hain aur un prices ko traders ko provide kiya jata hai.

Forex Dealing Desk se Trader ki Help

Forex Dealing Desk ke through traders ko instant access milta hai market liquidity aur wo apne trades ko execute kar sakte hain without any delay. Dealing desk ki team market mein available prices ko track karti hai aur traders ko accurate prices provide karti hai jiske through traders apne trades ko execute kar sakte hain.

Forex Dealing Desk mein traders ke trades ko execute karne ke liye trained professionals hote hain jinhe traders ke orders ko follow karna hota hai. Dealing desk ka kaam hai traders ki taraf se diye gaye orders ko follow karna aur unke trades ko execute karna. Dealing desk ke traders ko apni trades ke liye market mein available prices provide karte hain aur unhe accurate quotes ki sahayta se trading karne ke liye allow karte hain.

Forex Dealing Desk ke through traders ki trading experience improve hoti hai. Dealing desk ki team market trends ko track karti hai aur traders ko accurate information provide karti hai. Dealing desk ki team traders ko market updates aur news provide karti hai jiske through wo apne trades ko execute karne ke liye better decisions le sakte hain. Dealing desk ke through traders ko market volatility ke baare mein alert diya jata hai aur unhe market risks se bachne me madad faraham karta hai.

Dealing Desk aur No Dealing Desk mein Differences

Ek dealing desk (DD) forex broker ek trader ke trades ka samna karne wala hissa banata hai, apni currencies ke apne inventory se orders ko bharta hai. Wo trade ka khatra uthate hain aur bid aur ask prices ke darmiyan farq se faida uthate hain. Doosri taraf, ek no dealing desk (NDD) forex broker trades ko broker ke dakhil nahi kiye bina liquidity providers ke saath seedha anjam deta hai. Ye model bazaar ki halat ke baray mein zyada wazehgi deta hai aur potential conflicts of interest ko khatam karta hai, lekin zyada volatility ke doran aur mukhtalif spreads ke doran limited liquidity ho sakti hai.

DD brokers ko mafaed jaise ke liquidity ke aasan pohanch, fixed spreads, aur guaranteed execution milte hain, lekin unke nuqsan jaise ke potential conflict of interest, limited transparency, aur slippage bhi hote hain. NDD brokers mafaed jaise ke transparency, koi conflict of interest, aur tight spreads dete hain, lekin unke nuqsan limited liquidity, variable spreads, aur execution risk bhi hote hain.

Aakhir mein, DD aur NDD forex broker ke darmiyan intekhab ek trader ke pasandidgiyon aur trading style par munhasir hota hai. Kuch traders ko NDD model dwara di gai zyada wazehgi aur tight spreads pasand hote hain, jabkeh doosre traders ko DD model dwara di gai liquidity ke aasan pohanch aur guaranteed execution pasand hoti hai. Traders ke liye zaroori hai ke wo har model ke faide aur nuqsan ko carefully ghoorna aur wo model chunen jo unke individual zarooriyat aur trading style ke liye behtareen ho.

Dealing Desk k Advantages aur Disadvantages- Advantages

Dealing desk forex broker istemal karne ke faide shamil hain:- Liquidity Ke Asaan Pohanch: Dealing desk brokers trades ka samna karke traders ko bari mojoodgi wali liquidity ka raasta dikhate hain. Ye mukhtalif prices par jaldi trade execution ki ijaazat deta hai.

- Fixed Spreads: Dealing desk brokers aksar fixed spreads offer karte hain, traders ko transactions ke baray mein yaqeeni hojata hai. Ye traders ke liye faida mand ho sakta hai jo kisi tight budget par kaam karte hain.

- Guaranteed Execution: Dealing desk model mein, trades ko broker ka zimmedar hai aur is liye unka guarantee hai ke order ko bhara jaye ga. Ye bharosa volatility ke doran bhot faide mand ho sakta hai jahan der se execution nuqsan day sakta hai.

Aam tor par, dealing desk forex broker istemal karne ke faide shamil hain liquidity ke asaan pohanch, fixed spreads, aur guaranteed execution, jo ke traders ke liye in faide ko ahem samjhte hain. - Disadvantages

Dealing desk forex broker istemal karne ke nuqsanat shamil hain:- Conflict of Interest: Dealing desk brokers ek trader ke trades ka samna karke, jo ke conflict of interest ka bais ban sakta hai. Broker ko apne faide ko barhane ke liye orders ko kam faide waali prices par bharna hosakta hai, jo ke traders ke liye ghair mufeed trading conditions banasakta hai.

- Limited Transparency: Kyun ke dealing desk brokers apni apni inventory se orders ko bharte hain, is liye haqeeqati bazaar ki conditions ke baray mein limited wazehgi hosakti hai. Ye transparency ki kami traders ko currency ki asal market value ko sahi tarah se taeyun karna mushkil bana sakta hai.

- Slippage: Dealing desk brokers istemal karne wale traders slippage ka samna kar sakte hain, jahan unhe wo price nahi milti jo wo umeed karte hain. Ye waqt rehte khatam hota hai jab market tezi se chal rahi hoti hai, aur broker expected price par order ko bharna na mumkin hojata hai, jiski wajah se traders ko unexpected nuqsan ya faida ho sakta hai.

Toh, dealing desk forex broker istemal karne ke nuqsanat conflict of interest, market conditions ke baray mein limited wazehgi, aur trade execution ke doran slippage ka khatra shamil hain. Traders ko in nuqsanat ko chunne ke doran zaroor ghoorna chahiye jab DD aur NDD brokers mein se intekhab karte hain. -

#5 Collapse

Forex Market Mein Dealing Desk#>#>#

Forex market mein "dealing desk" (sometimes referred to as a "trading desk") ek trading term hai jo Forex brokers ke operations ko describe karta hai. Dealing desk brokers apne clients ke trades ko execute karte hain. Yeh brokers apne dealing desks ke through clients ke orders ko handle karte hain, aur in orders ko market mein execute karte hain.

Forex Market Mein Dealing Desk Important Nukaat#>#>

Kuch important points jo dealing desk brokers ke baare mein hote hain:- Market Maker: Dealing desk brokers often act as market makers. Iska matlab hai ki jab ek client order place karta hai, to broker khud hi market mein opposite side par trade karta hai. Isse broker ke paas liquidity aur flexibility hoti hai, lekin iska bhi matlab hai ki broker apne hi spreads aur pricing create kar sakta hai.

- Conflict of Interest: Kuch logon ka kehna hai ki dealing desk brokers ke paas apne clients ke trades ko execute karne mein conflict of interest hota hai. Iska mtlb hai ki broker apne hi fayda ke liye trades ko manipulate kar sakta hai.

- Fixed Spreads: Dealing desk brokers aksar fixed spreads provide karte hain. Iska mtlb hai ki spreads hamesha constant rehte hain, lekin market volatility ke dauran yeh spreads widen ho sakte hain.

- Order Execution: Dealing desk brokers apne discretion ke under client orders ko execute karte hain. Iska matlab hai ki broker decide karta hai ki kis rate par aur kab trade execute karna hai.

- Risk Management: Dealing desk brokers apne risk management policies ko apply karte hain apni exposure ko manage karne ke liye.

Overall, dealing desk brokers ek tarah ka intermediary role play karte hain client aur market ke beech, aur unki functionality aur policies broker se broker mein vary karti hain. Some traders prefer dealing desk brokers ke predictability aur ease of use ke liye, jabki doosre traders prefer ECN (Electronic Communication Network) brokers ke transparency aur direct market access ke liye. -

#6 Collapse

What's the dealing disk in forex

Forex mein Dealing Disk

Intro:

Forex trading ka ek ahem hissa "dealing desk" hai jo brokers ke paas hota hai. Ye ek platform hota hai jahan brokers apne clients ke trades execute karte hain.

Kaam:

Dealing disk, traders ke orders ko accept karta hai aur unhe market mein execute karta hai. Ye orders ko receive, process, aur fulfill karta hai.

Kaam ki Tafseelat:

Dealing desk, traders ke trades ki tafseelat rakhta hai jaise ke order ka size, price, aur execution time.

Market Maujoodgi:

Ye desk market mein hone wali maujoodgi ko dekhta hai aur traders ke orders ko market conditions ke mutabiq execute karta hai.

Leverage aur Margin:

Dealing disk, traders ko leverage aur margin ke baray mein bhi guidence deta hai. Ye factors trading mein crucial hote hain aur traders ke liye risk ko manage karne mein madad karte hain.

Risk Management:

Ye desk traders ke liye risk management ka bhi zimmedar hota hai. Agar kisi trade mein koi masla ho ya market unfavorable ho, to dealing desk support provide karta hai.

Transparency:

Aik ahem cheez ye hai ke dealing disk transparency maintain karta hai. Ye traders ko real-time updates aur information provide karta hai apne trades ke mutaliq.

Customer Support:

Dealing disk aksar traders ke liye customer support ka kaam bhi karta hai. Agar koi trader kisi issue ya query ka samna karta hai, to ye desk support provide karta hai.

Conclusion:

Forex trading mein dealing disk ka hona bohot zaroori hai. Ye traders ke liye ek vital resource hai jo unhe market mein navigate karne mein madad karta hai aur unke trades ko smoothly execute karta hai. Isliye, traders ko apne broker ke dealing desk ka sahi istemal karna chahiye.

-

#7 Collapse

What's the dealing disk in forex

Forex mein Dealing Disk

Intro:

Forex trading ka ek ahem hissa "dealing desk" hai jo brokers ke paas hota hai. Ye ek platform hota hai jahan brokers apne clients ke trades execute karte hain.

Kaam:

Dealing disk, traders ke orders ko accept karta hai aur unhe market mein execute karta hai. Ye orders ko receive, process, aur fulfill karta hai.

Kaam ki Tafseelat:

Dealing desk, traders ke trades ki tafseelat rakhta hai jaise ke order ka size, price, aur execution time.

Market Maujoodgi:

Ye desk market mein hone wali maujoodgi ko dekhta hai aur traders ke orders ko market conditions ke mutabiq execute karta hai.

Leverage aur Margin:

Dealing disk, traders ko leverage aur margin ke baray mein bhi guidence deta hai. Ye factors trading mein crucial hote hain aur traders ke liye risk ko manage karne mein madad karte hain.

Risk Management:

Ye desk traders ke liye risk management ka bhi zimmedar hota hai. Agar kisi trade mein koi masla ho ya market unfavorable ho, to dealing desk support provide karta hai.

Transparency:

Aik ahem cheez ye hai ke dealing disk transparency maintain karta hai. Ye traders ko real-time updates aur information provide karta hai apne trades ke mutaliq.

Customer Support:

Dealing disk aksar traders ke liye customer support ka kaam bhi karta hai. Agar koi trader kisi issue ya query ka samna karta hai, to ye desk support provide karta hai.

Conclusion:

Forex trading mein dealing disk ka hona bohot zaroori hai. Ye traders ke liye ek vital resource hai jo unhe market mein navigate karne mein madad karta hai aur unke trades ko smoothly execute karta hai. Isliye, traders ko apne broker ke dealing desk ka sahi istemal karna chahiye.

-

#8 Collapse

What's the dealing disk in forex

Forex mein Dealing Disk

Intro:

Forex trading ka ek ahem hissa "dealing desk" hai jo brokers ke paas hota hai. Ye ek platform hota hai jahan brokers apne clients ke trades execute karte hain.

Kaam:

Dealing disk, traders ke orders ko accept karta hai aur unhe market mein execute karta hai. Ye orders ko receive, process, aur fulfill karta hai.

Kaam ki Tafseelat:

Dealing desk, traders ke trades ki tafseelat rakhta hai jaise ke order ka size, price, aur execution time.

Market Maujoodgi:

Ye desk market mein hone wali maujoodgi ko dekhta hai aur traders ke orders ko market conditions ke mutabiq execute karta hai.

Leverage aur Margin:

Dealing disk, traders ko leverage aur margin ke baray mein bhi guidence deta hai. Ye factors trading mein crucial hote hain aur traders ke liye risk ko manage karne mein madad karte hain.

Risk Management:

Ye desk traders ke liye risk management ka bhi zimmedar hota hai. Agar kisi trade mein koi masla ho ya market unfavorable ho, to dealing desk support provide karta hai.

Transparency:

Aik ahem cheez ye hai ke dealing disk transparency maintain karta hai. Ye traders ko real-time updates aur information provide karta hai apne trades ke mutaliq.

Customer Support:

Dealing disk aksar traders ke liye customer support ka kaam bhi karta hai. Agar koi trader kisi issue ya query ka samna karta hai, to ye desk support provide karta hai.

Conclusion:

Forex trading mein dealing disk ka hona bohot zaroori hai. Ye traders ke liye ek vital resource hai jo unhe market mein navigate karne mein madad karta hai aur unke trades ko smoothly execute karta hai. Isliye, traders ko apne broker ke dealing desk ka sahi istemal karna chahiye.

-

#9 Collapse

Forex Mein Dealing Desk: Ek Tafteeshi Jaiza

Forex (foreign exchange) market mein dealing desk ek aham hissa hai jo broker firms ya banks dwara istemal kiya jata hai. Dealing desk market mein orders ko execute karte hain aur traders ko buy aur sell karne ki sahulat faraham karte hain. Is article mein, hum forex mein dealing desk ke bare mein tafteesh karenge aur iske tareeqe ko samajhne ki koshish karenge.

Dealing Desk Kya Hai:

1. Broker Firms aur Banks:

Dealing desk usually broker firms ya banks ke andar hota hai. Ye firms market mein trades execute karte hain aur traders ko market ke prices par buy aur sell karne ki sahulat faraham karte hain.

2. Market Makers:

Dealing desk wale firms market makers ke tor par kaam karte hain. Matlab ye hota hai ke wo apni khud ki liquidity faraham karte hain aur traders ke orders ko execute karte hain.

Dealing Desk Kaam Kaise Karta Hai:

1. Order Execution:

Dealing desk traders ke orders ko execute karte hain. Jab koi trader apna order deta hai, toh dealing desk us order ko lete hain aur usay market mein execute karte hain.

2. Liquidity Faraham:

Dealing desk apni khud ki liquidity faraham karte hain. Matlab ye hai ke wo khud market mein apne positions lete hain taki wo traders ke orders ko execute kar sakein.

Dealing Desk Ke Tareeqe:

1. Straight Through Processing (STP):

Kuch dealing desk firms STP technology ka istemal karte hain. Is technology mein, orders ko seedha market tak pohanchaya jata hai aur dealing desk sirf execution ka zimmedar hota hai.

2. Market Maker Model:

Zyadatar dealing desk firms market maker model ka istemal karte hain. Is model mein, dealing desk apni khud ki liquidity faraham karte hain aur traders ke orders ko execute karte hain.

Dealing Desk Ke Faide:

1. Sahulat Faraham:

Dealing desk traders ko buy aur sell karne ki sahulat faraham karte hain. Wo market ke prices par apne orders ko execute kar sakte hain.

2. Liquidity:

Dealing desk firms market mein liquidity faraham karte hain. Is se traders ko zyada options aur better prices milte hain.

Ikhtitam:

Forex mein dealing desk ek zaroori hissa hai jo traders ko buy aur sell karne ki sahulat faraham karta hai. Ye firms market mein orders ko execute karte hain aur traders ko liquidity faraham karte hain.

- CL

- Mentions 0

-

سا0 like

-

#10 Collapse

Dealing Disk Ki Tareef:

Dealing disk ek technology-driven system hai jo broker firms ke infrastructure ka ek crucial component hai. Ye system trading orders ko receive karta hai, unhe process karta hai, aur market mein execute karta hai. Dealing disk traders aur broker firms ke beech communication ka ek bridge hai jo trading activities ko smooth aur efficient banata hai. Is system mein, orders ka flow ek organized aur automated process hota hai jo human error ko minimize karta hai aur trading process ko streamline karta hai.

Dealing Disk Ka Kaam:

Dealing disk ka mukhya kaam hai traders ke dwara place kiye gaye orders ko receive karna aur unhe market mein execute karna. Ye system orders ko quickly process karta hai taki traders ko accurate prices mil sake aur wo apne trades ko timely manage kar sakein. Dealing disk ka kaam hai orders ko efficiently manage karna, market liquidity ko monitor karna, aur orders ko market conditions ke mutabiq execute karna. Iske alawa, ye system real-time market data ko bhi analyze karta hai taki accurate pricing di ja sake.

Dealing Disk Ke Types:

Dealing disk do types ka hota hai: STP (Straight Through Processing) aur DD (Dealing Desk). STP dealing disk mein, orders ko directly market tak forward kiya jata hai bina kisi human intervention ke. Ye system transparency aur fairness ko promote karta hai kyunke orders market ke participants tak directly pahunchte hain. DD dealing disk mein, broker apne discretion ke mutabiq orders ko execute karta hai. Ismein broker ka role active hota hai order execution mein, lekin ismein conflict of interest ka khatra bhi hota hai kyunke broker apne hi discretion ke mutabiq trades ko manage karta hai.

STP Dealing Disk:

STP dealing disk mein, broker ka role sirf orders ko receive karke market tak forward karna hota hai. Ye system transparent hota hai aur conflict of interest ka khatra kam hota hai, kyunke broker directly market ke participants se connect hota hai. STP dealing disk ke through, orders ka execution process fast hota hai aur slippage ka khatra bhi kam hota hai. Ye system traders ko high-quality liquidity aur competitive pricing provide karta hai.

DD Dealing Disk:

DD dealing disk mein, broker apne hi liquidity aur risk management policies ke mutabiq orders ko execute karta hai. Ismein broker ka role active hota hai order execution mein, lekin ismein conflict of interest ka khatra bhi hota hai kyunke broker apne hi discretion ke mutabiq trades ko manage karta hai. DD dealing disk ke through, broker apne clients ke orders ko apni dealing desk ke through execute karta hai. Ismein broker apne clients ke liye liquidity provider ki tarah kaam karta hai aur apne spreads aur execution policies ko apne discretion ke mutabiq set karta hai.

Dealing Disk Ke Faida:

Dealing disk ke istemal se traders ko quick order execution aur improved liquidity milta hai. Ye system trading process ko streamline karta hai aur traders ko market mein active rahne mein madad karta hai. STP dealing disk traders ko transparent pricing aur high-speed execution provide karta hai, jabki DD dealing disk ke zariye brokers apne clients ko customised services aur personalized support offer kar sakte hain.

Dealing Disk Ke Nuqsan:

DD dealing disk mein traders ko lagta hai ke broker apne hi faiday ke liye trades ko manipulate kar sakta hai. Ismein transparency kam hoti hai aur slippage ka khatra bhi hota hai agar broker ki execution speed slow ho. STP dealing disk mein, kuch traders ko market volatility ke samay mein liquidity ki kami ka samna karna pad sakta hai, jo ki unke trading strategies ko prabhavit kar sakta hai. Saath hi, STP dealing disk mein kuch traders ko higher spreads ka samna karna pad sakta hai, khaaskar jab market mein volatility badh jati hai.

Dealing Disk Aur Slippage:

Slippage ek common issue hai jo trading mein aata hai, aur dealing disk ka role slippage ko minimize karne mein hota hai. Agar dealing disk ki speed slow ho ya market mein volatility zyada ho, to slippage ka khatra badh jata hai. Slippage ka issue STP dealing disk mein bhi ho sakta hai, khaaskar jab market mein sudden price movements hote hain ya liquidity kam hoti hai. Isliye, traders ko apne trading strategies ko design karte waqt slippage ka risk bhi consider karna chahiye.

Dealing Disk Ka Impact:

Dealing disk ka sahi istemal karke traders apne trading strategies ko improve kar sakte hain aur apni trading performance ko optimize kar sakte hain. Saahi dealing disk ka chayan karke traders apne trading experience ko enhance kar sakte hain. Ye system traders ko market volatility aur liquidity fluctuations ke against protect karne mein madad karta hai aur unhe accurate pricing aur fast execution provide karta hai. Dealing disk ke through, traders apne trades ko timely manage kar sakte hain aur market ke movements ke saath sath adapt kar sakte hain.

Dealing Disk Aur Transparency:

STP dealing disk zyada transparency provide karta hai kyunke orders directly market tak forward kiye jate hain. Ye traders ko accurate pricing aur order execution ki guarantee deta hai. STP dealing disk ke zariye traders ko real-time market data aur pricing information bhi milti hai jo unhe informed trading decisions lene mein madad karta hai. Saath hi, DD dealing disk bhi transparency provide kar sakta hai, lekin ismein broker ki policies aur execution process ke bare mein traders ko clarity honi chahiye.

Dealing Disk Ke Selection Criteria:

Traders ko apne trading style, risk tolerance, aur preferences ke mutabiq dealing disk select karna chahiye. Ye unke trading experience aur performance ko improve karne mein madad karta hai. Traders ko apne trading goals aur requirements ke hisab se dealing disk ka chayan karna chahiye. Kuch traders prefer karte hain STP dealing disk kyunke ismein transparency zyada hoti hai aur slippage ka risk kam hota hai, jabki kuch traders prefer karte hain DD dealing disk kyunke ismein personalized support aur customized services milti hai.

Regulatory Guidelines:

Regulatory bodies ne dealing disk ko regulate karne ke liye guidelines jaari kiye hain taki traders ki interests protect ki ja sakein. Ye guidelines transparency, fairness, aur market integrity ko maintain karne ka aim rakhte hain. Regulatory bodies kuch minimum standards aur best practices bhi establish karte hain jinhe brokers ko follow karna hota hai. Regulatory compliance ke saath sahi dealing disk ka chayan karna traders ke liye zaroori hai taki wo apne funds aur trading activities ko secure rakhein.- Conclusion:

- Forex mein dealing disk ek critical aspect hai jo traders ki trading experience par asar daalta hai. Traders ko apne broker ki dealing disk ko samajh kar apni trading decisions leni chahiye taki wo apni trading performance ko optimize kar sakein. Dealing disk ke through, traders ko high-quality liquidity, fast execution, aur transparent pricing milta hai jo unhe successful trading journey mein madad karta hai. Saath hi, regulatory guidelines aur best practices ko follow karke, traders apne funds aur interests ko protect kar sakte hain.

Is tarah se, har heading ke neeche aur detailed information add karke, article ko more informative aur helpful bana sakte hain. Agar aapko kisi specific heading ke under aur details chahiye ho, toh mujhe bataiye. -

#11 Collapse

Forex Mein Dealing Desk: Kya Hai?

Dealing desk forex trading mein ek platform ya department hota hai jahan brokers apne clients ke trades ko execute karte hain. Is platform par brokers apne clients ke orders ko receive karte hain aur unhein market mein execute karte hain.

Dealing Desk Kaam Kaise Karta Hai?

1. Order Execution:

Clients apne trading platform ke through apne orders ko dealing desk tak send karte hain. Dealing desk phir un orders ko receive karta hai aur unhein market mein execute karta hai.

2. Market Maker:

Kuch brokers apne dealing desk ke through market maker ka kaam karte hain, yaani ke wo khud hi market mein liquidity provide karte hain aur clients ke trades ko execute karte hain.

3. Risk Management:

Dealing desk ke zariye brokers apni risk management strategies ko bhi implement karte hain, jaise ke hedging aur exposure control.

Dealing Desk Ke Types:

1. DD (Dealing Desk):

Kuch brokers apne clients ke trades ko apne dealing desk ke through execute karte hain. Ismein brokers apne clients ke trades ko khud hi handle karte hain.

2. NDD (No Dealing Desk):

Kuch brokers NDD model follow karte hain jismein unka koi apna dealing desk nahi hota. Orders directly market mein execute hote hain.

Dealing Desk Ke Faida aur Nuqsanat:

Faida:

- Personalized Service:

Dealing desk ke through brokers apne clients ko personalized service provide kar sakte hain.

- Market Liquidity:

Market maker dealing desk ke zariye market mein liquidity provide karte hain.

Nuqsanat:

- Conflict of Interest:

DD model mein brokers ke beech conflict of interest ka khatra hota hai kyunki wo apne clients ke trades ko khud execute karte hain.

- Slippage:

Kuch brokers ke dealing desk par trades ko execute karne mein slippage ka khatra hota hai.

Nateeja

Dealing desk forex trading mein ek common concept hai jismein brokers apne clients ke trades ko execute karte hain. Traders ko apne broker ka dealing desk model samajh kar apne trading decisions ko lena chahiye.

-

#12 Collapse

Forex market mein "dealing desk" (sometimes referred to as a "trading desk") ek trading term hai jo Forex brokers ke operations ko describe karta hai. Dealing desk brokers apne clients ke trades ko execute karte hain. Yeh brokers apne dealing desks ke through clients ke orders ko handle karte hain, aur in orders ko market mein execute karte hain.

Forex Market Mein Dealing Desk Important Nukaat#>#>

Kuch important points jo dealing desk brokers ke baare mein hote hain:

Market Maker: Dealing desk brokers often act as market makers. Iska matlab hai ki jab ek client order place karta hai, to broker khud hi market mein opposite side par trade karta hai. Isse broker ke paas liquidity aur flexibility hoti hai, lekin iska bhi matlab hai ki broker apne hi spreads aur pricing create kar sakta hai.

Conflict of Interest: Kuch logon ka kehna hai ki dealing desk brokers ke paas apne clients ke trades ko execute karne mein conflict of interest hota hai. Iska mtlb hai ki broker apne hi fayda ke liye trades ko manipulate kar sakta hai.

Fixed Spreads: Dealing desk brokers aksar fixed spreads provide karte hain. Iska mtlb hai ki spreads hamesha constant rehte hain, lekin market volatility ke dauran yeh spreads widen ho sakte hain.

Order Execution: Dealing desk brokers apne discretion ke under client orders ko execute karte hain. Iska matlab hai ki broker decide karta hai ki kis rate par aur kab trade execute karna hai.

Risk Management: Dealing desk brokers apne risk management policies ko apply karte hain apni exposure ko manage karne ke liye.

Overall, dealing desk brokers ek tarah ka intermediary role play karte hain client aur market ke beech, aur unki functionality aur policies broker se broker mein vary karti hain. Some traders prefer dealing desk brokers ke predictability aur ease of use ke liye, jabki doosre traders prefer ECN (Electronic Communication Network) brokers ke transparency aur direct market access ke liye.Forex mein dealing disk ek critical aspect hai jo traders ki trading experience par asar daalta hai. Traders ko apne broker ki dealing disk ko samajh kar apni trading decisions leni chahiye taki wo apni trading performance ko optimize kar sakein. Dealing disk ke through, traders ko high-quality liquidity, fast execution, aur transparent pricing milta hai jo unhe successful trading journey mein madad karta hai. Saath hi, regulatory guidelines aur best practices ko follow karke, traders apne funds aur interests ko protect kar sakte hainRegulatory bodies ne dealing disk ko regulate karne ke liye guidelines jaari kiye hain taki traders ki interests protect ki ja sakein. Ye guidelines transparency, fairness, aur market integrity ko maintain karne ka aim rakhte hain. Regulatory bodies kuch minimum standards aur best practices bhi establish karte hain jinhe brokers ko follow karna hota hai. Regulatory compliance ke saath sahi dealing disk ka chayan karna traders ke liye zaroori hai taki wo apne funds aur trading activities ko secure

-

#13 Collapse

Heading: Forex Mein Dealing Desk Kya Hai?

Forex trading mein, "dealing desk" ek aham hissa hai jo brokerage firms aur banks ke andar hota hai. Yeh ek department hota hai jo traders aur clients ke trades ko execute karta hai aur market liquidity maintain karta hai. Chaliye dekhte hain dealing desk ke functions aur uska kaam kaise hota hai.

Dealing Desk Kaam Kya Karta Hai?- Trade Execution (Trade Anjam): Dealing desk trades ko execute karta hai. Jab koi trader ya client order place karta hai, to dealing desk us order ko execute karta hai market conditions ke mutabiq.

- Market Making (Bazaar Banana): Kuch dealing desks market makers bhi hote hain, yaani ki wo khud market mein trades karte hain. Isse unka kaam hota hai market liquidity maintain karna aur spread provide karna.

- Risk Management (Khatra Prabandhan): Dealing desk ka ek mukhya kaam hota hai risk management. Wo market volatility aur client positions ko monitor karte hain taki kisi bhi unexpected situation mein risk ko manage kiya ja sake.

- Customer Support (Grahak Samarthan): Dealing desk aksar customer support bhi provide karta hai. Wo clients ke sawalon ka jawab dete hain aur unki madad karte hain trading related queries mein.

Dealing Desk Ke Types:- Dealing Desk (DD): DD brokers khud market ke against positions le sakte hain aur khud hi liquidity provide karte hain. Ismein conflict of interest ho sakta hai kyun ki broker khud bhi market participant hota hai.

- No Dealing Desk (NDD): NDD brokers dealing desk ke through orders ko directly market ke participants tak pohanchate hain. Ismein conflict of interest kam hota hai kyun ki broker khud market ke against positions nahi leta.

Nateeja:

Dealing desk ek mahatvapurna hissa hai forex trading ke process ka. Yeh brokerages aur banks ke liye zaroori hai taki wo trading operations ko smoothly chalaa sakein aur clients ko quality service provide kar sakein. Traders ko dealing desk ke types aur functions ko samajhna zaroori hai taki wo apne broker ko chunne mein sahi nirnay le sakein aur trading experience ko behtar bana sakein.

-

#14 Collapse

Dealing Desk in the forex

Forex Trading ka Aghaz Dealing Desk ka Tareeqa

Forex Trading: Ahmiyat aur Asal Usool

Forex Trading ki Ahmiyat

Forex Market ke Asal Usool

Dealing Desk: Kya Hai?

Dealing Desk ki Tafseelat

Dealing Desk ka Maqsad

Dealing Desk ke Tareeqa Amal

Kaise Dealing Desk Kaam Karta Hai?

Dealing Desk ke Kirdar

Dealing Desk aur Market Makers

Market Makers ka Kia Kaam Hai?

Dealing Desk mein Market Makers ka Kirdar

Straight Through Processing (STP) vs. Dealing Desk

STP aur Dealing Desk ka Faraq

Kis Tarah STP aur Dealing Desk Alag Hain?

Dealing Desk: Fawaid aur Nuqsanat

Fawaid: Kya Dealing Desk Trading ko Asaan Banata Hai?

Nuqsanat: Kya Dealing Desk mein Khatraat Hain?

Dealing Desk ka Regulatory Framework

Regulatory Compliance ki Ahmiyat

Forex Trading mein Regulatory Requirements

Dealing Desk aur Spread

Spread ki Tafseelat

Dealing Desk ka Spread par Asar

Dealing Desk ka Future

Dealing Desk ka Mustaqbil

Kya Future mein Dealing Desk mein Tabdeeliyan Aane Wali Hain?

Dealing Desk aur Trader ki Mukhtalif Nuqtae Nazar

Traders ka Dealing Desk par Nazariya

Dealing Desk ki Ahmiyat Traders ke Liye

Dealing Desk aur Risk Management

Risk Management ka Kia Hissa Hai?

Dealing Desk ka Risk Management mein Kirdar

Dealing Desk aur Transparency

Transparency ka Kia Maqsad Hai?

Dealing Desk ki Transparency

Dealing Desk ka Impact on Market Liquidity

Market Liquidity ki Ahmiyat

Dealing Desk ka Market Liquidity par Asar

Note

Dealing Desk ka Muqam Forex Trading mein

Aghaz se Ab Tak ka Safar: Dealing Desk ki Nigarani

Forex trading mein "Dealing Desk" (DD) ek aham concept hai. Yeh ek department hota hai brokerage firms ka jahan par trades execute ki jati hain. Dealing Desk traders ke orders ko receive karta hai aur unhein market mein execute karta hai. Is process mein, Dealing Desk kaam karta hai market maker ki tarah, jisme woh khud hi liquidity provide karte hain aur spreads set karte hain.

Dealing Desk ka tareeqa amal hota hai ke wo traders ke orders ko apne bazaar mein execute karte hain, jiske natije mein woh commission ya spread ke zariye apni earning karte hain. Yeh system traders ko market access provide karta hai aur unke orders ko quickly execute karne mein madadgar hota hai.

Ek important concept hai "Straight Through Processing" (STP), jo ke Dealing Desk se mukhtalif hai. STP mein, orders seedha market mein bheje jate hain bina kisi Dealing Desk intervention ke. Is tareeqe se, STP transparency aur execution speed ko barhata hai.

Dealing Desk ka regulatory framework bhi ahem hai taake yeh transparency, fair dealing, aur traders ki protection ko ensure kar sake. Regulatory compliance ke bina, Dealing Desk kaam karna mushkil ho jata hai aur traders ke liye khatraat barh jate hain.

Iske ilawa, Dealing Desk ka spread par asar bhi hota hai. Spread ek tarah ka fee hota hai jo traders broker ko dena hota hai. Dealing Desk ke through, spreads set kiye jate hain jo ke traders ki trades ko execute karte waqt dekhe jate hain.

Future mein, Dealing Desk mein tabdeeliyan ane ka imkan hai jaise ke technology ke advancements aur regulatory changes. Yeh tabdeeliyan traders ke liye naye opportunities aur challenges bhi laye gi.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 Collapse

What's the dealing disk in forex?

**Forex Mein Dealing Desk:

**1. Dealing Desk Ki Tareef**

Dealing desk (ya DD) forex brokers ki service hoti hai jo unke clients ko buy aur sell orders execute karne mein madad karti hai. Yeh ek centralised trading desk hota hai jahan brokers ke employees trades ko monitor aur execute karte hain.

**2. Kaise Kaam Karta Hai**

Dealing desk brokers apne clients ke trades ko execute karne ke liye market makers ya liquidity providers ke saath juda hotay hain. Jab client ek order place karta hai, toh dealing desk us order ko apne internal system mein enter karta hai aur phir market ke hisaab se us order ko execute karta hai.

**3. Market Makers**

Dealing desk ke zariye, brokers market makers ya liquidity providers ke saath juda hotay hain jo unko liquidity aur pricing provide karte hain. Market makers bid aur ask prices tay karte hain jin par traders apne orders place karte hain.

**4. Pricing Aur Spread**

Dealing desk brokers apne clients ko bid aur ask prices mein spread offer karte hain. Spread ka difference bid aur ask prices ke darmiyan hota hai aur yeh broker ki commission ya profit ka ek hissa hota hai.

**5. Conflict of Interest**

Ek masla jo dealing desk ke saath juda hota hai woh hai conflict of interest. Kyunki dealing desk brokers apne clients ke trades ko execute karte hain, isliye unka incentive hota hai ke clients ke nuqsanat ko minimize karke apna profit barhayein.

**6. Execution Speed**

Dealing desk brokers ki execution speed unke infrastructure aur market conditions par depend karta hai. Kuch brokers ki dealing desk ki execution speed tez hoti hai jabke doosre brokers ki execution mein deri hoti hai.

**7. Dealing Desk vs. No Dealing Desk (NDD)**

Dealing desk brokers ke opposite no dealing desk (NDD) brokers hote hain jo clients ke orders ko directly market mein execute karte hain bina kisi interference ke. NDD brokers ke through traders ko direct access market (DMA) milta hai.

**8. Regulatory Compliance**

Dealing desk brokers ko apne regulatory authorities ke guidelines aur regulations ka paalan karna hota hai. Regulatory compliance ke bina, dealing desk brokers apni services ko nahi provide kar sakte aur legal trouble mein pad sakte hain.

**Akhri Alfaaz**

Dealing desk forex brokers ek important part hain forex trading ke ecosystem ka. Iski samajh aur istemal se traders apne trading decisions ko better taur par samajh sakte hain aur apne trading strategies ko improve kar sakte hain.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 12:56 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим