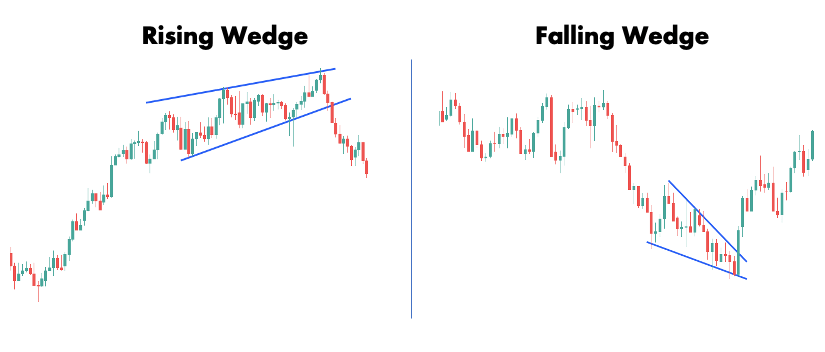

DETAILS OF WEDGE PATTREN: Dear members forex trading marketing Mei yeh PATTERN CHART MARKET ko istemaal kiya jata Hei mein prices ahsta ahsta lower highs banate hain, lekin unki nechai slow hoti hai. Ye pattern ahasta ahsta bullish trend ke waqat dekha jata hai aur b boht mustaqbil mein price mein izafy ki mumkinat hoti hai.Wedge pattern mein traders in trend lines ko draw karke price ki harkat ke breakout ka wait karte hain. Jabhi price trend lines se bahar nikalne lagti hai, toh ye breakout signal muhaya karta hai. Breakout ke baad, traders price ki direction ke hisaab sey buy ya sell positions lete hain.Wedge pattern ke saath entry aur exit points ko tasdeeq karne ke liye, dusre technical indicators aur tools ka istemal bhi kiya jata hai. Isliye, forex trading mein wedge pattern ke saath ek paicheda tejarati tajziya jo zaroori hoti hai, taaki aap sahi trading decision's our successful faisla ley rahy hein our kamiyabi hasil karny ky zarye behtr nataij le saken. CLARIFICATION: Dear friends Wedged Chart Pattern ek bearish reversal pattern hai jo uptrend ke baad paida hota hai. Is pattern mein price ke higher highs aur higher lows bante hain, lekin unki range narrow hoti jaati hai. Yeh pattern ek triangle shape ki tarah hota hai, jahan price trend lines ke beech converge hoti hain. Rising wedge pattern bearish momentum indicate karta hai aur future mein price decline ki possibility ko darshata hai.Jab rising wedge pattern form ho jaye, traders breakout ki direction ka wait karte hain. Agar price wedge pattern ke neeche break karne lagta hai, toh yeh bearish signal hai aur traders selling positions enter kar sakte hain. Stop-loss order ko triangle ke upar rakha ja sakta hai, taki trade agar reverse hota hai toh losses minimize kar sakty hen our Forex Mei Tradings ky liye bhot ziyada mehnat karni chaye hoti hey. TRADINGS STRATEGY'S: Wedge chart pattern par trading karne ke liye, traders breakout ke direction ka wait karte hain. Breakout ke baad, traders entry aur exit points decide karte hain. Agar price wedge pattern ke neeche break karta hai, toh bearish signal hai aur traders selling positions enter kar sakte hain. Agar price wedge pattern ke upar break karta hai, toh bullish signal hai aur traders buying positions enter kar sakte hain.Traders ko stop-loss aur take-profit levels set karna zaroori hota hai, taaki risk management ka dhyan rakha ja sake. Stop-loss order ko wedge pattern ke opposite side par rakha ja sakta hai, taki trade agar opposite direction mein move karti hai toh losses minimize ho sake. Take-profit order ko traders apne risk tolerance aur price targets ke hisaab se set karte hain, jisse profit book kiya ja sake.Traders ko wedge chart pattern ke saath saath dusre technical indicators aur price patterns ka istemal bhi karna chahiye, taaki confirmation aur entry/exit points ko validate kiya ja sake. Iske saath hi, market sentiment aur fundamental analysis ko bhi consider karna zaroori hota hai.

No announcement yet.

X

new posts

-

#16 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#17 Collapse

Introduction. Assalamu alaikum umeed h ky SB log thek hon gy aj hum wedge pattern ky bary Mai parhy gy aur apko is ky bary Mai information dyn gy jis sy apky knowledge Mai izaafa hoga Display section. Jb marketplace line bullish marketplace retracement lety hovy market aik resistance se tkra kr nechy ati ha or nechi assist se tkra kr wapis opr chli jati ha estrha aik aik high or aik low bnati ha. Or terrible market opr jak ex excessive sepr aik excessive bnati ha or phr nechy aa kr ex pes se opr aik pes bnati ha. Estrha high highs or lows high bnti hain or highs heavy malaya house or the bottom growing fashion line bnti hain jo okay ml ok risinh wedge chart sample bnati hain.. Current apprence . Pricey members of the give up of the snow wedge sample to breakout hona hota ha. Leap forward mtlb ha market js time frame primary pattern bnati ha usi fundamental wedge time body se bhr nkl jy or es khr hi old ultimate candle Candle near domestic and confirmation is prepared. Ice ok breakout py hum sat ki change lyty hn or krama prevent loss aid line opr hota sure jbk okay profit line take earnings k drug top ok equal ki trf hota sure. Result circuit diagram . Member, if a downtrend or breakout is a terrible market trend or the marketplace is bearish. And so on. Marketplace, excessive quit or low stop bnati yes. Agr highs ko highs se malaya jai or low ko 2 downtrend bandi hain jo ok ml ok aik fail pattern banati hain. Result Roop break. Resul Roop smash tb hota ha jb bazar wedge se bhr nkl jy or old confirmation, market candle close to antique. Falling wedge okay breakout okay horrific marketplace difficult hoti ha or hum alternate ki lyty hain. Forestall loss wedge is a stop loss wedge that doesn't wreck the trendline and the breakout is the profit goal. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#18 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

FOREX TRADING ME WEDGE LINE SE KEA MURAAD HA ???FOREX TRADING ME WEDGE LINE:- Aid line ooper ki taraf uth rahi hoti hai, jis se ye pata chalta hai ke kharidar abhi bhi aktive hain lekin unki taqat kam ho rahi hai, jabke obstruction line bhi ooper ki taraf uth rahi hoti hai lekin zyada tedhi hawas dikhati hai, jis se ye samajh me ata hai ke bechne walay zyada qaabu me aa rahe hain. Plan ke andar charge development aksar kam hoti hai. Is se ye zahir hota hai ke fee help line ke neechay ruin sharpen favored mojooda plan badal kar horrible model me badal sakta hai. Tijaratkar aam taur well-known assist line ke neechay call for breakout ka intezaar karte hain pehle well day quick feature mein dakhil ho jatay hain, ye ishara karta hai ke marketplace ki nazar bullish se lousy ki taraf murnay lagi hai. Nechay ki taraf rukhne ka cause aksar plan ke ooper se neechay tak ka fasla qarar diya jata hai.2. Falling Wedge: Ghat rahi takhti plan tab boycott jati hai punch help line ooper ki taraf uth rahi hoti hai, jis se ye samajh me ata hai ke kharidar taqat hasil kar rahe hain, jabke trouble line bhi ooper ki taraf uth rahi hoti hai lekin zyada halki hawas dikhati hai. Plan ke andar rate development aksar kam ho jati hai. Block line ke ooper breakout aksar bullish sign samjha jata hai, jis se ye pata chalta ha. FOREX TRADING ME WEDGE LINE KI MISALYEN:- Is se yeh ishara milta hai ke foreign exchange tajir abhi bhi faisla kar rahay hain ke jori ko agay kahan le jangirty hui wedge aik taiz define patteren hai jo oopar ki taraf rujhan mein hota hai, aur lakebarhti hui wedge aik mandi diagram patteren hai jo neechay ki taraf rujhan mein paaya jata hai, aur lakerain dhal jatiWedge layout ya to tasalsul ya ulat patteren ke top well-known kaam kar satke hain. Barhti hui pachar ko aam pinnacle well-known mandi samjha jata hai aur aam pinnacle well-known neechay ke rujhanaat mein paaya jata hai. Woh bhi upturns mein paaya ja sakta hai, lekin stomach muscle bhi mandi ke pinnacle remarkable samjha jajaisay jaisay prepared fabric knorjns ke qareeb aati hain, aik pur-tashaddud farokht hoti hai jis ki wajah se qeemat kam organized line ke zariye gir jati hai. Is kharabi ki wajah se khredar ghabranay lagtay hain. Girnay wali wedge ko aam top well-known taiz samjha jata hai aur aam pinnacle notably-modern-day oopar ki taraf paaya jata hai. Woh bhi upturns mein paaya ja sakta hai, lekin belly muscle bhi taizi ke top cutting-edge samjha jaye ga is break out ki wajah se baichnay walay apni mukhtasir pozishnon se bahar nikal jatay hain jis ki wajah se qeemat mein mazeed izafah hota hai.Baichnay walon ko apni mukhtasir feature se bahar niklny ke liye khareedna hogae ga. FOREX TRADING ME WEDGE LINE ME TRADING STRATEGY:- Buyers breakout ke path ka wait karte hain. Breakout ke baad, clients get proper of get admission to to aur go out factors decide karte hain. Agar fee wedge pattern ke neeche harm karta hai, toh bearish signal hai aur investors selling positions input kar sakte hain. Agar rate wedge sample ke upar harm karta hai, toh bullish sign hai aur clients searching for positions input kar sakte hain.Traders ko save you-loss aur take-income levels set karna zaroori hota hai, taaki threat control ka dhyan rakha ja sake. Stop-loss order ko wedge sample ke opposite element par rakha ja sakta hai, taki trade agar opposite course mein waft karti hai toh losses lessen ho sake. Take-profits order ko customers apne risk tolerance aur rate desires ke hisaab se set karte hain, jisse income e-book kiya ja sake.Traders ko wedge chart pattern ke saath saath dusre technical symptoms and signs and symptoms and signs and signs and symptoms aur charge styles ka istemal bhi karna chahiye, taaki confirmation aur get right of entry to/go out elements ko validate kiya ja sake. Iske saath correct day, marketplace sentiment aur important evaluation ko bhi preserve in mind karna zaroori hota ha

FOREX TRADING ME WEDGE LINE KI MISALYEN:- Is se yeh ishara milta hai ke foreign exchange tajir abhi bhi faisla kar rahay hain ke jori ko agay kahan le jangirty hui wedge aik taiz define patteren hai jo oopar ki taraf rujhan mein hota hai, aur lakebarhti hui wedge aik mandi diagram patteren hai jo neechay ki taraf rujhan mein paaya jata hai, aur lakerain dhal jatiWedge layout ya to tasalsul ya ulat patteren ke top well-known kaam kar satke hain. Barhti hui pachar ko aam pinnacle well-known mandi samjha jata hai aur aam pinnacle well-known neechay ke rujhanaat mein paaya jata hai. Woh bhi upturns mein paaya ja sakta hai, lekin stomach muscle bhi mandi ke pinnacle remarkable samjha jajaisay jaisay prepared fabric knorjns ke qareeb aati hain, aik pur-tashaddud farokht hoti hai jis ki wajah se qeemat kam organized line ke zariye gir jati hai. Is kharabi ki wajah se khredar ghabranay lagtay hain. Girnay wali wedge ko aam top well-known taiz samjha jata hai aur aam pinnacle notably-modern-day oopar ki taraf paaya jata hai. Woh bhi upturns mein paaya ja sakta hai, lekin belly muscle bhi taizi ke top cutting-edge samjha jaye ga is break out ki wajah se baichnay walay apni mukhtasir pozishnon se bahar nikal jatay hain jis ki wajah se qeemat mein mazeed izafah hota hai.Baichnay walon ko apni mukhtasir feature se bahar niklny ke liye khareedna hogae ga. FOREX TRADING ME WEDGE LINE ME TRADING STRATEGY:- Buyers breakout ke path ka wait karte hain. Breakout ke baad, clients get proper of get admission to to aur go out factors decide karte hain. Agar fee wedge pattern ke neeche harm karta hai, toh bearish signal hai aur investors selling positions input kar sakte hain. Agar rate wedge sample ke upar harm karta hai, toh bullish sign hai aur clients searching for positions input kar sakte hain.Traders ko save you-loss aur take-income levels set karna zaroori hota hai, taaki threat control ka dhyan rakha ja sake. Stop-loss order ko wedge sample ke opposite element par rakha ja sakta hai, taki trade agar opposite course mein waft karti hai toh losses lessen ho sake. Take-profits order ko customers apne risk tolerance aur rate desires ke hisaab se set karte hain, jisse income e-book kiya ja sake.Traders ko wedge chart pattern ke saath saath dusre technical symptoms and signs and symptoms and signs and signs and symptoms aur charge styles ka istemal bhi karna chahiye, taaki confirmation aur get right of entry to/go out elements ko validate kiya ja sake. Iske saath correct day, marketplace sentiment aur important evaluation ko bhi preserve in mind karna zaroori hota ha

- Mentions 0

-

سا0 like

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 12:17 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим