Aayiyae evening star patteren ke ajzaa aur khususiyaat ko daryaft karen

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

ulat jane ki nishandahi karta hai. evening star patteren ki tasdeeq ke liye tajir aksar izafi isharay aur tools istemaal karte hain. un mein trained lines, support aur rizstns levels, moving average ya ascilators shaamil ho satke hain. tasdeeq patteren ki washushneta ko badhaane mein madad karti hai aur mumkina ulat jane mein ziyada aetmaad faraham karti hai. evening star patteren ki shanakht karte waqt, is sayaq o Sabaq par ghhor karna zaroori hai jis mein yeh zahir hota hai. market ka majmoi rujhan, hajam ka tajzia, aur deegar takneeki isharay jaisay awamil patteren ki durustagi ke baray mein mazeed baseerat faraham kar satke hain. evening star ke patteren ki pehchan ho jane ke baad, tajir mukhtasir position lainay ya mojooda lambi pozishnon ko khatam karne par ghhor kar satke hain. rissk ko munazzam karne ke liye stap loss orders aksar din 3 k Aayiyae evening star patteren ke ajzaa aur khususiyaat ko daryaft karen pattern ki tashreeh market ke majmoi halaat aur deegar takneeki isharay ke tanazur mein ki jani chahiye. tajir aksar izafi tasdeeqi isharay talaash karte hain, jaisay ke tijarti hajam mein kami ya oscillators jaisay relative strength index ( rsi ) ya moving average convergence divergence ( macd ) mein mandi ke farq ki mojoodgi. yeh takmeeli isharay shaam ke setaaray ke patteren ki durustagi ko mazboot bana satke hain aur mumkina ulat phair mein tajir ke aetmaad ko barha satke hain . kisi bhi takneeki tajzia ke alay ki terhan, shaam ke setaaray ka namona durust nahi hai, aur ghalat signal ho satke hain. sirf is tarz ki bunyaad par tijarti faislay karne se pehlay tasdeeq ka intzaar karna aur deegar awamil par ghhor karna zaroori hai. agar patteren mukammal honay mein nakaam ho jata hai to tajir –apne aap ko mumkina nuqsanaat se bachanay ke liye aksar stop las orders aur rissk managment taknik istemaal karte hain . -

#3 Collapse

Bearish Evening Star kia ha?

Evening Star ek bearish reversal candlestick pattern hai jo teen candles se bana hota hai: aik bari bullish candlestick aik chhoti candle aur aik bearish candle. Evening Star patterns price uptrend ke top par dikhte hain, jis se ye pata chalta hai ke uptrend khatam hone wala hai. Evening Star ka opposite pattern Morning Star hai, jo ek bullish reversal candlestick pattern hai.

Evening Star Momentum:

Evening Star pattern ko asset price ki candlestick chart mein dekha ja sakta hai, jisme teen candles hote hain. Pehli candle ek lambi body wali hoti hai jo price mein bada izzafa dikhata hai aur close price open price se upar settle hoti hai. Ye bullish candle asset price ki upward momentum ko reflect karta hai.

Evening Star balanced Order:

Dusra candle star" hoti hai jiski body chhoti hoti hai (ya toh bullish ho ya bearish) ya phir body hi na ho (neutral). Star feature batata hai ki asset price close price ke level par settle hoti hai jo open price ke bahut kareeb hoti hai jahan balanced buying aur selling orders hote hain. Star previous bullish momentum mein slowdown signal karta hai. Ek ideal Evening Star pattern mein pehli candle se star tak ek gap hona chahiye. Iska matlab hai ki open price pehle ke close price se tezi se badha hai aur us dauran bahut kam ya phir koi bhi transaction nahi hua hai.

Common Evening Star:

Aam taur par pehle star se gap down ke saath teesri candle bearish hoti hai jisme close price open price se kam hoti hai. Pehli candle mein dikhayi gayi upward trend ulta ho gayi hai aur price gain hat gaya hai. Ye candle Evening Star pattern ko confirm karta hai (ideally gap down ke saath) aur selling signal deta hai.

Evening Star Characteristics Candle Shadows:

Candle bodies ke characteristics candle shadows ke characteristics se zyada mahatvapurna hote hain. Shadow candle body ke upar aur neeche ki lines hoti hain aur ek certain samay ke dauran sabse zyada aur kam prices ko reveal karti hain. Ek lambi shadow price mein zyada tivr parivartan ko darshata hai, ulta agar shadow chhoti hai toh parivartan kam hota hai.

Bearish Evening Star Identify:

Evening Star pattern teen candles se pehchana jata hai. Pehli candle badi bullish candle hoti hai, uske baad ek choti body wali candle hoti hai jo uncertainty ko indicate karti hai, aur phir ek badi bearish candle hoti hai jo trend reversal ka possibility batati hai. Ye aam taur par uptrend ke baad dikhta hai aur traders ke liye ek reliable signal ho sakta hai. Trading decisions lene se pehle additional confirmation indicators ya patterns ka istemal karna zaroori hai.

Evening Star Or Selling Pressure:

Evening Star pattern ka matlab hota hai ki buying pressure kam ho rahi hai aur sellers ko control milne laga hai. Jab ye pattern kisi significant uptrend ke baad dikhta hai, toh ye ek reliable signal consider kiya jata hai.

Traders Trading Decisions:

Traders trading decisions lene se pehle often additional confirmation indicators ya patterns ka istemal karte hain Evening Star pattern ko validate karne ke liye. Yaad rakhein ki koi bhi pattern ya indicator future price movements ko guarantee nahi karta hai, aur trading decisions lene ke samay dusre technical analysis tools aur risk management strategies ka istemal karna hamesha recommended hota hai. Ye malomat sirf educational purposes ke liye di gayi hai aur isse financial advice ke roop mein na lein. Hamesha recommended hai ki aap ek professional financial advisor se salah lein ya phir thorough research karein pehle investment decisions lene se pehle. -

#4 Collapse

Evening Star Pattern:

Shaam ki Sitare ka Tijarat mein Khaas Ahmiyat

Evening Star Pattern, technical analysis mein ek aham chart pattern hai jo shaam ki sitara ki misal se liya gaya hai. Ye pattern bearish reversal ko darust karti hai, yaani ke jab market mein uptrend ho, toh ye pattern indicate karta hai ke trend badalne wala hai aur ab downtrend shuru hone wala hai. Evening Star Pattern, tezi se girne wale market ke signals ke liye istemal hota hai. Is pattern ko samajhne ke liye, aapko iske ajzaa aur khususiyaat ko dhyan se daryaft karna hoga.

Evening Star Pattern Ke Ajzaa:- Pehla Candle (Bullish): Evening Star Pattern ka pehla part ek bullish (teziwala) candle hota hai. Is candle mein market mein tezi hoti hai aur prices upar ki taraf move karte hain.

- Dusra Candle (Doji or Spinning Top): Dusre part mein aata hai Doji ya Spinning Top candle, jo ke small body ke sath hoti hai. Is candle mein market mein uncertainty hoti hai, aur prices mein kamzori dikhai deti hai.

- Teesra Candle (Bearish): Teesra part ek bearish (girawatwala) candle hota hai. Is candle mein market mein girawat shuru hoti hai aur prices neeche ki taraf move karte hain.

Evening Star Pattern Ki Khususiyaat:- Reversal Signal: Evening Star Pattern bearish reversal signal provide karta hai, yaani ke uptrend ke badalne ki talaash mein hai. Is pattern ko samajhne se traders ko ye maloom hota hai ke ab market mein girawat ki taraf ja sakti hai.

- Confirmation Ke Liye Volume: Is pattern ko samajhne ke liye volume analysis ka istemal kiya ja sakta hai. Agar teesre candle ke sath girawat ke sath zyada volume bhi hota hai, toh ye pattern aur bhi mazboot ho jata hai.

- Short Selling Opportunity: Evening Star Pattern traders ko short selling opportunity provide karta hai. Agar ye pattern sahi taur par identify kiya jata hai, toh traders apne positions ko girne wale market mein protect kar sakte hain.

- Time Frame Par Dhyan: Is pattern ko samajhne ke liye sahi time frame ka chayan karna bhi zaroori hai. Dher saare traders daily chart ya weekly chart ka istemal karte hain is pattern ko daryaft karne ke liye.

Savdhanaiyan:- Confirmation Ke Liye Aur Indicators: Evening Star Pattern ko confirm karne ke liye, traders ko doosre technical indicators ka bhi istemal karna chahiye, jaise ke RSI, MACD, ya moving averages.

- Market Conditions Ka Dhyan Rakhein: Kabhi-kabhi market mein uncertainty hoti hai aur false signals bhi aate hain. Isliye, market conditions ka bhi dhyan rakhna zaroori hai.

Evening Star Pattern, agar sahi taur par samjha jaye aur sahi tajaweez ke saath istemal kiya jaye, toh ye traders ko market ke reversals se bachne mein madadgar ho sakta hai. Hamesha yeh yaad rakhein ke technical analysis mein istemal hone wale patterns ke istemal mein research aur tajaweez ka bhi khaas khayal rakha jaye.

-

#5 Collapse

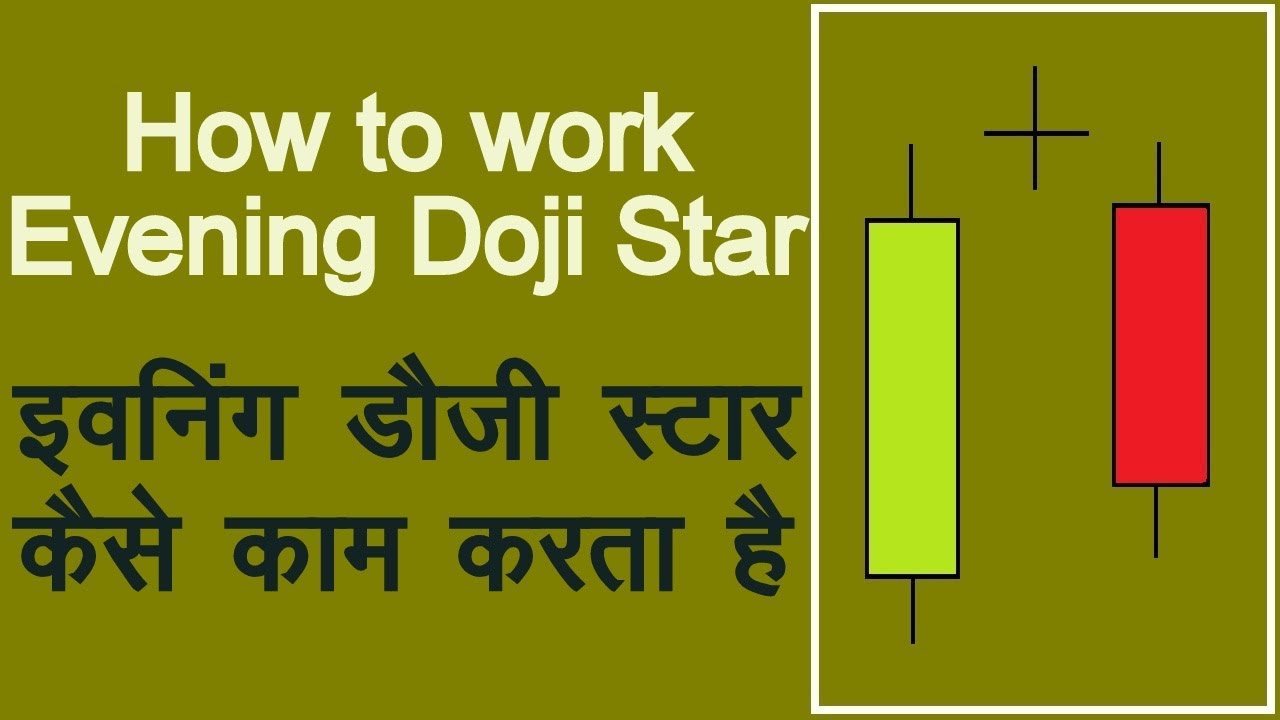

Evening Doji Star candlestick Kia Ha?

Ye ek bearish reversal pattern hai jo price trend ko indicate karta hai. Is pattern mein pehle ek long bullish candle hoti hai phir doji candle hoti hai jiske open aur close prices almost same hote hai, aur phir ek long bearish candle hoti hai jo pehle bullish candle ke half tak extend hoti hai. Ye pattern bullish trend ke baad bearish trend ka indication deta hai.

Evening Doji Star Candlestick Identify:

Evening Doji Star pattern ko identify karne ke liye, aapko kuch steps follow karne honge:

1. Pehle, dekhe ki market bullish trend mein hai ya nahi. Agar market bullish trend mein hai toh aap Evening Doji Star pattern ki possibility consider kar sakte hain.

2. Fist candle long bullish candle hai jismein price up jaa rahi hai.

3. Second candle ek doji hai jismein open aur close prices almost same hote hain. Is doji candle ki range pehli candle ki range ke andar honi chahiye.

4. Third candle ek long bearish candle hai jo pehli candle ke half tak extend hoti hai. Agar aapko ye steps follow karke aapko Evening Doji Star pattern identify ho jata hai toh aap bearish reversal ka indication samajh sakte hain. Is pattern mein, bullish trend ke baad bearish trend ki possibility hoti hai.

Evening Doji Star Interpretation:

Formation ka pehla safed mumkin ke baad oopar ki taraf gap hoti hai. Dosray din, trading range tang hoti hai aur trend tootnay ka ehsas hota hai. Tehreer ka ulat aik surkh mumkin teesray din mein hota hai. Behtar hai keh Bearish Evening Doji Star formation mein beech wali mumkin ke neechay aur baad mein gaps hon. Dosri gap nadir hoti hai. Agar woh mojood na ho toh formation ka signal kamzor nahi hota.

Evening Doji Star Important factors:

Doji ki tadad 1, 2 ya 3 ho sakti hai. Doji ka gap ahmiyat nahi rakhta. Formation anokhi aur bohat bharosemand hai lekin tasdeeq ki zaroorat hoti hai. Tasdeeq red mumkin se ho sakti hai jo neechay ki taraf gap ya kam closing price ke saath ho.

Evening Doji Star Candlestick Example:

Aik Evening Doji Star pattern mein ak lambi bullish mumkin hai phir secon Doji jis ka gap up hota hai phir aik teesri bearish mumkin hai jis ka gap down hota hai aur pehli mumkin ke andar band hoti hai. Aik Evening Doji Star, Evening Star ke barabar teen mumkin bearish reversal pattern hai.منسلک شدہ فائلیں -

#6 Collapse

Aayiyae evening star patteren ke ajzaa aur khususiyaat ko daryaft karen

Beshak, yeh raha "Evening Star" pattern ke ajzaa aur khasusiyaat:- Shuruat (1st Candle):

- Subse pehli candle, downtrend ya bearish market mein hoti hai.

- Isme sellers control mein hote hain aur price down ja rahi hoti hai.

- Doosri Candle (Doji ya Small Bullish Candle):

- Doosri candle, confusion ko darust karti hai.

- Ismein price mein thora sa giravat hota hai lekin overall range choti hoti hai, iska matlab hai ke buyers aur sellers mein equal competition hai.

- Tezi ka Izhar (3rd Candle):

- Tisri candle ek strong bullish candle hoti hai.

- Yeh dikhata hai ke buyers control mein aa gaye hain aur market mein tezi shuru ho sakti hai.

- Volume ki Tafseelat:

- Agar tisri candle ke sath tezi aaye aur volume bhi barh jaye, toh yeh confirmatory signal hota hai.

- Volume ki izafat, trend reversal ko confirm karti hai.

- Trend Reversal Confirm Hona:

- Agar tezi ke baad market mein sustained uptrend ho, toh yeh Evening Star pattern ko confirm karta hai.

- Trend reversal hone par traders ko entry point milta hai.

- Stop Loss Aur Target Points:

- Stop loss placement zaroori hai taki nuksan se bacha ja sake.

- Target points ko identify karna bhi zaroori hai, jisse ke traders apne profits secure kar sakein.

- Market Ki General Condition:

- Market ki overall condition, jaise ke major economic events ya trend direction, ko madde nazar rakhein.

- Evening Star pattern ko validate karne ke liye, market ke mukhtalif factors ka bhi tajziya karein.

Yeh pattern market mein trend reversal ko point out karta hai, is liye traders ko downtrend ki tafteesh karni chahiye.

7. Risk aur Reward ka Taqatvar Analysis:

Har trading decision se pehle risk aur reward ka taqatvar analysis karein. Evening Star pattern ke istemal mein is tajaweez ko mad e nazar rakhein.

8. Confirmation ke Liye Intezar:

Is pattern ko confirm karne ke liye traders ko agle kuch candlesticks ka intezar karna chahiye. Agar agle candles ne bhi downtrend ko confirm kiya, toh yeh signal aur bhi taqatwar hota hai.

9. Time Frame ka Intikhab:

Time frame ka munasib intikhab bhi ahem hai. Chhoti time frames par yeh pattern kam asar andaz hota hai, jabke baray time frames par iski taqat zyada hoti hai.

10. Hifazati Tadabeer:

Hamesha hifazati tadabeer baratne mein yaad rahein. Stop-loss orders ka istemal karein aur risk management ko mad e nazar rakhein.

Yeh the kuch mukhtasar malumat Evening Star pattern ke ajzaa aur khususiyaat ke mutalliq. Trading mein isey samajhna aur istemal karna maharat aur amal ka tajurba mangta hai.

- Shuruat (1st Candle):

-

#7 Collapse

Evening Doji Star candlestick Kia

Evening Doji Star candlestick ek technical analysis tool hai jo ke stock market mein istemal hoti hai. Ye ek specific candlestick pattern hai jo traders ko market ke possible reversals ke bare mein malumat deti hai. Is pattern ka naam "Evening Doji Star" is liye hai kyun ke ye sham ke waqt dikhai deta hai aur isme ek Doji candle bhi shamil hoti hai.

Is pattern mein teesra candle doji hota hai, jo ke aam taur par market mein uncertainty ya indecision ko darust karti hai. Doji candle ka matlab hai ke opening aur closing price barabar ya bohot qareeb hoti hain, is se ye malum hota hai ke buyers aur sellers mein kisi mein bhi zyada control nahi hai.

Evening Doji Star pattern ka sequence ye hota hai: pehle ek bullish candle aata hai, phir doji candle aati hai jiska matlab hai market mein indecision, aur akhir mein ek bearish candle aata hai jo ke indicate karta hai ke sellers ne control le liya hai aur market mein possible reversal hone wala hai.

Traders is pattern ko dekhte hain takay woh samajh sake ke market ka trend change hone wala hai. Agar ye pattern sahi taur par confirm hota hai toh traders ko signal milta hai ke ab prices girne wale hain aur woh apne positions ko adjust kar sakte hain.

Yeh ek example hai kaise technical analysis tools traders ko market trends ke bare mein malumat deti hain aur unhe help karti hain sahi waqt par decisions lene mein. Lekin yaad rahe ke kisi bhi tool ko istemal karte waqt risk ka bhi khayal rakhna zaroori hai aur har trade ko samajhdari se karna chahiye.

-

#8 Collapse

Evening Doji Star candlestick KiaShaam Doji Star Candlestick Pattern

1. Mud introductions:

"Evening Doji Star" ek candlestick pattern hai jo aam taur par uptrend ki mukhalifat mein tabdeel hone ki nishani deti hai. Yeh pattern teesre candle ke teht aata hai aur bullish trend ko indicate karta hai.

2. Pehele Candle - Bullish Candle:

Pehla candle bullish hota hai, jo ke trend ko jari rakhta hai. Is candle ki lambai aur chaudi hoti hai.

3. Dusra Candle - Doji:

Dusra candle Doji hota hai, jiska matlab hai ke opening aur closing price aapas mein bohot qareeb hoti hain. Is Doji candle ki lambai kam hoti hai.

4. Teesra Candle - Bearish Candle:

Teesra candle bearish hota hai, jo ke pehle candle ki taraf se upward movement mein aane wale traders ko indicate karta hai. Is candle ki opening price pehle candle ki closing price se neeche hoti hai.

5. Matnafis Signals:- Evening Doji Star ke baad aane wale bearish candle ki strong closing hone par, yeh pattern aur bhi mazboot ho jata hai.

- Is pattern ki confirmation ke liye, traders ko doosre din ki price action ko closely monitor karna chahiye.

- Is pattern ko confirm karne ke baad, traders bearish positions le sakte hain ya existing positions ko close kar sakte hain.

- Stop-loss orders ka istemal zaroori hai taaki nuksan se bacha ja sake.

- Har trading decision se pehle market conditions aur doosre technical indicators ka bhi moolya janna ahem hai.

- Yeh pattern sirf ek indicator hai, aur is par pura bharosa karne se pehle doosre factors ko bhi mad-e-nazar lena zaroori hai.

8. Market Psychology:- Pehla candle market mein bullish sentiment ko represent karta hai, lekin doji ke hone se ye dikhata hai ke buyers aur sellers mein balance ban gaya hai.

- Teesra candle bearish reversal ki shuruaat ko darust karta hai, jisse market ki sentiment badal sakti hai.

- Trading volume ko bhi ghor se dekha jana chahiye. Agar teesre bearish candle ke sath volume bhi badh raha hai, toh ye sell-off ko confirm karta hai.

- Kabhi-kabhi, Doji ke badle koi aur candle bhi aa sakta hai, jaise ki spinning top ya shooting star. In sabhi variations ko bhi monitor karna ahem hai.

- Is pattern ko alag-alag timeframes par bhi dekha jana chahiye. Kabhi-kabhi, chhote timeframes par iska asar bada hota hai.

- RSI, MACD, aur doosre technical indicators ka istemal karke is pattern ki confirmation ko aur bhi majboot kiya ja sakta hai.

- Har trader ko apne tajaweezat par yaqeen rakhna chahiye aur unhe apni research ke mutabiq amal karna chahiye.

- Is pattern ki past performance ka bhi mutala karna ahem hai, lekin yaad rahe ke market conditions hamesha badalte rehte hain.

- Har trade mein risk ko manage karna zaroori hai. Stop-loss orders ka istemal karna aur investment amount ko control mein rakhna ahem hai.

-

#9 Collapse

Aayiyae evening star patteren ke ajzaa aur khususiyaat ko daryaft karen

"Evening Star" ek candlestick pattern hai jo technical analysis mein istemal hota hai aur market ke potential reversal points ko indicate karne mein madad karta hai. Ye pattern bearish reversal ko darust karta hai aur aksar uptrend ke baad paya jata hai.

Evening Star Pattern Ke Ajzaa aur Khususiyaat:- Pehla Candle (Bullish):

- Evening Star pattern ka pehla part ek lambi bullish candle hoti hai jo existing uptrend ko reflect karti hai. Is candle ko "up day" bhi kaha jata hai.

- Dusra Candle (Small Body):

- Dusri candle chhoti si body ke sath hoti hai, jo market mein uncertainty ya indecision ko darust karti hai. Isko "doji" ya "spinning top" bhi kehte hain. Ye candle pehle candle ke upar ya neeche ho sakti hai.

- Teessra Candle (Bearish):

- Teesri candle bearish candle hoti hai aur pehli candle ke range ke neeche chali jati hai. Is bearish candle ki lambai crucial hoti hai. Agar ye lambi hai aur strong selling activity ko darust karti hai, to ye confirmation hoti hai ke bearish reversal shuru ho sakta hai.

Evening Star Pattern Ka Matlab:- Evening Star pattern ka zahiri matlab hai ke pehle bullish momentum mein tezi thi, lekin phir market mein uncertainty aur selling pressure ne control hasil kiya hai, jo ke bearish reversal ka indication hota hai.

Trading Mein Istemal:- Agar aapko lagta hai ke market mein Evening Star pattern ban raha hai, to aap short position le sakte hain (sell). Lekin, hamesha yaad rahe ke kisi bhi trading decision se pehle doosre technical indicators aur market conditions ka bhi tajzia karna zaroori hai.

Ihtiyaat:- Technical analysis tools, jaise ke candlestick patterns, hamesha 100% confirm nahi hoti aur kabhi-kabhi false signals bhi deti hain. Is liye, trading mein amal se pehle mukammal tehqiqat aur risk management ka tariqa zaroori hai.

Ikhtitami Guftagu:- Evening Star pattern ek useful tool hai bearish reversals ko identify karne ke liye. Lekin, iske istemal mein hamesha caution aur doosre confirming signals ka tajzia karna chahiye. Trader ko apni trading strategy ko mazboot banaye rakhne ke liye taaleem aur tajaweezat ka bhi intekhab karna chahiye.

- Pehla Candle (Bullish):

-

#10 Collapse

AAYIYAE EVENING STAR PATTERN KE AJZAA AND KHUSUSIYAAT KO DARYAFT ...... DEFINITION

Yah Ek Bearish candlestick pattern hai jo 3 candles per consist hai Ek large white candle Ek small bodied candle and a red candle evening ke Star ka opposite morning ke star ka pattern hai jisse bullish ke indicator ke Taur per Dekha jata hai evening ke star ki price ka chart pattern hai Jise technical analysts is Baat ke detect Lagane ke liye used karte hain trend kab reversal hone wala hai evening ke star ke pattern price ke uptrend Apne end ke nearing hai

SPECIAL CONSIDERATION

Trader often price ke oscillators and trend lines ka use karte hain Take ise reliably tareke se identify ki ja sake and is baat ki confirm ki Ja sake Ke Aaya evening ke star ka pattern in fact occurred Hua Hai evening ke star ke pattern ko ek reliable indication considered jata hai ki down ward Trend begun ho gaya hai but stock ki price Ke Data ke noise Ke between discern aimed Lagana difficult ho sakta hai trader ki own preference Hai Ke Jab voh trend Mein change ka detect Lagana Chahte Hain ta ke pattern ko watch chahie traders Mein popularity ke among evening ka star pattern only bearish ka indicator Nahin Hai other bearish candlestick pattern Mein dark in cloud ka cover and bearish engulfing include hain

WHAT ARE THE OPEN LOW HIGH AND CLOSE PRICES

High and low prices is baat ka detect Lagate Hain Ke whether din ke during stock ki price lost hui ya Gained Hui yah prices Ek. period Ke duran stock ki value ki monitor karti hai open ya opening price first price Hai Jis per stock trade karta hai Jab morning market open hai closing price Day ki last price hai yah is baat ka prime indicator ho sakta hai ke Jab price ka trend reverse hone wala hai evening ka star pattern in prices 3 days ke during correlate karta hai Upar ki movement is baat ki indicate karti hai Ke stock soon hi Sinking Hona begin kar sakta hai

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#11 Collapse

Aayiyae evening star patteren ke ajzaa aur khususiyaat ko daryaft karen

Evening Star Pattern: Shaam ki Taara Formation

Evening Star Pattern ek technical analysis pattern hai jo stock market mein istemal hota hai. Ye pattern market ke reversal ko darust karnay mein madad karta hai. Is pattern ka naam is wajah se hai ke jab ye pattern ban jata hai, toh market mein ek naya trend shuru hota hai.

Ajzaa (Components):- Upari Wick (Upper Wick): Jab candle ka closing price opening price se zyada hota hai, toh iski body green hoti hai aur uske upar ki line ko upper wick kehte hain. Evening Star pattern mein pehli candle ki upper wick lambi hoti hai, indicating ke buyers initially control mein hain.

- Choti Body (Small Body): Dusri candle ka body pehli candle ke upper part mein hota hai, lekin ye chhota hota hai, indicating ke market mein uncertainty hai.

- Nichli Wick (Lower Wick): Dusri candle ki lower wick lambi hoti hai, indicating ke sellers control mein aane lage hain.

- Badi Red Candle (Large Red Candle): Teesri candle pehli dono candles ko cover karte hue downward trend mein hoti hai, jo ke sellers ka dominance darust karti hai.

Khususiyaat (Characteristics):- Reversal Signal: Evening Star Pattern ek trend reversal signal hai. Jab ye pattern ban jata hai, toh ye show karta hai ke uptrend ke baad market mein downtrend shuru hone wala hai.

- Confirmation Ke Liye Zaroori Hai: Evening Star ko sahi se samajhne ke liye, traders ko doosre technical indicators ka bhi istemal karna chahiye jaise ke volume analysis ya trend lines.

- Risk Management: Is pattern ko istemal karte waqt risk management ka bhi dhyan rakhna zaroori hai. Stop-loss orders lagana important hai taake nuksan se bacha ja sake.

- Time Frame: Is pattern ka istemal aam taur par short to medium-term time frames par hota hai.

Evening Star Pattern ko samajh kar aur doosre technical indicators ke saath mila kar, traders market movements ko better predict kar sakte hain. Lekin yaad rahe ke kisi bhi trading decision se pehle thorough research aur risk analysis zaroori hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 03:16 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим