What is the currency correlation

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Currency coloration ShowForex, ya Unfamiliar Trade, mein monetary forms ki values aik dusre se mutasir hoti hain. Money relationship yeh darust karte hai keh do monetary standards ki values mein aik dusre se kaisa taluq hai. Relationship forex dealers ke liye ahem hai, kyunkeh yeh unko market patterns samajhne mein madad karta hai aur unki exchanging choices ko behetar bana sakta hai. Money relationship, do monetary standards ke beech ka ta'alluq hai, jo unki values mein samarati hai. Yeh connection positive ya negative ho sakti hai. Money connection types a. Positive Relationship: Positive relationship mein, do monetary forms ki values aik dusre ke saath barhte ya ghate hain. Yeh matlab hai keh agar aik money ki esteem barhti hai, toh doosri cash ki esteem bhi barh sakti hai. Is tarah ke ta'alluqat mein aam taur standard doosri cash matches bhi musbat connection ke saath move karte hain. b. Negative Relationship : Negative relationship mein, do monetary forms ki values aik dusre ke saath ulte hain. Yeh matlab hai keh agar aik money ki esteem barhti hai, toh doosri cash ki esteem ghate sakti hai. Is tarah ke ta'alluqat mein aam taur standard doosri money matches manfi relationship ke saath move karte hain. Use Associations with trade forex: Cash relationship ko samajhna aur istemal karna forex sellers ke liye behad zaroori hai, kyunke yeh unhein market ke mazboot aur kamzor mudraon ke beech rishton ko samajhne mein madad deta hai. jabkay deegar qutbi mukhalif ho satke hain. cash ke artbat ke baray mein seekhnay se koi taajiron ko - apne port ko ziyada munasib tareeqay se munazzam karne mein madad millti hai. aap ki tijarti sy hikmat e amli se qata nazar aur chahay aap apni sy to pozishnon ko mtnoa banana chahtay hain ya - apne nuqta nazar se faida uthany ke liye mutabadil jore talaash kar rahay hain, mukhtalif cash joron aur un ke bdalty conceal rujhanaat ke darmiyan talluq ko zehen mein rakhna bohat zaroori Australia aur Europe ke markazi bankon mein maliyati methodology ke mukhtalif tasbat hain, is liye dollar mein izafay ki soorat mein, australvi dollar euro se kam mutasir ho sakta hai, ya is ke bar aks. -

#3 Collapse

Aslamoalekum members kesay hain ap sab. Mujhay umed hay sah thek thak hon gay. Aj ka hamara disscussion ka jo topic hay woh currency correlation kay bary hain. Isy dekhty hain kay yeh kia hay r hamen kia information deta hay. currency correlation Forex trading mein currency correlation, yaani do currency kay joray ke darmiyan rishta, ek dusre se kisi tareeqay se mutasir hota hai. Currency correlation ka bhe Matlab hota hai keh do currency kay joray ka price ke harkaat ek dusre par kaise asar andaz hota hai. Yeh information traders ko market kay tajziya aur trading jo decisions mein madad deti hai.Currency correlation ko do tarah se wazahat kiya jata hai. Masbat correlation aur manfi correlation.Positive correlation mein, do ki currency kay joray ek dusre ke saath ek saath harkat karte hain. Matlab agar ek currency ky joray ki value barhti hai, toh doosra currency ky joray bhi barhta hai, aur agar ek curency ky joray ki value ghati hai, toh doosra currency kay joray bhi ghati hai. Yeh am tor par un currency ky joray mein dekha jata hai jo ek hi geographical region se taluk karte hain. Jaise ke EUR/USD aur GBP/USD, jo Europe se belong karte hain, inme masbat correlation payi jaati hai. explanation Negative correlation mein, do currency ky joray ek dusre ke saath ulte move karte hain. Matlab agar ek currency ky joray ki value barhti hai, toh doosra currency kay joray ghati hai, aur agar ek currency kay joray ki value ghati hai, toh doosra currency kay joray barhta hai. Yeh correlation am tor pr do currency kay joray mein dekhi jaati hai jo ek dusre se Wazh tor pr muqabla karte hain ya alag geographical regions se belong karte hain. Jaise ke USD/JPY aur USD/CHF, inme manfi correlation payi jaati hai.Currency correlation trading mein ahmiyat rakhti hai kyunki isse traders ko market trends aur price movements samajhne mein madad milti hai. Agar do currency kay joray ki masbat correlation mein hain, toh ek currency kay joray r ki harkat dusre currency kay joray ka bhi asar karegi. Isi tarah, agar do currency ky kay joray manfi correlation mein hain, toh ek currency kay joray ki movement dusre currency ki joray ke mukhalif simit mein hogi.Traders currency correlation ka bh istemal karke risk management strategies banate hain aur trading decisions lete hain. Isse unhe market volatility aur currency kay joray ke movements ko samajh samajhne mein madad milti hai. -

#4 Collapse

Assalamu Alaikum Dosto!Forex Currency Correlation

Forex market mein currencies ke darmiyan aik khaas ta'alluq mojud hai jo dekha ja sakta hai. Yani ke currencies pairs mein trade hoti hain, unko aik dosre se alag nahi kiya ja sakta. Currency pairs ke darmiyan ta'alluqat ka mustaqbil ka andaza lagane ke liye, aik trader mukhtalif statistics ke coefficients ka istemal kar sakta hai, jismein se ek sab se mashhoor hai correlation.

Aik trader ke liye jo apne account par mukhtalif currency pairs ka istemal karta hai, unko bohot zaroori hai ke yeh pairs aik dosre se kaise mutalliq hain, Yeh agar aik trader sirf aik pair par tawajjo dete hain, to yeh itna ahem nahi ho sakta. Agar kuch currency pairs ke darmiyan mazboot ta'alluqat hain aur sath mein move karte hain, to yeh yeh mana jata hai ke agar woh dono pairs par trade karein to trader ko kafi zyada khatra ho sakta hai. Is liye, correlation coefficient risk ko manage karne mein aik ahem nishan hai.

Currency pairs ki correlation, Forex trading mein aham rol ada karti hain. In correlation ko samajh kar aap high-probability Forex trading strategies tayar kar sakte hain. Currency correlation ka ilm hone se risk kam kia ja sakta hai, hedging mein sudhar kia ja sakta hai, aur trading instruments ko taqat di ja sakti hai. Is article mein, hum aapko Forex trading mein intermarket correlations ka istemal karne ka tariqa batayenge.

Correlation, do trading assets ke darmiyan taalluqat ka statisticsi hisaab hai. Currency correlation woh darust darust bata hai ke do currency pairs ne kisi muddat mein ek doosre ke sath kis tarah ka rawayya dikhaya hai.- Do assets ke taalluqat ko past statistical data ki roshni mein dekh kar aane wale waqt ke liye is ka tajziya kar sakte hain. Correlation coefficient ka istemal karke hum do values ke taalluqat ko samajh sakte hain aur risk ko manage kar sakte hain. Ye coefficient -1 se +1 tak ke asal mei mojood hai.

- +1 ki correlation dikhata hai ke do currency pairs 100% waqt ek hi taraf move karenge. Ye ek mukammal musbat taalluqat hai. For example, EUR/USD aur GBP/USD ki correlation achha example hai - agar EUR/USD upar ja raha hai, to GBP/USD bhi usi taraf move karega.

- -1 ki correlation dikhata hai ke do currency pairs 100% waqt ulte taraf move karenge. EUR/USD aur USD/CHF mein mukammal manfi correlation hai, to agar EUR/USD upar ja raha hai, to USD/CHF neeche jaega.

0 ki correlation hoti hai jab do currency pairs ke darmiyan koi taalluq na ho, matlab ke woh poori tarah se alehda hain.

Natural hai ke jo correlation zyada mojood hongi, unka analysis se zyada sahi tajziya niklega. Zyada lambi muddat ke liye ki gayi technical analysis, mukhtalif short-term taalluqat ke muqable mein zyada sahi malumat deti hai. Maheena aur saalana data amuman sabse bharosemand malumat farahem karte hain.

Correlation Impacts

Ye currency correlations, ek statistical high probability Forex trading strategy ka asal bunyad ban sakti hain.

Ye dikhate hain ke aapke Forex trading account ko kitna risk hai. For example, agar aapne kai currency pairs kharide hain jo ke strong positive correlation mein hain, to aap directional risk ke zyada exposed hain.

Aap positions avoid kar sakte hain jo asal mein ek doosre ko cancel kar deti hain. EUR/USD aur USD/CHF ke darmiyan powerful negative correlation hai. Agar aapka koi directional bias hai, to both EUR/USD aur USD/CHF kharidna ek doosre ke moves ko counter kar dega.

Taalluqat samajhne se aap apne exposure ko Forex market mein hedge ya diversify kar sakte hain.

Agar aapke paas kisi currency ke liye ek directional bias hai, to aap apne risk ko do strongly positive correlated pairs istemal karke spread kar sakte hain, diversification ke liye.

Correlation Strategies

Jab do pairs zyada correlated hote hain, to ek doosre ke price movement ka leading indicator ban sakte hain. Agar aapne dekha ke ek positively correlated pair mein tez move hota hai, to aap dusre pair mein bhi ek mutawakkal move ki umeed kar sakte hain.

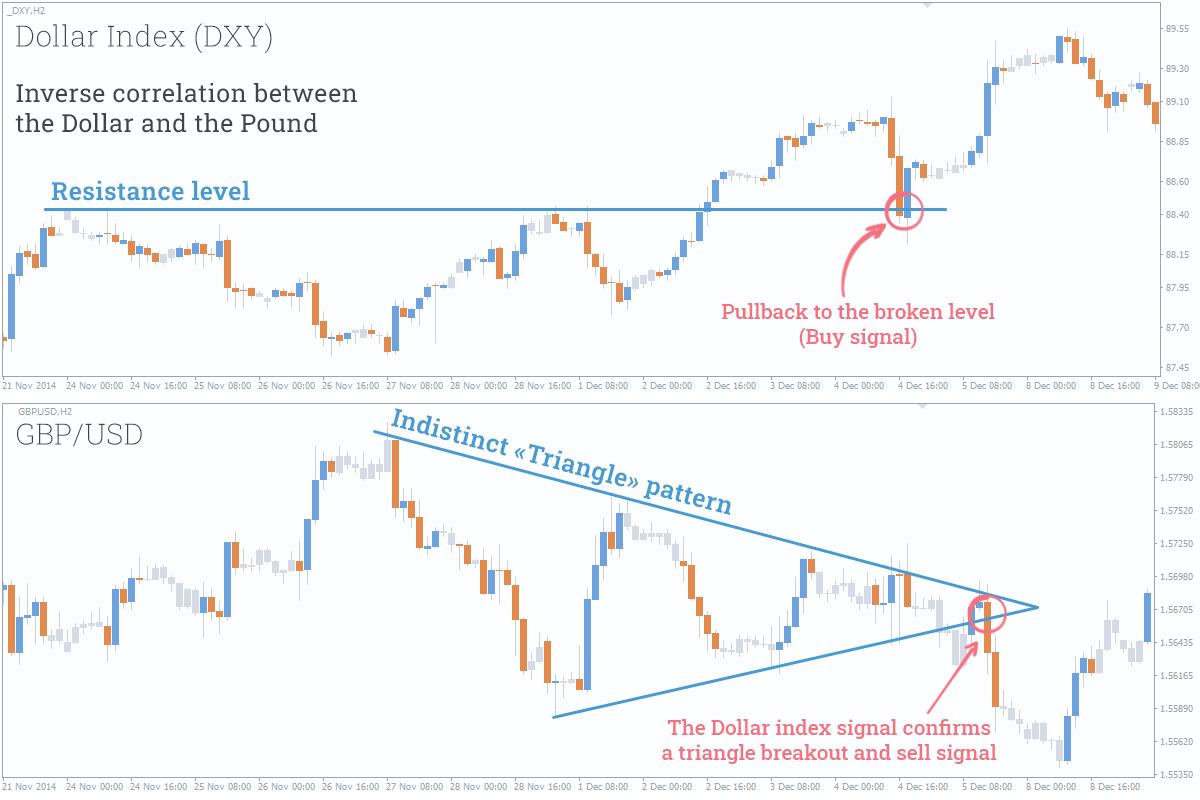

Correlation, doosre Forex indicators ke saath istemal mein bhi aik taqatwar tool ho sakta hai. For example, agar ek pair kisi significant technical level of support ya resistance ko break karta hai, to closely positively correlated pair ko bhi wahi risk follow karne ka zyada imkan hota hai.

Agar aapne notice kiya hai ke do negatively correlated currency pairs hain aur ek pair mein significant upward price reversal hota hai, to aap dusre pair mein potential downward reversal ki tawakul kar sakte hain. Ye ek price reversal hota hai.

Intezaar karein ek abnormal divergence ka, do highly correlated currency pairs ke darmiyan, aur phir ek ko kharidein aur doosre ko bechein, umeed hai ke woh phir se price movement mein miltay jultay honge. Ye ek non-directional arbitrage hai jo currency correlations ka istemal karta hai.

Commodities Currencies Correlation

Forex trading mein correlation sirf currencies k darmeyan nahi hota hai, bulkeh ye relationship commodities aur currency k darmeyan bhi hoti hai, jiss ki tafseel darjazel mein hen:

Canadian dollar aur crude oil ke darmiyan aik positive correlation hai kyun ke Canada bara oil producer aur exporter hai.

Australian dollar aur gold ke darmiyan bhi aik positive correlation hai kyun ke Australia bara gold producer aur exporter hai. Dono gold aur Japanese Yen uncertainty ke doran safe havens ki tarah dekhe jate hain, aur in dono mein bhi positive correlation hai.

Jabke, gold aur U.S. dollar mein aam tor par aik negative correlation hoti hai. Jab U.S. dollar ke value mein girawat hoti hai inflation ke doran, to investors gold jese alternative stores of value ki taraf mudakhalat karte hain.

Example:

Ye baat ghawar talab hai aur yaad rakhen ke correlation ke buland musbat values yeh darust karte hain ke currency pairs ek hi direction mein kafi had tak move karte hain, jabke negative values -1 ke qareeb wale yeh darust karte hain ke woh barabar move karte hain, lekin mukhalif directions mein. Agar correlation coefficient 0 ke qareeb hai, to currency pairs ke darmiyan koi ta'alluq nahi hai aur woh aik dosre se azaad taur par move karte hain.

EUR/USD aur GBP/USD kafi mutabiqat ke sath move karte hain. Chaliye tasawwur karen neeche di gayi situation. Aik trader faisla karta hai ke woh aik position EUR/USD aur doosri position GBP/USD ke sath kholay, samajhte hue ke yeh ek mukhtalif aur risk kam karne wala kadam hoga. Magar, yeh galat sabit hota hai, kyunke pairs ke darmiyan buland correlation coefficient suggest karta hai ke GBP/USD ko shamil karna trader ko koi risk reduction nahi dega. Upar di gayi positions mein dakhil hone se trader ke risk ko be-shak barha diya jayega, kyunke EUR aur GBP bohot bar ek hi direction mein move karte hain. Humare pass 0.89 ka correlation coefficient hai, to hum isay 1 lot of GBP/USD ke 0.89 lot of EUR/USD ke sath soch sakte hain. EUR/USD mein 1 lot aur GBP/USD mein 1 lot kholna 1.89 lot of EUR/USD ke barabar sabit hoga. Yeh yeh darust hai ke trader ne apna risk exposure taqreeban dugna kar diya hai.

Agar aik trader aise currency pairs ka istemal karta hai jo aik dosre ke liye buland tanasub ke sath hote hain (EUR/USD aur USD/CHF, phir 1-hour charts jaisa neeche dikhaya gaya hai) aur unke sath mukhalif positions le, to yeh bilkul wahi sabit hoga jaise aik direction mein highly positively correlated currency pairs ke sath positions lena. Ya phir, agar woh EUR/USD mein long position lete hain aur waqtan-fa-waqtan USD/CHF mein short position lete hain, to yeh unhein wahi situation dega jaise EUR/USD mein long position aur doosre long position ke sath GBP/USD mein kholna, ya phir EUR/USD ke size ka do guna long position mein dakhil hona.

Currency Correlations Forex Mein Tabdeel Hoti Hain

Yad rakhein ke currency correlations waqt ke sath tabdeel hote rehte hain jis ki wajah se mukhtalif economic aur siyasi factors hote hain. Ye factors monetary policies ki mukhalif hone, commodity prices, central banks ke policies mein tabdiliyan aur bhi shamil hote hain. Ye dikhata hai ke strong correlations waqt ke sath tabdeel ho sakte hain, is liye ye zaroori hai ke aap currency relationships mein hone wali tabdiliyon ko hamesha nazar mein rakhein. Hum ye mashwara dete hain ke aap long-term correlations ko dekhein takmeel pazeer nazariya hasil karne ke liye. -

#5 Collapse

Currency Correlationاصل پيغام ارسال کردہ از: Fazalnaqvi12 پيغام ديکھيےWhat is the currency correlation

Currency correlation ek important concept hai jo forex trading mein currencies ke behavior ko samajhne mein madad karta hai. Yeh batata hai ke kis tarah se do different currencies ek dosre ke sath move karti hain. Currency correlation ko numerical values se express kiya jata hai, jahan +1 ka matlab hai perfect positive correlation (matlab do currencies hamesha ek dosre ke sath move karti hain) aur -1 ka matlab hai perfect negative correlation (matlab do currencies hamesha ek dosre ke opposite move karti hain). Zero correlation ka matlab hai koi consistent relationship nahi hai.

Positive Correlation

Agar do currencies positively correlated hain, to jab ek currency ka rate barhta hai, doosri currency ka rate bhi barhta hai. Misal ke tor par, EUR/USD aur GBP/USD aksar positively correlated hoti hain. Jab Euro strong hota hai, chances hain ke British Pound bhi strong hoga. Is tarah ki correlation ko samajhne se traders apni trading strategies ko diversify kar sakte hain aur risk management kar sakte hain.

Negative Correlation

Negative correlation mein, jab ek currency ka rate barhta hai, doosri currency ka rate girta hai. Misal ke tor par, EUR/USD aur USD/JPY aksar negatively correlated hoti hain. Jab Euro strong hota hai aur USD weak hota hai, us waqt JPY strong hota hai. Yeh information traders ko help karti hai ke woh hedge kar sakein aur apne portfolios ko balance mein rakh sakein.

Importance of Currency Correlation

Currency correlation ka samajh aur istimal karne se traders multiple positions le kar apne risk ko manage kar sakte hain. Agar trader multiple highly correlated pairs mein positions leta hai, to yeh unka risk barha sakta hai, kyunki agar market unke khilaf move karti hai, to sabhi positions loss mein ja sakti hain. Isliye, currency correlation ke analysis se trader apne portfolio ko diversify aur protect kar sakte hain.

Conclusion

Currency correlation forex trading mein ek powerful tool hai jo risk management aur trading strategies ko enhance kar sakta hai. Positive aur negative correlations ko samajh kar, traders informed decisions le sakte hain aur apne trading outcomes ko improve kar sakte hain. Forex market mein successful hone ke liye, currency correlation ko samajhna aur effectively use karna bohot zaroori hai.

- CL

- Mentions 0

-

سا0 like

-

#6 Collapse

What is the currency correlation?

### Currency Correlation - Roman Urdu

Currency correlation ek concept hai jo forex trading mein currencies ke movements ke relationships ko describe karta hai. Ye relationships positive, negative ya neutral ho sakte hain aur traders ke liye market analysis aur risk management mein useful hote hain.

**Currency Correlation ka Matlab:**

Currency correlation measures karta hai ke do currencies ke prices ek doosre ke saath kaise move karte hain. Agar do currencies ke prices usually ek saath move karte hain (yaani positive correlation), to unmein strong correlation hai. Agar ek currency ka price upar jaata hai to doosre ka bhi generally upar jaata hai, aur agar ek currency ka price niche jaata hai to doosre ka bhi niche jaata hai. Negative correlation mein, agar ek currency ka price upar jaata hai to doosre ka price generally niche jaata hai.

**Types of Currency Correlation:**

1. **Positive Correlation:** Positive correlation mein currencies ek doosre ke saath move karte hain. For example, EUR/USD aur GBP/USD typically positive correlated hote hain, matlab agar EUR/USD ka price upar jaata hai to generally GBP/USD ka bhi price upar jaayega.

2. **Negative Correlation:** Negative correlation mein currencies opposite directions mein move karte hain. For example, USD/JPY aur EUR/USD negative correlated hote hain, matlab agar USD/JPY ka price upar jaata hai to generally EUR/USD ka price niche jaayega.

3. **Neutral Correlation:** Kabhi kabhi currencies ke beech mein koi correlation nahi hoti, ya phir bahut kam hoti hai. Is situation ko neutral correlation kaha jata hai, jisme currencies ke movements ek doosre se koi specific pattern follow nahi karte.

**Importance of Currency Correlation:**

- **Risk Management:** Currency correlation traders ko help karta hai risk spread karte waqt. Agar trader ek currency pair mein position open karta hai, to wo doosre correlated currency pair ko bhi consider karta hai apne risk ko hedge karne ke liye.

- **Diversification:** Correlated currencies ko analyze karna traders ko allow karta hai diversified trading strategies develop karne mein. Agar ek currency pair mein market conditions unfavorable hote hain, to doosre correlated pair mein positions open karke traders apne risks ko spread kar sakte hain.

- **Market Analysis:** Currency correlation ke through traders market movements ko better samajh sakte hain. Agar ek currency pair specific economic news ya events ke impact se move kar raha hai, to correlated pairs mein bhi uska impact dekha ja sakta hai.

**Currency Correlation ka Istemal:**

Traders currency correlation ko analyze karte hain tools jaise ki correlation matrices, charts, ya indicators ke through. Isse wo apne trading decisions better inform kar sakte hain aur market volatility ke dauran apne positions ko effectively manage kar sakte hain.

**Conclusion:**

Currency correlation forex trading mein ek important concept hai jo traders ko currencies ke movements ke relationships ko samajhne mein madad deta hai. Iska sahi istemal karke traders apne risk ko diversify kar sakte hain aur market conditions ke according apni strategies ko adjust kar sakte hain. Isliye, har forex trader ko currency correlation ke implications ko samajhna aur uska sahi tareeke se istemal karna zaroori hai trading success ke liye.

-

#7 Collapse

Currency Correlation

Currency correlation foreign exchange trading ka ek important concept hai jo different currency pairs ke price movements ke darmiyan talluq ko explain karta hai. Yeh correlation traders ko forex market mein trading decisions lete waqt bohot madadgar hota hai. Agar aap currency correlation ko samajh lein, to aap risk management aur trading strategy mein better informed decisions le sakte hain.

Currency correlation se murad hai ke kaise do different currency pairs ka price ek doosre ke sath move karta hai. Yeh correlation positive bhi ho sakta hai aur negative bhi, aur kabhi kabar neutral bhi hota hai.- Positive Correlation:

- Positive correlation tab hoti hai jab do currency pairs ek hi direction mein move karte hain. Agar ek pair upar jata hai, to doosra pair bhi upar jata hai, aur vice versa. Misaal ke taur par, EUR/USD aur GBP/USD aksar positive correlated hote hain.

- Negative Correlation:

- Negative correlation tab hoti hai jab do currency pairs opposite directions mein move karte hain. Agar ek pair upar jata hai, to doosra pair neeche jata hai, aur vice versa. Misaal ke taur par, EUR/USD aur USD/JPY aksar negative correlated hote hain.

- Zero Correlation:

- Zero correlation tab hoti hai jab do currency pairs ke movements ek doosre par koi asar nahi dalte. Yeh currency pairs randomly move karte hain bina kisi consistent pattern ke.

Currency correlation ko measure karne ke liye correlation coefficient ka use hota hai, jo -1 se 1 ke darmiyan hota hai.- Correlation Coefficient (+1):

- +1 ka matlab hai perfect positive correlation. Yeh do currency pairs hamesha ek hi direction mein move karte hain.

- Correlation Coefficient (-1):

- -1 ka matlab hai perfect negative correlation. Yeh do currency pairs hamesha opposite directions mein move karte hain.

- Correlation Coefficient (0):

- 0 ka matlab hai no correlation. Yeh do currency pairs ke darmiyan koi consistent relationship nahi hota.

Currency Correlation ke Asar- Risk Management:

- Currency correlation ka samajhna risk management ke liye bohot zaroori hai. Agar aap positive correlated pairs mein trade kar rahe hain, to yeh apka risk barha sakta hai, kyunki agar ek pair loss mein jaye to doosra bhi loss mein jaane ka chance hai. Wahi par, negative correlated pairs mein trade karne se risk diversify ho jata hai.

- Hedging:

- Hedging strategy mein currency correlation ka use hota hai. Traders negative correlated pairs mein positions le kar apne exposure ko hedge karte hain. Yeh strategy loss ko minimize karne mein madadgar hoti hai.

- Portfolio Diversification:

- Currency correlation ko samajh kar aap apna trading portfolio diversify kar sakte hain. Positive aur negative correlated pairs ko mix karke aap apne portfolio ka overall risk reduce kar sakte hain.

Negative Correlation

EUR/USD aur USD/JPY aksar negative correlated hote hain. Iski waja yeh hai ke jab USD strength gain karta hai, to EUR/USD neeche jata hai aur USD/JPY upar jata hai. Aur jab USD weak hota hai, to EUR/USD upar jata hai aur USD/JPY neeche jata hai.

Factors Influencing Currency Correlation- Economic Indicators:

- Economic indicators jaise GDP, inflation, employment data, aur interest rates currency pairs ke movements ko influence karte hain. Yeh indicators currency correlation par bhi asar dalte hain.

- Political Events:

- Political events jaise elections, geopolitical tensions, aur policy changes bhi currency correlation ko influence karte hain. For example, Brexit vote ne GBP/USD aur EUR/USD ki correlation ko temporarily affect kiya.

- Market Sentiment:

- Market sentiment bhi ek important factor hai jo currency correlation ko influence karta hai. Risk-on aur risk-off sentiments ke doran different currency pairs ki correlation change ho sakti hai.

- Correlation Matrices:

- Forex trading platforms aur financial websites correlation matrices provide karte hain jo different currency pairs ke darmiyan correlation coefficients show karti hain. Yeh matrices visual representation hoti hain jo trading decisions mein madadgar hoti hain.

- Charting Software:

- Charting software jaise MetaTrader aur TradingView mein indicators hote hain jo currency correlation ko analyze karne mein madadgar hote hain. Yeh software historical data ko analyze karke correlation trends ko identify karne mein madadgar hote hain.

- Economic Calendars:

- Economic calendars important economic events aur indicators ko highlight karte hain jo currency pairs ke movements aur correlation ko influence karte hain. Yeh calendars aapko upcoming events ke baare mein informed rakhte hain taake aap apni trading strategy accordingly plan kar sakein.

- Dynamic Nature:

- Currency correlation dynamic hoti hai aur time ke sath change hoti rehti hai. Isliye past correlation ko future movements ke liye perfect predictor nahi mana ja sakta.

- External Shocks:

- External shocks jaise natural disasters, political upheavals, aur sudden economic policy changes currency correlation ko unexpectedly impact kar sakte hain.

- Market Volatility:

- High market volatility ke doran currency pairs ke darmiyan correlation unpredictable ho sakti hai, jo trading decisions ko challenging bana deti hai.

Currency correlation forex trading mein bohot ahem concept hai jo currency pairs ke price movements ke darmiyan relationship ko explain karta hai. Isko samajhna aur effectively use karna traders ke liye bohot zaroori hai. Yeh correlation risk management, hedging, aur portfolio diversification mein madadgar hota hai.

Positive aur negative correlation ke understanding se traders apni trading strategies ko optimize kar sakte hain aur potential losses ko minimize kar sakte hain. Lekin iske sath sath, yeh bhi zaroori hai ke traders currency correlation ke dynamic nature ko samajhkar apni strategies ko regularly review aur adjust karein.

Aaj ke globalized aur interconnected financial markets mein, currency correlation ka effective use traders ko competitive edge de sakta hai aur unki trading performance ko enhance kar sakta hai. - Positive Correlation:

-

#8 Collapse

What is the currency correlation

Currency correlation se murad hoti hai ke do currencies ka ek dosray ke saath kaise taluq hai. Ye taluq positive ho sakta hai, negative ho sakta hai, ya phir neutral ho sakta hai. Agar do currencies positively correlated hain, to agar ek currency ki value barhti hai to doosri ki bhi barh jati hai. Agar negatively correlated hain, to agar ek ki value barhti hai to doosri ki girti hai.

Description

Currency Correlation kya hai?

Currency correlation ka matlab hai ke do currencies ka ek dosray ke saath kaise behave karti hain. Ye correlation positive bhi ho sakta hai, negative bhi, aur kabhi kabhi neutral bhi. Currency pairs ki trading forex market ka ek ahem hissa hai, aur currency correlation samajhna traders ke liye bohot zaroori hai taake woh apni risk management strategies ko better bana saken.

Positive Correlation

Positive correlation ka matlab hai ke do currencies ek dosray ke saath ek hi direction mein move karti hain. Matlab agar ek currency ki value barhti hai to doosri ki bhi barh jati hai. Misal ke taur pe, Euro (EUR) aur British Pound (GBP) aksar positively correlated hoti hain. Agar Euro ki value US Dollar (USD) ke muqablay mein barhti hai, to aksar GBP ki value bhi USD ke muqablay mein barh jati hai.

Negative Correlation

Negative correlation ka matlab hai ke do currencies opposite directions mein move karti hain. Matlab agar ek currency ki value barhti hai to doosri ki girti hai. Misal ke taur pe, US Dollar (USD) aur Japanese Yen (JPY) aksar negatively correlated hoti hain. Agar USD ki value barhti hai, to JPY ki value gir jati hai.

Neutral Correlation

Neutral correlation ka matlab hai ke do currencies ka ek dosray pe koi khas asar nahi hota. Matlab agar ek currency ki value change hoti hai to doosri pe koi asar nahi padta. Ye situation tab hoti hai jab do currencies ka economic factors ek dosray se mukhtalif hoti hain.

Importance of Currency Correlation

Currency correlation traders ke liye bohot important hoti hai, kyunki isse woh apni trading strategies ko improve kar sakte hain. Agar ek trader ko maloom ho ke do currencies positively correlated hain, to woh simultaneously un dono currencies mein positions le sakta hai aur apni profits ko maximize kar sakta hai. Isi tarah, negative correlation ko samajh ke woh hedging strategies bana sakte hain taake losses ko minimize kiya ja sake.

Calculation of Currency Correlation

Currency correlation ko calculate karne ke liye statistical tools ka use hota hai, jaise ke Pearson correlation coefficient. Ye coefficient -1 se 1 tak hota hai, jahan -1 ka matlab perfect negative correlation, 1 ka matlab perfect positive correlation, aur 0 ka matlab no correlation hota hai.

Factors Influencing Currency Correlation

Currency correlation ko bohot se factors influence karte hain, jin mein se kuch ye hain:- Economic Data: GDP growth rates, inflation, employment data aur interest rates ka asar currencies pe hota hai.

- Political Stability: Political events aur stability bhi currencies ki values ko affect karte hain.

- Market Sentiment: Traders aur investors ka behavior aur market sentiment bhi currency correlation ko influence karta hai.

- Trade Relationships: Do countries ke beech trade relationships aur policies bhi currency correlation ko impact karte hain.

Practical application ke taur pe, agar ek trader ko pata hai ke EUR/USD aur GBP/USD positively correlated hain, to woh apni positions ko accordingly adjust kar sakta hai. Agar woh EUR/USD mein long position le raha hai, to woh GBP/USD mein bhi long position le sakta hai taake apni profits ko maximize kar sake.

Conclusion

Currency correlation forex trading ka ek ahem hissa hai aur isse traders ko apni trading strategies ko better banane mein madad milti hai. Positive, negative, aur neutral correlations ko samajh kar, traders apni risk management aur profit optimization strategies ko effectively implement kar sakte hain. Economic factors, political stability, aur market sentiment jaise factors ko samajhna aur inka asar currency correlations pe dekhna trading mein success ka zariya ban sakta hai.

-

#9 Collapse

**Currency Correlation Kya Hai Aur Forex Trading Mein Iska Kya Role Hai?**

Forex trading mein currency correlation ek ahem concept hai jo aapko currency pairs ke beech ke relationships ko samajhne mein madad karta hai. Currency correlation ko samajh kar, traders apne trading strategies ko better plan kar sakte hain aur market movements ko accurately predict kar sakte hain. Aaj hum currency correlation ko detail mein samjhenge aur dekhenge ke forex trading mein iska kya role hai.

**Currency Correlation Kya Hai?**

Currency correlation ek statistical measure hai jo do currency pairs ke beech ke price movements ke relationship ko show karta hai. Yeh correlation -1 se lekar +1 tak ke range mein hota hai:

1. **Positive Correlation (+1):** Jab do currency pairs ki movements ek dusre ke sath same direction mein hoti hain, to inka positive correlation hota hai. For example, agar EUR/USD aur GBP/USD dono ek hi direction mein move karte hain, to inka correlation positive hota hai.

2. **Negative Correlation (-1):** Jab do currency pairs ki movements opposite directions mein hoti hain, to inka negative correlation hota hai. For example, agar USD/JPY aur EUR/USD ki movements opposite hoti hain, to inka correlation negative hota hai.

3. **Zero Correlation (0):** Jab do currency pairs ke beech koi clear relationship nahi hota, to inka correlation zero hota hai. In pairs ki movements independent hoti hain aur ek dusre ko affect nahi karti.

**Currency Correlation Ka Role Forex Trading Mein**

1. **Diversification:** Currency correlation ko samajh kar aap apne portfolio ko diversify kar sakte hain. Positive correlated pairs ko avoid karne se aap apne risks ko reduce kar sakte hain aur better risk management achieve kar sakte hain.

2. **Hedging:** Negative correlated currency pairs ka use karke aap hedging strategies implement kar sakte hain. Agar aap ek currency pair mein position le rahe hain aur uski opposite direction mein correlated pair ki position lete hain, to aap apne risks ko hedge kar sakte hain.

3. **Trade Confirmation:** Currency correlation ka use trade confirmation ke liye bhi kiya ja sakta hai. Agar ek currency pair ka movement aapke trade signals ko confirm karta hai, to aapko higher confidence milta hai ki trade successful ho sakti hai.

4. **Understanding Market Trends:** Correlated currency pairs ko monitor karke aap market trends aur price movements ko better samajh sakte hain. Yeh analysis aapko market ke broader perspective ko dekhne aur informed trading decisions lene mein madad karta hai.

**Currency Correlation Kaise Analyze Karein?**

1. **Historical Data Analysis:** Currency correlation ko analyze karne ke liye historical data ka use karein. Historical correlation data aapko currency pairs ke beech ke relationships ko samajhne mein madad karta hai.

2. **Correlation Coefficient:** Statistical tools aur software ka use karke correlation coefficient calculate karein. Yeh coefficient aapko currency pairs ke beech ke relationship ki strength aur direction ko measure karta hai.

3. **Regular Monitoring:** Currency correlations ko regularly monitor karein, kyunki market conditions aur economic events ke changes ke sath correlations bhi change ho sakte hain.

**Conclusion**

Currency correlation forex trading mein ek valuable tool hai jo currency pairs ke beech ke relationships ko samajhne mein madad karta hai. Positive aur negative correlations ko samajh kar, aap apne trading strategies ko diversify, hedge, aur confirm kar sakte hain. Historical data analysis aur correlation coefficient ke zariye, aap better trading decisions le sakte hain aur market trends ko accurately predict kar sakte hain.

-

#10 Collapse

## Currency Correlation Kya Hai?

Currency correlation ek ahem concept hai jo forex trading mein traders ko samajhne mein madad karta hai ke kaise different currency pairs ek dusre ke sath interact karte hain. Yeh correlation market ki dynamics ko samajhne aur trading decisions ko behtar banane mein madadgar hota hai. Is post mein, hum currency correlation ke bare mein tafseeli taur par jaanenge.

### 1. **Basic Concept of Currency Correlation**

Currency correlation se murad hai do ya zyada currency pairs ke darmiyan ka taluq. Agar do currency pairs ek hi direction mein move karte hain, to unhein positively correlated kaha jata hai. Iska matlab hai ke agar ek currency pair ka price barhta hai, to doosra bhi barhta hai. Iske muqablay, agar do currency pairs opposite direction mein move karte hain, to unhein negatively correlated kaha jata hai.

### 2. **Types of Correlation**

- **Positive Correlation**: Jab do currency pairs ek hi direction mein move karte hain. Misal ke taur par, agar EUR/USD aur GBP/USD dono barhte hain, to inka correlation positive hai.

- **Negative Correlation**: Jab do currency pairs opposite direction mein move karte hain. Jaise, agar USD/JPY barhta hai, lekin EUR/USD girta hai, to inka correlation negative hai.

- **No Correlation**: Jab do currency pairs ke darmiyan koi khas taluq nahi hota. Misal ke taur par, agar USD/CHF aur AUD/NZD ke prices ek dusre se mutasir nahi hote, to inka correlation negligible hai.

### 3. **Importance of Currency Correlation in Trading**

Currency correlation ko samajhna traders ke liye kaafi faida mand hai:

- **Risk Management**: Agar aap ek hi currency ke saath positive correlated pairs kholte hain, to aapka risk barh jata hai. Isliye, aapko apne positions ko diversify karna chahiye taake risk ko kam kar saken.

- **Hedging Opportunities**: Negative correlation ko samajh kar aap hedging strategies develop kar sakte hain. Agar aapko lagta hai ke ek currency pair girega, to aap doosre negatively correlated pair par buy kar sakte hain, jo aapke losses ko mitigate kar sakta hai.

- **Enhanced Trading Decisions**: Currency correlation ko dekh kar aapko market ki overall direction aur trends ka andaza hota hai, jo aapke trading decisions ko behtar bana sakta hai.

### 4. **Tools for Analyzing Currency Correlation**

Aaj kal, forex traders ke paas kai tools aur software hote hain jo currency correlation ko analyze karne mein madad karte hain. Aap correlation matrices ya online calculators ka istemal kar sakte hain jo aapko different currency pairs ke darmiyan correlation coefficients dikhate hain.

### 5. **Conclusion**

Currency correlation ek crucial concept hai jo forex trading ko samajhne mein madad karta hai. Isse aap apne trading strategy ko behtar bana sakte hain, risk ko manage kar sakte hain, aur profitable trades karne ke mauqe talash kar sakte hain. Trading mein success hasil karne ke liye hamesha currency correlation ko apne analysis mein shamil karein, taake aap market ke trends aur dynamics ko achi tarah samajh saken.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#11 Collapse

**Currency Correlation**

Currency correlation ka matlab hai do ya zyada currency pairs ke darmiyan price movement ka taluq ya rishta. Is concept ko samajhna traders ke liye bohot zaroori hai kyunki yeh unko market trends aur trading strategies tay karne mein madad deta hai. Currency correlation ko analyze kar ke traders apne risk ko manage kar sakte hain aur profitable trading opportunities dhoond sakte hain.

1. **Definition**

Currency correlation aik statistical relationship hai jo do currency pairs ke darmiyan hota hai. Jab do currency pairs ek saath move karte hain, to unke darmiyan positive correlation hota hai, jab ke agar unki movements opposite direction mein hoti hain, to negative correlation hota hai.

2. **Positive Correlation**

- Positive correlation tab hota hai jab do currency pairs ek hi direction mein move karte hain.

- Iska matlab yeh hai ke agar ek currency pair ki value increase hoti hai, to doosra pair bhi increase hota hai.

- Yeh correlations aksar similar economic factors ya geopolitical events ki wajah se hoti hain.

3. **Negative Correlation**

- Negative correlation tab hota hai jab do currency pairs opposite directions mein move karte hain.

- Iska matlab hai ke agar ek pair ki value increase hoti hai, to doosra pair decrease hota hai.

- Yeh correlation aksar market sentiment ya risk aversion ki wajah se hoti hai.

4. **Importance in Trading**

Currency correlation ka samajhna traders ko apne portfolios ko diversify karne aur risk ko manage karne mein madad deta hai. Agar koi trader ek positively correlated pair ko buy karta hai, to woh doosre pair ko sell karke apne risk ko balance kar sakta hai.

5. **Correlation Coefficient**

Correlation coefficient ek numerical value hota hai jo currency correlation ko measure karta hai. Yeh value -1 se lekar +1 tak hoti hai:

- +1 ka matlab hai perfect positive correlation

- -1 ka matlab hai perfect negative correlation

- 0 ka matlab hai koi correlation nahi hai.

6. **Practical Application**

Traders currency correlation ko apni trading strategies mein integrate kar sakte hain. Agar kisi trader ko lagta hai ke EUR/USD aur GBP/USD positively correlated hain, to woh ek pair ko buy karne par doosre pair ko bhi buy kar sakta hai taake profit ko maximize kiya ja sake.

7. **Monitoring Currency Pairs**

Currency correlations ko monitor karne ke liye traders charts aur statistical tools ka istemal karte hain. Is se unko pata chalta hai ke kaun se currency pairs ek dusre se correlated hain aur kaun se pairs ka koi rishta nahi hai.

8. **Limitations**

- Currency correlation hamesha stable nahi hota; market conditions ke badalne par yeh bhi badal sakta hai.

- Kabhi kabhi false correlations bhi ho sakti hain, is liye traders ko dusre factors ko bhi dekhna chahiye.

9. **Risk Management**

Correlation ka istemal risk management ke liye bhi hota hai. Agar kisi trader ka ek pair mein position hai aur uski correlation dusre pair ke sath positive hai, to woh dusre pair mein bhi position le sakta hai taake risk ko diversify kiya ja sake.

10. **Conclusion**

Currency correlation forex trading mein aik crucial concept hai jo traders ko market trends ko samajhne aur profitable trades karne mein madad deta hai. Iski sahi pehchan aur istemal se traders apne trading strategies ko enhance kar sakte hain aur risk ko effectively manage kar sakte hain.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 05:51 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим