Bullish Harami Candlestick Pattern:

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

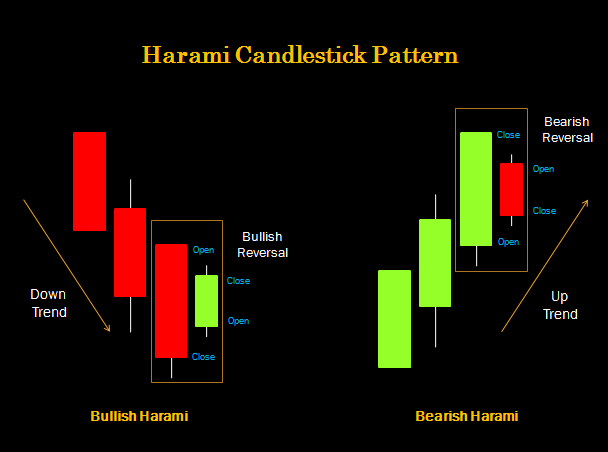

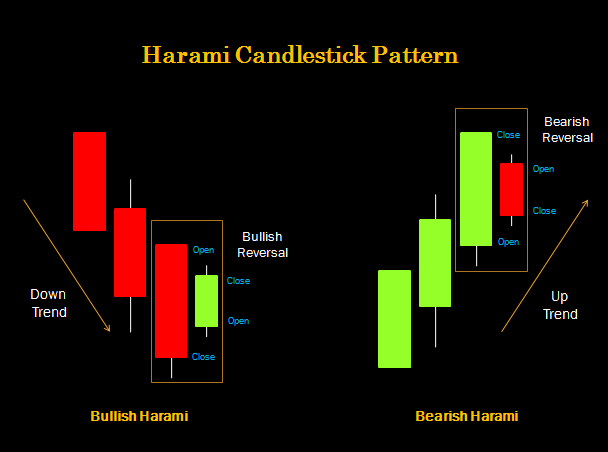

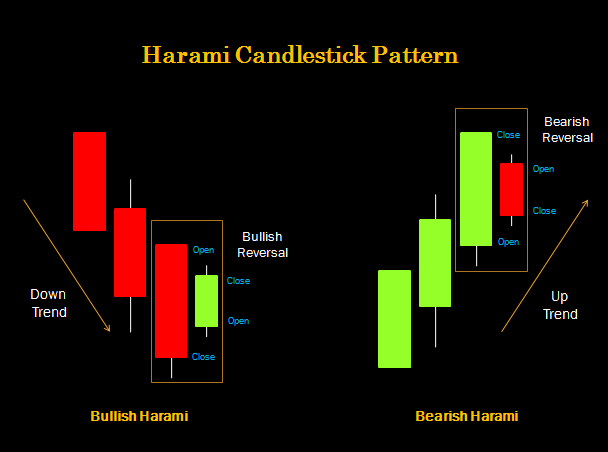

Bullish Harami Candlestick Pattern: Bullish harami candlestick pattern jab b aik bearish trend ya low prices area mein two days candles sy mil kr bnta hy, to yeh aik bullish trend reversal ka kaam krta hy. Yeh pattern risk reward ratio mein sb sy best pattern hy. Pattern ke dono candles main dusri candle pehli candle sy shape main ya length main small hoti hy, jis main pehli candle ka open or close price dusri candle k open or close price sy zyada hota hy. Traders es pattern ko buyers k pressure k tor pr daikhty hain, jis sy prices mazeed bullish ja skti hain. Yeh chart pattern bearish trend k ikhtam or sellers sy buyers main market k control k trf ishara dta hy.or hm trading kr skty hain. Formation: Bullish harami candlestick pattern prices k bottom pr banney ke wja sy aik strong bullish trend k indication dta hy, jo k do candle ka aik simple sa pattern hy. Pattern main candles ke formation es trha sy hoti hy. 1st Candle: Bullish harami candlestick pattern ke pehli candle aik strong real body wali bearish candle hoti hy, jis ka colour b bearish pattern k mutabiq black ya red hota hy. Yeh candle prices k bottom ya low price main bearish trend k mazed ke koshish hoti hy.or market upward move krti hy. 2nd Candle: *Bullish harami candlestick pattern main shamil dusri candle aik small real body wali hoti hy, jis ka open or close same point pr nai hona chaheay. Yeh candle aik bullish trend wali banti hy, jis ka colour white ya green hota hy. Yeh candle pehli candle k andr banti hy.or easily hm daikh skty hain. Expalination: Bullish harami pattern aik strong bullish trend reversal pattern hy.jo k bearish trend main bnta hy, jo direction ke tabdeli k nishan-dahi karta hy. Yeh pattern do candles pr mushtamil hy, jis main dusri candle pehli candle k real body main open or close hoti hy. Yeh pattern bgair confirmation aik strong bullish signal dta hy, k ab bullish trend reversal hone wala hy. Pattern ke dusri candle pehli candle sy size main small hoti hy, jis sy market ka mojuda trend weak par jata hy. Sellers k market main interest kam ho jati hy, jis sy market buyers k control main chla jata hy. Yeh pattern support zone k qareb zyada bnta hy. Trading Strategy: Bullish harami candlestick pattern price chart k bottom pr banney sy aik strong message milta hy, k ab market mazed down jany ke nai ho sakta hy. Ess wja sy ye pattern jab b bearish trend ya low price main bnta hy, to ye bullish trend reversal ka aik strong signal deta hy.

- Mentions 0

-

سا0 like

-

#3 Collapse

Bullish Harami Candlestick Pattern: Bullish Harami Candlestick Pattern, ek technical analysis tool hai jo traders aur investors istemal karte hain market ke price movements aur trend ka pata lagane ke liye. Ye pattern ek bullish reversal pattern hai, yaani ki jab market downtrend se uptrend mein badalne ka indication deta hai. Bullish Harami pattern, do candlesticks se mil kar banta hai. Pehle candlestick negative (bearish) trend ko represent karti hai aur dusri candlestick iske andar banti hai, jo positive (bullish) trend ko represent karti hai. Is pattern ko dekh kar traders ko uptrend ki possibility ka pata lagta hai. Bullish Harami Pattern make: 'Harami' Arabic zubaan se liya gaya hai aur iska matlab hota hai "pregnant". Isliye, is pattern ko Harami pattern kaha jata hai kyunki do candlesticks ke beech mein ek choti si candle hoti hai, jaise ek maa ke pet mein bacha hota hai. Bullish Harami pattern ko recognize karne ke liye aapko do candlesticks ki zarurat hoti hai. Pehla candlestick, bearish trend ko indicate karta hai aur ismein price down jaata hai. Dusra candlestick choti hoti hai aur ismein price up jaata hai, jo bullish trend ki shuruwat ko darshaata hai. Doosri candlestick pehli candlestick ke andar banti hai, jiske wajah se Harami pattern banta hai. Interpretation aur Trading Strategy: Bullish Harami pattern ko dekh kar traders ko bullish trend ki possibility ka pata chalta hai. Is pattern ki confirmation ke liye, traders aur investors ko dusri candlestick ke close ke upar ek aur bullish candle ki confirmation ki zarurat hoti hai. Agar ye confirmation milti hai, toh traders ko uptrend mein entry leni chahiye.5. Stop loss, trading strategy mein ek crucial component hai. Bullish Harami pattern mein, stop loss normally pehli candlestick ke low ke just neeche rakha jaata hai. Target ko decide karte waqt, traders pehli candlestick ke high tak price movement ko consider kar sakte hain. -

#4 Collapse

Bullish Harami Candlestick Pattern : Introduction : Bullish Harami Candlestick Pattern ek powerful reversal pattern hai jo forex market mein use hota hai. Is pattern ko samajhna zaroori hai kyunki ye trend change aur price reversal ki indication deta hai. Formation : Bullish Harami pattern 2 candlesticks se banta hai. Pehla candlestick bearish (گرانÛ) hai, jiska range bada hota hai. Dosra candlestick, jise Mother Candle (ماں کینڈل) kehte hain, pehle candlestick ke andar form hota hai aur bullish (اجوار) hota hai. Isse harami pattern ka formation complete hota hai. Mother Candle, Bullish Harami pattern ka main component hota hai. Is candlestick ka range pehle bearish candlestick ke andar rehta hai. Iski body bearish candlestick ki body se chhoti hoti hai. Confirmation : Bullish Harami pattern ki confirmation ke liye, next candlestick ka price bullish hona chahiye. Yani, bullish harami pattern ke baad bullish candle form ho jati hai. Bullish Harami pattern price reversal ki indication deta hai. Is pattern ke appearance ke baad market trend change kar sakta hai aur price bullish direction mein move kar sakta hai. Trading Strategy : Bullish Harami pattern ko identify karne ke baad, traders long positions enter kar sakte hain. Stop loss order bearish candlestick ki low price ke below rakh sakte hain. Target profit order price ke upar set kiya ja sakta hai. Conclusion: Bullish Harami Candlestick Pattern forex market mein price reversal ki indication deta hai. Is pattern ko samajhna aur identify karna traders ke liye zaroori hai, takay wo trading decisions ko better tariqe se le saken. -

#5 Collapse

-

#6 Collapse

​Bullish harami candlestick pattern py bat kreingy aj Bullish Harami Candlestick Pattern Bullish Harami Candlestick Pattern, ek technical analysis tool hai jo traders aur investors istemal karte hain market ke price movements aur trend ka pata lagane ke liye. Ye pattern ek bullish reversal pattern hai, yaani ki jab market downtrend se uptrend mein badalne ka indication deta hai. Bullish Harami pattern, do candlesticks se mil kar banta hai. Pehle candlestick negative (bearish) trend ko represent karti hai aur dusri candlestick iske andar banti hai, jo positive (bullish) trend ko represent karti hai. Is pattern ko dekh kar traders ko uptrend ki possibility ka pata lagta hai.Bullish Harami Pattern make:

'Harami' Arabic zubaan se liya gaya hai aur iska matlab hota hai "pregnant". Isliye, is pattern ko Harami pattern kaha jata hai kyunki do candlesticks ke beech mein ek choti si candle hoti hai, jaise ek maa ke pet mein bacha hota hai. Bullish Harami pattern ko recognize karne ke liye aapko do candlesticks ki zarurat hoti hai. Pehla candlestick, bearish trend ko indicate karta hai aur ismein price down jaata hai. Dusra candlestick choti hoti hai aur ismein price up jaata hai, jo bullish trend ki shuruwat ko darshaata hai. Doosri candlestick pehli candlestick ke andar banti hai, jiske wajah se Harami pattern banta hai. Interpretation aur Trading Strategy:

Bullish Harami pattern ko dekh kar traders ko bullish trend ki possibility ka pata chalta hai. Is pattern ki confirmation ke liye, traders aur investors ko dusri candlestick ke close ke upar ek aur bullish candle ki confirmation ki zarurat hoti hai. Agar ye confirmation milti hai, toh traders ko uptrend mein entry leni chahiye.5. Stop loss, trading strategy mein ek crucial component hai. Bullish Harami pattern mein, stop loss normally pehli candlestick ke low ke just neeche rakha jaata hai. Target ko decide karte waqt, traders pehli candlestick ke high tak price movement ko consider kar sakte hain. Thank you so much .

-

#7 Collapse

BULLISH HARAMI CANDLESTICK PATTERN DEFINITION Ek Bullih Harami Ek basic candles stick chart pattern hai Jo is baat ki maloomat Karta Hai Ki Kisi Asset ya market mein bearish ka trend tabdil ho sakta hai Ek Bullish Harami indicators bhi Hota Hai Jo batata Hai Ki Bearish Ka end ho raha hai Kuchh investor Bullish ke Harami ko ek good sign ke Taur per dekhte hain ki unhen Kisi ASseT per long position mein enter Hona chahie Ek candle stick chart aamtaur per Ek Day ki stock ki price ke typically represent karta hai Harami pattern ki identity karne ke Hawa investor ko pahle candle stick charts Mein report Karda Daily market ki performance ko dekhna chahie Jiska Naam chart Mein dikhaya gaya hai Upar and Niche Se lines phali Hui Hai aur isko security ki performance ko track karne ke liye istemal Kiya jata hai BULLISH AND BEARISH HARAMI CROSS Jiske bad Ek small body hoti hai Jise doji Kaha jata hai Jo Mukammal Taur per pichhali body ki vertical range mein maujud Hota Hai world Harami Ek purani Japanese word se aaya hai bullish ke Harami ke zahar hone ke liye bad mein aane wali do ji per Ek small body Pichhle Day ki candle ke andar Upar close ho jayegi jisse is baat ka signal Milta Hai Ke reversal ho jayega pahle two black candles down Trends ki maloomat Karti Hain aur white candle teesre day value ki taraf Hota Hai market ko analysis karne ke tarike Talash karne ke liye broker ko follow Karen bashmol bullish and bearish crosses, evening stars, rising three, and engulfing pattern three gaps pattern Hote Hain crypto currency khariden trade Karen

BULLISH AND BEARISH HARAMI CROSS Jiske bad Ek small body hoti hai Jise doji Kaha jata hai Jo Mukammal Taur per pichhali body ki vertical range mein maujud Hota Hai world Harami Ek purani Japanese word se aaya hai bullish ke Harami ke zahar hone ke liye bad mein aane wali do ji per Ek small body Pichhle Day ki candle ke andar Upar close ho jayegi jisse is baat ka signal Milta Hai Ke reversal ho jayega pahle two black candles down Trends ki maloomat Karti Hain aur white candle teesre day value ki taraf Hota Hai market ko analysis karne ke tarike Talash karne ke liye broker ko follow Karen bashmol bullish and bearish crosses, evening stars, rising three, and engulfing pattern three gaps pattern Hote Hain crypto currency khariden trade Karen  GUIDE TO TECHNICAL ANALYSIS Bullish Harami ko guides karna chahie lihaza uski confirmation Ki Zaroorat Hai Ek long Pehle candle best and Zyada powerful hai yah Ishara karta hai ki volume zyada hai and Kyunki is pattern ka nikala part support line ke Taur per work karta hai to pattern Ke Niche Stop loss lagaen to iska ratio reward main best rahega traders is pattern ko buyers ke pressure ke Taur per dekhte hain

GUIDE TO TECHNICAL ANALYSIS Bullish Harami ko guides karna chahie lihaza uski confirmation Ki Zaroorat Hai Ek long Pehle candle best and Zyada powerful hai yah Ishara karta hai ki volume zyada hai and Kyunki is pattern ka nikala part support line ke Taur per work karta hai to pattern Ke Niche Stop loss lagaen to iska ratio reward main best rahega traders is pattern ko buyers ke pressure ke Taur per dekhte hain

-

#8 Collapse

Bullish Harami Candle Example,,, Dear Trader's: Ess Bullishness Harami Candlestick Pattern, ek TECHNICAL ANALYSIS'S tool hai jo traders aur investors istemal karte hain MARKET ke Price movements aur trend ka pata lagane ke liye. Ye Patterned ek Bullishness reversal pattern hai, yaani ki jab market downtrend se up-trending mein badalne ka indication deta hai. Bullish Harami pattern, do Candlestick's se mil kar banta hai. Pehle Candlestick's negatively (bearish) trend ko representative karti hai aur dusri Candlestick's iske andar banti hai, jo positive (bullish) trend ko represent karti hai. Is PATTERN ko dekh kar traders ko up-trending ki possibility ka Easily Pta Chale Ga..... Bullish Harami Example Markeeting,, Dear 'Harami' Mukhtalif zubaan se liya Gaya hai aur iska MATLAB hota hai "pregnancy". Isliye, is PATTERN ko Harami pattern kaha jata hai kyunki do Candlesticks ke beech mein ek choti si candle hoti hai, jaise ek maa ke pet mein Bacha hota hai. Bullish Harami pattern ko recognized karne ke liye Aap me do Candlestick's ki zarurat hoti hai. Pehla Candlestick's, BEARISH trend ko indicated karta hai aur ismein price down jaata hai. Dusra Candlestick's choti hoti hai aur ismein PRICE up jaata hai, jo Bullishness TREND ki shuruwat ko darshaata hai. Doosra Candlestick's pehli Candlestick's ke andar banti hai, jiske wajah se HARAMI CHART PATTERN Say Hi Banta Hy.....

Dear Trader's: Ess Bullishness Harami Candlestick Pattern, ek TECHNICAL ANALYSIS'S tool hai jo traders aur investors istemal karte hain MARKET ke Price movements aur trend ka pata lagane ke liye. Ye Patterned ek Bullishness reversal pattern hai, yaani ki jab market downtrend se up-trending mein badalne ka indication deta hai. Bullish Harami pattern, do Candlestick's se mil kar banta hai. Pehle Candlestick's negatively (bearish) trend ko representative karti hai aur dusri Candlestick's iske andar banti hai, jo positive (bullish) trend ko represent karti hai. Is PATTERN ko dekh kar traders ko up-trending ki possibility ka Easily Pta Chale Ga..... Bullish Harami Example Markeeting,, Dear 'Harami' Mukhtalif zubaan se liya Gaya hai aur iska MATLAB hota hai "pregnancy". Isliye, is PATTERN ko Harami pattern kaha jata hai kyunki do Candlesticks ke beech mein ek choti si candle hoti hai, jaise ek maa ke pet mein Bacha hota hai. Bullish Harami pattern ko recognized karne ke liye Aap me do Candlestick's ki zarurat hoti hai. Pehla Candlestick's, BEARISH trend ko indicated karta hai aur ismein price down jaata hai. Dusra Candlestick's choti hoti hai aur ismein PRICE up jaata hai, jo Bullishness TREND ki shuruwat ko darshaata hai. Doosra Candlestick's pehli Candlestick's ke andar banti hai, jiske wajah se HARAMI CHART PATTERN Say Hi Banta Hy.....  Understanding aur Exchanging Procedure,,, Sir: Ess Bullishness HARAMI PATTERN ko dekh kar Trader's ko Bullishness TREND ki possibility ka pata chalta hai. Is PATTERN ki conformation ke liye, trader's aur Investors ko dusri Candlesticks ke close ke upar ek aur Bullishness candle ki conformation ki zarurat hoti hai. Agar ye conformation milti hai, toh traders ko up-trending mein Entry leni chahhaye gy Stopped loss, TRADING STRATEGY mein ek crucial components hai. Bullishnes Harami PATTERN mein, stop loss normally pehli CANDLESTICK'S ke low ke just Neeche rakha jaata hai. Targeted ko decided karte waqt, Trader's pehli CANDLESTICK'S ke high tak Price movements ko consideration kr Saken gy

Understanding aur Exchanging Procedure,,, Sir: Ess Bullishness HARAMI PATTERN ko dekh kar Trader's ko Bullishness TREND ki possibility ka pata chalta hai. Is PATTERN ki conformation ke liye, trader's aur Investors ko dusri Candlesticks ke close ke upar ek aur Bullishness candle ki conformation ki zarurat hoti hai. Agar ye conformation milti hai, toh traders ko up-trending mein Entry leni chahhaye gy Stopped loss, TRADING STRATEGY mein ek crucial components hai. Bullishnes Harami PATTERN mein, stop loss normally pehli CANDLESTICK'S ke low ke just Neeche rakha jaata hai. Targeted ko decided karte waqt, Trader's pehli CANDLESTICK'S ke high tak Price movements ko consideration kr Saken gy

- Mentions 0

-

سا0 like

-

#9 Collapse

Bullish Harami Candle Example Bullish Harami Candle Example, ek specialized investigation device hai jo brokers aur financial backers istemal karte hain market ke cost developments aur pattern ka pata lagane ke liye. Ye design ek bullish inversion design hai, yaani ki hit market downtrend se upswing mein badalne ka sign deta hai. Bullish Harami design, do candles se mil kar banta hai. Pehle candle negative (negative) pattern ko address karti hai aur dusri candle iske andar banti hai, jo positive (bullish) pattern ko address karti hai. Is design ko dekh kar merchants ko upturn ki probability ka pata lagta hai. Bullish Harami Example make: 'Harami' Arabic zubaan se liya gaya hai aur iska matlab hota hai "pregnant". Isliye, is design ko Harami design kaha jata hai kyunki do candles ke beech mein ek choti si flame hoti hai, jaise ek maa ke pet mein bacha hota hai. Bullish Harami design ko perceive karne ke liye aapko do candles ki zarurat hoti hai. Pehla candle, negative pattern ko demonstrate karta hai aur ismein cost down jaata hai. Dusra candle choti hoti hai aur ismein cost up jaata hai, jo bullish pattern ki shuruwat ko darshaata hai. Doosri candle pehli candle ke andar banti hai, jiske wajah se Harami design banta hai.

Bullish Harami Example make: 'Harami' Arabic zubaan se liya gaya hai aur iska matlab hota hai "pregnant". Isliye, is design ko Harami design kaha jata hai kyunki do candles ke beech mein ek choti si flame hoti hai, jaise ek maa ke pet mein bacha hota hai. Bullish Harami design ko perceive karne ke liye aapko do candles ki zarurat hoti hai. Pehla candle, negative pattern ko demonstrate karta hai aur ismein cost down jaata hai. Dusra candle choti hoti hai aur ismein cost up jaata hai, jo bullish pattern ki shuruwat ko darshaata hai. Doosri candle pehli candle ke andar banti hai, jiske wajah se Harami design banta hai. Understanding aur Exchanging System: Bullish Harami design ko dekh kar brokers ko bullish pattern ki probability ka pata chalta hai. Is design ki affirmation ke liye, brokers aur financial backers ko dusri candle ke close ke upar ek aur bullish flame ki affirmation ki zarurat hoti hai.

Agar ye affirmation milti hai, toh merchants ko upturn mein passage leni chahiye.5. Stop misfortune, exchanging system mein ek critical part hai. Bullish Harami design mein, stop misfortune ordinarily pehli candle ke low ke just neeche rakha jaata hai. Target ko choose karte waqt, merchants pehli candle ke high tak cost development ko consider kar sakte hain.Many thanks .

-

#10 Collapse

Asslam-O-Alaikum! Dear members Me ummed kerti hoke ap sb ka forex trading py kam bht acha chl rha hoga. Aj jis topic py hum baat kre gy wo Neeche mention hy. TOPIC:BULLISH HARAMI CANDLESTICK PATTERN Bullish harami candle stick pattern aik mazboot taizi ka ishara hai jisay tajir qeematon ke ulat jane walay zone ki nishandahi karne ke liye istemaal karte hain. pattern is waqt bantaa hai jab aik choti Bullish candle barri bearish candle ki pairwi karti hai, jis se zahir hota hai ke khredar market par control haasil kar rahay hain. is pattern ko takneeki tajzia car taweel pozishnon ke liye khareed entry points aur aygzt strategy ki shanakht ke liye barray pemanay par istemaal karte hain. blush harami pattern ko charts par talaash karna aasaan hai aur usay kisi bhi time frame par istemaal kya ja sakta hai - intra day se le kar mahana charts tak . Bullish harami pattern do ahem ajzaa par mushtamil hai. sab se pehlay aik bearish candle hai, jis ka aam tor par aik bara asli jism aur lambi oopri aur nichli vicks hoti hai. doosri aik choti Bullish candle hai, jo pichlle din ke band se kam khulti hai aur bearish candle ke mid point ke oopar band hoti hai. Bullish candle jitni choti hogi, itna hi mazboot signal hoga ke ulat jane ka rasta hai . EXPLAINATION: Bullish harami candle stick patteren hamein kya bta raha hai is ko poori terhan samajhney ke liye, aayiyae is pattern ke peechay ki nafsiat ko dekhte hain. jab hum aik barri bearish candle ko aik lambi asli body ke sath dekhte hain, to is se zahir hota hai ke reechh market par haawi hain, aur baichnay walay control mein hain. mandi wali mom batii zahir karti hai ke taajiron ki aik qabil zikar tadaad farokht kar rahi hai aur yeh ke market neechay ja rahi hai. taham, is maqam par, khredar qadam barhana shuru kar dete hain aur qeemat ko berhate hain. jab doosri, choti taizi ki mom batii banti hai, to yeh kharidaron ko control haasil karne aur qeemat ko mukhalif simt mein dhakelnay ki numaindagi karti hai. nateejay ke tor par, bullish harami mandi se taizi ki taraf rujhan mein tabdeeli ka ishara deta hai . Bullish harami pattern ki kamyabi ki mazboot sharah hai, khaas tor par dosray takneeki isharay aur tajzia ke alaat ke sath. jab pattern kaleedi support levels ya fabnoki retrasment level par bantaa hai, to yeh aur bhi ziyada ahem taizi ka ishara ho sakta hai. Bullish harami pattern ko dosray ulatnay walay pattern ke sath mil kar bhi istemaal kya ja sakta hai taakay rujhan ki tabdeeli ki tasdeeq ki ja sakay. misaal ke tor par, agar Bullish harami patteren aik barhay hue neechay ke rujhaan ke baad bantaa hai, aur blush engulfing candle stick pattern is ki pairwi karta hai, to yeh aur bhi mazboot taizi ka ishara hai . bullish harami pattern ka istemaal karte waqt, kuch ahem tahaffuzaat hain jinhein taajiron ko zehen mein rakhna chahiye. sab se pehlay, jab ke patteren qabil aetmaad hai, yeh durust nahi hai, aur traders ko tijarat mein daakhil honay se pehlay patteren ki tasdeeq dosray tjzyati tools se karni hogi. un mein moving average, trained lines, aur deegar takneeki isharay shaamil ho satke hain taakay ziyada mazboot khareed signal mil sakay . aik aur ahem ghhor yeh hai ke jab bullish harami pattern bantaa hai to taajiron ko tijarti hajam ko dekhna chahiye. ziyada volume qeematon ki ziyada ahem harkat ki nishandahi kar satke hain, jis se taajiron ko reversal pattern mein ziyada aetmaad milta hai. doosri taraf, kam hajam is baat ki nishandahi kar sakta hai ke ulat phair honay ka imkaan kam hai, aur taajiron ko lambi pozishnon mein daakhil honay ke baray mein mohtaat rehna chahiye . Bullish harami patteren ko dekhte waqt, taajiron ko is ke bearish hum mansab, bearish harami se bhi aagah hona chahiye. yeh patteren bhi do mom btyon par mushtamil hai, lekin ulat mein - aik barri taizi ki candle jis ke baad aik choti bearish candle hoti hai. bearish harami is ke bar aks ishara karta hai - ke reechh market par control haasil karna shuru kar rahay hain, aur taajiron ko mukhtasir position mein daakhil honay ki taraf dekhna chahiye . aakhir mein, bullish harami pattern aik taaqatwar tool hai jisay takneeki tajzia car market mein kharidari ke mawaqay ki nishandahi karne ke liye istemaal karte hain. pattern is waqt bantaa hai jab aik choti bullish candle barri bearish candle ki pairwi karti hai, jo bearish se taizi ki taraf rujhan ke ulat jane ki nishandahi karti hai. yeh zehen mein rakhna zaroori hai ke pattern durust nahi hai, aur taajiron ko ulat jane ki tasdeeq ke liye deegar takneeki tajzia ke ozaar istemaal karne chahiye. jab patteren bantaa hai to tijarti hajam ko dekhna bhi zaroori hai, taakay ulat jane ki taaqat ka andaza lagaya ja sakay . tajir bullish harami patteren ka istemaal dosray takneeki tajzia tools ke sath mil kar kaleedi dakhlay aur kharji sthon, jaisay ke support aur muzahmati sthon ki nishandahi karne ke liye kar satke hain. mazeed bar-aan, pattern time frame ki aik had ke liye mozoon hai aur usay intra day aur taweel mudti tijarti hikmat e amli dono mein istemaal kya ja sakta hai . majmoi tor par, bullish harami patteren aik taaqatwar tool hai jisay tajir market mein kharidari ke mawaqay ki nishandahi karne ke liye istemaal kar satke hain. agarchay yeh 100 % guarantee wala isharay nahi hai, phir bhi yeh aik qabil aetmaad aur wasee pemanay par istemaal honay wala namona hai jis se har satah ke taajiron ko waaqif hona chahiye. kisi bhi takneeki tajzia ke alay ki terhan, taajiron ko bakhabar tijarti faislay karne ke liye dosray tjzyati tools ke sath mil kar bullish harami pattern ka istemaal karna chahiye . -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#11 Collapse

Bullish Harami pattern kia hy??? iska matlab hota hai "pregnant". Isliye, is pattern ko Harami pattern kaha jata hai kyunki do candlesticks ke beech mein ek choti si candle hoti hai, jaise ek maa ke pet mein bacha hota hai. Bullish Harami pattern ko recognize karne ke liye aapko do candlesticks ki zarurat hoti hai. Pehla candlestick, bearish trend ko indicate karta hai aur ismein price down jaata hai. Dusra candlestick choti hoti hai aur ismein price up jaata hai, jo bullish trend ki shuruwat ko darshaata hai. Doosri candlestick pehli candlestick ke andar banti hai, Bullish harami candlestick sample jab b aik bearish trend ya low prices region mein days candles sy mil kr bnta hy, to yeh aik bullish fashion reversal ka kaam krta hy. Yeh pattern hazard reward ratio mein sb sy nice pattern hy. Pattern ke dono candles foremost dusri candle pehli candle sy shape fundamental ya duration main small hoti hy, jis most important pehli candle ka open or close charge dusri candle okay open or near charge sy zyada hota candlestick pattern fundamental shamil dusri candle aik small actual body wali hoti hy Explanation aur Phchan kya hy??? candlestick sample jab b aik bearish fashion ya low expenses region mein two days candles sy mil kr ullish Harami Candlestick Pattern, ek technical analysis tool hai jo traders aur investors istemal karte hain market ke price movements aur trend ka pata lagane ke liye.Ye pattern ek bullish reversal pattern hai, yaani ki jab market downtrend se uptrend mein badalne ka indication deta hai. Bullish Harami pattern, do candlesticks se mil kar banta hai. Pehle candlestick negative (bearish) trend ko bnta hy, to yeh aik bullish fashion reversal ka kaam krta hy.Yeh patternmi' Arabic zubaan se liya gaya hai aur iska matlab hota hai "pregnant". Isliye, is sample ko Harami sample kaha jata hai kyunki do candlesticks ke beech mein ek choti si candle hoti hai, jaise ek maa ke pet mein bacha hota hai. Bullish Harami pattern ko recognize karne ke liye aapko do candlesticks ki zarurat hoti hai. Pehla candlestick, bearish fashion ko suggest karta hai aur ismein price down jaata hai. Dusra candlestick choti hoti hai aur ismein rate up jaata hai, jo bullish trend ki shuruwat ko darshaata hai. Doosri candlestick pehli candlestick ke andar banti hai, jiske wajah se Harami pattern banta hai. Danger praise ratio mein sb sy pleasant sample hy. Pattern ke dono candles essential dusri candle pehli candle sy form primary ya length essential small hoti hy, jis principal pehli candle ka open or near fee dusri candle okay open or close rate sy zyada hota hy. Traders es sample ko consumers ok pressure k tor pr daikhty hain, Treading strategy kya hy is pattern ki forex market ke muqablay stock chart par mukhtalif nazar aaye ga, lekin patteren ki shanakht ke liye wohi hikmat e amli laago hoti hai. blush harami check list : mojooda kami ka rujhan talaash karen. un ishaaron ki talaash karen jo raftaar sust ho rahi hai / ulat rahi hai blush moving average cross over, ya baad mein blush candle farmishnz ). Iss baat ko yakeeni banayen ke choti sabz mom batii ki body pichli bearish candle ke 25 % se ziyada nah ho. pichli mom batii ke wast mein sabz mom batii dikhata hue, stock mein farq ho jaye ga. forex charts ziyada tar dono mom batian sath sath deikhein ge. Mushahida karen ke poori blush candle pichli bearish candle ki body ki lambai ke andar band hai. Muawin isharay ya muawnat ki kaleedi sthon ke istemal ke sath sangam talaash karen. forex market mein blush harami patteren ki tashkeel forex market 24 / 5 ki bunyaad par kaam karti hai jis ka hon matlab hai ke jab aik candle band hoti hai to doosri taqreeban pichli candle ki band honay wali qeemat ki isi satah par khulti hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 02:48 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим