Role of market psychology in pull back trading

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

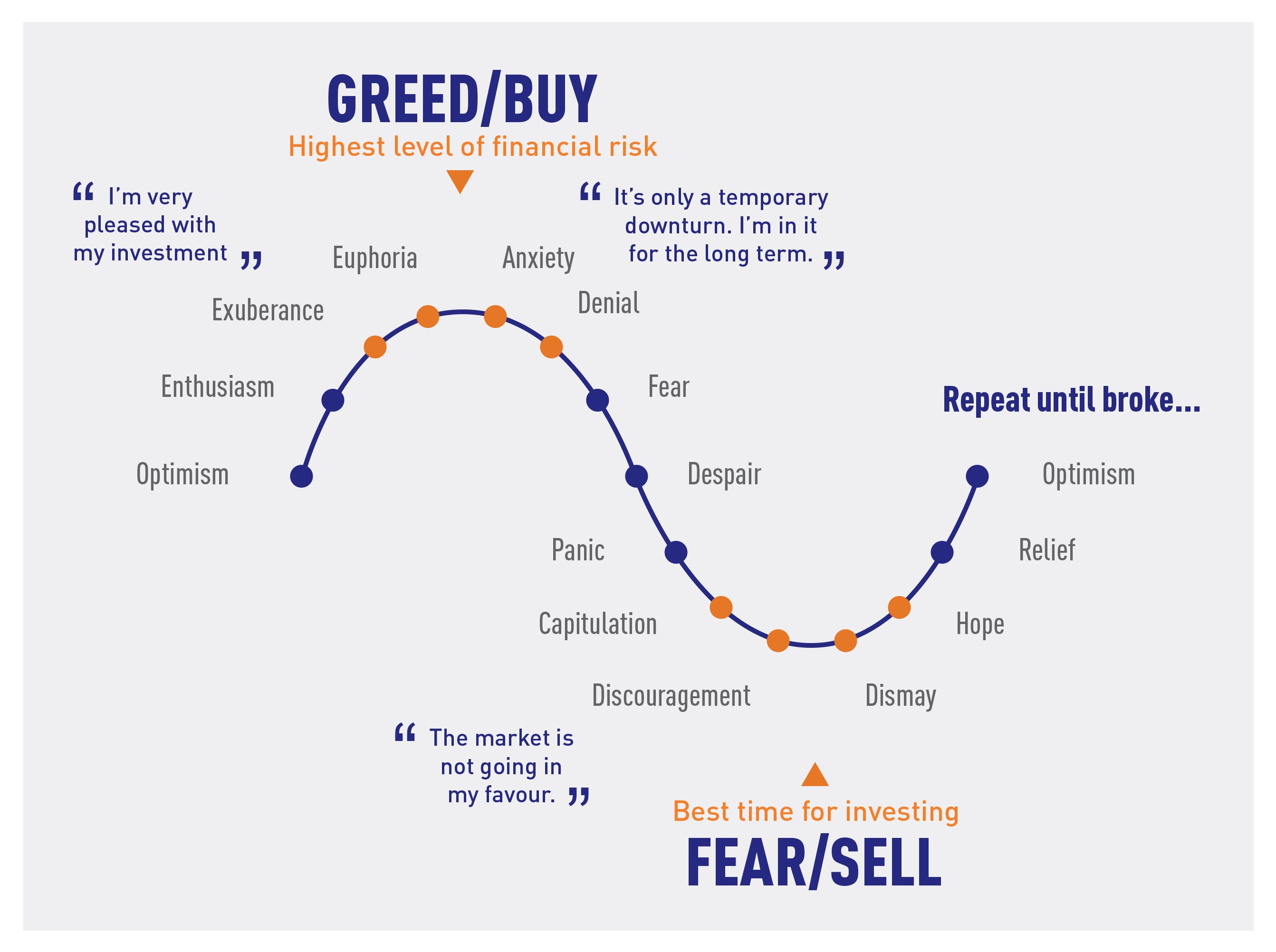

Market psychology plays a crucial role in pull back trading. It refers to the collective mindset, emotions, and behavior of traders and investors in the market. Understanding and effectively utilizing market psychology can provide valuable insights into market trends, price movements, and potential pull back opportunities. Here are some key aspects of market psychology in pull back trading: 1. Herd Mentality: Market participants often exhibit herd mentality, where they tend to follow the crowd and make decisions based on the actions of others. This behavior can create momentum in the market, leading to extended trends or pull backs when sentiment changes. 2. Greed and Fear: Greed and fear are powerful emotions that significantly impact market psychology. During uptrends, greed may drive traders to chase higher prices, while fear can cause panic selling during market downturns. Pull back traders capitalize on these emotions by identifying points where fear or greed may result in price retracements. 3. Support and Resistance Levels: Market psychology plays a role in the formation of support and resistance levels. Traders tend to remember previous price levels where the market reversed, creating psychological barriers. Pull back traders monitor these levels as potential entry or exit points when prices pull back or bounce. 4. Investor Sentiment Indicators: Various sentiment indicators, such as surveys, options market data, or the Volatility Index (VIX), reflect the overall sentiment of market participants. Pull back traders analyze these indicators to gauge the prevailing sentiment, as extreme optimism or pessimism can indicate potential pull back opportunities. 5. Overbought and Oversold Conditions: Market psychology influences the concept of overbought and oversold conditions. When a market becomes overbought, it suggests excessive buying and potential exhaustion, increasing the likelihood of a pull back. Conversely, oversold conditions may indicate excessive selling and potential buying opportunities. 6. Trend Reversal Signals: Market psychology is instrumental in identifying trend reversal signals. Traders monitor price patterns, such as double tops or bottoms, head and shoulders formations, or trendline breaks, to gauge the sentiment shift in the market. Pull back traders look for these signals as potential entry points. 7. Emotional Discipline: Pull back traders need to maintain emotional discipline and avoid being swayed by short-term market fluctuations or noise. Emotional control is crucial to sticking to the trading plan and executing trades based on objective analysis rather than succumbing to impulsive decisions driven by fear or greed. 8. Contrarian Approach: Pull back trading often involves adopting a contrarian approach, where traders go against the prevailing market sentiment. This requires understanding market psychology to identify potential turning points and profit from market reversals when the majority of traders are positioned in the opposite direction. Conclusion In conclusion, market psychology plays a vital role in pull back trading. By understanding and leveraging the emotions, behaviors, and sentiment of market participants, pull back traders can identify potential opportunities and make informed trading decisions. It is essential to combine technical analysis, fundamental analysis, and an understanding of market psychology to effectively execute pull back trading strategies.

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#3 Collapse

"Role of market psychology in pull back trading"- "Role of market psychology in pull back trading"

- Pull back trading mein market psychology ka role kuch is tarah hota hai:

- Identification of Pullbacks: Market psychology pullbacks ko identify karne mein madad karta hai. Jab market strong trend mein hota hai aur pullback occur karta hai, traders ka fear aur uncertainty badh jata hai. Ye psychological factors traders ko pullbacks ko recognize karne aur unpar focus karne mein madad karte hain.

- Emotional Reactions: Market psychology pullbacks mein traders ke emotional reactions ko samajhne mein madad karta hai. Jab price reverse hota hai aur pullback start hota hai, traders ka fear aur doubt badh jata hai. Yeh emotional reactions unke trading decisions aur behavior ko influence karte hain.

- Entry Points: Market psychology traders ko pullback ke entry points ko identify karne mein madad karta hai. Jab pullback occur hota hai, traders ko opportunity milta hai ki woh strong trend ke direction mein entry lein aur profits banayein. Market psychology ke through traders pullback ke reversal points aur trend continuation ke signals ko samajh sakte hain.

- Risk Management: Market psychology traders ko pullback trading mein risk management ke liye madad karta hai. Jab pullback occur hota hai, traders ko price movements aur volatility ke saath deal karna hota hai. Market psychology traders ko risk ke samay par aware rakhta hai aur unko apne trades ko manage karne mein madad karta hai.

- Patience aur Discipline: Market psychology traders ko pullback trading mein patience aur discipline maintain karne mein madad karta hai. Jab price pullback karta hai, traders ko wait karna hota hai ki price apne trend ke direction mein wapas move kare. Market psychology traders ko impulsive decisions se bachata hai aur unko apne trading plan aur strategy ko follow karne mein madad karta hai.

Types of Market Psychology in Pullback Trading:- Fear and Greed: Khof aur hirs market psychology ke do aam tareeqe hain jo pullback trading mein ahem kirdar ada karte hain. Khof traders ko pullbacks ke doran bechna ka hosla deta hai, jabke hirs unko kharidne ka jazba dilata hai.

Market Sentiment: Market sentiment yaani market ki jazbaati halat traders aur investors ke mindset aur attitude ko represent karta hai. Musbat market sentiment bullish pullbacks ka natija ho sakta hai, jabke manfi sentiment bearish pullbacks ko jan sakti hai.

Support aur Resistance Levels: Psychological levels, jaise support aur resistance levels, pullback trading par asar dalte hain. Traders aksar in levels par tawajah dete hain kyunki ye aise areas hote hain jahan market participants khareedne ya bechne ka trend dikha sakte hain, jisse pullbacks paida ho sakte hain.

Trend Following: Trend following ek psychological approach hai jisme pullback trading ke doran traders yeh maante hain ki poora trend temporary pullback ke baad bhi jaari rahega. Woh trend ke context mein pullbacks ko pehchanne par tawajah dete hain.

Market Psychology ka Istemal Pullback Trading Mein:

- Entry aur Exit Points: Market psychology pullback trading mein potential entry aur exit points ko pehchanne mein madad karti hai. Market sentiment aur jazbati reactions ko samajh kar traders trades ko sahi waqt par enter aur exit kar sakte hain.

- Risk Management: Market psychology pullback trading mein risk management ko samjhne mein madad karti hai. Market psychology ko samajh kar traders sahi stop-loss levels set kar sakte hain aur position sizes adjust kar sakte hain apne capital ko bachane ke liye.

- Trade Confirmation: Market psychology pullback trading strategies mein ek confirmation tool ki tarah kaam karti hai. Traders aksar market sentiment ki signs ko dekhte hain jo pullback direction ke saath milte hain, tabhi woh trades mein enter karte hain.

Market Psychology ka Fayda Pullback Trading Mein:

- Behtar Timing: Market psychology ko samajhne se traders ka timing behtar ho jata hai, jisse pullback trades mein kamyaabi ki sambhavna badh jati hai.

- Risk Management Mein Sudhar: Market psychology ko dhyan mein rakhte hue traders apna risk management behtar tarike se kar sakte hain. Market psychology ko samajhne se traders sahi stop-loss levels set kar sakte hain aur position sizes ko prevailing market sentiment ke hisaab se adjust kar sakte hain.

Market Psychology ka Nuksaan Pullback Trading Mein:- Subjectivity: Market psychology subjective hoti hai aur alag-alag traders ke beech mein farq ho sakti hai. Isse market behavior ka mukhtalif tashkeel samajhna aur alag-alag trading decisions lena ho sakta hai.

- Jazbati Asar: Market psychology traders ke jazbati halat ko asar dal sakti hai aur impulsive trading decisions ko jan sakti hai, jisse overall trading performance par asar padh sakta hai.

Ikhtitam:

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 03:17 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим